(Abridged) 72 a Nnual R Eport 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is the Vice Chairman and Managing

Mr Jayadev Galla Vice-Chairman Amara Raja Group Mr Jayadev Galla (Jay) is the Vice Chairman and Managing Director of Amara Raja Batteries Limited (ARBL), a leading manufacturer of Advanced Lead Acid batteries for Industrial and Automotive applications. ARBL is a joint venture between Amara Raja group and US based Johnson Controls Inc. (JCI). JCI is a USD 35 billion conglomerate and the global leader in building efficiency, automotive interior experience and automotive power solutions. The company owns the brand name “Amaron” which is the second largest selling automotive battery brand in India today. ARBL is a widely held public limited company listed on the National Stock Exchange of India Limited and the Bombay Stock Exchange Limited. The gross revenue for the year ending March 31, 2012 is more than USD 450 mn. Achievements Spearheading ARBL’s automotive batteries (Amaron) venture Striking a partnership with JCI, U.S.A. for the automotive battery business Winning the prestigious Ford World Excellence Award in 2004 achieved by meeting global delivery standards. ARBL is the 3rd supplier from India to be given this award. Posts and Responsibilities Confederation of Indian Industry Young Indians National Branding Chair Young Indian’s National Immediate Past Chairman Young Indians Immediate Past Chairman - District Chapter Initiatives Amara Raja Group of Companies Vice Chairman, Amara Raja Power Systems Limited Vice Chairman and Managing Director, Amara Raja Electronics Limited Vice Chairman, Mangal Industries Limited Director, Amara Raja Infra Private Limited Director, Amaron Batteries (P) Ltd. Director, Amara Raja Industrial Services (P) Ltd. Permanent Trustee of the Rajanna Trust The Trust was established in 1999 and is dedicated to rural development and to improve the economic conditions of the farmers in Chittoor District, Andhra Pradesh. -

“Tata Motors Group Q3 FY18 Earnings Conference Call”

“Tata Motors Group Q3 FY18 Earnings Conference Call” February 05, 2018 MANAGEMENT: MR. N. CHANDRASEKARAN – CHAIRMAN, TATA MOTORS MR. GUENTER BUTSCHEK – MANAGING DIRECTOR & CHIEF EXECUTIVE OFFICER, TATA MOTORS MR. P.B. BALAJI – CHIEF FINANCIAL OFFICER, TATA MOTORS GROUP DR. RALF SPETH – CHIEF EXECUTIVE OFFICER, JAGUAR LAND ROVER MR. KENNETH GREGOR – CHIEF FINANCIAL OFFICER, JAGUAR LAND ROVER MODERATOR: MR. CHIRAG SHAH – RESEARCH ANALYST, EDELWEISS SECURITIES Page 1 of 31 Tata Motors Group February 05, 2018 Moderator: Ladies and Gentlemen, Good Day and Welcome to Tata Motors Q3 FY2018 Earnings Conference Call, hosted by Edelweiss Securities Limited. As a reminder, all participant lines will be in the listen-only mode. There will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal for an operator by pressing ‘*’ followed-by ‘0’ on your touchtone phone. Please note that this conference is being recorded. I now hand the conference over to Mr. Chirag Shah from Edelweiss Securities. Thank you and over to you, sir. Chirag Shah: Thank you, Ali. Hi, everyone. Good afternoon and good evening. Thank you for joining Tata Motors’ Q3 Earnings Call. We thank the management for giving us the opportunity to host the call. From the management side we have today with us Mr. N. Chandrasekaran – Chairman; Mr. Guenter Butschek – MD & CEO, Tata Motors; Dr. Ralf Speth – CEO, Jaguar Land Rover; Mr. P.B. Balaji – Group CFO, Tata Motors; Mr. Kenneth Gregor – CFO, Jaguar Land Rover and other members of the Investor Relations team. Now, I would request Mr. -

Trent Hypermarket Ties up with Future Consumer Enterprise Ltd to Retail a Wide Range of Products ~A First of Its Kind Tie-Up

Trent Hypermarket ties up with Future Consumer Enterprise Ltd to retail a wide range of products ~A first of its kind tie-up that aims to bring customers of Star Bazaar, a unique product-price proposition~ Mumbai, 3rd March, 2016: Star, a TATA & TESCO enterprise, has tied up with Future Consumer Enterprise Ltd. (FCEL), to launch a wide range of food and non-food products across Star Bazaar stores. Star Bazaar aims to launch close to 148 SKUs across 10 FCEL brands with a view to provide their customers a unique product price proposition. FCEL’s portfolio includes popular consumer brands in the food category like ‘Sunkist’, ‘Tasty Treat’, “Karmiq” “Desi Atta” and ‘Fresh & Pure’; while “Think Skin”, ‘Clean Mate’ and ‘Care Mate’ constitute the non-food category. The FCEL range will be made available across large format hypermarkets of Star Bazaar in its initial phase. While this alliance offers customers a unique advantage of accessing everyday products at a great price, the launch will also see exclusive offers and promotions for Star’s Club card loyalty members. This association aims to serve the customers an unmatched array of products and introduce services that will see the store as a one stop destination for all daily household needs. Speaking on the launch, Mr. Jamshed Daboo, Managing Director, Trent Hypermarket Ltd. said, “We are excited about our collaboration with Future Consumer Enterprise to retail their flagship brands. With this tie- up, we will be bringing our customers an extensive range of high quality food products and non-food merchandise. Our objective is to enhance our existing range and ensure we address the growing needs of customers to access unique products at affordable price points” Mr. -

Presentation Title ( Arial, Font Size 28 )

PresentationThe Tata Power Title (Company Arial, Font size Ltd. 28 ) Date, Venue, etc ..( Arial, January Font size 18 2013 ) …Message Box ( Arial, Font size 18 Bold) Disclaimer •Certain statements made in this presentation may not be based on historical information or facts and may be “forward looking statements”, including those relating to The Tata Power Company Limited’s general business plans and strategy, its future outlook and growth prospects, and future developments in its industry and its competitive and regulatory environment. Actual results may differ materially from these forward-looking statements due to a number of factors, including future changes or developments in The Tata Power Company Limited’s business, its competitive environment, its ability to implement its strategies and initiatives and respond to technological changes and political, economic, regulatory and social conditions in India. •This presentation does not constitute a prospectus, offering circular or offering memorandum or an offer to acquire any Shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of The Tata Power Company Limited’s Shares. Neither this presentation nor any other documentation or information (or any part thereof) delivered or supplied under or in relation to the Shares shall be deemed to constitute an offer of or an invitation by or on behalf of The Tata Power Company Limited. •The Company, as such, makes no representation or warranty, express or implied, as to, and do not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any information or opinions contained herein. -

Titan Company Limited Jewellery Business Back on Track

Titan Company Limited Jewellery business back on track Powered by the Sharekhan 3R Research Philosophy Consumer Discretionary Sharekhan code: TITAN Result Update Update Stock 3R MATRIX + = - Summary Right Sector (RS) ü Titan’s standalone business recovered to 89% (consolidated recovered to 98%) with the jewellery business growing by 9% in Q2FY2021; watches and eyewear Right Quality (RQ) ü business recoveredto 56% and 61%, respectively. Consolidated OPM declined 433 bps to 6.9%, affected by hedging loss and lower operating leverge. Operating profit was down 40% to Rs. 313 crore. Right Valuation (RV) ü Higher demand during the festive season and improving wedding demand will help Titan post sustained recovery in the jewellery business going ahead. + Positive = Neutral - Negative We have fine-tuned our estimates for FY2021 to factor in lower-than-expected OPM. We have maintained them for FY2022/FY2023E. We maintain Buy with a Reco/View Change revised PT of Rs. 1,350. Reco: Buy Titan Company’s (Titan) consolidated revenue decreased by 2.3% to Rs. 4,553 crore as against our expectation of Rs. 4175.7 crore. This is including the gold-ingots sale of CMP: Rs. 1,218 Rs. 391 crore. Revenue of the jewellery business grew by 9%, while watches and eye wear businesses recovered to 56% and 61%, respectively, in Q2 (both the businesses Price Target: Rs. 1,350 á recovered to 70% each in September 2020). Operating profit margin (OPM) decreased by 433 bps to 6.9% as against our expectation of 7.5%. During the quarter, the company á Upgrade Maintain â Downgrade has recognised loss of Rs. -

Tata Motors Annual Report

68th Annual Report 2012-13 CONTENTS FINANCIAL HIGHLIGHTS FINANCIAL STATEMENTS 36 Financial Performance Standalone Financial Statements 40 Summarised Balance Sheet 116 Independent Auditors’ Report and Statement of Profit and 120 Balance Sheet Loss Standalone 121 Profit and Loss Statement 42 Summarised Balance Sheet and Statement of Profit and 122 Cash Flow Statement Loss Consolidated 124 Notes to Accounts 44 Fund Flow Statement Consolidated Financial Statements 160 Independent Auditors’ Report STATUTORY REPORTS 162 Balance Sheet 45 Notice 163 Profit and Loss Statement 52 Directors’ Report 164 Cash Flow Statement 66 Management Discussion and 166 Notes to Accounts Analysis CORPORATE OVERVIEW Subsidiary Companies 98 Report on Corporate 02 Corporate Information Governance 197 Financial Highlights 03 Mission, Vision and Values 115 Secretarial Audit Report 200 Listed Securities 04 Chairman’s Statement 201 Financial Statistics 08 Board of Directors 12 Delivering Experiences Attendance Slip & Proxy Form 14 Key Performance Indicators 16 Products and Brands 18 Global Presence 20 Milestones 22 Driving Accountability 24 Focusing on Customers & Products 26 Emphasising Excellence 28 Delivering with Speed 30 Sustainability 34 Awards and Achievements ANNUAL GENERAL MEETING Date: Wednesday, August 21, 2013 Time: 3.00 p.m. Venue: Birla Matushri Sabhagar, 19, Sir Vithaldas Thackersey Marg, Mumbai 400 020 ANTICIPATING NEEDS. DELIVERING EXCITEMENT. At Tata Motors, we believe that our Our renewed commitment to these mobility needs of our customers. We are strengths stem from an organisation- pillars drives us to achieve our mission engaging with them at our dealerships wide culture which rests on four of anticipating and providing the best and adopting processes to ensure that pillars – Accountability, Customer & vehicles and experiences to excite our industry-leading practices form a key part Product Focus, Excellence and customers. -

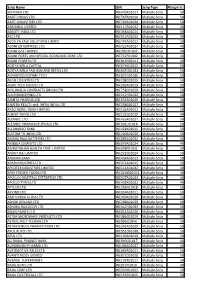

Scrip Name ISIN Scrip Type Margin % 3M INDIA LTD INE470A01017

Scrip Name ISIN Scrip Type Margin % 3M INDIA LTD INE470A01017 Multiple Scrip 50 AARTI DRUGS LTD INE767A01016 Multiple Scrip 50 AARTI INDUSTRIES LTD INE769A01020 Multiple Scrip 50 ABB INDIA LIMITED INE117A01022 Multiple Scrip 40 ABBOTT INDIA LTD INE358A01014 Multiple Scrip 50 ACC LTD INE012A01025 Multiple Scrip 40 ACCELYA KALE SOLUTIONS LIMITD INE793A01012 Multiple Scrip 50 ADANI ENTERPRISES LTD INE423A01024 Multiple Scrip 40 ADANI GAS LIMITED INE399L01023 Multiple Scrip 40 ADANI PORTS AND SPECIAL ECONOMIC ZONE LTD INE742F01042 Multiple Scrip 40 ADANI POWER LTD INE814H01011 Multiple Scrip 40 ADITYA BIRLA CAPITAL INE674K01013 Multiple Scrip 50 ADITYA BIRLA FASHION AND RETAIL LTD INE647O01011 Multiple Scrip 50 ADVANCED ENZYME TECH INE837H01020 Multiple Scrip 50 AEGIS LOGISTICS LTD INE208C01025 Multiple Scrip 50 AGRO TECH FOODS LTD INE209A01019 Multiple Scrip 50 AHLUWALIA CONTRACTS (INDIA) LTD INE758C01029 Multiple Scrip 50 AIA ENGINEERING LTD INE212H01026 Multiple Scrip 50 AJANTA PHARMA LTD INE031B01049 Multiple Scrip 50 AJMERA REALTY and INFRA INDIA LTD INE298G01027 Multiple Scrip 50 AKZO NOBEL INDIA LIMITED INE133A01011 Multiple Scrip 50 ALBERT DAVID LTD INE155C01010 Multiple Scrip 40 ALEMBIC LTD INE426A01027 Multiple Scrip 50 ALEMBIC PHARMACEUTICALS LTD INE901L01018 Multiple Scrip 50 ALLAHABAD BANK INE428A01015 Multiple Scrip 50 ALSTOM TD INDIA LTD INE200A01026 Multiple Scrip 50 AMARA RAJA BATTERIES LTD INE885A01032 Multiple Scrip 50 AMBUJA CEMENTS LTD INE079A01024 Multiple Scrip 40 AMRUTANJAN HEALTH CARE LIMITED INE098F01031 Multiple -

Presentation Title ( Arial, Font Size 28 )

PresentationThe Tata Power Title (Company Arial, Font size Ltd. 28 ) Date, Venue, etc ..( Arial, September Font size 18 ) 2013 …Message Box ( Arial, Font size 18 Bold) Disclaimer •Certain statements made in this presentation may not be based on historical information or facts and may be “forward looking statements”, including those relating to The Tata Power Company Limited‟s general business plans and strategy, its future outlook and growth prospects, and future developments in its industry and its competitive and regulatory environment. Actual results may differ materially from these forward-looking statements due to a number of factors, including future changes or developments in The Tata Power Company Limited‟s business, its competitive environment, its ability to implement its strategies and initiatives and respond to technological changes and political, economic, regulatory and social conditions in India. •This presentation does not constitute a prospectus, offering circular or offering memorandum or an offer to acquire any Shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of The Tata Power Company Limited‟s Shares. Neither this presentation nor any other documentation or information (or any part thereof) delivered or supplied under or in relation to the Shares shall be deemed to constitute an offer of or an invitation by or on behalf of The Tata Power Company Limited. •The Company, as such, makes no representation or warranty, express or implied, as to, and do not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any information or opinions contained herein. -

Ti\Ti\ Motors Limited

G TATA SSE Limited Listing Compliance Department First Floor, New Trading Ring National Stock Exchange of India Ltd. Rotunda Building, P J Towers, Exchange Plaza, Sandra Kurla Complex, Dalal Street, Fort, Mumbai 400 001 Bandra(E), Mumbai 400 051 Kind Attn: Mr Khushro A. Bulsara Kind Attn: Mr Lokesh Bhandari General Manager & Head Senior Manager Listing Compliance & Legal Regulatory Listing & Compliance January 30, 2020 Sc. No.- 15870 Dear Sirs, Ref: ISIN: INE155A01022- Ordinary Shares IN9155A01020- 'A' Ordinary Shares Debt Securities on NSE & BSE Re: Retirement of Dr Ralf Speth - Executive Director & CEO of Jaguar LandRover Automotive Pic (JLR) Pursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and with respect to the captioned matter, please find enclosed a press release issued by the Company which is self explanatory. This is for the information to the exchanges and the members. Yours faithfully, Tata Mo~sLimited 1\ ... s l... >1- H K Seth . Company Secretary TI\TI\ MOTORS LIMITED Bombay House 24 Homi Mody Street Mumbai 400 001 Tel 91 22 6665 8282 Fax 91 22 6665 7799 www.tatamotors.com CIN L28920MH 1945PLC004520 TATAMOTORS uTATA Connecting Asp ~rations for immediate use Mumbai, January 30, 2020: Mr Chandrasekaran, Chairman of Tata Sons, Tata Motors and Jaguar Land Rover plc would Like to announce that Professor Sir Ralf Speth has decided to retire from his current role as Executive Director and Chief Executive Officer of JLR at the end of his contract term in September 2020. "I want to thank Ralf for his passion and commitment over the Last 10 years. -

Board of Directors

Corporate Overview Statutory Reports Financial Statements BOARD OF DIRECTORS Mr Cyrus P Mistry Non-Executive Director and Chairman Mr Mistry was appointed as a Director of Tata Motors with effect from May 29, 2012, and as deputy chairman of the Company with effect from November 7, 2012. Mr Mistry took over as Chairman from Mr Ratan N Tata on his retirement with effect from December 28, 2012. Mr Mistry was earlier managing director of the Shapoorji Pallonji group. He was also responsible for building the infrastructure development vertical in the Shapoorji Pallonji group. Mr Mistry is a Graduate of Civil Engineering from the Imperial College London (1990) and has an MSc in Management from the London Business School (1997). He was recently bestowed with the Alumni Achievement Award by the London Business School. Mr Nusli N Wadia Non-Executive, Independent Director Educated in the UK, Mr Wadia is the Chairman of the Bombay Dyeing & Manufacturing Company Limited and heads the Wadia Group. He is also the Chairman / Trustee of various charitable institutions and non-profit organisations. Mr Wadia has been on the Company’s Board since December 1998 as an Independent Director. Dr Raghunath A Mashelkar Non-Executive, Independent Director Dr Mashelkar is an eminent chemical engineering scientist who retired from the post of Director General from the CSIR and is the President of Indian National Science Academy (INSA), National Innovation Foundation, Institution of Chemical Engineers, UK and Global Research Alliance. The President of India honoured Dr Mashelkar with the Padma Shri (1991), the Padma Bhushan (2000) and the Padma Vibhushan (2014). -

Naamsa Industry New Sales

Jul 2019 Industry New Vehicle sales Total Vehicles by Manufacturer RSA Export TOYOTA 10 142 4 689 VOLKSWAGEN GROUP SA 7 617 2 927 NISSAN 4 820 716 FMC 4 289 9 253 HYUNDAI AUTOMOTIVE SOUTH AFRICA 2 787 ISUZU MOTORS SOUTH AFRICA 2 125 281 RENAULT 2 048 KIA SOUTH AFRICA 1 599 SUZUKI AUTO 1 577 1 MERCEDES-BENZ SA ** 1 537 9 495 BMW GROUP 1 284 6 788 MAZDA SOUTHERN AFRICA 1 065 HAVAL MOTORS SA 993 12 MAHINDRA 733 VOLVO GROUP SOUTHERN AFRICA 558 61 HONDA 398 25 JAGUAR LAND ROVER 343 OPEL 304 SCANIA 255 3 MAN 215 1 VOLVO CARS 186 MITSUBISHI MOTORS SA 184 26 PORSCHE ** 164 FCA SOUTH AFRICA 134 3 PCSA 125 IVECO 124 9 FAW TRUCKS 120 7 TATA 110 SUBARU 84 JMC 54 POWERSTAR 36 BABCOCK 24 VECV SOUTH AFRICA 21 SCUDERIA SOUTH AFRICA 9 BENTLEY ** 7 MASERATI SOUTH AFRICA 5 LAMBORGHINI SOUTH AFRICA ** 1 INDUSTRY TOTAL 46 077 34 297 Market Totals by Manufacturer Passenger Light Medium CV Heavy CV Extra Heavy CV Bus CV < 3501kg 3501-8500kg 8501-16500kg > 16500kg > 8500kg RSA Export RSA Export RSA Export RSA Export RSA Export RSA Export TOYOTA 4 739 195 5 008 4 494 234 125 36 VOLKSWAGEN GROUP SA 7 088 2 927 461 68 NISSAN 1 755 3 065 716 FMC 2 019 6 2 266 9 247 4 HYUNDAI AUTOMOTIVE SOUTH AFRICA 2 532 235 20 ISUZU MOTORS SOUTH AFRICA 96 2 1 723 276 160 3 130 16 RENAULT 2 034 14 KIA SOUTH AFRICA 1 395 204 SUZUKI AUTO 1 484 1 93 MERCEDES-BENZ SA ** 945 9 489 113 168 4 47 2 251 13 BMW GROUP 1 284 6 788 MAZDA SOUTHERN AFRICA 1 039 26 HAVAL MOTORS SA 805 5 188 7 MAHINDRA 396 337 VOLVO GROUP SOUTHERN AFRICA 100 22 451 39 7 HONDA 398 25 JAGUAR LAND ROVER 343 OPEL 272 -

Printmgr File

As filed with the Securities and Exchange Commission on August 2, 2013 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal year ended March 31, 2013 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number: 001-32294 TATA MOTORS LIMITED (Exact name of Registrant as specified in its charter) Not applicable (Translation of Registrant’s name into English) Bombay House 24, Homi Mody Street Republic of India Mumbai 400 001, India (Jurisdiction of incorporation or organization) (Address of principal executive offices) H.K. Sethna Tel.: +91 22 6665 7219 Facsimile: +91 22 6665 7260 Address: Bombay House 24, Homi Mody Street Mumbai 400 001, India (Name, telephone, facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Ordinary Shares, par value Rs.2 per share * The New York Stock Exchange, Inc Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.