Report No 3 of 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

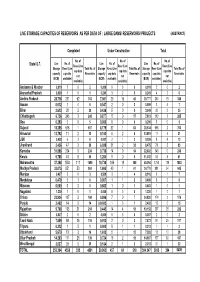

Live Storage Capacities of Reservoirs As Per Data of : Large Dams/ Reservoirs/ Projects (Abstract)

LIVE STORAGE CAPACITIES OF RESERVOIRS AS PER DATA OF : LARGE DAMS/ RESERVOIRS/ PROJECTS (ABSTRACT) Completed Under Construction Total No. of No. of No. of Live No. of Live No. of Live No. of State/ U.T. Resv (Live Resv (Live Resv (Live Storage Resv (Live Total No. of Storage Resv (Live Total No. of Storage Resv (Live Total No. of cap data cap data cap data capacity cap data Reservoirs capacity cap data Reservoirs capacity cap data Reservoirs not not not (BCM) available) (BCM) available) (BCM) available) available) available) available) Andaman & Nicobar 0.019 20 2 0.000 00 0 0.019 20 2 Arunachal Pradesh 0.000 10 1 0.241 32 5 0.241 42 6 Andhra Pradesh 28.716 251 62 313 7.061 29 16 45 35.777 280 78 358 Assam 0.012 14 5 0.547 20 2 0.559 34 7 Bihar 2.613 28 2 30 0.436 50 5 3.049 33 2 35 Chhattisgarh 6.736 245 3 248 0.877 17 0 17 7.613 262 3 265 Goa 0.290 50 5 0.000 00 0 0.290 50 5 Gujarat 18.355 616 1 617 8.179 82 1 83 26.534 698 2 700 Himachal 13.792 11 2 13 0.100 62 8 13.891 17 4 21 J&K 0.028 63 9 0.001 21 3 0.029 84 12 Jharkhand 2.436 47 3 50 6.039 31 2 33 8.475 78 5 83 Karnatka 31.896 234 0 234 0.736 14 0 14 32.632 248 0 248 Kerala 9.768 48 8 56 1.264 50 5 11.032 53 8 61 Maharashtra 37.358 1584 111 1695 10.736 169 19 188 48.094 1753 130 1883 Madhya Pradesh 33.075 851 53 904 1.695 40 1 41 34.770 891 54 945 Manipur 0.407 30 3 8.509 31 4 8.916 61 7 Meghalaya 0.479 51 6 0.007 11 2 0.486 62 8 Mizoram 0.000 00 0 0.663 10 1 0.663 10 1 Nagaland 1.220 10 1 0.000 00 0 1.220 10 1 Orissa 23.934 167 2 169 0.896 70 7 24.830 174 2 176 Punjab 2.402 14 -

Committee on Government Assurances (2011-2012)

21 COMMITTEE ON GOVERNMENT ASSURANCES (2011-2012) (FIFTEENTH LOK SABHA) TWENTY FIRST REPORT REVIEW OF PENDING ASSURANCES PERTAINING TO MINISTRY OF WATER RESOURCES Presented to Lok Sabha on 16 May, 2012 LOK SABHA SECRETARIAT NEW DELHI May, 2012/Vaisakha, 1934 (Saka) CONTENTS PAGE Composition of the Committee (2011-2012) (ii) Introduction (iii) Report 1-20 Appendices Appendix-I - Questions and the Answers 21-57 Appendix-II - Extracts from Manual of Practice & Procedure in the Government 58-60 of India, Ministry of Parliamentary Affairs, New Delhi Appendix-III - Status of USQ No. 4355 dated 7 May, 2007 regarding 61 Restructuring of Brahmaputra Board as received from the Ministry of Water Resources. Appendix-IV - Implementation Report of USQ No. 2281 dated 15 December, 62-105 2008 regarding Maintenance of Dams. Appendix-V - Implementation Report of USQ No. 1766 dated 04 August, 106-125 2010 regarding Dams in the Country. Annexures Annexure I- Minutes of the Sitting of the Committee held on 11 April, 2012. 126-128 Annexure II- Minutes of the Sitting of the Committee held on 26 April, 2012. 129-131 Annexure III- Minutes of the Sitting of the Committee held on 14 May, 2012. 132-133 COMPOSITION OF THE COMMITTEE ON GOVERNMENT ASSURANCES* (2011 - 2012) Shrimati Maneka Gandhi - Chairperson MEMBERS 2. Shri Hansaraj Gangaram Ahir 3. Shri Avtar Singh Bhadana 4. Shri Kantilal Bhuria 5. Shri Dara Singh Chauhan 6. Shri Bansa Gopal Chowdhury 7. Shri Ram Sundar Das 8. Smt. J. Helen Davidson 9. Shri Bijoy Krishna Handique 10. Sardar Sukhdev Singh Libra 11. Shri Ramkishun 12.# Rajkumari Ratna Singh 13. -

Government of India Ministry of Jal Shakti, Department of Water Resources, River Development & Ganga Rejuvenation Lok Sabha Unstarred Question No

GOVERNMENT OF INDIA MINISTRY OF JAL SHAKTI, DEPARTMENT OF WATER RESOURCES, RIVER DEVELOPMENT & GANGA REJUVENATION LOK SABHA UNSTARRED QUESTION NO. †919 ANSWERED ON 27.06.2019 OLDER DAMS †919. SHRI HARISH DWIVEDI Will the Minister of JAL SHAKTI be pleased to state: (a) the number and names of dams older than ten years across the country, State-wise; (b) whether the Government has conducted any study regarding safety of dams; and (c) if so, the outcome thereof? ANSWER THE MINISTER OF STATE FOR JAL SHAKTI & SOCIAL JUSTICE AND EMPOWERMENT (SHRI RATTAN LAL KATARIA) (a) As per the data related to large dams maintained by Central Water Commission (CWC), there are 4968 large dams in the country which are older than 10 years. The State-wise list of such dams is enclosed as Annexure-I. (b) to (c) Safety of dams rests primarily with dam owners which are generally State Governments, Central and State power generating PSUs, municipalities and private companies etc. In order to supplement the efforts of the State Governments, Ministry of Jal Shakti, Department of Water Resources, River Development and Ganga Rejuvenation (DoWR,RD&GR) provides technical and financial assistance through various schemes and programmes such as Dam Rehabilitation and Improvement Programme (DRIP). DRIP, a World Bank funded Project was started in April 2012 and is scheduled to be completed in June, 2020. The project has rehabilitation provision for 223 dams located in seven States, namely Jharkhand, Karnataka, Kerala, Madhya Pradesh, Orissa, Tamil Nadu and Uttarakhand. The objectives of DRIP are : (i) Rehabilitation and Improvement of dams and associated appurtenances (ii) Dam Safety Institutional Strengthening (iii) Project Management Further, Government of India constituted a National Committee on Dam Safety (NCDS) in 1987 under the chairmanship of Chairman, CWC and representatives from State Governments with the objective to oversee dam safety activities in the country and suggest improvements to bring dam safety practices in line with the latest state-of-art consistent with Indian conditions. -

Godavari Primer an Essential Guide on the Utilization of the Godavari Waters and Resources

THE GODAVARI PRIMER AN ESSENTIAL GUIDE ON THE UTILIZATION OF THE GODAVARI WATERS AND RESOURCES SAKTI The Godavari Primer - An Essential Guide to Understanding the Debate on the Utilization of the Godavari Waters April 2006 We are grateful to Dr. Uma Shankari for preparing the document. However SAKTI owns responsibility for the contents of the document. We thank Vijay Burgula for editorial assistance. SAKTI, 305, I Block, Janapriya Abodes, Gandhinagar, Hyderabad – 500 080 Ph: 040 – 55614787, 040-55627893, [email protected] www.sakti.in Suggested contribution Rs. 50/- Printed at : Anupama Printers, 126, Shantinagar, Hyderabad - 500 028 Tel : 040-23391364, Telefax : 040-23304194 E-mail : [email protected] 2 The Godavari Primer - An Essential Guide to Understanding the Debate on the Utilization of the Godavari Waters Table of Contents Chapter 1: Introduction ...................................................................................................................................................... 5 Chapter 2. Godavari – The River, Land and Society ........................................................................................................ 8 a. The Journey .................................................................................................................................................... 8 b. Physical Features ............................................................................................................................................. 8 The Delta Region ........................................................................................................................................ -

Tribes of India: the Struggle for Survival

Preferred Citation: von Fürer-Haimendorf, Christoph. Tribes of India: The Struggle for Survival. Berkeley: University of California Press, c1982 1982. http://ark.cdlib.org/ark:/13030/ft8r29p2r8/ Tribes of India The Struggle for Survival Christoph von Fürer-Haimendorf UNIVERSITY OF CALIFORNIA PRESS Berkeley · Los Angeles · Oxford © 1982 The Regents of the University of California To N. V. Raja Reddi and Urmila Pingle in memory of our journeys in tribal country Preferred Citation: von Fürer-Haimendorf, Christoph. Tribes of India: The Struggle for Survival. Berkeley: University of California Press, c1982 1982. http://ark.cdlib.org/ark:/13030/ft8r29p2r8/ To N. V. Raja Reddi and Urmila Pingle in memory of our journeys in tribal country Preface ― xi ― This book tells of observations among Indian tribal populations spanning the period from 1940 to 1980. Ever since 1936, when a study of the Konyak Nagas marked the beginning of my career as an anthropological field-worker, I have maintained contacts with Indian tribesmen. True, there were years when I concentrated on the study of the mountain peoples of Nepal, but even then I paid periodic visits to some of the tribal areas of India, and this enabled me to keep abreast of current developments. When in 1976 I retired from the Chair of Asian Anthropology at the University of London and could devote more time to fieldwork, I decided to undertake a systematic investigation of social and economic changes affecting the tribal societies which I had studied in the 1940s. A grant from the Social Science Research Council of Great Britain, as well as subsidiary awards from the Leverhulme Trust Fund and the Wenner-Gren Foundation for Anthropological Research, provided the material basis for this project, which included also the funding of parallel research by my young colleague Dr. -

“Repair, Renovation and Restoration of Water Bodies- Encroachment on Water Bodies and Steps Required to Remove the Encroachment and Restore the Water Bodies”

10 STANDING COMMITTEE ON WATER RESOURCES (2015-16) SIXTEENTH LOK SABHA MINISTRY OF WATER RESOURCES, RIVER DEVELOPMENT AND GANGA REJUVENATION. “Repair, Renovation and Restoration of Water Bodies- Encroachment on Water Bodies and Steps Required to Remove the Encroachment and Restore the Water Bodies”. TENTH REPORT LOK SABHA SECRETARIAT NEW DELHI August, 2016 / Shravana,1938 (Saka) 1 TENTH REPORT STANDING COMMITTEE ON WATER RESOURCES (2015-16) (SIXTEENTH LOK SABHA) MINISTRY OF WATER RESOURCES, RIVER DEVELOPMENT AND GANGA REJUVENATION. “Repair, Renovation and Restoration of Water Bodies- Encroachment on Water Bodies and Steps Required to Remove the Encroachment and Restore the Water Bodies”. Presented to Lok Sabha on 02.08.2016 Laid on the Table of Rajya Sabha on 02.08.2016 LOK SABHA SECRETARIAT NEW DELHI August, 2016/ Shravana,1938 (Saka) 2 CONTENTS Part – I REPORT Page No. COMPOSITION OF THE COMMITTEE (2015-2016) (iii) INTRODUCTION (v) Chapter – I Introductory 1 Chapter – II - State of Water Bodies in the country 4 - Minor Irrigation Census 4 - Reasons for increase/ decrease in total number of water bodies 5 - Survey of water bodies by the Ministry 7 - Classification of Water Bodies 9 - Measures taken to revive perishing water bodies 12 Chapter – III - Encroachment on Water Bodies 16 - Extent of encroachment 16 - Impact of encroachment on water bodies 21 - Action against encroachers 24 - Monitoring mechanism for prevention and removal of encroachments 26 (a) Monitoring mechanism under Repair, Renovation and Restoration 26 (RRR) Scheme (b) -

Blueprint for Godavari River Water Utilisation In

BLUE PRINT FOR GODAVARI RIVER WATER UTILIZATION IN ANDHRA PRADESH N. Sasidhar. Abstract: This paper explains how the unutilized Godavari river water could be put to use fully for irrigation with the help of water powered pump units and pumped storage schemes without proposing inter state dam projects. This paper also proposes how the available water in Godavari and Krishna rivers could be used for irrigating most of upland areas in Telangana and Rayalaseema regions with optimum pumping power. Godavari is the largest river of all peninsular rivers in India. It has a total drainage area of 312,812 square km of which 48.6% lies in Maharashtra, 23.8% in Andhra Pradesh (AP), 18.7% in Chattisgarh, 5.5% in Orissa, 2% in Madhya Pradesh (MP) and 1.4 % in Karnataka. Principal tributaries of Godavari are Pranhita, Indravati and Sabari. All these tributaries drain water from high rainfall areas (i.e. more than 100 cm annual rain fall) except the main river Godavari. These tributaries contribute 80% flow of the total river. The average yearly water flow in Godavari is nearly 110 billion cubic meters. Pranhita drains Vidarbha region and joins the main river near Kaleswaram temple town in AP at 95 meters Mean Sea Level (m MSL). Indravati traverses through parts of Orissa and southern part of Chattisgarh and joins main river upstream of proposed inter state dam project at Inchampalli in AP. Sabari drains from parts of Orissa and Chattisgarh and joins the main river upstream of proposed Polavaram dam in AP. WATER AVAILABILITY: The water available in the upper reaches of Godavari up to Pranhita tributary confluence are fully utilized by Maharashtra, Karnataka and AP by developing various irrigation projects. -

Water Quality of Lakes & Tank in Andhra Pradesh

WATER QUALITY OF LAKES & TANK IN ANDHRA PRADESH - 2019 Type Temperature DissolvedO2 Conductivity Nitrate N + Fecal Coliform Total Coliform Station pH BOD (mg/l) Station Name Water State Name (°C) (mg/l) (µmhos/cm) Nitrite N (mg/l) (MPN/100ML) (MPN/100ML) Code Body Min Max Min Max Min Max Min Max Min Max Min Max Min Max Min Max ANDHRA 1790 PULICATE LAKE , NELLORE DIST LAKE 18.0 28.0 4.9 5.5 6.7 8.2 21840 47890 2.20 2.80 0.46 2.80 3 4 210 1600 PRADESH KONDAKARLA-AAVA LAKE, PARAWADA ANDHRA 2353 LAKE 24.0 30.0 5.0 6.8 7.0 8.5 714 1950 1.60 4.20 0.00 5.82 11 23 150 1100 PHARMA CITY, VISHAKHAPATNAM PRADESH KOLLERU LAKE KOKKIRAYALANKA (V), ANDHRA 4368 LAKE 25.0 28.0 3.7 7.5 7.2 8.1 979 14730 1.70 5.40 0.00 3.47 4 20 150 1300 KAILALUR (M) PRADESH CHENGAMBAKAM TANK IN SRI CITY SEZ, ANDHRA 4391 TANK 25.0 36.0 3.2 6.1 6.8 7.9 228 1098 2.00 22.00 0.00 4.40 100 200 400 1400 TIRUPATHI PRADESH WATER QUALITY OF LAKE, POND & TANK IN ASSAM-2019 Type Temperature DissolvedO2 Conductivity Nitrate N + Fecal Coliform Total Coliform Station pH BOD (mg/l) Station Name Water State Name (°C) (mg/l) (µmhos/cm) Nitrite N (mg/l) (MPN/100ML) (MPN/100ML) Code Body Min Max Min Max Min Max Min Max Min Max Min Max Min Max Min Max 1529 DEEPAR BEEL, ASSAM LAKE ASSAM 22.0 34.0 4.6 11.0 7.1 8.0 144 273 2.70 4.80 1.10 2.00 2 360 360 1500 2205 MER BEEL AT MADHABPUR, ASSAM LAKE ASSAM 13.0 32.0 0.4 8.2 6.3 7.7 29 228 1.30 18.00 0.80 2.40 300 730 720 2000 2206 DALONI BEEL NEAR JOGIGHOPA, ASSAM LAKE ASSAM 22.0 36.0 4.7 5.7 7.2 8.1 51 213 1.80 2.60 0.80 2.10 2 360 300 2300 DEEPAR BEEL AT BORAGAON NEAR IASST, 2218 LAKE ASSAM 22.0 34.0 3.7 10.0 7.1 7.9 146 275 2.60 4.60 1.10 2.10 2 730 720 1500 GUWAHATI, ASSAM 3804 SON BEEL WATER AT KARIMGANJ LAKE ASSAM 20.0 26.0 4.1 5.4 6.4 7.4 88 126 1.20 4.00 0.70 1.30 300 730 720 2000 KAMALABARI LAKE INSIDE KAMALABARI 4337 LAKE ASSAM 18.0 31.0 5.5 6.3 6.9 7.6 32 46 1.30 2.30 0.50 1.30 2 300 2 720 CHILDREN,S PARK, GELEKY ELANGABEEL SYSTEM POND (CONNECTED TO 1263 POND ASSAM 22.0 32.0 2.0 5.3 7.1 8.0 396 953 2.70 17.50 1.30 2.80 2 730 360 2800 R. -

Annual Report 2014-2015

Annual Report 2014-2015 The Vision of TSPCB is Cleaner and Safe Telangana State & "To Achieve Economic Growth with Environmental Management for an Improved Quality of Life in Telangana State” TELANGANATELANGANA STATESTATE POLLUTIONPOLLUTION CONTROLCONTROL BOARDBOARD ANNUAL REPORT - 2014-15 © Telangana State Pollution Control Board 1000 Copies, 2016 Published by Member Secretary, Telangana State Pollution Control Board, Paryavaran Bhavan, A-3, IE, Sanathnagar, Hyderabad 500 018. Compiled by EEW Section T.S. Pollution Control Board, Sanathnagar, Hyderabad Printed by: Surya Graphics Shop # 14, APHB, Vidyanagar, Hyderabad. Ph : 040 - 27671055 Pollution Control is our Motto About this Annual Report The Annual Report of Telangana State Pollution Control Board of the Financial Y ear 2014-15 has two parts. The first part describes the statutory mandates of the Board, its composition, organizational structure and the present infrastructure of the Board. The second part illustrates the environmental issues and activities of the Board, thus representing the present picture of the State of Environment of Telangana State Pollution Control Board during the 2014-2015. TTELANGANAELANGANA SSTATETATE POLLUTIONPOLLUTION CONTROLCONTROL BOARDBOARD Paryavaran Bhavan, A-3, Industrial Estate, Sanathnagar, Hyderabad – 500 018. Dr. RAJIV SHARMA, I.A.S., Chief Secretary, Government of Telangana State Chairman, TSPCB. Chairman’s Message The Telangana State Pollution Control Board was reconstituted on 07/07/2014 under the Water (Prevention and Control of Pollution) Act 1974, with a mandate to plan a comprehensive programme for the prevention, control and abatement of Water and Air pollution in the state of Telangana State. The Board also advises the state government on matters concerning the prevention, control and abatement of Water and Air pollution and has well equipped laboratories which are capable of analyzing a wide variety of contaminants in Air and Water. -

Phytoplanktonic Study of Rice Fields of Jammikunta Region, Karimnagar District, Telangana, India

Available online at www.ijpab.com G. Odelu Int. J. Pure App. Biosci. 3 (6): 130-136 (2015) ISSN: 2320 – 7051 DOI: http://dx.doi.org/10.18782/2320-7051.2151 ISSN: 2320 – 7051 Int. J. Pure App. Biosci. 3 (6): 130-136 (2015) Research Article Phytoplanktonic Study of Rice Fields of Jammikunta Region, Karimnagar District, Telangana, India G. Odelu* Department of Botany, Government Degree College, Jammikunta, Karimnagar, (Satavahana University) Telangana - 505122 India *Corresponding Author E-mail: [email protected] ABSTRACT Food grain production to meet the dietary requirement of ever increasing Indian population. Some of the algae and bacteria have capable to fixation of atmospheric nitrogen to ammonia, which are some from BGA members. During this present investigation out of total 25 taxa of Cyanophyceae 14 species and 8 families, Chlorophyceae belonging to 10 where, Chlorellaceae represent cladophoraceae 2 species, desmidaceae 1 species, following Oedogoniaceae 1 species Zygnemataceae have been found with 2 species, 2species from Characeae etc.1species from naviculaceae under class of Bacillariophyceae. Cosmarium, species were high, observed during the period of August to October, during these months the water level declined gradually in rice field. It was found that population of algae belongs to above mentioned order were less in number during advent of summer month. Key words: N,-fixing, Blue-Green Algae, Rice Fields, Chemical Fertilizers INTRODUCTION Paddy is one of the major crops in India. It can grow in aquatic habitat, one of the grass family members. India has different climatic conditions, vary from Kashmir to Kanya Kumari. Algae are grown in variety of habitats like marine, freshwater, epiphytic, association with other higher group plants like, Azolla, Cycas etc. -

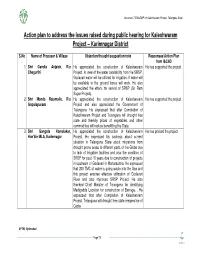

Action Plan to Address the Issues Raised During Public Hearing for Kaleshwaram Project – Karimnagar District

Annexure 7 EIA&EMP for Kaleshwaram Project, Telangana State Action plan to address the issues raised during public hearing for Kaleshwaram Project – Karimnagar District S.No Name of Proposer & Village Objection/thought/suggestion/note Responses/Action Plan . from I&CAD 1. Shri Gandla Anjaiah, R/o He appreciated the construction of Kaleshwaram He has supported the project. Chegurthi Project. In view of the water availability from the SRSP, Godavari water will be utilized for irrigation. If water will be available in the ground bores will work. He also appreciated the efforts for revival of SRSP (Sri Ram Sagar Project). 2. Shri Manda Rajamallu, R/o He appreciated the construction of Kaleshwaram He has supported the project. Gopalapuram Project and also appreciated the Government of Telangana. He expressed that after Completion of Kaleshwaram Project and Telangana will drought free state and thereby prices of vegetables and other commodities will reduce benefitting the State. 3. Shri Gangula Kamalakar, He appreciated the construction of Kaleshwaram He has praised the project. Hon'ble MLA, Karimnagar Project. He expressed his sadness about current situation in Telangana State about migrations from drought prone areas to different parts of the Globe due to lack of Irrigation facilities and also the condition of SRSP for past 10 years due to construction of projects in upstream of Godavari in Maharashtra. He expressed that 200 TMC of water is going waste into the Sea and this project ensures effective utilization of Godavari River and also improves SRSP Project. He also thanked Chief Minister of Telangana for identifying Medigadda Location for construction of Barrage. -

District Census Handbook, Warangal, Part XII-A & B, Series-2

CENSUS OF INDIA 1991 SERIES 2 ANDHRA PRADESH DISTRICT CENSUS HANDBOOK WARANGAL PART XII - A & B VILLAGE & TOWN DIRECTORY VILLAGE & TOWNWISE PRIMARY CENSUS ABSTRACT R.P.SINGH OF THE INDIAN ADMINISTRATIVE SERVICE DIRECTOR OF CENSUS OPERATIONS ANDHRA PRADESH \ PUBLISHED BY THE GOVERNMENT OF ANDHRA PRADESH 1996 FOREWORD Publication of the District Census Handbooks (DCHs) was initiated after the 1951 Census and is continuing since then with some innovations/modifications after each decennial Census. This is the most valuable district level publication brought out by the Census Organisation on behalf of each State Govt./ Union Territory administration. It Inter alia Provides data/information on some of the basic demographic and socio-economic characteristics and on the availability of certain important civic amenities/facilities in each village and town of the respective districts. This publication has thus proved to be of immense utility to the planners:, administrators, academicians and researchers.. The scope of the DCH was initially confined to certain important census tables on population, economic and socio-cultural aspects as also the Primary Census Abstract (PCA) of each village and town (ward wise) of the district. The DCHs published after the 1961 Census contained a descriptive account of the district, administrative statistics, census tables and Village and Town Directories including PCA. After the 1971 Census, two parts of the District Census Handbooks (Part-A comprising Village and Town Directories and Part-B comprising Village and Town PCA) were released in all the States and Union Territories. The third Part (C) of the District Census Handbooks comprising administrative statistics and district census tables, which was also to be brought out, could not be published in many States/UTs due to considerable delay in compilation of relevant material.