Odyssey V Commissioner of Valuation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Figures Are for Tickets Sold Worldwide As Reported to POLLSTAR for Shows Played Between 1/1/13 and 3/31/13

1 446,893 The O2 - London London, UNITED KINGDOM 2 320,148 Manchester Arena Manchester, UNITED KINGDOM 3 220,234 Lanxess Arena Cologne, GERMANY 4 210,906 Palais Omnisports de Paris-Bercy Paris, FRANCE 5 200,404 The O2 - Dublin Dublin, IRELAND 6 198,193 Hallenstadion Zurich Zurich, SWITZERLAND 7 190,166 AmericanAirlines Arena Miami, FL 8 151,237 O2 World Hamburg Hamburg, GERMANY 9 149,546 HP Pavilion At San Jose San Jose, CA 10 143,866 Allphones Arena Sydney, AUSTRALIA 11 143,470 Sprint Center Kansas City, MO 12 140,947 Staples Center Los Angeles, CA 13 135,962 Odyssey Arena Belfast, UNITED KINGDOM 14 132,049 Nassau Veterans Memorial Coliseum Uniondale, NY 15 121,297 BB&T Center Sunrise, FL 16 117,975 Bridgestone Arena Nashville, TN 17 116,468 S.E.C.C. Glasgow, UNITED KINGDOM 18 114,975 Madison Square Garden Arena New York, NY 19 112,219 Konig - Pilsener Arena Oberhausen, GERMANY 20 112,086 O2 World Berlin, GERMANY 21 107,929 LG Arena Birmingham, UNITED KINGDOM 22 102,706 Bell Centre Montreal, CANADA 23 101,626 American Airlines Center Dallas, TX 24 98,670 Sydney Entertainment Centre Darling Harbour, AUSTRALIA 25 93,697 Valley View Casino Center San Diego, CA 26 92,733 Barclays Center Brooklyn, NY 27 90,441 SAP Arena Mannheim, GERMANY 28 88,003 Vector Arena Auckland, NEW ZEALAND 29 86,225 Philips Arena Atlanta, GA 30 83,220 Ziggo Dome Amsterdam, NETHERLANDS 31 76,213 Amway Center Orlando, FL 32 74,969 BOK Center Tulsa, OK 33 74,883 Toyota Center Houston, TX 34 73,757 Arena Monterrey Monterrey, MEXICO 35 69,152 Arena Ciudad De Mexico Mexico City, MEXICO 36 68,183 Coliseo de Puerto Rico San Juan, PR 37 67,623 Greensboro Coliseum Greensboro, NC 38 67,337 Scottrade Center St. -

160 Shows, 2 Million Tickets Sold

160 SHOWS, 2 MILLION TICKETS SOLD 24/02/09 NICE PALAIS NIKAIA 25/07/09 BRISBANE ENTERTAINMENT CENTRE 26/02/09 ANTWERP SPORTPALEIS 26/07/09 BRISBANE ENTERTAINMENT CENTRE 28/02/09 ROTTERDAM AHOY 29/07/09 MELBOURNE ROD LAVER ARENA 01/03/09 ROTTERDAM AHOY 30/07/09 MELBOURNE ROD LAVER ARENA 05/03/09 REGENSBERG DONAU ARENA 01/08/09 MELBOURNE ROD LAVER ARENA 06/03/09 FRIEDRICHSHAFEN MESSEHALLE 02/08/09 MELBOURNE ROD LAVER ARENA 08/03/09 OBERHAUSEN KOENIG-PILSNER ARENA 04/08/09 ADELAIDE ENTERTAINMENT CENTRE 09/03/09 PARIS 0NMINP0RT / EERCY ARENA 05/08/09 ADELAIDE ENTERTAINMENT CENTRE 12/03/09 MANNHEIM SAP ARENA 07/08/09 PERTH BURSWOOD DOME 14/03/09 STUTTGART SCHLEVERHALLE 08/08/09 PERTH BURSWOOD DOME 17/03/09 LEIPZIG ARENA 10/09/09 ADELAIDE ENTERTAINMENT CENTRE 18/03/09 BERLIN 02 ARENA 11/09/09 ADELAIDE ENTERTAINMENT CENTRE 21/03/09 GENEVA ARENA 13/09/09 MELBOURNE ROD LAVER ARENA 22/03/09 ZURICH HALLESTADION 14/09/09 MELBOURNE ROD LAVER ARENA 24/03/09 BUDAPEST PAPP LASLO SPORTARENA 16/09/09 CANBERRA AUSTRALIAN INDOOR STADIUM 25/03/09 VIENNA STARHALLE 17/09/09 CANBERRA AUSTRALIAN INDOOR STADIUM 27/03/09 FRANKFURT FESTHALLE 19/09/09 MELBOURNE ROD LAVER ARENA 28/03/09 NORNBERG ARENA NURNBERGER 20/09/09 MELBOURNE ROD LAVER ARENA 30/03/09 COLOGNE LANXESS ARENA 22/09/09 WOLLONGONG ENTERTAINMENT CENTRE 01/04/09 HAMBURG COLORLINE ARENA 23/09/09 WOLLONGONG ENTERTAINMENT CENTRE 02/04/09 HAMBURG COLORLINE ARENA 25/09/09 BRISBANE ENTERTAINMENT CENTRE 04/04/09 HANNOVER TUI ARENA 26/09/09 BRISBANE ENTERTAINMENT CENTRE 06/04/09 MUNICH OLYMPIAHALLE 28/09/09 SYDNEY -

Dealing with the Reality NORTHERN IRELAND ENVIRONMENT LINK CONFERENCE REPORT Foreword

Conference Proceedings April 2009 Climate Change: Dealing with the Reality NORTHERN IRELAND ENVIRONMENT LINK CONFERENCE REPORT Foreword Scientific and international political opinion agree that climate change is happening, that it is largely caused by human activities and that the implications are far ranging and very serious. Although there are uncertainties around the speed of change, the severity of that change and the nature and extent of its impacts, we cannot delay action to address the issues. An internationally renowned group of scientists assembled in W5 (Odyssey Complex), Belfast for Climate Change: Dealing with the Reality on 20th January 2009 to discuss the issues; this document is a summary of their thoughts. There are opportunities for Northern Ireland to be in the vanguard of both adaptation and mitigation technologies, bringing strong economic benefits to local companies. There are also opportunities to adopt policies and programmes that address the social and economic consequences of climate change while bringing benefits to Northern Ireland’s citizens. Grasping these opportunities requires strong and mature political leadership and offers Northern Ireland an opportunity to establish itself as a serious international leader. Climate change is just one of the many challenges facing Northern Ireland at this time and therefore cannot be dealt with in isolation. It provides a context within which specific issues — such as the increasing role of local authorities, tackling waste, changes in agriculture and the economic recession — can be better understood and more effectively addressed. Acknowledgements This report was compiled and designed by David McCann, and edited by David McCann and Sue Christie. We would like to thank all of the speakers at the conference both for the time and effort they put into producing their presentations and for writing their subsequent articles. -

Annual Reports

GENERAL ASSEMBLY 2014 2014 ANNUAL REPORTS PresbyterCHURCH IN IRELAND an Tuesday 1 Business 2 SPUD 3 General (p/t 1 – Appointments) 4 Presbyterian Women 5 Youth and Children 6 PresbyterCHURCH IN IRELAND an Mission in Ireland 7 GENERAL ASSEMBLY Union Commission 8 Wednesday H Mission Overseas 1 Christian Training 2 2014 2014 General (p/t 2) 3 United Appeal 4 Trustees 5 ANNUAL REPORTS Trusts 6 Thursday H Judicial Commission 1 Special Judicial Commission 2 Applications Commission 3 ORDER OF BUSINESS Special Commission (Principal) 4 Notes: (i) Business commences at 9.30 a.m. on Tuesday, Education 5 Wednesday and Thursday. Social Witness 6 (ii) An “Introduction to Assembly Business” will be Finance and Personnel 7 given in the Assembly Hall on Tuesday at 9.00 a.m. (iii) Communion will be held on Tuesday at 11.45 a.m. and Worship on Wednesday and Thursday at 12.15 p.m. The break for lunch will be at 1p.m. each day. (iv) Figures in brackets refer to page numbers in the Annual Reports. i NOTES ii MONDAY, JUNE 2 Assembly Buildings 7.00 p.m. – Service of Worship Constitution of Assembly Election of Moderator TUESDAY, JUNE 3 9.30 a.m. – 1. BUSINESS BOARD: Report and Resolutions (1-8). Arrangements Committee. 2. Overture anent Appendix 1 of the Code (9). 3. Reports of Presbyteries (10-16). 4. SPUD YOUTH ASSEMBLY: Report and Resolutions (279-281) 5. Reception of Corresponding Members and Delegates. Church of Scotland: Rt Rev John Chalmers, Rev Mary Ann Rennie; Mr Angus Hogg United Reformed Church: Mr John Ellis; Rev Nigel Uden Presbyterian Church of -

Figures Are for Tickets Sold Worldwide As Reported to POLLSTAR for Shows Played Between 1/1/13 and 6/30/13 26 JULY 22, 2013 | *

1 1,129,914 The O2 - London London, UNITED KINGDOM 51 127,994 Valley View Casino Center San Diego, CA 2 698,766 Manchester Arena Manchester, UNITED KINGDOM 52 124,704 Consol Energy Center Pittsburgh, PA 3 657,423 Barclays Center Brooklyn, NY 53 121,768 CenturyLink Center Omaha Omaha, NE 4 491,848 Palais Omnisports de Paris-Bercy Paris, FRANCE 54 120,556 Grenslandhallen - Ethias Arena Hasselt, BELGIUM 5 470,034 Lanxess Arena Cologne, GERMANY 55 119,565 Intrust Bank Arena Wichita, KS 6 349,588 Sportpaleis Antwerpen Merksem, BELGIUM 56 119,357 Palacio De Los Deportes Mexico City, MEXICO 7 333,033 Wells Fargo Center Philadelphia, PA 57 117,537 Chesapeake Energy Arena Oklahoma City, OK 8 330,267 LG Arena Birmingham, UNITED KINGDOM 58 117,240 Thomas & Mack Center Las Vegas, NV 9 323,481 The O2 - Dublin Dublin, IRELAND 59 114,208 Allstate Arena Rosemont, IL 10 314,493 Hallenstadion Zurich Zurich, SWITZERLAND 60 112,630 Target Center Minneapolis, MN 11 308,699 Arena Ciudad De Mexico Mexico City, MEXICO 61 111,395 Time Warner Cable Arena Charlotte, NC 12 303,186 O2 World Hamburg Hamburg, GERMANY 62 108,529 The NIA Birmingham, UNITED KINGDOM 13 286,990 Philips Arena Atlanta, GA 63 102,899 United Center Chicago, IL 14 282,664 Ziggo Dome Amsterdam, NETHERLANDS 64 100,819 Cotai Arena At Venetian Macao Macau, CHINA 15 273,196 Air Canada Centre Toronto, CANADA 65 98,079 Lotto Arena Merksem, BELGIUM 16 270,258 Metro Radio Arena Newcastle upon Tyne, UK 66 96,967 Van Andel Arena Grand Rapids, MI 17 259,476 O2 World Berlin, GERMANY 67 96,525 TD Garden Boston, -

Still on the Road Venue Index 1956 – 2016

STILL ON THE ROAD VENUE INDEX 1956 – 2016 STILL ON THE ROAD VENUE INDEX 1956-2016 2 Top Ten Concert Venues 1. Fox Warfield Theatre, San Francisco, California 28 2. The Beacon Theatre, New York City, New York 24 3. Madison Square Garden, New York City, New York 20 4. Nippon Budokan Hall, Tokyo, Japan 15 5. Hammersmith Odeon, London, England 14 Royal Albert Hall, London, England 14 Vorst Nationaal, Brussels, Belgium 14 6. Earls Court, London, England 12 Jones Beach Theater, Jones Beach State Park, Wantagh, New York 12 The Pantages Theater, Hollywood, Los Angeles, California 12 Wembley Arena, London, England 12 Top Ten Studios 1. Studio A, Columbia Recording Studios, New York City, New York 27 2. Studio A, Power Station, New York City, New York 26 3. Rundown Studios, Santa Monica, California 25 4. Columbia Music Row Studios, Nashville, Tennessee 16 5. Studio E, Columbia Recording Studios, New York City, New York 14 6. Cherokee Studio, Hollywood, Los Angeles, California 13 Columbia Studio A, Nashville, Tennessee 13 7. Witmark Studio, New York City, New York 12 8. Muscle Shoals Sound Studio, Sheffield, Alabama 11 Skyline Recording Studios, Topanga Park, California 11 The Studio, New Orleans, Louisiana 11 Number of different names in this index: 2222 10 February 2017 STILL ON THE ROAD VENUE INDEX 1956-2016 3 1st Bank Center, Broomfield, Colorado 2012 (2) 34490 34500 30th Street Studio, Columbia Recording Studios, New York City, New York 1964 (1) 00775 40-acre North Forty Field, Fort Worth Stockyards, Fort Worth, Texas 2005 (1) 27470 75th Street, -

Annual Reports

GENERAL ASSEMBLY 2004 2004 ANNUAL REPORTS Tuesday Business Board Education Board Residential Assembly 2004 PWA Nomination Board Board of Studies & Christian Training GENERAL ASSEMBLY Communications Board Ministry and Pensions Board Wednesday Doctrine 2004 2004 Church and Government General Board (Other C’ttes.) Youth Board ANNUAL REPORTS Union Commission Thursday Overseas Board Board of Mission in Ireland Shankill Road Mission ORDER OF BUSINESS Judicial Commission Notes: Business commences at 9.30 a.m. each morning. Reception of Ministers Luncheon adjournment at 1.00 p.m. each day. Inter-Church Relations Board United Appeal Board The figures printed in brackets are page references to the Annual Reports. Finance and Administration Board References to the Minutes of Assembly are given Friday in full. Trustees Trusts Social Witness Board Priorities Committee NOTES ii MONDAY, JUNE 7 Within Church House 7.00 p.m.— Service of Worship Constitution of Assembly Memorial Roll Election of Moderator TUESDAY, JUNE 8 9.30 a.m.— 1. BUSINESS BOARD: Report and Resolutions (90-100). Arrangements Committee. 2. Reports of Synods and Presbyteries (79-89). (10.00) 3. Reception of Corresponding Members and Delegates. Church of Scotland: Dr. Alison Elliot, Rev. Johnston McKay, Mr. Andrew F. Stewart. United Reformed Church: Rev. Alasdair Pratt. Presbyterian Church of Wales: Rev. Dafydd Owen. Church of Ireland: Rev. Canon W.A. Lewis, Mr. Roy Totten. The Methodist Church in Ireland: Rev. W. Graham, Mrs. Sandra Dickson. Irish Council of Churches: (10.30) 4. BOARD OF EDUCATION: Report and Resolutions (277-292). Church Education, State Education, University Education Committees. 5. 2004 Assembly Conference Committee: Report and Resolutions (353). -

Country City on Product 3Dlm

Country City on product 3dlm - lmic Name alb tirana Resurrection Cathedral alb tirana Clock Tower of Tirana alb tirana The Plaza Tirana alb tirana TEATRI OPERAS DHE BALETIT alb tirana Taivani Taiwan Center alb tirana Toptani Shopping Center alb tirana Muzeu Historik Kombetar and andorra_la_vella Sant Joan de Caselles and andorra_la_vella Rocòdrom - Caldea and andorra_la_vella Sant Martí de la Cortinada and andorra_la_vella Santa Coloma and andorra_la_vella Sant Esteve d'Andorra la Vella and andorra_la_vella La Casa de la Vall and andorra_la_vella La Noblesse du Temps aut bischofshofen Paul Ausserleitner Hill aut graz Graz Hauptbahnhof aut graz Stadthalle Graz aut graz Grazer Opernhaus aut graz Merkur Arena aut graz Kunsthaus Graz aut graz Universität Graz aut graz Technische Universität Graz aut graz Universität für Musik und darstellende Kunst Graz aut graz Mariatrost aut graz Mausoleum aut graz Vereinigte Bühnen Schauspielhaus Graz aut graz Heiligen Blut aut graz Landhaus aut graz Grazer Uhrturm aut graz Schloss Eggenberg aut graz Magistrat der Stadt Graz mit eigenem Statut aut graz Neue Galerie Graz aut graz Ruine Gösting aut graz Herz Jesu aut graz Murinsel aut graz Dom aut graz Herzogshof aut graz Paulustor aut graz Franciscan Church aut graz Holy Trinity Church aut graz Church of the Assumption am Leech aut graz Mariahilf aut graz Universalmuseum Joanneum, Museum im Palais aut graz Straßengel aut graz Kirche Hl. Kyrill und Method aut graz Kalvarienberg aut graz Pfarrkirche der Pfarre Graz-Kalvarienberg aut graz Glöckl Bräu aut innsbruck -

Still on the Road Venue Index 1956 – 2020

STILL ON THE ROAD VENUE INDEX 1956 – 2020 STILL ON THE ROAD VENUE INDEX 1956-2020 2 Top Concert Venues Venue # 1. The Beacon Theatre, New York City, New York 46 2. Fox Warfield Theatre, San Francisco, California 28 3. Madison Square Garden, New York City, New York 20 4. Nippon Budokan Hall, Tokyo, Japan 15 5. Hammersmith Odeon, London, England 14 Royal Albert Hall, London, England 14 Vorst Nationaal, Brussels, Belgium 14 6. Earls Court, London, England 12 Heineken Music Hall, Amsterdam, The Netherlands 12 Jones Beach Theater, Jones Beach State Park, Wantagh, New York 12 Spektrum, Oslo, Norway 12 The Pantages Theater, Hollywood, Los Angeles, California 12 Wembley Arena, London, England 12 7. Entertainment Centre, Sydney, New South Wales, Australia 11 Greek Theatre, University Of California, Berkeley, California 11 Pine Knob Music Theatre, Clarkston, Michigan 11 The Tower Theater, Upper Darby, Pennsylvania 11 8. Globe Arena, Stockholm, Sweden 10 Hammersmith Apollo, London, England 10 Le Grand Rex, Paris, France 10 Palais Theatre, Melbourne, Victoria, Australia 10 Pavillon de Paris, Paris, France 10 Scandinavium, Gothenburg, Sweden 10 State Theatre, Sydney, New South Wales, Australia 10 The Forum, Inglewood, Los Angeles, California 10 The Orpheum Theatre, Boston, Massachusetts 10 Top Ten Studios rank Studio # 1. Studio B, The Abernathy Building, Washington, District Of Columbia 85 2. Rundown Studios, Santa Monica, California 63 3. Studio A, Columbia Recording Studios, New York City, New York 27 4. Studio A, Power Station, New York City, New York 26 5. Columbia Music Row Studios, Nashville, Tennessee 16 6. Studio E, Columbia Recording Studios, New York City, New York 14 7. -

Our Common Futureour Urban We’Re One of the Sound Science UK’S August 2015

IES ENDS Adverts - Portrait - NO-BLEED (2)210x297_1.pdf 1 23/12/2014 13:41 INTRODUCTION There are many SCIENTIST environmental Professionalism August 2015 reasons why Journal of the Institution of Environmental Sciences Our common urbanOur future common we’re one of the Sound Science UK’s August 2015 August Quality assurance fastest growing Responsibility C M Y CM Equality MY professional CY Equity CMY bodies. K Find out why you Integrity should join us. www.the-ies.org OUR COMMON The Institution of Environmental Sciences URBAN FUTURE August 2015 | environmental SCIENTIST | 1 ies_augst_cover_2015_spreads_fin.indd 46 26/08/2015 17:35 IES ENDS Adverts - Portrait - NO-BLEED (2)210x297_1.pdf 1 23/12/2014 13:41 There are many SCIENTIST environmental Professionalism August 2015 reasons why Journal of the Institution of Environmental Sciences EDITORIAL Our common urbanOur future common CONTENTS > we’re one of the Sound Science INTRODUCTION 4 UK’s Our urban future James Hale describes the work being done to design sustainable and liveable August 2015 August cities. Green cities FEATURE 9 Quality assurance Cities Alive: rethinking the cities of the future Tom Armour asks whether nature can help restore harmony in our cities? fastest growing Responsibility CASE STUDY ore of us than ever before live and work in energy, resources, food and nature. The Bristol Green 33 1 C cities nationally and globally . But cities are Capital Partnership has increased its membership from 65 Belfast: back to the future M heavily dependent on their interaction with to over 800 in two years. During 2015, over £15 million from Joseph Martin and Mary Maguire outline the way that Belfast is embracing a M sustainable future. -

A Historical Materialist Analysis of the Theological Turn of Alain Badiou

Archives of Defeat? A historical materialist analysis of the theological turn of Alain Badiou. Thomas Matthew Rudman A thesis submitted in partial fulfilment of the requirements of the Department of English, Manchester Metropolitan University for the Degree of Doctor of Philosophy August 2015 1 ABSTRACT This thesis offers a historical materialist analysis of the use of messianic discourses in contemporary theoretical and literary texts. It focuses on the way the recent ‘theological turn’ in Marxist theory relates to two major historical developments: the ascendency of neoliberal capitalism and the perceived absence of any socialist alternative. In theoretical terms, it produces a symptomatic analysis of Alain Badiou and his attempt to re-invigorate communist militancy via the figure of Saint Paul. Rather than follow Badiou’s avowedly atheistic turn to Paul, I undertake a materialist analysis of the texts of early Christianity in order to show that their style of ideological and political subversion is not incompatible with the egalitarian aims of Marxism. I extend this analysis of the radical potentiality of Christian discourses by examining the significance of messianic discourses in contemporary fiction in novels by Eoin McNamee and Roberto Bolaño. Both novelists deploy the conventions of crime fiction to narrate stories of revolutionary disillusionment and the impact of neoliberal economics in the north of Ireland and the Mexico-US border. My analysis focuses on issues of literary form and how the use of messianic imagery produces formal ruptures in the texts which trouble or disturb their manifest ideologies, notably the sense of revolutionary disillusionment and the notion that there is no longer any possibility of radical social change. -

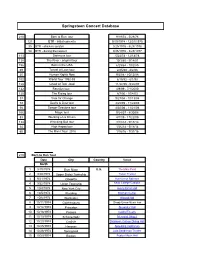

Springsteen Concert Database

Springsteen Concert Database 210 Born to Run tour 9/19/74 - 5/28/76 121 BTR - initial concerts 9/19/1974 - 12/31/1975 35 BTR - chicken scratch 3/25/1976 - 5/28/1976 54 BTR - during the lawsuit 9/26/1976 - 3/25/1977 113 Darkness tour 5/23/78 - 12/18/78 138 The River - original tour 10/3/80 - 9/14/81 156 Born in the USA 6/29/84 - 10/2/85 69 Tunnel of Love tour 2/25/88 - 8/2/88 20 Human Rights Now 9/2/88 - 10/15/88 102 World Tour 1992-93 6/15/92 - 6/1/93 128 Ghost of Tom Joad 11/22/95 - 5/26/97 132 Reunion tour 4/9/99 - 7/1/2000 120 The Rising tour 8/7/00 - 10/4/03 37 Vote for Change 9/27/04 - 10/13/04 72 Devils & Dust tour 4/25/05 - 11/22/05 56 Seeger Sessions tour 4/30/06 - 11/21/06 106 Magic tour 9/24/07 - 8/30/08 83 Working on a Dream 4/1/09 - 11/22/09 134 Wrecking Ball tour 3/18/12 - 9/18/13 34 High Hopes tour 1/26/14 - 5/18/14 65 The River Tour 2016 1/16/16 - 7/31/16 210 Born to Run Tour Date City Country Venue North America 1 9/19/1974 Bryn Mawr U.S. The Main Point 2 9/20/1974 Upper Darby Township Tower Theater 3 9/21/1974 Oneonta Hunt Union Ballroom 4 9/22/1974 Union Township Kean College Campus Grounds 5 10/4/1974 New York City Avery Fisher Hall 6 10/5/1974 Reading Bollman Center 7 10/6/1974 Worcester Atwood Hall 8 10/11/1974 Gaithersburg Shady Grove Music Fair 9 10/12/1974 Princeton Alexander Hall 10 10/18/1974 Passaic Capitol Theatre 11 10/19/1974 Schenectady Memorial Chapel 12 10/20/1974 Carlisle Dickinson College Dining Hall 13 10/25/1974 Hanover Spaulding Auditorium 14 10/26/1974 Springfield Julia Sanderson Theater 15 10/29/1974 Boston Boston Music Hall 16 11/1/1974 Upper Darby Tower Theater 17 11/2/1974 18 11/6/1974 Austin Armadillo World Headquarters 19 11/7/1974 20 11/8/1974 Corpus Christi Ritz Music Hall 21 11/9/1974 Houston Houston Music Hall 22 11/15/1974 Easton Kirby Field House 23 11/16/1974 Washington, D.C.