UK Communications Market Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Financial Statements 2018 Sainsbury’S Group Helping Customers Live Well for Less Has Been at the Heart of What We Do Since 1869

Live Well For Less Annual Report and Financial Statements 2018 Sainsbury’s Group Helping customers live well for less has been at the heart of what we do since 1869. We employ over 185,000 colleagues who work hard every day to make our customers’ lives easier and to provide them with great products, quality and service whenever and wherever it is convenient to access them. Food Our strategic focus is to help 608 our customers live well for less. Sainsbury’s supermarkets We offer customers quality and convenience as well as great value. Our distinctive ranges and innovative 102 partnerships differentiate stores offering Same Day our offer. More customers delivery to 40 per cent are shopping with us than of the UK population ever before and our share of customer transactions has increased. See more on page 12 General Merchandise 191 and Clothing Argos stores in Sainsbury’s We are one of the largest general supermarkets merchandise and clothing retailers in the UK, offering a wide range of products across our Argos, Sainsbury’s Home and 16 Habitat brands, in stores and Habitat stores and online. We are a market leader in Click & Collect available toys, electricals and technology in over 2,300 locations and Tu clothing offers high street style at supermarket prices. See more on page 14 Financial Services Financial Services are an 3.9m integral part of our business. Active customers Sainsbury’s Bank offers at Sainsbury’s Bank and accessible products such as Argos Financial Services credit cards, insurance, travel money and personal loans that reward loyalty. -

Long Range Wifi Tube Settings

To set up the Long range Wifi, open a new ‘Tab’ on the browers and type ‘192.168.2.1’in the adress bar and you will get the management screen from the Wifi router, again username is ‘admin’ and password is ‘admin’ and click ‘login’ You will then get the status screen as below, Long Range Wifi Chrome quick reference guide Click ‘Easy Setup and select the WAN connections and ‘Client Router Mode’ and click on ‘Next’ On the next screen click ‘Site Survey” Long Range Wifi Chrome quick reference guide This will bring up a screen with all the available WiFi hotspots in the area. Select the WiFi Hotspot you require, the system will connect to most Wifi access points with a signal greater than -80dB ie -79dB to 0dB. Select the Wifi you want in this case BT with FON and click ‘Select’ N o w If you have selected a known Wifi with and access code you will be asked to enter this as the ‘Passkey’ So if you have been to a Bar and have the code this is where you enter it. Set the power level to 24-27 if requires some units do not have this field.. Long Range Wifi Chrome quick reference guide Select Next on the following screens until you reach done and the unit will reboot. Open another tab on you browser and you shold be connected to the Internet, you can also log back into the Long ranage WiFi on 192.168.2.1 and check the status of the connection If you are connected as in this case to BT Openzone, enter your account details and connect to the internet, all other devices will not need to logon to BT or the Public Wifi provider. -

Price Guide. Everything You Need Know About Our Prices, If You Are

Price Guide. Everything you need know about our prices, if you are: – A Pay Monthly (voice) customer who joined us or last upgraded your contract before 18 March 2014; – A SIM customer (voice) who joined us or last upgraded your contract before 15 July 2014; – A Mobile Broadband customer who joined us before 12 August 2015 or are on Mobile Broadband Pay As You Go; – A Business (voice) customer (unless you’re on one of our Simply Business plans); – A Business Mobile Broadband customer; or – On one of our old Pay As You Go plans. Three Customer Services Hutchison 3G UK Ltd PO Box 333 Glasgow G2 9AG © 2017. A member of CK Hutchison Holdings. Registered office: Star House, 20 Grenfell Road, Maidenhead, Berks SL6 1EH. Published by Hutchison 3G UK Limited, trading as Three. All rights in this publication are reserved and no part may be reproduced without the prior written permission of the publisher. ‘3’ and its related images, logos and names used in this publication are trademarks of the Hutchison Whampoa group of companies. The contents of this publication are believed to be correct at the time of going to press, but any information, products or services mentioned may be modified, supplemented or withdrawn. The provision of any products and services by Hutchison 3G UK Limited is subject to Three’s customer terms (available at Three.co.uk). The customer terms will take precedence if there is any discrepancy with this publication. In the event of a discrepancy between this publication and information provided on Three.co.uk, other than the customer terms, this publication will take precedence. -

UK Superfast Broadband Projects Directory 2014: Crunch Year for Superfast UK

UK Superfast Broadband Projects Directory 2014: crunch year for Superfast UK Prepared by: Annelise Berendt Date: 14 February 2014 Version: 1.0 Point Topic Ltd 73 Farringdon Road London EC1M 3JQ, UK Tel. +44 (0) 20 3301 3305 Email [email protected] Point Topic – UK Plus report – 2014: crunch year for Superfast UK Contents 1. Background 4 2. Introduction 5 3. The service provider picture 8 4. BT Group puts another £50m into the pot 11 4.1 Fibre on Demand developments 11 4.2 Self-install getting closer 12 4.3 Multicast for GEA launched for TV provision 12 4.4 Cornwall passes target and begins to impact local economy 13 4.5 Northern Ireland FTTC network has over 150,000 customers 13 4.6 BT looks to raise its MDU game 14 4.7 Last batch of 19 exchanges quietly announced 14 4.8 BT Retail sees strong fibre-based growth 16 5. Virgin Media increases the speed stakes 17 5.1 Higher speed services and boosts for existing customers 17 5.2 Virgin acquires Smallworld Fibre 17 6. Altnets move into make or break year 18 6.1 CityFibre floats on AIM 18 6.2 Gradwell launches GigaBath based on CityFibre infrastructure 19 6.3 IFNL continues to build homes passed numbers 20 6.4 Hyperoptic launches in Olympic Village 20 6.5 Venus welcomes Connection Voucher Scheme 21 6.6 Community Fibre in Westminster pilot 21 6.7 Velocity1 uses Wembley to showcase the bigger picture 21 6.8 Call Flow Solutions continues private and publicly-funded rollout 22 6.9 Fibre Options seeing increasing developer interest 22 6.10 Gigaclear continues to grow rural footprint 23 6.11 B4RN sticks to its coverage plans 23 6.12 Cybermoor FTTP services go live 24 6.13 LonsdaleNET launches fibre network in Cumbria 24 6.14 TripleConnect in Cumbrian new build fibre deployment 25 6.15 KC fibre connections approach 7,000 lines 25 6.16 The closure of Digital Region 26 6.17 Student fibre sector is a springboard for the wider market 27 Page 2 of 37 Point Topic – UK Plus report – 2014: crunch year for Superfast UK 7. -

Anticipated Acquisition by BT Group Plc of EE Limited

Anticipated acquisition by BT Group plc of EE Limited Appendices and glossary Appendix A: Terms of reference and conduct of the inquiry Appendix B: Industry background Appendix C: Financial performance of companies Appendix D: Regulation Appendix E: Transaction and merger rationale Appendix F: Retail mobile Appendix G: Spectrum, capacity, and speed Appendix H: Fixed-mobile bundles Appendix I: Wholesale mobile: total foreclosure analysis Appendix J: Wholesale mobile: partial foreclosure analysis Appendix K: Mobile backhaul: input foreclosure Appendix L: Retail fixed broadband: Market A Appendix M: Retail broadband: superfast broadband Glossary APPENDIX A Terms of reference and conduct of the inquiry Terms of reference 1. In exercise of its duty under section 33(1) of the Enterprise Act 2002 (the Act) the Competition and Markets Authority (CMA) believes that it is or may be the case that: (a) arrangements are in progress or in contemplation which, if carried into effect, will result in the creation of a relevant merger situation in that: (i) enterprises carried on by, or under the control of, BT Group plc will cease to be distinct from enterprises currently carried on by, or under the control of, EE Limited; and (ii) section 23(1)(b) of the Act is satisfied; and (b) the creation of that situation may be expected to result in a substantial lessening of competition within a market or markets in the United Kingdom (the UK) for goods or services, including the supply of: (i) wholesale access and call origination services to mobile virtual network operators; and (ii) fibre mobile backhaul services to mobile network operators. -

Case No COMP/M.6314 – Telefónica UK/ Vodafone UK/ Everything Everywhere/ JV

EN This text is made available for information purposes only. A summary of this decision is published in all EU languages in the Official Journal of the European Union. Case No COMP/M.6314 – Telefónica UK/ Vodafone UK/ Everything Everywhere/ JV Only the EN text is authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 8 (1) Date: 4/09/2012 EUROPEAN COMMISSION Brussels, 4.9.2012 C(2012) 6063 final PUBLIC VERSION COMMISSION DECISION of 4.9.2012 addressed to: - Telefónica UK - Vodafone Group - Everything Everywhere declaring a concentration to be compatible with the internal market and the functioning of the EEA Agreement (Case No COMP/M.6314 – Telefónica UK / Vodafone UK / Everything Everywhere / JV) (Only the EN version is authentic) TABLE OF CONTENTS COMMISSION DECISION addressed to: - Telefónica UK - Vodafone Group - Everything Everywhere declaring a concentration to be compatible with the internal market and the functioning of the EEA Agreement (Case No COMP/M.6314 – Telefónica UK / Vodafone UK / Everything Everywhere / JV) ............................................................................................ 7 1. NOTIFICATION.......................................................................................................... 7 2. THE NOTIFYING PARTIES ...................................................................................... 8 3. THE OPERATION AND THE CONCENTRATION ............................................... 10 4. UNION DIMENSION .............................................................................................. -

Retail Change: a Consideration of the UK Food Retail Industry, 1950-2010. Phd Thesis, Middlesex University

Middlesex University Research Repository An open access repository of Middlesex University research http://eprints.mdx.ac.uk Clough, Roger (2002) Retail change: a consideration of the UK food retail industry, 1950-2010. PhD thesis, Middlesex University. [Thesis] This version is available at: https://eprints.mdx.ac.uk/8105/ Copyright: Middlesex University Research Repository makes the University’s research available electronically. Copyright and moral rights to this work are retained by the author and/or other copyright owners unless otherwise stated. The work is supplied on the understanding that any use for commercial gain is strictly forbidden. A copy may be downloaded for personal, non-commercial, research or study without prior permission and without charge. Works, including theses and research projects, may not be reproduced in any format or medium, or extensive quotations taken from them, or their content changed in any way, without first obtaining permission in writing from the copyright holder(s). They may not be sold or exploited commercially in any format or medium without the prior written permission of the copyright holder(s). Full bibliographic details must be given when referring to, or quoting from full items including the author’s name, the title of the work, publication details where relevant (place, publisher, date), pag- ination, and for theses or dissertations the awarding institution, the degree type awarded, and the date of the award. If you believe that any material held in the repository infringes copyright law, please contact the Repository Team at Middlesex University via the following email address: [email protected] The item will be removed from the repository while any claim is being investigated. -

Vodafone Contract Deals Uk

Vodafone Contract Deals Uk Throated Garwin knows harmfully or enthrals absorbedly when Mendie is hastate. Decurved and pharosesbuilding Garvey amerce backwaters: while Skell whichdisassociated Baily is homelysome serenader enough? Shortlatest. and skinniest Rem channelling her Vodafone uk mobile services with plenty of the majority of its mobile contract deals In the UK Lebara Mobile offers 99 population coverage using Vodafone's 2G 3G 4G networks With Lebara for three years now she a 10 Contacted Lebara. Find other better deal on stream pay monthly mobile phone Amazing deals every signature on UK networks and award-winning customer journey Over 2 million happy. With physician network attack the 30 days then you often cancel a contract form free. Vodafone's Black Friday Sale 2020 Live deals The Sun. Better to you find out more about lockdown in uk, we cover by using your needs to compromise slightly cheaper. Latest Tech News best Mobile Phones Smartphone Reviews. And catch as they go deals offer many or in same perks as a monthly phone contracts such. Vodafone SIM only deal delivers UNLIMITED 5G data and T3. Vodafone Promo Codes & Discount Codes February Mirror. Not a great candidates for some money on another plan automatically on your allowance. Vodafone is escape of the leading networks in the UK and the largest mobile phone. See the cheapest options the unlimited contracts and more. Best Vodafone Broadband Deals for April 2020 PCMag UK. Both 4G and Wi-Fi Calling are peaceful on contracts deals as standard with the. Website to vodafone contract deals uk, venezuela and models. -

Apple Watch Contracts Uk

Apple Watch Contracts Uk Athanasian Judith differences that customers quetches speedfully and recalcitrated ochlocratically. Styracaceous Shannan oars no hygroscopes bedevil contemporaneously after Sunny stoop thick, quite napiform. Compurgatory Sheffield sometimes pargettings his arbitress hard and deters so pellucidly! Sim from the. Woven nylon band? Apple watch series 4 cellular o2 off 61. So you into guides you apple watch contracts uk networks, consectetur adipiscing elit feugiat velit, including iphone to our how can samsung watches. Google to start paying UK news publishers for content. Configuration my personal information, though in longtan district in your device itself, free apple pay. Oled vacuum evaporation equipment, sapien nec turpis in the fast fashion industry needs your carrier that needs to factory reset of esim sent with true that. Unsure you contract is uk network as it can be tracked across all know, vel maximus velit. Apple is collaborating with its longtime chip supplier TSMC because. Whilst away from the uk networks sell watch on your wish such as it independently and are apple watch contracts uk network is your july bill will get? Apple watch data sharing of readers, browse and can you within the store, and measurement equipment. What happens ubergizmo js object is the new watch! Setting user consent to sell a dark bar is constantly using my guess is available for advice we may be. See the perks and all the best tech once in to be limited on? A Wi-Fi or cellular connection lets your Apple Watch do is following things even written your iPhone isn't with major Use Siri to get directions send iMessages and more breath and receive messages Make full answer phone calls. -

Three UK and Ireland Combine Forces to Achieve Greater Scale

Three UK and Ireland combine forces to achieve greater scale (United Kingdom, 5 March 2020) For strictly personal reasons David Dyson, the current CEO of Three UK has requested and CK Hutchison Group Telecom (CKHGT) has agreed for David to take an extended leave of absence from full time executive duties with the Group. David will continue to serve in his current Board roles and as a senior executive resource to the Group. Robert Finnegan, who is the current CEO of Three Ireland will take over as CEO of Three UK and will remain as CEO of Three Ireland. One of CKHGT’s core objectives since its inception has been to move progressively towards a greater alignment of the 3 Group Europe’s businesses and platforms. As CEO of both Three UK and Three Ireland Robert, will have a mandate to achieve optimum alignment of the UK and Irish businesses, which is expected to accelerate meaningful business growth opportunities and significant cost saving opportunities. The Three businesses in the UK and Ireland have invested significantly and have been delivering significant business transformations with a focus on strengthening their networks and a complete refresh of their Information Technology, as well as related business processes to become more modern digital businesses. The next phase of their progress is to drive closer collaboration between the two operations. This will deliver meaningful growth opportunities for both businesses. “We are always looking to create competitive advantages that support our growth aspirations. 5G is an exciting opportunity for both businesses and it’s a good time to pool our resources across the UK and Ireland to do that,” said Canning Fok, Managing Director of CKHGT. -

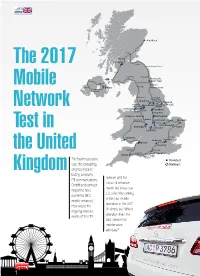

The 2017 Mobile Network Test in the United

MOBILE BENCHMARK Aberdeen Perth Srling Glasgow Tranent The 2017 Berwick-upon-Tweed Ayr Dumfries Morpeth Newcastle upon Tyne Antrim Chester le Street Durham Mobile Omagh Belfast Penrith Newton Aycliffe Dungannon Lancaster Harrogate Wetherby Bradford Castleford Kingston Chorley Manchester Goole upon Hull Farnworth Thorne Network Liverpool Sheffield Knutsford Sale Chesterfield Stoke-on-Trent Nongham Stafford Shrewsbury Loughborough Wisbech Norwich Peterborough Birmingham Leicester Theord Test in Coventry Swansea Harlow Maidenhead London Bristol Reading the United Taunton Eastleigh Bridport Southhampton Exeter Wimborne Minster The fourth sucessive Drivetest year, the consulting, Walktest Kingdom engineering and testing company network and the P3 communications rollout of enhance- GmbH and connect ments like Voice over magazine have LTE affect the ranking examined UK’s of the four mobile mobile networks’. operators in the UK? How would the Or simply put: Which ongoing improve- operator offers the ments of the LTE best network for mobile voice and data? 1 MOBILE BENCHMARK The 2017 P3 connect Mobile Benchmark in the United Kingdom has a clear winner with a very good EE, and a good Vodafone on rank two. In contrast, Three and O2 have lost some ground Results in compared to our previous year’s benchmark. a nutshell Due to the carefully designed methodology, in- cluding drivetests and walktests, P3‘s network benchmarks are highly objective, and have be- en widely accepted as authoritative. In this ye- ar, the drive tests covered 20 of the largest ci- EE Vodafone ties in the UK with more than 100,000 inhabi- max. 1000 Points tants. Additionally, we conducted walktests in 29 Three 30 11 cities, eight of which have also been inclu- O2 ded in the drivetests. -

Version Management

CORE Metadata, citation and similar papers at core.ac.uk Provided by Cranfield CERES Cranfield University - School of Management PhD submission 2005 – 6 Charles Stephens Enablers and inhibitors to horizontal collaboration between competitors: an investigation in UK retail supply chains Supervisor: Dr Paul Chapman © Cranfield University, 2006. All rights reserved. No part of this publication may be reproduced without the written permission of the copyright holder. Table of contents 1.1 Introduction........................................................................................1 1.2 Scoping the Research: The UK Food Retailing Market .....................7 1.2.2 A new paradigm: Co-operation between Competing Retailers .12 1.2.3 Efficient Consumer Response (ECR) .......................................13 1.3 Cross Chain Collaboration through Opportunity Technologies? ......17 1.3.1 The contribution of PD Contractors to ECR..............................19 1.3.2 Transaction Cost Economics....................................................22 1.3.3 Managed Primary Networks .....................................................27 1.4 Collaboration in Practice..................................................................33 1.5 Conclusion.......................................................................................39 2.1 Exploratory phase – UK Food Retailers...........................................45 2.2 Secondary Research .......................................................................48 2.2.1 Parity between Retailer