Land Value LOOK Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JR East Group Sustainability Report 2018 JR East Group Sustainability Report 2018 105

Management Information Businesses Outline of the JR East Group (as of Transportation Business Distributions and Services Businesses Customers and Counterparty companies 〈Operating Revenues〉 〈Operating Income〉 September, 2018) Railway business, bus business, cleaning and maintenance Retail business, restaurant business, advertising agency (billion yen) Non-consolidated Consolidated (billion yen) Non-consolidated Consolidated business, rolling stock manufacturing business Our company and our affiliated companies are 30,000 5,000 Major subsidiaries with consolidated accounts Major subsidiaries with consolidated accounts engaged in transportation business, distribution and Tokyo Monorail Co., Ltd./JR Bus Kanto Co., Ltd./JR East JR East Retail Net Co., Ltd. ,/Nippon services business, real estate and hotel business, and Environment Access Co., Ltd./JR East Facility Management Restaurant Enterprise Co., Ltd./East Japan 26,71826,71826,718 27,02927,02927,029 27,56127,56127,561 28,67128,67128,671 28,80828,80828,808 29,50129,50129,501 4,000 Co.,Ltd./Japan Transport Engineering Company/JR East Rail Marketing & Communications, Inc. other businesses. In each business our company’s 20,000 Car Technology & Maintenance Co., Ltd. 3,975 4,067 4,275 4,878 4,663 4,812 position in relation to each of our affiliated companies 19,10819,10819,108 19,32519,32519,325 19,66019,66019,660 20,57320,57320,573 20,68820,68820,688 20,93220,93220,932 3,000 is described below: Real estate and Hotel Business Others Management of shopping centers, office building leases 3,228 3,278 3,526 4,099 3,886 3,951 Credit card business such as IT ・Suica, information 2,000 and hotel business processing business, etc. -

2012 Annual Report Pursuing Our Unlimited Potential Annual Report 2012

For the year ended March 31, 2012 Pursuing Our Unlimited Potential Annual Report 2012 Annual Report 2012 EAST JAPAN RAILWAY COMPANY JR East’s Strengths 1 AN OVERWHELMINGLY SOLID AND ADVANTAGEOUS RAILWAY NETWORK The railway business of the JR East Being based in the Tokyo metro- Group covers the eastern half of politan area is a major source of our Honshu island, which includes the strength. Routes originating in the Tokyo metropolitan area. We provide Kanto area (JR East Tokyo Branch transportation services via our Office, Yokohama Branch Office, Shinkansen network, which connects Hachioji Branch Office, Omiya Tokyo with regional cities in five Branch Office, Takasaki Branch directions, Kanto area network, and Office, Mito Branch Office, and intercity and regional networks. Our Chiba Branch Office) account for JR EAST’S SERVICE AREA networks combine to cover 7,512.6 68% of transportation revenue. kilometers and serve 17 million Japan’s total population may be people daily. We are the largest declining, but the population of the railway company in Japan and one of Tokyo metropolitan area (Tokyo, TOKYO the largest in the world. Kanagawa Prefecture, Saitama Prefecture, and Chiba On a daily basis, about 17million passengers travel a network of 70 train lines stretching 7,512.6 operating kilometers An Overwhelmingly Solid and Advantageous Railway Network Annual Report 2012 SECTION 1 OVERALL GROWTH STRATEGY Prefecture) continues to rise, mean- OPERATING REVENUES OPERATING INCOME ing our railway networks are sup- For the year ended March 31, 2012 For the year ended March 31, 2012 ported by an extremely sturdy Others 7.9% Transportation Others 6.1% Transportation operating foundation. -

In This Issue

to Kanazawa In this issue to JoetsuJCT Toyoda-Iiyama I.C P.12 Nakano City Shinsyu-Nakano I.C P.14 Yudanaka Station Shinsyu-Nakano P.04 P.10 Station Nagano Yamanouchi Town Nagano City Obuse Town Snow Monkey Obuse Dentetsu Station Line Obuse P.A P.08 Suzaka Station Takayama Vill Nagano Zenkoji Temple Station P.06 Nagano I.C Expressway Suzaka City Nagano Expressway Joshinetsu Koshoku J.C.T Nagano Prefecture Nagano City Suzaka City Greetings from Northern 1Zenkoji × Soba× Oyaki p04 2 What´s Misosuki Don ? p06 Nagano! Come take a JoshinetsuExpressway Shinshu Matsumoto Airport Mathumoto I.C JR Hokuriku Shinkansen to Tokyo journey of 24 stations ! 02 Enjoy a scenic train ride through the 03 Nagano Hongo Kirihara Kamijyo Hino Kita-suzaka Entoku Nakano-Matsukawa Fuzokuchugakumae Murayama Shiyakushomae Shinano-Yoshida Suzaka Sakurasawa Shinsyu-Nakano Shinano-Takehara Gondo Obuse Zenkojishita Asahi Tsusumi Yomase Yudanaka Yanagihara Nagano countryside on the Nagano Dentetsu line. Nicknamed “Nagaden”, min 2 min 2 min 2 min 2 min 2 min 2 min 3 min 2 min 2 min 3 min 2 min 3 min 4 min 4 min 2 min 4 min 3 min 4 min 3 min 4 min 2 min 2 min 3 the train has linked Nagano City with Suzaka, Obuse, Nakano and Yamanouchi since it opened in 10- June, 1922. Local trains provide min 2 min 2 min 3 min 2 min 3 min 8 min 6 min 9 12min Limited B express leisurely service to all 24 stations min 2 14min min 6 min 9 12min along the way, while the express trains Limited A express such as the “Snow Monkey” reaches Takayama Village Obuse Town 【About express train 】 Yudanaka from Nagano Station in as quickly as 44 minutes. -

A 5 Day Tokyo Itinerary

What To Do In Tokyo - A 5 Day Tokyo Itinerary by NERD NOMADS NerdNomads.com Tokyo has been on our bucket list for many years, and when we nally booked tickets to Japan we planned to stay ve days in Tokyo thinking this would be more than enough. But we fell head over heels in love with this metropolitan city, and ended up spending weeks exploring this strange and fascinating place! Tokyo has it all – all sorts of excellent and corky museums, grand temples, atmospheric shrines and lovely zen gardens. It is a city lled with Japanese history, but also modern, futuristic neo sci- streetscapes that make you feel like you’re a part of the Blade Runner movie. Tokyo’s 38 million inhabitants are equally proud of its ancient history and culture, as they are of its ultra-modern technology and architecture. Tokyo has a neighborhood for everyone, and it sure has something for you. Here we have put together a ve-day Tokyo itinerary with all the best things to do in Tokyo. If you don’t have ve days, then feel free to cherry pick your favorite days and things to see and do, and create your own two or three day Tokyo itinerary. Here is our five day Tokyo Itinerary! We hope you like it! Maria & Espen Nerdnomads.com Day 1 – Meiji-jingu Shrine, shopping and Japanese pop culture Areas: Harajuku – Omotesando – Shibuya The public train, subway, and metro systems in Tokyo are superb! They take you all over Tokyo in a blink, with a net of connected stations all over the city. -

Shiseido Donates Public Art Titled “Crystal of Light” to Tokyo Metro Ginza Line Ginza Station

October, 2020 Shiseido Company, Limited Shiseido Donates Public Art Titled “Crystal of Light” to Tokyo Metro Ginza Line Ginza Station Shiseido Company, Limited (“Shiseido”) will donate public art titled “Crystal of Light” to the Tokyo Metro* Ginza Line, Ginza Station on Friday, October 16, 2020 as part of community development plans toward the beautification of the city of Ginza, which is Shiseido’s birthplace, and sharing beauty with the world through art. * Tokyo Metro Co., Ltd. (Headquarters: Taito-ku, Tokyo; President: Akiyoshi Yamamura, hereafter “Tokyo Metro”) About "Crystal of Light" The work, a light sculpture consisting of 636 crystal glasses with special facets, was created by world-famous artist Tokujin Yoshioka. He used a world map to program the directions of lights in the work and designed to express the world with light. Innumerable glows emitted from the crystal glasses form a huge light, which conveys a wish for peace, that “the world be united as one with all lives on earth”, and gives off a radiance for the people in the city, becoming a new symbol of Ginza Station. Tokyo Metro public art installation Tokyo Metro is promoting the installation of public artworks in sync with station construction and renewal to create comfortable, enriched cultural spaces. Works will be installed at five stations on the Ginza Line (Kyobashi Station, Ginza Station, Toranomon Station, Aoyama 1-chome Station, and Gaienmae Station) where renewal construction is carried out. Shiseido and Ginza Shiseido was founded in Ginza in 1872 as Japan's first private Western-style pharmacy. Since then, we have continued to create new value together with the city of Ginza, which has always embraced and developed newness with willing, accepting attitude. -

Niigata, Sado Island & Tokyo Fall Foliage Tour

Niigata, Sado Island & Tokyo Fall Foliage Tour October 31st - November 9th, 2021 In Hot Water-Onsen & Sake Dream Tour 9nts/11days from: $3,695 triple; $3,795 double; $4,295 single Cancel for any reason up to 60 days prior-FULL REFUND! Maximum Tour size is 24 tour members! Little visited and often overlooked, Niigata is a beautiful remote region with fabulous sights, great food, and excellent countryside landscapes -deserving much more attention than it gets. 200 miles northwest from Tokyo, the Niigata-Sado Island region offers a very different experience to the hustle and bustle of the Tokaido seaboard. It is koyo season and time to enjoy the grandeur of nature, the viewing of autumn colors, part of the Japanese culture dating back centuries. The trees clad themselves in brilliant scarlets and golds, offering a grand finale to the year as these beautiful landscapes spread around the Niigata prefecture. Besides some of the best sightseeing spot the tour also includes a ferry ride to Sado Island, bullet train to Tokyo, onsen stay, hands-on experiences, Japanese drum session, and saki tastings! We are also visiting Takasaki, home to towering Byakue Kannon statue, and Shorinzan Darumaji Temple, famous for its round daruma dolls, believed to bring good luck. And then, Minakami, a mountainous hot spring resort town. Not so quick, as we end in Tokyo, 2-nights, for that big city feel. Here we will be visiting the more popular spots, Tsukiji and Ameyoko. and Shibuya Sky for omiyage shopping along with Meiji Jingu Gaien to enjoy fall colors. Itinerary Day 1 – October 31st Sunday – Depart from Honolulu Hawaiian Airlines #863 Departs Honolulu at 1:35pm - Arrives Haneda at 5:1- pm + 1 Please meet your Panda Travel representative at the Hawaiian Airlines international check-in counters located in Terminal 2, Lobby 4 a minimum of 3 hours prior to the flight departure time Day 2 – November 1st - Wednesday –Haneda On arrival in Tokyo, please make your way to the baggage claim area and then proceed to customs clearing. -

East Japan Railway Company Shin-Hakodate-Hokuto

ANNUAL REPORT 2017 For the year ended March 31, 2017 Pursuing We have been pursuing initiatives in light of the Group Philosophy since 1987. Annual Report 2017 1 Tokyo 1988 2002 We have been pursuing our Eternal Mission while broadening our Unlimited Potential. 1988* 2002 Operating Revenues Operating Revenues ¥1,565.7 ¥2,543.3 billion billion Operating Revenues Operating Income Operating Income Operating Income ¥307.3 ¥316.3 billion billion Transportation (“Railway” in FY1988) 2017 Other Operations (in FY1988) Retail & Services (“Station Space Utilization” in FY2002–2017) Real Estate & Hotels * Fiscal 1988 figures are nonconsolidated. (“Shopping Centers & Office Buildings” in FY2002–2017) Others (in FY2002–2017) Further, other operations include bus services. April 1987 July 1992 March 1997 November 2001 February 2002 March 2004 Establishment of Launch of the Launch of the Akita Launch of Launch of the Station Start of Suica JR East Yamagata Shinkansen Shinkansen Suica Renaissance program with electronic money Tsubasa service Komachi service the opening of atré Ueno service 2 East Japan Railway Company Shin-Hakodate-Hokuto Shin-Aomori 2017 Hachinohe Operating Revenues ¥2,880.8 billion Akita Morioka Operating Income ¥466.3 billion Shinjo Yamagata Sendai Niigata Fukushima Koriyama Joetsumyoko Shinkansen (JR East) Echigo-Yuzawa Conventional Lines (Kanto Area Network) Conventional Lines (Other Network) Toyama Nagano BRT (Bus Rapid Transit) Lines Kanazawa Utsunomiya Shinkansen (Other JR Companies) Takasaki Mito Shinkansen (Under Construction) (As of June 2017) Karuizawa Omiya Tokyo Narita Airport Hachioji Chiba 2017Yokohama Transportation Retail & Services Real Estate & Hotels Others Railway Business, Bus Services, Retail Sales, Restaurant Operations, Shopping Center Operations, IT & Suica business such as the Cleaning Services, Railcar Advertising & Publicity, etc. -

Public Spa Second Home Breakfast

Kamejimagawa Hot Spring Natural Hot Spring Shirasagi-no-Yu You can use our hotels as dormy inn EXPRESS Hakodate-Goryokaku SN Shinkawa-no-Yu dormy inn Tokyo Hatchobori Natural Hot Spring Kaga-no-Yusen dormy inn Kanazawa N SA B Natural Hot Spring Kirizakura-no-Yu dormy inn Kagoshima Business hotel with a spa You can use our hotels as 【TEL】+81(0)138-35-5489 【TEL】+81(0)3-5541-6700 N SA B 【TEL】+81(0)76-263-9888 N SA B dormy inn Himeji 【TEL】+81(0)99-216-5489 N S A B 【Address】29-26 Hon-cho, Hakodate City, Hokkaido 【Address】2-20-4 Shinkawa, Chuo-ku, Tokyo 【Address】2-25 Horikawa Shinmachi, Kanazawa City, Ishikawa 【TEL】+81(0)79-286-5489 【Address】17-30 Nishisengoku-cho, Kagoshima City, Kagoshima “your home” all over Japan 【 】 About 3 minutes walk from Streetcar Goryokaku Koen-mae Station. About 2 minutes walk from JR Hatchobori Station. Approx. 4 minutes About 2 minutes walk from JR Kanazawa Station. Approx. 5 km from Address 160-2 Toyozawa-cho, Himeji City, Hyogo About 2 minutes’ walk from Tram “Takamibaba” Stop Kinki Area Hokkaido Area Kyushu Area Kanto Area walk from Tokyo Metro Hibiya Line Hatchobori Station. Kanazawa-nishi Interchange of Hokuriku Expressway. 3 minutes walk from JR Sanyo Main Line/Shinkansen Himeji Station. (from JR Kagoshima-Chuo Station east exit). Chubu Area Natural Hot Spring Tenboku-no-Yu N SA B Natural Hot Spring Iwakisakura-no-Yu N SA B Suehiro-no-Yu dormy inn Akihabara SP SA M dormyinn EXPRESS Nagoya SP SA B dormy inn EXPRESS Matsue B dormy inn PREMIUM SEOUL Garosugil *Designated days only dormy inn Wakkanai dormy inn Hirosaki 【TEL】+81(0)3-5295-0012 【TEL】+81(0)52-586-6211 【TEL】+81(0)852-59-5489 【TEL】+82(0)2-518-5489 SP B 【TEL】+81(0)162-24-5489 【TEL】+81(0)172-37-5489 【Address】4-12-5 Sotokanda, Chiyoda-ku, Tokyo 【Address】1-11-8 Meieki Minami, Nakamura-ku, Nagoya City, Aichi 【Address】498-1 Asahi-machi, Matsue City, Shimane 【Address】119,Dosan-daero,Gangnam-gu,Seoul,135-887 South Korea 【 】2-7-13 Chuo Wakkanai City, Hokkaido 【Address】71-1 Hon-cho, Hirosaki City, Aomori Address About 1 minute walk from Tokyo Metro Ginza Line Suehiro-cho Station. -

Pdf/Rosen Eng.Pdf Rice fields) Connnecting Otsuki to Mt.Fuji and Kawaguchiko

Iizaka Onsen Yonesaka Line Yonesaka Yamagata Shinkansen TOKYO & AROUND TOKYO Ōu Line Iizakaonsen Local area sightseeing recommendations 1 Awashima Port Sado Gold Mine Iyoboya Salmon Fukushima Ryotsu Port Museum Transportation Welcome to Fukushima Niigata Tochigi Akadomari Port Abukuma Express ❶ ❷ ❸ Murakami Takayu Onsen JAPAN Tarai-bune (tub boat) Experience Fukushima Ogi Port Iwafune Port Mt.Azumakofuji Hanamiyama Sakamachi Tuchiyu Onsen Fukushima City Fruit picking Gran Deco Snow Resort Bandai-Azuma TTOOKKYYOO information Niigata Port Skyline Itoigawa UNESCO Global Geopark Oiran Dochu Courtesan Procession Urabandai Teradomari Port Goshiki-numa Ponds Dake Onsen Marine Dream Nou Yahiko Niigata & Kitakata ramen Kasumigajo & Furumachi Geigi Airport Urabandai Highland Ibaraki Gunma ❹ ❺ Airport Limousine Bus Kitakata Park Naoetsu Port Echigo Line Hakushin Line Bandai Bunsui Yoshida Shibata Aizu-Wakamatsu Inawashiro Yahiko Line Niigata Atami Ban-etsu- Onsen Nishi-Wakamatsu West Line Nagaoka Railway Aizu Nō Naoetsu Saigata Kashiwazaki Tsukioka Lake Itoigawa Sanjo Firework Show Uetsu Line Onsen Inawashiro AARROOUUNNDD Shoun Sanso Garden Tsubamesanjō Blacksmith Niitsu Takada Takada Park Nishikigoi no sato Jōetsu Higashiyama Kamou Terraced Rice Paddies Shinkansen Dojo Ashinomaki-Onsen Takashiba Ouchi-juku Onsen Tōhoku Line Myoko Kogen Hokuhoku Line Shin-etsu Line Nagaoka Higashi- Sanjō Ban-etsu-West Line Deko Residence Tsuruga-jo Jōetsumyōkō Onsen Village Shin-etsu Yunokami-Onsen Railway Echigo TOKImeki Line Hokkaid T Kōriyama Funehiki Hokuriku -

Western Area Guidebook 406 151 a B C D E 62 16 Niigata Shibukawa 335

Gunma Gunma Prefecture Western Area Guidebook 406 151 A B C D E 62 16 Niigata Shibukawa 335 Mt. Harunasan J 334 o Shibukawa- 336 e Ikaho IC 338 Lake Harunako t s u Nagano S 1 h Yagihara 1 i Tochigi Haruna-jinja Shrine n 333 Gunma k 102 Dosojin a Annaka City Takasaki City n of Kurabuchi s e 333 Tomioka City n 114 406 Shimonita Town Kurabuchi Ogurinosato Kanra Town Roadside Station 338 Komayose PA 342 Ibaraki Misato Komayose Smart IC 17 333 Nanmoku Village Fujioka City Shibazakura Park Gumma-Soja 17 Ueno Village Kanna Town ay 3 Takasaki w il a Saitama City R n inkanse 102 u Sh Jomo Electri c 114 Western Gunma okurik H Chuo Maebashi Tokyo Chiba Maebashi IC 76 Yamanashi Maebashi 50 50 Shim- Lake Kirizumiko Hachimanzuka 2 Maebashi 2 Sunflower Maze R 波志江 293 yo m Kanagawa Annaka City o スマート IC 17 Aputo no Michi Li Annakaharuna 406 ne 17 Ino 波志江 PA 18 Akima Plum Grove Komagata IC 太田藪塚 IC 316 Lake Usuiko Touge no Yu Robai no Sato Haruna Fruit Road Takasakitonyamachi Maebashi- 伊勢崎 IC Yokokawa SA Gumma-Yawata Kita-Takasaki Karuizawa Usuitouge Tetsudo Minami IC Usui Silk 332 Bunka Mura Reeling Annaka Takasaki IC 太田桐生 IC What is Yokokawa 18 伊勢崎 Cooperative e i n Takasaki Pageant Takasaki Matsuida- L 354 Takasaki Annaka City Office Takasaki Myogi IC u of Starlight 78 Nishi-Matsuida s JCT 39 t City office e - Minami 354 Isobe Onsen i n Hanadaka Takasaki 2 Matsuida h Byakue Myogi-jinja S 18 Flower Hill Dai-kannon Takasaki-Tamamura 128 Shrine Isobeyana Lookout Kuragano Western Gunma like? Mt. -

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered And/Or Non-Authorized Entities)

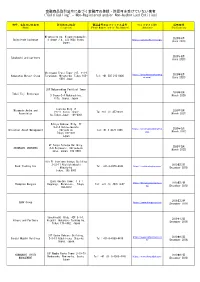

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered and/or Non-Authorized Entities) 商号、名称又は氏名等 所在地又は住所 電話番号又はファックス番号 ウェブサイトURL 掲載時期 (Name) (Location) (Phone Number and/or Fax Number) (Website) (Publication) Miyakojima-ku, Higashinodamachi, 2020年6月 SwissTrade Exchange 4-chōme−7−4, 534-0024 Osaka, https://swisstrade.exchange/ (June 2020) Japan 2020年6月 Takahashi and partners (June 2020) Shiroyama Trust Tower 21F, 4-3-1 https://www.hamamatsumerg 2020年6月 Hamamatsu Merger Group Toranomon, Minato-ku, Tokyo 105- Tel: +81 505 213 0406 er.com/ (June 2020) 0001 Japan 28F Nakanoshima Festival Tower W. 2020年3月 Tokai Fuji Brokerage 3 Chome-2-4 Nakanoshima. (March 2020) Kita. Osaka. Japan Toshida Bldg 7F Miyamoto Asuka and 2020年3月 1-6-11 Ginza, Chuo- Tel:+81 (3) 45720321 Associates (March 2021) ku,Tokyo,Japan. 104-0061 Hibiya Kokusai Bldg, 7F 2-2-3 Uchisaiwaicho https://universalassetmgmt.c 2020年3月 Universal Asset Management Chiyoda-ku Tel:+81 3 4578 1998 om/ (March 2022) Tokyo 100-0011 Japan 9F Tokyu Yotsuya Building, 2020年3月 SHINBASHI VENTURES 6-6 Kojimachi, Chiyoda-ku (March 2023) Tokyo, Japan, 102-0083 9th Fl Onarimon Odakyu Building 3-23-11 Nishishinbashi 2019年12月 Rock Trading Inc Tel: +81-3-4579-0344 https://rocktradinginc.com/ Minato-ku (December 2019) Tokyo, 105-0003 Izumi Garden Tower, 1-6-1 https://thompsonmergers.co 2019年12月 Thompson Mergers Roppongi, Minato-ku, Tokyo, Tel: +81 (3) 4578 0657 m/ (December 2019) 106-6012 2019年12月 SBAV Group https://www.sbavgroup.com (December 2019) Sunshine60 Bldg. 42F 3-1-1, 2019年12月 Hikaro and Partners Higashi-ikebukuro Toshima-ku, (December 2019) Tokyo 170-6042, Japan 31F Osaka Kokusai Building, https://www.smhpartners.co 2019年12月 Sendai Mubuki Holdings 2-3-13 Azuchi-cho, Chuo-ku, Tel: +81-6-4560-4410 m/ (December 2019) Osaka, Japan. -

Sustainability Report 2009 Environment Safety Society

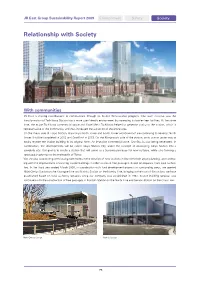

JR East Group Sustainability Report 2009 Environment Safety Society Relationship with Society With communities JR East is making contributions to communities through its Station Renaissance program. One such initiative was the transformation of Tachikawa Station into a more user-friendly environment by increasing its barrier-free facilities. At the same time, the ecute Tachikawa commercial space and Hotel Mets Tachikawa helped to generate vitality to the station, which is representative of the community, and thus increased the attraction of the entire area. On the Yaesu side of Tokyo Station, GranTokyo North Tower and South Tower and GranRoof are continuing to develop; North Tower II will be completed in 2012 and GranRoof in 2013. On the Marunouchi side of the station, work is now under way to totally restore the station building to its original form. An in-station commercial zone, GranSta, is also being developed. In combination, the developments will be called Tokyo Station City, under the concept of developing Tokyo Station into a complete city. Our goal is to create a station that will serve as a transmission base for new cultures, while also forming a spectacular gateway to the metropolis of Tokyo. We are also cooperating with local governments in the creation of new stations in line with their urban planning, and continu- ing with the improvement of existing station buildings in order to create free passages, based on requests from local authori- ties. In the fiscal year ended March 2009, in coordination with land development projects in surrounding areas, we opened Nishi-Omiya Station on the Kawagoe Line and Nishifu Station on the Nambu Line, bringing to the total of 39 stations we have established based on local authority requests since our company was established in 1987.