Building an Edge with Technical Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Course Content

Course Content Basic Forex Education (12 Topics) Lesson Content 12 Steps Why Trade Forex When to Trade Forex Trading Terminology Or Where Am I Going Long How To Trade With Leverage Whats a PIP How To Place a Trade in Forex Types of Forex Orders Technical Analysis in Forex Fundamental Analysis in Forex Types of Forex Charts Support and Resistance in Forex Trendlines Fibonacci (4 Topics) Lesson Content 4 Steps Fibonacci Forex Fibonacci Extensions Learn Forex Fibonacci Fan and Arcs Learn Forex Combining Fibonacci With Other Technical Analysis Tools Understanding Candlesticks (13 Topics) Lesson Content 13 Steps Candlesticks Doji Candlestick in Forex Marubazu Candlestick in Forex Hammer and Hanging Man Candlesticks Shooting Star and Inverted Hammer Candlestick Bullish Piercing Pattern Dark Cloud Cover Pattern Bullish and Bearish engulfing patterns Tweezer Tops and Bottoms Morning and Evening Star Patterns 3 White Soldiers 3 Black Crows 3 Inside Up 3 Inside Down Pattern Rising and Falling Three Methods Chart Formation Patterns (13 Topics) Lesson Content 13 Steps Forex Double Top and Double Bottom Formation Patterns Learn Forex Head and Shoulders Pattern Forex Inverse Head and Shoulders Pattern Forex Bull Flag Formation Patterns Forex Bear Flag Patterns Forex Bullish and Bearish Pennant Formation Forex Falling Wedge Pattern Forex Ascending and Descending Triangle Formations Forex Symmetrical Triangle Pattern Forex Box Range Forex Cup and Handle Formation Pattern Forex Inverse Cup and Handle Pattern Forex Rising Wedge Pattern Forex Indicators -

Rising Wedge, Falling Wedge (PDF)

RISING WEDGE, FALLING WEDGE Rewarding patterns…provided you stay disciplined! Introduction The wedge is a very usual chartist pattern which is made of two converging trendlines that go in the same direction, both upwards or both downwards. As such, it can be immediately distinguished from a triangle. This pattern can be found on every timeframe, from the monthly charts to intraday price action. There are two sorts of wedges that have opposite consequences: Falling wedges, mostly completed following a sharp slump and which have a bullish implication, Rising wedges, which foreshadow a violent, downwards reversal phase. Their bearish bias is all the more pronounced since they are completed after a long period of time, and following a clear uptrend. But regarding most wedges as reversal patterns are just an opinion on our own. Many authors, however, consider that following the examples of triangles, pennants and flags, wedges are essentially continuation patterns, sloped against the trend. True, you can find falling wedges just in the middle of a bullish trend, or rising wedges within a bearish trend. A perfect example of continuation rising wedge made on the Japanese Topix index in 2007 is shown on the chart below. 1 Setting up precise figures on the continuation or reversal nature of wedges is hard and useless, we think. What is of more interest is that continuation wedges tend to complete in a generally shorter lapse of time than reversal wedges. Furthermore, the debate over the reversal/continuation nature of wedges is of minor importance as these patterns are overwhelmingly broken in the "natural" sense: downwards for a rising wedge, upwards for a falling wedge. -

Classic Patterns

CLASSIC PATTERNS TABLE OF CONTENTS Classic Patterns . Bullish Patterns: …………………………………………………………………………………………………………. 1 Ascending Continuation Triangle…………………………………………………………………….. 2 Bottom Triangle – Bottom Wedge…………………………………………………………………… 5 Continuation Diamond (Bullish) ……………………………………………………………………… 9 Continuation Wedge (Bullish) …………………………………………………………………………. 11 . Diamond Bottom…………………………………………………………………………………………….. 13 Double Bottom……………………………………………………………………………………………….. 15 Flag (Bullish) …………………………………………………………………………………………………… 19 . Head and Shoulders Bottom……………………………………………………………………………. 22 Megaphone Bottom………………………………………………………………………………………… 27 Pennant (Bullish) ……………………………………………………………………………………………. 28 Symmetrical Continuation Triangle (Bullish) …………………………………………………… 31 Triple Bottom………………………………………………………………………………………………….. 35 Upside Breakout……………………………………………………………………………………………… 39 Rounded Bottom…………………………………………………………………………………………….. 42 . Bearish Patterns…………………………………………………………………………………………………………. 45 Continuation Diamond (Bearish) …………………………………………………………………….. 46 Continuation Wedge (Bearish) ……………………………………………………………………….. 48 Descending Continuation Triangle…………………………………………………………………… 50 Diamond top…………………………………………………………………………………………………… 53 Double Top (Bearish) ……………………………………………………………………………………… 55 Downside Breakout…………………………………………………………………………………………. 60 Flag (Bearish) ………………………………………………………………………………………………….. 62 . Head and Shoulders top (Bearish) ………………………………………………………………….. 65 Megaphone Top……………………………………………………………………………………………… 71 Pennant -

7 Winning Strategies for Trading Forex

7 Winning Strategies for Trading Forex Grace Cheng 7 Winning Strategies for Trading Forex Many traders go around searching for that one perfect trading strategy that works all the time in the global FOREX (foreign exchange/currency) market. Frequently, they will complain that a strategy doesn’t work. Few people understand that successful trading of the FOREX market entails the application of the right strategy for the right market condition. Winning 7 Winning Strategies For Forex Trading covers: • Why people should be paying attention to the FOREX market, which is the world’s largest and most liquid financial market Strategies for • How understanding the structure of this market can be beneficial to the independent trader • How to overcome the odds and become a successful trader • How you can select high-probability trades with good entries and exits. Trading Forex Grace Cheng highlights seven trading strategies, each of which is to be applied in a unique way and is designed for differing market conditions. She shows how traders can use the various market conditions to their advantage by tailoring the strategy to suit each one. Real and actionable techniques This revealing book also sheds light on how the FOREX market works, how you can for profiting from the currency markets incorporate sentiment analysis into your trading, and how trading in the direction of institutional activity can give you a competitive edge in the trading arena. Grace Cheng This invaluable book is ideal for new and current traders wanting to improve their trading performance. Filled with practical advice, this book is a must-read for traders who want to know exactly how they can make money in the FOREX market. -

Jul/Aug 2009

CHART PATTERNS SECTORS MARKET UPDATE Yahoo! Developing Energy NASDAQ 100 A Bullish Triangle Consolidating Outperforms JULY/AUGUST 2009 US$7.95 .com THE MAGAZINE FOR INSTITUTIONAL AND PROFESSIONAL TRADERS TM CANTr YOU HANDLEaders THE DRAWDOWNS? Trading systems 101 10 EIGHT STRAIGHT WEEKS Two months of steady gains? 18 WILL DIAMONDS BREAK THE BANKS? Stopping the bulls in their tracks 20 short-TERM VIEW OF GOLD Fibonacci levels may affect price 25 COILS AND LEDGES The less volatile they are… 30 YAHOO GAPS UP Will the trend reversal breakout pull Yahoo higher? 35 WHAT BIG RALLY? XLF DAILY VS. XLF HOURLY Step back and look 39 APPLE ABOVE BAND Will the rally continue? 41 MAILING LABEL Change service requested service Change 98116-4499 WA ttle, Sea XLF, DAILY. Prices may form a higher low and XLF, HOURLY. Prices gap lower from the bearish diamond pattern as 4757 California Ave. SW Ave. California 4757 begin to channel high. negative divergence begins unraveling on the MACD. Traders.com page 2 • Traders • With The Higher Volatility And 300-500 Point Dow Moves In A Day, 3 Interviews At Why More and More Investors Trust My Day Trading Profi ts Are Approximately 4 Times Higher Than In 2007 Interview Mr. Jim Kane – A Trader Using AbleSys Software www.ablesys.com .com AbleTrend to Make Their Trading Decisions Mr. Jim Kane, How long have you been trading? What is the most important factor in trading? How does I have been trading, on and off, for 20 years. Several times AbleTrend help? I got so frustrated that I switched to mutual funds, but that Risk management. -

Financial Trading with Five Regularities of Nature: Scientific Guide to Price Action and Pattern Trading

some strong technical language. Table of Contents Introduction to Five Regularities in the Financial Market 1. Introduction to Technical Analysis 2. Introduction to Charting Techniques 3. The Five Regularities in the Financial Market 4. Random Process 5. Stationary Process 6. Equilibrium Process 7. Wave Process 8. Fractal-Wave Process 9. Equilibrium Wave Process 10. Equilibrium Fractal-Wave Process 11. Choice of trading strategy and Price Patterns 12. Peak Trough Analysis to visualize equilibrium fractal wave 13. Using Equilibrium Fractal Wave Index to Select Your Trading Strategy 14. Appendix-Equilibrium Fractal Wave Derived Patterns 15. References Price Action and Pattern Trading Overview on Practical Trading with the Fifth Regularity 1. Support and Resistance 1.1 Horizontal Support and Resistance 1.2 Diagonal Support and Resistance 1.3 Identification of Support and Resistance with the Template and Pattern Approach 2. Trading with Equilibrium Fractal Wave 2.1 Introduction to EFW Index for trading 2.2 Trading with the shape ratio of equilibrium fractal wave 2.3 Introduction to Equilibrium Fractal Wave (EFW) Channel 2.4 Practical trading with Equilibrium Fractal Wave (EFW) Channel 2.5 Combining the shape ratio trading and (EFW) Channel 3. Harmonic Pattern 3.1 Introduction to Harmonic Pattern 3.2 Harmonic Pattern Trading 3.3 Pattern Matching Accuracy and Pattern Completion Interval 3.4 Potential Reversal Zone 4. Elliott Wave Trading 4.1 Introduction to the Wave Principle 4.2 Scientific Wave Counting with the Template and Pattern Approach 4.3 Impulse Wave Structural Score and Corrective Wave Structural Score 4.4 Channelling Techniques 5. Triangle and Wedge Patterns 5.1 Introduction to Triangle and Wedge patterns 5.2 Classic Perspective of Triangle and Wedge Patterns 5.3 Diagonal Support and Resistance Perspective of Triangle and Wedge Pattern 5.4 Elliott Wave Perspective of Triangle and Wedge Pattern 6. -

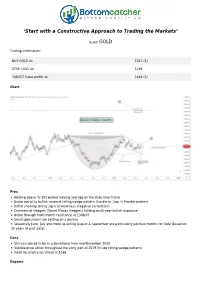

With a Constructive Approach to Trading the Markets’

‘Start with a Constructive Approach to Trading the Markets’ Asset: GOLD Trading Information: BUY GOLD at: 1311 (1) STOP LOSS at: 1289 TARGET (take profit) at: 1484 (2) Chart Pros Holding above its 200 period moving average on the daily time frame Broke out of its bullish reversal falling wedge pattern (handle of, Cup 'n' Handle pattern) Dollar showing strong signs of weakness (negative correlation) Commercial Hedgers (Smart Money Hedgers) holding multi-year bullish exposure Broke through multi-month resistance at 1306/07 Small speculators are betting on a decline Seasonally June, July and more so during August & September are particularly positive months for Gold (based on 30 years of past data) Cons Still considered to be in a downtrend from mid-November 2020 Volatile price action throughout the early part of 2019 (Inside falling wedge pattern) Good resistance up ahead at 1365 Reports A good risk vs reward trade set-up here for Gold. Many fundamental and technical factors contributing to further upside in the coming weeks. Bottomcatcher's Opinion: Our buy signal triggered shortly after Gold broke out of its Falling Wedge pattern to the upside also completing the Cup 'n' Handle pattern. A variety of indicators (not shown on chart) are showing reliable signs of curling from there lows to the upside. A bullish convergence is also in play on the Relative Strength Index. My call for this trade is to... Take a Long (buy) position at 1311 (1) with a stop loss placed at 1289. And our target is at 1484, which is also the 50% Fibonacci Retracement level taken from the highs of September 2011 and the lows of December 2015. -

FX Summary: Technical Views Relative Performance Over the Past

FX | Retail Research | 15 May, 2020 FX Summary: Technical Views FX USDSGD EURUSD GBPUSD USDCAD AUDUSD NZDUSD USDCHF USDJPY Medium Term Long Short Short Neutral Short Short Short Short Short Term Long Neutral Short Neutral Short Short Neutral Neutral Relative Performance over the past 12 months Figure 1: FX Performance Daily Timeframe Source: Bloomberg, CGS-CIMB RESEARCH FX Price 1M % Change 3M % Change 6M % Change 12M % Change USDSGD 1.4235 0.68% 2.24% 4.52% 3.99% EURUSD 1.0805 -1.59% -0.24% -1.97% -3.56% GBPUSD 1.2230 -3.11% -6.26% -5.06% -5.23% USDCAD 1.4050 1.20% 6.02% 6.05% 4.37% AUDUSD 0.6462 0.31% -3.75% -4.77% -6.94% NZDUSD 0.6003 -1.69% -6.76% -5.92% -8.71% USDJPY 107.25 0.03% -2.30% -1.08% -2.15% USDCHF 0.973 1.36% -0.94% -1.51% -3.53% DXY 100.47 1.60% 1.35% 2.35% 3.01% Price as of Thursday 14th May 2020, closing price. DXY is the US Dollar Index benchmark Analyst(s) LIM Say Boon T (852) 2532 1116 E [email protected] Benjamin CHAN T (65) 6210 8848 E [email protected] Please read carefully the important disclosures at the end of this publication. FX | Retail Research | 15 May, 2020 Dollar Makes Selective Comeback – Focus on Aussie Easing of risk appetites on equities markets has helped the US Dollar Index DXY stage a rebound. But the strengthening is at this stage still tentative and selective. -

Wedge Pattern Breakouts: Explosive Winning Trades

Wedge Pattern Breakouts: Explosive Winning Trades Prices move in patterns! This is due to one basic investment truism. Human nature exhibits the same habits when it comes to managing investment funds which are at risk. Investor sentiment reacts the same way time after time. This is why patterns can be recognized. The Wedge formation is a pattern that incorporates very simple facets as far as the conviction between the Bulls and the Bears. The pattern illustrates a diminished oscillation as trading progresses. Visually, the pattern is recognized by witnessing two trend lines converging. The trend lines are formed by connecting the peaks of the trading range on the upside, and the bottoms of the trading range at the lower end of the wedge formation. The direction of the wedge can create a Falling Wedge, a Rising Wedge, or a Horizontal Wedge. Falling Wedge A Falling Wedge has the elements of the highs (peaks) consistently moving lower. The lows can be in a downward direction, but don’t necessarily need to be in a direction. The peaks consistently forming lower and the lows in a downward direction, or trading flat, will still reveal the trend lines compressing to a point. Rising Wedge A Rising Wedge is made up of the points of higher consecutive lows with the trading range peaks either moving upwards or remaining flat. In either case, the trend lines are converging. When the trading range compresses, usually to a very small range, more scrutiny should be put into analyzing the candlestick signals at those levels. Horizontal Wedge The Horizontal Wedge reveals important information to the investor. -

Harmonic Patterns

Legal Notices and Disclaimer: Trade Chart Patterns Like The Pros - 2007 ALL RIGHTS RESERVED No part of this book may be reproduced or transmitted without the express written consent of the author and the publisher. This book relies on sources and information reasonably believed to be accurate, but neither the author nor publisher guarantees accuracy or completeness. Trading is risky. You are 100% responsible for your own trading. The author, Suri Duddella, specifically disclaims any and all express and implied warranties. Your trades may entail substantial loss. Nothing in this book should be construed as a recommendation to buy or sell any security or other instrument, or a determination that any trade is suitable for you. The examples in this book could be considered hypothetical trades. The CFTC warns that: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT AlVY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. -

NIFTY Nifty50 on the Daily Chart Continues to Trade in a Downward Sloping Channel Pattern and the Width of the Channel Is Almos

Date: 17th MAY 2021 NIFTY Nifty50 on the daily chart continues to trade in a downward sloping channel pattern and the width of the channel is almost a thousand points henceforth prices are trading within a band of 14100 to 15100 levels. The index has broken out its Rising channel pattern on the weekly chart and has most likely completed its pullback near its trend line resistance. After trading within the rising channel pattern for more than 12 months, the index registered a decisive breakdown that suggests if prices continued to trade below their trend line resistance then there will a change in the trend from upward to negative. INDIA VIX is reading in a range between 16.50 – 24 levels and currently hovering around 20.27 levels. If VIX moves above 23, then it might test the upper band of the channel at 25 levels. Indian bourses on the daily chart are trading above their 100-day exponential moving average which is placed above the lower band of the channel pattern acting as a crucial support zone for the index. We expect Nifty to trade with a sideways to negative bias as prices have prices has taken a stiff resistance near the upper band of the pattern. Support for the Index is placed at 14450 levels while resistance rests near 14950 post-break of the level will open the gate for 15100 levels. Bonanza Research Team |1 BANK NIFTY NIFTY BANK Bank Nifty on the weekly chart has engulfed its previous week's candle and has formed a bearish engulfing candlestick pattern near the downward slanting trend line resistance. -

Chart Patterns and Technical Indicators

Flags and Pennants Flags and Pennants are short-term continuation patterns that mark a small consolidation before the previous move resumes. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a mid- point of the move. 1. Sharp Move: To be considered a continuation pattern, there should be evidence of a prior trend. Flags and pennants require evidence of a sharp advance or decline on heavy volume. These moves usually occur on heavy volume and can contain gaps. This move usually represents the first leg of a significant advance or decline and the flag/pennant is merely a pause. 2. Flagpole: The flagpole is the distance from the first resistance or support break to the high or low of the flag/pennant. The sharp advance (or decline) that forms the flagpole should break a trendline or resistance/support level. A line extending up from this break to the high of the flag/pennant forms the flagpole. 3. Flag: A flag is a small rectangle pattern that slopes against the previous trend. If the previous move was up, then the flag would slope down. If the move was down, then the flag would slope up. Because flags are usually too short in duration to actually have reaction highs and lows, the price action just needs to be contained within two parallel trendlines. 4. Pennant: A pennant is a small symmetrical triangle that begins wide and converges as the pattern matures (like a cone). The slope is usually neutral. Sometimes there will not be specific reaction highs and lows from which to draw the trendlines and the price action should just be contained within the converging trendlines.