DBA's Analysis of Salient Human Rights Issues in the Palm Oil Value

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AD Monitoring Sheet PALM OIL V2018-1002

- Palm Oil - Date: 20 June 2018 The Amsterdam Declarations towards deforestation-free and sustainable commodities were launched in 2015. Denmark, France, Germany, Italy, the Netherlands, Norway and the United Kingdom signed these declarations. The Amsterdam Declaration regarding palm oil supports the private sector-driven commitment towards 100% sustainable palm oil in Europe that was signed by European initiatives for sustainable palm oil (ESPO). Relevant private sector rela ted alliances and Status of palm oil production and European organisations import • ESPO – European Sustainable Palm Oil initiative: The main producer countries are Indonesia (over 50% of includes national alliances from eight European global production and 50% of European imports in 2017) countries and Caobisco (Association of Chocolate, and Malaysia (around 30% of global production and 22% Biscuit and Confectionery Industries of Europe ), of European imports in 2017). In Indonesia, palm oil is FEDIOL (European Vegetable Oil and Protein meal mainly planted and expanding on the islands of Sumatra, Industry Federation) and IMACE (European Kalimantan and Papua. Palm oil is also expanding into Margarine Association). Papua New Guinea. In Malaysia, palm oil is mainly • ESPOAG – European Sustainable Palm Oil Advocacy planted in West Malaysia and Sabah. Both Kalimantan Group. and Sabah are situated on the island of Borneo. Not all • Voluntary certification schemes: Round Table for palm oil is traded on the world market. In 2017, Sustainable Palm Oil (RSPO), International Indonesia produced 42 million tons and exported 31.1 Sustainability and Carbon Certification (ISCC), million tons (74%). The largest palm oil importers were Rainforest Alliance (RA). India, EU28 and China. In 2017, the AD countries • Mandatory certification schemes: Indonesian accounted for 71% of total European palm oil import. -

Moment of Truth

COUNTDOWN MOMENTTO EXTINCTIONOF WILL GLOBALTRUTH BRANDS CLEAN UP THE PALM OIL TRADE BEFORE 2020? TIME FOR BRANDS TO COME CLEAN ABOUT THEIR LINKS TO FOREST DESTRUCTION FOR PALM OIL A FROM? COMES PALM OIL WHO THEIR DISCLOSE BRANDS WHICH TRADERS/ SUPPLIERS MILLS/ PRODUCERS 100% CLEAN PALM OIL CONTENTS CRUNCH TIME FOR CLIMATE COMMITMENTS 1 THE HIGH PRICE OF CHEAP PALM OIL 5 ARE CORPORATE COMMITMENTS MORE THAN HOT AIR? 9 HOW TRADERS SCORED ON NDPE IMPLEMENTATION 11 BRANDS ADMIT LINKS TO RAINFOREST DESTRUCTION 12 CONFRONTING THE BRANDS WITH EVIDENCE 15 HOW CONSUMER BRANDS ARE LINKED TO FOREST DESTROYERS 16 FELDA/FELDA GLOBAL VENTURES (FGV) 18 SALIM GROUP 20 SAMLING GROUP 22 TIME FOR ACTION 24 BRANDS MUST DISCLOSE WHERE THEIR PALM OIL COMES FROM... 26 ...AND TAKE CONTROL OF THEIR SUPPLY CHAINS 27 COUNTDOWN TO 2020 29 DEMANDS 31 APPENDIX 1: HOW COMPANIES PERFORM ON TRANSPARENCY 32 APPENDIX 2: LITERATURE REVIEW 42 ENDNOTES 48 REFERENCES 52 ‘ Whilst the causes of deforestation are complex, it is generally acknowledged that the biggest drivers are the cultivation of soya and palm oil, logging for the production of paper and board and the rearing of cattle. All of these commodities are major ingredients in the supply chains of most consumer goods companies. Our member companies drive the demand for these commodities and have an opportunity to ensure that the sourcing of these ingredients does not contribute to deforestation.’1 CONSUMER GOODS FORUM ‘The unsustainable use of natural resources has caused a dramatic decline of Bornean orangutans ... Our findings suggest that more than 100,000 individuals have been lost in the 16 years between 1999 and 2015.’2 MARIA VOIGHT, RESEARCHER AT THE MAX PLANCK INSTITUTE FOR EVOLUTIONARY ANTHROPOLOGY D 11 DECEMBER 2016, 1°3 0 46́ ̋ S 110°15 28́ ̋ E: DRONE FOOTAGE REVEALS A NEW CANAL CUTTING INTO PEATLAND FOREST FROM THE PT DAMAI AGRO SEJAHTERA (PT DAS) OIL PALM CONCESSION WITHIN THE SUNGAI PUTRI PEATLAND LANDSCAPE OF KETAPANG DISTRICT, WEST KALIMANTAN. -

Environmental Impacts and Costs of Hydrotreated Vegetable Oils, Transesterified Lipids and Woody BTL—A Review

Energies 2011, 4, 845-877; doi:10.3390/en4060845 OPEN ACCESS energies ISSN 1996-1073 www.mdpi.com/journal/energies Review Environmental Impacts and Costs of Hydrotreated Vegetable Oils, Transesterified Lipids and Woody BTL—A Review Kathrin Sunde 1;?, Andreas Brekke 2 and Birger Solberg 1 1 Department of Ecology and Natural Resource Management, Norwegian University of Life Sciences, Sørhellinga, Høgskoleveien 12, 1430 As,˚ Norway; E-Mail: [email protected] 2 Østfoldforskning AS, Gamle Beddingv. 2B, 1671 Krakerøy,˚ Norway; E-Mail: [email protected] ? Author to whom correspondence should be addressed; E-Mail: [email protected]; Tel.: +47-64965759; Fax: +47-64965001. Received: 1 February 2011; in revised form: 30 March 2011 / Accepted: 19 May 2011 / Published: 25 May 2011 Abstract: This article reviews and compares assessments of three biodiesel fuels: (1) transesterified lipids, (2) hydrotreated vegetable oils (HVO), and (3) woody biomass-to-liquid (BTL) Fischer-Tropsch diesel and selected feedstock options. The article attempts to rank the environmental performance and costs of fuel and feedstock combinations. Due to inter-study differences in goal and study assumptions, the ranking was mostly qualitative and intra-study results are emphasized. Results indicate that HVO made from wastes or by-products such as tall oil, tallow or used cooking oil outperforms transesterified lipids and BTL from woody material, both with respect to environmental life cycle impacts and costs. These feedstock options are, however, of limited availability, and to produce larger volumes of biofuels other raw materials must also be used. BTL from woody biomass seems promising with good environmental performance and the ability not to compete with food production. -

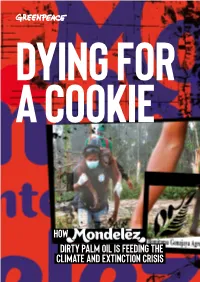

How Dirty Palm Oil Is Feeding the Climate and Extinction

DYING FOR A COOKIE HOW DIRTY PALM OIL IS FEEDING THE CLIMATE AND EXTINCTION CRISIS ‘Wearetakingstepstoensurethatthepalmoilwebuyisproduced onlegallyheldland,doesnotleadtodeforestationorlossofpeat land,respectshumanrights,includinglandrights,anddoesnot useforcedorchildlabor.’ Mondelēz International Palm Oil Action Plan, June 2014 11 December 2016, PT Ladang Sawit Mas, 1°32’20.856”S 110°18’58.122”E: ©Ifansasti/Greenpeace Cover and right: March 2013, PT Ladang Sawit Mas:One of several orangutan rescue attempts by International Animal Rescue Indonesia in the Bumitama oil palm concession. ‘Theunsustainable useofnatural resourceshas causedadramatic declineofBornean orangutans[...]Our findingssuggest thatmorethan 100,000individuals havebeenlostinthe 16yearsbetween 1999and2015.’ Maria Voigt, researcher at the Max Planck Institute for Evolutionary Anthropology, September 2017 CONTENTS CALLING TIME ON MONDELēZ 1 EYES WIDE SHUT: HOW CONSUMER BRANDS AND THE RSPO SUPPORT THE TRADE IN DIRTY PALM OIL 2 BUMITAMA AND ITS DIRTY SECRETS 5 Bumitama’s ownership, structure and landbank 4 Quantifying Bumitama’s forest loss liability 7 Bumitama’s and IOI’s response 7 CRUNCH TIME FOR MONDELĒZ AND THE PALM OIL SECTOR 8 BUMITAMA’S LAUNDERING OF A TOXIC LEGACY 12 Associated parties 13 Citro Utomo 13 Djoni Rusmin and Tommy Santoso 14 Nita Gartika and Janta Halim 16 CASE STUDIES 20 PT Gunajaya Harapan Lestari (PT GHL), West Kalimantan 20 PT Hatiprima Agro (PT HPA), Central Kalimantan 22 PT Golden Youth Plantation Indonesia (PT GYP) and PT Ladang Sawit Mas (PT LSM), -

Current Knowledge on Interspecific Hybrid Palm Oils As Food and Food

foods Review Current Knowledge on Interspecific Hybrid Palm Oils as Food and Food Ingredient Massimo Mozzon , Roberta Foligni * and Cinzia Mannozzi * Department of Agricultural, Food and Environmental Sciences, Università Politecnica delle Marche, Via Brecce Bianche 10, 60131 Ancona, Italy; m.mozzon@staff.univpm.it * Correspondence: r.foligni@staff.univpm.it (R.F.); c.mannozzi@staff.univpm.it (C.M.); Tel.: +39-071-220-4010 (R.F.); +39-071-220-4014 (C.M.) Received: 6 April 2020; Accepted: 10 May 2020; Published: 14 May 2020 Abstract: The consumers’ opinion concerning conventional palm (Elaeis guineensis) oil is negatively affected by environmental and nutritional issues. However, oils extracted from drupes of interspecific hybrids Elaeis oleifera E. guineensis are getting more and more interest, due to their chemical and × nutritional properties. Unsaturated fatty acids (oleic and linoleic) are the most abundant constituents (60%–80% of total fatty acids) of hybrid palm oil (HPO) and are mainly acylated in position sn-2 of the glycerol backbone. Carotenes and tocotrienols are the most interesting components of the unsaponifiable matter, even if their amount in crude oils varies greatly. The Codex Committee on Fats and Oils recently provided HPO the “dignity” of codified fat substance for human consumption and defined the physical and chemical parameters for genuine crude oils. However, only few researches have been conducted to date on the functional and technological properties of HPO, thus limiting its utilization in food industry. Recent studies on the nutritional effects of HPO softened the initial enthusiasm about the “tropical equivalent of olive oil”, suggesting that the overconsumption of HPO in the most-consumed processed foods should be carefully monitored. -

4.1 Cocos Nucifera Coconut

4.1 Cocos nucifera Coconut Valerie Hocher, [ean-Luc Verdeil and Bernard Malaurie IRD/CIRAD Coconut Program, UMR 1098 BEPC, IRD, BP 64501-911 Av. Agropolis, 34394 Montpellier, Cedex 5, France 1. Introduction length and 30-120 cm deep and continu ously generate adventitious roots (Reynolds, 1.1. Botany and history 1988; Persley, 1992). Nutrients and water are absorbed by the rootlets. The coconut palm (Cocos nucifera L.) is a rela The coconut palm 'trunk' is a stem with tively slow growing woody perennial species. no true bark, no branches and no cambium. It is the only species in the genus Cocos. All Secondary growth (increased stem diameter) forms known to date are diploid (2n = 2x = is by secondary enlargement meristem 32). No closely related species with even par located below the shoot meristem. Growth tial interfertility has been reported (Bourdeix depends on age, ecotype and edaphic condi et al., 2001). The lifespan of a coconut palm tions, but is generally between 30 and 100 cm can be > 60 years under favourable ecological per annum. The stem is surmounted by a conditions. Coconuts can grow to a height of crown of approx. 30 compound leaves, approx. 25 m (Ohler, 1999). which protect the terminal vegetative bud Optimum growing conditions for coconut and whose destruction causes the death of are in the lowland humid tropics at altitudes the palm. An adult coconut has virtually as < 1000 m near coastal areas in sandy, weII many unopened (20-30) as opened leaves. drained soils (Persley, 1992); however, Leaves are produced continuously at approx. -

Sustainable Palm Derivatives in Cleaning and Personal Care Products

Sustainable Palm Derivatives in Cleaning and Personal Care Products A CPET Special Newsletter July 2015 The Purpose of this Special Newsletter This newsletter is meant to provide information and guidance to businesses and government departments on sourcing cleaning products and personal care products made with sustainable palm oil derivatives. It outlines the complexities in the derivatives supply chain, explains why sustainable palm-based derivatives have been difficult to source in the past, and provides a quick guide to sourcing certified derivatives. Introduction to Palm-based Derivative Supply Chain Palm oil and palm kernel oil are complex commodities because of the demand for a large number of fractions and derivatives of the oils. In fact, about 60% of the palm oil and palm kernel oil consumed globally is in the form of derivatives such as olein and stearin.1 The supply chains for these derivatives are multi-layered and have been historically difficult to trace. Although traceability is improving, the derivatives can be challenging to source as sustainable. Oleochemicals, which are produced from the fatty acid distillates that result from the refining process of palm oil and palm kernel oil, are typically used in the production of cleaning products and personal care products. Palm based oleochemicals have a diverse range of applications. In the past decade, many European manufacturers and traders have shifted towards the use of palm-derived oleochemicals (as opposed to petrochemicals or other plant based oleochemicals), due to the increase in the number of plants in Southeast Asia with access to palm feedstocks. The environmental and social repercussions of this shift in usage, and the parallel significant increase in oil palm plantations in Southeast Asia, have been dramatic, leading to deforestation, climate change, habitat loss, and disruptions to local communities. -

Organic & Sustainable Palm

Organic & Sustainable Palm Oil 680g 36MP shortening 15kg 32MP Shortening 18kg 25MP Olein for Household use /15kg 48MP Stearin for deep frying ORGANIC • DAABON Group has 4 beautiful organic certified palm plantations of total 4500 ha located on the western slopes of the Santa Marta mountain range. • DAABON has vertically integrated the palm oil production from seeder to farming, harvesting, mechanical pressing, physical refinery and finally to end products such as RBD, Stearin, Shortenings, Olein, Kernel oils, Margarine, Soap base and byproducts such as Kernel cake and vegetable residues for compost making at our own facilities. Our products and processes are vertically integrated and fully traceable. TRANSFAT FREE • Due to the extensive hazards posed by animal fat cholesterol and excessive levels of trans fats derived from hydrogenation, organic palm fruit oil is becoming the preferred option of high quality, health conscious food processors. Organic Palm fruit oil does not require hydrogenation as it is solid at room temperature, therefore avoiding harmful trans fatty acids. • There are several uses of palm fruit oil. Among the most common our customers use our products in baking, frying, food mixes, coatings, ice cream and others. SUSTAINABLE • DAABON Group is a member of the Roundtable on Sustainable Palm Oil and a certified grower. • Our refinery, soap factory and oil terminal is RSPO SCCS certified supply chain. • We are one of the only global suppliers of organic and fully identity-preserved palm oil products (RSPO/IP). SOCIAL RESPONSIBILITY – Suppor ng Smallholders Farmers in Northern Colombia have seen much hardship and have had to face many challenges in creating livelihoods over the past decades. -

The Green Tigers

The Green Tigers Which Southeast Asian Companies Will Prosper in the New Age of Forest Conservation? SEPTEMBER 2014 Which Southeast Asian companies will prosper in the new age of forest conservation? © DeanBirinyi / istockphoto.com THE GREEN TIGERS Which Southeast Asian companies will prosper in the new age of forest conservation? By Glenn Hurowitz Southeast Asia’s economies are roaring. The rise of the so-called “Asian tiger” economies has been one of the most profound developments in global business over the past half-century. But even as the region grows, the manner of its growth is imperiling its future prosperity. Too much of Asia’s growth has relied upon defor- estation and pollution. Instead of pursuing lasting development, many countries and companies in the region have favored “spreadsheet development” that prioritizes goosing national gross domestic prod- uct numbers at the expense of making a positive impact on the communities where it occurs. Southeast Asia is by no means unique in pursuing this model, but it is possibly the place where it is followed most energetically—and with the most visible consequences. Too many companies are still putting the region’s environment and economy at risk through continued deforestation and other irresponsible practices. But some countries and companies are choosing a different path. They are adapting to the revolutionized global market by evolving to ensure that their growth does not come at the expense of forests. These are the Green Tigers – and they are set to roar for decades to come. There is great urgency behind this corporate evolution: Deforestation for palm oil and paper plantations has turned the region into a tinderbox. -

Unilever Palm Oil Mill List

2017 Palm Oil Mills No. Mill Name Parent Company RSPO Certified Country Province District Latitude Longitude 1 ABDI BUDI MULIA PKS 1 AATHI BAGAWATHI MANUFACTURING SDN BHD No Indonesia Sumatera Utara Labuhan Batu 2.0512694 100.252339 2 ABEDON OIL MILL KRETAM HOLDING BERHAD Yes Malaysia Sabah Kinabatangan 5.312106 117.9741 3 ACEITES CIMARRONES SAS ACEITES S.A. Yes Colombia Meta Puerto Rico 3.035593889 -73.11146556 4 ACEITES MANUELITA YAGUARITO CI BIOCOSTA Yes Colombia Meta San Carlos de Guaroa 3.882933 -73.341206 5 ACEITES MORICHAL CI BIOCOSTA No Colombia Meta San Carlos de Guaroa 3.92985 -73.242775 6 ADELA POM FELDA No Malaysia Johor Kota Tinggi 1.552768 104.1873 7 ADHYAKSA DHARMASATYA ADHYAKSA DHARMASATYA No Indonesia Kalimantan Tengah Kotawaringin Timur -1.588931 112.861883 8 ADITYA AGROINDO AGRINDO No Indonesia Kalimantan Barat Ketapang -0.476029 110.151418 9 ADOLINA PTPN IV No Indonesia Sumatera Utara Serdang Bedagai 3.568533 98.94805 10 ADONG MILL WOODMAN GROUP No Malaysia Sarawak Miri 4.541035 114.119098 11 AEK BATU WILMAR No Indonesia Sumatera Utara Labuhan Batu 1.850583 100.1457 12 AEK LOBA SOCFIN INDONESIA Yes Indonesia Sumatera Utara Asahan 2.651389 99.617778 13 AEK NABARA RAJA GARUDA MAS Yes Indonesia Sumatera Utara Labuhan Batu 1.999722222 99.93972222 14 AEK NABARA SELATAN PTPN III Yes Indonesia Sumatera Utara Labuhan Batu 2.058056 99.955278 15 AEK RASO PTPN III Yes Indonesia Sumatera Utara Labuhan Batu 1.703883 100.172217 16 AEK SIBIRONG MAJU INDO RAYA No Indonesia Sumatera Utara Tapanuli Selatan 1.409317 98.85825 17 AEK SIGALA-GALA -

Production of Aviation Biofuel from Palm Kernel Oil

319 A publication of CHEMICAL ENGINEERING TRANSACTIONS VOL. 80, 2020 The Italian Association of Chemical Engineering Online at www.cetjournal.it Guest Editors: Eliseo Maria Ranzi, Rubens Maciel Filho Copyright © 2020, AIDIC Servizi S.r.l. DOI: 10.3303/CET2080054 ISBN 978-88-95608-78-5; ISSN 2283-9216 Production of Aviation Biofuel from Palm Kernel Oil a b a a Manuel A. Mayorga* , Mauricio López , Camilo A. López , Javier A. Bonilla , Vladimir Silvaa, Gabriel F. Taleroa, Felipe Correac, Mario A. Noriegad aChemical Engineering Department, GIATME Group, Universidad ECCI, Bogotá, Colombia bNCO School of the Colombian Air Force, TESDA Research Group, Madrid, Colombia c Chemical Engineering Department, Fundación Universidad de América, Bogotá, Colombia d Chemical Engineering Department, Universidad de la Salle, Bogotá, Colombia [email protected] In order to partially replace the use of fossil fuels in the aeronautical sector, it is proposed to produce FAME- type biofuels from palm kernel oil. Short chain methyl esters can be used so that the FAME biodiesel have no significant effects on the cold properties of the Jet Fuels when these are mixtures. In this sense, a study of the production of biodiesel FAME from palm kernel by transesterification oil at bench scale was carried out using a batch reactor with the optimal value of the process conditions that were obtained in a previous work but at laboratory level. In that research, the input variables were the methanol-oil ratio, the temperature and the amount of catalyst (% KOH). In this work, the response variable was on the production yield of methyl esters, which were analysed by GC. -

NDPE Policies Cover 83% of Palm Oil Refineries; Implementation at 72%

NDPE Policies Cover 83% of Palm Oil Refineries; Implementation at 72% April 2020 Chain Reaction Research is a coalition Palm oil refiners are a strategic bottleneck in the global supply chain. Since of Aidenvironment, Profundo and Climate Advisers. 2014, the largest refiners have adopted No Deforestation, No Peat, No Exploitation (NDPE) policies, the strongest private instrument to cut the direct Contact: link between deforestation and palm oil. Refiners commit to NDPE policies that cover their own plantations and the plantations of their third-party suppliers. www.chainreactionresearch.com; This market mechanism functions best when the entire industry follows [email protected] commitments. However, non-cooperating refiners continue to leak unsustainable palm oil into the market. Authors: Albert ten Kate, Aidenvironment Key Findings: Barbara Kuepper, Profundo Matt Piotrowski, Climate Advisers • As of April 2020, NDPE policies cover 83 percent of palm oil refining With contributions from: capacity in Indonesia and Malaysia. In November 2017, this percentage Tim Steinweg, Aidenvironment stood at 74 percent. The increase is the result of six company groups with Gerard Rijk, Profundo large refining capacity adopting NDPE policies. • Because of weak implementation, effective NDPE coverage falls to 72 percent. Due to lagging transparency and grievance processes, three of the eleven largest refiners in Indonesia and Malaysia remain part of the leakage market. • The seven largest leakage refiners in Indonesia and Malaysia are FGV Holdings, Permata Hijau Group, Salim Group, BEST Group, Tunas Baru Lampung, Darmex Agro and the Wings Group. In India, the world’s largest importer of crude palm oil, there are three leakage refiners: Emami Agrotech, Patanjali Ayurved and Gokul Agro Resources.