Annecy Lake), June 27, 2008

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2014 Registration Document 2

REGISTRATION DOCUMENT PART 1. PRESENTATION OF THE GROUP 1 MARIE BRIZARD WINE & SPIRITS REGISTRATION DOCUMENT 2014 REGISTRATION DOCUMENT 2 MARIE BRIZARD WINE & SPIRITS 19, BOULEVARD PAUL VAILLANT COUTURIER 40, QUAI JEAN COMPAGNON 94200 IVRY-SUR-SEINE CRÉTEIL TRADE & COMPANIES REGISTER UNDER NUmbER 380 695 213 Shae Capital of € 52,973,242 REGISTRATION DOCUMENT 2014 Pursuant to its general regulations, and specifically to Article 212-13, the French Financial Markets Authority (the “AMF”) registered this Registration Document on 14 october 2015 under number R.15-074 (the “Registration Docu- ment”). This document may only be used in support of a financial transaction if supplemented by a transaction notice certified by the AMF. It has been prepared by the Company and engages the liability of its signatories. In accordance with the provisions of Article L. 621-8-1-I of the French Monetary and Financial Code, this document was registered once the AMF had ascertained that it was complete and understandable, and that the information that it contains was consistent. It does not imply ratification by the AMF of the financial and accounting items included herein. Copies of the Registration Document are available free of charge from Marie Brizard Wine & Spirits, 19, boulevard Paul Vaillant Couturier – 40, quai Jean Compagnon – 94200 Ivry-sur-Seine, on the AMF website (http://amf-france. org), and on the Company’s website (http://www.belvedere.fr). It is reminded last Shareholders General Meeting on 30th June 2015 decided to change the name of the Company, which is now “ Marie Brizard Wine & Spirits ”, instead of “ Belvédère ”. Thus, within the present Registration Docu- ment, the reader would find both Company’s names, some legal and/or financial information was established before this legal Company’s name change. -

Business Meeting of the Michigan Liquor Control

BUSINESS MEETING OF THE MICHIGAN LIQUOR CONTROL COMMISSION Held: Tuesday, September 12, 2017 Lansing District Office 525 W Allegan Lansing MI 48933 Present: Andrew J. Deloney, Chairman Teri L. Quimby, Commissioner Dennis Olshove, Commissioner Absent: None Staff: Pam Hamilton, Director of Finance Division Liliana Paceagiu, Deputy Director of Finance Division Anita Fawcett, Administrative Assistant ______________________________________ The meeting was called to order by Chairman Deloney at 9:30 a.m., noting a quorum was present. I. Moved by Commissioner Olshove, supported by Commissioner Quimby, that the minutes of the Commission meeting of August 15, 2017, be approved as written and presented, motion carried by unanimous vote. II. Ms. Hamilton presented the E-Quote reports for product listings in four categories and requested approval of the following: A. That the products listed below be granted exceptions to the standard pack size, inasmuch as the items are packaged nationally or meets other exceptions as indicated and be approved for listing in the approved products list effective October 1, 2017: COMPANY/ADA PRODUCT PACK SIZE A. Hardy/U.S.A. Ltd. 750ml Auchroisk 23 Yr. First Editions 6 Bottles (NWS Michigan, LLC) 750ml Blair Athol 18 Yr. First Editions 6 Bottles 750ml Craigellachie 19 Yr. First Editions 6 Bottles 750ml FOS Greek Masitha 6 Bottles 750ml Glen Garioch 24 Yr. First Editions 6 Bottles 750ml Glengoyle 18 Yr. First Editions 6 Bottles 750ml Inchgower 19 Yr. First Editions 6 Bottles 750ml Longmorn 18 Yr. First Editions 6 Bottles Meeting Conducted on Tuesday, September 12, 2017 Page 2 750ml Speyside 18 Yr. First Editions 6 Bottles 750ml Tamdhu 16 Yr. -

Champagne Type Content Price (€)

CHAMPAGNE TYPE CONTENT PRICE (€) Armand de Brignac Gold bottle 0,75 212 Armand de Brignac Gold + box box 0,75 225 Armand de Brignac Rose bottle 0,75 330 Armand de Brignac Rose + box box 0,75 344 Armand de Brignac Gold Magnum bottle 1,5 502 Armand de Brignac Rose Magnum bottle 1,5 766 Armand de Brignac Gold Jeroboam bottle 3 1536 Armand de Brignac Rose Jeroboam bottle 3 2400 Armand de Brignac Gold Rehoboam bottle 4,5 2484 Armand de Brignac Rose Rehoboam bottle 4,5 3840 Armand de Brignac Gold Methuselah bottle 6 4560 Armand de Brignac Rose Methuselah bottle 6 7200 Armand de Brignac Gold Salmanzar bottle 9 7440 Armand de Brignac Rose Salmanzar bottle 9 11640 Armand de Brignac Gold Balthazar bottle 12 10560 Armand de Brignac Rose Balthazar bottle 12 16080 Armand de Brignac Gold Nebuchadnezar bottle 15 14160 Armand de Brignac Rose Nebuchadnezar bottle 15 24600 Armand de Brignac Gold Midas bottle 30 40200 Moet & Chandon Brut Imperial bottle 0,38 24 Moet & Chandon Brut Imperial bottle 0,75 35 Moet & Chandon Brut Imperial Magnum bottle 1,5 86 Moet & Chandon Brut Imperial Jeroboam bottle 3 308 Moet & Chandon Brut Imperial Mathusalem bottle 6 618 Moet & Chandon Brut Imperial Salmanazar bottle 9 927 Moet & Chandon Brut Imperial Balthazar bottle 12 1541 Moet & Chandon Brut Imperial Nebunchondonsor bottle 15 1923 Moet & Chandon Grand Vintage 2002 bottle 0,75 56 Moet & Chandon Grand Vintage Rose 2003 bottle 0,75 67 Moet & Chandon Brut Rose bottle 0,38 30 Moet & Chandon Brut Rose bottle 0,75 48 Moet & Chandon Brut Rose Magnum bottle 1,5 110 Moet & Chandon -

1. Ameritini Danzka Cranberyraz Vodka, Blue Curaçao and Cranberry

1. Ameritini 25. Candied Apple Danzka Cranberyraz Vodka, Blue Curaçao and cranberry juice $8.00 Smirnoff Apple Twist, DeKuyper Sour Apple Pucker 2. Applefest and Chambord $8.25 Grey Goose, Sour Apple Pucker and Cointreau $8.25 26. Banana Split 3. Vegas Lemon Drop Absolut Vanilia, Godiva White Chocolate Liqueur and Absolut Citron, Triple Sec and lime juice $8.00 banana liqueur $8.00 4. Classic Cosmopolitan 27. The Italian Job Absolut Citron, Cointreau, lime and cranberry juice $8.25 Grapefruit juice, lemon juice, mandarin liqueur, 5. PB & J Monasterium Liqueur and a splash of tonic $9.00 Grey Goose, Frangelico and Chambord $8.25 28. Tiramisù 6. Purple Hooter Absolut Vanilia, Amaretto and Kahlúa $8.00 Absolut, Chambord and sour mix $8.00 29. Florida Sunshine 7. Bellini-tini Absolut Mandrin, Bombay Gin and Grand Marnier $8.25 Grey Goose, DeKuyper Peachtree Schnapps and Champagne $9.00 30. Strawberry Shortcake 8. Astro Pop Smirnoff Strawberry Twist, Absolut Vanilia and cranberry juice $8.00 Layers of Absolut, Midori and Chambord $8.25 31. Truffle-Shuffle 9. The Surfer Absolut, Godiva White Chocolate Liqueur and Chambord $9.00 Absolut, Bacardi Coco, Jägermeister and pineapple juice $8.00 32. Stormy Kiss 10. Blue Lagoon Absolut, Absolut Mandrin, Absolut Vanilia, Absolut Grey Goose, Blue Curaçao and sour mix $8.25 Citron, gin, Cointreau and Grand Marnier $9.00 11. Caramel Apple 33. Afterschool Special Absolut and DeKuyper Sour Apple Pucker with a splash Absolut, Absolut Citron, Grand Marnier and Coke $8.00 of butterscotch schnapps $8.00 34. Cranapple Martini 12. Windex Martini Grey Goose, DeKuyper Apple Pucker and a splash Grey Goose, Triple Sec and Blue Curaçao $8.25 of cranberry juice $8.00 13. -

Beverage Menu

THE BAR BEVERAGE AFTER DINNER COCKTAILS USD 12 SMOOTHIE USD 10 FRITINI BANANA COLADA Prosecco, vodka, Cointreau, crème de cassis, pineapple juice Coconut milk, banana, pineapple, vanilla syrup CAFIN BANANA & PAPAYA Malibu, Grand Marnier, espresso, caramel syrup, cream Banana, papaya, soya milk, basil leaves, vanilla syrup HOLLY HONEY PALM TREES MANGROVES Southern Comfort, vanilla vodka, Drambuie, honey Mango purée, yoghurt, palm sugar BAILEYS ESPRESSO ORANGE JULIUS Vodka, Baileys, crème de menthe, espresso Orange juice, vanilla ice cream, soya milk, honey CINNAMON DUST FRUITY DELIGHT Amaretto, crème cacao, Galliano, cream, cinnamon powder Mango purée, passionfruit purée, peach purée, coconut milk, yoghurt GRASSHOPPER Crème de menthe, crème de cacao, cream, chocolate sauce GREEN TEA & BANANA GINGER SMOOTHIE Green tea, fresh banana, ginger, coconut cream, oats, honey Calypso Coffee – Tia Maria, coffee, cream MILKSHAKE Irish Coffee – Irish whiskey, coffee, cream, sugar Vanilla | Chocolate | Strawberry | Mixed Caffe’ al Grand – Grand Marnier, coffee, cream, orange peel NONALCOHOLIC SPARKLING WINE USD 750ml bottle Cafè Amore – Cognac VS, amaretto, coffee, cream AISHAL, FREIXENET, SPAIN 45 AFFOGATO I COFFEE BLENDS APÉRITIF | 45ml AFFOGATO USD 10 Vanilla ice cream, espresso, chocolate sauce Fernet Branca, Pimms no. 1, Campari, Ricard 9 Martini Extra dry, Martini Rosso, Martini Bianco PEANUT BUTTER FROSTY Pernod, Noilly Prat, Cynar, Averna Amaro, Aperol USD 12 Espresso, peanut butter, vanilla ice cream, whipped cream, BAIJIU | 45ml chocolate sauce -

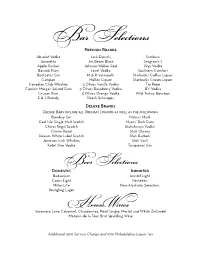

Bar Selections

Bar Selections Premium Brands Absolut Vodka Jack Daniels Bourbon Sambvca Amaretto Jim Beam Black Seagram’s 7 Apple Pucker Johnnie Walker Red Skyy Vodka Bacardi Rum Level Vodka Smirnoff Vodka Beefeater Gin M & R Vermouth Southern Comfort Campari Mellon Liquor Starbucks Coffee Liquor Canadian Club Whiskey 3 Olives Vanilla Vodka Starbucks Cream Captain Morgan Spiced Rum 3 Olives Berry Vodka Tio Pepe Cruzan Rum 3 Olives Orange Vodka UV Vodka E & J Brandy Peach Schnapps Wild Turkey Bourbon Deluxe Brands Deluxe Bars include all Premium Liquors as well as the following: Bombay Gin Makers Mark Caol Isle Singlw Malt Scotch Myers’ Dark Rum Chivas Regal Scotch Stolichnaya Vodka Crown Royal Blend Stoli Ohranj Dewars White Label Scotch Stoli Razberi Jameson Irish Whiskey Stoli Vanil Ketel One Vodka Tanqueray Gin Beer Selections Domestic Imported Budweiser Amstel Light Coors Light Heineken Miller Lite Non-Alcoholic Selection Yeungling Lager H W Sycamore Lane Cabernet, Chardonnay,ouse Pinot Grigio,ines Merlot and White Zinfandel Marquis de la Tour Brut Sparkling Wine Additional 20% Service Charge and 10% Philadelphia Liquor Tax Bar Pacaes Open Bar Premium Bar $12.50 for first hour per person $8.00 for each additional hour With a Martini Station $14.50 first hour, $9.50 each additional Deluxe Bar $14.50 for the first hour per person $9.00 for each additional hour With a Martini Station $16.50 first hour, $9.50 each additional Beer, Wine & Soft Drink Bar Imported & Domestic Beer, House Wines, Assorted Sodas & Mineral Waters $10.50 for first hour $6.50 -

The Beverage Company Liquor List

The Beverage Company Liquor List Arrow Kirsch 750 Presidente Brandy 750 Stirrings Mojito Rimmer Raynal Vsop 750 Glenlivet French Oak 15 Yr Canadian Ltd 750 Everclear Grain Alcohol Crown Royal Special Reserve 75 Amaretto Di Amore Classico 750 Crown Royal Cask #16 750 Amarito Amaretto 750 Canadian Ltd 1.75 Fleishmanns Perferred 750 Canadian Club 750 G & W Five Star 750 Canadian Club 1.75 Guckenheimer 1.75 Seagrams Vo 1.75 G & W Five Star 1.75 Black Velvet Reserve 750 Imperial 750 Canadian Club 10 Yr Corbys Reserve 1.75 Crown Royal 1.75 Kessler 750 Crown Royal W/Glasses Seagrams 7 Crown 1.75 Canadian Club Pet 750 Corbys Reserve 750 Wisers Canadian Whisky 750 Fleishmanns Perferred 1.75 Black Velvet Reserve Pet 1.75 Kessler 1.75 Newport Canadian Xl Pet Kessler Pet 750 Crown Royal 1.75 W/Flask Kessler 375 Seagrams Vo 375 Seagrams 7 Crown 375 Seagrams 7 Crown 750 Imperial 1.75 Black Velvet 375 Arrow Apricot Brandy 750 Canadian Mist 1.75 Leroux Blackberry Brandy 1ltr Mcmasters Canadian Bols Blackberry Brandy 750 Canada House Pet 750 Arrow Blackberry Brandy 750 Windsor Canadian 1.75 Hartley Brandy 1.75 Crown Royal Special Res W/Glas Christian Brothers Frost White Crown Royal 50ml Christian Broyhers 375 Seagrams Vo 750 Silver Hawk Vsop Brandy Crown Royal 375 Christian Brothers 750 Canada House 750 E & J Vsop Brandy Canada House 375 Arrow Ginger Brandy 750 Canadian Hunter Pet Arrow Coffee Brandy 1.75 Crown Royal 750 Korbel Brandy 750 Pet Canadian Rich & Rare 1.75 E&J Brandy V S 750 Canadian Ric & Rare 750 E&J Brandy V S 1.75 Seagrams Vo Pet 750 -

Major-Brands-Price-Book Jan-2020.Pdf

January 2020 MB - EAST MO License # 178674 Table of Contents Spirits Non-potable ..................................................................................59 Eisbock ..................................................................................166 Vodka ..................................................................................3 Potable ..................................................................................59 Kellerbier/Zwickelbier ..................................................................................166 Vodka ..................................................................................3 Specialty Spirits ..................................................................................59 Light ..................................................................................166 Flavored Vodka ..................................................................................7 Aquavit ..................................................................................59 Maibock/Helles Bock ..................................................................................167 Gin ..................................................................................14 Arrack ..................................................................................59 Oktoberfest/Märzen ..................................................................................167 London Dry ..................................................................................14 Neutral Spirit ..................................................................................59 -

Press Release IAAW NO LABEL

Stockholm, October 2009 IN AN ABSOLUT WORLD, THERE ARE NO LABELS Naked ABSOLUT bottle challenges labels and prejudice ABSOLUT VODKA is proudly introducing In An ABSOLUT World, There Are No Labels, a bold and innovative project where the brand is challenging labels and prejudice about sexual identities. A manifestation of a world with no labels is a limited edition naked ABSOLUT bottle, with no label and no logo, launched globally in the fall of 2009. Part of the initiative is also a 24-page interview magazine, produced in collaboration with celebrated men’s magazine Fantastic Man. ”For the first time we dare to face the world completely naked. We launch a bottle with no label and no logo, to manifest the idea, that no matter what’s on the outside, it’s the inside that really matters. The bottle visually manifests our belief in diversity and our standpoint when it comes to sexual identities. Off course it is also a wonderful piece of delicate and minimalist design, a true collectors item” says Kristina Hagbard, Global PR Manager at The Absolut Company. ABSOLUT was one of the first commercial brands to openly embrace the LGBT (Lesbian, Gay, Bisexual, Transgender) community and its ads have appeared in gay media since 1981. With this initiative, ABSOLUT is again showing its support for the LGBT community. “There are too many clichés associated with the LGBT community. LGBT people are often referred to as one homogenous group but when you think about it: does a 60-year old lesbian woman from South Korea necessarily have that much in common with a 20-year old gay man from Berlin, or a Brazilian transgender person of indeterminable age?” Kristina Hagbard continues. -

Russian Restaurant & Vodka Lounge M O SC O W

Moscow on the hill Russian Restaurant & Vodka Lounge V o d k a Russians do not consider their meal complete without vodka. It is never sipped: it should be swallowed in one gulp. The custom of drinking neat in cold countries was probably designed for this purpose for it not only thaws out those who travelled through the snow, but breaks the social ice. House Infusions 5.00 * Referent Horseradish * Chateau Marusya (cherry) * Tiramisu * Caramel * Garlic & Dill * Pepper * Coffee * Cinnamon * * Listed Prices per shot *Russia* * USA * *Poland* Stoli Elit 10.00 Hangar One CA (assorted flavors) 8.00 Ultimat (assorted flavors) 8.00 Jewel of Russia 8.00 Skyy 90˚ CA 8.00 Alchemia (Ginger) 7.00 Imperia 8.00 Opulent MN 7.00 Alchemia (Wild Cherry, Chocolate) 7.00 Youri Dolgoruki 8.00 Yazi OR (Ginger) 7.00 Chopin (Potato) 6.00 Stoli Gold 7.00 Shakers MN 6.00 Belvedere (assorted flavors) 6.00 Cristall 7.00 Roth CA 6.00 Sobieski 6.00 Russian Standard Platinum 7.00 Square 1 Cucumber ID (Rye) 6.00 Zubrowka (Bison Grass) 5.00 Russian Standard 6.00 45th Parallel WI (Corn) 6.00 Luksusowa (Potato) 5.00 White Gold 6.00 Jeremiah Weed Sweet Tea 5.00 Pravda 5.00 Stolichnaya (assorted flavors) 5.00 Rain (Organic) 5.00 Old Krupnik (Honey) 5.00 Ruskova 5.00 Tito TX 5.00 *Ukraine Tovarich 5.00 Teton Glacier ID (Potato) 5.00 Nemiroff 5.00 Blue Ice ID (Potato) 5.00 *Armenia* 3 Vodka FL (Soy) 5.00 *Estonia* Armyanskaya 6.00 Skyy CA 5.00 Tall Blonde 6.00 *England* Smirnoff 5.00 *France* Three Olives (assorted flavors) 5.00 *Holland* XO 9.00 Blavod 5.00 Vox (assorted flavors) -

Bar Selections

Bar Selections Premium Brands Absolut Vodka Jack Daniels Sambvca Amaretto Jim Beam Black Seagram’s 7 Apple Pucker Johnnie Walker Red Skyy Vodka Bacardi Rum Level Vodka Southern Comfort Beefeater Gin M & R Vermouth Starbucks Coffee Liquor Campari Mellon Liquor Starbucks Cream Liquor Canadian Club Whiskey 3 Olives Vanilla Vodka Tio Pepe Captain Morgan Spiced Rum 3 Olives Raspberry Vodka UV Vodka Cruzan Rum 3 Olives Orange Vodka Wild Turkey Bourbon E & J Brandy Peach Schnapps Deluxe Brands Deluxe Bars include all Premium Liquors as well as the following: Bombay Gin Makers Mark Caol Isle Single Malt Scotch Myers’ Dark Rum Chivas Regal Scotch Stolichnaya Vodka Crown Royal Stoli Ohranj Dewars White Label Scotch Stoli Razberi Jameson Irish Whiskey Stoli Vanil Ketel One Vodka Tanqueray Gin Beer Selections Domestic Imported Budweiser Amstel Light Coors Light Heineken Miller Lite Non-Alcoholic Selection Yeungling Lager H W Sycamore Lane Cabernet, Chardonnay,ouse Pinot Grigio,ines Merlot and White Zinfandel Marquis de la Tour Brut Sparkling Wine Additional 20% Service Charge and 10% Philadelphia Liquor Tax Bar Pacaes Open Bar Premium Bar $12.50 for first hour per person $8.00 for each additional hour With a Martini Station $14.50 first hour, $9.50 each additional Deluxe Bar $14.50 for the first hour per person $9.00 for each additional hour With a Martini Station $16.50 first hour, $9.50 each additional Beer, Wine & Soft Drink Bar Imported & Domestic Beer, House Wines, Assorted Sodas & Mineral Waters $10.50 for first hour $6.50 for each additional -

Herald 12.13.06.Indd

Herald NEWS It's DI GESTS Inside. Last Chance to Share It's Your RIO GRANDE — Today’s the deadline for this newspaper’s annual holiday edi- Year-Round tion, which will appear Dec. 20. Share your Guide. past or present holiday stories, poems, photos with 75,000 Herald readers. Email: [email protected] and put “holiday piece” in the subject line, fax to 609-886- 1879, Attention: Joe Zelnik, Editor, or drop it off at the offi ce here. Thanks. JCOW Date Change PUBLISHED EVERY WEDNESDAY BY THE SEAWAVE CORP. Vol. 42 No. 49 Copyright 2006 Seawave Corp. All rights reserved. December 13, 2006 1508 Route 47, Rio Grande NJ 08242-1402 COURT HOUSE — Homeowners of some 500 condominium units constructed in violation of state building codes will have until Jan. 12 to take “substantial” steps to County Plans fi x those violations, or risk having their certifi cates of occupancy revoked by JCOW. Attorney Henry Lewandowski, who repre- 10 More Beds sents numerous homeowner associations, told the Herald he was “happy for the exten- At Crest Haven sion.” Lewandowski has noted several times various “stumbling blocks” his clients have By JOE ZELNIK encountered trying to satisfy the original Dec. 21 deadline. Superior Court Judge Ste- CREST HAVEN — The county expects to ven Perskie reportedly agreed to push back build a 10-bed addition to the 180-bed Crest the court date after John Becker, attorney Haven Nursing and Rehabilitation Center here for architect Kevin Young, proposed putting which has 70 on its waiting list. fi xes for buildings designed by Young, up for The project got tentative approval in pre- public bid.