Ucluelet Economic Development Strategy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BCBUA Areas - 2019

BCBUA Areas - 2019 AREA 1: Vancouver Island South Towns included: Brentwood Bay; Chemainus; Cobble Hill; Crofton; Duncan; Esquimalt; Ladysmith; Lake Cowichan; Langford; Metchosin; Saanichton; Salt Spring Island; Shawnigan Lake; Sidney; Victoria; AREA DIRECTOR: Scott Eckardt, [email protected] AREA 2: Vancouver Island North Towns included: Black Creek; Bowser; Campbell River; Comox; Courtenay; Cumberland; Lantzville;Lazo; Merville; Nanaimo; Nanoose Bay; Parksville; Port Alberni; Qualicum Beach; Royston AREA DIRECTOR: Brad Jones, [email protected] AREA 3: Lower Mainland East Towns included: Abbotsford; Agassiz; Aldergrove; Anmore; Chilliwack; Coquitlam; Maple Ridge; Mission; Pitt Meadows; Port Coquitlam; Port Moody; Rosedale; Sardis; AREA DIRECTOR: Gary Webber, [email protected] AREA 4: Lower Mainland West Towns included: Burnaby; Gibsons; Halfmoon Bay; New Westminster; North Vancouver; Powell River; Richmond; Roberts Creek; Sechelt; Squamish; Vancouver; West Vancouver; AREA DIRECTOR: Michael Yamaguchi, [email protected] AREA 5: Lower Mainland South Towns included: Cloverdale; Delta; Ladner; Langley; Surrey; Tsawwassen; White Rock; AREA DIRECTOR: Brad Woof, [email protected] AREA 6: Thompson Okanagan Towns included: Canoe; Celista; Chase; Kamloops; Merritt; Revelstoke; Salmon Arm; Sicamous; Sorrento; AREA DIRECTOR: Mark Wright, [email protected] AREA 7: South Okanagan Towns included: Coldstream; Enderby; Kaleden; Kelowna; Lumby; Oliver; Peachland; Penticton; Rutland; Summerland; Vernon; Westbank; AREA DIRECTOR: Darcy Rysz, [email protected] AREA 8: Kootenays Towns included: Castlegar; Cranbrook; Creston; Fernie; Fruitvale Golden; Grand Forks; Greenwood; Invermere; Kaslo; Montrose; Nelson; Parsons; Slocan Park; South Slocan; Trail; AREA DIRECTOR: Bill MacMillan, [email protected] AREA 9: Northern B.C. Towns included: Burns Lake; Dawson Creek;Fort St. James; Fort Nelson; Fort St. John; Houston; Kitimat; Prince George; Prince Rupert; McBride; Smithers; Quesnel; Terrace; Vanderhoof; Williams Lake; AREA DIRECTOR: Matt Lowndes, [email protected] . -

Qualicum Beach Retail and Tourism Gap and Opportunity Analysis

Qualicum Beach Retail and Tourism Gap and Opportunity Analysis May 2009 Prepared for: Town of Qualicum Beach By: Coriolis Consulting Corp. RETAIL AND TOURISM GAP AND OPPORTUNITY ANALYSIS Table of Contents 1.0 Introduction ............................................................................................................ 1 2.0 Retail and Service Market Analysis ...................................................................... 2 2.1 Qualicum Beach’s Role in the Regional Retail and Service Market ................. 2 2.2 Trade Area Population Trends and Projections ................................................. 2 2.2.1 Existing Population and Recent Trends ................................................... 2 2.2.2 Population Projections ............................................................................. 4 2.3 Retail and Service Market Conditions in Qualicum Beach ................................ 4 2.3.1 Types of Businesses ............................................................................... 4 2.3.2 Vacancy .................................................................................................. 5 2.3.3 Recent Development ............................................................................... 6 2.3.4 Commercial Character ............................................................................. 6 2.3.5 Demand for Retail and Service Floor Space ............................................ 6 2.4 Economic Viability of Retail Development ........................................................ -

C02-Side View

FULTON RESERVOIR REGULATING BUILDING ACCESS STAIR REPLACEMENT REFERENCE ONLY FOR DRAWING LIST JULY 30, 2019 Atlin ● Atlin Atlin C00 COVER L Liard R C01 SITE PLAN C02 SIDE VIEW Dease Lake ● Fort ine R ● S1.1 GENERAL NOTES AND KEY PLAN kkiii Nelson tititi SS S3.1 DETAILS SHEET 1 S3.2 DETAILS SHEET 2 S3.3 DETAILS SHEET 2 Stewart Fort St ●Stewart Hudson’s John Williston Hope John L ● New Dawson● Creek Dixon upert Hazelton ● ● ● Entrance cce R Mackenzie Chetwynd iiinn Smithers ● Terrace Smithers Masset PrPr ● ● ● ● ● Tumbler Ridge Queen ttt Kitimat Houston Fort Ridge iii Kitimat ●Houston ● ● Charlotte sspp Burns Lake ● St James dds Burns Lake San Fraser R ●● a Fraser Lake ● ● Fraser R Haida Gwaii HecateHecate StrStr Vanderhoof ● Prince George McBride Quesnel ● Quesnel ● ● Wells Bella Bella ● Valemount● Bella Bella ● Bella Williams Valemount Queen Coola Lake Kinbasket Charlotte ● Kinbasket L Sound FraserFraserFraser R RR PACIFIC OCEAN ColumbiaColumbia ●100 Mile Port House Hardy ● ● Port McNeill Revelstoke Golden ●● Lillooet Ashcroft ● Port Alice Campbell Lillooet RR Campbell ● ● ● ● River Kamloops Salmon Arm ● Vancouver Island Powell InvermereInvermere ●StrStr Whistler Merritt ●Vernon Nakusp Courtenay ●River ● ● ●Nakusp ● Squamish Okanagan Kelowna Elkford● Port ofofSechelt ● ●Kelowna Alberni G ● L Kimberley Alberni eeoror Vancouver Hope Penticton Nelson ● Tofino ● ● giagia ● ● ● ● ee ● ● ● Castlegar Cranbrook Ucluelet ● oo ● ksvillvillm o● ●Abbotsford Osoyoos Creston Parks aim ● ●Trail ●Creston Nan mithithith ●Sidney Ladys ●Saanich JuanJuan -

Community Plan

TOWN OF LAKE COWICHAN OFFICIAL COMMUNITY PLAN Bylaw No. 910-2011 A Bylaw to adopt the Official Community Plan. WHEREAS Section 876 of the Local Government Act provides that a local government may adopt and amend one or more official community plans to guide decisions on planning and land use management; AND WHEREAS Section 875 of the Local Government Act provides that a local government may have a community plan prepared or revised and such plans shall be expressed in writing and my include plans, maps, tables or other graphic material and shall include statements and map designations for the area covered by the plan; AND WHEREAS In accordance with the Local Government Act, the Council has undertaken the necessary consultations and other steps required for the adoption of the new official community plan.; NOW THEREFORE, the Council of the Town of Lake Cowichan in open meeting assembled enacts as follows: 1. This bylaw may be cited for all purposes as “Town of Lake Cowichan Official Community Plan Bylaw No. 910-2011”. 2. For the purpose of expressing the policies for the development of the Town of Lake Cowichan, the Municipal Council hereby adopts the Town of Lake Cowichan Official Community Plan and the plan maps and appendices, marked Schedule “A”, which shall be an integral part of this bylaw. 3. If any section, subsection, sentence, clause or phrase contained within this bylaw is, for any reason, held to be invalid by the decision of any Court of competent jurisdiction, the invalid portion shall be severed and the decision that it is invalid shall not affect the validity of the remainder of the bylaw. -

A Sustainable Development Strategy for the District of Sooke – July 2008

A SSUSTAINABLE DDEVELOPMENT SSTRATEGY FOR THE DDISTRICT OF SSOOKE TABLE OF CONTENTS Introduction.................................................................................................... 3 A COMMUNITY AT A THRESHOLD OF THE 21ST CENTURY.................................................. 3 THE ROLE OF THIS STRATEGY .......................................................................................... 4 CONTROL OVER CHANGE................................................................................................... 5 EIGHT PILLARS OF SUSTAINABLE DEVELOPMENT............................................................. 5 CREATING THIS STRATEGY................................................................................................ 5 A SHARED VISION FOR A SUSTAINABLE FUTURE.............................................................. 6 PRIORITIES......................................................................................................................... 6 Strategy #1: Create neighbourhood centres and a downtown waterfront that are compact and complete.................................................................... 8 Strategy #2: Develop a transportation system that provides viable opportunities for non-automobile transportation and transit use. ......... 11 Strategy #3: Support low-impact, energy-efficient, healthy buildings in which to live, work and play. ...................................................................... 15 Strategy #4: Celebrate cultural and ecological assets through the management -

Living in Qualicum Beach, Vancouver Island 2010

Living in Qualicum Beach, Vancouver Island 2010 About Local Community City Hall 250 752 6921 http://www.qualicumbeach.com/ Chamber of Commerce 250 752 0960 http://www.qualicum.bc.ca/ Library 250 752 6121 http://www.virl.bc.ca/pages/index_e.aspx?ArticleID=232 Member Legislative Assembly 250 951-6018 http://www.leg.bc.ca/mla/39thParl/cantelonR.htm (Provincial Government) Member of Parliament 250 390 7550 http://bit.ly/mpnanaimoalberni (Federal Government) Oceanside Tourism 250 248 6300 http://www.visitparksvillequalicumbeach.com/ Parks & Recreation 250 248 3252 http://www.rdn.bc.ca/cms.asp?wpID=1613 - Ice Arena - Oceanside Place 250 248 3252 http://www.rdn.bc.ca/cms.asp?wpID=607 - Swimming Pool - Ravensong 250 752 5014 http://www.rdn.bc.ca/cms.asp?wpID=1054 Post Office 250 752 6435 http://bit.ly/findpostoffice Regional District 250 390 4111 http://www.rdn.bc.ca/ Visitor Information Center 250 752 2923 http://www.qualicum.bc.ca/visitor/ Volunteer Opportunities 250 248 2637 http://www.oceansidevolunteer.org/ Welcome Wagon 1866 518 7287 http://www.welcomewagon.ca/en/community/community.php Attractions http://www.visitparksvillequalicumbeach.com/cms.asp?wpID=379 Events calendar http://bit.ly/oceansideevents Map of the area http://bit.ly/mapquestQB Parks on Vancouver Island (Central Island) http://www.vancouverisland.com/ParksAndTrails/Parks Accommodation (Finding a Place to Live) Rentals (Short or Long-term) BC Classified (local regions) http://www.bcclassified.com Canwest publishing http://classifieds.canada.com/nanaimo/index.aspx Craigslist -

Significant Watersheds in the District of Sooke and Surrounding Areas

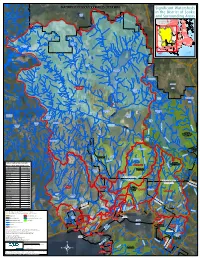

Shawnigan Lake C O W I C H A N V A L L E Y R E G I O N A L D I S T R I C T Significant Watersheds in the District of Sooke Grant Lake and Surrounding Areas North C o w i c h a n V a l l e y Saanich R e g i o n a l D i s t r i c t Sidney OCelniptrahl ant Lake Saanich JdFEA H a r o S t r a Highlands it Saanich View Royal Juan de Fuca Langford Electoral Area Oak Bay Esquimalt Jarvis Colwood Victoria Lake Sooke Weeks Lake Metchosin Juan de Fuca Electoral Area ca SpectaFcu le Lake e d it an ra STUDY Ju St AREA Morton Lake Sooke Lake Butchart Lake Devereux Sooke River Lake (Upper) Council Lake Lubbe Wrigglesworth Lake Lake MacDonald Goldstream Lake r Lake e iv R e k o Bear Creek o S Old Wolf Reservoir Boulder Lake Lake Mavis y w Lake H a G d Ranger Butler Lake o a l n d a s Lake Kapoor Regional N C t - r i a s Forslund Park Reserve e g n W a a a o m r l f C r a T Lake r e R e k C i v r W e e e r a k u g h C r e Mount Finlayson e k Sooke Hills Provincial Park Wilderness Regional Park Reserve G o ld s Jack t re a Lake m Tugwell Lake R iv e r W augh Creek Crabapple Lake Goldstream Provincial Park eek Cr S ugh o Wa o Peden k Sooke Potholes e Lake C R Regional Park h i v a e Sheilds Lake r r t e r k e s re C ne i R ary V k M e i v e r e r V C Sooke Hills Table of Significant Watersheds in the e d i t d c Wilderness Regional h o T Charters River C Park Reserve District of Sooke and Surrounding Areas r e e k Watershed Name Area (ha) Sooke Mountain Sooke River (Upper) 27114.93 Boneyard Provincial Park Lake DeMamiel Creek 3985.29 Veitch Creek 2620.78 -

Greater Victoria Police Integrated Units

GREATER VICTORIA POLICE INTEGRATED UNITS ANNUAL REPORT 2017/18 Review :: 2017/18 A MESSAGE FROM THE GREATER VICTORIA POLICE CHIEFS AND DETACHMENT COMMANDERS he Greater Victoria Police Chiefs and Detachment Commanders are pleased to present the second annual Greater Victoria TPolice Integrated Units Annual Report for 2017/2018. This report highlights the work on the many integrated policing units working within Greater Victoria area communities. Common among all of the integrated policing units is a shared desire to work with communities to deliver high-quality, well-coordinated, and cost effective police services. The area Police Chiefs and Detachment Commanders, in consultation with community leaders, remain committed to the identification and implementation of further integration options in situations where improvements in service delivery and financial efficiencies are likely to be realized. Please take a few moments to read the report which highlights the mandate and ongoing work of each integrated policing unit. We wish to thank the dedicated officers working within the integrated policing units for their professionalism and continued commitment to our communities. Proudly, The Greater Victoria Police Chiefs and Detachment Commanders: » Chief Del Manak – Victoria Police » Inspector Todd Preston – Westshore Detachment » Chief Bob Downie – Saanich Police » S/Sgt Wayne Conley – Sidney/North Saanich Detachment » Chief Les Sylven – Central Saanich Police » S/Sgt Jeff McArthur – Sooke Detachment » Chief Andy Brinton – Oak Bay Police Table -

NEWS RELEASE COVID-19 Parksville-Qualicum Beach

NEWS RELEASE emergencyoceanside.ca June 15, 2020 ass COVID-19 Parksville-Qualicum Beach Community Update As our weather improves (we can hope) and with the easing of our isolation, we are able to get outside more and slowly expand our personal bubbles. We recognize many of our residents are concerned with returning to normal too quickly but if we continue to stay vigilant, limit our contact with others, maintain physical distance, practice good hand hygiene and stay home when sick, we will continue to weather this pandemic together. We are encouraged by the recent information and statistics on COVID 19 rates from the province that show the community’s efforts have dramatically reduced the spread of the virus in our region and on Vancouver Island. As we work through this next phase of the pandemic and a safe transition to Phase 3 in the provincial Restart Plan, the EOC will remain at Level 1 activation and continue to monitor the COVID-19 pandemic situation for our region. Ongoing, the EMO enewsletter will be distributed monthly rather than weekly, on the second Tuesday of each month. When relevant COVID-19 related information becomes available, please know we will pass along to you in a timely manner. Thank you for signing up for this EMO newsletter which will now include such topics as emergency preparedness and fire smart info. We’d love to hear from you; ideas and input welcome to [email protected] We recognize this summer will be very different for our residents. Perhaps this summer is an opportunity to be a tourist in our own region, creating new summer adventures right at home. -

Cowichan Valley Trail Brochure (2021)

FLIP FOR MAP FOR FLIP treaded tires are highly recommended. recommended. highly are tires treaded Kinsol Trestle. Surface conditions vary so cyclists should note that that note should cyclists so vary conditions Surface Trestle. Kinsol reconnects with your start point in Duncan. Duncan. in point start your with reconnects south through forests and rural farmland before arriving at the Historic Historic the at arriving before farmland rural and forests through south Ganges. Catch another ferry from Vesuvius to Crofton and a short ride ride short a and Crofton to Vesuvius from ferry another Catch Ganges. Glenora Trails Head Park on Robertson Road. The trail route travels travels route trail The Road. Robertson on Park Head Trails Glenora from Swartz Bay, the route meanders along roads to the village of of village the to roads along meanders route the Bay, Swartz from This popular cycling and equestrian route starts and finishes at at finishes and starts route equestrian and cycling popular This Difficulty: Difficulty: Saanich Peninsula. After a quick ferry connection to Saltspring Island Island Saltspring to connection ferry quick a After Peninsula. Saanich Easy Distance: Distance: before connecting with the Lochside Trail and heading north up the the up north heading and Trail Lochside the with connecting before 26 km return km 26 ROUTE B — Glenora Trails Head Park to Kinsol Trestle Kinsol to Park Head Trails Glenora — B ROUTE route continues on the Galloping Goose Regional Trail into Victoria Victoria into Trail Regional Goose Galloping the on continues route dropping into Langford, along the Sooke Hills Wilderness Trail. The The Trail. -

March 2021 February 17, 2021

Circulation Package Area B - Winter Harbour March 2021 February 17, 2021 Mayors and Regional District Chairs of British Columbia Attendees of January 2021 Regional Calls with Minister Josie Osborne Dear Mayors and Chairs, Thank you for taking the time to join Minister Josie Osborne and UBCM President Brian Frenkel for the first round of regional calls in the new year. Hearing from UBCM directly on some of its key interests and issues was very much appreciated. As Minister Osborne and President Frenkel said during the calls, these calls continue to be a great opportunity to hear from you about the key issues and opportunities you are working on in your communities for 2021 (in addition to COVID-19). There were a number of themes that came up during the calls including connectivity, reopening of BC parks in the spring and roll out of vaccine distribution. This email sets out links and resources on some of the topics raised. As well, on specific issues such as grant applications or questions particular to your community, please remember that your staff can reach out to Ministry of Municipal Affairs staff for assistance (see the Local Government Division staff finder for the appropriate staff person for your area). COVID-19 update The state of emergency is extended to March 2, allowing health and emergency management officials to continue to use extraordinary powers under the Emergency Program Act. On February 5th, Minister Dix and Dr. Henry announced that the province-wide restrictions, put in place to significantly reduce COVID-19 transmission related to social interactions and travel, would continue until further notice based on direction from the PHO. -

Creosote Evaluation: Phase II Sooke Basin Study - Baseline to 535 Days Post Construction 1995-1996

Creosote Evaluation: Phase II Sooke Basin Study - Baseline to 535 Days Post Construction 1995-1996 Prepared by: D. Goyette Commercial Chemicals Division Environment Canada Pacific and Yukon Region And K. M. Brooks Aquatic Environmental Sciences 644 Old Eaglemount Road Port Townsend, WA 98368 Prepared for: Creosote Evaluation Steering Committee Regional Program Report PR98-04 December, 1998 Readers may direct comments or questions to: Mr. D. Goyette Commercial Chemicals Division Environmental Protection Branch Environment Canada 224 West Esplanade North Vancouver, British Columbia V7M 3H7 Phone: (604) 666-2880 Fax: (604) 666-6800 e-mail: [email protected] For information on creosote risk assessment modeling and its application the reader may contact: Dr. K. Brooks Aquatic Environmental Sciences 644 Old Eaglemount Road Port Townsend, WA 98368 Phone: (360) 732-4464 FAX: (360) 732-4464 e-mail: [email protected] ABSTRACT A jointly sponsored study by Environment Canada, Fisheries and Oceans, the Province of British Columbia and the wood treatment industry was undertaken in Sooke Basin, Vancouver Island to evaluate the impact of creosote treated wood on the marine environment. The primary purpose of this study was to provide a scientific basis for establishing guidelines on the use and placement of creosote treated wood in sensitive marine aquatic habitats under ‘worst case’ conditions. The study focused on the chemical and biological effects from newly installed six- piling dolphins constructed with used pilings treated by conventional methods and pilings freshly treated with techniques designed to produce a cleaner and more environmentally sensitive product by placing them in a natural undisturbed location, free from outside sources of contamination.