March 30, 2020 the Honorable Maxine Waters the Honorable

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Congressional Affairs Programming at a Glance 2016

Congressional Affairs Programming At A Glance 2016 - 2020 Congressional Delegations Congress-Bundestag Forum 2020 February 15-20, 2020 Elmau and Munich, Germany The German Marshall Fund of the United States (GMF) and the Robert Bosch Stiftung Foundation (Bosch) hosted the 17th Annual Congress-Bundestag Forum. A bipartisan delegation of members of the U.S. House of Representatives met with members of the German Bundestag for a series of discussions on areas of mutual concern, such as: Asia in the transatlantic space, challenges to the West, European reunification after the end of communism, social cohesion, energy issues, and workforce development. Participants of the Congress-Bundestag Forum 2020 included Representatives Rob Bishop (R-UT), Bill Flores (R-TX), Mark Green (R-TN), Robin Kelly (D-IL), Brenda Lawrence (D-MI), Barbara Lee (D-CA), Debra Lesko (R-AZ), C. A. Dutch Ruppersberger (D-MD), Eric Swalwell (D- CA), Mike Turner (R-OH), as well as fifteen members of the German Bundestag. Transatlantic Technology Congressional Delegation 2019 November 3-8, 2019 Berlin, Germany and Brussels, Belgium GMF held, with Software.org, The Transatlantic Technology Congressional Delegation (TTCD), held in Brussels, Belgium and Berlin, Germany, enabled members of Congress to engage directly with stakeholders on topics relating to the transatlantic digital space. TTCD 2019 covered issues such as data protection, data ownership, cybersecurity, workforce development, digital trade, and digital entrepreneurship, among other issues. Participants of TTCD 2019 included Representatives Lisa Blunt Rochester (D-DE), Charlie Crist (D-FL), Glen Grothman (R-WI), James Sensenbrenner (R-WI), Greg Walden (D-OR), and four senior congressional staffers. -

Congressional Report Card

Congressional Report Card NOTE FROM BRIAN DIXON Senior Vice President for Media POPULATION CONNECTION and Government Relations ACTION FUND 2120 L St NW, Suite 500 Washington, DC 20037 ou’ll notice that this year’s (202) 332–2200 Y Congressional Report Card (800) 767–1956 has a new format. We’ve grouped [email protected] legislators together based on their popconnectaction.org scores. In recent years, it became twitter.com/popconnect apparent that nearly everyone in facebook.com/popconnectaction Congress had either a 100 percent instagram.com/popconnectaction record, or a zero. That’s what you’ll popconnectaction.org/116thCongress see here, with a tiny number of U.S. Capitol switchboard: (202) 224-3121 exceptions in each house. Calling this number will allow you to We’ve also included information connect directly to the offices of your about some of the candidates senators and representative. that we’ve endorsed in this COVER CARTOON year’s election. It’s a small sample of the truly impressive people we’re Nick Anderson editorial cartoon used with supporting. You can find the entire list at popconnectaction.org/2020- the permission of Nick Anderson, the endorsements. Washington Post Writers Group, and the Cartoonist Group. All rights reserved. One of the candidates you’ll read about is Joe Biden, whom we endorsed prior to his naming Sen. Kamala Harris his running mate. They say that BOARD OF DIRECTORS the first important decision a president makes is choosing a vice president, Donna Crane (Secretary) and in his choice of Sen. Harris, Joe Biden struck gold. Carol Ann Kell (Treasurer) Robert K. -

Newly Elected Representatives in the 114Th Congress

Newly Elected Representatives in the 114th Congress Contents Representative Gary Palmer (Alabama-6) ....................................................................................................... 3 Representative Ruben Gallego (Arizona-7) ...................................................................................................... 4 Representative J. French Hill (Arkansas-2) ...................................................................................................... 5 Representative Bruce Westerman (Arkansas-4) .............................................................................................. 6 Representative Mark DeSaulnier (California-11) ............................................................................................. 7 Representative Steve Knight (California-25) .................................................................................................... 8 Representative Peter Aguilar (California-31) ................................................................................................... 9 Representative Ted Lieu (California-33) ........................................................................................................ 10 Representative Norma Torres (California-35) ................................................................................................ 11 Representative Mimi Walters (California-45) ................................................................................................ 12 Representative Ken Buck (Colorado-4) ......................................................................................................... -

Congresswoman Alma S. Adams From

1 MEMORANDUM 5/22/2019 4:13 PM To: Congresswoman Alma S. Adams From: Katherine Stewart Date: Wednesday, May 22, 2019 Re: Natural Resources Committee – National Parks, Forests, and Public Lands Subcommittee Legislative Hearing including H.R.1179, African-American Burial Ground Network Act Date: Tuesday, May 21, 2019 Location: 1334 Longworth House Office Building Time: 10:00 am Staff: Katherine Stewart Topics: Legislative hearing on the following bills: • H.R. 182 (Rep. Keating), To extend the authorization for the Cape Cod National Seashore Advisory Commission. • H.R. 307 (Rep. Hice), Preserving America’s Battlefields Act • H.R. 473 (Rep. Neguse), To authorize the Every Word We Utter Monument to establish a commemorative work in the District of Columbia and its environs, and for other purposes. • H.R. 1088 (Rep. Marshall), First Infantry Recognition of Sacrifice in Theater Act (FIRST Act) • H.R. 1130 (Rep. Rush), Fort Pillow National Battlefield Park Study Act” • H.R. 1179 (Rep. Adams), African-American Burial Grounds Network Act • H.R. 1248 (Rep. Pingree), York River Wild and Scenic River Act of 2019 • H.R. 1472 (Rep. Adrian Smith), To rename the Homestead National Monument of America near Beatrice, Nebraska, as the Homestead National Historical Park. • H.R. 1487 (Rep. Lieu), Santa Monica Mountains National Recreation Area Boundary Adjustment Study Act • H.R. 1727 (Rep. Connolly), Complete America’s Great Trails Act • H.R. 2369 (Rep. Rice), Long Island Aviation History Act • H.R. 2427 (Rep. Sarbanes), Chesapeake Bay Gateways and Watertrails Network Reauthorization Act of 2019 • H.R. 2490 (Rep. Fortenberry), To amend the National Trails System Act to direct the Secretary of the Interior to conduct a study on the feasibility of designating the Chief Standing Bear National Historic Trail, and for other purposes. -

August 10, 2021 the Honorable Nancy Pelosi the Honorable Steny

August 10, 2021 The Honorable Nancy Pelosi The Honorable Steny Hoyer Speaker Majority Leader U.S. House of Representatives U.S. House of Representatives Washington, D.C. 20515 Washington, D.C. 20515 Dear Speaker Pelosi and Leader Hoyer, As we advance legislation to rebuild and renew America’s infrastructure, we encourage you to continue your commitment to combating the climate crisis by including critical clean energy, energy efficiency, and clean transportation tax incentives in the upcoming infrastructure package. These incentives will play a critical role in America’s economic recovery, alleviate some of the pollution impacts that have been borne by disadvantaged communities, and help the country build back better and cleaner. The clean energy sector was projected to add 175,000 jobs in 2020 but the COVID-19 pandemic upended the industry and roughly 300,000 clean energy workers were still out of work in the beginning of 2021.1 Clean energy, energy efficiency, and clean transportation tax incentives are an important part of bringing these workers back. It is critical that these policies support strong labor standards and domestic manufacturing. The importance of clean energy tax policy is made even more apparent and urgent with record- high temperatures in the Pacific Northwest, unprecedented drought across the West, and the impacts of tropical storms felt up and down the East Coast. We ask that the infrastructure package prioritize inclusion of a stable, predictable, and long-term tax platform that: Provides long-term extensions and expansions to the Production Tax Credit and Investment Tax Credit to meet President Biden’s goal of a carbon pollution-free power sector by 2035; Extends and modernizes tax incentives for commercial and residential energy efficiency improvements and residential electrification; Extends and modifies incentives for clean transportation options and alternative fuel infrastructure; and Supports domestic clean energy, energy efficiency, and clean transportation manufacturing. -

Official List of Members

OFFICIAL LIST OF MEMBERS OF THE HOUSE OF REPRESENTATIVES of the UNITED STATES AND THEIR PLACES OF RESIDENCE ONE HUNDRED SIXTEENTH CONGRESS • DECEMBER 15, 2020 Compiled by CHERYL L. JOHNSON, Clerk of the House of Representatives http://clerk.house.gov Democrats in roman (233); Republicans in italic (195); Independents and Libertarians underlined (2); vacancies (5) CA08, CA50, GA14, NC11, TX04; total 435. The number preceding the name is the Member's district. ALABAMA 1 Bradley Byrne .............................................. Fairhope 2 Martha Roby ................................................ Montgomery 3 Mike Rogers ................................................. Anniston 4 Robert B. Aderholt ....................................... Haleyville 5 Mo Brooks .................................................... Huntsville 6 Gary J. Palmer ............................................ Hoover 7 Terri A. Sewell ............................................. Birmingham ALASKA AT LARGE Don Young .................................................... Fort Yukon ARIZONA 1 Tom O'Halleran ........................................... Sedona 2 Ann Kirkpatrick .......................................... Tucson 3 Raúl M. Grijalva .......................................... Tucson 4 Paul A. Gosar ............................................... Prescott 5 Andy Biggs ................................................... Gilbert 6 David Schweikert ........................................ Fountain Hills 7 Ruben Gallego ............................................ -

The Importance of Politics to CAALA and the Importance of CAALA to Politicians THIS ELECTION IS ABOUT YOUR PRACTICE

CAALA President Mike Arias ARIAS SANGUINETTI WANG & TORRIJOS, LLP October 2018 Issue The importance of politics to CAALA and the importance of CAALA to politicians THIS ELECTION IS ABOUT YOUR PRACTICE In a few short weeks, the mid-term Republicans, we will take back the House. efforts to pare down, strip down and take elections will take place, and I hope I don’t What does this mean to you as a Trial away access to justice.” Swalwell added that have to tell you how important this election Lawyer? It means that the wrath of legislta- “23 seats are between where we are and cut- is for consumer attorneys and the people tion that has emanated out of the ting in half our time in hell. We can prove we represent. Like so many CAALA mem- Republican-controlled House – that is that we are better than that in America.” bers, politics means a lot to me; not just designed to limit consumer rights, deny Katie Hill and Gil Cisneros both said they because I’m CAALA’s President and I’m trial by jury and eliminate our practices – have lived a life of service. Katie as a nurse and about to be installed as President of our will stop. Cisneros in the Navy. They say they are both state trial lawyer association, CAOC. And As is usually the case, California is at the fighting to keep President Trump from taking not because I’m a political junkie who center of the national political landscape, away what trial lawyers work to do. -

Transcript by Rev.Com This Transcript Was Exported on May 18, 2021 - View Latest Version Here

This transcript was exported on May 18, 2021 - view latest version here. Melissa Murray: Hey Strict Scrutiny listeners, it's Melissa Murray. When I'm not chopping it up with Leah and Kate on Strict Scrutiny, I'm a professor at NYU Law, where I also have the privilege of being the faculty director of the Birnbaum Women's Leadership Network. Each year the BWLN host's a symposium on issues relating to gender justice, and gender equity. This year, our symposium, which was held on March 5th, focused on politics, power, and women's leadership. The day featured incredible panels from a wide range of women leaders from across the country, but the highlight of the day was certainly a keynote conversation between myself and Representative Katie Porter, who represents California's 45th congressional district, aka the OC, in the US House of Representatives. We are delighted to share that conversation with all of you today as a very special episode brought to you by Strict Scrutiny and the BWLN. We hope you enjoy it. Intro: As Chief Justice, may it please the court, it's an old joke but when a man argues against two beautiful ladies like this, they're going to have the last word. Intro: She spoke, not elegantly, but with unmistakable clarity. She said, "I ask no favor for my sex, all I ask of our brethren is that they take their feet off our necks." Melissa Murray: I am thrilled to introduce our keynote conversation participant, and that is Congresswoman Katie Porter. Congresswoman Porter represents the 45th congressional district in Orange County, California, and in Congress she is a member of the House oversight and reform committee, and the House natural resources committee, and she chairs the oversight and investigation sub committee. -

CHC Task Force Meeting November 20, 2020 Zoom Help

CHC Task Force Meeting November 20, 2020 Zoom Help You can also send questions through Chat. Send questions to Everyone or a specific person. Everyone will be muted. You can unmute yourself to ask questions by clicking on the microphone or phone button. Agenda • Welcome, Chris Shank, President & CEO, NCCHCA • Election Debrief, Harry Kaplan & Jeff Barnhart, McGuireWoods Consulting • 2021 Policy Priorities, Brendan Riley, Director of Policy, NCCHCA • Experience with Carolina Access, Daphne Betts-Hemby, CFO, Kinston Community Health Center • Updates, Shannon Dowler, MD, NC Division of Health Benefits • Wrap-Up Slides & Other Info will be available on our website: www.ncchca.org/covid-19/covid19-general-information/ Welcome from Chris Shank, President & CEO, NCCHCA North Carolina Election Recap November 18, 2020 McGuireWoods | 5 CONFIDENTIAL THE COUNT McGuireWoods Consulting | 6 CONFIDENTIAL VOTER TURNOUT In North Carolina… ✓ 5,545,859 voters ✓ 75.4% of registered voters cast a ballot ✓4,629,200 of voters voted early ✓ 916,659 voted on Election Day ✓ Voter turnout increased about 6% over 2016 McGuireWoods Consulting | 7 CONFIDENTIAL FEDERAL RACES McGuireWoods Consulting | 8 CONFIDENTIAL FEDERAL RACES ✓ US PRESIDENT President Donald Trump (R) Former Vice President Joe Biden INCUMBENT (D) 2,758,776 (49.93%) 2,684,303 (48.59%) ✓ US SENATE Cal Cunningham (D) Thom Tillis (R) 2,569,972 (46.94%) INCUMBENT 2,665,605(48.69%) McGuireWoods | 9 CONFIDENTIAL FEDERAL RACES US HOUSE Virginia Foxx (R)- INCUMBENT- 66.93% ✓ DISTRICT 9: David Brown (D)- 31.11% -

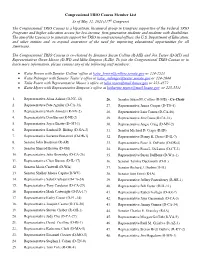

Caucus Member List

Congressional TRIO Caucus Member List As of May 12, 2021(117th Congress) The Congressional TRIO Caucus is a bipartisan, bicameral group in Congress supportive of the Federal TRIO Programs and higher education access for low-income, first-generation students and students with disabilities. The aim of the Caucus is to generate support for TRIO in congressional offices, the U.S. Department of Education, and other entities and, to expand awareness of the need for improving educational opportunities for all Americans. The Congressional TRIO Caucus is co-chaired by Senators Susan Collins (R-ME) and Jon Tester (D-MT) and Representatives Gwen Moore (D-WI) and Mike Simpson (R-ID). To join the Congressional TRIO Caucus or to learn more information, please contact any of the following staff members: • Katie Brown with Senator Collins’ office at [email protected] or 224-2523 • Katie Rubinger with Senator Tester’s office at [email protected] or 224-2644 • Talia Rosen with Representative Moore’s office at [email protected] or 225-4572 • Katie Myers with Representative Simpson’s office at [email protected] or 225-5531 1. Representative Alma Adams (D-NC-12) 26. Senator Susan M. Collins (R-ME) - Co-Chair 2. Representative Pete Aguilar (D-CA-31) 27. Representative James Cooper (D-TN-5) 3. Representative Mark Amodei (R-NV-2) 28. Representative Luis Correa (D-CA-46) 4. Representative Don Bacon (R-NE-2) 29. Representative Jim Costa (D-CA-16) 5. Representative Joyce Beatty (D-OH-3) 30. Representative Angie Craig (D-MN-2) 6. -

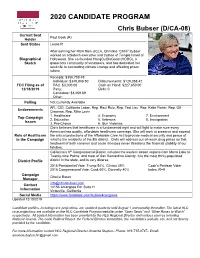

2020 Candidate Program

2020 CANDIDATE PROGRAM Chris Bubser (D/CA-08) Current Seat Paul Cook (R) Holder Seat Status Leans R After earning her MBA from UCLA, Christine “Chris” Bubser worked as a biotech executive and trustee of Temple Israel of Biographical Hollywood. She co-founded HangOutDoGood (HODG), a Sketch grassroots community of volunteers, and has dedicated her adult life to combatting climate change and affecting prison reform. Receipts: $356,708.49 Individual: $349,848.50 Disbursements: $129,058.42 FEC Filing as of PAC: $3,000.00 Cash on Hand: $227,650.00 12/18/2019 Party: Debt: 0 Candidate: $3,459.69 Other: Polling Not Currently Available AFL-CIO, California Labor, Rep. Raul Ruiz, Rep. Ted Lieu, Rep. Katie Porter, Rep. Gil Endorsements Cisneros, Rep. Mike Levin 1. Healthcare 4. Economy 7. Environment Top Campaign 2. Education 5. Veterans 8. Immigration Issues 3. Pro-Choice 6. Gun Violence Chris believes that healthcare is a fundamental right and will fight to make sure every American has quality, affordable healthcare coverage. She will work to preserve and expand Role of Healthcare the critical protections of the Affordable Care Act to provide medical security and peace of in the Campaign mind to the residents of the 8th district. Chris will address out-of-reach drug prices so that treatment of both common and acute illnesses never threatens the financial stability of our families. California’s 8th Congressional District includes the eastern desert regions from Mono Lake to Twenty-nine Palms, and most of San Bernardino County. It is the most thinly-populated District Profile district in the state, and is very diverse. -

Congress of the United States Washington D.C

Congress of the United States Washington D.C. 20515 April 29, 2020 The Honorable Nancy Pelosi The Honorable Kevin McCarthy Speaker of the House Minority Leader United States House of Representatives United States House of Representatives H-232, U.S. Capitol H-204, U.S. Capitol Washington, D.C. 20515 Washington, D.C. 20515 Dear Speaker Pelosi and Leader McCarthy: As Congress continues to work on economic relief legislation in response to the COVID-19 pandemic, we ask that you address the challenges faced by the U.S. scientific research workforce during this crisis. While COVID-19 related-research is now in overdrive, most other research has been slowed down or stopped due to pandemic-induced closures of campuses and laboratories. We are deeply concerned that the people who comprise the research workforce – graduate students, postdocs, principal investigators, and technical support staff – are at risk. While Federal rules have allowed researchers to continue to receive their salaries from federal grant funding, their work has been stopped due to shuttered laboratories and facilities and many researchers are currently unable to make progress on their grants. Additionally, researchers will need supplemental funding to support an additional four months’ salary, as many campuses will remain shuttered until the fall, at the earliest. Many core research facilities – typically funded by user fees – sit idle. Still, others have incurred significant costs for shutting down their labs, donating the personal protective equipment (PPE) to frontline health care workers, and cancelling planned experiments. Congress must act to preserve our current scientific workforce and ensure that the U.S.