FACTORS of SUPPLY & DEMAND Price Quantity Supplied

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introductory Discussions of Supply and Demand and of the Working of the Price Mechanism Normally Treat Quantities Demanded and S

STRATHCLYDE DISCUSSION PAPERS IN ECONOMICS ‘ECONOMIC GEOMETRY’: MARSHALL’S AND OTHER EARLY REPRESENTATIONS OF DEMAND AND SUPPLY. BY ROY GRIEVE NO. 08-06 DEPARTMENT OF ECONOMICS UNIVERSITY OF STRATHCLYDE GLASGOW ‘ECONOMIC GEOMETRY’: MARSHALL’S AND OTHER EARLY REPRESENTATIONS OF DEMAND AND SUPPLY ROY GRIEVE1 ABSTRACT Does an apparent (minor) anomaly, said to occur not infrequently in elementary expositions of supply and demand theory, really imply – as seems to be suggested – that there is something a bit odd about Marshall’s diagrammatic handling of demand and supply? On investigation, we find some interesting differences of focus and exposition amongst the theorists who first developed the ‘geometric’ treatment of demand and supply, but find no reason, despite his differences from other marginalist pioneers such as Cournot, Dupuit and Walras, to consider Marshall’s treatment either as unconventional or forced, or as to regard him as the ‘odd man out’. Introduction In the standard textbooks, introductory discussions of demand and supply normally treat quantities demanded and supplied as functions of price (rather than vice versa), and complement that discussion with diagrams in the standard format, showing price on the vertical axis and quantities demanded and supplied on the horizontal axis. No references need be cited. Usually this presentation is accepted without comment, but it can happen that a more numerate student observes that something of an anomaly appears to exist – in that the diagrams show price, which, 1 Roy’s thanks go to Darryl Holden who raised the question about Marshall's diagrams, and for his subsequent advice, and to Eric Rahim, as always, for valuable comment. -

Supply and Demand Is Not a Neoclassical Concern

Munich Personal RePEc Archive Supply and Demand Is Not a Neoclassical Concern Lima, Gerson P. Macroambiente 3 March 2015 Online at https://mpra.ub.uni-muenchen.de/63135/ MPRA Paper No. 63135, posted 21 Mar 2015 13:54 UTC Supply and Demand Is Not a Neoclassical Concern Gerson P. Lima1 The present treatise is an attempt to present a modern version of old doctrines with the aid of the new work, and with reference to the new problems, of our own age (Marshall, 1890, Preface to the First Edition). 1. Introduction Many people are convinced that the contemporaneous mainstream economics is not qualified to explaining what is going on, to tame financial markets, to avoid crises and to provide a concrete solution to the poor and deteriorating situation of a large portion of the world population. Many economists, students, newspapers and informed people are asking for and expecting a new economics, a real world economic science. “The Keynes- inspired building-blocks are there. But it is admittedly a long way to go before the whole construction is in place. But the sooner we are intellectually honest and ready to admit that modern neoclassical macroeconomics and its microfoundationalist programme has come to way’s end – the sooner we can redirect our aspirations to more fruitful endeavours” (Syll, 2014, p. 28). Accordingly, this paper demonstrates that current mainstream monetarist economics cannot be science and proposes new approaches to economic theory and econometric method that after replication and enhancement may be a starting point for the creation of the real world economic theory. -

Macroeconomics: an Introduction the Demand for Money

Lecture Notes for Chapter 7 of Macroeconomics: An Introduction The Demand for Money Copyright © 1999-2008 by Charles R. Nelson 2/19/08 In this chapter we will discuss - What does ‘demand for money’ mean? Why do we need to know about it? What is the price of money? How the supply and demand for money determine the interest rate. The Fed controls the supply of money, so the Fed can control the interest rate. Why Study the Demand for Money? Fed controls the supply of money through open market operations. The demand for money depends on the interest rate. Interest rate is a price, and it adjusts to balance the supply and demand for money. That means the Fed can control interest rates by changing the supply of money. 1 Why are interest rates important? Low interest rates stimulate spending on - plant and equipment - and consumer durables. High interest rates discourage spending, - affect GDP and employment, - finally, prices and wages too. Control over interest rates gives the Fed a lever to move the economy. What is the Demand for Money? How much money would you like to have? - One billion? - Two? That can’t be it. Instead ‘How much money (currency and bank deposits) do you wish to hold, given your total wealth.’ Puzzle - Why hold any money at all? It pays no interest. It loses purchasing power to inflation. 2 Motives for holding money: 1. To settle transactions. - Money is the medium of exchange. 2. As a precautionary store of liquidity. - Money is the most liquid of all assets. -

A Primer on Modern Monetary Theory

2021 A Primer on Modern Monetary Theory Steven Globerman fraserinstitute.org Contents Executive Summary / i 1. Introducing Modern Monetary Theory / 1 2. Implementing MMT / 4 3. Has Canada Adopted MMT? / 10 4. Proposed Economic and Social Justifications for MMT / 17 5. MMT and Inflation / 23 Concluding Comments / 27 References / 29 About the author / 33 Acknowledgments / 33 Publishing information / 34 Supporting the Fraser Institute / 35 Purpose, funding, and independence / 35 About the Fraser Institute / 36 Editorial Advisory Board / 37 fraserinstitute.org fraserinstitute.org Executive Summary Modern Monetary Theory (MMT) is a policy model for funding govern- ment spending. While MMT is not new, it has recently received wide- spread attention, particularly as government spending has increased dramatically in response to the ongoing COVID-19 crisis and concerns grow about how to pay for this increased spending. The essential message of MMT is that there is no financial constraint on government spending as long as a country is a sovereign issuer of cur- rency and does not tie the value of its currency to another currency. Both Canada and the US are examples of countries that are sovereign issuers of currency. In principle, being a sovereign issuer of currency endows the government with the ability to borrow money from the country’s cen- tral bank. The central bank can effectively credit the government’s bank account at the central bank for an unlimited amount of money without either charging the government interest or, indeed, demanding repayment of the government bonds the central bank has acquired. In 2020, the cen- tral banks in both Canada and the US bought a disproportionately large share of government bonds compared to previous years, which has led some observers to argue that the governments of Canada and the United States are practicing MMT. -

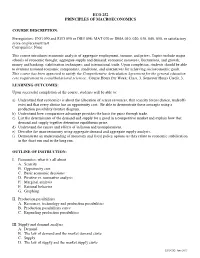

Eco 252 Principles of Macroeconomics Course

ECO 252 PRINCIPLES OF MACROECONOMICS COURSE DESCRIPTION: Prerequisites: ENG 090 and RED 090 or DRE 098; MAT 070 or DMA 010, 020, 030, 040, 050, or satisfactory score on placement test Corequisites: None This course introduces economic analysis of aggregate employment, income, and prices. Topics include major schools of economic thought; aggregate supply and demand; economic measures, fluctuations, and growth; money and banking; stabilization techniques; and international trade. Upon completion, students should be able to evaluate national economic components, conditions, and alternatives for achieving socioeconomic goals. This course has been approved to satisfy the Comprehensive Articulation Agreement for the general education core requirement in social/behavioral sciences. Course Hours Per Week: Class, 3. Semester Hours Credit, 3. LEARNING OUTCOMES: Upon successful completion of the course, students will be able to: a) Understand that economics is about the allocation of scarce resources, that scarcity forces choice, tradeoffs exist and that every choice has an opportunity cost. Be able to demonstrate these concepts using a production possibility frontier diagram. b) Understand how comparative advantage provides the basis for gains through trade. c) List the determinants of the demand and supply for a good in a competitive market and explain how that demand and supply together determine equilibrium price. d) Understand the causes and effects of inflation and unemployment. e) Describe the macroeconomy using aggregate demand and aggregate supply analysis. f) Demonstrate an understanding of monetary and fiscal policy options as they relate to economic stabilization in the short run and in the long run. OUTLINE OF INSTRUCTION: I. Economics: what it’s all about A. -

Housing Supply and Affordability: Do Affordable Housing Mandates Work?

April 2004 HOUSING SUPPLY AND AFFORDABILITY: DO AFFORDABLE HOUSING MANDATES WORK? By Benjamin Powell, Ph.D and Edward Stringham, Ph.D Project Director: Adrian T. Moore, Ph.D POLICY STUDY 318 Reason Public Policy Institute division of the Los Angeles-based Reason Foundation, Reason APublic Policy Institute is a nonpartisan public policy think tank promoting choice, competition, and a dynamic market economy as the foundation for human dignity and progress. Reason produces rigorous, peer-reviewed research and directly engages the policy process, seek- ing strategies that emphasize cooperation, flexibility, local knowledge, and results. Through practical and innovative approaches to complex problems, Reason seeks to change the way people think about issues, and promote policies that allow and encourage individuals and volun- tary institutions to flourish. Reason Foundation Reason Foundation’s mission is to advance a free society by develop- ing, applying, and promoting libertarian principles, including indi- vidual liberty, free markets, and the rule of law. We use journalism and public policy research to influence the frameworks and actions of poli- cymakers, journalists, and opinion leaders. Reason Foundation is a tax-exempt research and education organiza- tion as defined under IRS code 501(c)(3). Reason Foundation is sup- ported by voluntary contributions from individuals, foundations, and corporations. The views are those of the author, not necessarily those of Reason Foundation or its trustees. Copyright © 2004 Reason Foundation. Photos used in this publication are copyright © 1996 Photodisc, Inc. All rights reserved. Policy Study No. 318 Housing Supply and Affordability: Do Affordable Housing Mandates Work? By Benjamin Powell, Ph.D. and Edward Stringham, Ph.D Project Director: Adrian T. -

Chapter 4: the Market Forces of Supply and Demand Principles of Economics, 8Th Edition N

Chapter 4: The Market Forces of Supply and Demand Principles of Economics, 8th Edition N. Gregory Mankiw Page 1 1. Supply and demand are the most important concepts in economics. 2. Markets and Competition a. Market is a group of buyers and sellers of a particular good or service. P. 66. b. These individuals are assumed to be rational attempting to maximize their welfare subject to the constraints that they face. c. A competitive market is a market in which there are many buyers and many sellers so that each has a negligible impact on the market price. P. 66. d. What is Competition? i. Perfectly competitive markets are defined by two characteristics: (1) homogeneous products and (2) many buyers and sellers so no one influences the price. ii. Under perfect competition, firms are price takers. iii. A market with only one seller is called monopoly. iv. A market with few sellers is called an oligopoly. v. A market with many sellers who sell slightly differentiated products is called monopolistic competition. vi. Some degree of competition is present in most markets. e. The different environments in which firms operate: Type of Product Number of Sellers Many Few One Homogeneous Competition Oligopoly Monopoly (Wheat) (Airlines) (Patent Holder) Differentiated Monopolistic (Automobiles) Price Competition Discriminating (Retail Shoes) Monopolist (Publisher) f. We can also think about markets in terms of the difficulty of entry with i. competitive markets being easy to enter and ii. monopolistic markets being difficult to enter. 3. Demand a. The Demand Curve: The Relationship between Price and Quantity Demanded i. -

Neoclassical Labor Supply

NEOCLASSICAL LABOR SUPPLY Jón Steinsson UC Berkeley April 2019 Steinsson (UC Berkeley) Neoclassical Labor Supply 1 / 45 BASIC MACRO BUILDING BLOCKS Consumption-Savings Decision Labor-Leisure Decision Capital Accumulation Factor Demand Price and Wage Setting (Phillips Curve) Etc. Steinsson (UC Berkeley) Neoclassical Labor Supply 2 / 45 LABOR MARKET Plausible (likely) that “frictions” are important in the labor market: Jobs and workers are very heterogeneous, suggesting that search frictions may be important Monopsony power may be important Monopoly power may be important (unions) Unemployment (the market doesn’t clear) Nevertheless, useful to understand neoclassical labor market theory (i.e., perfectly competitive labor market) as one benchmark Neoclassical labor market theory may make sense for “big” questions Steinsson (UC Berkeley) Neoclassical Labor Supply 3 / 45 Labor Supply: Household’s intratemporal labor-leisure choice max U(Ct ; Lt ) subject to: Ct = Wt Lt First order condition: ULt = Wt UCt Ignores participation margin for simplicity NEOCLASSICAL LABOR ECONOMICS Labor Demand: Wt = FL(Lt ; ·) Ignores hiring and firing costs Views labor market as a spot market Steinsson (UC Berkeley) Neoclassical Labor Supply 4 / 45 NEOCLASSICAL LABOR ECONOMICS Labor Demand: Wt = FL(Lt ; ·) Ignores hiring and firing costs Views labor market as a spot market Labor Supply: Household’s intratemporal labor-leisure choice max U(Ct ; Lt ) subject to: Ct = Wt Lt First order condition: ULt = Wt UCt Ignores participation margin for simplicity Steinsson (UC -

The Work of Commodity Definition and Price Under Neoliberal Environmental Policy

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln U.S. Environmental Protection Agency Papers U.S. Environmental Protection Agency 2007 Discovering Price in All the Wrong Places: The Work of Commodity Definition and Price under Neoliberal Environmental Policy Morgan Robertson U.S. Environmental Protection Agency, [email protected] Follow this and additional works at: https://digitalcommons.unl.edu/usepapapers Robertson, Morgan, "Discovering Price in All the Wrong Places: The Work of Commodity Definition and Price under Neoliberal Environmental Policy" (2007). U.S. Environmental Protection Agency Papers. 150. https://digitalcommons.unl.edu/usepapapers/150 This Article is brought to you for free and open access by the U.S. Environmental Protection Agency at DigitalCommons@University of Nebraska - Lincoln. It has been accepted for inclusion in U.S. Environmental Protection Agency Papers by an authorized administrator of DigitalCommons@University of Nebraska - Lincoln. Discovering Price in All the Wrong Places: The Work of Commodity Definition and Price under Neoliberal Environmental Policy Morgan Robertson US Environmental Protection Agency, Office of Water, Wetlands Division, Washington, DC, USA; [email protected] Abstract: Price plays a unique role in neoliberal economic theory, quantifying value and pro- viding markets with the information needed to produce equilibrium conditions and optimal social welfare. While the role of price is clear, the mechanisms by which prices are discovered, and by which the commodities they value are defined, are left obscure in neoliberal theory. Automatic price discovery, and self-evident commodity identities, are assumed. Observation of newly created markets in ecosystem services suggests that this is a moment of significant ten- sion within neoliberal practice, as potential market participants seek guidance from the state on appropriate commodity measures and pricing practices. -

Price Determination in Coffee Market

School of Business and Economics Price Determination in Coffee Market: The Impact of Supply and Demand shifts — John Ssenkaaba Master’s Thesis in Economics - May 2019 Acknowledgement Firstly, am grateful to God almighty for the good health and wellbeing that were necessary to completion of this work. I wish to express my gratitude to my Supervisors, Associate professor Eirik Eriksen Heen and Associate professor Sverre Braathen Thyholdt for sharing their knowledge and guidance with me in the most efficient way to this accomplishment. With great regards, I would like to express my appreciation to all the staff at the school of business and economics, all courses that were part of my master’s program have been great and useful. To all my classmates, friends and family, thank you very much for your love and support. Abstract. Coffee market prices have been unstable over time. Determining the relative impact of supply and demand shift on price is a subject of discussion in this thesis. I use an index approach that was first introduced by Marsh (2003) to estimate the annual shifts in demand and supply for the periods from 2005 to 2017. This approach gives estimates to change in demand and supply of a given commodity which is due to other factors apart from the commodity’s own price. The results show that both demand and supply for coffee beans shifts considerably between periods, with the global average annual supply shift as 0.99% and global average annual demand shift as 3.19%. Much of the shift in supply fluctuate frequently between positive and negative shifts implying an increase and decrease in supply respectively, where as much of the shifts in demand are mainly positive implying demand growth over the same period. -

Price Theory – Supply and Demand Lecture

Price Theory Lecture 2: Supply & Demand I. The Basic Notion of Supply & Demand Supply-and-demand is a model for understanding the determination of the price of quantity of a good sold on the market. The explanation works by looking at two different groups – buyers and sellers – and asking how they interact. II. Types of Competition The supply-and-demand model relies on a high degree of competition, meaning that there are enough buyers and sellers in the market for bidding to take place. Buyers bid against each other and thereby raise the price, while sellers bid against each other and thereby lower the price. The equilibrium is a point at which all the bidding has been done; nobody has an incentive to offer higher prices or accept lower prices. Perfect competition exists when there are so many buyers and sellers that no single buyer or seller can unilaterally affect the price on the market. Imperfect competition exists when a single buyer or seller has the power to influence the price on the market. The supply-and-demand model applies most accurately when there is perfect competition. This is an abstraction, because no market is actually perfectly competitive, but the supply-and-demand framework still provides a good approximation for what is happening much of the time. III. The Concept of Demand Used in the vernacular to mean almost any kind of wish or desire or need. But to an economist, demand refers to both willingness and ability to pay. Quantity demanded (Qd) is the total amount of a good that buyers would choose to purchase under given conditions. -

OXFAM, Steps Towards a Living Wage in Global Supply Chains

OXFAM ISSUE BRIEFING DECEMBER 2014 STEPS TOWARDS A LIVING WAGE IN GLOBAL SUPPLY CHAINS Cambodian garment workers travelling to work in Phnom Penh, 97 percent of whom are women. They earn between $3 and $5 a day and many suffer from malnutrition1. 2014 has been a year of unrest and violence, with demands for an increase in the minimum wage from $100 to $177 per month. Photo: Emma Hardy/Oxfam ‘Peace and harmony in the world requires an adequate living wage’. International Labour Organization Constitution (1919) Almost a century after the ILO Constitution recognized the need for workers to earn a living wage, the question of whether wages enable workers to meet their needs and those of their families has gained renewed momentum. Much has been written on the issue, but very little that assesses how companies are implementing it, and the outcomes. In this paper, we outline the root causes of low wages, the barriers to ensuring a living wage is paid and the compelling reasons for responsible companies to act now. We give credit for steps taken in a range of sectors, provide a framework for deeper change and signpost initiatives that are aligned with this. The aim is to help companies who source from developing countries understand and tackle the issue and see what success looks like from an Oxfam perspective. www.oxfam.org THE ISSUE OF A LIVING WAGE Over the last 25 years, income from labour has made up a declining share of GDP across low-, middle- and high-income countries alike.2 As Oxfam highlighted in its 2014 report ‘Even It Up: Time to End Extreme Inequality’, this is a key driver of growing inequality which is harmful both for society and the economy.3 A living wage4 does more than keep people out of poverty.