2016-2017 MY Summary of FCA US LLC's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Buyer's Guide

NEXT 2018 BUYER’S GUIDE TOUCH THE SELECTION TABS AND BUTTONS THROUGHOUT THE PDF TO NAVIGATE Page 1 2 018 SEDANS 2017MY vehicle shown. CHRYSLER 300 DODGE CHARGER FIAT® 500 FIAT 500L 300 Touring, 300 Touring-L, 300S, Models SE, SXT, R/T Pop, Lounge, Abarth® Pop, Trekking, Lounge 300 Limited, 300C 3.6L (RWD / AWD) — 19 / 30 18 / 27 3.6L (RWD / AWD) — 19 / 30 18 / 27 500 — 31 / 38 MPG(7) (City / Hwy) 22 / 30 5.7L (RWD) — 16 / 25 5.7L (RWD) — 16 / 25 Abarth — 28 / 33 Total Range(7) 426 total miles 499 total miles 315 total miles 330 total miles Available Engines 3.6L V6 / 5.7L HEMI® 3.6L V6 / 5.7L V8 HEMI 1.4L I-4 / 1.4L I-4 Turbo 1.4L I-4 Turbo Drivetrains RWD, AWD RWD / AWD FWD FWD Wheelbase 120.2 — 90.6 102.8 Overall Height 58.7 58.5 59.8 65.7 Overall Width 75.0 75 73.5 80.2 Overall Length 198.6 198.4 144.4 168.1 Seating Capacity 5 5 4 5 Head Room (front / rear) 38.6 / 37.9 (without dual-pane sunroof) 38.6 / 36.6 38.9 / 35.6 (without sunroof or soft top) 40.7 / 38.7 Leg Room (front / rear) 41.8 / 40.1 41.8 / 40.1 40.7 / 31.7 40.0 / 36.7 Shoulder Room 59.5 / 57.7 59.5 / 57.9 49.4 / 46.4 57.3 / 54.6 (front / rear) Hip Room (front / rear) 56.2 / 56.1 56.2 / 56.1 47.9 / 42.6 54.9 / 49.4 Cargo Volume (cu ft) 122.6 30.1 (trunk liftover height) — 68.0 Curb Weight (lb) 4,013 (Touring) 3,958 (SE) 2,545 3,254 Towing Capacity(13) (lb) 1,000 1,000 (trailer weight) — — Fuel Tank Capacity (gal) 18.5 18.5 10.5 13.2 EPA Interior 106.3 120.8 84.9 121.1 Volume (cu ft) Page 2 All dimensions, specifications and MPG are based on 2017MY vehicle information. -

Pr Ess R El Ea Se

2 FCA and CNH Industrial host first international TechPro event Turin, June 7, 2016 The first ever international event held in honor of the TechPro2 youth technical training initiative took RELEASE place today at the headquarters of the Salesians of Don Bosco in Turin, Italy. The event illustrated the activities achieved thus far by TechPro2 and rewarded some of the most deserving students who have participated in the training program from different countries around the world. PRESS PRESS The TechPro2 program is a joint initiative from sister companies Fiat Chrysler Automobiles (FCA) and CNH Industrial, in collaboration with the National Centre for Salesian Works (CNOS FAP). CNOS FAP’s mission is to promote formation and professional development according to its founder Don Bosco’s teaching principles. The aim of TechPro2 is to provide young people from over 50 countries around the world – such as Poland, Ethiopia, Argentina, Italy, India and Brazil – with the knowledge and commercial skills that are needed to prepare them for future employment in the automotive and industrial machinery sectors. Mopar, the services, Customer Care, original spare parts and accessories brand of FCA, led this project back in 2008 together with CNOS-FAP. CNH Industrial later joined the initiative in 2011, introducing a specific training program related to commercial vehicles. TechPro2 has grown to be more than a development program to form highly specialised individuals; today it has a global scope which actively involves and fosters a direct dialogue with young people, many of which come from socially underprivileged backgrounds, to offer them a secure professional future. -

Chrysler Group Global Electric Motorcars LLC Remains Segment Leader in Industry

Contact: Nick Cappa Dianna Gutierrez Chrysler Group Global Electric Motorcars LLC Remains Segment Leader in Industry Global Electric Motorcars (GEM) has sold more than 40,000 electric vehicles worldwide, logging almost a half billion emissions-free miles GEM vehicles have saved more than 19.5 million gallons of gasoline and reduced CO2 emissions by more than 93,000 metric tons CO2 reduction is equivalent to planting nearly a half-million CO2 absorbing trees Chrysler Group LLC celebrates 10 years with GEM subsidiary January 24, 2010, Washington, D.C. - Chrysler Group LLC’s wholly-owned subsidiary, Global Electric Motorcars (GEM), has reached a milestone in the Low-speed Vehicle (LSV) industry by selling more than 40,000 GEM battery-electric vehicles. The GEM vehicle line is 100 percent electric and emits zero tailpipe emissions. GEM vehicles have been driven almost 500 million emission- free miles, saving more than 19.5 million gallons of gasoline. This translates into a CO2 reduction equivalent to planting nearly a half-million trees. “GEM is a successful example of how Chrysler Group is reducing CO2 emissions while answering customer needs for alternatively powered vehicles,” said Steve Bartoli—Head of Regulatory Affairs and Engineering Planning, Chrysler Group LLC. “GEM is directly responsible for cutting CO2 output by more than 93,000 tons by replacing gasoline-powered vehicles with electric vehicles.” The Fargo, North Dakota based manufacturer was acquired 10 years ago by Chrysler Group to assist the major automaker in their continuing efforts and commitment to developing, producing and selling environmentally-friendly vehicles. GEM Battery-Electric Vehicles – The Eco-Friendly, Cost-Effective Transportation Alternative Classified as Low Speed Vehicles (LSV) or Neighborhood Electric Vehicles (NEVs) by the National Highway Traffic Safety Administration, the GEM vehicle line is street-legal in most states on roads posted 35 mph or less. -

[email protected] Rick Deneau

January 29, 2010 Contact: Kathy Graham (248) 512-6218 (office) (810) 333-9035 (cell) [email protected] Rick Deneau (248) 512-2694 (office) (248) 730-1685 (cell) [email protected] Chrysler Group LLC Announces Revised Incentives Focused on Promoting Award-winning Vehicles Chrysler Group LLC announces new incentives effective today that keep its award-winning vehicle lineup competitive in the marketplace Incentives valid today through March 1 Tactical incentives encourage customers to “try us again” Auburn Hills, Mich. , Jan 29, 2010 - Chrysler Group LLC today announced new incentives that will give consumers a level playing field when shopping our products against the competition and keep the company competitive in the marketplace. Beginning today, the company is offering current Tundra, Tacoma and Sienna owners an additional $1,000 trade-in bonus cash with the purchase or lease of any new Chrysler, Jeep®, Dodge car or Ram truck. “The 2010 Ram Heavy Duty is Motor Trend magazine’s 'Truck of the Year' and the Ram 1500 is our most awarded truck ever,” said Fred Diaz, President and Chief Executive Officer–Ram Brand and Lead Executive for the Sales Organization, Chrysler Group LLC. “Chrysler invented the minivan and with more than 65 minivan- first innovations has the best minivans in the marketplace with the Dodge Grand Caravan and Chrysler Town & Country. Dodge has sold more minivans than any other manufacturer, and combined with the Town & Country has more than 42 percent market share in the minivan segment,” Diaz added. The company also announced today $1,000 bonus cash for all Toyota returning lessees who purchase or lease a new Chrysler, Jeep, Dodge car or Ram truck vehicle. -

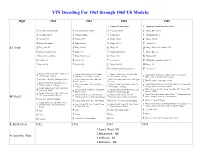

VIN Decoding for 1962 Through 1965 US Models

VIN Decoding For 1962 through 1965 US Models: Digit 1962 1963 1964 1965 1 Plymouth Valiant Slant-6 1 Plymouth Valiant/Barracuda Slant-6 1 Plymouth Valiant Slant-6 1 Plymouth Valiant Slant-6 2 Plymouth Slant-6 2 Dodge Dart Slant-6 2 Plymouth Slant-6 2 Plymouth Slant-6 3 Plymouth V8 3 Plymouth Slant-6 3 Plymouth V8 3 Plymouth V8 4 Dodge Slant-6 4 Dodge Slant-6 4 Dodge Dart Slant-6 4 Dodge Slant-6 5 Dodge 880 V8 C Chrysler V8 L Car line 5 Dodge Dart V8 5 Dodge 880 V8 6 Dodge V8 D Dodge Polara, 880, Monaco V-8 6 Dodge Custom 880 V8 6 Dodge V8 7 Dodge Dart Slant-6 L Dodge Dart V8 7 Dodge Lancer Slant-6 7 Dodge Dart Slant-6 8 Chrysler V8 R Plymouth V8 8 Chrysler V8 8 Chrysler V8 9 Imperial V8 V Plymouth Valiant/Barracuda V8 9 Imperial V8 9 Imperial V8 L Dodge Dart V8 W Dodge V8 V Plymouth Valiant/Barracuda V8 Y Imperial V8 Valiant V100, Savoy, Dart, 880, Lancer Valiant V100, Savoy, 330, Custom Valiant V100, Savoy, 330, 880, Dart Valiant V100, Belvedere I, Fury I, Dart 170, Coronet 1 170, Newport, Custom 1 1 880, Dart 170, Newport, Custom 170, Newport, Custom 1 Deluxe, Polara, Custom 880, Newport Belvedere, Dart 330, 300 Sport, Crown Valiant V200, Belvedere, 440, 300 Belvedere, 440, 880 Custom, 300 Sport, 2 Fury II, Coronet, 300 Sport, Crown 2 Sport, Crown 2 Crown 2 Valiant V200, Fury, Dart 440, Lancer Valiant V200, Belvedere II, Fury III, Dart 270, Coronet 440, 3 770, New Yorker, LeBaron Fury, Polara, Dart 270, New Yorker, Valiant V200, Fury, Polara, Dart 270, 3 3 LeBaron 3 New Yorker, LeBaron Custom 880, New Yorker, LeBaron Valiant Signet, -

Electric Vehicle Market Status - Update Manufacturer Commitments to Future Electric Mobility in the U.S

Electric Vehicle Market Status - Update Manufacturer Commitments to Future Electric Mobility in the U.S. and Worldwide September 2020 Contents Acknowledgements ....................................................................................................................................... 2 Executive Summary ...................................................................................................................................... 3 Drivers of Global Electric Vehicle Growth – Global Goals to Phase out Internal Combustion Engines ..... 6 Policy Drivers of U.S. Electric Vehicle Growth ........................................................................................... 8 Manufacturer Commitments ....................................................................................................................... 10 Job Creation ................................................................................................................................................ 13 Charging Network Investments .................................................................................................................. 15 Commercial Fleet Electrification Commitments ........................................................................................ 17 Sales Forecast.............................................................................................................................................. 19 Battery Pack Cost Projections and EV Price Parity ................................................................................... -

Road & Track Magazine Records

http://oac.cdlib.org/findaid/ark:/13030/c8j38wwz No online items Guide to the Road & Track Magazine Records M1919 David Krah, Beaudry Allen, Kendra Tsai, Gurudarshan Khalsa Department of Special Collections and University Archives 2015 ; revised 2017 Green Library 557 Escondido Mall Stanford 94305-6064 [email protected] URL: http://library.stanford.edu/spc Guide to the Road & Track M1919 1 Magazine Records M1919 Language of Material: English Contributing Institution: Department of Special Collections and University Archives Title: Road & Track Magazine records creator: Road & Track magazine Identifier/Call Number: M1919 Physical Description: 485 Linear Feet(1162 containers) Date (inclusive): circa 1920-2012 Language of Material: The materials are primarily in English with small amounts of material in German, French and Italian and other languages. Special Collections and University Archives materials are stored offsite and must be paged 36 hours in advance. Abstract: The records of Road & Track magazine consist primarily of subject files, arranged by make and model of vehicle, as well as material on performance and comparison testing and racing. Conditions Governing Use While Special Collections is the owner of the physical and digital items, permission to examine collection materials is not an authorization to publish. These materials are made available for use in research, teaching, and private study. Any transmission or reproduction beyond that allowed by fair use requires permission from the owners of rights, heir(s) or assigns. Preferred Citation [identification of item], Road & Track Magazine records (M1919). Dept. of Special Collections and University Archives, Stanford University Libraries, Stanford, Calif. Conditions Governing Access Open for research. Note that material must be requested at least 36 hours in advance of intended use. -

Approved Vehicles List

The School Board of Superintendent of Schools Hillsborough County, FL Jeff Eakins Deputy Superintendent, Instruction Van Ayres Tamara P. Shamburger, Chair Deputy Superintendent, Operations Melissa Snively, Vice Chair Christopher Farkas Steve P. Cona III Chief of Schools, Administration Lynn L. Gray Harrison Peters Stacy A. Hahn General Manager of Employee Relations Karen Perez OPERATIONS DIVISION Mark West Cindy Stuart SAFETY AND RISK MANAGEMENT Director of Safety & Risk Management Corries Culpepper APPROVED VEHICLES LIST 2019-2020 INTER-OFFICE COMMUNICATION Date: August 15, 2019 TO: All Principals/Program Administrators FROM: Corries Culpepper, Director of Safety and Risk Management SUBJECT: Transportation for School Related Functions (Updated List) Florida Statutes regulate the type of vehicles that may be used to transport students for school related functions, such as field trips and athletic events. • No Pick-up trucks of any type • No Conversion Vans of any type • No Compact Recreation Vehicles (CRV) Parents, teachers, coaches and other volunteers may use the following vehicles to transport students: • ALL PASSENGER CARS (except convertibles) ARE APPROVED. Approved Multipurpose Passenger Vehicles (MPV’s), listed below Must meet the National Highway Traffic Safety Administration Passenger Car Standards and be on the Florida Department of Education’s TSA #T-00-4. If you have a question regarding your vehicle, please call the Safety and Risk Management Office at 840 - 7324. The Approved MPV’s are: MANUFACTURER MODEL YEAR NOTES Acura -

2019-2020 Parents, Teachers, Coaches and Other Volunteers May

The School Board of Superintendent of Schools Hillsborough County, FL Jeff Eakins Deputy Superintendent, Instruction Van Ayres Tamara P. Shamburger, Chair Deputy Superintendent, Operations Melissa Snively, Vice Chair Christopher Farkas Steve P. Cona III Chief of Schools, Administration Lynn L. Gray Harrison Peters Stacy A. Hahn General Manager of Employee Relations Karen Perez OPERATIONS DIVISION Mark West Cindy Stuart SAFETY AND RISK MANAGEMENT Director of Safety & Risk Management Corries Culpepper APPROVED VEHICLES LIST 2019-2020 INTER-OFFICE COMMUNICATION Date: August 15, 2019 TO: All Principals/Program Administrators FROM: Corries Culpepper, Director of Safety and Risk Management SUBJECT: Transportation for School Related Functions (Updated List) Florida Statutes regulate the type of vehicles that may be used to transport students for school related functions, such as field trips and athletic events. • No Pick-up trucks of any type • No Conversion Vans of any type • No Compact Recreation Vehicles (CRV) Parents, teachers, coaches and other volunteers may use the following vehicles to transport students: • ALL PASSENGER CARS (except convertibles) ARE APPROVED. Approved Multipurpose Passenger Vehicles (MPV’s), listed below Must meet the National Highway Traffic Safety Administration Passenger Car Standards and be on the Florida Department of Education’s TSA #T-00-4. If you have a question regarding your vehicle, please call the Safety and Risk Management Office at 840 - 7324. The Approved MPV’s are: MANUFACTURER MODEL YEAR NOTES Acura -

April 2013 Sales Release

Contact: Ralph Kisiel Chrysler Group LLC Reports April 2013 U.S. Sales Increased 11 Percent; Best April Sales in Six Years Best April sales since 2007 37th-consecutive month of year-over-year sales gains Seven Chrysler Group vehicles set sales records for month of April Dodge Dart compact car records highest monthly sales since 2012 vehicle launch Dodge Durango sales up 65 percent; best April sales since 2005 Jeep® Grand Cherokee sales up 27 percent; best April sales since 2005 Ram Truck brand sales up 49 percent; largest percentage sales gain of any Chrysler Group brand in April April 30, 2013, Auburn Hills, Mich. - Chrysler Group LLC today reported U.S. sales of 156,698 units, an 11 percent increase compared with sales in April 2012 (141,165 units), and the group’s best April sales since 2007. The Jeep®, Dodge, Ram Truck and FIAT brands each posted year-over-year sales gains in April compared with the same month a year ago. The Ram Truck brand’s 49 percent increase was the largest sales gain of any Chrysler Group brand in April. Chrysler Group extended its streak of year-over-year sales gains to 37-consecutive months in April. “Chrysler Group’s best April sales in six years helped to maintain our sales momentum and drove us to our 37th- consecutive month of year-over-year sales gains,” said Reid Bigland, Head of U.S. Sales. “Our sales last month were solid across the board with seven Chrysler Group vehicles recording their best April sales ever.” The Dodge Durango’s 65 percent sales increase was the largest sales gain of any Dodge brand vehicle in April and second only to the Ram Cargo Van’s 110 percent sales gain among Chrysler Group vehicles. -

Barracuda / Valiant / Dodge Dart

Chrysler Corp./MoPar (64-66) SVRA Supplemental Regulations (revised 1/2013) Plmouth Barracuda sedan (1964-1966) Plymouth Valiant sedan (1964-1966) Dodge Dart sedan (1964-1966) as prepared for SVRA Group 6 competition; Class AS The following cars are covered under these regulations: 1964-1966 Plymouth Barracuda (273 CID) 1964-1966 Plymouth Valiant (273 CID) 1964-1966 Dodge Dart (273 CID) -------------------------------------------------------------------------------------------------------------------------------------------------------------------------- Engines: .060” maximum overbore allowed 273 CID Bore x stroke…………………3.625” x 3.31” 318 CID Bore x stroke…………………3.910” x 3.31” (With 100# weight penalty) (Alternate bores & strokes permitted which yield displacements under 5.0L) Head & block material……….cast iron Carburetion…………….…….One Holley 4-bbl. (1.687” throttle) or equivalent -------------------------------------------------------------------------------------------------------------------------------------------------------------------------- Standard Transmissions: Manual: Chrysler A833 4-speed; Automatic: Chrysler A904 3-speed -------------------------------------------------------------------------------------------------------------------------------------------------------------------------- Chassis: Steel unibody, 2-door hardtop coupe Wheelbase……………………………………106” (Barracuda/Valiant), 111” (Dart), +/- 0.5” Track dimension, front……………………….57”, +/- 2” , rear…....56.6”, +/- 2” Wheels, all listed models: 8” x 15” Brakes, all listed -

2021 Chrysler Nationals Event Guide

OFFICIAL EVENT GUIDE TABLE OF CONTENTS 5 WELCOME 7 SPECIAL GUESTS 8 EVENT HIGHLIGHTS 2021-22 EVENT SCHEDULE JAN. 15-17, 2021 11 SHOWFIELD HIGHLIGHTS AUTO MANIA ALLENTOWN PA FAIRGROUNDS JAN. 14-16, 2022 14 TRIBUTE TO MR. NORM WINTER CARLISLE NEW EVENT! AUTO EXPO CARLISLE EXPO CENTER JAN. 28-29, 2022 FEATURED VEHICLE 18 DISPLAYS WINTER AUTOFEST CANCELLED FOR 2021 LAKELAND FEATURED VEHICLE SUN ’n FUN, LAKELAND, FL FEB. 25-27, 2022 DISPLAY: MOPAR 22 LAKELAND WINTER FEB. 19-20, 2021 SURVIVORS COLLECTOR CAR AUCTION SUN ’n FUN, LAKELAND, FL FEB. 25-26, 2022 25 EVENT SCHEDULE SPRING CARLISLE APRIL 21-25, 2021* PRESENTED BY EBAY MOTORS APRIL 20-24, 2022 26 EVENT MAP CARLISLE PA FAIRGROUNDS SPRING CARLISLE APRIL 22-23, 2021 COLLECTOR CAR AUCTION 28 VENDORS: BY SPECIALTY CARLISLE EXPO CENTER APRIL 21-22, 2022 IMPORT & PERFORMANCE NATS. MAY 14-15, 2021 VENDORS: A-Z 34 CARLISLE PA FAIRGROUNDS MAY 13-14, 2022 FORD NATIONALS JUNE 4-6, 2021* 40 ABOUT OUR PARTNERS PRESENTED BY MEGUIAR’S CARLISLE PA FAIRGROUNDS JUNE 3-5, 2022 HELPFUL INFORMATION & JUNE 25-26, 2021 43 POLICIES GM NATIONALS CARLISLE PA FAIRGROUNDS JUNE 24-25, 2022 44 CONCESSIONS CHRYSLER NATIONALS JULY 9-11, 2021* CARLISLE PA FAIRGROUNDS JULY 15-17, 2022 47 CARLISLE EVENTS APP TRUCK NATIONALS AUG. 6-8, 2021* PRESENTED BY A&A AUTO STORES 49 AD INDEX CARLISLE PA FAIRGROUNDS AUG. 5-7, 2022 CORVETTES AT CARLISLE AUG. 26-28, 2021 PRESENTED BY TOP FLIGHT AUTOMOTIVE 49 OUR TEAM CARLISLE PA FAIRGROUNDS AUG. 25-27, 2022 FALL CARLISLE SEPT.