Arm : Roadshow Slides

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Itraxx Japan Series 36 Provisional Membership List September 2021

iTraxx Japan Series 36 Provisional Membership List September 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Japan Series 36 Provisional Membership List 1 iTraxx Japan Series 36 Provisional Membership List................................. 3 2 iTraxx Japan Series 36 Provisional vs. Series 35.......................................5 3 Further information .....................................................................................6 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Japan Series 36 Provisional Membership List 1 iTraxx Japan Series 36 Provisional Membership List IHS Markit Ticker IHS Markit Long Name ACOM ACOM CO., LTD. JUSCO AEON CO., LTD. ANAHOL ANA HOLDINGS INC. FUJITS FUJITSU LIMITED HITACH HITACHI, LTD. HNDA HONDA MOTOR CO., LTD. CITOH ITOCHU CORPORATION JAPTOB JAPAN TOBACCO INC. JFEHLD JFE HOLDINGS, INC. KAWHI KAWASAKI HEAVY INDUSTRIES, LTD. KAWKIS KAWASAKI KISEN KAISHA, LTD. KINTGRO KINTETSU GROUP HOLDINGS CO., LTD. KOBSTL KOBE STEEL, LTD. KOMATS KOMATSU LTD. MARUB MARUBENI CORPORATION MITCO MITSUBISHI CORPORATION MITHI MITSUBISHI HEAVY INDUSTRIES, LTD. MITSCO MITSUI & CO., LTD. MITTOA MITSUI CHEMICALS, INC. MITSOL MITSUI O.S.K. LINES, LTD. NECORP NEC CORPORATION NPG-NPI NIPPON PAPER INDUSTRIES CO.,LTD. NIPPSTAA NIPPON STEEL CORPORATION NIPYU NIPPON YUSEN KABUSHIKI KAISHA NSANY NISSAN MOTOR CO., LTD. OJIHOL OJI HOLDINGS CORPORATION ORIX ORIX CORPORATION PC PANASONIC CORPORATION RAKUGRO RAKUTEN GROUP, INC. RICOH RICOH COMPANY, LTD. SHIMIZ SHIMIZU CORPORATION SOFTGRO SOFTBANK GROUP CORP. SONYGRO SONY GROUP CORPORATION Copyright © 2021 IHS Markit Ltd | 3 T180614 iTraxx Japan Series 36 Provisional Membership List SUMICH SUMITOMO CHEMICAL COMPANY, LIMITED SUMI SUMITOMO CORPORATION SUMIRD SUMITOMO REALTY & DEVELOPMENT CO., LTD. TFARMA TAKEDA PHARMACEUTICAL COMPANY LIMITED TOKYOEL TOKYO ELECTRIC POWER COMPANY HOLDINGS, INCORPORATED TOSH TOSHIBA CORPORATION TOYOTA TOYOTA MOTOR CORPORATION Copyright © 2021 IHS Markit Ltd | 4 T180614 iTraxx Japan Series 36 Provisional Membership List 2 iTraxx Japan Series 36 Provisional vs. -

C T B I Fi Corporate Briefing

CtBifiCorporate Briefing 平成 25 年 4 月 25 日 06/2014 ITmedia Inc. Copyright © 2014 ITmedia Inc. ITmedia -AT A GLANCE The laagrgest on-line media comppyany in Jap an EtblihdiEstablished in Lis te d on TSE SftbkSoftbank group 1999 Mothers in 2007 company Copyright © 2014 ITmedia Inc. P 1 ITmedia -AT A GLANCE with Numbers Paid Capital Sites ¥1.64B 30+ Clients Number of Employees Monthly Readers 600+ 175 20MUB Annual Sales Editorial Sales 80 65 Monthly Traffic ¥2.9B Professional contributors PV 500+ 100M Copyright © 2014 ITmedia Inc. P 2 ITmedia -Our Strengths Professional Editors Strong Consulting Sales And its network Unique add-value services such as Dominance of IT market Lead Generation and Smart Media Copyright © 2014 ITmedia Inc. P 3 ITmedia -Our Future specialized information media figure of specialist information through magazines media in Internet era model in 1980s to 90s - model of ITmedia - •Professional industrial •Professional industrial websites Magazines C •Free browse/ membership-based r •Subscriptions eation content •Magazine advertisement publi •Internet advertising business business model s o hing ECO f new Energy Management Businesses Electronics Businesses Computers Entertainment m Interne odel IT Architectur Medical/ Engineers Real estate Lifestyle e/ design biotech Job t offers Copyright © 2014 ITmedia Inc. P 4 ITmedia -Our Media and Services IT総合情報ポータル 「ITmedia」 Consumer IT II ndustry Market Electronics, Mechanics Others And Manufacturing Industries Copyright © 2014 ITmedia Inc. P 5 ITmedia -Our contents Providing electricity -

Earnings Results for the Interim Period Ended Spetember 30, 2007

Earnings Results for the Interim Period Ended September 30, 2007 November 6, 2007 SOFTBANK CORP. March 12, 2010 Version Due to protection of rights, some of the photos and images included at the time of publication have been modified or revised. <Highlights> 1. Consolidated earnings results: H1 operating income increased by 49% (YoY) H1 net income: 3.2 times (YoY) 2. Success in mobile operations: 1.14 million of net subscriber additions in H1 3. Becoming No.1 Internet company in Asia: IPO of Alibaba + Yahoo! JAPAN 2 H1/FY2007 Summary of Consolidated Earnings Results <bn JPY> <Interim> H1/FY07 H1/FY06 YoY (Apr 07 – Sep) (Apr 06 – Sep) Net Sales 1,364.7 1,120.1 +244.5 EBITDA 314.2 228.4 +85.8 Operating income 167.7 112.5 +55.1 Ordinary income 111.1 62.6 +48.4 Income before income taxes and 122.9 118.8 +4.0 minority interests Net income 46.4 14.4 +32.0 Note: Operating results of SOFTBANK MOBILE Corp. (formerly Vodafone K.K.) are included beginning in May 2006 3 H1/FY2007 Highlights <k> Interim Net Additions 1,140 1,030 1,000 960 960 +1.05 million YoY 500 320 97 0 FY06 FY07 FY06 FY07FY06 FY07 H1 H1 H1 SBM NTT DoCoMo KDDI 4 H1/FY2007 Highlights <bn JPY> Interim Operating Income 180 167.7 160 140 112.5 120 Increased by 100 49% YoY 80 60 40 20 0 H1/FY06 H1/FY07 5 H1/FY2007 Highlights <%> Interim Operating Income YoY Movement 50% 49% SOFTBANK Increased by 9% KDDI 49%YoY 0% -21% NTT DoCoMo -50% H1/FY06 H1/FY07 6 Consolidated Net Sales (interim) 1,364.7 <bn JPY> 1,120.1 1,000 H1/FY2007 1,364.7bn JPY 522.7 500 IncreasedIncreased byby 2222%% YoYYoY 0 H1/FY05 H1/FY06 H1/FY07 Note: Operating results of SOFTBANK MOBILE Corp. -

Softbank Family, Two Years Ago I Was Given the Mandate to Create A

SoftBank Family, Two years ago I was given the mandate to create a Government Affairs department to manage the legislative, regulatory and political matters affecting Softbank and its global investments. Today, the group’s world- class leadership team brings to bear public policy and public affairs expertise that allows Government Affairs to effectively serve the entire SoftBank’s ecosystem including the SoftBank Group Corp, SoftBank Vision Fund, Softbank Group International, SoftBank Latam Fund and others. Under Ziad Ojakli’s leadership, the Government Affairs team has made many significant contributions to SoftBank, including most notably: • Facilitating regulatory approval of the Sprint-T-Mobile merger – a $195B enterprise value merger and the 7th largest stock merger in history • Implementing SoftBank’s national security policy and creating a compliance and training framework to ensure adherence and protect our investments • Obtaining CFIUS approvals on all of our investments with limited to no mitigation requirements • Providing strategic counsel and direct support to 35+ portfolio companies • Building a strong SoftBank brand with political leaders globally But arguably Ziad’s greatest achievement is the Government Affairs team that he has built. Even before Ziad joined SoftBank, he and I discussed the importance of building a high-performing team of such caliber and cohesiveness that Government Affairs would be ‘future-proofed’. I explained to Ziad that the hallmark of leadership excellence is creating a team that can predictably deliver value beyond its leader – that is the legacy of a great leader. And Ziad has executed on this leadership mission flawlessly. Ziad will be leaving SoftBank on September 22nd to begin a new chapter in his career. -

Itraxx Japan Series 35 Final Membership List March 2021

iTraxx Japan Series 35 Final Membership List March 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List...........................................3 2 iTraxx Japan Series 35 Final vs. Series 34................................................ 5 3 Further information .....................................................................................6 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List IHS Markit Ticker IHS Markit Long Name ACOM ACOM CO., LTD. JUSCO AEON CO., LTD. ANAHOL ANA HOLDINGS INC. FUJITS FUJITSU LIMITED HITACH HITACHI, LTD. HNDA HONDA MOTOR CO., LTD. CITOH ITOCHU CORPORATION JAPTOB JAPAN TOBACCO INC. JFEHLD JFE HOLDINGS, INC. KAWHI KAWASAKI HEAVY INDUSTRIES, LTD. KAWKIS KAWASAKI KISEN KAISHA, LTD. KINTGRO KINTETSU GROUP HOLDINGS CO., LTD. KOBSTL KOBE STEEL, LTD. KOMATS KOMATSU LTD. MARUB MARUBENI CORPORATION MITCO MITSUBISHI CORPORATION MITHI MITSUBISHI HEAVY INDUSTRIES, LTD. MITSCO MITSUI & CO., LTD. MITTOA MITSUI CHEMICALS, INC. MITSOL MITSUI O.S.K. LINES, LTD. NECORP NEC CORPORATION NPG-NPI NIPPON PAPER INDUSTRIES CO.,LTD. NIPPSTAA NIPPON STEEL CORPORATION NIPYU NIPPON YUSEN KABUSHIKI KAISHA NSANY NISSAN MOTOR CO., LTD. OJIHOL OJI HOLDINGS CORPORATION ORIX ORIX CORPORATION PC PANASONIC CORPORATION RAKUTE RAKUTEN, INC. RICOH RICOH COMPANY, LTD. SHIMIZ SHIMIZU CORPORATION SOFTGRO SOFTBANK GROUP CORP. SNE SONY CORPORATION Copyright © 2021 IHS Markit Ltd | 3 T180614 iTraxx Japan Series 35 Final Membership List SUMICH SUMITOMO CHEMICAL COMPANY, LIMITED SUMI SUMITOMO CORPORATION SUMIRD SUMITOMO REALTY & DEVELOPMENT CO., LTD. TFARMA TAKEDA PHARMACEUTICAL COMPANY LIMITED TOKYOEL TOKYO ELECTRIC POWER COMPANY HOLDINGS, INCORPORATED TOSH TOSHIBA CORPORATION TOYOTA TOYOTA MOTOR CORPORATION Copyright © 2021 IHS Markit Ltd | 4 T180614 iTraxx Japan Series 35 Final Membership List 2 iTraxx Japan Series 35 Final vs. -

Ricoh Group Integrated Report 2019 (English)

Message from Executives (As of June 21, 2019) Directors (Internal) Responsibilities as a Director of Under the “RICOH Resurgent” strategy in the year ended March 31, the Company Nomination Committee Member/ 2018, we prioritized business structural reforms, and as a result, we Compensation Committee Member were able to lay the foundations for transitioning to a more stable Responsibilities as an Executive Officer of the Company earnings structure. CEO In the year ended March 31, 2019, we built on those foundations and further solidified the recovery in business profitability. In addition, we Yoshinori Yamashita worked on the execution of each growth strategy under “RICOH Ignite,” (August 22, 1957) which shows our direction in the future, by utilizing external resources through M&A and capital alliances as strategic moves for growth and Attended all of the 12 board meetings held in the year ended March 31, 2019. “Lift Off.” Brief personal profile In the year ending March 31, 2020, we will accelerate the realization Mar 1980 Joined the Company Apr 2008 President of Ricoh Electronics, Inc. process of our growth strategy by proceeding with business investments Apr 2010 Group Executive Officer, Corporate Vice President Apr 2011 Corporate Senior Vice President that benefit the Company’s focus areas while shifting to a management General Manager of Corporate Planning Division structure that is more conscious of capital costs. In addition, we will Jun 2012 Director Corporate Executive Vice President strengthen our efforts to achieve future sustainable growth through a Apr 2013 In charge of Internal Management and Control Apr 2014 General Manager of Business Solutions Group variety of measures, such as training the leaders of the next-generation Apr 2015 In charge of core business Jun 2016 Deputy President and reforming our corporate structure. -

Ranking of Stocks by Market Capitalization(As of End of Jan.2018)

Ranking of Stocks by Market Capitalization(As of End of Jan.2018) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 244,072 2 8306 Mitsubishi UFJ Financial Group,Inc. 115,139 3 9437 NTT DOCOMO,INC. 105,463 4 9984 SoftBank Group Corp. 98,839 5 6861 KEYENCE CORPORATION 80,781 6 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 73,587 7 9433 KDDI CORPORATION 71,225 8 7267 HONDA MOTOR CO.,LTD. 69,305 9 8316 Sumitomo Mitsui Financial Group,Inc. 68,996 10 7974 Nintendo Co.,Ltd. 67,958 11 7182 JAPAN POST BANK Co.,Ltd. 66,285 12 6758 SONY CORPORATION 65,927 13 6954 FANUC CORPORATION 60,146 14 7751 CANON INC. 58,005 15 6902 DENSO CORPORATION 54,179 16 4063 Shin-Etsu Chemical Co.,Ltd. 53,624 17 8411 Mizuho Financial Group,Inc. 52,124 18 6594 NIDEC CORPORATION 52,025 19 9983 FAST RETAILING CO.,LTD. 51,647 20 4502 Takeda Pharmaceutical Company Limited 50,743 21 7201 NISSAN MOTOR CO.,LTD. 49,108 22 8058 Mitsubishi Corporation 48,497 23 2914 JAPAN TOBACCO INC. 48,159 24 6098 Recruit Holdings Co.,Ltd. 45,095 25 5108 BRIDGESTONE CORPORATION 43,143 26 6503 Mitsubishi Electric Corporation 42,782 27 9022 Central Japan Railway Company 42,539 28 6501 Hitachi,Ltd. 41,877 29 9020 East Japan Railway Company 41,824 30 6301 KOMATSU LTD. 41,162 31 3382 Seven & I Holdings Co.,Ltd. 39,765 32 6752 Panasonic Corporation 39,714 33 4661 ORIENTAL LAND CO.,LTD. 38,769 34 8766 Tokio Marine Holdings,Inc. -

State Street Japan ESG Screened Index Equity Fund

FACTSHEET EMEA_INST2 State Street Global Advisors Luxembourg SICAV State Street Japan ESG Screened Index Equity Fund As of 31 August 2021 Equities 31 August 2021 Share Class Performance [P] All Investors Annualised Benchmark Fund Gross Difference Fund Net Difference 1 Year (%) 24.30 24.41 0.11 23.57 -0.73 Fund Objective 3 Year (%) 7.32 7.39 0.07 6.66 -0.65 The objective of the Fund is to track the performance of 5 Year (%) 10.44 10.52 0.08 9.78 -0.66 the Japanese equity market. Since Inception (%) 2.90 3.03 0.12 2.37 -0.54 Investment Strategy Cumulative The investment policy of the Fund is to track the 1 Month (%) 3.18 3.18 0.00 3.12 -0.06 performance of the MSCI Japan ex UNGC and CW Index 3 Month (%) 1.92 2.14 0.22 1.96 0.04 (or any other index determined by the Directors from time to time to track substantially the same market as the 1 Year (%) 24.30 24.41 0.11 23.57 -0.73 Index) as closely as possible while seeking to minimize as 3 Year (%) 23.60 23.84 0.25 21.36 -2.24 far as possible the tracking difference between the Fund's 5 Year (%) 64.27 64.88 0.60 59.41 -4.86 performance and that of the Index. Since Inception (%) 102.15 108.24 6.09 77.78 -24.37 The Index measures the performance of Japanese equities. Securities are weighted by free float-adjusted Calendar market capitalization after screening out securities based 2021 (year to date) 9.69 9.74 0.05 9.25 -0.44 on an assessment of their adherence to ESG criteria i.e. -

Stoxx True Exposure™ Developed Markets Ex Europe 100% Index

STOXX TRUE EXPOSURE™ DEVELOPED MARKETS EX EUROPE 100% INDEX Components1 Company Supersector Country Weight (%) Berkshire Hathaway Inc. Cl B Insurance United States 3.60 UnitedHealth Group Inc. Health Care United States 3.48 Verizon Communications Inc. Telecommunications United States 2.98 Comcast Corp. Cl A Media United States 2.46 AT&T Inc. Telecommunications United States 2.25 BERKSHIRE HATHAWAY 'A' Insurance United States 1.72 Union Pacific Corp. Industrial Goods & Services United States 1.62 NextEra Energy Inc. Utilities United States 1.61 Lowe's Cos. Retail United States 1.36 Softbank Group Corp. Telecommunications Japan 1.14 Wells Fargo & Co. Banks United States 1.13 Fidelity National Information Industrial Goods & Services United States 1.08 Intuit Inc. Technology United States 0.93 CVS HEALTH CORP. Retail United States 0.93 Target Corp. Retail United States 0.90 Canadian National Railway Co. Industrial Goods & Services Canada 0.89 Altria Group Inc. Personal & Household Goods United States 0.88 CHARTER COMMUNICATIONS CL.A Media United States 0.87 ANTHEM INC Health Care United States 0.79 Crown Castle International Cor Real Estate United States 0.79 Dominion Energy Utilities United States 0.78 Enbridge Inc. Oil & Gas Canada 0.74 CSX Corp. Industrial Goods & Services United States 0.73 Duke Energy Corp. Utilities United States 0.73 CME Group Inc. Cl A Financial Services United States 0.72 Progressive Corp. Insurance United States 0.68 Norfolk Southern Corp. Industrial Goods & Services United States 0.67 Southern Co. Utilities United States 0.67 Humana Inc. Health Care United States 0.63 Truist Financial Corp Banks United States 0.63 DOLLAR GENERAL Retail United States 0.62 U.S. -

Rothschild & Co Risk-Based Global Developed Index

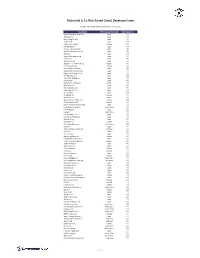

Rothschild & Co Risk-Based Global Developed Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Nippon Telegraph & Telephone C Japan 1.11 Softbank Corp Japan 1.10 Nitori Holdings Co Ltd Japan 0.75 Toshiba Corp Japan 0.67 Kirkland Lake Gold Ltd Canada 0.61 NTT DOCOMO Inc Japan 0.58 Mizuho Financial Group Inc Japan 0.54 Takeda Pharmaceutical Co Ltd Japan 0.50 KDDI Corp Japan 0.49 Japan Post Holdings Co Ltd Japan 0.48 Subaru Corp Japan 0.48 Sekisui House Ltd Japan 0.45 Singapore Telecommunications L Singapore 0.45 Franco-Nevada Corp Canada 0.43 Oriental Land Co Ltd/Japan Japan 0.43 Chugai Pharmaceutical Co Ltd Japan 0.40 Nippon Paint Holdings Co Ltd Japan 0.39 Fast Retailing Co Ltd Japan 0.38 Tokio Marine Holdings Inc Japan 0.38 ITOCHU Corp Japan 0.38 Bandai Namco Holdings Inc Japan 0.37 Bridgestone Corp Japan 0.36 MEIJI Holdings Co Ltd Japan 0.35 Japan Airlines Co Ltd Japan 0.34 Unicharm Corp Japan 0.33 Aroundtown SA Germany 0.33 Ajinomoto Co Inc Japan 0.33 Algonquin Power & Utilities Co Canada 0.32 Deutsche Wohnen SE Germany 0.32 MS&AD Insurance Group Holdings Japan 0.32 Lamb Weston Holdings Inc United States 0.32 ANA Holdings Inc Japan 0.32 Evergy Inc United States 0.32 Kirin Holdings Co Ltd Japan 0.32 Asahi Group Holdings Ltd Japan 0.32 Shiseido Co Ltd Japan 0.32 Wesfarmers Ltd Australia 0.32 Cboe Global Markets Inc United States 0.32 Canon Inc Japan 0.31 Jardine Matheson Holdings Ltd Singapore 0.31 Kao Corp Japan 0.31 Secom Co Ltd Japan 0.31 Agnico Eagle Mines Ltd Canada 0.31 -

MNE Heads Included in the GGR Last Updated: 18 December 2020

MNE Heads included in the GGR Last Updated: 18 December 2020 Aeon Co., Ltd. Agricultural Bank Of China Limited Airbus Se Allianz Se Alphabet Inc. Amazon.Com, Inc. Amerisourcebergen Corporation Anthem, Inc. Apple Inc. Assicurazioni Generali - Societa Per Azioni At&T Inc. Axa S.A. Banco Santander, S.A. Bank Of America Corporation Bank Of China Limited Bayerische Motoren Werke Aktiengesellschaft Beijing Automotive Group Co., Ltd. Berkshire Hathaway Bnp Paribas Bp P.L.C. Cardinal Health, Inc. Carrefour Caterpillar Inc. Chevron Corporation China Communications Construction China Construction Bank Corporation China Life Insurance China Minmetals Corporation China Mobile Limited China National Offshore Oil China National Petroleum Corporation China North Industries Group China Pacific Construction Group China Petrochemical Corporation China Railway Engineering China Resources National China South Industries Group China Southern Power Grid International Co., Ltd. China State Construction Engineering Corporation China Telecommunications Corporation Cisco Systems, Inc. Citigroup Inc. Cnp Assurances Comcast Corporation Costco Wholesale Corporation Crédit Agricole S.A. Cvs Health Corporation Daimler Ag Dell Technologies Inc. Deutsche Telekom Ag Dongfeng Motor Corporation Electricite De France Enel - Spa Engie Sa Euris Express Scripts Holding Company Exxon Mobil Corporation Facebook, Inc. Federal Home Loan Mortgage Corporation Federal National Mortgage Association Ford Motor Company General Electric Company General Motors Company Giovanni Agnelli B.V. Glencore Plc Hitachi,Ltd. Hon Hai Precision Industry Co., Ltd. Honda Motor Co., Ltd. Hsbc Holdings Plc Huawei Investment & Holding Hyundai Motor Company Industrial And Commercial Bank Of China Intel Corporation International Business Machines Corporation Itau Unibanco Holding S.A. Japan Post Holdings Co.Ltd Johnson & Johnson Jpmorgan Chase & Co. -

Softbank Group - Wikipedia

10/15/2018 SoftBank Group - Wikipedia SoftBank Group SoftBank Group Corp. ( Sofutobanku ソ フ ト バ ン ク グ ル ー プ 株 式 会 社 SoftBank Group Corp. Gurūpu Kabushiki-gaisha)[4] is a Japanese multinational holding ソフトバンクグループ株式会 conglomerate headquartered in Tokyo, Japan. The company wholly owns 社 Softbank Corp., Softbank Vision Fund (in Japanese), Arm Holdings, Fortress Investment Group, Boston Dynamics, and also owns stakes in Sprint (ca.85%), Alibaba (29.5%), Yahoo Japan (48.17%), Bright Star (87.1%), Uber (15%), Didi Chuxing (ca.20%), Ola (ca.30%), Grab, Renren (42.9%), InMobi (45%), Hike (25.8%), Snapdeal (ca.30%), Brain, Fanatics (ca.22%), Guardant Health, Improbable Worlds (ca.50%), Mapbox, Nauto, Nvidia (ca.5%), One97 Communications (ca.20%), Oravel Stays (42%), OSIsoft, PingAn Heath Cloud (7.41%), Plenty United, Roviant Sciences, Slack Technologies (ca.5%), Vir Biotechnology, WeWork (ca.22%), Zhongan Online P&C Insurance (5%), Compass (ca.22%), Auto1 (ca.20%), Wag (45%), Katerra (ca.28%), Cruise Automation (ca.19.6%), Ele.me, Getaround, Packet (https://www.packet.net/bl og/announcing-our-series-a-funding-softbank/).[5] It runs the world's largest technology fund, Vision Fund.[6] The company is known for its leadership by founder Masayoshi Son.[7] It now owns operations in broadband; fixed-line telecommunications; e-commerce; internet; technology services; finance; media and marketing; semiconductor design; and other businesses. Tokyo Shiodome Building, SoftBank was ranked in the Forbes Global 2000 list as the 38th largest public SoftBank's global headquarters in company in the world,[8] and the 4th largest publicly traded company in Japan Tokyo.