Fleet Trends in the European Technology Industry 2018-2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The All-New BMW 3 Series Brochure

Sheer Driving Pleasure THE 3 08 2019 BMW India Pvt. Ltd. Printed in India 2019. Printed India Pvt. Ltd. 08 2019 BMW For more information, call 1800 102 2269. The models, equipment and possible vehicle configurations illustrated in this brochure may differ from vehicles supplied in the Indian market. For precise Sheer information, please contact your local Authorised BMW Dealer. Subject to change in design and equipment. © BMW India Pvt. Ltd., Gurugram, India. BMW 3 Series. BMW EFFICIENTDYNAMICS. Driving Pleasure Not to be reproduced wholly or in part without written permission of BMW India Pvt. Ltd., Gurugram, India. LESS EMISSIONS. MORE DRIVING PLEASURE. Job No. 2607 / BMW 3 Series (G20) Brochure (EN) / Size: 20W X 30H cm / Date 06-08-19 BMW Type Global Pro Light | Regular | Bold | Wingdings 3 (TT) Regular THE ALL-NEW BMW 3 SERIES. INNOVATION AND TECHNOLOGY. 17 Dynamics and Efficiency 19 Driver Assistance and Connectivity 20 Comfort and Functionality 18 Powertrain and Suspension EQUIPMENT. 21 Models and Lines 27 Equipment Highlights 34 Original BMW Accessories DISCOVER MORE. Scan the code to get more information, more driving pleasure on the all-new BMW 3 Series. 39 Exterior colours 40 Interior colours 41 Technical data Job No. 2607 / BMW 3 Series (G20) Brochure (EN) / Size: 20W X 30H cm / Date 06-08-19 BMW Type Global Pro Light | Regular | Bold | Wingdings 3 (TT) Regular THRILL SEEKER, TECH B U F F. P A C K E D INTO ONE. Job No. 2607 / BMW 3 Series (G20) Brochure (EN) / Size: 20W X 30H cm / Date 06-08-19 BMW Type Global Pro Light | Regular | Bold | Wingdings 3 (TT) Regular THE ONLY THING THAT KEEPS PACE IS YOUR EXCITEMENT. -

Roadways to Exploit and Secure Connected BMW Cars

0-days & Mitigations: Roadways to Exploit and Secure Connected BMW Cars Zhiqiang Cai, Aohui Wang, Wenkai Zhang {zhiqiangcai, aohwang, wenkaizhang}@tencent.com with contributions from: Michael Gruffke, Hendrik Schweppe {michael.gruffke, hendrik.schweppe}@bmwgroup.com Abstract In years 2016 and 2017, Keen Security Lab[1] has demonstrated two remote attacks against Tesla Model S/X[2][3]; During a study conducted between early 2017 and early 2018, Keen Security Lab successfully implemented exploit chains on multiple BMW car models through physical access and a remote approach without user interaction. At that time, following a responsible disclosure procedure common in the security industry, Keen Security Lab released a security assessment report[4] to make a brief vulnerabilities disclosure, instead of a full disclosure. The security findings by Keen Security Lab were verified by BMW shortly after having received. All issues were addressed, and fixes and mitigations have been rolled out. In this paper, we will share the findings with the public, introducing system architecture of BMW cars, analyzing external attack surfaces from a security perspective. We will then give details about multiple vulnerabilities that existed in two vehicle components: NBT Head Unit[5] (a.k.a. In-Vehicle Infotainment[7]) and Telematic Communication Box[8]. By having leveraged these vulnerabilities, it has proven the possibilities of arbitrary code execution in the Head Unit via common external interfaces including USB, Ethernet and OBD-II, as well as a more powerful remote exploitation of Telematic Communication Box over a fake mobile network with the payload delivered in HTTP and Short Message Service (SMS). -

BMW Price List

Recommended Retail Price List – January 2021 Fuel Consumption Electrical Energy VES (band) Retail Price (l/100km) (kWh/100km) BMW 1 Series 116i Sport B 5.5 $146,888 116i Luxury B 5.5 $151,888 BMW 2 Series 216i Active Tourer Sport B 6.3 $157,888 216i Gran Tourer Sport B 6.5 $163,888 216i Gran Tourer Luxury B 6.5 $170,888 218i Gran Coupe Luxury B 5.5 $171,888 218i Gran Coupe M Sport B 5.5 $174,888 BMW 3 Series 318i Sedan Sport B 5.8 $208,888 320i Sedan Luxury - - P.O.A. 320i Sedan M Sport - - P.O.A. 330e Sedan Luxury A2 2.2 15.4 $261,888 BMW 4 Series 420i Coupe M Sport B 5.8 $228,888 430i Coupe M Sport Pro B 6.2 $276,888 BMW 5 Series 520i Sedan C1 5.5 $259,888 520i Sedan Luxury C1 5.5 $277,888 520i Sedan M Sport C1 5.5 $287,888 530i Sedan M Sport B 5.6 $299,888 530i Sedan M Sport Edition B 5.6 $308,888 530e Sedan B 1.9 15.3 $278,888 Booking Fees (Non-refundable and inclusive of $10,000 COE deposit): A1. BMW 1 Series / BMW 2 Series / BMW 3 Series / BMW X1/ BMW X2 / BMW i3 $20,000 A2. BMW 4 Series / BMW 5 Series / BMW 6 Series / BMW 7 Series / BMW 8 Series / BMW X3 / BMW X4 / BMW X5 / BMW X6 / BMW $28,000 X7 / BMW Z4 B1. Special Indent cars – BMW 1 Series / BMW 2 Series / BMW 3 Series / BMW 4 Series / BMW 5 Series $30,000 BMW X1 / BMW X2 / BMW X3 / BMW X4 / BMW i3 / BMW Z4 B2. -

BMW Technical Training Documents

Technical training. Product information. F31 Complete Vehicle Edited for the U.S. market by: BMW Group University Technical Training BMW Service v_/ST1301 8/1/2013 General information Symbols used The following symbol/schematic diagram is used in this document to facilitate better comprehension or to draw attention to very important information: A Contains important safety information and information that needs to be observed strictly in order to guarantee the smooth operation of the system. Information status and national-market versions BMW Group vehicles meet the requirements of the highest safety and quality standards. Changes in requirements for environmental protection, customer benefits and design render necessary continuous development of systems and components. Consequently, there may be discrepancies between the contents of this document and the vehicles available in the training course. This document basically relates to the European version of left-hand drive vehicles. Some operating elements or components are arranged differently in right-hand drive vehicles than shown in the graphics in this document. Further deviations may arise as a result of the equipment specification in specific markets or countries. Additional sources of information Further information on the individual topics can be found in the following: • Operator's manual • Integrated Service Technical Application. Contact: [email protected] ©2012 BMW AG, Munich, Germany Reprints of this publication or its parts require the written approval of BMW AG, Munich The information contained in this document forms an integral element of the technical training of the BMW Group and is intended for the trainer and participants in the seminar. Refer to the current respective information systems of the BMW Group for any changes/additions to the specifications. -

BMW 3 Series 320D Diesel 4×2 Automatic

2020 BMW 3-Series 320d diesel 4x2 automatic 6.2 6.0 0.6 /10 /10 /10 Clean Air Energy Efficiency Greenhouse Gas Index Index Index Green NCAP © BMW 3-Series — 11/20 — Version 140121 — p 1 GreenNCAP_BMW-3-Series-2020-0035_Datasheet 6.2 Clean Air Tests /10 Yellow Laboratory Test Yellow NMHCYellow NOGreenX NHYellow3 COOrange PN Yellow Yellow Green Green Orange 7.4/10 Cold Test Orange Orange Orange Yellow Orange 7.4/10 Warm Test Orange Yellow Red Green Orange 5.2/10 Cold Ambient Test Yellow 4.9/10 Highway Road Test Grey Yellow Grey Yellow Orange Green Green Orange 6.9/10 On-Road Drive Grey Grey Orange Green Orange 5.8/8 On-Road Heavy Load Grey Grey Orange Yellow Green 2.9/5 On-Road Light Load Grey Grey Red 3.4/5 On-Road Short Trip Grey Grey Grey Grey Orange 0.0/2 Congestion Robustness n.a. good adequate marginal weak poor Comments The 320d keeps particulate number (PN) under tight control, thanks to its diesel particulate filter (DPF). In general Oxides of Nitrogen (NOx) are also kept in check by selective catalyst reduction (SCR) but are high in the on-road congestion test. Green NCAP © BMW 3-Series — 11/20 — Version 140121— p 2 6.0 Energy Efficiency Tests /10 Yellow Laboratory Test Yellow Energy Yellow 6.7/10 Cold Test Orange 7.4/10 Warm Test Orange 4.6/10 Cold Ambient Test 5.4/10 Highway Consumption Driving Range Average 5.2 l/100 km 1144 km Worst-case 6.4 l/100 km 926 km n.a. -

BMW Group Plant Munich

BMW PLANT MUNICH. FLEXIBILITY. INNOVATION. PASSION. The BMW Group’s parent plant. Production in the heart of a metropolitan city. Plant Munich PREFACE. Dear Reader, the heart of BMW beats in Munich. different technologies, ranging from years. Key projects include the expan- Here, right by the Olympic Park, are the press shop to the body shop and sion of the body shop and assembly as our parent plant as well as BMW Welt, the paint shop and on to assembly and well as a new, resource-friendly paint the BMW Museum and our landmark engine production. shop. BMW Headquarters. The beginnings of our plant date back to the year 1913. The complexity we are facing will But our greatest asset are the approx. So it is truly the starting point for what only grow further with the increasing 8,000 people who work at the plant. has since become the BMW Group’s electrification of our vehicle offering. It is their expertise and experience, global production network with 30 Already today, we produce cars with creativity and passion that allow us to sites in 14 countries. conventional petrol or diesel engines create the perfect car and inspire our on a single line together with plug- customers – a thousand times a day. The plant’s unique location in the in hybrids. In the near future, the center of a big city poses challenges all-electric BMW i4 will complement I hope you enjoy discovering for us on a daily basis. The confined our model range. In other words, our BMW Group Plant Munich. -

The New BMW 5 Series Sedan. Lighter, More Dynamic, More

BMW Media The new BMW 5 Series Sedan. Information Lighter, more dynamic, more 10/2016 Page 1 economical and fully connected. The seventh generation of the BMW 5 Series Sedan will cut a sporty, elegant and stylish figure when it hits the roads in markets around the world in February 2017. Further enhanced dynamics, an unbeatable line-up of assistance systems, an unmatched degree of connectivity and a new and innovative operating system are the most important new features. The new BMW 5 Series Sedan therefore has all the tools it needs to continue the remarkable success recorded by its predecessors; more than 7.6 million BMW 5 Series cars were sold across its first six generations. “The seventh generation of the BMW 5 Series points the way into the future, as we have defined it with our NUMBER ONE > NEXT strategy. We see technological leadership, emotionally rich products and digitalisation as essential factors in achieving success. With the expansion of our model portfolio in the large- vehicle classes, we are satisfying the wishes of many customers. I’m in no doubt that the new BMW 5 Series will set new benchmarks technologically, but also have huge emotional appeal. It remains the epitome of the business sedan,” says Harald Krüger, Chairman of the Board of Management at BMW AG. Superior driving pleasure and unsurpassed aerodynamics. Rigorous application of the BMW EfficientLightweight lightweight design concept, with increased use of aluminium and high-strength steels, reduces the weight of the 5 Series Sedan by up to 100 kilograms from that of its predecessor. -

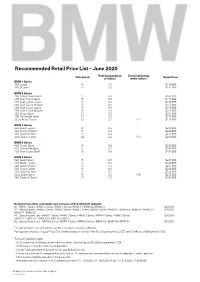

Recommended Retail Price List – June 2020

Recommended Retail Price List – June 2020 Fuel Consumption Electrical Energy VES (band) Retail Price (l/100km) (kWh/100km) BMW 1 Series 118i Luxury B 5.9 $139,888 118i M Sport B 5.9 $142,888 BMW 2 Series 216i Active Tourer Sport B 6.3 $141,888 216i Gran Tourer Sport B 6.5 $147,888 216i Gran Tourer Luxury B 6.5 $154,888 216i Gran Tourer M Sport B 6.5 $157,888 218i Gran Coupe Luxury B 5.9 $155,888 218i Gran Coupe M Sport B 5.9 $158,888 218i Coupe Sport C1 5.5 $161,888 218i Convertible Sport C1 5.8 $177,888 225xe Active Tourer B 2.4 17.4 $176,888 BMW 3 Series 320i Sedan Luxury B 6.3 $200,888 320i Sedan M Sport B 6.3 $206,888 330i Sedan M Sport B 6.4 $233,888 330e Sedan Luxury A2 2.2 15.4 $240,888 BMW 4 Series 420i Coupe Sport B 5.8 $200,888 420i Convertible Sport B 6.2 $242,888 420i Gran Coupe Sport B 5.8 $194,888 BMW 5 Series 520i Sedan Sport B 6.5 $237,888 520i Sedan Luxury B 6.5 $240,888 520i Sedan M Sport B 6.5 $251,888 530i Sedan Luxury B 6.5 $256,888 530i Sedan M Sport B 6.5 $274,888 530e Sedan Sport B 2.0 15.6 $272,888 540i Sedan M Sport C1 7.3 $345,888 Booking Fees (Non-refundable and inclusive of $10,000 COE deposit): A1. -

European Vehicle Market Statistics: Pocketbook 2016/2017

EUROPEAN VEHICLE MARKET STATISTICS Pocketbook 2016/17 European Vehicle Market Statistics 2016/17 Statistics Market Vehicle European International Council on Clean Transportation Europe Neue Promenade 6 10178 Berlin +49 (30) 847129-102 [email protected] www.theicct.org ICCT Table of Contents 1 Introduction 2 2 Number of Vehicles 14 3 Fuel Consumption & CO2 26 4 Technologies 42 5 Key Technical Parameters 52 6 Other Emissions & On-road 68 Annex Remarks on Data Sources 72 List of Figures and Tables 74 References 78 Abbreviations 80 Tables 81 An electronic version of this Pocketbook including more detailed statistical data is available online: http://eupocketbook.theicct.org EUROPEAN VEHICLE MARKET STATISTICS 2016/17 1 INTRODUCTION Market share EU-28 Registrations (million) in 2015 (in %) Fig. 1-1 16 100 Passenger cars: 90 14 Registrations by Others The 2016/17 edition of European Vehicle Market SUV/ 80 vehicle segment Of-Road 12 Statistics ofers a statistical portrait of passenger car, Van Sport 70 light commercial and heavy-duty vehicle fleets in Luxury 10 Upper 60 the European Union (EU) from 2001 to 2015. Medium Medium As in previous editions, the emphasis is on vehicle 8 50 techno logies, fuel consumption, and emissions of Lower 40 greenhouse gases and other air pollutants. 6 Medium The following pages give a concise overview 30 4 of data in subsequent chapters and also summarize 20 Small the latest regulatory developments in the EU. 2 10 More comprehensive tables are included in the annex, Mini 0 0 along with information on sources. 01 10 07 02 03 04 05 06 09 008 2011 2012 2013 2014 2015 20 20 20 20 20 20 20 20 2 20 Number of vehicles Data source: ACEA; data until 2007 is for EU-25 only After declining for several years, new passenger car registrations in the EU increased to about 13.7 million in 2015. -

The Bmw 1 Series

THE BMW 1 SERIES. April 2019 MODELS. 118i (1R52) Model Highlights: • 8-speed Steptronic transmission • 16" light alloy wheels Star-spoke style 654 • BMW TwinPower Turbo 3-cylinder petrol engine Product Details: • Concierge Services [1] [1] • Cruise control with braking function Consumption: 5.2l / 100km CO2: 122g/ km • Navigation system Business 0-100km/h: 8.7 sec Transmission: 8-speed automatic • Park Distance Control (PDC), rear • Rain sensor Engine: 3-cylinder Power/Torque: 100kW / 220Nm • Real Time Traffic Information (RTTI) • Rear view camera Price incl. GST $47,200 125i (1S32) Model Highlights: • 8-speed Steptronic sport transmission • 18'' light alloy wheels Double-spoke style 385 • Automatic air conditioning, 2 zone • BMW TwinPower Turbo 4-cylinder petrol engine Product Details: • Interior rear-view mirror with automatic anti- [1] [1] dazzle function Consumption: 5.9l / 100km CO2: 134g / km • LED fog lights 0-100km/h: 6.1 sec Transmission: 8-speed sport automatic • LED headlights • Seat heating for driver and front passenger Engine: 4-cylinder Power/Torque: 165kW / 310Nm • Sport Line • Sport seats for driver and front passenger Price incl. GST $59,700 [1] IMPORTANT INFORMATION ABOUT OUR DATA Fuel consumption is determined in accordance with the ECE driving cycle (93/116/EC) made up of approximately one third urban traffic and two thirds extra-urban driving (based on the distance covered). CO2 emissions are measured in addition to fuel consumption. All data is presented based on a vehicle of this model with standard equipment as tested for the German market. Where those vehicles are available in a right hand drive variant, they can be specially ordered from the factory by New Zealand customers. -

5)& #.8 4&3*&4 $0/7&35*#-&

#.8 ए 4FSJFT$POWFSUJCMF एऎऔJ एएऑJ 5IF6MUJNBUF एएऑJT %SJWJOH.BDIJOFn 5)&#.8ए 4&3*&4 $0/7&35*#-& #3*()5&/:063%":ѭ'"45 #.8&GGJDJFOU%ZOBNJDT -FTTFNJTTJPOT.PSFESJWJOHQMFBTVSF Information Provided by: Provided Information #&$0.&"46/8034)*11&3 'PSTPNF BTVOSPPGJTOѳUFOPVHI5IFZXBOUUIFXIPMFTLZ*GUIBUѳTZPV XFJOWJUFZPVUPHSFFUUIFEBZJOUIF #.8᠇ 4FSJFT$POWFSUJCMF+VNQJO QSFTTUIF4UBSUCVUUPO MPXFSUIFSFUSBDUBCMFIBSEUPQBOETMJQJUJOUPHFBS 'FFMUIFTVSHFPGFGGPSUMFTTQPXFSGSPNBOBEWBODFE IJHIFGᡡ DJFODZFOHJOF#FOEUIF$POWFSUJCMFJOUPUJHIU DPSOFST XJUIQSFDJTFSPBEIPMEJOHUIBUOFWFSGBJMTUPEJBMVQUIFGVO/FFEBTPVOEUSBDLGPSZPVSHPPEUJNFT -FUUIFBWBJMBCMF)BSNBO,BSEPOn4VSSPVOE4PVOETZTUFNNPWFZPV BTZPVMVYVSJBUFJODPNGPSUJOUIF CFBVUJGVMMZDSBGUFEDPDLQJU5IFTLZBCPWF UIFSPBECFMPX BOEOPUIJOHCVUZPVJOCFUXFFO1FSGFDU Information Provided by: Provided Information Editorial OPEN TO FRESH IDEAS. Fresh styling. Fresh engine concepts. A fresh High Performance model. All these ideas and more: now opening on the BMW fi Series Convertible. This sleek sun-lover sports reᡡ ned styling and gorgeous lighting features, front and rear. Under the long hood, high-efᡡ ciency, TwinPower Turbo engines breathe ᡡ re while sipping gasoline. A quick- shifting -speed sport automatic Double Clutch Transmission (DCT) is available in the fi fi is High Performance, which features a race- inspired Aerodynamic kit, a fi -hp twin-scroll TwinPower Turbo engine with up to fi lb-ft of torque, and more fun than anyone really deserves to have in a car. (Except you.) All this is combined with a level of everyday practicality you wouldn’t expect in a sporting vehicle: a fold-down rear seat cargo area, accessible trunk storage – even with the roof stowed – door storage compartments and more. It’s all in this ever-popular member of the The BMW Technology Equipment Overviews iconic BMW fi Series, selected as one of Car and Driver’s “ Best” Cars for a record years in a row. Want details? You’ll discover a Series Convertible wealth of them in these pages. -

E-Segment Car Case

Social Data for marketing intelligence E-segment cars audience profiling Discover unique insights about your audiences and drive marketing effectiveness www.soprism.com Belgium - Audience report - 2018 About SoPRISM SoPRISM is an innovative technological company which provides a new understanding of audiences through its powerful and awarded profiling solution. Our mission aims at supporting leading agencies & brands to benefit from the full power of social data to drive marketing effectiveness. Automatic persona(s) & ads campaign generation Out of GDPR scope Standard partner of Facebook Proudly serving best in-class brands & agencies in EU 02 Table of contents 02 About SoPRISM 11 Personas identification 04 Introduction to methodology 12 Successful fathers - 1st Persona 05 Everything starts from data 13 Businessmen - 2nd Persona 06 Added value - Data-driven strategy 14 Car lovers - 3nd Persona 07 E-segment cars - Audiences definition 15 A new generation of market research 08 Socio-demographics - Overall audience 16 What’s next ? Introduction to methodology Be connected to an unprecedented source of data updated in real time from Facebook® & Instagram® active users in a faster, deeper and smarter way than ever. 01 02 03 AUDIENCE DEFINITION ANALYSIS LENS UNCOVER MEANINGFUL INSIGHTS Explore motivations and behaviors of Get to know what makes your target Deep dive into your audiences by learning strategic audiences as well as people who audience different to a benchmark audience their passions, way of life, consumption showed an interest for your brand or and gain accurate audience knowledge for h a b i t s , h o b b i e s , m e d i a a ffin i t i e s , website visitors or current customers or data-driven decisions.