Sirwar Renewable Energy Private Limited: Rating Moved to Issuer Not Cooperating Category, Rating Downgraded Based on Best Available Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

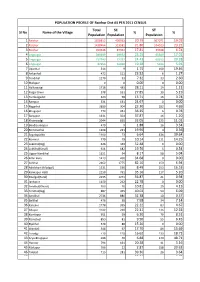

Sl No Name of the Village Total Population SC Population % ST

POPULATION PROFILE OF Raichur Dist AS PER 2011 CENSUS Total SC ST Sl No Name of the Village % % Population Population Population 1 Raichur 1928812 400933 20.79 367071 19.03 2 Raichur 1438464 313581 21.80 334023 23.22 3 Raichur 490348 87352 17.81 33048 6.74 4 Lingsugur 385699 89692 23.25 65589 17.01 5 Lingsugur 297743 72732 24.43 60393 20.28 6 Lingsugur 87956 16960 19.28 5196 5.91 7 Upanhal 514 9 1.75 100 19.46 8 Ankanhal 472 111 23.52 6 1.27 9 Tondihal 1270 93 7.32 33 2.60 10 Mallapur 0 0 0.00 0 0.00 11 Halkawatgi 1718 483 28.11 19 1.11 12 Palgal Dinni 578 161 27.85 30 5.19 13 Tumbalgaddi 423 58 13.71 16 3.78 14 Rampur 531 131 24.67 0 0.00 15 Nagarhal 3880 904 23.30 182 4.69 16 Bhogapur 773 281 36.35 6 0.78 17 Baiyapur 1331 504 37.87 16 1.20 18 Khairwadgi 2044 655 32.05 225 11.01 19 Bandisunkapur 479 9 1.88 16 3.34 20 Bommanhal 1108 221 19.95 4 0.36 21 Sajjalagudda 1100 73 6.64 436 39.64 22 Komnur 779 79 10.14 111 14.25 23 Lukkihal(Big) 646 339 52.48 0 0.00 24 Lukkihal(Small) 921 182 19.76 5 0.54 25 Uppar Nandihal 1151 94 8.17 58 5.04 26 Killar Hatti 1413 490 34.68 0 0.00 27 Ashihal 2162 1775 82.10 150 6.94 28 Advibhavi (Mudgal) 1531 130 8.49 253 16.53 29 Kannapur Hatti 2250 791 35.16 117 5.20 30 Mudgal(Rural) 2235 1271 56.87 21 0.94 31 Jantapur 1150 262 22.78 0 0.00 32 Yerdihal(Khurd) 703 76 10.81 29 4.13 33 Yerdihal(Big) 887 355 40.02 54 6.09 34 Amdihal 2736 886 32.38 10 0.37 35 Bellihal 476 38 7.98 34 7.14 36 Kansavi 1778 395 22.22 83 4.67 37 Adapur 1022 228 22.31 126 12.33 38 Komlapur 951 59 6.20 79 8.31 39 Ramatnal 853 81 9.50 55 -

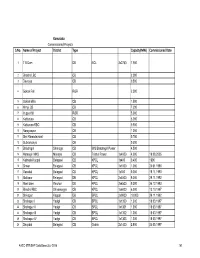

Karnataka Commissioned Projects S.No. Name of Project District Type Capacity(MW) Commissioned Date

Karnataka Commissioned Projects S.No. Name of Project District Type Capacity(MW) Commissioned Date 1 T B Dam DB NCL 3x2750 7.950 2 Bhadra LBC CB 2.000 3 Devraya CB 0.500 4 Gokak Fall ROR 2.500 5 Gokak Mills CB 1.500 6 Himpi CB CB 7.200 7 Iruppu fall ROR 5.000 8 Kattepura CB 5.000 9 Kattepura RBC CB 0.500 10 Narayanpur CB 1.200 11 Shri Ramadevaral CB 0.750 12 Subramanya CB 0.500 13 Bhadragiri Shimoga CB M/S Bhadragiri Power 4.500 14 Hemagiri MHS Mandya CB Trishul Power 1x4000 4.000 19.08.2005 15 Kalmala-Koppal Belagavi CB KPCL 1x400 0.400 1990 16 Sirwar Belagavi CB KPCL 1x1000 1.000 24.01.1990 17 Ganekal Belagavi CB KPCL 1x350 0.350 19.11.1993 18 Mallapur Belagavi DB KPCL 2x4500 9.000 29.11.1992 19 Mani dam Raichur DB KPCL 2x4500 9.000 24.12.1993 20 Bhadra RBC Shivamogga CB KPCL 1x6000 6.000 13.10.1997 21 Shivapur Koppal DB BPCL 2x9000 18.000 29.11.1992 22 Shahapur I Yadgir CB BPCL 1x1300 1.300 18.03.1997 23 Shahapur II Yadgir CB BPCL 1x1301 1.300 18.03.1997 24 Shahapur III Yadgir CB BPCL 1x1302 1.300 18.03.1997 25 Shahapur IV Yadgir CB BPCL 1x1303 1.300 18.03.1997 26 Dhupdal Belagavi CB Gokak 2x1400 2.800 04.05.1997 AHEC-IITR/SHP Data Base/July 2016 141 S.No. Name of Project District Type Capacity(MW) Commissioned Date 27 Anwari Shivamogga CB Dandeli Steel 2x750 1.500 04.05.1997 28 Chunchankatte Mysore ROR Graphite India 2x9000 18.000 13.10.1997 Karnataka State 29 Elaneer ROR Council for Science and 1x200 0.200 01.01.2005 Technology 30 Attihalla Mandya CB Yuken 1x350 0.350 03.07.1998 31 Shiva Mandya CB Cauvery 1x3000 3.000 10.09.1998 -

NAIS / MNAIS -- Hobli Level Average Yield Data for 2013-14 Experiments Average Yield District Taluk Hobli Planned Analysed (In Kgs/Hect.)

Government of Karnataka Directorate of Economics and Statistics NAIS / MNAIS -- Hobli level Average Yield data for 2013-14 Experiments Average Yield District Taluk Hobli Planned Analysed (in Kgs/Hect.) Crop : JOWAR Irrigated Season : RABI 1 Raichur 1 Devadurga 1 Arkera 10 10 2135 2 Devadurga 10 10 2164 3 Gabbur 10 10 1708 2 Lingasugur 4 Lingasugur 10 10 1968 5 Maski 10 10 2208 6 Mudgal 10 10 1909 3 Manvi 7 Halapur 10 10 2575 8 Hirekotnakal 10 10 2659 9 Kallur 10 10 1907 10 Kuradi 10 10 2786 11 Mallata 10 10 1987 12 Manvi 10 10 2042 13 Sirwar 10 10 2373 4 Raichur 14 Kalmala 10 0 * 5 Sindhanur 15 Badarli 10 10 1467 16 Balaganur 10 10 1711 17 Gorebal 10 10 1709 18 Gunjahalli 10 10 1809 19 Hedaginal 10 10 1648 20 Hooda 10 10 1720 21 Jalihal 10 0 * 22 Jawalgera 10 10 1749 23 Kunnatgi 10 10 1735 24 Salgunda 10 10 2132 25 Sindhanur 10 10 1615 26 Turvihal 10 10 1578 27 Walkamdinni 10 10 3492 Page 1 of 3 Experiments Average Yield District Taluk Hobli Planned Analysed (in Kgs/Hect.) Crop : GRAM Irrigated Season : RABI 1 Raichur 1 Lingasugur 28 Lingasugur 10 10 617 29 Mudgal 10 10 556 2 Manvi 30 Halapur 10 10 670 31 Hirekotnakal 10 10 693 32 Kallur 10 10 1113 33 Kuradi 10 10 1265 34 Manvi 10 10 945 35 Sirwar 10 10 1102 3 Raichur 36 Kalmala 10 0 * 4 Sindhanur 37 Badarli 10 10 1281 38 Balaganur 10 10 1103 39 Jawalgera 10 10 1122 40 Salgunda 10 10 1169 41 Sindhanur 10 10 1155 42 Turvihal 10 10 1138 Crop : SUNFLOWER Irrigated Season : RABI 1 Raichur 1 Lingasugur 43 Gurgunta 10 10 973 44 Lingasugur 10 10 973 45 Maski 10 10 1066 46 Mudgal 10 10 1140 2 -

KEONICS Training Center Address

KEONICS Training Center Address Sl.N District Place Cen Code Name & Address Phoneno E-Mail ID o 1 Bagalkot Badami Premiu K0002 Sri.Jameelahmad R. Saiyad JMC m-Taluk KEONICS Franchisee Centre, M/s. J. M. Computers, Desai Cross, Goudar Complex, [email protected], Near SVVP & Govt. Degree College, 9620153124 [email protected] BADAMI - 587201, Bagalkot Dist. , Phone No. 9620153124, 9480033662 2 Bagalkot Badami SC Premiu K0003 Sri.Mohammed Jameel H. Naik m-Taluk KEONICS Franchisee Centre, M/s. SYSTEK Computer Center, Grain Market, Talwar Street, systekcomputersbdm@gma BADAMI - 587201, Bagalkot Dist. 9880134934 Phone No. 9880134934, il.com, 7899446363 3 Bagalkot Navanagar( Premiu K0005 Sri.Holebasayya Hiremath AE) m-Dist KEONICS Franchisee Centre, Bagalkot M/s. Anushree Enterprises, 1st Floor, CMC Complex, BEC [email protected] College Rd, 9341070404 NAVANAGAR BAGALKOT - , 587103 Phone No. 9341070404 4 Bagalkot Bilgi Premiu K0006 Smt.Suma S. Bagshetti m-Taluk KEONICS Yuva.Com Centre, M/s. Infoline Systems, Behind Corporation Bank 9448640336 [email protected], Building, BILGI - 587116. Bagalkot Dist. Phone No. 9448640336 5 Bagalkot Ilkal Premiu K0007 Sri.Mahantesh S. Tatrani m-Hobli KEONICS Yuva.Com Centre, M/s. Pragati Enterprises, Basavashree Complex, 2nd Floor, Opp. Bus Stand, Hungund Tq. 9880520226 [email protected], ILKAL - 587125, Bagalkot Dist. Phone No. 9880520226, 9739293001 6 Belagavi Athani Premiu K0015 Sri.Vishwanath C. Mamdapur m-Taluk KEONICS Yuva.Com Centre M/s. Vishweshwarayya Computers Shahare Galli, Near Hanuman Chowk, 9448690565 [email protected], ATHANI - 591304, Belagavi Dist. Phone No. 9448690565 7 Belagavi Bailhongal Premiu K0016 Smt.Shakuntala Tatawati m-Taluk KEONICS Yuva.Com Centre M/s. -

43152 1961 SIR.Pdf

CENSUS OF INDIA, 1961 VOLU~1E XI MYSORE PART VI VILLAGE SURVEY MONOGRAPHS No. 26 VILLAGE SURVEY MONOGRAPH ON SIRWAR Editnr K. BAL\SUBRA\\['\'NYA~r fit Ihl' II/dian Admillislratii'e Sl'rl'iCl', SUjJerintnzdent 0ICmsus UPfrotioJls, /lfysore 7 . ,. MAP OF MYSORE (Showing Villages selected Fo,. ". 16· ·r.:'.... · ":'~~>:- .. :;:~:~ . DIU IS' 15· ARABIAN SEA i8tr;ct .. a/uk tL 7 S' 7 8· ~retJared by. K.V.LAXMINARA9'",HA FOREWORD hUIIl "\ bric[ accolillt of the tests of selection will help ,\pan !<i\illg', ~J the fouudatiolls- of dClllOO-rar>hv0) in this sub-continent, a hundrcd years of the Indian to explain. :\ minimulll of thirty-five villages was to CenslIs has also produced 'elaborate and scholarly be chosen with gTeat care to represent adequately accollnts of the yariegated phenomena of Indian life__:_ geographical, occupational and even ethnic diversity. sometimes with no statistics attached, but usually Of this minimulll of thirty-five, the distribution was "'ith just enough statistics to give empirical ullder to be as follows: pirllling to their conclusions'. In a country, largely illiterate, where statistical or Ilumerical comprehen (II) ,\t least eight village, WCle to be so selected sion of elen snch a simple thing as age was liable to that cach of them '\'QuId contain one dominant COllllllllllity ,\·ith Olle predominating occupa he inaccurate, all ultderstanding of the s()< ial slruc t JOIl, e.g. {i,hClllllll. fore,it "'ollero;, .ihum cult tun: \I"a, esselltial. It \ras mOle II('CCS,;1r\ to attain a broad understauding of what was happ~u ing' arou ud \:111)1" ]>()Itt'l" \I (';1 I'l'b , ~;t1(-lllakers, quarT ,,·orl..('I'o;. -

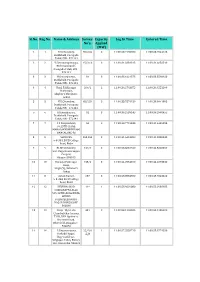

Sl.No. Reg.No. Name & Address Survey No's. Capacity Applied (MW

Sl.No. Reg.No. Name & Address Survey Capacity Log In Time Entered Time No's. Applied (MW) 1 1 H.V.Chowdary, 65/2,84 3 11:00:23.7195700 11:00:23.7544125 Doddahalli, Pavagada Taluk, PIN - 572141 2 2 Y.Satyanarayanappa, 15/2,16 3 11:00:31.3381315 11:00:31.6656510 Bheemunikunte, Pavagada Taluk, PIN - 572141 3 3 H.Ramanjaneya, 81 3 11:00:33.1021575 11:00:33.5590920 Doddahalli, Pavagada Taluk, PIN - 572141 4 4 Hanji Fakkirappa 209/2 2 11:00:36.2763875 11:00:36.4551190 Mariyappa, Shigli(V), Shirahatti, Gadag 5 5 H.V.Chowdary, 65/2,84 3 11:00:38.7876150 11:00:39.0641995 Doddahalli, Pavagada Taluk, PIN - 572141 6 6 H.Ramanjaneya, 81 3 11:00:39.2539145 11:00:39.2998455 Doddahalli, Pavagada Taluk, PIN - 572141 7 7 C S Nanjundaiah, 56 2 11:00:40.7716345 11:00:41.4406295 #6,15TH CROSS, MAHALAKHSMIPURAM, BANGALORE-86 8 8 SRINIVAS, 263,264 3 11:00:41.6413280 11:00:41.8300445 9-8-384, B.V.B College Road, Bidar 9 9 BLDE University, 139/1 3 11:00:23.8031920 11:00:42.5020350 Smt. Bagaramma Sajjan Campus, Bijapur-586103 10 10 Basappa Fakirappa 155/2 3 11:00:44.2554010 11:00:44.2873530 Hanji, Shigli (V), Shirahatti Gadag 11 11 Ashok Kumar, 287 3 11:00:48.8584860 11:00:48.9543420 9-8-384, B.V.B College Road, Bidar 12 12 DEVUBAI W/O 11* 1 11:00:53.9029080 11:00:55.2938185 SHARANAPPA ALLE, 549 12TH CROSS IDEAL HOMES RAJARAJESHWARI NAGAR BANGALORE 560098 13 13 Girija W/o Late 481 2 11:00:58.1295585 11:00:58.1285600 ChandraSekar kamma, T105, DNA Opulence, Borewell Road, Whitefield, Bangalore - 560066 14 14 P.Satyanarayana, 22/*/A 1 11:00:57.2558710 11:00:58.8774350 Seshadri Nagar, ¤ltĔ Bagewadi Post, Siriguppa Taluq, Bellary Dist, Karnataka-583121 Sl.No. -

Rural Water Supply 07-08 Action Plan

PANCHAYAT RAJ ENGINEERING DIVISION, RAICHUR PROFORMA FOR ACTION PLAN 2007-08 Present water supply Proposed water supply status Scheme Expendi Sl Estimate Gram Panchayat Village/ Habitation ture as on No cost LPCD Taluk TOTAL District 31-3-2007 Remarks HP HP OWS OWS PWSS PWSS MWSS MWSS MWSS MWSS MWSS MWSS for recharging for Supply Levelof Population 2001 Population 2007 Population Amount required Amount required Amount PWSS R/A PWSS MWSSR/A Single phase Single Single phase Single 1 2 3 4 5 6 7 8 9 1011121314151617181920212223 24 25 26 SPILLOVER FOR 2007-08 (STATE SECTOR) 1 RCR RCR Yapaldinni Naradagadde 30 34 3.00 1.77 - - - - - - - - 1 - - - - 1.23 0.00 1.23 Completed 2 RCR RCR Marchetal Pesaldinni 97 107 2.00 0.00 - - 1 - - 114 - - - - - - 1 2.00 0.00 2.00 C-99 In progress 3 RCR RCR Matmari Heerapur 2575 2884 1.25 0.00 1 1 7 - - 40 - A - - - - - 1.25 0.00 1.25 In progress 4 RCR RCR Gillesugur Duganur 1375 1540 2.00 0.00 - 1 4 - - 26 - - - A - - - 2.00 0.00 2.00 C-99 In progress 5 RCR RCR J.Venkatapur Gonal 952 1066 4.50 0.24 - 1 3 - - 30 - - - A - - - 4.26 0.00 4.26 In progress 6 RCR RCR Sagamkunta Mamadadoddi 1125 1260 4.00 0.00 - 1 4 - - 15 - - - R - - - 4.00 0.00 4.00 S.B In progress 7 RCR RCR Kalmala Kalmala 5797 6493 1.00 0.00 2 1 8 - - 23 - A - - - - - 1.00 0.00 1.00 C-99 Completed 8 RCR RCR Mamdapur Nelhal 2242 2511 0.35 0.00 1 1 1 - 1 31 - A - - - - - 0.35 0.00 0.35 S.B- Completed 9 RCR RCR Idapanur Idapanur 4934 5526 4.00 0.00 2 - 8 - - 21 - R - - - - - 4.00 0.00 4.00 S.B In progress 10 RCR RCR Kamalapur Manjarla 1463 1639 1.00 -

Ground Water Year Book of Karnataka State 2015-2016

FOR OFFICIAL USE ONLY No. YB-02/2016-17 GROUND WATER YEAR BOOK OF KARNATAKA STATE 2015-2016 CENTRAL GROUND WATER BOARD SOUTH WESTERN REGION BANGALORE NOVEMBER 2016 GROUND WATER YEAR BOOK 2015-16 KARNATAKA C O N T E N T S SL.NO. ITEM PAGE NO. FOREWORD ABSTRACT 1 GENERAL FEATURES 1-10 1.1 Introduction 1.2 Physiography 1.3. Drainage 1.4. Geology RAINFALL DISTRIBUTION IN KARNATAKA STATE-2015 2.1 Pre-Monsoon Season -2015 2 2.2 South-west Monsoon Season - 2015 11-19 2.3 North-east Monsoon Season - 2015 2.4 Annual rainfall 3 GROUND WATER LEVELS IN GOA DURING WATER YEAR 20-31 2015-16 3.1 Depth to Ground Water Levels 3.2 Fluctuations in the ground water levels 4 HYDROCHEMISTRY 32-34 5 CONCLUSIONS 35-36 LIST OF FIGURES Fig. 1.1 Administrative set-up of Karnataka State Fig. 1.2 Agro-climatic Zones of Karnataka State Fig. 1.3 Major River Basins of Karnataka State Fig. 1.4 Geological Map of Karnataka Fig. 2.1 Pre-monsoon (2015) rainfall distribution in Karnataka State Fig. 2.2 South -West monsoon (2015) rainfall distribution in Karnataka State Fig. 2.3 North-East monsoon (2015) rainfall distribution in Karnataka State Fig. 2.4 Annual rainfall (2015) distribution in Karnataka State Fig. 3.1 Depth to Water Table Map of Karnataka, May 2015 Fig. 3.2 Depth to Water Table Map of Karnataka, August 2015 Fig. 3.3 Depth to Water Table Map of Karnataka, November 2015 Fig. 3.4 Depth to Water Table Map of Karnataka, January 2016 Fig. -

MLA Constituency Name This Report Is Published by Karnataka Learning

MLA Constituency Name Mon Aug 24 2015 Manvi Elected Representative :G. Hampayya Nayak Ballatgi Political Affiliation :Indian National Congress Number of Government Schools in Report :183 KARNATAKA LEARNING PARTNERSHIP This report is published by Karnataka Learning Partnership to provide Elected Representatives of Assembly and Parliamentary constituencies information on the state of toilets, drinking water and libraries in Government Primary Schools. e c r s u k o o S t o r e l e B i t o a h t t t T e i e W l l i n i W g o o o y y n T T i r r m k s a a s r r l m y n r i b b i o o r i i District Block Cluster School Name Dise Code C B G L L D RAICHUR MANVI ATHNOOR GHPS ATHANUR 29060600801 Tap Water RAICHUR MANVI ATHNOOR GLPS ANJANEYA CAMP ATHANUR 29060600802 Others RAICHUR MANVI ATHNOOR GLPS BHAGYANAGAR CAMP 29060602603 Others RAICHUR MANVI ATHNOOR GLPS GANADINNI 29060604201 Tap Water RAICHUR MANVI ATHNOOR GLPS JAKKALADINNI 29060607201 Tap Water RAICHUR MANVI ATHNOOR GLPS NEELOGAL CAMP 29060617301 Others RAICHUR MANVI ATHNOOR GLPS SHAKAPUR 29060613601 Others RAICHUR MANVI ATHNOOR LPS URDU ATHUNOOR 29060613831 Others RAICHUR MANVI BAGALWADA GHPS BYAGAVAT 29060602501 Tap Water RAICHUR MANVI BAGALWADA GHPS NAKKUNDA 29060611201 Others RAICHUR MANVI BAGALWADA GLPS AMBDKER NAGAR BAYGWAT 29060602505 Tap Water RAICHUR MANVI BAGALWADA GLPS BASAVESWAR CAMP 29060601202 Tap Water RAICHUR MANVI BAGALWADA GLPS DEVATHAGAL 29060603701 Tap Water RAICHUR MANVI BAGALWADA GLPS DPEP NADUGADDE CAMP 29060601003 Tap Water RAICHUR MANVI BAGALWADA GLPS DPEP SHIVANAGAR -

Mainstreaming Disaster Risk Reduction for Resilient Infrastructure

WEB BASED ONLINE TRAINING PROGRAM Mainstreaming Disaster Risk Reduction for Resilient Infrastructure (01- 03 September 2020) Organized by: National Institute of Disaster Management Ministry of Home Affairs, Govt. of India in collaboration with Centre for Disaster Management Administrative Training Institute, Government of Karnataka, Mysuru [COMPANY NAME] | [Company address] WEB BASED ONLINE TRAINING ON Mainstreaming Disaster Risk Reduction for Resilient Infrastructure DATE 01.09.2020 to 03.09.2020 SUPERVISING PATRON Manjula V, IAS, Director General, ATI, Mysuru Maj.Gen. Manoj Kumar Bindal, Executive Director, NIDM, New Delhi COURSE DIRECTOR Dr. Ashok Sanganal Sr. Faculty& Head,CDM,ATI, Mysuru Mobile No.9886756005 Dr. Amir Ali Khan, Asso. Professor, NIDM, New Delhi CO-COORDINATOR Sri. Suresh R Smt. Sankalpa COURSE ASSOCIATES Manu T.M. Nirmala S.P. Eligibility of Participants : The course is designed for Middle to Senior Level Officers From various departments and agencies of Karnataka. Total No. Participants : 241 National Institute of Disaster Management, LalithaMahal Road, Mysuru-570011 Jai Singh Road, New Delhi - 110001 WEB BASED ONLINE TRAINING SCHEDULE Session Topic Faculty Day 1 (01.09.2020) Manjula V, IAS, Director General, ATI Maj. Gen. Manoj K. Bindal, Executive Director, NIDM 11.00 am To Introduction and Inauguration Dr. Ashok Sanganal, 11.30 am Sr. Faculty and Head, CDM, ATI Mysuru Dr. Amir Ali Khan, Asso. Professor, NIDM, New Delhi 11.30 am Basic concepts of disaster risk mitigation and Dr. Amir Ali Khan To management NIDM, New Delhi 12.10 pm 12.10 pm Challenges in Making Infrastructure Resilient (Geo- Prof. S K Prasad, To Tech and Structural Aspects) Professor& Head 12.50 pm VVCE,Mysuru 12. -

Karnataka Circle Cycle III Vide Notification R&E/2-94/GDS ONLINE CYCLE-III/2020 DATED at BENGALURU-560001, the 21-12-2020

Selection list of Gramin Dak Sevak for Karnataka circle Cycle III vide Notification R&E/2-94/GDS ONLINE CYCLE-III/2020 DATED AT BENGALURU-560001, THE 21-12-2020 S.No Division HO Name SO Name BO Name Post Name Cate No Registration Selected Candidate gory of Number with Percentage Post s 1 Bangalore Bangalore ARABIC ARABIC GDS ABPM/ EWS 1 DR1786DA234B73 MONU KUMAR- East GPO COLLEGE COLLEGE Dak Sevak (95)-UR-EWS 2 Bangalore Bangalore ARABIC ARABIC GDS ABPM/ OBC 1 DR3F414F94DC77 MEGHANA M- East GPO COLLEGE COLLEGE Dak Sevak (95.84)-OBC 3 Bangalore Bangalore ARABIC ARABIC GDS ABPM/ ST 1 DR774D4834C4BA HARSHA H M- East GPO COLLEGE COLLEGE Dak Sevak (93.12)-ST 4 Bangalore Bangalore Dr. Dr. GDS ABPM/ ST 1 DR8DDF4C1EB635 PRABHU- (95.84)- East GPO Shivarama Shivarama Dak Sevak ST Karanth Karanth Nagar S.O Nagar S.O 5 Bangalore Bangalore Dr. Dr. GDS ABPM/ UR 2 DR5E174CAFDDE SACHIN ADIVEPPA East GPO Shivarama Shivarama Dak Sevak F HAROGOPPA- Karanth Karanth (94.08)-UR Nagar S.O Nagar S.O 6 Bangalore Bangalore Dr. Dr. GDS ABPM/ UR 2 DR849944F54529 SHANTHKUMAR B- East GPO Shivarama Shivarama Dak Sevak (94.08)-UR Karanth Karanth Nagar S.O Nagar S.O 7 Bangalore Bangalore H.K.P. Road H.K.P. Road GDS ABPM/ SC 1 DR873E54C26615 AJAY- (95)-SC East GPO S.O S.O Dak Sevak 8 Bangalore Bangalore HORAMAVU HORAMAVU GDS ABPM/ SC 1 DR23DCD1262A44 KRISHNA POL- East GPO Dak Sevak (93.92)-SC 9 Bangalore Bangalore Kalyananagar Banaswadi GDS ABPM/ OBC 1 DR58C945D22D77 JAYANTH H S- East GPO S.O S.O Dak Sevak (97.6)-OBC 10 Bangalore Bangalore Kalyananagar Kalyananagar GDS ABPM/ OBC 1 DR83E4F8781D9A MAMATHA S- East GPO S.O S.O Dak Sevak (96.32)-OBC 11 Bangalore Bangalore Kalyananagar Kalyananagar GDS ABPM/ UR 1 DR26EE624216A1 DHANYATA S East GPO S.O S.O Dak Sevak NAYAK- (95.8)-UR 12 Bangalore Bangalore St. -

Finance Accounts 200708

GOVERNMENT OF KARNATAKA FINANCE ACCOUNTS 2007-2008 TABLE OF CONTENTS Reference to page Certificate of the Comptroller and Auditor General of India 3 Introductory 4 PART 1 - SUMMARISED STATEMENTS No. 1 - Summary of Transactions 8 - Explanatory Notes 20 No. 2 - Capital Outlay outside the Revenue Account (i) Progressive Capital Outlay to end of 2007-08 40 (ii) Explanatory Notes 43 No. 3 - (i) Financial results of Irrigation Works 46 (ii) Financial results of Electricity Schemes 47 No. 4 - Debt Position - (i) Statement of Borrowings 48 (ii) Other Obligations 50 (iii) Service of Debt 51 No. 5 - Loans and Advances by State Government - (i) Statement of Loans and Advances 52 (ii) Recoveries in arrears 53 No. 6 - Guarantees given by the Government of Karnataka in respect of loans etc., raised by Statutory Corporations, Government Companies, Local Bodies and other Institutions 56 No. 7 - Cash balances and investments of cash balances 62 No. 8 - Summary of balances under Consolidated Fund, Contingency Fund and Public Account 64 PART II - DETAILED ACCOUNTS AND OTHER STATEMENTS SECTION A - REVENUE AND EXPENDITURE No. 9 - Statement of revenue and expenditure for the year 2007-08 expressed as a percentage of total revenue / total expenditure 71 No. 10 - Statement showing the distribution between charged and voted expenditure 74 No. 11 - Detailed account of revenue receipts and capital receipts by minor heads 75 No. 12 - Detailed account of expenditure by minor heads 95 No. 13 - Detailed statement of capital expenditure during and to end of the year 2007-08 132 No. 14 - Details of investments of Government in Statutory Corporations, Government Companies, Other Joint Stock companies, Co-operative Banks and Societies etc., to end of 2007-08 251 No.