Research Downtown Lures Two Big Tenant Relocations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rochester Blue Book 1928

Central Library of Rochester and Monroe County · Miscellaneous Directories V,ZP7. ROCHESTER V^SZ 30GIC Central Library of Rochester and Monroe County · Miscellaneous Directories NASH-GATES CO. NASH DISTRIBUTORS TWO RETAIL STORES 336 EAST AVENUE 775( CULVER ROAD Phones: Stone 804-805 Phones: Culver 2600-2601 32 (Thestnut Street-' M.D.JEFFREYS -^VOCuC^tCt*;TX.TJ. L. M. WEINER THE SPIRIT OF GOOD SERVICE AND UNEQUALED FACILITIES FOR ITS ACCOMPLISHMENT 2 Central Library of Rochester and Monroe County · Miscellaneous Directories 0 UNION ROCHESTER'S best families for over a quarter of a TRUST century have profitably em ployed tlie service of this COMPANY fifty-million dollar, five-branch, financial institution. Attractive separate depart ments for women. OFFICES Union Trust Building Main St eet at South Avenue Main Street at East Avenue OF Clifford and Joseph Avenues ROCHESTER 4424 Lake Avenue j^+*4^********4-+***+****+*4-+++++*++44'*+****++**-fc*4.*^ (dlfntrp 3Unuimf, 1 ROCHESTER, N,Y Bworattottfl. ijpahttB, Jforttn ani Jfflmuering flanta «S*THpTT,T*,f"f"Wwww**^************^*********^****** * 3 Central Library of Rochester and Monroe County · Miscellaneous Directories |imaiiyMMMMMiu«MM^ Phones: Main 1737-1738 Joseph A. Schantz Co. Furniture, Fire-Proof Storage and Packing of Household Goods AUTO VANS FOR OUT OF TOWN MOVING Office and Salesroom 253 St. Paul, cor. Central Avenue Central Crust Company ROCHESTER, N. Y. The "Friendly" Bank Capital, Surplus and Undivided Profits $1,500,000 Interest Paid on Special Deposits Safe Deposit Boxes for Rent Main Office Brighton Branch 25 MAIN STREET, EAST 1806 EAST AVENUE 4 Central Library of Rochester and Monroe County · Miscellaneous Directories B.FORMAN CD WOMEN'S, GIRLS' and INFANTS' APPAREL AND ALL ACCESSORIES Clinton Avenue South Rochester, N. -

X SUSAN DULING

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK -------------------------------------------------------x SUSAN DULING, MARGARET ANDERSON, and LAKEYA SEWER on behalf of themselves and all others similarly situated, Plaintiffs, -v- No. 06 Civ. 10197 (LTS)(HBP) GRISTEDE'S OPERATING CORP., et al., Defendants. -------------------------------------------------------x OPINION AND ORDER APPEARANCES: OUTTEN & GOLDEN,LLP MORGAN, LEWIS & BOCKIUS LLP By: Adam T. Klein, Esq. By: Michael J. Puma, Esq. Justin M. Swartz, Esq. Amber L. Kagan, Esq. Cara E. Greene, Esq. 101 Park Avenue 3 Park Avenue, 29th Floor New York, New York 10178 New York, New York 10016 FINKEL GOLDSTEIN ROSENBLOOM & NASH LLP By: Kevin J. Nash, Esq. 26 Broadway, Suite 711 New York, NY 10004 Attorneys for Plaintiffs Attorneys for Defendants LAURA TAYLOR SWAIN, United States District Judge GRISTEDES CLASS CERT.WPD VERSION 3/8/10 1 Plaintiffs Susan Duling, Margaret Anderson, and Lakeya Sewer (collectively “Plaintiffs”) bring this action on behalf of themselves and all others similarly situated, asserting intentional discrimination and disparate impact claims for violations of Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e et seq. (“Title VII”), the New York State Human Rights Law, N.Y. Exec. L. § 296 et seq. (“NYSHRL”), and the New York City Human Rights Law, N.Y.C. Admin. Code § 8-101 et seq. (“NYCHRL”), by defendants Gristede’s Operating Corp., Red Apple Group, Inc., d/b/a Gristede’s, Gristede’s Foods, Inc., Gristede’s Delivery Service, Inc., Gristede’s Foods NY, Inc., Gristede’s NY, LLC, Namdor, Inc., and John Catsimatidis (collectively “Gristede’s” or “Defendants”). Sewer also asserts individual claims for interference with her restoration rights under the Family and Medical Leave Act, 29 U.S.C. -

Park Ave Noise Assessment

Final Environmental Impact Statement for the Proposed Emergency Ventilation Plant for the Lexington Avenue Subway Line between the 33rd Street/Park Avenue South Station and the Grand Central Station/42nd Street Station July 2017 MTA New York City Transit Proposed Emergency Ventilation Plant Lexington Avenue Subway Line This page intentionally blank. MTA New York City Transit Proposed Emergency Ventilation Plant Lexington Avenue Subway Line COVER SHEET Document: Final Environmental Impact Statement Project Title: Proposed Emergency Ventilation Plant for the Lexington Avenue Subway Line between 33rd Street/Park Avenue South Station and the Grand Central Terminal/42nd Street Station Location: The Proposed Emergency Ventilation Plant would be located in the streetbed of Park Avenue between East 36th Street and East 39th Street, New York City, New York County, New York Lead Agency: Metropolitan Transportation Authority New York City Transit (MTA NYCT), 2 Broadway, New York, NY 10004 Lead Agency Contact: Mr. Emil F. Dul P.E., Principal Environmental Engineer, New York City Transit, phone 646-252-2405 Prepared by: Michael Tumulty, Vice President STV Group; Steven P. Scalici, STV Group; Patrick J. O’Mara, STV Group; Douglas S. Swan, STV Group; Niek Veraart, Vice President, Louis Berger; G. Douglas Pierson, Louis Berger; Leo Tidd, Louis Berger; Jonathan Carey, Louis Berger; Steve Bedford, Louis Berger; Allison Fahey, Louis Berger; Cece Saunders, President, Historical Perspectives, Inc.; Faline Schneiderman, Historical Perspectives, Inc. Date of -

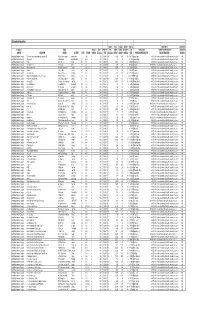

193R Application Spreadsheet

193R Application Spreadsheet GROUP TOTAL ELIGIBLE NUMBER ORIGINAL PRODUCER OR EXPERIENCE INSURANCE STREET AUTO (A) or RATE EFFECTIVE TYPE NUMBER NUMBER OF CURRENT PLAN PRODUCER OR MARKETING REPRESENTATIVE SUBMITTED COMPANY GROUP NAME ADDRESS CITY/TOWN STATE ZIP CODE HOME (H) DEV. (0.0%) DATE (CU, E, M, U) IN GROUP IN GROUP INSUREDS DATE MARKETING REPRESENTATIVE CONTACT INFORMATION YES OR NO Liberty Mutual Insurance Company 360 Federal Credit Union dba Hamilton Sundstrand FCU 191 Ella Grasso Turnpike Windsor Locks CT 06096 A 5.00% 1/1/2013 CU 17,100 3,596 122 12/1/1998 Cristina Sayre (888)538-2146 or call a Liberty Mutual Sales Office. www.libertymutual.com NO Liberty Mutual Insurance Company 3balls.com, Inc. 220 Nahatan St West Bridgewater MA 02379 A 5.00% 1/1/2013 E 75 75 4 10/17/2011 Shannon Krappe (888)538-2146 or call a Liberty Mutual Sales Office. www.libertymutual.com NO Liberty Mutual Insurance Company 3M Inc. 3M Center St. Paul MN 55144 A 5.00% 1/1/2013 E 55,001 668 51 9/30/2009 Kimberly Knecht (888)538-2146 or call a Liberty Mutual Sales Office. www.libertymutual.com NO Liberty Mutual Insurance Company A123 Systems, Inc. 20 West Street Waltham MA 02451 A 5.00% 1/1/2013 E 1,100 350 1 10/10/2012 Cheryl Mix (888)538-2146 or call a Liberty Mutual Sales Office. www.libertymutual.com NO Liberty Mutual Insurance Company Abbott Laboratories Inc. 4611 N. Ravenswood Ave Chicago IL 60064-6223 A 5.00% 1/1/2013 E 10,000 70 59 5/1/2008 Gail Butler (888)538-2146 or call a Liberty Mutual Sales Office. -

Business Taxable OMB No

EXTENDED TO NOVEMBER 16, 2020 Return of Private Foundation OMB No. 1545-0047 Form 990-PF or Section 4947(a)(1) Trust Treated as Private Foundation | Do not enter social security numbers on this form as it may be made public. Department of the Treasury 2019 Internal Revenue Service | Go to www.irs.gov/Form990PF for instructions and the latest information. Open to Public Inspection For calendar year 2019 or tax year beginning , and ending Name of foundation A Employer identification number NEWMAN'S OWN FOUNDATION 06-1606588 Number and street (or P.O. box number if mail is not delivered to street address) Room/suite B Telephone number ONE MORNINGSIDE DRIVE NORTH 203-222-0136 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is pending, check here ~ | WESTPORT, CT 06880 G Check all that apply: Initial return Initial return of a former public charity D 1. Foreign organizations, check here ~~ | Final return Amended return 2. Foreign organizations meeting the 85% test, Address change Name change check here and attach computation ~~~~ | H Check type of organization: X Section 501(c)(3) exempt private foundation E If private foundation status was terminated Section 4947(a)(1) nonexempt charitable trust Other taxable private foundation under section 507(b)(1)(A), check here ~ | I Fair market value of all assets at end of year J Accounting method: Cash X Accrual F If the foundation is in a 60-month termination (from Part II, col. (c), line 16) Other (specify) under section 507(b)(1)(B), check here ~ | | $ 228,783,632. -

Manhattan Year BA-NY H&R Original Purchaser Sold Address(Es)

Manhattan Year BA-NY H&R Original Purchaser Sold Address(es) Location Remains UN Plaza Hotel (Park Hyatt) 1981 1 UN Plaza Manhattan N Reader's Digest 1981 28 West 23rd Street Manhattan Y NYC Dept of General Services 1981 NYC West Manhattan * Summit Hotel 1981 51 & LEX Manhattan N Schieffelin and Company 1981 2 Park Avenue Manhattan Y Ernst and Company 1981 1 Battery Park Plaza Manhattan Y Reeves Brothers, Inc. 1981 104 W 40th Street Manhattan Y Alpine Hotel 1981 NYC West Manhattan * Care 1982 660 1st Ave. Manhattan Y Brooks Brothers 1982 1120 Ave of Amer. Manhattan Y Care 1982 660 1st Ave. Manhattan Y Sanwa Bank 1982 220 Park Avenue Manhattan Y City Miday Club 1982 140 Broadway Manhattan Y Royal Business Machines 1982 Manhattan Manhattan * Billboard Publications 1982 1515 Broadway Manhattan Y U.N. Development Program 1982 1 United Nations Plaza Manhattan N Population Council 1982 1 Dag Hammarskjold Plaza Manhattan Y Park Lane Hotel 1983 36 Central Park South Manhattan Y U.S. Trust Company 1983 770 Broadway Manhattan Y Ford Foundation 1983 320 43rd Street Manhattan Y The Shoreham 1983 33 W 52nd Street Manhattan Y MacMillen & Co 1983 Manhattan Manhattan * Solomon R Gugenheim 1983 1071 5th Avenue Manhattan * Museum American Bell (ATTIS) 1983 1 Penn Plaza, 2nd Floor Manhattan Y NYC Office of Prosecution 1983 80 Center Street, 6th Floor Manhattan Y Mc Hugh, Leonard & O'Connor 1983 Manhattan Manhattan * Keene Corporation 1983 757 3rd Avenue Manhattan Y Melhado, Flynn & Assocs. 1983 530 5th Avenue Manhattan Y Argentine Consulate 1983 12 W 56th Street Manhattan Y Carol Management 1983 122 E42nd St Manhattan Y Chemical Bank 1983 277 Park Avenue, 2nd Floor Manhattan Y Merrill Lynch 1983 55 Water Street, Floors 36 & 37 Manhattan Y WNET Channel 13 1983 356 W 58th Street Manhattan Y Hotel President (Best Western) 1983 234 W 48th Street Manhattan Y First Boston Corp 1983 5 World Trade Center Manhattan Y Ruffa & Hanover, P.C. -

3 Park Avenue 29Th Floor Shared Office Space

3 PARK AVENUE 29TH FLOOR SHARED OFFICE SPACE ROBERT BURKE ASSOCIATES | 3 PARK AVENUE, NEW YORK, NY 10016 | 212.750.4680 | WWW.ROBERTBURKEASSOCIATES.COM QUICK FACTS ● Located at 3 Park Avenue, 29th Floor ● Office newly built and designed by award-winning BR Design Associates ● Flexible space agreement & customizable options (for individuals and organizations up to 12 employees) ○ Up to three 9 x 11 sq ft private offices with custom office desk ○ Up to nine workstations ○ Private conference room available ● Enhanced social distancing measures ○ Teams can practice healthy social distancing in the workplace from colleagues and members; 9ft office desk dimension ● High-speed internet and phone service (international and domestic) ● Usage of commercial color printer ● Kitchen usage ● No additional utilities expenses ● Cleaning and trash removal services ROBERT BURKE ASSOCIATES | 3 PARK AVENUE, NEW YORK, NY 10016 | 212.750.4680 | WWW.ROBERTBURKEASSOCIATES.COM LOCATION 3 Park Avenue is located in the Midtown South neighborhood in Grand Central Manhattan. The building was built in 1977 and is 42 stories tall. Terminal The building is centrally located offering easy access to: Penn Station - Park Avenue South - Grand Central Station 10 min walk - NoMad 10 min walk - Murray Hill - Herald Square - Union Square ROBERT BURKE ASSOCIATES | 3 PARK AVENUE, NEW YORK, NY 10016 | 212.750.4680 | WWW.ROBERTBURKEASSOCIATES.COM BUILDING LOBBY New Lobby - Starbucks and Le Pain Quotidien with connected entrances ROBERT BURKE ASSOCIATES | 3 PARK AVENUE, NEW YORK, NY 10016 -

East Harlem, Manhattan (September 2016)

PLACE-BASED COMMUNITY BROWNFIELD PLANNING FOUNDATION REPORT ON EXISTING CONDITIONS EAST HARLEM, MANHATTAN FINAL SEPTEMBER 2016 BILL deBLASIO MAYOR DANIEL C. WALSH, Ph.D. DIRECTOR Mayor’s Office of Environmental Remediation This document was prepared by the New York City Department of City Planning for the New York City Mayor’s Office of Environmental Remediation and the New York State Department of State with state funds provided through the Brownfield Opportunity Areas Program. CONTENTS PURPOSE 4 EXECUTIVE SUMMARY 5 PART ONE Geography and Land Use 10 Demographic and Economic Profile 28 Recent Public Initiatives and Private Investments 35 PART TWO Environmental Conditions 41 Potential Strategic Sites 43 KEY FINDINGS AND NEXT STEPS 57 APPENDIX 58 PURPOSE This existing conditions foundation report was commissioned by the New York City Mayor’s Office of Environmental Remediation (OER) to help community members and community-based organizations (CBO’s) conduct place-based planning for revitalization of vacant and underutilized brownfield properties. Place- based planning by community groups is supported by OER under the NYC Place-Based Community Brownfield Planning Program and by the New York State Department of State in the Brownfield Opportunity Area Program. To advance implementation of plans, OER provides financial and technical assistance to CBO’s for cleanup and redevelopment of brownfield properties and seeks to help people foster greater health and well-being in their neighborhoods. Brownfields are vacant or underutilized properties where environmental pollution has deterred investment and redevelopment. Pollution introduces many risks to land development and often causes community and private developers to pass over these properties, especially in low-income neighborhoods where land values may be depressed and insufficient to cover added cleanup costs. -

The City Record

VOLUME CXLIII NUMBER 65 TUESDAY, APRIL 5, 2016 Price: $4.00 Asset Management . 1322 Education . 1322 THE CITY RECORD TABLE OF CONTENTS Contracts and Purchasing . 1322 BILL DE BLASIO Environmental Protection ������������������������ 1322 Mayor PUBLIC HEARINGS AND MEETINGS Agency Chief Contracting Office . 1322 City Planning �������������������������������������������� 1313 LISETTE CAMILO Wastewater Treatment . 1323 Commissioner, Department of Citywide Community Boards . 1317 Homeless Services . 1323 Administrative Services Franchise and Concession Review Fiscal and Procurement Operations . 1323 Committee . 1317 Housing Authority . 1323 ELI BLACHMAN Editor, The City Record Housing Authority . 1317 Supply Management . 1323 Office of Labor Relations �������������������������� 1317 Human Resources Administration . 1324 Published Monday through Friday except legal Landmarks Preservation Commission . 1317 Parks and Recreation �������������������������������� 1324 holidays by the New York City Department of Transportation ������������������������������������������ 1319 Transportation ������������������������������������������ 1325 Citywide Administrative Services under Authority of Section 1066 of the New York City Charter. PROPERTY DISPOSITION Transportation Planning and Management . 1325 Subscription $500 a year, $4.00 daily ($5.00 by Citywide Administrative Services ������������ 1320 mail). Periodicals Postage Paid at New York, N.Y. Triborough Bridge and Tunnel Authority . 1325 Office of Citywide Procurement . 1320 POSTMASTER: Send address -

1St Half FARA Report to Congress Ending June 30, 2007

U.S. Department of Justice . Washington, D.C. 20530 Report of the Attorney General to the Congress of the United States on the Administration of the . Foreign Agents Registration Act . of 1938, as amended, for the six months ending June 30, 2007 Report of the Attorney General to the Congress of the United States on the Administration of the Foreign Agents Registration Act of 1938, as amended, for the six months ending June 30, 2007 TABLE OF CONTENTS INTRODUCTION.................................................. 1-1 AFGHANISTAN......................................................1 ALGERIA..........................................................2 ANGOLA...........................................................3 ARMENIA..........................................................4 ARUBA............................................................5 AUSTRALIA........................................................6 AUSTRIA..........................................................7 AZERBAIJAN.......................................................8 BAHAMAS..........................................................9 BANGLADESH.......................................................10 BARBADOS.........................................................11 BELGIUM..........................................................12 BELIZE...........................................................13 BENIN............................................................14 BERMUDA..........................................................15 BOLIVIA..........................................................16 -

Manhattan Office Market

Manhattan Offi ce Market 1 ST QUARTER 2016 REPORT A NEWS RECAP AND MARKET SNAPSHOT Pictured: 915 Broadway Looking Ahead Finance Department’s Tentative Assessment Roll Takes High Retail Rents into Account Consumers are not the only ones attracted by the luxury offerings along the city’s prime 5th Avenue retail corridor between 48th and 59th Streets where activity has raised retail rents. The city’s Department of Finance is getting in on the action, prompting the agency to increase tax assessments on some of the high-profi le properties. A tentative tax roll released last month for the 2016-2017 tax year brings the total market value of New York City’s real estate to over $1 trillion — reportedly for the fi rst time. The overall taxable assessed values for the city would increase 8.10%. Brooklyn’s assessed values accounted for the sharpest rise of 9.83% from FY 2015/2016, followed by Manhattan’s 8.47% increase. Although some properties along the 5th Avenue corridor had a reduction in valuations the properties were primarily offi ce, not retail according to a reported analysis of the tentative tax roll details. Building owners have the opportunity to appeal the increase; but an unexpected rise in market value — and hence real estate taxes, will negatively impact the building’s bottom line and value. Typically tenants incur the burden of most of the tax increases from the time the lease is signed, and the landlord pays the taxes that existed before the signing; but in some cases the tenant increase in capped, leaving the burden of the additional expense on the landlord. -

Case 8-15-71074-Reg Doc 953 Filed 10/09/17 Entered 10/09/17 18:11:49

Case 8-15-71074-reg Doc 953 Filed 10/09/17 Entered 10/09/17 18:11:49 UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF NEW YORK ----------------------------------------------------------------- x In re : : Chapter 11 FEDERATION EMPLOYMENT AND GUIDANCE : SERVICE INC. d/b/a FEGS,1 : Case No. 15-71074 (REG) : Debtor. : : ---------------------------------------------------------------- x AFFIDAVIT OF SERVICE State of California ) ) ss County of Los Angeles ) I, Darleen Sahagun, being duly sworn, depose and says: 1. I am employed by Rust Consulting/Omni Bankruptcy, located at 5955 DeSoto Avenue, Suite 100, Woodland Hills, CA 91367. I am over 18 years of age and am not a party to this above-captioned adversary proceeding. 2. On October 6, 2017, I caused to be served the: a. Plan of Liquidation Under Chapter 11 of the Bankruptcy Code of Federation Employment and Guidance Service, Inc. d/b/a/ FEGS [Docket No. 949], (the “Plan”), b. Disclosure Statement on Plan of Liquidation Under Chapter 11 of the Bankruptcy Code of Federation Employment and Guidance Service, Inc. d/b/a/ FEGS [Docket No. 950], (the “Disclosure Statement”), c. Motion for Entry of an Order, (I) Approving Disclosure Statement; (II) Scheduling Hearing on Confirmation of the Plan; and (III) Approving Related Procedures and Relief [Docket No. 951], (the “Motion”), d. Notice of Hearing on Motion for Entry of an Order, (Approving Disclosure Statement; (II) Scheduling Hearing on Confirmation of the Plan; and (III) Approving Related Procedures and Relief [Docket No. 952], (the “Notice”). By causing true and correct copies to be served (i) via email to the parties listed in Exhibit A, (ii) via first class mail to the parties listed in Exhibit B, and (iii) via overnight mail by placing the documents in a sealed envelope, affixing a pre-paid air bill, and delivering envelopes to an overnight courier location in Los Angeles, California to the parties listed on the Service List in Exhibit C attached hereto: I.