Download Download

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

One and Only

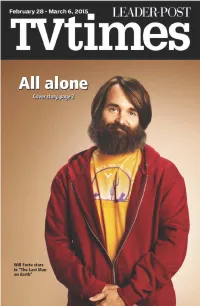

Cover Story One and only Fox tackles the loneliest number in ‘The Last Man on Earth’ By Cassie Dresch people after a virus takes out him get into a lot of really silly TV Media all of Earth’s population. His shenanigans. family is gone, his coworkers “It’s all just kind of stupid ello? Hi? Anybody out are gone, the president is gone. stuff that I go around and do,” Hthere? Of course there is, Everyone. Gone. he said in an interview with otherwise life would be very, So what does he do? He “Entertainment Weekly.” very, very lonely. Fox is taking a travels the United States doing “That’s been one of the most stab at the ultimate life of lone- things he never would have fun parts of the job. About once liness in the new half-hour been able to do otherwise — a week I get to do something comedy “The Last Man on sing the national anthem at that seems like it’d be amaz- Earth,” premiering Sunday, Dodger Stadium, smear gooey ingly fun to do: shoot a flame March 1. peanut butter all over a price- thrower at a bunch of wigs, The premise around “Last less piece of art ... then walk have a steamroller steamroll Man” is a simple one, albeit a away with it, break things. The over a case of beer. Just dumb little strange. An average, un- show, according to creator and stuff like that, which pretty assuming man is on the hunt star Will Forte (“Saturday Night much is all it takes to make me for any signs of other living Live,” “Nebraska,” 2013), sees happy.” Registration $25.00 online: www.skseniorsmechanism.ca or phone 306-359-9956 2 Cover Story Flame throwers and steam- ally proud of what has come rollers? Again, it’s a strange out of it so far.” concept, but Fox is really be- Of course, you have to won- Index hind the show. -

The Travails of the Working-Class Auction Bidder

Butler University Digital Commons @ Butler University Scholarship and Professional Work - Communication College of Communication 2015 “Get Rich or Die Buying:” The Travails of the Working-Class Auction Bidder Mark A. Rademacher Butler University, [email protected] Follow this and additional works at: https://digitalcommons.butler.edu/ccom_papers Part of the Broadcast and Video Studies Commons, and the Critical and Cultural Studies Commons Recommended Citation Rademacher, Mark A., "“Get Rich or Die Buying:” The Travails of the Working-Class Auction Bidder" (2015). Scholarship and Professional Work - Communication. 100. https://digitalcommons.butler.edu/ccom_papers/100 This Article is brought to you for free and open access by the College of Communication at Digital Commons @ Butler University. It has been accepted for inclusion in Scholarship and Professional Work - Communication by an authorized administrator of Digital Commons @ Butler University. For more information, please contact [email protected]. “Get Rich or Die Buying:” The Travails of the Working-Class Auction Bidder Mark A. Rademacher These are the rules of storage auctions. This is a cash only sale. All sales are final. We're gonna cut the lock. We're gonna open the door. You're gonna have five minutes to look. You cannot go inside the unit, you cannot open any boxes. We are gonna sell this to the highest cash bidder. Are you ready to go? Dan Dotson, Storage Wars Auctioneer (“High Noon in the High Desert”) With these basic rules, auctioneer Dan Dotson sets the stage for the drama that unfolds during A&E Network's popular reality TV (RTV) program Storage Wars (2010–). -

P25tv Layout 1

THURSDAY, AUGUST 31, 2017 TV PROGRAMS And Cat Noir 14:15 Future-Worm! 21:00 Ancient Aliens 05:48 SpongeBob SquarePants 19:30 Less Than Perfect 19:30 Food Factory USA 14:30 EastEnders 11:55 Disney Mickey Mouse 14:40 Kirby Buckets 22:00 Bible Secrets Revealed 06:12 SpongeBob SquarePants 20:00 The Tonight Show Starring 19:55 Food Factory USA 15:00 Death In Paradise 12:00 Welcome To The Ronks 15:05 Lab Rats: Bionic Island 23:00 How 2 Win 06:36 Teenage Mutant Ninja Turtles Jimmy Fallon 20:20 How Do They Do It? 15:55 Doctor Who 12:15 Hank Zipzer 15:30 Walk The Prank 07:00 The Loud House 21:00 Seinfeld 20:45 Food Factory 16:45 Stella 12:40 Dog With A Blog 15:55 Right Now Kapow 07:24 Rabbids Invasion 21:30 Seinfeld 21:10 Science Of The Movies 17:30 New Tricks 00:00 Escaping Polygamy 13:05 Star Darlings 16:25 K.C. Undercover 07:48 Get Blake 22:00 Modern Family 22:00 Food Factory USA 18:20 Carters Get Rich 01:00 Celebrity Ghost Stories 13:10 Good Luck Charlie 16:50 Kirby Buckets Warped 08:12 Harvey Beaks 22:30 Modern Family 22:25 Food Factory USA 18:45 EastEnders 02:00 My Haunted House 13:35 Austin & Ally 17:15 Mech-X4 08:36 Sanjay And Craig 23:00 The Big C 19:15 Death In Paradise 03:00 My Haunted Vacation 14:00 Jessie 17:40 Gravity Falls 09:00 Rank The Prank 23:30 Late Night With Seth Meyers 20:10 Holby City 04:00 Escaping Polygamy 14:25 Lolirock 18:05 Disney Mickey Mouse 00:20 Counting Cars 09:24 Henry Danger 21:00 Carters Get Rich 05:00 Celebrity Ghost Stories 14:50 The Zhuzhus 18:10 Milo Murphyʼs Law 00:45 Counting Cars 09:48 100 Things To Do Before 21:30 Mum 06:00 It Takes A Killer 15:15 Whisker Haven Tales With 18:35 Disney11 01:10 Forged In Fire High School 22:00 Uncle 08:00 The First 48 The Palace Pets 19:00 Disney11 02:00 Hunting Hitler 10:12 Game Shakers 09:00 Homicide Hunter 15:20 Miraculous Tales Of Ladybug 19:25 K.C. -

Child Tax Credits Are Expected to Drastically Reduce Child Poverty in Michigan

___ • Watch Live Menu Quick links... ADVERTISEMENT Be prepared with State Farm Life Insurance. State Farm Life Insurance Company (Not licensed in MA, NY or WI) State Farm and Accident Assurance Company (Licensed in NY and WI) Bloomington, IL NEIGHBORHOODS STATE CAPITOL Child tax credits are expected to drastically reduce child poverty in Michigan --> Play Video Pause Unmute Current Time 0:35 This/ is a modal window. Duration Time 2:39 Child tax credits which provide monthly payments to many Michigan families are expected to roll out this week. By: Elle Meyers Posted at 7:04 PM, Jul 13, 2021 and last updated 7:04 PM, Jul 13, 2021 LANSING, Mich. — Eligible Michigan families with children will receive payments directly to their bank accounts starting this week as part of the expanded child tax credit from the federal government, which was prompted by the economic effects of he pandemic. Experts estimate this will cut child poverty by nearly half, a move the United States has never seen before. “These will be monthly payments to families that will show up in their bank accounts based on the number of children they have and their income level," said Matt Gillard who serves as president and CEO of Michigan's Children, a Lansing based advocacy group. Families across mid-Michigan will be eligible for up to $300 per month, per child. Recent Stories from fox47news.com ' “The credits vary depending upon the age of the child and they vary as well based on the family income but they are designed in a way to truly benefit families on a monthly basis to meet the high costs that they’re incurring in raising children, he said." Families making up to $150,000 a year and single parents making up to $112,500 per year are eligible for the monthly payments. -

A16 TV Friday [16-16].Indd

16 TIMES-TRIBUNE / FRIDAY, MARCH 9, 2012 ENTERTAINMENT , FRIDAY PRIME TIME MARCH 9, 2012 PEOPLE IN THE NEWS 6:00 6:30 7:00 7:30 8:00 8:30 9:00 9:30 10:00 10:30 11:00 11:30 BROADCAST ABC & WATE 6 ABC World News & Judge Judy & Judge Shark Tank Body jewelry; organic Primetime: What Would You Do? 20/20 (N) ’ Å & WATE 6 (:35) Nightline News at 6 With Diane Saw- D Entertain- Judy Å skin care. (N) ’ Å (N) ’ Å News at 11 (N) Å WATE & D ABC 36 yer (N) Å ment Tonight D The Insider D ABC 36 WTVQ D News at 6 (N) Å News at 11 Ky. company sues CBS Y News CBS Evening Y Season College Basketball SEC Tournament, Third Quarterfinal: Teams TBA. From New Orleans. (N) College Basketball SEC Tournament, Fourth Quarterfinal: Teams TBA. From ( Local 8 News News With Scott Special (Live) New Orleans. (N) (Live) WYMT Y ; Newsfirst at Pelley (N) ’ Å ( Entertain- WVLT ( 6:00pm ment Tonight WKYT ; ; Wheel of to stop name airing Fortune NBC 2 LEX 18 News NBC Nightly 2 LEX 18 2 Access Hol- Who Do You Think You Are? “Je- Grimm “Plumed Serpent” Investigat- Dateline NBC (N) ’ Å 2 LEX 18 News (:35) The Tonight at 6 (N) Å News (N) ’ Å NEWS lywood rome Bettis” Retired football player ing an arson-related homicide. (N) at 11 Show With Jay WLEX 2 * News (N) * Wheel of * Jeopardy! Jerome Bettis. (N) ’ Å ’ Å * 10 News Leno Å WBIR * Fortune Nightbeat on Limbaugh FOX Judge Judy ’ Å Judge Judy ’ Å Two and a Half The Big Bang Kitchen Nightmares “Blackberry’s; Leone’s” Improving a New Jersey eatery. -

Weekender, May 15, 2021

That traffi c! SATURDAY, 15 MAY, 2021 TWILIGHT HOLD-UP: Motorists at the end of this traffi c jam are about fi ve to seven minutes away from reaching the roundabout at the intersection of Childers Road and Customhouse Street. Gisborne’s new traffi c congestion problems are at peak times only, and still a far cry from the other regions in New Zealand. Picture by Ben Cowper Gisborne used to have a rush minute rather than a rush hour. Not any more. Also gone is the “fi ve minutes to anywhere”. Now motorists face a seven-minute wait at intersections some mornings. But help is on the way. Sophie Rishworth fi nds out about planned improvements. isborne residents have had this District/Tairawhiti, including the East Coast, slow in the early years and only over the has to do with schools’ start and fi nish times, city to themselves for years was 49,500 (Stats NZ). past two to three years has that traffi c really and Dave says that happens around the Gand years. We’ve been through In two years 2400 more people will be ramped up. country. decades of zero population living here, and in 2028, seven years later, Some even say over the past few months. “If you can minimise that, you can improve growth. Stats NZ is predicting a population in But that fi ve-to-seven minute wait as the your effi ciency around town. Gisborne drivers have been known to go Tairawhiti of 53,100 — that’s 3600 more car inches along Ormond Road, Gladstone “ at’s why we’ve got school buses, and around the block — a couple of times if need people and their cars. -

Read Storage Wars S Docx for Ipod

Storage wars s. Ueda Hankyu Bldg. Office Tower 8-1 Kakuda-cho Kita-ku, Osaka 530-8611, JAPAN ISO9001/ISO14001 Company Our missions You'll get more livable space while getting rid of clutter. It's a win-win! Achieving Goals: The Ultimate Guide to Goal Achieving & Goal Setting in 2021. 100 Incredible Life Hacks That Make Life So Much Easier. This Webopedia guide will show you how to create a website shortcut on your desktop using. Digital Robberies Are Also at Play For the Stars. Robberies Can Be a Price to Pay for Cast Members. Under Hester's new contract, he's likely required to stay loyal to the show. Even though he made his original feelings very clear in court. In his suit, he said, "The defendants would like the public to believe that the series presents an accurate portrayal of the auction process. The truth is that every aspect of the series is fake." Now that he's back on the show, he no longer makes those accusations. Monday.com is a cloud-based work operating system that can be used for a. The robbers must have been first-timers because they made a crucial mistake after committing credit card theft. The couple's credit cards had several sudden charges, alerting the card's security systems, and their cards were immediately shut down. While the cast of the show may appear to look far from affluent during bids, the stars bank accounts would beg to differ. According to Hester's lawsuit, searching through other people's left behind junk would earn him a staggering $25,000 per episode with a guaranteed minimum of 26 episodes. -

The Muppets Return for New Escapade

04:00 American Idol 05:00 Survivor: Brawn vs. Brain vs. Beauty TV listings SATURDAY, MARCH 22, 2014 09:00 The Next Three Days-PG15 19:15 Hyde Park On Hudson-PG15 05:00 ICC T20I World Cup 01:30 Duck Dynasty 12:30 Storage Wars 11:15 Offline-PG15 21:00 Celeste And Jesse Forever-PG15 07:30 ICC World T20 Highlights 02:00 Storage Wars 13:00 Pawn Stars 13:00 Class-PG15 22:30 Looper-18 08:30 ICC World T20 Highlights 02:30 Storage Wars 13:30 Pawn Stars 15:00 Someday This Pain Will Be 02:00 Inside The PGA Tour 09:30 ICC World T20 Highlights 03:00 Storage Wars: New York 14:00 Pawn Stars Useful To You-PG15 02:30 Super League 10:30 ICC World T20 Highlights 03:30 Storage Wars: New York 14:30 Pawn Stars 17:00 Red Lights-PG15 04:30 ICC Cricket 360 11:30 ICC Cricket 360 04:00 Storage Wars Texas 15:00 American Restoration 19:00 Salmon Fishing In The Yemen- 05:00 Top 14 12:00 Live OSN Studio 04:30 Storage Wars Texas 15:30 American Restoration PG15 07:00 Super Rugby 12:30 Live ICC T20I World Cup 05:00 Duck Dynasty 16:00 Storage Wars: New York 21:00 Little Birds-18 01:15 Free Birds 09:00 Total Rugby 16:00 Live OSN Studio 05:30 Duck Dynasty 16:30 Storage Wars: New York 23:00 The Most Fun You Can Have 02:45 Zambezia 09:35 Live Super Rugby 16:30 Live ICC T20I World Cup 06:00 Pawn Stars 17:00 Storage Wars Texas Dying-18 04:15 Dino Time 11:40 Live Super Rugby 20:00 Live OSN Studio Post Match 06:30 Storage Wars 17:30 Storage Wars Texas 06:00 Peter Pan (1953) 13:30 Total Rugby 20:30 ICC Cricket 360 07:00 Storage Wars Texas 18:00 Counting Cars 08:00 The Ugly Duckling -

Evil in the 'City of Angels'

Visit Our Showroom To Find The Perfect Lift Bed For You! April 24 - 30, 2020 2 x 2" ad 300 N Beaton St | Corsicana | 903-874-82852 x 2" ad M-F 9am-5:30pm | Sat 9am-4pm milesfurniturecompany.com FREE DELIVERY IN LOCAL AREA WA-00114341 W L M C A B L R G R C S P L N Your Key 2 x 3" ad P E Y S W Z A Z O V A T T O F L K D G U E N R S U H M I S J To Buying D O I B N P E M R Z Y U S A F and Selling! N K Z N U D E U W A R P A N E 2 x 3.5" ad Z P I M H A Z R O Q Z D E G Y M K E P I R A D N V G A S E B E D W T E Z P E I A B T G L A U P E M E P Y R M N T A M E V P L R V J R V E Z O N U A S E A O X R Z D F T R O L K R F R D Z D E T E C T I V E S I A X I U K N P F A P N K W P A P L Q E C S T K S M N T I A G O U V A H T P E K H E O S R Z M R “Penny Dreadful: City of Angels” on Showtime Bargain Box (Words in parentheses not in puzzle) Lewis (Michener) (Nathan) Lane Supernatural Place your classified Classified Merchandise Specials Solution on page 13 Magda (Natalie) Dormer (1938) Los Angeles ad in the Waxahachie Daily Light, Merchandise High-End 2 x 3" ad Tiago (Vega) (Daniel) Zovatto (Police) Detectives Midlothian Mirror and Ellis Evil in the Peter (Craft) (Rory) Kinnear Murder County Trading1 Post! x 4" ad Deal Merchandise Word Search Maria (Vega) (Adriana) Barraza Espionage Call (972) 937-3310 Run a single item Run a single item priced at $50-$300 priced at $301-$600 ‘City of Angels’ for only $7.50 per week for only $15 per week 6 lines runs in The Waxahachie Daily Light, Midlothian Mirror and Ellis County Trading2 x 3.5" Post ad and online at waxahachietx.com Natalie Dormer stars in “Penny Dreadful: City of Angels,” All specials are pre-paid. -

Has Become a Familiar Face in Lake Havasu City the Gambler's Kids Using His Contar from the Criminal Underworld

If either of these things happens, you've encountered Darrell Sheets colorful reality star on A&E's Storal Wars. Nicknamed "The Gambler/' Sheets has appeared in over 230 ep sodes since its premiere in 2010, th year he coined his catchphrase, "th wow factor." ' Storage Wars is a show about wh, \i \ er-dealers who, without opening boxes, bid on articles in abandoner storage lockers. Auction winners could get a container full of treasur or a unit filled with junk. ,i. In Season 3, Sheets scored the bii gest profit in the show's history. Hir winning bid of $3,600 gave him ow ership of original paintings by Fran Guti6,rrez, worth $300,000, netting r* Sheets $296,400. "The paintings were priceless. I s or,rrn 15 of them. I love artl'There's more to the story. There were coins and other valuables in that locker which brought the total value to ov a million dollars. That's not the 61-year old's most valuable locker either. He outbid everyone on a comic book collectir containing the first stories of Spide man in the Amazing Fantasy 15 epi sodes, It took seven pickup trucklor to move the books. Sheets paid $3,1 TREAS [{TTR for the comics and attempted to se t the group back to its original owne 'Storage who was a homicide detective. The Darrell Sheets, star 0f A&E's Warsj dickwouldn't buy it back at the asl price. Instead, he plotted to kidnap has become a familiar face in Lake Havasu City the Gambler's kids using his contar from the criminal underworld. -

New Mayor in Town

FINAL-1 Sat, Sep 23, 2017 6:59:12 PM Your Weekly Guide to TV Entertainment for the week of September 30 - October 6, 2017 OLD FASHIONED SERVICE New mayor FREE REGISTRY SERVICE in town Massachusetts’ First Credit Union Brandon Micheal Hall stars in “The Mayor” Located at 370 Highland Avenue, Salem John Doyle St. Jean's Credit Union INSURANCEDoyle Insurance AGENCY When rapper Courtney Rose (Brandon Micheal 3 x 3 Voted #1 1 x 3 Hall, “Search Party”) runs for office in an ef- Serving over 15,000 Members • A Part of your Community since 1910 Insurance fort to promote his music, he’s shocked when Agency he actually wins in the premiere of “The May- Supporting over 60 Non-Profit Organizations & Programs or,” airing Tuesday, Oct. 3, on ABC. Lea Michele Serving the Employees of over 40 Businesses (“Glee”) co-stars as his new chief of staff, Auto • Homeowners • Business • Life Insurance while Yvette Nicole Brown (“Community”) 978.219.1000 www.stjeanscu.com 978-777-6344 plays his supportive mother. Offices also located in Lynn, Newburyport & Revere Federally Insured by NCUA www.doyleinsurance.com FINAL-1 Sat, Sep 23, 2017 6:59:13 PM 2 • Salem News • September 30 - October 6, 2017 Rapper runs for office and wins in ABC’s ‘The Mayor’ By Kyla Brewer actually really good at his new job. Rapper and Broadway actor Dav- in the upcoming thriller “Monster while still tied to NBC’s quirky cult TV Media It turns out that the same outspo- eed Diggs, who won both a Gram- Party.” comedy hit “Community.” The pop- Video ken optimism and charisma that my and Tony -

Lakes Precision, Inc

PAID ECRWSS Eagle River • Rubicon • 3.6L • 2.4L • 40K miles • 3.6L • miles 11K PRSRT STD PRSRT U.S. Postage 45,367 17,580 32,970 Permit No. 13 $ $ $ POSTAL PATRON POSTAL 715-479-4401 1050 E. Wall St. 1050 E. Wall 50138 50280P 50280P 50219P LINE-X of Eagle River ’18 Jeep Wrangler’18 Jeep ’17 Jeep Renegade ’17 Jeep ’18 Dodge Durango • JK Unlimited • Black leather • Hardtop - 3 piece • Nav. • Latitude 4x4 • UConnect • One owner •AWD GT • Heated leather seats • Remote start • One owner NEW • 3.6L • 24K miles • 2.4L • 36K miles 31,985 Wednesday, Wednesday, 44,330 14,770 • Hemi 5.7L • Alpine Sound $ $ $ June 20, 2018 20, June (715) 479-4421 Offer expires June 30, 2018. Coupon valid at participating LINE-X Store locations Offer Limit Not to be combined with any other offer. Not valid with any other offer. only. per visit. No cash value. © 2014 LINE-X LLC one coupon per customer, 50253 AND THE THREE LAKES NEWS 50275P 50275P 50281P 50281P ’19 Ram 1500 ’17 Jeep Compass ’17 Jeep bucket seats Premium lighting ’17 Jeep Grand Cherokee ’17 Jeep • Limited 4x4 • Heated leather seats • Sirius XM • Nav. • Big Horn Crew • Deluxe cloth • • Latitude FWD • Heated seats • Remote start • One owner NEW Best Price, • Hemi 5.7L • 18K miles No Exception! 44,857 31,764 25,770 • Hemi 5.7L • Alpine Sound Best Selection, $ $ $ • Alloy wheels • 3.6L A SPECIAL SECTION OF THE VILAS COUNTY NEWS-REVIEW THE VILAS COUNTY SECTION OF SPECIAL A 50295 50078 50221P 50221P ’19 Ram 1500 ’18 Chrysler Pacifica ’17 Ram 1500 SLT bucket seats • Quad Cab 4x4 • Sirius XM • One owner • Big Horn Crew • Black appearance • Deluxe cloth • Plus Touring • 8-passenger • Safety Group NEW NEW • Leather • Power seats • 3.8L • 94K miles • Hemi 5.7L • Fuel Wheels 41,989 29,754 22,985 $ $ $ 50226 50165 50027A 50027A • 715-479-4RAM (4726) EagleRiverDodge.com ’18 Ram 1500 ’18 Dodge Journey ’11 Jeep Wrangler’11 Jeep *All leases are based on approved credit, first month’s payment down, 36-month ultra-low mileage lease.