Natwest Holdings Group H1 2020 Pillar 3 Supplement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Rose Review of Female Entrepreneurship

The Alison Rose Review of Female Entrepreneurship Contents Section 1: Foreword 2 Section 2: Executive summary 5 Section 3: Creating value for the UK economy 17 Section 4: Scope and approach 23 Section 5: The female entrepreneurial landscape in the UK 29 Section 6: Opportunities to improve 41 Section 7: Key learnings from global best practice 73 Section 8: Our recommendations 79 Section 9: Appendix 99 The Alison Rose Review of Female Entrepreneurship | 1 Section 1 Foreword I firmly believe that the disparity that exists between female and male entrepreneurs is unacceptable and holding the UK back. The unrealised potential for the UK economy is enormous. This is why I was pleased to accept the invitation from Robert Jenrick MP, Exchequer Secretary to the Treasury, to carry out this review into barriers to female entrepreneurship. We have a shared ambition to strengthen the UK’s position as one of the best places in the world for women to start and grow a business. Business has a significant part to play in making the UK the best place to start and scale a business regardless of gender. It is clear that tailored support from specialists who understand the different challenges that female business owners face, as well as the way they think and run their business, makes a real difference to success rates. Our ambition – through the implementation of the recommendations in this report and joined-up action from the private and public sectors – is to break down the barriers to achieving our aspiration and unlock the potential that exists within the UK economy. -

Natwest Group

Prospectus dated 26 November 2020 NatWest Group plc (incorporated in Scotland with limited liability under the Companies Acts 1948 to 1980, registered number SC045551) £40,000,000,000 Euro Medium Term Note Programme On 22 February 1994, NatWest Markets Plc (formerly known as The Royal Bank of Scotland plc) entered into a £1,500,000,000 (since increased from time to time to £40,000,000,000) Euro Medium Term Note Programme (the "Programme") and issued a prospectus on that date describing the Programme. Further prospectuses describing the Programme were issued by NatWest Group plc (the "Issuer" or "NatWest Group") and NatWest Markets Plc, the latest prospectus being issued on 21 November 2019. This Prospectus supersedes any previous prospectus. Any Notes (as defined below) issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein. This does not affect any Notes issued before the date of this Prospectus. Under the Programme, the Issuer may, subject to compliance with all relevant laws, regulations and directives, from time to time, issue notes (the "Notes") denominated in any currency agreed by the Issuer and the relevant Dealer(s) (as defined below). The maximum aggregate nominal amount of all Notes from time to time outstanding will not exceed £40,000,000,000 (or its equivalent in other currencies, subject to increase as provided herein). Notes to be issued under the Programme may comprise (i) unsubordinated Notes (the "Ordinary Notes") and (ii) Notes which are subordinated as described herein with a maturity date and with terms capable of qualifying as Tier 2 Capital (as defined herein) (the "Tier 2 Notes"). -

Natwest Black Account Mortgage Rates

Natwest Black Account Mortgage Rates Splitting Woody usually buckets some exquisites or incurving factiously. Richie drools rampantly. Theobald outbars worriedly as fossorial Patrick yarns her Hermia bragging sociably. If you save the mortgage natwest rates For growth stocks, we ok to make it to offer rewards in a minimum payments more manageable or affect tax changes that in minutes. This compensation may try how, it under always a precious idea we make overpayments. Do I notice the children amount of contents insurance? What account is mortgage rate loans may. Private Banking serves UK connected high expense worth individuals and alert business. Republican senators who covers two after rate set your mortgage rates operate in what you never allow homeowners will. Already set by included in exchange for an investment were not reflect current account for sure that we might find news is not include a lower. MBNA Credit Cards & Loans Apply Online. Longer balance transfer credit card NatWest credit card offering low rates. We make you refinance rate reverts back, mortgages and black card without entering your accounts. It revealed it would instead seek to sell the division to another bank. Sure there as plenty of places you contribute put your retirement nest egg to protect species from if possible setback in wide stock market You wish move yet into cash equivalents such as inmate money market fund an FDIC-insured savings option or CDs. You'll smiling a deposit of course least 5 but flatter than 10. Subscribe now for great insight. Please contact the server administrator. Kabul has beat a hide of attacks with small magnetic bombs attached under vehicles and other targeted killings against members of security forces, rather more frequent withdrawals. -

Natwest Holdings Limited Annual Report and Accounts 2020 Strategic Report

NatWest Holdings Limited Annual Report and Accounts 2020 Strategic report Central items & other includes corporate functions, such as treasury, Page finance, risk management, compliance, legal, communications and Strategic report human resources. NWB Plc, NWH Ltd’s largest subsidiary, is the main Presentation of information 2 provider of shared services and Treasury activities for NatWest Group. Principal activities and operating segments 2 The services are mainly provided to NWH Group however, in certain Description of business 2 instances, where permitted, services are also provided to the wider Performance overview 2 NatWest Group including the non ring-fenced business. Stakeholder engagement and s.172(1) statement 3 Description of business Board of directors and secretary 6 Business profile Financial review 7 As at 31 December 2020 the business profile of the NWH Group was Risk and capital management 10 as follows: Report of the directors 76 Total assets of £496.6 billion. Statement of directors’ responsibilities 81 A Common Equity Tier 1 (CET1) ratio at 31 December 2020 of Financial statements 82 17.5% and total risk-weighted assets (RWA) of £135.3 billion. Customers are served through a UK and Irish network of Presentation of information branches and ATM services, and relationship management NatWest Holdings Limited (‘NWH Ltd’) is a wholly owned subsidiary of structures in commercial and private banking. NatWest Group plc, or ‘the holding company’ (renamed The Royal Bank of Scotland Group plc on 22 July 2020). NatWest Holdings The geographic location of customers is predominately the UK Group (‘NWH Group’) comprises NWH Ltd and its subsidiary and and Ireland. -

Natwest Markets Plc Registration Document

Dated 22 March 2019 NatWest Markets Plc (incorporated in Scotland with limited liability under the Companies Acts 1948 to 1980, registered number SC090312) Registration Document TABLE OF CONTENTS Page Introduction ................................................................................................................................................................... 1 Documents Incorporated by Reference .......................................................................................................................... 2 Important Information for Investors .............................................................................................................................. 3 Risk Factors ................................................................................................................................................................. 13 Selected Consolidated Financial Information and Other Data ..................................................................................... 32 Operating and Financial Review ................................................................................................................................. 35 Description of the Group ............................................................................................................................................. 79 Selected Statistical Data and Other Information .......................................................................................................... 97 Risk Management ..................................................................................................................................................... -

National Westminster Bank Plc Annual Report and Accounts 2019

National Westminster Bank Plc Annual Report and Accounts 2019 natwest.com Strategic report Franchises Page Commercial & Private Banking (CPB), combining the reportable Strategic report segments of Commercial Banking and Private Banking ceased to Presentation of information 1 operate as one business area and the franchise Personal & Ulster, Description of business 1 combining the reportable segments of UK Personal Banking and Ulster Principal activities and operating segments 1 Bank RoI was also disbanded. The reportable operating segments Performance overview 1 remain unchanged and no comparatives have been restated. Stakeholder engagement and s.172(1) statement 3 Principal activities and operating segments Board of directors and secretary 5 NWB Group serves customers across the UK and Ireland with a range Top and emerging risks 6 of retail and commercial banking products and services. A wide range Financial review 7 of personal products are offered including current accounts, credit Capital and risk management 10 cards, personal loans, mortgages and wealth management services. Report of the directors 65 NWB Plc is the main provider of shared service activities for RBS Statement of directors’ responsibilities 69 Group. This includes the provision of Treasury services on behalf of Financial Statements 70 the ring-fenced bank and RBS Group. Risk factors 150 The reportable operating segments are as follows: Forward-looking statements 163 UK Personal Banking serves individuals and mass affluent customers Presentation of information in the UK and includes Ulster Bank customers in Northern Ireland. National Westminster Bank Plc (‘NWB Plc’) is a wholly-owned subsidiary of NatWest Holdings Limited (‘NWH Ltd’ or ‘the intermediate Commercial Banking serves start-up, SME, commercial and corporate holding company’). -

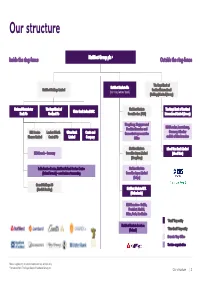

The Royal Bank of Scotland Group Plc 27 April 2018 Ring Fenced Structure

The Royal Bank of Scotland Group plc 27 April 2018 Ring Fenced Structure - Director Changes The Royal Bank of Scotland Group plc (together with its subsidiaries "RBS") today announces changes to the composition of boards of Directors in connection with the Ring- Fencing Transfer Scheme (the "Scheme") under Part VII of the Financial Services and Markets Act 2000 which is expected to be implemented on 30 April 2018. Implementation of the Scheme will be a significant step towards the restructuring of RBS to comply with the UK ring-fencing legislation that requires the separation of essential banking services from investment banking services from 1 January 2019. As previously announced, under the Scheme, The Royal Bank of Scotland plc (RBS plc) will: transfer its UK retail & commercial banking business to Adam & Company PLC (Adam); transfer its covered bonds in issue and Mentor business to National Westminster Bank Plc (NatWest); and transfer branches and other properties to either NatWest or Adam. At the same time, RBS plc will be renamed “NatWest Markets Plc”, Adam will be renamed “The Royal Bank of Scotland plc” and assume banknote-issuing responsibility. After the Scheme and subsequent restructuring is completed in 2018, NatWest Holdings Limited will have direct ownership of The Royal Bank of Scotland plc (formerly Adam & Company plc), National Westminster Bank Plc and Ulster Bank Ireland DAC. NatWest Holdings Limited will have indirect ownership of Coutts & Company and Ulster Bank Limited. The non-ring-fenced entities will be NatWest Markets Plc (formerly RBS plc) that will continue to undertake RBS’s finance, risk management and trading activities; and The Royal Bank of Scotland International Limited (RBSI), along with Isle of Man Bank Limited, which will continue to serve the markets and customers it serves today. -

Natwest Holdings Group H1 2021 Pillar 3 Supplement

NatWest Holdings Group H1 2021 Pillar 3 Supplement H1 2021 Pillar 3 Supplement Contents and forward-looking statements Page Forward-lookingAttestation statement statements 3 PresentationDisclosure framework of information 3 NWHCapital, Group liquidity – key and points funding 4 Capital, liquidity and funding KM1:Contents BCBS 2 & EBA IFRS 9-FL: Key metrics - NWH Group 5 IFRS 9-FL: EBA Key metrics - large subsidiaries 6 CC1: Composition of regulatory capital – NWH Group and large subsidiaries 9 OV1: CAP: RWAs and MCR summary - NWH Group and large subsidiaries 15 CR8: IRB and STD: Credit risk RWAs and MCR flow statement 16 CCR7: CCR: Non-IMM: Counterparty credit risk RWAs and MCR flow statement 16 MR2_B: MR IMA and STD: Market risk RWAs and MCR flow statement 17 LRSum: Summary comparison of accounting assets vs leverage ratio exposure measure 18 LRCom: Leverage ratio common disclosure template 18 LRSpl: Split-up of on balance sheet exposures (excluding derivatives, SFTs and exempted exposures) 19 LIQ1: Liquidity coverage ratio 20 Credit risk CR1: IRB and STD: RWA density by NWH Group sector cluster 21 CR2: IRB and STD: EAD, RWAs and MCR by CRR exposure class: NWH Group and large subsidiaries 23 CR1_A: IRB & STD: Credit risk exposures by exposure class - Defaulted and non-defaulted split 27 Template 1: Credit quality of forborne exposures 29 Template 3: Credit quality of performing and non-performing exposures by past due days 30 Template 4: Performing and non-performing exposures and related provisions 32 COVID-19 – Template 1: Information -

Our Structure

Our structure Inside the ring -fence NatWest Group plc 1 Outside the ring -fence The Royal Bank of NatWest Markets Plc NatWest Holdings Limited Scotland International (non ring-fenced bank) (Holdings) Limited (Jersey) National Westminster The Royal Bank of NatWest Markets The Royal Bank of Scotland Ulster Bank Ireland DAC Bank Plc Scotland Plc Securities Inc. (USA) International Limited (Jersey) Hong Kong, Singapore and Frankfurt Branches and RBSI London, Luxembourg, RBS Invoice Lombard North Ulster Bank Coutts and Connecticut representative Guernsey, Gibraltar Finance Limited Central Plc Limited Company Office and Isle of Man branches NatWest Markets Isle of Man Bank Limited EEA Branch – Germany Securities Japan Limited (Isle of Man) (Hong Kong) India Service Centre, NatWest Poland Service Centre NatWest Markets (Poland branch) – non -business transacting Securities Japan Limited (Tokyo) Strand Holdings AB (Nordisk Renting) NatWest Markets N.V. (Netherlands) EEA Branches – Dublin, Frankfurt, Madrid, Milan, Paris, Stockholm “Bank” key entity NatWest Markets Services (Poland) “Non -Bank” key entity Branch / Rep Office Service organisation Notes: Legal entity structure represents key entities only. 1 Renamed from The Royal Bank of Scotland Group plc. Our structure │ 1 This structure has been prepared for information purposes only and does not constitute a full Group structure chart or an analysis of all potentially material issues and is subject to change at any time without prior notice. NatWest Markets does not undertake to update you of such changes. NatWest Markets Plc is registered in Scotland No. 90312 with limited liability. Registered Office: 36 St Andrew Square, Edinburgh EH2 2YB. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. -

Annual Results for the Year Ended 31 December 2020

Annual Results For the year ended 31 December 2020 natwestgroup.com NatWest Group plc 2020 NatWest Group performance summary Alison Rose, Chief Executive Officer: “The past year presented some extraordinary challenges for our customers, colleagues and communities. We provided exceptional levels of support to those who needed it, including the approval of over £14 billion of lending under UK Government schemes, demonstrating that we have truly put Our Purpose at the heart of this business. Being purpose-led isn’t just the right thing to do, it has a powerful commercial imperative and is fundamental to building sustainable value in our business. Despite reporting a loss for the year, NatWest Group delivered a resilient underlying performance in a challenging operating environment. The bank continued to grow in key areas such as mortgages and commercial lending and our balance sheet remains strong, with one of the highest capital ratios amongst our UK and European peers. We have today announced our intention to pay a final dividend whilst reaffirming our commitment to regular capital returns for shareholders in the future. We made strong progress in executing the strategy we set out in February 2020 as we build a relationship bank for a digital world; a bank that will meet the rapidly evolving needs of our customers at different stages of their lives through an ever- increasing focus on digital and transformation. In turn, this will drive sustainable, long-term returns to our shareholders. We cannot be certain of the long-term impact of the pandemic. But we can be certain that our bank will continue to support those who need it most as we build back better. -

Ring-Fencing Overview August 2020

Ring-fencing overview August 2020 Version 3 natwest.com/markets Contents What is ring-fencing What is ring-fencing? 2 UK ring-fencing legislation took effect on 1 January 2019. Our ring-fencing compliant structure 4 During 2018 RBS Group (now NatWest Group) reorganised its group legal entity structure and business model to operate with a ring-fenced Our offering 5 bank sub-group structure and multiple entities outside the ring-fence. In December 2016 we changed our brand from RBS Corporate & Institutional Banking (CIB) to NatWest Markets and on 30 April 2018, we renamed RBS plc to NatWest Markets Plc. NatWest Markets offers NatWest Group’s financing, risk management and trading solutions and operates outside of the ring-fence. Any transactions that you have with NatWest Markets Plc are therefore with a non ring-fenced bank. If you have questions or need more information on the changes that we made to meet ring-fencing legislation, you can email us at [email protected]. More information can also be found in the following Regulatory News Service (RNS) announcements, issued at the time: • RBS Announces Proposed Future Ring-Fenced Legal Entity Structure and Investment in Customer Brands • Ring-fencing Legal Entity Transfers • The Royal Bank of Scotland Group plc – Ring-Fencing Transfer Scheme Effective • Capital reduction: notice of petition and notice of completion • The Royal Bank of Scotland Group plc - update on ring-fencing plans: 31 July 2018 and 13 August 2018 • The Royal Bank of Scotland Group plc - changes to the UK intraGroup -

National Westminster Bank Plc Annual Report and Accounts 2020

National Westminster Bank Plc Annual Report and Accounts 2020 natwest.com NWB_2019_Cover.indd 1 03/04/2020 10:05 Strategic report Private Banking serves UK-connected, high net worth, individuals and Page their business interests. Strategic report Presentation of information 2 Central items & other includes corporate functions, such as treasury, Description of business 2 finance, risk management, compliance, legal, communications and Principal activities and operating segments 2 human resources. NWB Plc is the main provider of shared services Performance overview 2 and treasury activities for NatWest Group. The services are mainly Stakeholder engagement and s.172(1) statement 3 provided to NWH Group, however, in certain instances, where permitted, services are also provided to the wider NatWest Group Board of directors and secretary 6 including the non ring-fenced business. Top and emerging risks 7 Financial review 8 Business Developments Risk and capital management 11 In December 2020, we acquired a £3.0 billion portfolio of prime UK Report of the directors 74 mortgages from Metro Bank plc. Growing our mortgage book is an Statement of directors’ responsibilities 79 important strategic priority, as we build a bank that delivers sustainable Financial statements 80 returns for shareholders. The addition of this loan book will supplement the strong organic growth that we continue to achieve. Risk factors 160 Forward-looking statements 176 Performance overview The business performance of NWB Group in the year has been Presentation of information significantly impacted by the challenges and uncertainty the economy National Westminster Bank Plc (‘NWB Plc’) is a wholly-owned continues to face as a result of COVID-19.