CHINA EVERBRIGHT ENVIRONMENT GROUP LIMITED 中國光大環境(集團)有限公司 (Incorporated in Hong Kong with Limited Liability) (Stock Code: 257)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LEAGUE TABLES Q1 2020 Preliminary As of 25 March 2020 Q1 2020 PRELIMINARY AS of 25 MARCH 2020

GLOBAL EQUITY CAPITAL MARKETS LEAGUE TABLES Q1 2020 Preliminary As of 25 March 2020 Q1 2020 PRELIMINARY AS OF 25 MARCH 2020 MANAGER RANKINGS GLOBAL EQUITY, EQUITY LINKED & RIGHTS CONTENTS Bloomberg’s global equity offerings database consists of nearly 87,000 deals (with approximately 43,000 IPOs and over 43,000 additional offerings), and coverage of more than 1. Global market review 500 financial advisors and 500 legal advisors. 2. US market review LEAG<GO> for a full range of league tables 3. Canada market review IPO<GO> for Bloomberg’s equity offerings product 4. Latin America market review Due to the dynamic nature of the Professional Service product, league table rankings may vary between 5. EMEA market review this release and data found on the Bloomberg Professional Service. 6. Asia market review 7. Table criteria DATA SUBMISSIONS AND QUERIES Contact Phone Email North America Larisa Bykova +1 646 324 2355 [email protected] EMEA Dimitri Quemard +44 20 3525 0253 [email protected] Asia-Pacific Zhen Hao Toh +65 6499 2931 [email protected] © 2020 Bloomberg Finance L.P. All rights reserved. Bloomberg Preliminary Global Equity | Q1 2020 Global Equity, Equity Linked & Rights: Industry Breakdown Global Equity Review 8% Financials 22% Q1 2020 credited Global Equity, Equity Linked & Rights volume decreased 3.11% to USD 128.6 Bln while deal count 5% 22% Health Care 18% decreased 8.94% to 906 offerings year-on-year. Global Equity IPO volume increased 73.37% year-on-year to USD 32.2 Bln 6% Consumer Discretionary 16% while the deal count decreased 0.40% to 247. -

Schedule of Investments (Unaudited) Ishares MSCI Total International Index Fund (Percentages Shown Are Based on Net Assets) September 30, 2020

Schedule of Investments (unaudited) iShares MSCI Total International Index Fund (Percentages shown are based on Net Assets) September 30, 2020 Mutual Fund Value Total International ex U.S. Index Master Portfolio of Master Investment Portfolio $ 1,034,086,323 Total Investments — 100.4% (Cost: $929,170,670) 1,034,086,323 Liabilities in Excess of Other Assets — (0.4)% (3,643,126) Net Assets — 100.0% $ 1,030,443,197 iShares MSCI Total International Index Fund (the “Fund”) seeks to achieve its investment objective by investing all of its assets in International Tilts Master Portfolio (the “Master Portfolio”), which has the same investment objective and strategies as the Fund. As of September 30, 2020, the value of the investment and the percentage owned by the Fund of the Master Portfolio was $1,034,086,323 and 99.9%, respectively. The Fund records its investment in the Master Portfolio at fair value. The Fund’s investment in the Master Portfolio is valued pursuant to the pricing policies approved by the Board of Directors of the Master Portfolio. Fair Value Hierarchy as of Period End Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows: • Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access • Level 2 – Other observable inputs (including, but not limited to, quoted prices -

League Tables

GLOBAL EQUITY CAPITAL MARKET LEAGUE TABLES Q1 2016 Q1 2016 MANAGER RANKINGS GLOBAL EQUITY, EQUITY LINKED & RIGHTS CONTENTS Bloomberg’s global equity offerings database consists of nearly 87,000 deals (with approximately 43,000 IPOs and over 43,000 additional offerings), and coverage of more than 500 financial advisors 1. Global market review and 500 legal advisors. 2. US market review LEAG<GO> for a full range of league tables 3. Canada market review IPO<GO> for Bloomberg’s equity offerings product 4. Latin America market review 5. EMEA market review Due to the dynamic nature of the Professional Service product, league table rankings may vary between this release 6. Asia market review and data found on the Bloomberg Professional Service. 7. Table criteria DATA SUBMISSIONS AND QUERIES Contact Phone Email North America Elizabeth Entrup +1 646 324 4666 [email protected] Irina Arefyeva +1 646 324 4663 [email protected] EMEA Karan Aswani +44 20 3525 4331 [email protected] Asia Pacific Billy Sun +886 2 7719 1571 [email protected] © 2015 Bloomberg Finance L.P. All rights reserved. Global Equity, Equity Linked & Rights: Industry Breakdown Global Equity Review Technology 27% 11% Financials 18% Q1 2016 credited Global Equity, Equity Linked & Rights volume decreased 56.27% to USD 102.5 Bln while deal 5% 27% count decreased 42.90% to 627 offerings year-on-year. Global Equity IPO volume decreased 65.23% year-on- 6% Energy 16% year to USD 14.1 Bln while the deal count decreased 36.23% to 176. Global Equity Linked volume decreased Health Care 9% 41.99% year-on-year to USD 15.8 Bln over 61 deals. -

Everbright Securities Company Limited 光大證券股份有限公司 (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 6178)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Everbright Securities Company Limited 光大證券股份有限公司 (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 6178) ANNOUNCEMENT OF annual RESULTS FOR THE YEAR ENDED DECEMBER 31, 2018 The board of directors (the “Board”) of Everbright Securities Company Limited (the “Company”) hereby announces the audited annual results of the Company and its subsidiaries (the “Group”) for the year ended December 31, 2018. This announcement, containing the full text of the 2018 annual report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcement of annual results. The Group’s final results for the year ended December 31, 2018 have been reviewed by the audit committee of the Company. This results announcement will be published on the website of The Stock Exchange of Hong Kong Limited (www.hkexnews.hk) and the Company’s website (www.ebscn.com). The Company’s 2018 annual report will be dispatched to the holders of H shares of the Company and published on the websites of The Stock Exchange of Hong Kong Limited and the Company in due course. -

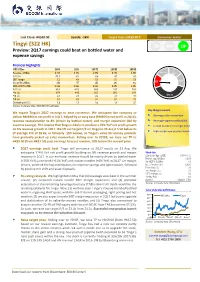

Tingyi (322 HK) up MP OP Preview: 2Q17 Earnings Could Beat on Bottled Water and Expense Savings

Last Close: HK$10.92 Upside: -18% Target Price: HK$9.00↑ Consumer Sector Tingyi (322 HK) UP MP OP Preview: 2Q17 earnings could beat on bottled water and expense savings Financial Highlights Y/E 31 Dec 2015 2016 2017E 2018E 2019E LT Revenue (US$m) 9,103 8,372 8,756 9,154 9,580 Neutral BUY YoY (%) -11.1 -8.0 4.6 4.5 4.7 EBIT margin 5.2 4.8 5.1 5.3 5.6 SELL BUY Net profit (US$m) 256 177 245 280 332 Diluted EPS (US$) 0.046 0.032 0.044 0.050 0.059 YoY (%) -35.9 -30.9 38.5 14.1 18.7 P/E (x) 30.8 44.6 32.2 28.2 23.8 P/B (x) 2.0 2.3 2.2 2.0 1.9 Stock P/S (x) 0.9 0.9 0.9 0.9 0.8 Dividend yield (%) 1.6 1.1 1.6 1.8 2.1 Source: Company data, BOCOM Int’l estimates Key things to watch We expect Tingyi’s 2Q17 earnings to beat consensus. We anticipate the company to deliver RMB361m net profit in 2Q17, helped by an easy base (RMB76m net profit in 2Q16), Beverage sales momentum revenue reacceleration to 8% (driven by bottled water), and margin expansion (led by Beverage segment profitability expense savings). This implies that Tingyi is likely to produce a 76% YoY net profit growth Instant noodle EBIT margin trend on 6% revenue growth in 1H17. We lift our target P/E on Tingyi to 23.4x (-0.5 SD below its High-margin new product launch LT-average P/E of 26.0x, vs formerly -1SD below), as Tingyi’s value-for-money products have gradually picked up sales momentum. -

Everbright Securities Company Limited

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect about this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Everbright Securities Company Limited, you should at once hand this circular, together with the form of proxy and reply slip that have been despatched to you, to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was affected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. Everbright Securities Company Limited 光大證券股份有限公司 (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock code: 6178) (1) 2019 Report of the Board of Directors (2) 2019 Report of the Supervisory Committee (3) 2019 Annual Report and its summary (4) 2019 Profit Distribution Plan (5) Proposal of Expected Ordinary Related Party/Connected Transactions in 2020 (6) Proposal of Proprietary Trading Businesses Scale in 2020 (7) Proposal of Amendments to the Articles of Association (8) Independent Directors’ Annual Work Report for 2019 (Non-voting matter) and (9) Notice of AGM The 2019 Annual General Meeting (“AGM”) of Everbright Securities Company Limited (the “Company”) will be held at 2:30 p.m. -

MPF All-World

2 FTSE Russell Publications 19 August 2021 FTSE MPF All-World Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 1&1 AG <0.005 GERMANY Agilent Technologies 0.07 USA Alumina <0.005 AUSTRALIA 360 Security (A) (SC SH) <0.005 CHINA AGL Energy 0.01 AUSTRALIA Aluminum Corp of China (A) (SC SH) <0.005 CHINA 3i Group 0.02 UNITED Agnico Eagle Mines 0.02 CANADA Aluminum Corp of China (H) <0.005 CHINA KINGDOM Agricultural Bank of China (A) (SC SH) 0.01 CHINA Amada <0.005 JAPAN 3M Company 0.18 USA Agricultural Bank of China (H) 0.02 CHINA Amadeus IT Group SA 0.05 SPAIN 3M India <0.005 INDIA Ahold Delhaize 0.05 NETHERLANDS Amano Corp <0.005 JAPAN 3SBio (P Chip) <0.005 CHINA AIA Group Ltd. 0.23 HONG KONG Amazon.Com 2.28 USA A P Moller - Maersk A 0.02 DENMARK AIB Group <0.005 IRELAND Ambev SA 0.02 BRAZIL A P Moller - Maersk B 0.03 DENMARK Aica Kogyo <0.005 JAPAN Ambu A/S 0.01 DENMARK a2 Milk 0.01 NEW ZEALAND Aier Eye Hospital Group (A) (SC SZ) 0.01 CHINA Ambuja Cements <0.005 INDIA A2A <0.005 ITALY Ain Pharmaciez <0.005 JAPAN Amcor CDI 0.03 AUSTRALIA AAC Technologies Holdings 0.01 HONG KONG Air China (A) (SC SH) <0.005 CHINA Amdocs 0.02 USA Aalberts NV 0.01 NETHERLANDS Air China (H) <0.005 CHINA Ameren Corp 0.03 USA ABB 0.09 SWITZERLAND Air Liquide 0.12 FRANCE America Movil L 0.03 MEXICO ABB India <0.005 INDIA Air New Zealand <0.005 NEW ZEALAND American Airlines Group 0.01 USA Abbott Laboratories 0.31 USA Air Products & Chemicals Inc -

Eligible Assets and Credit-To-Asset Ratio for Secured Credit

Eligible Assets and Credit-to-asset Ratio for Secured Credit Effective from 30 Sep 2021 List of Eligible Assets (Excluding Stocks) Asset Types Credit-to-asset Ratio HKD Time Deposits 100% Foreign Currency Time or Saving Deposits 85% Deposit Plus 70% Structured Investment Deposits (Including Capital Protected Investment Deposits) 70% Unit Trusts*/Bonds*#/Certificates of Deposit/Equity Link Notes/Equity Link Investment with Product Risk Level 1 70% Product Risk Level 2 70% Product Risk Level 3 50% Product Risk Level 4 30% Product Risk Level 5 – *exclude the Non-eligible Products listed below. #For new bonds issued on or after 17 Mar 2020, the timeline for assignment of Credit -to-asset Ratio for Secured Credit Facility will be revised follow: for new bonds issued between 1 Jan to 30 Jun each year, Credit-to-asset Ratio will be assigned in Sep of the same year (where applicable); for new bonds issued between 1 Jul to 31 Dec, Credit-to-asset Ratio will be assigned in Mar of next year (where applicable); Please refer to the relevant bond term sheet or the bond details in our website for the issue date of the relevant bond. Gold 0% (Credit-to-asset Ratio for Gold (Wayfoong Statement Gold) is removed from 20 Dec 2019) List of Non-eligible Products (Capital in Nature Instruments and Other TLAC-eligible Instruments, Hedge Funds, Liquid Alternative Funds are not eligible) Product Type Bond / Fund Code Bond / Fund Name Bonds US404280AN99 HSBC HOLDINGS PLC 4% USD BOND 3/30/2022 Bonds US404280AL34 HSBC HOLDINGS PLC 4.875% USD BOND 1/14/2022 Bonds -

China Equity Capital Markets Review

China Equity Capital Markets Review FIRST HALF 2019 | MANAGING UNDERWRITERS & LEGAL ADVISORS China Equity Capital Markets Review First Half 2019 | Overall Review Deals Intelligence China Equity Capital Markets Issuance - Issue Type Composition $120.0 450 CHINA EQUITY CAPITAL MARKET FALLS 14.3% FROM THE FIRST HALF OF 2018 Chinese equity and equity-related (ECM) proceeds this during the first half of 2019 reached US$66.8 billion, a 14.3% decrease from the same period last year. Total initial public offerings (IPOs) issued by China-domiciled companies raised an aggregate amount of US$19.6 400 billion, a 30.4% decline in proceeds compared to the first half of 2018, and the lowest first half period since 2016 (US$12.1 billion). $100.0 Chinese convertibles, or equity-related issuance, witnessed a record first half period and raised US$30.9 billion so far this year, up 350 110.3% from the same period in 2018. This is the highest ever semi-annual period for Chinese convertibles, in terms of proceeds, surpassing the record high set in the second half of 2017 (US$18.2 billion). Companies in the Financial sector accounted for 30.0% of $80.0 300 China's ECM issuance during the first half of 2019, up 91.0% in proceeds from a year ago. CHINESE A-SHARE ECM HITS FIVE-YEAR LOW 250 Chinese A-share ECM proceeds reached US$37.8 billion in the first half of 2019, down 3.8% compared to the same period last year. This $60.0 is the lowest first half period since 2014 (US$25.0 billion). -

Annual Report 2018

COVT ER S ORY O PPORTUNITIES IN DISRUPTION The financial markets in 2018 were dynamic with challenges and game-changing moments like a volleyball match. Steady performance, professional skills and a cohesive team are the basics and core competencies of the greatest teams as well as leading financial institutions. But to win and stand out among their peers, the team has to be responsive to changes on the court and be decisive, mastering tactics and adjusting strategies according to the environment. Building on the DNA of being STABLE and STRONG yet AGILE and INNOVATIVE, Everbright has demonstrated its capability to Master the Playbook and Embrace Opportunities in Disruption. With sound fundamentals and its out-the-box thinking, Everbright has consistently delivered winning plays. TABLE OF CONTENTS 8 Company Overview 10 2018 Business Development Highlights 14 2018 Review 26 Chairman’s Statement 28 Management Discussion and Analysis 46 Environmental, Social and Governance Report 76 Corporate Governance Report 100 Risk Management Report 108 Directors’ Report 122 Directors and Senior Management FINANCIAL SECTION 127 Independent Auditor’s Report 133 Consolidated Statement of Profit or Loss 134 Consolidated Statement of Comprehensive Income 135 Consolidated Statement of Financial Position 137 139 Consolidated Statement of Changes in Equity Notes to the Financial Statements 138 222 Consolidated Statement of Cash Flows Financial Summary 223 Particulars of Major Properties 224 Corporate Information SOLIDSOLID FUNDAMENTALS In 2018, the global economy experienced a tumultuous year with increased market uncertainties and depressed sentiment. Even in the face of a sector-wide downturn in private equity, however, China Everbright Limited’s core businesses delivered a solid performance, showcasing its core competencies in cross-border investment and asset management. -

ATC Event Series Attendee Companies - up to 19 Nov

ATC Event Series Attendee Companies - Up to 19 Nov 100 Women in Finance BPS-World 9+ Family Oce Brevan Howard Aberdeen Asset Managers Beijing BRIdata Technology Aberdeen Standard Investments Bryan Cave Leighton Paisner ACA Compliance Group BTM Global Partners LLP Advanced Custom Fields Group Bupa Active Asset Allocation BWC global growth fund Adept Advisory C Group Developments Ltd Aexam Services Capco Aliated Managers Group Capital Corise Association Française de la Gestion Financière CCB FUTURES Agricultural Bank of China CCB Life AMC American International Group CCB TRUST Aijian Secrurities CDAM (UK) Limited Albourne Partners China Europe International Exchange AG Alcova Asset Management Central China Securities Alibaba Group Cerulli Associates Allianz Changjiang Pension Insurance Allianz France Changjiang Securities Allianz Global Investors Charles Russell Speechlys LLP Alpha FMC Chatham House Alpha Real Capital Chi-Courser Investment Anthemis China Bond Insurance Corporation Armadillo Group Ltd China Central Depository & Clearing Aviva Investors China Connect Partners AXA Investment Managers China Construction Bank Balyasny Europe Asset Management LLP China Construction Bank Corporate Luxembourg Bank of Beijing Limited Shanghai Branch Branch Bank of China China Construction Bank London Ltd Bank of China Investment Management China Construction Bank Paris Branch Bank of China Paris Branch China Financial Futures Exchange Bank of Communications Financial Leasing China Futures Bank of Montreal China Huarong Asset Management Bank of Ruifeng -

The Current Pilot Details

On April 10, CSRC and SFC both announced the launch of what has been dubbed “Shanghai-Hong Kong Stock Connect”, a pilot program that aims to establish mutual stock market access between the Mainland and Hong Kong. As a form of hybrid cross-border program that combines the long-awaited QDII2 and essentially a QFII2 scheme, the implications will be wide-reaching for eligible investors on both sides of the border. Brokerage opportunities for those able to execute trades into and out of the Mainland will be particularly significant – Z-Ben Advisors urges such potentially-eligible participants to consider their strategic positioning now, in advance of the launch (expected in October). Brokerages best positioned to take advantage of Shanghai-Hong Kong Stock Connect Mainland market Mainland brokerage Brokerages’ HK subsidiaries share (%) Essence Securities Co., Ltd. Essence International Securities (Hong Kong) Limited 2.34 Caitong Securities Co.,Ltd Caitong International Securities Co., Limited 1.07 Orient Securities Co.,Ltd. Orient Securities (Hong Kong) Limited 1.47 Everbright Securities Company Limited China Everbright Securities (HK) Limited 3.11 GF Securities Co., Ltd. GF Securities (Hong Kong) Brokerage Limited 4.06 Guodu Securities Co.,Ltd. Guodu Securities (Hong Kong) Limited 0.45 Guotai Jun'An Securities Co., Ltd Guotai Junan Securities (Hong Kong) Limited 5.05 These are the only two Guosen Securities Co.,Ltd. Guosen Securities (HK) Brokerage Company, Limited 3.95 foreign-owned Guoyuan Securities Company Limited Guoyuan Securities Brokerage (Hong Kong) Limited 1.09 brokerages with two- HAITONG Securities Company Limited Haitong International Securities Company Limited 4.58 way play potential for Ping An Securities Company Ltd.