Lawrence County Single Audit for the Year Ended December 31, 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CARES ACT GRANT AMOUNTS to AIRPORTS (Pursuant to Paragraphs 2-4) Detailed Listing by State, City and Airport

CARES ACT GRANT AMOUNTS TO AIRPORTS (pursuant to Paragraphs 2-4) Detailed Listing By State, City And Airport State City Airport Name LOC_ID Grand Totals AK Alaskan Consolidated Airports Multiple [individual airports listed separately] AKAP $16,855,355 AK Adak (Naval) Station/Mitchell Field Adak ADK $30,000 AK Akhiok Akhiok AKK $20,000 AK Akiachak Akiachak Z13 $30,000 AK Akiak Akiak AKI $30,000 AK Akutan Akutan 7AK $20,000 AK Akutan Akutan KQA $20,000 AK Alakanuk Alakanuk AUK $30,000 AK Allakaket Allakaket 6A8 $20,000 AK Ambler Ambler AFM $30,000 AK Anaktuvuk Pass Anaktuvuk Pass AKP $30,000 AK Anchorage Lake Hood LHD $1,053,070 AK Anchorage Merrill Field MRI $17,898,468 AK Anchorage Ted Stevens Anchorage International ANC $26,376,060 AK Anchorage (Borough) Goose Bay Z40 $1,000 AK Angoon Angoon AGN $20,000 AK Aniak Aniak ANI $1,052,884 AK Aniak (Census Subarea) Togiak TOG $20,000 AK Aniak (Census Subarea) Twin Hills A63 $20,000 AK Anvik Anvik ANV $20,000 AK Arctic Village Arctic Village ARC $20,000 AK Atka Atka AKA $20,000 AK Atmautluak Atmautluak 4A2 $30,000 AK Atqasuk Atqasuk Edward Burnell Sr Memorial ATK $20,000 AK Barrow Wiley Post-Will Rogers Memorial BRW $1,191,121 AK Barrow (County) Wainwright AWI $30,000 AK Beaver Beaver WBQ $20,000 AK Bethel Bethel BET $2,271,355 AK Bettles Bettles BTT $20,000 AK Big Lake Big Lake BGQ $30,000 AK Birch Creek Birch Creek Z91 $20,000 AK Birchwood Birchwood BCV $30,000 AK Boundary Boundary BYA $20,000 AK Brevig Mission Brevig Mission KTS $30,000 AK Bristol Bay (Borough) Aleknagik /New 5A8 $20,000 AK -

Airport Listings of General Aviation Airports

Appendix B-1: Summary by State Public New ASSET Square Public NPIAS Airports Not State Population in Categories Miles Use Classified SASP Total Primary Nonprimary National Regional Local Basic Alabama 52,419 4,779,736 98 80 75 5 70 18 25 13 14 Alaska 663,267 710,231 408 287 257 29 228 3 68 126 31 Arizona 113,998 6,392,017 79 78 58 9 49 2 10 18 14 5 Arkansas 53,179 2,915,918 99 90 77 4 73 1 11 28 12 21 California 163,696 37,253,956 255 247 191 27 164 9 47 69 19 20 Colorado 104,094 5,029,196 76 65 49 11 38 2 2 27 7 Connecticut 5,543 3,574,097 23 19 13 2 11 2 3 4 2 Delaware 2,489 897,934 11 10 4 4 1 1 1 1 Florida 65,755 18,801,310 129 125 100 19 81 9 32 28 9 3 Georgia 59,425 9,687,653 109 99 98 7 91 4 18 38 14 17 Hawaii 10,931 1,360,301 15 15 7 8 2 6 Idaho 83,570 1,567,582 119 73 37 6 31 1 16 8 6 Illinois 57,914 12,830,632 113 86 8 78 5 9 35 9 20 Indiana 36,418 6,483,802 107 68 65 4 61 1 16 32 11 1 Iowa 56,272 3,046,355 117 109 78 6 72 7 41 16 8 Kansas 82,277 2,853,118 141 134 79 4 75 10 34 18 13 Kentucky 40,409 4,339,367 60 59 55 5 50 7 21 11 11 Louisiana 51,840 4,533,372 75 67 56 7 49 9 19 7 14 Maine 35,385 1,328,361 68 36 35 5 30 2 13 7 8 Maryland 12,407 5,773,552 37 34 18 3 15 2 5 6 2 Massachusetts 10,555 6,547,629 40 38 22 22 4 5 10 3 Michigan 96,716 9,883,640 229 105 95 13 82 2 12 49 14 5 Minnesota 86,939 5,303,925 154 126 97 7 90 3 7 49 22 9 Mississippi 48,430 2,967,297 80 74 73 7 66 10 15 16 25 Missouri 69,704 5,988,927 132 111 76 4 72 2 8 33 16 13 Montana 147,042 989,415 120 114 70 7 63 1 25 33 4 Nebraska 77,354 1,826,341 85 83 -

FFY2017-AIP-Grants.Pdf

FAA ‐ Office of Airports Airport Improvement Program FFY 2017 Grants Awarded to Ohio Airports Service LocID Airport AIP Federal Funds Entitlement Discretionary Brief Description of Work Level 17G Port Bucyrus‐Crawford County GA $ 624,344 $ 624,344 $ ‐ Rehabilitate Runway ‐ 04/22 3G4 Ashland County GA $ 262,485 $ 262,485 $ ‐ Reconstruct Taxiway 3W2 Put‐in‐Bay GA $ 673,713 $ 673,713 $ ‐ Construct Building 3X5 North Bass Island GA $ 91,800 $ 91,800 $ ‐ Conduct Environmental Study 4G5 Monroe County GA $ 42,205 $ 42,205 $ ‐ Rehabilitate Runway ‐ 07/25 4I3 Knox County GA $ 299,885 $ 299,885 $ ‐ Reconstruct Apron Rehabilitate Apron, Rehabilitate Taxiway [A], 4I9 Morrow County GA $ 495,181 $ 495,181 $ ‐ Rehabilitate Taxiway [C], Rehabilitate Taxiway 5A1 Norwalk‐Huron County GA $ 176,336 $ 176,336 $ ‐ Rehabilitate Apron 6G5 Barnesville‐Bradfield GA $ 85,076 $ 85,076 $ ‐ Remove Obstructions [Non‐Hazard APP or DEP] 7W5 Henry County GA $ 410,637 $ 410,637 $ ‐ Rehabilitate Runway ‐ 10/28, Rehabilitate Taxiway Reconstruct Runway Lighting ‐ 13/31, Rehabilitate 8G6 Harrison County GA $ 2,612,286 $ 2,612,286 $ ‐ Runway ‐ 13/31 AOH Lima Allen County GA $ 150,000 $ 150,000 $ ‐ Acquire Snow Removal Equipment CQA Lakefield GA $ 150,000 $ 150,000 $ ‐ Construct Building Acquire Land for Development, Install Perimeter CYO Pickaway County Memorial GA $ 324,211 $ 324,211 $ ‐ Fencing not Required by 49 CFR 1542 Acquire Land For Approaches, Remove Obstructions [Non‐Hazard], Wildlife Hazard DFI Defiance Memorial GA $ 281,383 $ 281,383 $ ‐ Assessments DLZ Delaware -

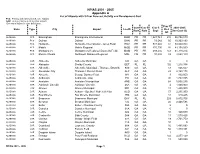

List of NPIAS Airports with 5-Year Forecast Activity and Development

NPIAS 2001 - 2005 Appendix A List of Airports with 5-Year Forecast Activity and Development Cost PCS: Primary and Commercial Service Airports GAR: Reliever and General Aviation Airports (See end of listing for other definitions) Year 5 Curr Year 5 Year 5 2001-2005 State Type City Airport LocID Bsd Role Role Enpl Dev Cost ($) Aft ALABAMA PCS Birmingham Birmingham International BHM PR PR 1,947,743 274 55,754,570 ALABAMA PCS Dothan Dothan DHN PR PR 73,542 65 10,303,193 ALABAMA PCS Huntsville Huntsville International - Jones Field HSV PR PR 587,940 82 50,930,743 ALABAMA PCS Mobile Mobile Regional MOB PR PR 415,106 94 84,158,560 ALABAMA PCS Montgomery Montgomery Regional (Dannelly Field) MGM PR PR 289,235 143 61,318,274 ALABAMA PCS Muscle Shoals Northwest Alabama Regional MSL CM PR 10,398 89 3,588,100 ALABAMA GAR Abbeville Abbeville Municipal 0J0 GA GA 0 0 ALABAMA GAR Alabaster Shelby County EET RL RL 102 1,218,334 ALABAMA GAR Albertville Albertville Municipal - Thomas J Brumlik 8A0 GA GA 53 866,667 ALABAMA GAR Alexander City Thomas C Russell Field ALX GA GA 28 2,198,178 ALABAMA GAR Aliceville George Downer Field AIV GA GA 3 832,000 ALABAMA GAR Andalusia Andalusia - Opp 79J GA GA 30 1,762,095 ALABAMA GAR Anniston Anniston Metropolitan ANB GA GA 64 5,008,235 ALABAMA GAR Ashland / Lineville Ashland / Lineville 26A GA GA 4 1,000,000 ALABAMA GAR Atmore Atmore Municipal 0R1 GA GA 11 1,250,000 ALABAMA GAR Auburn Auburn - Opelika / Robert G Pitts AUO GA GA 57 2,235,950 ALABAMA GAR Bay Minette Bay Minette Municipal 1R8 GA GA 12 819,445 ALABAMA GAR -

FY 2017 AIP Grants Awarded in FY 2017 by State

FAA Airports AIP Grants Awarded by State: FY 2017 AIP Grants Awarded in FY 2017 by State Grant Federal City Airport/Project Location Service Level Description of Project No. Funds Alabama Alabaster Shelby County General Aviation 20 55,404 Construct Building Albertville Albertville Regional-Thomas J General Aviation 27 655,350 Improve Airport Erosion Control, Brumlik Field Install Perimeter Fencing, Reconstruct Taxiway, Rehabilitate Apron, Update Airport Master Plan Study Alexander City Thomas C Russell Field General Aviation 17 1,222,200 Reconstruct Taxiway Andalusia South Alabama Regional at Bill General Aviation 22 154,711 Rehabilitate Runway Benton Field Ashland Ashland/Lineville General Aviation 11 40,500 Rehabilitate Runway Atmore Atmore Municipal General Aviation 14 318,217 Construct Fuel Farm, Remove Obstructions [Non-Hazard] Auburn Auburn University Regional General Aviation 30 3,811,500 Rehabilitate Taxiway Bay Minette Bay Minette Municipal General Aviation 13 1,303,838 Rehabilitate Runway Bessemer Bessemer Reliever 16 238,008 Install Perimeter Fencing Centre Centre-Piedmont-Cherokee County General Aviation 10 310,968 Rehabilitate Apron, Rehabilitate Regional Runway, Rehabilitate Taxiway Centreville Bibb County General Aviation 11 238,371 Acquire Land for Development, Update Airport Master Plan Study Clanton Chilton County General Aviation 14 102,960 Conduct Environmental Study, Conduct Miscellaneous Study Total AIP Grant Funds Awarded Page 1 of 125 FY 2017 Grant Federal City Airport/Project Location Service Level Description -

2040 MTP Chapter 7 Aviation, Freight, Maritime and Rail Element

2040 Metropolitan Transportation Plan KYOVA INTERSTATE PLANNING COMMISSION CHAPTER 7 │ AVIATION, FREIGHT, MARITIME, AND RAIL ELEMENT May 2013 Introduction Recent Freight Related Studies The purpose of this chapter of the KYOVA 2040 Several recent studies contributed to the Metropolitan Transportation Plan is to assess the understanding of existing issues related to the existing freight conditions in the region. For this freight transportation system in the KYOVA region. effort, the project team utilized data available from a The summaries that follow supported the variety of sources as well as information obtained development of the KYOVA 2040 MTP. The through a series of interviews with freight Huntington Tri-State Airport Master Plan is stakeholders in the KYOVA region. Freight by discussed in detail later in the chapter. mode, weight, and value is documented, and information related to employment by industry is KYOVA Freight Planning Study provided. This study, completed in November 2008 includes a A key element of the KYOVA 2040 MTP is to freight profile and description of the importance of evaluate and provide recommendations to improve freight to the regional economy. The study details upon the existing transportation system to provide the regional freight infrastructure, major freight efficient and cost-effective transportation of freight movements by mode, trading partners, and major and to enhance the future regional economy and shippers and receivers. Recommendations focused trading environment. The freight analysis portion of on improving goods movement in a cost efficient, the KYOVA 2040 MTP involved three inputs: 1) a time-sensitive, and reliable way. According to the review of existing freight related studies; 2) freight study, the proposed freight planning framework stakeholder interviews; and 3) an evaluation of should recognize the importance of strengthening existing conditions and future trends. -

Evaluating the Behavior of General Aviation Aircraft and Design of General Aviation Runways Towards Mitigating Runway Excursions

Evaluating the Behavior of General Aviation Aircraft and Design of General Aviation Runways towards Mitigating Runway Excursions THESIS Presented in Partial Fulfillment of the Requirements for the Degree Master of Science in the Graduate School of The Ohio State University By Eunsun Ryu Graduate Program in Civil Engineering The Ohio State University 2017 Master's Examination Committee: Seth Young, Advisor Mark McCord Philip Smith Copyrighted by Eunsun Ryu 2017 Abstract A runway excursion is an event whereby an aircraft has strayed from a declared runway during takeoff or landing. Runway excursions are the most frequent of all runway related accidents. Aviation authorities such as the Federal Aviation Administration (FAA) recommend runway design standards with additional safety areas to protect an aircraft in the case of a runway excursion. Despite their precautions, runway excursions remain a significant issue in the aviation industry. Previous research on the development of runway excursion risk models focused primarily on commercial aviation with relatively little attention paid to general aviation (GA). In this research, to further understand the characteristics of general aviation runway excursions, various statistical analyses were conducted on several years of runway excursion accident and incident data from publicly available sources including FAA, National Aeronautics and Space Administration (NASA), and the National Transportation Safety Board (NTSB). The analysis included the determination of potential differences in runway excursion rates between commercial and general aviation operations, operations at towered vs. non-towered GA airports, varying weather conditions and runway dimensions. In some instances, where data such as national totals of general aviation operations and flight hours was not available, estimation models were developed based on the known data for the State of Ohio. -

How the Federal Airport Improvement Program (AIP) Supports Investment in Ohio Airports

How the Federal Airport Improvement Program (AIP) Supports Investment in Ohio Airports • 95 airports in Ohio have identified $828.3 million in unfunded improvements needed over the next five years that would be eligible for AIP grants. • There are 4,182 aircraft based at these airports, with 8.9 million enplanements each year. • Over the last decade, Ohio airports have received 882 grants worth a total of $868.1 million through the AIP. • 83 percent of that funding—$721.2 million—has gone towards projects that included the construction, repair, upgrade or rehabilitation of airport runways, aprons or taxiways. AIP Grants for Ohio Airports, by FFY $120 $101.3 $102.2 $100 $90.8 $15.2 $14.9 $85.3 $83.8 $79.9 $8.3 $80 $13.0 $7.6 $74.2 $22.6 $63.4 $19.1 $60 $7.9 $53.8 $48.7 in millions in $5.4 $86.1 $87.3 $7.1 $40 $82.6 $72.2 $76.1 $57.3 $55.5 $55.1 $48.4 $20 $41.6 $0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Projects that include runway, taxiway or apron repair/construction work Other projects Total AIP Grants by Type of Airport, AIP Construction-Related Grants by FFY 2007-2016 Type of Airport, FFY 2007-2016 Commercial Commercial Other, $2.2, Reliever, Service, Reliever, <1% Service, $74.5, 10% $15.4, 2% $68.8, 10% $14.2, 2% General General Aviation, Aviation, $143.5, 22% $189.5, 24% Primary, Primary, $501.8, 64% $435.7, 66% © 2017 The American Road & Transportation Builders Association (ARTBA). -

Ohio Airports Economic Impact Study

Technical Report 2014 OHIO AIRPORTS ECONOMIC IMPACT STUDY October 2014 Prepared for: Prepared by: OHIO DEPT. OF TRANSPORTATION CDM SMITH OFFICE OF AVIATION 8805 Governor’s Hill Drive, Suite 305 2829 West Dublin-Granville Road Cincinnati, OH 45249 Columbus, OH 43235 513-583-9800 614-793-5040 With: RS&H Engage Public Affairs CAD Concepts, Inc. Table of Contents Chapter 1: Executive Summary Introduction ............................................................................................................................................................... 1-1 Study Background ................................................................................................................................................... 1-2 Study Findings .......................................................................................................................................................... 1-6 Summary .................................................................................................................................................................. 1-10 Chapter 2: Socioeconomic Overview of Ohio Introduction ............................................................................................................................................................... 2-1 Population .................................................................................................................................................................. 2-1 Employment ............................................................................................................................................................. -

CARES Act Grant Amounts to Airports (Pursuant to Paragraphs 2-4), 14

CARES ACT GRANT AMOUNTS TO AIRPORTS (pursuant to Paragraphs 2-4) Detailed Listing By State, City And Airport State City Airport Name LOC_ID Grand Totals AK Alaskan Consolidated Airports Multiple [individual airports listed separately] AKAP $16,855,355 AK Adak (Naval) Station/Mitchell Field Adak ADK $30,000 AK Akhiok Akhiok AKK $20,000 AK Akiachak Akiachak Z13 $30,000 AK Akiak Akiak AKI $30,000 AK Akutan Akutan 7AK $20,000 AK Akutan Akutan KQA $20,000 AK Alakanuk Alakanuk AUK $30,000 AK Allakaket Allakaket 6A8 $20,000 AK Ambler Ambler AFM $30,000 AK Anaktuvuk Pass Anaktuvuk Pass AKP $30,000 AK Anchorage Lake Hood LHD $1,053,070 AK Anchorage Merrill Field MRI $17,898,468 AK Anchorage Ted Stevens Anchorage International ANC $26,376,060 AK Anchorage (Borough) Goose Bay Z40 $1,000 AK Angoon Angoon AGN $20,000 AK Aniak Aniak ANI $1,052,884 AK Aniak (Census Subarea) Togiak TOG $20,000 AK Aniak (Census Subarea) Twin Hills A63 $20,000 AK Anvik Anvik ANV $20,000 AK Arctic Village Arctic Village ARC $20,000 AK Atka Atka AKA $20,000 AK Atmautluak Atmautluak 4A2 $30,000 AK Atqasuk Atqasuk Edward Burnell Sr Memorial ATK $20,000 AK Barrow Wiley Post-Will Rogers Memorial BRW $1,191,121 AK Barrow (County) Wainwright AWI $30,000 AK Beaver Beaver WBQ $20,000 AK Bethel Bethel BET $2,271,355 AK Bettles Bettles BTT $20,000 AK Big Lake Big Lake BGQ $30,000 AK Birch Creek Birch Creek Z91 $20,000 AK Birchwood Birchwood BCV $30,000 AK Boundary Boundary BYA $20,000 AK Brevig Mission Brevig Mission KTS $30,000 AK Bristol Bay (Borough) Aleknagik /New 5A8 $20,000 AK -

AIP Grants Awarded by State: 2018 City Airport / Project Location Service Level Grant No

FAA Airports AIP Grants Awarded by State: 2018 City Airport / Project Location Service Level Grant No. AIP Federal Funds Description of Project Alabama Alabaster Shelby County General Aviation 021 $249,970 Construct Building - T-Hangar Construction (Reimbursement-Phase 1) Alexander City Thomas C Russell Field General Aviation 018 $162,000 Install Runway Vertical/Visual Guidance System - PAPI installation Anniston Anniston Regional General Aviation 033 $384,413 Rehabilitate Apron - Terminal area - crack seal and seal coat Anniston Anniston Regional General Aviation 033 $88,987 Rehabilitate Taxiway - Taxilane - crack seal and seal coat Ashland/Lineville Ashland/Lineville General Aviation 012 $206,013 Construct Taxiway - Phase 2 - Grading and Drainage Ashland/Lineville Ashland/Lineville General Aviation 012 $206,013 Construct Apron - Phase 2 - Grading and Drainage Atmore Atmore Municipal General Aviation 015 $56,089 Update Airport Master Plan Study - Master Plan Update (ALP and Narrative) Auburn Auburn University Regional General Aviation 031 $832,500 Rehabilitate Taxiway - Rehabilitate Taxiway - Phase 2 (Paving and Marking) Bay Minette Bay Minette Municipal General Aviation 014 $69,766 Update Airport Master Plan Study - Update Master Plan and ALP Bay Minette Bay Minette Municipal General Aviation 015 $55,440 Remove Obstructions [APP or DEP] - Ph 1 - Acquire Parcel 12 (22 acres for RW 8 obstruction removal) Bessemer Bessemer Reliever 017 $122,607 Rehabilitate Runway - Design Page 1 of 206 City Airport / Project Location Service Level Grant -

Multimodal Economic Impact Study for Huntington Tri-State Airport

MULTIMODAL ECONOMIC IMPACT STUDY FOR HUNTINGTON TRI-STATE AIRPORT PREPARED FOR: KYOVA INTERSTATE PLANNING COMMISSION PREPARED BY: CDM SMITH Multimodal Economic Impact Study for Huntington Tri-State Airport May 2018 Prepared for: KYOVA Interstate Planning Commission 400 Third Avenue P.O. Box 939 Huntington, West Virginia 25712 Phone: 304-523-7434 Prepared by: 8845 Governor’s Hill Drive, Suite 430 Cincinnati, OH 45249 513-583-9800 With assistance from: French Engineering MULTIMODAL ECONOMIC IMPACT STUDY FOR HUNTINGTON TRI-STATE AIRPORT TABLE OF CONTENTS Chapter 1: Report Overview............................................................................................. 1-1 Study Results ...................................................................................................................................................................... 1-1 Huntington Tri-State Airport Overview ....................................................................................................... 1-1 Overview of the Tri-State Area ......................................................................................................................... 1-2 Study Approach ....................................................................................................................................................... 1-2 Economic Impacts of Huntington Tri-State Airport ................................................................................ 1-2 Qualitative Impacts ..............................................................................................................................................