Continental European Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Power Point Presentation Template

POHJOLA PANKKI ONE-ON-ONE -PÄIVÄ March 9, 2011 Pekka Lundmark, President and CEO Teo Ottola, CFO © 2011 Konecranes Plc. All rights reserved. 1 HIGHLIGHTS OF Q4/10 • Positives – Key macroeconomic indicators continuously positive – Pick-up in Port Cranes boosted Equipment order intake – Continued EBIT margin expansion • Negatives – New equipment orders still relatively low in developed markets Board of Directors proposes a dividend of EUR 1.00 per share © 2011 Konecranes Plc. All rights reserved. 2 CAPACITY UTILIZATION: EU27 AND USA SOURCES: Eurostat (latest data point Q1/11), Federal Reserve Bank of St. Louis (December 2010) © 2011 Konecranes Plc. All rights reserved. 3 CONTAINER TRAFFIC Annual container handling volume Monthly container handling volume SOURCES: Drewry Container Annual 2009/2010, Drewry Freight Shipper Insight (latest data point October 2010) © 2011 Konecranes Plc. All rights reserved. 4 MARKET OUTLOOK AND FINANCIAL GUIDANCE AS OF FEBRUARY 3, 2011 • The demand for maintenance ¾We forecast year 2011 sales and services is expected to be above operating profit to be higher than in last year’s level due to higher 2010 capacity utilization within customer industries • The demand for new equipment is expected to continue to grow in Asia-Pacific and in emerging markets in general. Also, customers in Western Europe and North America are gradually gaining confidence to increase their new equipment investments © 2011 Konecranes Plc. All rights reserved. 5 ABU DHABI PORTS COMPANY (ADPC) RELIES ON KONECRANES • Order of 30 automated stacking cranes (ASC) and a container terminal operating system (TOS) • Order value over EUR 80 million • Delivery in 2012 • Konecranes has a proven solution for ASCs – Earlier delivery of 30 ASCs to Norfolk, Virginia, USA, in operation – 36 ASCs on order for Barcelona, Spain, for delivery in 2012 © 2011 Konecranes Plc. -

Annual Report 2005

,$*,POFDSBOFT"OOVBM3FQPSU .BJO1SPEVDU3BOHFT .0%&3/*4"5*0/4&37*$&4 GPSJNQSPWFEBWBJMBCJMJUZ SFMJBCJMJUZBOETBGFUZPG FYJTUJOHFRVJQNFOU ."*/5&/"/$&4&37*$&4 GPSBMMDSBOFNBLFT SFHBSEMFTTPGPSJHJOBM NBOVGBDUVSFS "OOVBM3FQPSU ,$*,0/&$3"/&41-$ */%6453*"-$3"/&4 -*()5$3"/&4:45&.4 10#PY '* GFBUVSJOHUIF$95IPJTUGPS GPSQSPEVDUJWFBOEFSHP )ZWJOLÊÊ 'JOMBOE MJGUJOHDBQBDJUJFTVQUPUPOT OPNJDIBOEMJOHPGMPBET Kuvia puuttuu VQUP LH 5FM 'BY XXXLPOFDSBOFTDPN #VTJOFTT*% 5VSOGPSJOGPSNBUJPOUPTIBSFIPMEFST )"3#063$3"/&4 GPSIBSCPVST JOUFSNPEBM UFSNJOBMTBOEUIFTIJQ 130$&44$3"/&4 QJOHJOEVTUSZ FOHJOFFSFEGPSTFWFSFEVUZ MJGUJOHVQUP UPOTPS NPSF 4)*1:"3%$3"/&4 GFBUVSFBDPNQSFIFOTJWFSBOHF PGKJCQPSUBMBOE(PMJBUIHBOUSZ DSBOFT )&"7:%65:-*'5536$,4 GPSLMJGUUSVDLTBOESFBDI TUBDLFSTXJUIMJGUJOHDBQBDJUJFT VQUPUPOT 7/2,$,%!$).'#2!.%4%#(./,/'9 7/2,$,%!$).'#2!.%4%#(./,/'9 Covers KCI_ENG_6.indd 1 15.2.2006 19:24:31 ,$*,POFDSBOFT"OOVBM3FQPSU .BJO1SPEVDU3BOHFT .0%&3/*4"5*0/4&37*$&4 GPSJNQSPWFEBWBJMBCJMJUZ SFMJBCJMJUZBOETBGFUZPG FYJTUJOHFRVJQNFOU ."*/5&/"/$&4&37*$&4 GPSBMMDSBOFNBLFT SFHBSEMFTTPGPSJHJOBM NBOVGBDUVSFS "OOVBM3FQPSU ,$*,0/&$3"/&41-$ */%6453*"-$3"/&4 -*()5$3"/&4:45&.4 10#PY '* GFBUVSJOHUIF$95IPJTUGPS GPSQSPEVDUJWFBOEFSHP )ZWJOLÊÊ 'JOMBOE MJGUJOHDBQBDJUJFTVQUPUPOT OPNJDIBOEMJOHPGMPBET Kuvia puuttuu VQUP LH 5FM 'BY XXXLPOFDSBOFTDPN #VTJOFTT*% 5VSOGPSJOGPSNBUJPOUPTIBSFIPMEFST )"3#063$3"/&4 GPSIBSCPVST JOUFSNPEBM UFSNJOBMTBOEUIFTIJQ 130$&44$3"/&4 QJOHJOEVTUSZ FOHJOFFSFEGPSTFWFSFEVUZ MJGUJOHVQUP UPOTPS NPSF 4)*1:"3%$3"/&4 GFBUVSFBDPNQSFIFOTJWFSBOHF PGKJCQPSUBMBOE(PMJBUIHBOUSZ DSBOFT -

Record-High Adjusted EBITA-% Powered by Excellent Commitment and Execution

Record-high adjusted Interim Report EBITA-% powered by January–September 2020 excellent commitment and execution Q3 Interim Report 2 Q3 January–September 2020 Record-high adjusted EBITA-% powered by excellent commitment and execution This report contains comparison to Konecranes’ historical figures which are Konecranes’ stand-alone financial information as -re ported for 2019. These do not include figures for MHE-Demag as the acquisition of MHE-Demag was completed in January 2020. The combined operations of Konecranes and MHE-Demag started on January 2, 2020. To provide a basis for comparison, this Report contains under separate headings comments to the financial performance of MHE- Demag for the year 2020. Please note that starting from the fourth quarter 2020 any comments on the stand-alone MHE-Demag performance are based on estimates due to the proceeding integration work and legal entity consolidation. Figures in brackets, unless otherwise stated, refer to the same period a year earlier. THIRD QUARTER HIGHLIGHTS JANUARY–SEPTEMBER 2020 • Order intake EUR 565.5 million (715.3), -20.9 percent HIGHLIGHTS (-18.8 percent on a comparable currency basis), orders • Order intake EUR 1,884.0 million (2,386.0), -21.0 per- declined in all Business Areas. Excluding MHE-Demag, cent (-20.3 percent on a comparable currency basis) order intake declined 24.6 percent • Service order intake EUR 694.1 million (765.1), -9.3 • Service annual agreement base value increased 5.9 percent (-8.0 percent on a comparable currency basis) percent (+10.9 percent in comparable currencies) to • Sales EUR 2,242.1 million (2,393.6), -6.3 percent (-5.4 EUR 278.8 million (263.4). -

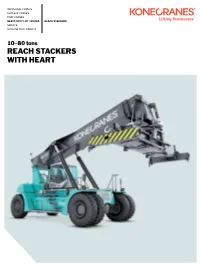

REACH STACKERS with HEART 2 Konecranes Reach Stackers Remarkable Versatility from CONTAINERS to INDUSTRIAL CARGO

INDUSTRIAL CRANES NUCLEAR CRANES PORT CRANES HEAVY-DUTY LIFT TRUCKS REACH STACKERS SERVICE MACHINE TOOL SERVICE 10–80 tons REACH STACKERS WITH HEART 2 Konecranes Reach Stackers Remarkable versatility FROM CONTAINERS TO INDUSTRIAL CARGO We have a long history of working with container ports and intermodal terminals that are expert buyers and operators of reach stackers. Our container handling customers demand a lot of us, and we have a long track record of meeting their requirements year after year. Larger reach stackers are needed for railroad stacking. To load and unload on more than one track you need a flexible reach stacker with a large lifting capacity and an extended set of functions. You will find a reach stacker in our range that will meet the specific requirements of your terminal. Industrial workhorses We also work with many industrial companies that need customized reach stackers for their specific industry. Our reach stackers are remarkably adaptable to industrial cargo handling. We provide special spreaders incorporating steel grabs, lifting magnets, vacuum grippers, and coil C-hooks among other attachments. What kind of material do you need to lift and move? Contact us. You’ll probably find we have plenty of experience in your industry and can provide the ideal reach stacker. Applications • Container ports and terminals • Automotive • Railroads and intermodal • Oil and gas • Trimodal river handling • Wind power • Transport, shipping, and logistics • Nuclear power • Steel and aluminum • Waste-to-energy This publication is for general informational purposes only. Konecranes reserves the right at any time, without notice, to alter or discontinue the products and/or specifications referenced herein. -

PRESS RELEASE Public Joint Stock Company «Mining and Metallurgical Company «NORILSK NICKEL» (PJSC “MMC “Norilsk Nickel”, “Nornickel” Or the “Company”)

PRESS RELEASE Public Joint Stock Company «Mining and Metallurgical Company «NORILSK NICKEL» (PJSC “MMC “Norilsk Nickel”, “Nornickel” or the “Company”) NORNICKEL AWARDS MAJOR CONTRACT FOR PROCESSING EQUIPMENT SUPPLY TO METSO OUTOTEC Moscow, August 10, 2021 - Nornickel, the world’s largest producer of palladium and high- grade nickel and a major producer of platinum and copper, has awarded a major contract for the supply of some of the key industry-leading equipment used in mining operations to Metso Outotec, further extending the partnership with Finland’s technology solutions provider. Nornickel and Metso Outotec have signed an agreement to deliver industry-leading dewatering, flotation and automation equipment for Nornickel’s Talnakh concentrator expansion project in Russia’s Arctic city of Norilsk. The contract value is a commercially sensitive matter and therefore may not be disclosed publicly. Metso Outotec’s delivery scope consists of modernization of three existing thickeners and delivery of over 100 TankCell® flotation machines and an automation system for the new Talnakh concentrator Line 3 flotation area. In addition, the contract covers the supply of spare parts and consumables. Metso Outotec will also provide a metallurgical performance guarantee as well as advisory services for the installation and commissioning of the equipment. The delivery is scheduled for 2022-23. Sergey Dubovitsky, Nornickel Senior Vice President Strategy, Strategic Projects, Logistics & Procurement, commented: “The new contract further develops the collaboration with our longstanding partner Metso Outotec, which has supplied technology to us for many years. We have an excellent track record of using the Metso Outotec machinery across the entire geography of our operations. -

Creating the Technology to Connect the World

Nokia Annual Report on Form 20-F 2019 on Form Nokia Annual Report Creating the technology to connect the world Nokia Annual Report on Form 20-F 2019 As filed with the Securities and Exchange Commission on March 5, 2020 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 Commission file number 1-13202 Nokia Corporation (Exact name of Registrant as specified in its charter)) Republic of Finland (Jurisdiction of incorporation) Karaportti 3 FI-02610 Espoo, Finland (Address of principal executive offices) Esa Niinimäki, Deputy Chief Legal Officer, Corporate, Telephone: +358 (0) 10 44 88 000, Facsimile: +358 (0) 10 44 81 002, Karakaari 7, FI 02610 Espoo, Finland (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”): Title of each class Trading Symbol(s) Name of each exchange on which registered American Depositary Shares NOK New York Stock Exchange Shares New York Stock Exchange(1) (1) Not for trading, but only in connection with the registration of American Depositary Shares representing these shares, pursuant to the requirements of the Securities and Exchange Commission. Securities registered pursuant to Section 12(g) of the Exchange Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Exchange Act: None Indicate the number of outstanding shares of each of the registrant’s classes of capital or common stock as of the close of the period covered by the annual report. -

FORK LIFT TRUCKS with HEART 2 Konecranes Fork Lift Trucks

INDUSTRIAL CRANES NUCLEAR CRANES PORT CRANES HEAVY-DUTY LIFT TRUCKS FORK LIFT TRUCKS SERVICE MACHINE TOOL SERVICE 10 – 65 tons FORK LIFT TRUCKS WITH HEART 2 Konecranes FORK LIFT TRUCKS What are your requirements? THE RIGHT FORK LIFT TRUCK FOR YOUR JOB Konecranes has hundreds of heavy industry customers around the world and deep knowledge of heavy industry requirements for fork lift trucks. Choose your fork lift according to the weight of the material you need to handle and the diversity of tasks you need it to perform. You will find the right lifting capacity, features and attachments in our range. EXPERIENCE at YOUR SERVICE Konecranes fork lift trucks are remarkably adaptable to industrial material handling. We have a long track record of meeting specialized industrial handling requirements like yours. What is your industry? What kind of material do you need to lift and move? Contact us. You’ll probably find we have lots of experience in your industry and can provide the ideal fork lift truck. Industries we serve • Steel, aluminum and mining • Wood and building materials • Container ports and terminals • Transport, shipping and logistics • Pulp and paper • Concrete, bricks and rock • Automotive • General manufacturing • Oil and gas • Wind power • Nuclear • Waste-to-energy • Shipyards and marinas This publication is for general informational purposes only. Konecranes reserves the right at any time, without notice, to alter or discontinue the products and/or specifications referenced herein. This publication creates no warranty on the part of Konecranes, express or implied, including but not limited to any implied warranty or merchantability or fitness for a particular purpose. -

Digital Game Changers National Growth Project for European Market Leadership the Global Coronavirus Pandemic Has Brought a Major Upheaval for Business and Industry

Digital Game Changers national growth project for European market leadership The global coronavirus pandemic has brought a major upheaval for business and industry. The way we work, optimised value chains and established market positions have changed overnight. The crisis has also altered customer expectations and behaviours. The change is not only due to the business life, the result will be a substantial coronavirus: the maturing of new new growth market for new and future technologies plays a part. The transition competences. has been amplified by the coronavirus Many of these potential future growth areas crisis and recovery package investments are based in Finland. Finland has many will further accelerate this development. factors in its favour. Strengths that we take The old playing field and modes of for granted are gaining global pull. operation are becoming obsolete as new Finland will make its own national choices. business is being developed and the These decisions should fully support the markets are redistributed. We will see new efforts of business and industry to firmly winners. We have a unique opportunity in seize the new opportunities arising from our hands that must not be wasted. the crisis. In practice, the national recovery Pioneering businesses and countries plan must be in line with the policies of our grasping the opportunities created by a European partners and the national growth, transition are best positioned to succeed, education and innovation policy choices grow and create jobs. must allocate resources to the six growth In Finland, the coronavirus crisis has areas. This will stimulate investments in brought out a unique shared national spirit Finland and create new high-value-added of collaboration. -

Financial Statements Review 2019

2019 Financial Statements Review Metso’s Financial Statements Review January 1 – December 31, 2019 Metso has classified its Minerals segment as discontinued operations from October 29, 2019, in accordance with IFRS. This was based on the decision taken by Metso’s Extraordinary General Meeting on October 29, 2019, to approve the partial demerger of the company. As a result, the depreciation and amortization of the Minerals segment is calculated only for the period of January-October 2019 according to IFRS. Metso has also prepared consolidated financial information, where the depreciation and amortization of Minerals is calculated for the full- year 2019, and these figures are comparable to the year 2018. Analysis of the fourth-quarter 2019 and January-December 2019 in this Financial Statements Review is based on the comparable figures unless otherwise noted. Figures in brackets refer to the corresponding period in 2018, unless otherwise stated. Fourth-quarter 2019 in brief • Market activity continued to be good • Orders received increased 1% to EUR 914 million (902 million) • Sales grew 7%, totaling EUR 963 million (897 million) • Adjusted EBITA improved to EUR 117 million, or 12.2% of sales (98 million, or 10.9%) • Operating profit improved to EUR 96 million, or 10.0% of sales (93 million, or 10.4%) • Earnings per share were EUR 0.41 (0.42) • Free cash flow was EUR 18 million (57 million) • Acquisition of the Canadian mobile aggregates equipment supplier McCloskey was completed • Shareholders approved Metso’s partial demerger to create -

Annual Report 2007 Nordea Is the Largest fi Nancial Services Group in the Nordic and Baltic Sea Region with a Market Capitalisation of Approx

Annual Report 2007 Nordea is the largest fi nancial services group in the Nordic and Baltic Sea region with a market capitalisation of approx. EUR 30bn, total assets of EUR 389bn and a tier 1 capital of EUR 14.2bn, as of end December 2007. Nordea is the region’s largest asset manager with EUR 157bn in assets under management. Nordea has approx. 10 million customers in the Nordic region and new European markets, of which 6.8 million are personal customers in customer programme and 0.7 million are active corporate customers. Contents Nordea in brief 2 Highlights 2007 3 CEO letter 4 The Nordea share 6 Key fi nancial fi gures 11 Vision, values and strategy 12 Integrated Group operating model 17 Business development – customers and products 18 People forming Great Nordea 36 Group organisation 38 Corporate Social Responsibility 40 Board of Directors’ report – Financial Review 2007 42 – Customer area results and Product results 46 – Risk, Liquidity and Capital management 52 – Corporate governance 76 5 year overview 82 Quarterly development 83 Income statement 84 Balance sheet 85 Statement of recognised income and expense 86 Cash-fl ow statements 87 Notes to the fi nancial statements 89 Risk and capital adequacy reports for the Parent company 145 Proposed distribution of earnings 148 Audit report 149 Business defi nitions 150 Legal structure 151 Ratings 151 Board of Directors 152 Group Executive Management 154 Group Organisation 155 Annual General Meeting 156 Financial calendar 157 Corporate Governance Report I-II This Annual Report contains forward-looking statements that refl ect management’s current views with respect to certain future events and potential fi nancial performance. -

Annual Report 2010 (Pdf)

ANNUAL REPORT 2010 REPORT ANNUAL NORTHERN INVENTIVENESS NOkIaN Tyres plc Ann ual report 2010 2 Year 2010 iN bRiEf NokiaN Tyres plc 2010 Safest tyres for northern content conditions Mission statement, year 2010 in brief, key figures..................... 2 Nokian Tyres in brief .................. 3 We have an innate ability to understand clients operating in northern letter from the president conditions, as well as their needs and expectations. We operate in growing and CEO ........................................ 4 strategy ....................................... 6 markets and focus on tyre products and services that offer sustainable Values and success factors ......... 7 added value to our customers in northern conditions. our range also Business environment ................ 8 provides the foundation for the company’s profitable growth. profit centres: Nokian passenger car Tyres ....... 10 Vianor ........................................... 12 Nokian Heavy Tyres .................... 13 year 2010: Nokian Truck Tyres ...................... 14 sales and distribution ................. 15 Rapid return r&D and testing .......................... 16 to the growth track a selection of new products ...... 18 production ................................... 20 ▪ Demand and sales increased strongly in all product environment and safety ............. 22 groups in Nokian Tyres’ core markets. The Group’s competence development ......... 23 net sales improved by 32.5%, and its market share Management 31.12.2010 ........... 24 increased. Board of Directors 31.12.2010 .... 26 ▪ The average price of tyres rose thanks to a better key figures, graphs ..................... 27 sales mix and price increases, and the company enjoyed excellent profitability despite the increase in consolidated income statement .................................... 28 raw material cost. ▪ The success of the company’s main products in car consolidated statement of Financial position ........................ 29 magazine tests boosted the Nokian Tyres brand further. -

Dealing with Data: Cybersecurity in the COVID-19 Era Working Smarter and Safer Has Become an Industry Creed for Employee Welfare

EEMJ_991MJ_991 FC.inddFC.indd 991991 88/7/20/7/20 33:43:43 PPMM Improves productivity Eliminates unplanned stops Increases employee safety — Condition monitoring For mechanical components The ABB AbilityTM Smart Sensor for mechanical products is an easy-to-use, wireless sensor which monitors the health of mounted bearings and gear reducers. The sensor provides warnings when health status declines, reducing the risk of unplanned downtime. In addition, connectivity and trend data allow maintenance to be planned proactively instead of reactively, and remote monitoring capabilities keep employees away from areas that are difficult or dangerous to access. Operate safely. Reduce downtime. Improve reliability. new.abb.com AEEMJ_992BMBJ_E99_2M IFC.inddIJF_CC.oinndddit i o 9992n9 M2 onitoring for Mechanical Components_0320.indd 1 788/3/20/1/3//20 99:542::5149 AAMPM AUGUST 2020 • VOL 221 • NUMBER 8 FEATURES Machines That Help Reduce Dilution The top narrow vein mining solutions on the market offer an increased power-to-weight ratio, lower ownership costs and higher productivity ...........28 Mineral Processing Titans Merge Stephan Kirsch, president of Metso Outotec’s new Minerals Business Area, discusses the next steps for the business and new opportunities ..................34 Refining Gold Processing E&MJ looks at designs and technologies that are making gold flowsheets more efficient and economic .........................................................................36 Dealing With Data: Cybersecurity in the COVID-19 Era Working smarter and safer