Midea Group Co., Ltd. the 2017 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

12.203 MB (Pdf)

CSR Compilation Instructions What this report is about This report is, in principle, about Midea Group Co., Ltd. and its subsidiaries. It will be specifically noted in the report if it reports on any entities that are outside Midea Group. For easy expression, all of the terms "Midea Group", "the Company" and "we" in the report refer to "Midea Group Co., Ltd.". Reporting period This report includes the economic, environmental and social activities of Midea Group during 2017 (from January 1 to December 31, 2017), as well as some of the previous or recent related activities. Date of publication March 31, 2018 (the next report is expected to be published in March 2019). Principles for disclosure In the process of selecting contents for the report, Midea Group follows the principles of importance, completeness and comparability of the G3 guidelines proposed by the Global Reporting Initiative, and the report presents information on the economy, society, and environment, focusing on Midea Group’s responsibility for sustainable development on its products, the environment, its staff and business partners, etc. The indicators in this report cover all entities that are effectively controlled or significantly influenced by the Company on financial matters, operational policies and measures, which are consistent with the scope covered by the annual report of the Company. Subject to various objective conditions, the report may not be prepared in a satisfactory manner, but the Company will continue to improve the report in content and format, and publish such a corporate social responsibility (CSR) report every year. Data collection In order to effectively collect data on the work and achievements of each subsidiary regarding the economy, environment, and society in 2017, the data collection was conducted in accordance with the existing work process of the Company. -

Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd

Page 1 of 4 Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd. - Class A 9,230 $ 120,977 Wens Foodstuffs Group Co Ltd. - Class A 4,660 15,857 136,834 Auto Manufacturers - 0.7% SAIC Motor Corp Ltd. - Class A 24,600 64,077 Banks - 23.7% Agricultural Bank of China Ltd. - Class H 352,300 163,039 Bank of China Ltd. - Class H 193,900 92,512 Bank of Communications Co Ltd. - Class A 184,100 125,556 China CITIC Bank Corp Ltd. - Class H 24,700 18,261 China Construction Bank Corp. - Class H 81,500 71,464 China Everbright Bank Co Ltd. - Class H 126,400 68,456 China Merchants Bank Co Ltd. - Class A 108,200 539,489 China Minsheng Banking Corp Ltd. - Class A 254,300 201,851 Industrial & Commercial Bank of China Ltd. - Class A 198,400 140,993 Industrial Bank Co Ltd. - Class A 127,400 285,849 Ping An Bank Co Ltd. - Class A 75,000 143,348 Shanghai Pudong Development Bank Co Ltd. - Class A 132,300 196,379 2,047,197 Beverages - 17.9% Jiangsu Yanghe Brewery Joint-Stock Co Ltd. - Class A 4,000 77,398 Kweichow Moutai Co Ltd. - Class A 4,000 961,777 Wuliangye Yibin Co Ltd. - Class A 16,200 504,835 1,544,010 Building Materials - 1.6% Anhui Conch Cement Co Ltd. - Class H 15,900 139,921 Coal - 0.5% China Shenhua Energy Co Ltd. -

Kweichow Moutai Growth Declines on Slow Deliveries

CHINA DAILY Tuesday, October 30, 2018 BUSINESS 17 Kweichow Moutai growth Execs optimistic on import expo By WANG YING in Shanghai products, their know-how, “Shanghai has become a [email protected] and how interesting they are vital center for advanced as a company,” said Brian technology leadership — for Top multinational corpora- Duperreault, president, CEO ABB and the world ... We will tions’ executives have and director of finance cor- make full use of the city’s declines on slow deliveries expressed their enthusiasm poration American Interna- existing advantages and for the first China Internation- tional Group Inc. make clear the main challen- al Import Expo set to launch According to Severin ges facing Shanghai, focus Share price of on Nov 5, as part of the nation’s Schwan, CEO of Roche Group, support policies on measures efforts to expand opening-up. the pharmaceuticals giant that can address the challen- liquor maker slips While attending the 30th will showcase its cutting-edge ges, and develop specific but consumption International Business Lead- technology at the import plans and solutions,” Spies- ers’ Advisory Council, held expo, covering early research shofer said, explaining the upgrades to buoy annually in Shanghai, busi- and development, integrated company’s rationale. ness leaders said they are diagnosis and treatment solu- “We are not only seeing future prospects optimistic about China’s tions, and personalised progress in Shanghai’s reform opening-up policy and new healthcare offerings. and opening-up, but we at By ZHU WENQIAN in Beijing opportunities. Roche are taking an active role and YANG JUN in Guiyang “The import expo is in the development of China’s unprecedented in China for biomedical industry. -

Midea Group IR Presentation 2017.02

Midea Group IR presentation 2017.02 1 Corporate Snapshot 2 Milestones Successful transition into a multi-product and global industry leader 3 Return to Shareholders Stable dividend distribution to shareholders every year RMB Bn 4 Overview Leading Technology Group in consumer appliances, HVAC, robotics and automation systems FY 2015 Export to Ranked Credit ratings $22 billion 200+ 481st A-/A3/A- Revenue Countries/Regions Fortune 2016 S&P/Moody’s/Fitch # 1 Global Home Appliances Player by Revenue Market Cap and rankings 2015 Revenue,FY 2015, US$ US$ Bn Bn Market cap: ~ RMB 200bn Ranking among A-share companies: 26 + Ranking among A-share companies (excl. financial and energy companies):4 Ranking among Shenzhen stock exchange: 2 5 Product Portfolio Major Domestic Kitchen Appliances General SDA Residential A/C Appliances Commercial A/C Products Split A/C Hood Electric Oven Side by Side French Doors Chillers Rice Cooker Kettle Refrigerator Refrigerator VRF Range Cooktop Standing A/C Freezer In-line Water Heater Juicer Heater Microwave Movable A/C Roof-top Central A/C Dish Smart Washing Washing Washer System Fan Water Machine Machine Mini VRF Purifier Key Components Vacuum Electric HVAC and Magnetron Electronic Cleaner A/C and REF U.S. Ducted Compressor Motor Appliance Motor Controller Robotics & Industrial Automation 6 Market Position Induction Microwave Pressure Water Residential Water Vacuum Rice Cooker Kettle Washer Refrigerator Hoods Gas Stove Cooker Oven Cooker Purifier AC Heater Cleaner No.1 No.2 No.1 No.1 No.1 No.1 No.2 No.2 No.3 No.3 -

China Weigao Reducer Success Case (Large Enterprise Version) Serial Company Name Serial Company Name

China Weigao reducer success case (large enterprise version) serial Company Name serial Company Name 1 Shanghai Automobile Group Co., Ltd. 231 Chongqing Textile Holding (Group) Company 2 Dongfeng Motor Corporation 232 Aoyang Group Co., Ltd. 3 Huawei Investment Holdings Co., Ltd. 233 Guangxi Shenglong Metallurgy Co., Ltd. 4 China Ordnance Equipment Group Corporation 234 Lingyuan Iron and Steel Group Co., Ltd. 5 China Minmetals Corporation 235 Futong Group Co., Ltd. 6 China FAW Group Corporation 236 Yongfeng Group Co., Ltd. 7 China Ordnance Industry Corporation 237 Shandong Taishan Iron and Steel Group Co., Ltd. 8 Beijing Automobile Group Co., Ltd. 238 Xinjiang Zhongtai (Group) Co., Ltd. 9 Shandong Weiqiao Venture Group Co., Ltd. 239 Guangdong Haida Group Co., Ltd. 10 China Aviation Industry Corporation 240 Jiangsu Yangzijiang Shipbuilding Group Corporation 11 Zhengwei International Group Co., Ltd. 241 Shenzhen Oufeiguang Technology Co., Ltd. 12 China Baowu Iron and Steel Group Co., Ltd. 242 Dongchen Holding Group Co., Ltd. 13 Lenovo Holdings Co., Ltd. 243 Xinjiang Goldwind Technology Co., Ltd. 14 China National Chemical Corporation 244 Wanji Holding Group Co., Ltd. 15 Hegang Group Co., Ltd. 245 Tsingtao Brewery Co., Ltd. 16 China Shipbuilding Industry Corporation 246 Tasly Holding Group Co., Ltd. 17 Guangzhou Automobile Industry Group Co., Ltd. 247 Wanfeng Auto Holding Group Co., Ltd. 18 Aluminum Corporation of China 248 Wuhan Institute of Posts and Telecommunications 19 China National Building Material Group Co., Ltd. 249 Red Lion Holdings Group Co., Ltd. 20 Hengli Group Co., Ltd. 250 Xinjiang Tianye (Group) Co., Ltd. 21 CRRC Corporation Limited 251 Juhua Group Company 22 Xinxing Jihua Group Co., Ltd. -

Wuxi Little Swan Company Limited

2014 Annual Report of Wuxi Little Swan Company Limited Wuxi Little Swan Company Limited 2014 Annual Report March 2015 1 2014 Annual Report of Wuxi Little Swan Company Limited Section I. Important Reminders, Catalogue & Explanation The Board of Directors, the Supervisory Committee as well as all directors, supervisors and senior management staff of Wuxi Little Swan Company Limited (hereinafter referred to as ―the Company‖) warrant that this report is factual, accurate and complete without any false record, misleading statement or material omission. And they shall be jointly and severally liable for that. All directors attended the board session for reviewing this report. The Company‘s profit distribution preplan upon review and approval of this board session: Based on the total shares of the Company as at 31 Dec. 2014, a cash dividend of RMB 4.50 (tax included) will be distributed for every 10 shares held by shareholders. No bonus shares will be granted and no capital reserve will be turned into share capital. Mr. Fang Hongbo, chairman of the board, Mr. Sun Yunan, CFO, and Mr. Zhong Fangliu, chief of the accounting organ (chief of accounting), hereby confirm that the Financial Report enclosed in this report is factual, accurate and complete. This report involves futures plans and some other forward-looking statements, which shall not be considered as virtual promises to investors. Investors are kindly reminded to pay attention to possible risks. This report is prepared in both Chinese and English. Should there be any discrepancy between the two versions, the Chinese version shall prevail. 2 2014 Annual Report of Wuxi Little Swan Company Limited Catalogue Section I. -

GMO Trust Semiannual Report August 31, 2020

GMO Trust Semiannual Report August 31, 2020 Climate Change Fund Cyclical Focus Fund Emerging Domestic Opportunities Fund Emerging Markets Fund International Equity Fund Quality Fund Resources Fund Risk Premium Fund Tax-Managed International Equities Fund U.S. Equity Fund U.S. Small Cap Value Fund Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, GMO expects that paper copies of each Fund’s annual and semiannual reports to shareholders will no longer be sent by mail, unless you specifically request paper copies of the reports by writing or calling GMO Shareholder Services at the address or phone number below or by contacting your financial intermediary, such as a broker or agent. Instead, reports will be available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you are a direct investor, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting GMO Shareholder Services or if you own your shares through a financial intermediary, you may contact your financial intermediary. Beginning January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request to continue to receive paper copies of your shareholder reports or you can follow instructions included with this disclosure. -

Press Release

Hang Seng Indexes Company Launches Hang Seng New Consumption Index and Hang Seng Shanghai-Shenzhen-Hong Kong New Consumption Index Investable Indexes to Reflect Performances of Stocks in Traditional and Online Consumption Sectors (Hong Kong, 26 July 2021) Hang Seng Indexes Company today launched the Hang Seng New Consumption Index and Hang Seng Shanghai-Shenzhen-Hong Kong New Consumption Index. With a series of policies put forward by mainland China recently to focus on facilitating Internet+ and e-commerce, China will likely see a new growth in the consumption sector driven by these policies in the coming years. Meanwhile, the two new indexes are designed by Hang Seng Indexes Company to capture the full picture of listed companies in traditional consumption sectors (i.e., consumer discretionary and consumer staples) as well as online consumption sectors such as e-commerce, online/mobile gaming, media streaming and healthcare retail amid the shifting megatrends in consumption patterns in China. The Hang Seng New Consumption Index covers Hong Kong-listed Greater China companies; while the Hang Seng Shanghai-Shenzhen-Hong Kong New Consumption Index is a cross-market index, covering Mainland-listed A shares and Hong Kong-listed shares that are eligible for southbound trading under the Stock Connect Scheme. Daniel Wong, Director & Chief Index Officer at Hang Seng Indexes Company, said: “According to China’s National Bureau of Statistics, online retail sales amounted to RMB11.76 trillion in 2020, representing an increase of 10.9% compared with 20191, indicating that the rise of China’s technology-driven consumption brands and development of e-commerce are catalysing the transformation of China’s consumption model to weigh more on online consumption. -

Midea Group (000333

2 Sep 2020 CMB International Securities | Equity Research | Company Update Midea Group (000333 CH) BUY (Maintain) Outperformer during sector turnaround Target Price RMB86.57 (Previous TP RMB72.80) 2Q20 was highly resilient for Midea and we are more positive on 2H20E given a Up/Downside +20.7% less promotional environment and strong export orders outlook. Therefore, we Current Price RMB71.70 maintain BUY and lifted TP to RMB 86.57, based on 20x FY21E P/E (up from 17x FY20E), vs China/ Int’l peers’ avg. of 22x/ 18x. China Home Appliance Sector 1H20E results slight beat. Midea sales/ net profit att. declined by 10%/ 8% YoY to RMB 136.1bn/ 13.9bn in 1H20, above BBG’s est. by 2%/ 9%. We Walter Woo attributed the beat to better-than-expected exports and cost control in 2Q20. (852) 3761 8776 3.9ppt reduction of GP margin to 25.6% in 1H20 was due to: 1) change in [email protected] accounting standard and 2) relocating of installation fees to COGS (from selling expenses). GP margin would have fallen by only 1ppt after adjustments. Stock Data Rapid turnaround in 2Q20, where A.C. and fridge outperformed. Midea Mkt Cap (RMB mn) 503,463 resumed a 3% YoY sale growth in 2Q20, from 23% drop in 1Q20. A healthy Avg 3 mths t/o (RMB mn) 1,846.85 pick up in domestic and resilient overseas was also seen in 2Q20, where sales 52w High/Low (RMB) 74.74/46.30 growth for both A.C./ fridge accelerated to 8%/ 15% in 2Q20 (vs -10%/ 3% in Total Issued Shares (mn) 7,021.8 Source: Bloomberg 1Q20) and sales decline for washing machines/ small appliances also narrowed to 8%/ 5% in 2Q20 (vs -15%/ -10% in 1Q20). -

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms -

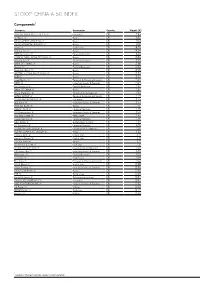

Stoxx® China a 50 Index

STOXX® CHINA A 50 INDEX Components1 Company Supersector Country Weight (%) PING AN INSUR GP CO. OF CN 'A' Insurance CN 7.93 Ind Bank 'A' Banks CN 5.82 CHINA MERCHANTS BANK 'A' Banks CN 5.13 CHINA MINSHENG BANKING 'A' Banks CN 4.91 Vanke 'A' Real Estate CN 4.76 Pudong Dev 'A' Banks CN 4.64 CITIC Securities 'A' Financial Services CN 3.25 AGRICULTURAL BANK OF CHINA 'A' Banks CN 2.84 Haitong Sec 'A' Financial Services CN 2.73 BANK OF COMMS.'A' Banks CN 2.66 Moutai 'A' Food & Beverage CN 2.60 Everbright Bank 'A' Banks CN 2.58 INDSTRL & COML.BK.OF CHINA 'A' Banks CN 2.29 BOB 'A' Banks CN 2.27 Gree Electric 'A' Personal & Household Goods CN 2.04 CRRC 'A' Industrial Goods & Services CN 2.04 Yili Company 'A' Food & Beverage CN 1.92 BANK OF CHINA 'A' Banks CN 1.84 China State Con 'A' Construction & Materials CN 1.83 MIDEA GROUP 'A' Personal & Household Goods CN 1.79 CHINA PAC.IN.(GROUP) 'A' Insurance CN 1.75 BOE Tech 'A' Industrial Goods & Services CN 1.67 PING AN BANK 'A' Banks CN 1.61 ORIENT SECS.'A' Financial Services CN 1.56 CN Shipbuilding 'A' Industrial Goods & Services CN 1.50 Poly Real Estate 'A' Real Estate CN 1.47 Huatai Security 'A' Financial Services CN 1.36 SAIC Motor 'A' Automobiles & Parts CN 1.35 GF Securities 'A' Financial Services CN 1.28 CHINA RAILWAY GROUP 'A' Construction & Materials CN 1.26 SUNING COMMERCE GROUP 'A' Retail CN 1.22 Hengrui Medi 'A' Health Care CN 1.17 Kangmei Pharm 'A' Health Care CN 1.17 Hua Xia Bank 'A' Banks CN 1.17 CHINA PTL.& CHM.'A' Oil & Gas CN 1.11 CHINA RAILWAY CON.'A' Construction & Materials CN 1.07 -

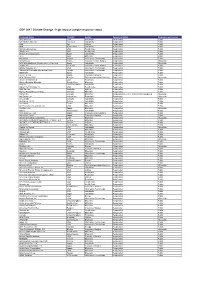

Grid Export Data

CDP 2017 Climate Change - high-impact sample response status Company Name Country Sector Response Status Response permission 3M Company USA Industrials Responded Public A.P. Moller - Maersk Denmark Industrials Responded Public A2A Italy Utilities Responded Public ABB Switzerland Industrials Responded Public Abbott Laboratories USA Health Care Responded Public AbbVie Inc USA Health Care Responded Public Abertis Infraestructuras Spain Industrials Responded Public ACC India Materials Responded Public Accenture Ireland Information Technology Responded Public AccorHotels France Consumer Discretionary Responded Not public ACS Actividades de Construccion y Servicios Spain Industrials Responded Not public adidas AG Germany Consumer Discretionary Responded Public Adobe Systems, Inc. USA Information Technology Responded Public Advanced Semiconductor Engineering Taiwan Information Technology Responded Public AENA SA Spain Industrials Responded Public Aeon Co., Ltd. Japan Consumer Staples Responded Public AFK Sistema JFSC Russia Telecommunication Services Responded Not public AFLAC Incorporated USA Financials Responded Public African Rainbow Minerals South Africa Materials Responded Public Aggreko United Kingdom Industrials Responded Public Agilent Technologies Inc. USA Health Care Responded Public AGL Energy Australia Utilities Responded Public Agnico-Eagle Mines Limited Canada Materials Responded Public Agrium Inc. Canada Materials Responded late, after analysis was completed Not public AIA Group Ltd. Hong Kong Financials Responded Not public Air Canada Canada Industrials Responded Public Air France - KLM France Industrials Responded Public Air Liquide France Materials Responded Public Air Products & Chemicals, Inc. USA Materials Responded Public Air Water Inc. Japan Materials Responded Not public Airbus Netherlands Industrials Responded Public Aisin Seiki Co., Ltd. Japan Consumer Discretionary Responded Public Ajinomoto Co.Inc. Japan Consumer Staples Responded Public AK Steel Holding Corporation USA Materials Responded Not public AKÇANSA ÇİMENTO SANAYİ VE TİCARET A.Ş.