Pet Overpopulation: an Economic Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Animal Shelters List by County

MICHIGAN REGISTERED ANIMAL SHELTERS BY COUNTY COUNTY FACILITY NAME FACILITY ADDRESS CITY ZIP CODE PHONE Alcona ALCONA HUMANE SOCIETY 457 W TRAVERSE BAY STATE RD LINCOLN 48742 (989) 736-7387 Alger ALGER COUNTY ANIMAL SHELTER 510 E MUNISING AVE MUNISING 49862 (906) 387-4131 Allegan ALLEGAN COUNTY ANIMAL SHELTER 2293 33RD STREET ALLEGAN 49010 (269) 673-0519 COUNTRY CAT LADY 3107 7TH STREET WAYLAND 49348 (616) 308-3752 Alpena ALPENA COUNTY ANIMAL CONTROL 625 11th STREET ALPENA 49707 (989) 354-9841 HURON HUMANE SOCIETY, INC. 3510 WOODWARD AVE ALPENA 49707 (989) 356-4794 Antrim ANTRIM COUNTY ANIMAL CONTROL 4660 M-88 HWY BELLAIRE 49615 (231) 533-6421 ANTRIM COUNTY PET AND ANIMAL WATCH 125 IDA ST MANCELONA 49659 (231) 587-0738 HELP FROM MY FRIENDS, INC. 3820 RITT ROAD BELLAIRE 49615 (231) 533-4070 Arenac ARENAC COUNTY ANIMAL CONTROL SHELTER 3750 FOCO ROAD STANDISH 48658 (989) 846-4421 Barry BARRY COUNTY ANIMAL CONTROL SHELTER 540 N INDUSTRIAL PARK DR HASTINGS 49058 (269) 948-4885 Bay BAY COUNTY ANIMAL CONTROL SHELTER 800 LIVINGSTON BAY CITY 48708 (989) 894-0679 HUMANE SOCIETY OF BAY COUNTY 1607 MARQUETTE AVE BAY CITY 48706 (989) 893-0451 Benzie BENZIE COUNTY ANIMAL CONTROL SHELTER 543 S MICHIGAN AVE BEULAH 49617 (231) 882-9505 TINA'S BED AND BISCUIT INC 13030 HONOR HWY BEULAH 49617 (231) 645-8944 Berrien BERRIEN COUNTY ANIMAL SHELTER 1400 S EUCLID AVE BENTON HARBOR 49022 (269) 927-5648 HUMANE SOCIETY - SOUTHWESTERN MICHIGAN 5400 NILES AVE ST JOSEPH 49085 (269) 927-3303 Branch BRANCH COUNTY ANIMAL SHELTER 375 KEITH WILHELM DR COLDWATER 49036 (517) 639-3210 HUMANE SOCIETY OF BRANCH COUNTY, INC. -

Amelioration of Pet Overpopulation and Abandonment Using Control of Breeding and Sale, and Compulsory Owner Liability Insurance

animals Article Amelioration of Pet Overpopulation and Abandonment Using Control of Breeding and Sale, and Compulsory Owner Liability Insurance Eva Bernete Perdomo 1,* , Jorge E. Araña Padilla 1 and Siegfried Dewitte 2 1 University of Las Palmas de Gran Canaria, 35017 Las Palmas de Gran Canaria, Spain; [email protected] 2 Katholieke Universiteit Leuven, 3000 Leuven, Belgium; [email protected] * Correspondence: [email protected] Simple Summary: Overpopulation and abandonment of pets are long-standing and burgeoning concerns that involve uncontrolled breeding and selling, illegal trafficking, overpopulation, and pet- safety and well-being issues. Historical and current prevention measures for avoiding these problems, such as sanctions, taxes, or responsibility education, have failed to provide significant moderation or resolution. Globally, millions of pets are commercially and privately bred and abandoned annually, damaging biodiversity and ecosystems, and presenting road safety and public health risks, in addition to becoming victims of hardship, abuse, and illegal trafficking, especially in the case of exotic species. This article proposes a novel comprehensive management system for amelioration of overpopulation and abandonment of pets by using greater control of supply and demand of the pet market, highlighting the role of the compulsory owner liability insurance to prevent pet abandonment and all its associated costs. This system aims to act preventatively, through flexible protocols within the proposed management system to be applied to any pet and any country. Citation: Bernete Perdomo, E.; Araña Padilla, J.E.; Dewitte, S. Abstract: Overpopulation and abandonment of pets are long-standing and burgeoning concerns that Amelioration of Pet Overpopulation involve uncontrolled breeding and selling, illegal trafficking, overpopulation, and pet safety and well- and Abandonment Using Control of being issues. -

Animal Welfare Law Book

STATE OF MAINE ANIMAL WELFARE LAWS And Regulations PUBLISHED BY THE ANIMAL WELFARE PROGRAM Maine Department of Agriculture Conservation & Forestry Division of Animal Health 28 State House Station Augusta, Maine 04333-0028 (207) 287-3846 Toll Free (In Maine Only) 1-877-269-9200 Revised December 6, 2019 RESERVATION OF RIGHTS AND DISCLAIMER All copyrights and other rights to statutory text are reserved by the State of Maine. The text included in this publication is current to the end of the 129th Legislature. It is a version that is presumed accurate but which has not been officially certified by the Secretary of State. Refer to the Maine Revised Statutes Annotated and supplements for certified text. Editors Notes: Please note in the index of this issue that changes to the statutes are in bold in the index and they are also underlined in the body of the law book. Missing section numbers are sections that have been repealed and can be found at maine.gov website under the Revisor of Statutes website. 2 | Page ANIMAL WELFARE LAWS MAINE REVISED STATUTES ANNOTATED TABLE OF CONTENTS 17 § 3901 Animal Welfare Act................................................................. 14 7 § 3902 Purposes .............................................................................. 14 7 § 3906-B Powers and Duties of Commissioner ........................................ 14 7 § 3906-C Animal Welfare Advisory Council ........................................... 16 7 § 3907 Definitions ........................................................................ -

Behavior Analysis of Companion-Animal Overpopulation: a Conceptualization of the Problem and Suggestions for Intervention

Behavior and Social Issues, 13, 51-68 (2004). © Angela K. Fournier and E. Scott Geller. Readers of this article may copy it without the copyright owner’s permission, if the author and publisher are acknowledged in the copy and the copy is used for educational, not-for-profit purposes. BEHAVIOR ANALYSIS OF COMPANION-ANIMAL OVERPOPULATION: A CONCEPTUALIZATION OF THE PROBLEM AND SUGGESTIONS FOR INTERVENTION Angela K. Fournier and E. Scott Geller Virginia Polytechnic Institute and State University ABSTRACT: This paper conceptualizes the societal problem of companion-animal overpopulation and offers a framework to humanely reduce the current surplus of animals and prevent further overpopulation. Overpopulation is described as a societal problem, with the individual and collective behavior of people as a causal agent. Variables in the environment, including animal-welfare agencies and the pet industry, are also discussed as contributing factors. Behavior and environment factors described in the conceptualization are targeted in a proposed framework for intervention. The intervention framework details relevant target populations and agencies, target behaviors, and dependent measures for evaluating intervention programs. Finally, environmental contingencies are described that support current behavior deficits and will likely impede environment and behavior changes proposed in the framework. It is suggested that behavior analysis can be used to manipulate these contingencies to initiate and sustain proposed changes to beneficially impact companion-animal overpopulation. Key words: companion-animal overpopulation, animal welfare, behavior analysis, social issues The Humane Society of the United States (HSUS) estimates eight to ten million companion animals (i.e., cats and dogs) are relinquished to shelters each year and of those, four to five million are euthanized (HSUS, 2002). -

Shelter Terminology Last Reviewed: February 2017

Shelter Terminology Last reviewed: February 2017 Introduction The Association of Shelter Veterinarians supports the development of animal shelter operational policies based on an organization’s capacity for humane care and available resources, regardless of organizational philosophy. The guiding principle in the provision of humane care should always be animals’ needs, which remain the same regardless of an organization’s mission or challenges in meeting those needs. It is commonplace for humane organizations to describe their work philosophy through the use of popular terminology. However, such language often lacks clear and consistent definitions which has led to confusion, misperception, and discord in many communities. The ASV supports the Guiding Principles of the Asilomar Accords in their urge for organizations “to discuss language and terminology which has been historically viewed as hurtful or divisive by some animal welfare stakeholders (whether intentional or inadvertent), identify ‘problem’ language, and reach a consensus to modify or phase out language and terminology accordingly.”1 The ASV encourages sheltering organizations to define, adopt, and utilize language that describes their work clearly and consistently to both internal and external stakeholders. To that end, this document is meant to summarize the common ways in which sheltering language is used within the animal welfare field so that this information can be considered by organizations trying to refine the language they use to describe their own work. General Language Community Cats are free roaming feral, stray, abandoned or lost cats living outside with or without an owner or caretaker. The terms community cat, feral, and free roaming are sometimes used interchangeably. -

Animal Welfare Act. § 19A-20

Article 3. Animal Welfare Act. § 19A-20. Title of Article. This Article may be cited as the Animal Welfare Act. (1977, 2nd Sess., c. 1217, s. 1.) § 19A-21. Purposes. The purposes of this Article are (i) to protect the owners of dogs and cats from the theft of such pets; (ii) to prevent the sale or use of stolen pets; (iii) to insure that animals, as items of commerce, are provided humane care and treatment by regulating the transportation, sale, purchase, housing, care, handling and treatment of such animals by persons or organizations engaged in transporting, buying, or selling them for such use; (iv) to insure that animals confined in pet shops, kennels, animal shelters and auction markets are provided humane care and treatment; (v) to prohibit the sale, trade or adoption of those animals which show physical signs of infection, communicable disease, or congenital abnormalities, unless veterinary care is assured subsequent to sale, trade or adoption. (1977, 2nd Sess., c. 1217, s. 2.) § 19A-22. Animal Welfare Section in Animal Health Division of Department of Agriculture and Consumer Services created; Director. There is hereby created within the Animal Health Division of the North Carolina Department of Agriculture and Consumer Services, a new section thereof, to be known as the Animal Welfare Section of said division. The Commissioner of Agriculture is hereby authorized to appoint a Director of said section whose duties and authority shall be determined by the Commissioner subject to the approval of the Board of Agriculture and subject to the provisions of this Article. (1977, 2nd Sess., c. -

50 Ways Kids Can Help Animals

50 Ways Kids Can Help Animals humanedecisions.com/50-ways-kids-can-help-animals/ Image by PublicDomainPictures from Pixabay 50 Ways Kids Can Help Animals Animals need our help—whether they are farm animals, animals in your backyard, wild animals whose habitat is endangered, domestic pets, animals used for entertainment, or abandoned and homeless animals. There are many impactful ways kids of all ages can help animals today and make a difference, from volunteering time, to raising awareness, launching campaigns, raising money, writing letters to elected officials or promoting issues on social media. Here are some great ways kids can help animals today: 1. Foster a cat or dog – Cats and dogs that come into shelters and rescue groups desperately need foster homes to care for them, while they get ready for adoption. Contact your local animal shelter or rescue group to learn about their foster programs. Fostering is only temporary until the animal gets adopted. When you foster a rescue pet you will be saving an animal’s life each time you foster! 1/7 2. Volunteer to help a neighbor’s pet – Help infirm, immobile, or neighbors who have difficulty getting out by taking their dog for a walk and giving it attention. If you have neighbors that work long hours, then volunteer to take their dog for a walk midday. If the owner is going to be home late, volunteer to feed their dog or cat. Your kindness means the world to these animals. 3. Learn to speak up for animals – Join the Humane Society’s Mission Humane specifically designed for kids. -

Law Enforcement Takes Legal Action Angell to the Rescue

SPRING/SUMMER 2010 MSPCA.ORG 350 South Huntington Avenue, Boston, MA 02130 Non-profit Org. U.S. Postage PAID MSPCA/Angell The mission of the Massachusetts Society for the Prevention of Cruelty to Animals–Angell Animal Medical Center is to protect animals, relieve their suffering, advance their health and welfare, prevent cruelty, and work for a just and compassionate society. GOOD NEWS! ADOPTIONS UP EVEN IN DOWN ECONOMY ANGELL TO Please Will You Be Our Fan? Can You See into the Future? THE RESCUE Do you and your friends enjoy connecting with each You don’t need a crystal ball to know that animals will always need our OBSERVANT OWNERS, other on Facebook? If so, please become an official help. We’ve been helping them, with the support of friends like you, since 1868. VIGILANT VETS Fan of the MSPCA–Angell page. MSPCA at Nevins Farm has its own Facebook page too, as do Please, as you make your estate plans, consider a bequest to the our MSPCA Animal Action Team and The American MSPCA–Angell as a fitting continuation of your lifelong love for animals. And when you do, please let us know! We’d like to invite you Fondouk. All our pages are updated frequently and into our Circle of Friends and acknowledge your thoughtful concern for the LAW filled with interesting news about animals and the future of our organization. By providing for the animals in your own people who love them. It’s yet another important way future plans, you become an essential member of our Society. -

VIRGINIA ANIMAL CRUELTY LAWS Carrie Rose Wilkinson1

Updated as of April 3rd, 2012 VIRGINIA ANIMAL CRUELTY LAWS Carrie Rose Wilkinson1 Introduction In Virginia, criminal animal protection laws are contained primarily within Title 3.2, the Comprehensive Animal Care laws, which include the state's anti-cruelty and animal fighting provisions. However, there are also other laws related to animal cruelty defined elsewhere within the Code of Virginia. This document lists each animal protection law currently in place and the procedural sections of each law with which officers must comply when enforcing a provision of that law. When available, relevant case law from Virginia follows each law. This summary begins with the basic cruelty to animal statute and moves on to the neglect of companion animals, followed by relative statutes involving abandonment, animal fighting, and sexual assault. The remaining portion of the summary details penalties, punishments, and enforcement. Overview of Statutory Provisions and Case Law 1. Cruelty to animals: VA. CODE ANN. § 3.2-6570 2. Companion animal neglect: VA. CODE ANN. § 3.2-6503 3. Abandonment: VA. CODE ANN. § 3.2-6504 4. Malicious injury, killing, or poisoning animals owned by another: VA. CODE ANN. § 18.2-144 5. Animal Fighting: VA. CODE ANN. § 3.2-6571 6. Sexual assault: VA. CODE ANN. § 18.2-361 7. Penalties, Punishment, and Enforcement: VA. CODE ANN. §§ 18.2-403, 18.2-10, 18.2-11 8. Seizure of Animals: VA. CODE ANN. §§ 3.1-796.115, 3.2-6569, 9. Reporting Animal Cruelty: VA. CODE ANN. § 3.2-6564-6468 1 Carrie Rose Wilkinson produced this document as an undertaking of the George Washington University (GWU) Law School’s Animal Welfare Project, and worked under the guidance of the Project’s founder and faculty director, Professor Joan Schaffner. -

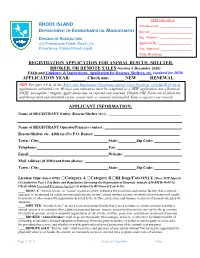

Rescue Shelter Etc

DEM USE ONLY RHODE ISLAND Date Received: ____________________ DEPARTMENT OF ENVIRONMENTAL MANAGEMENT Entered: __________________________ DIVISION OF AGRICULTURE Reg. Numbers: ________/___________ 235 Promenade Street, Room 370 Approved By: ____________________ Providence, Rhode Island 02908 Date Approved:____________________ Online Reporting:___________________ REGISTRATION APPLICATION FOR ANIMAL RESCUE, SHELTER, BROKER, OR REMOTE SALES (version 6 December 2020) FAQs and Guidance & Instructions: Application for Rescues, Shelters, etc. (updated for 2020) APPLICATION YEAR: ______ Check one: _____ NEW _____RENEWAL NEW Per part 4.9 K of the Rules and Regulations Governing Animal Care Facilities (250-RICR-40-05-4) applications submitted over 90 days past expiration must be completed as a NEW application, not a Renewal. NOTE: Incomplete / illegible Applications may be rejected and returned. Fillable PDF Form can be filled out and then printed and submitted via fax, postal mail, or scanned and emailed. Keep a copy for your records. APPLICANT INFORMATION: Name of REGISTRANT Entity (Rescue/Shelter etc.): ____________________________________________________________________________________ Name of REGISTRANT Operator/Primary contact: Rescue/Shelter etc. Address (No P.O. Boxes): Town / City: State: Zip Code: Telephone: Fax: Email: Website: Mail Address (if different from above): Town / City: State: Zip Code: License type (Select ONE):□Category A □Category B □RI Dogs/Cats ONLY (Does NOT Import) (As defined in Part 1.5 of Rules and Regulations Governing the Importation of Domestic Animals (250-RICR-40-05-1)) Check which Licensed Releasing Agency (As defined in RI General Law 4-19): ____ RESCUE "Animal rescue" or "rescue" means an entity, without a physical brick-and-mortar facility, that is owned, operated, or maintained by a duly incorporated humane society, animal welfare society, society for the prevention of cruelty to animals, or other nonprofit organization devoted to the welfare, protection, and humane treatment of animals intended for adoption. -

An Unprecedented Year

An Unprecedented Year SINCE 1954, THE HUMANE SOCIETY OF THE UNITED STATES (HSUS) has worked to create a more humane world through our programs and campaigns, regional offices, and global affiliates. We made an unprecedented leap forward in 2005 by joining with The Fund for Animals, which was founded by the legendary Cleveland Amory in 1967. Combining forces with The Fund represented a significant step toward uniting the entire humane movement in one powerful voice and streamlined our operations, freeing more resources for action on behalf of animals. This historic union also produced the youngest member of our family of organizations—the Humane Society Legislative Fund—and a new section devoted to major campaigns against factory farming, animal fighting and cruelty, the fur industry, and inhumane hunting practices, as well as the nation’s largest in-house animal protection litigation department. The year also saw unprecedented action—a massive mobilization to rescue animals left in the wake of natural disaster—and our staff and members rose to the challenge with unprecedented dedication and generosity. and helped offset costs to allow the sale Helping Pets and Their People of more than 100,000 copies for only 99 cents each. Our Pets for Life® program continued to In close cooperation with several provide a wealth of resources to help Massachusetts organizations, we put our caregivers solve the problems weight heavily behind an initiative to ban that too often separate them greyhound racing, prevent cruelty to service from their pets. We also dogs, and provide stronger penalties for produced new billboards, dogfighters in the state. -

Fall Victim in the United States to Their Own Good Intentions

The Many Victims of Animal Hoarding We all love our pets, and though most of us can maintain a balance Each year between providing them with a healthy home environment while not compromising our own well-being, some pet owners fall victim in the United States to their own good intentions. the ASPCA* estimates This past June, Fairfax County Animal Protection Police were alerted to a hoarding situation and subsequently seized nearly 70 cats from a single-family home. The cats were brought to the Fairfax County aa quarterquarter Animal Shelter with a host of medical issues and malnutrition. ofof aa millionmillion animalsanimals Fairfax County Animal Shelter staff worked tirelessly to support the intake and care of the felines ranging in age from newborn to 11 years old. Friends of the Fairfax County Animal Shelter stepped in fallfall victimvictim toto hoarding.hoarding. to help fund the rehabilitation and adoption effort. Supported by The animals and the people donations from our animal-loving community and grants provided by PetSmart Charities and the ASPCA, the cats have received life- often experience saving treatments, daily care and socialization, and spay or neuter. great suffering. and only eight remain at the shelter awaiting their forever homes. *American Society for the If you suspect or are aware of an animal hoarding situation in Fairfax County, Prevention of Cruelty to Animals please contact the police non-emergency dispatch number at (703) 691-2131. The term Though intervention is essential and imminent, it also places a "animal hoarding" tremendous burden on a local shelter’s limited staff, space and budget.