Hasbro Reports First Quarter 2018 Financial Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Name That! 90S Toy Answers – Adder Apps Level 1 1. Talkboy 2. Bop It 3

5. Spice Girls Dolls Level 6 Level 9 6. Tamagotchi 1. Jenga 1. Puffkins 7. Laser Challenge 2. Weebles 2. Brain Warp 8. Super Soaker 3. He-Man 3. Snardvark 9. Creepy Crawlers 4. Snoopy Sno Cone 4. Chatter Ring Name That! 90s Toy Answers 10. Talkback Dear diary Machine 5. Dragon Flyz – Adder Apps 11. Nerf Guns 5. Dungeons and Dragons 6. Tazos 12. Don’t Wake Daddy* 6. Risk 7. Doodle Bears Level 1 7. Captain Action 8. Neopets 1. Talkboy Level 4 8. Pogo Stick 9. Quints 2. Bop It 1. Jibba Jabba 9. Barrel of Monkeys 10. Vortex Football 3. Buzz Lightyear 2. Hit Clips 10. Koosh Balls 11. Party Mania 4. Crocodile Dentist 3. Bumble Ball 11. BB Gun 12. Zbots 5. Woody 4. Moon Shoes 12. Ker Plunk 6. Pogs 5. Sega Genesis Level 10 7. Nintendo 64 6. Beanie Babies Level 7 1. Fantastic Flowers 8. Furby 7. Mr Potato Head 1. Pretty Pretty Princess 2. Zoids 9. Playstation 8. Polly Pocket 2. Power Rangers 3. Ouija Boards 10. Power Wheels 9. Silly Putty 3. Spin Art 4. Magna Doodle 11. Game Boy 10. Mighty Max 4. Tonka Truck 5. Sticky Hands 12. Easy Bake Oven 11. Sock Em Boppers 5. Wonderful Waterful 6. Boggle 12. Mr Bucket 6. Slip n Slide 7. Lite Brite Level 2 7. Baby Sinclair 8. Cootie 1. Uno Level 5 8. Roller Blades 9. Fashion Plates 2. Barbie 1. Glitter Magic Wand 9. Laser Pointer 10. Hypercolor T-Shirt 3. Tiddlywinks 2. Stretch Armstrong 10. Slap Bracelet 11. -

Resume Artisan

MARK WIESENHAHN VERSATILE German origin: Wiese:(n) yard, meadow, or farm. Hahn:(n) rooster or hen. A free-ranging creative always on the lookout for problems to solve, products to design, businesses to build, stories to tell, and consumers to engage, entertain, and empower! CURIOUS WHO? Pronounciation: “weeze-n-hon” CREATIVELEADER A proven creative leader with experience designing, developing, and implementing successful global products, programs, and stories. A problem solving partner who connects brand centric strategies, stories, products and experiences to seamlessly engage, entertain, and empower their consumers. INNOVATOR Who thrives in and works to create fun, collaborative, dynamic, risk-taking, idea and results driven teams that aren’t afraid to take creative leaps...I always STORYTELLER pack an extra parachute. SELECT ACCOMPLISHMENTS Global Property Development & Creative Brand Management Created and managed Hasbro’s Global Property Development Team After Hasbro made the strategic pivot from a toy and game manufacturer to a branded entertainment company, I led the development team charged with envisioning and Produced over 200 episodes of executing a total brand development process centered around our brand story. entertainment and $1B in total Leveraging this process my team set the brand’s creative vision, strategy, and story commercial revenue. which activated the brand’s commercial blueprint. We worked with all brand partners to align their products and expressions against the blueprint (including core toy and game Grew the Girl’s Entertainment Portfolio products, digital games, entertainment, publishing, and licensed goods). from $125M to over $500M in 3 years. Our branded entertainment development process drove the successful launches of the Grew the Pre-School Entertainment My Little Pony, The Littlest PetShop, Transformers, Transformers Rescue Heroes, Chuck Portfolio by $50M in the first year. -

Hasbro Third Quarter 2011 Financial Results Conference Call Management Remarks October 17, 2011

Hasbro Third Quarter 2011 Financial Results Conference Call Management Remarks October 17, 2011 Debbie Hancock, Hasbro, Vice President, Investor Relations: Thank you and good morning everyone. Joining me today are Brian Goldner, President and Chief Executive Officer; David Hargreaves, Chief Operating Officer; and Deb Thomas, Chief Financial Officer. Our third quarter 2011 earnings release was issued earlier this morning and is available on our website. The press release includes information regarding Non-GAAP financial measures included in today's call. Additionally, whenever we discuss earnings per share or EPS, we are referring to earnings per diluted share. This morning Brian will discuss key factors impacting our results and Deb will review the financials. We will then open the call to your questions. 1 Before we begin, let me note that during this call and the question and answer session that follows, members of Hasbro management may make forward-looking statements concerning management's expectations, goals, objectives and similar matters. These forward- looking statements may include comments concerning our product and entertainment plans, anticipated product performance, business opportunities and strategies, costs, financial goals and expectations for our future financial performance and achieving our objectives. There are many factors that could cause actual results and experience to differ materially from the anticipated results or other expectations expressed in these forward-looking statements. Some of those factors are set forth in our annual report on form 10-K, in today's press release and in our other public disclosures. We undertake no obligation to update any forward looking statements made today to reflect events or circumstances occurring after the date of this call. -

This Exclusive Report Ranks the World's Largest Licensors. the 2012 Report

MAY 2012 VOLUME 15 NUMBER 2 ® This exclusive report ranks the world’s largest licensors. Sponsored by The 2012 report boasts the addition of 20 new licensors, reinforcing the widespread growth of brand extensions, and represents more than $192 billion in retail sales. YOUR RIGHTS. YOUR PROPERTY. YOUR MONEY. Royalty, licensing, joint venture, and profit participation agreements present great revenue opportunities. But, protecting property rights and managing the EisnerAmper Royalty Audit & accuracy of royalty and profit reports often poses significant challenges. The Compliance Services dedicated team of professionals in EisnerAmper’s Royalty Audit & Contract Compliance Services Group use their expertise and experience to assist clients in n Royalty, Participation & Compliance Examinations protecting intellectual properties and recovering underpaid royalties and profits. n Financial Due Diligence There are substantial benefits for licensors and licensees when they know that n Litigation Consultation reports and accountings are fairly presented, truthful and in accordance with the n provisions of their agreements. Put simply: licensors should collect all amounts Royalty Process Consultation to which they are entitled and licensees should not overpay. Furthermore, our licensor clients turn to EisnerAmper when they require information about certain non-monetary activities of their licensees or partners in order to protect the value and integrity of their intellectual properties, and to plan for the future. Find out how EisnerAmper’s professionals can assist licensors prevent revenue from slipping away and how we provide licensees the tools they need to prepare the proper reports and payments. Let’s get down to business. TM Lewis Stark, CPA www.eisneramper.com Partner-in-Charge EisnerAmper Royalty Audit and Contract Compliance EisnerAmper LLP Accountants & Advisors 212.891.4086 [email protected] Independent Member of PKF International Follow us: This exclusive report ranks the world’s largest licensors. -

Stretch Armstrong and the Flex Fighters

Become our fan on Facebook facebook.com/idwpublishing Follow us on Twitter @idwpublishing Subscribe to us on YouTube youtube.com/idwpublishing See what’s new on Tumblr tumblr.idwpublishing.com Check us out on Instagram instagram.com/idwpublishing Greg Goldstein, President & Publisher Robbie Robbins, EVP & Sr. Art Director www.IDWPUBLISHING.com Chris Ryall, Chief Creative Officer & Editor-in-Chief Matthew Ruzicka, CPA, Chief Financial Officer David Hedgecock, Associate Publisher Laurie Windrow, Senior Vice President of Sales & Marketing Lorelei Bunjes, VP of Digital Services Eric Moss, Sr. Director, Licensing & Business Development COVER ARTIST ALUIR AMANCIO Ted Adams, Founder & CEO of IDW Media Holdings COLLECTION EDITORS JUSTIN EISINGER ISBN: 978-1-68405-250-9 21 20 19 18 1 2 3 4 & ALONZO SIMON COLLECTION DESIGNER STRETCH ARMSTRONG AND THE FLEX FIGHTERS. JUNE 2018. FIRST PRINTING. CLAUDIA CHONG HASBRO and its logo, STRETCH ARMSTRONG & THE FLEX FIGHTERS and all related characters are trademarks of Hasbro and are used with permission. © 2018 PUBLISHER Hasbro. All Rights Reserved.The IDW logo is registered in the U.S. Patent and GREG GOLDSTEIN Trademark Office. IDW Publishing, a division of Idea and Design Works, LLC. Editorial offices: 2765 Truxtun Road, San Diego, CA 92106. Any similarities to persons living or dead are purely coincidental. With the exception of artwork used for review purposes, none of the contents of this publication may be reprinted without the permission of Idea and Design Works, LLC. Printed in Korea. IDW Publishing does not read or accept unsolicited submissions of ideas, stories, or artwork. Originally published as STRETCH ARMSTRONG AND THE FLEX FIGHTERS issues #1–3. -

“HEARTBEAT AWAY” Greater Wenatchee Mended Hearts - Chapter 91

“HEARTBEAT AWAY” Greater Wenatchee Mended Hearts - Chapter 91 “Offering hope and encouragement to heart patients, their families and caregivers in North Central Washington” December 2020 ADVANCING ATRIAL FIBRILLATION CARE IN CENTRAL WASHINGTON Roy Lin, MD, Director of Arrhythmia Care and Electrophysi- ology Lab at Confluence Health, spoke at our meeting on Monday, December 7 November 2 about Afib devices and treatments. He de- MENDED HEARTS scribed atrial fibrillation (Afib) as disorganized atrial activa- tion due to atrial myopathy and increases as we age due to HOLIDAY MEETING VIA ZOOM heart changes over the years and increased scaring. 11:30 am -1:00 pm (Sign in 11:15 - 11:30 am) Dr. Lin said the signs and symptoms and signs of Afib include palpita- tions, fatigue, fainting, shortness of breath during physical activity, dizzi- Greater Wenatchee Mended Hearts ness and angina. However, 30 percent of people don’t feel any symp- is inviting heart patients and their toms at all. He indicated that there is a steady increase of Afib in the families in Chelan, Douglas, Grant U.S. as we live longer. He reported that the prevalence of Afib in Chelan and Okanogan Counties to attend. and Douglas Counties is higher than the national and WA average due to an aging population. Come dressed in holiday attire and bring a Christmas ornament/ Dr. Lin said the goals of Afib care for patients at Confluence Health in- tradition to share. clude reducing stroke risk, identifying risk factors, improving quality of life with medications 30-50% and catheter ablation 40-80%, minimizing Guest speaker: Scott Langager, adverse effects of therapy and tailoring therapy for individual patients. -

Relativity and Hasbro Team up to Bring Stretch Armstrong to the Big Screen

January 30, 2012 Relativity and Hasbro Team Up to Bring Stretch Armstrong to the Big Screen Targeted for April 11, 2014 Release BEVERLY HILLS, Calif.--(BUSINESS WIRE)-- Relativity Media has partnered with global branded play company Hasbro, Inc. [NASDAQ-HAS] to develop and produce a live-action tent-pole film based on Stretch Armstrong, the iconic action hero figure launched in the 1970s, it was announced today by Relativity's Co-President, Tucker Tooley and Hasbro's President and CEO, Brian Goldner. Relativity will be the domestic distributor and will release the film internationally through its network of foreign output partners. The film is targeted for an April 11, 2014 release date. The film will be produced by Relativity's CEO, Ryan Kavanaugh (The Fighter), Hasbro's Goldner (Transformers) and Bennett Schneir, Senior Vice President and Managing Director, Motion Pictures (Battleship). Tooley (Immortals) will serve as executive producer. Hasbro has become an entertainment powerhouse by creating hit movies and television shows from its rich portfolio of world class brands. Since 2007, Hasbro's Transformers and G.I. Joe franchises have grossed nearly $3 billion at the worldwide box office. 2012 is shaping up to be another stellar year for Hasbro with its partners Universal Pictures releasing Battleship in April and Paramount Pictures releasing G.I. Joe: Retaliation in June. In television, Hasbro Studios produces shows like Transformers Prime and My Little Pony: Friendship is Magic that can be seen on the HUB television network in the U.S. and in more than 140 countries globally. "We are absolutely thrilled to partner with Hasbro, a company whose global reach and ability to innovate has made them immensely successful in the arena of brand re-imagination-- as evidenced by their legacy of creating such franchises as Transformers and G.I. -

Customer Order Form

#351 | DEC17 PREVIEWS world.com ORDERS DUE DEC 18 THE COMIC SHOP’S CATALOG PREVIEWSPREVIEWS CUSTOMER ORDER FORM CUSTOMER 601 7 Dec17 Cover ROF and COF.indd 1 11/9/2017 3:19:35 PM Dec17 Dark Horse.indd 1 11/9/2017 9:27:19 AM KICK-ASS #1 (2018) INCOGNEGRO: IMAGE COMICS RENAISSANCE #1 DARK HORSE COMICS GREEN LANTERN: EARTH ONE VOLUME 1 HC DC ENTERTAINMENT MATA HARI #1 DARK HORSE COMICS VS. #1 IMAGE COMICS PUNKS NOT DEAD #1 IDW ENTERTAINMENT THE BRAVE AND THE BOLD: BATMAN AND WONDER DOCTOR STRANGE: WOMAN #1 DAMNATION #1 DC ENTERTAINMENT MARVEL COMICS Dec17 Gem Page ROF COF.indd 1 11/9/2017 3:15:13 PM FEATURED ITEMS COMIC BOOKS & GRAPHIC NOVELS Jimmy’s Bastards Volume 1 TP l AFTERSHOCK COMICS Dreadful Beauty: The Art of Providence HC l AVATAR PRESS INC 1 Jim Henson’s Labyrinth #1 l BOOM! STUDIOS WWE #14 l BOOM! STUDIOS Dejah Thoris #1 l D. E./DYNAMITE ENTERTAINMENT 1 Pumpkinhead #1 l D. E./DYNAMITE ENTERTAINMENT Is This Guy For Real? GN l :01 FIRST SECOND Battle Angel Alita: Mars Chronicle Volume 1 GN l KODANSHA COMICS Dead of Winter Volume 1: Good Good Dog GN l ONI PRESS INC. Devilman: The Classic Collection Volume1 GN l SEVEN SEAS ENTERTAINMENT LLC Your Black Friend and Other Strangers HC l SILVER SPROCKET Bloodborne #1 l TITAN COMICS Robotech Archive Omnibus Volume 1 GN l TITAN COMICS Disney·Pixar Wall-E GN l TOKYOPOP Bloodshot: Salvation #6 l VALIANT ENTERTAINMENT LLC BOOKS Doorway to Joe: The Art of Joe Coleman HC l ART BOOKS Neon Visions: The Comics of Howard Chaykin SC l COMICS Drawing Cute With Katie Cook SC l HOW-TO 2 Action Presidents -

Hasbro Expands All-Star Lineup for First-Ever HASCON with Flo Rida

Hasbro Expands All-Star Lineup for First-Ever HASCON with Flo Rida, Maddie Ziegler, Isabela Moner, David Ortiz, Jackie Bradley Jr., Eh Bee Family and the Cast of ‘Stretch Armstrong and the Flex Fighters' August 9, 2017 Just Announced: Performance by Flo Rida and Meet and Greets with Maddie Ziegler, Isabela Moner, Eh Bee Family, David Ortiz, James White, Jackie Bradley Jr., Susan Blu, Len Cabral and the voice cast of Hasbro's Netflix Original Series for Kids ‘Stretch Armstrong and the Flex Fighters' PAWTUCKET, R.I.--(BUSINESS WIRE)-- Today Hasbro, Inc. (NASDAQ:HAS), a global play and entertainment company, unveiled additional entertainment programming details for the first ever HASCON FANmily event. Happening September 8 - 10, 2017 at the Rhode Island Convention Center and Dunkin' Donuts Center in Providence, Rhode Island, HASCON will bring Hasbro's most iconic brands to life. Joining the previously announced all-star lineup is a performance by GRAMMY®-nominated rapper and singer-songwriter Flo Rida ("My House," "Whistle"), who will perform a full set to HASCON guests the evening of Saturday, September 9, and a meet and greet with actress, dance icon and NYT bestselling author, Maddie Ziegler (as featured in "Sia: Chandelier," "Leap!"), Isabela Moner (Transformers: The Last Knight), and family-friendly internet personalities, the Eh Bee Family. Also joining HASCON is veteran voice actress Susan Blu ("The Transformers: The Movie," "Jem"), MLB-retired designated hitter David "Big Papi" Ortiz, current center fielder Jackie Bradley Jr. (of the Boston Red Sox), New England Patriots running back and Super Bowl™ 51 Hero James White (of theNew England Patriots) and internationally acclaimed and award-winning storyteller Len Cabral. -

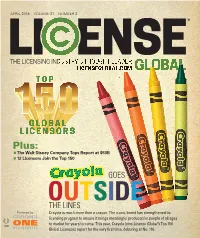

Top 150 Global Licensors Report for the Very First Time, Debuting at No

APRIL 2018 VOLUME 21 NUMBER 2 Plus: The Walt Disney Company Tops Report at $53B 12 Licensors Join the Top 150 GOES OUTSIDE THE LINES Powered by Crayola is much more than a crayon. The iconic brand has strengthened its licensing program to ensure it brings meaningful products for people of all ages to market for years to come. This year, Crayola joins License Global’s Top 150 Global Licensors report for the very first time, debuting at No. 116. WHERE FASHION AND LICENSING MEET The premier resource for licensed fashion, sports, and entertainment accessories. Top 150 Global Licensors GOES OUTSIDE THE LINES Crayola is much more than a crayon. The iconic brand has strengthened its licensing program to ensure it brings meaningful products for people of all ages to market for years to come. This year, Crayola joins License Global’s Top 150 Global Licensors report for the very first time, debuting at No. 116. by PATRICIA DELUCA irst, a word of warning for prospective licensees: Crayola Experience. And with good reason. The Crayola if you wish to do business with Crayola, wear Experience presents the breadth and depth of the comfortable shoes. Initial business won’t be Crayola product world in a way that needs to be seen. Fconducted through a series of email threads or Currently, there are four Experiences in the U.S.– conference calls, instead, all potential partners are asked Minneapolis, Minn.; Orlando, Fla.; Plano, Texas; and Easton, to take a tour of the company’s indoor family attraction, Penn. The latter is where the corporate office is, as well as the nearby Crayola manufacturing facility. -

GL NAME SUBCATDESC Asin EAN DESCRIPTION QTY TOTAL RETAIL

GL NAME SUBCATDESC Asin EAN DESCRIPTION QTY TOTAL RETAIL Toy Electric & Battery Car Sets / AccessB07DD8B92G 8411845011540 FEBER - My Lovely Unicorn con Melena Rosa, Mascota electronica1 y276,07 vehiculo € de bateria 12 V (Famosa 800011603) Toy Electric & Battery Car Sets / AccessB07DD8B92G 8411845011540 FEBER - My Lovely Unicorn con Melena Rosa, Mascota electronica1 y276,07 vehiculo € de bateria 12 V (Famosa 800011603) Toy Electric & Battery Car Sets / AccessB07DD8B92G 8411845011540 FEBER - My Lovely Unicorn con Melena Rosa, Mascota electronica1 y276,07 vehiculo € de bateria 12 V (Famosa 800011603) Toy Radio Control Vehicles B00IYNHX8M 4042774392826 Jamara Dakar 1:10 BL Remote controlled helicopter - Juguetes1 de control273,63 remoto€ (Polimero de litio, 3700 mAh, 500 mm, 280 mm, 210 mm, 2,17 kg) Toy Action Figure Playsets & Access B00IF1VYEW 4008789060006 Playmobil 6000 - Knights - castillo de los caballeros del leon imperial1 168,43 - € Toy Radio Control Vehicles B01BPFDZL4 795752995376 SIKU6778 1 160,30 € Toy Non-Powered Vehicles B072C9BF66 887961627084 Justice League Batman Batmovil Radio Control Mattel Spain 1FRL54159,99 € Toy Building Sets (3 Years Old and More)B075GQ854W 5702016110609 Lego Star Wars - Halcon Milenario del Corredor De Kessel (75212)1 138,68 € Toy Action Figure Playsets & Access B01L93GCTO 5010993335442 Star Wars - R2d2 Inteligente (Hasbro B7493EU0) 1 136,78 € Toy Battery Operated For Movement B0756F8HF2 5902860652724 moleo - Coche Infantil Mercedes-Benz ML con 2 Motores, MP3,1 Mando131,25 a Distancia € Toy Doll Houses -

$5.99 Toy List

$5.99 TOY LIST K’nex® Asst. Starter Vehicles CRA-Z-ART® Nickelodeon Pink or Blue Slime Disney Princess® Cupcake Party Tutti Frutti® Banana & Strawberry Star Wars® Asst. Mighty Mugs Expressions Characters Craft City™ DIY Slime Kit Nerf® Asst. Microshots AST Blasters Wecool® Mix & Mash Slime Mixer Series 2 Family Feud 6th Edition Pressman® Photo Pearls Animal Kits Asst. Family Feud Strike Out Card Game WindNSun® WindSical Outdoor Animated Orca Fisher Price® S&S Friends Hasbro® Doh Vinci Advent Calendar Mattel® Mega First Builders Animal Bucket Asst. National Geographic® Trek Pack HobbyKids® Slime Toss Challenge Sunny Days® Cupcake Surprise Dolls Disney Princess® Style Light-Up Play Watch Zuru® X-Shot Barrel Breaker Star Wars® Science Millennium Falcon UV Light Laser Star Wars® Asst. Play-Doh® Can Heads Star Wars® Obi Wan Lightsaber Room Light Zuru® X-Shot Recoil Kickback BRIT +CO® Weave Necklace Kit Learning Journey® Construction Floor Puzzle Liz Woodzeez® The Croakalily™ Frog Family & Storybook Beat Bugs Band™ Kumi’s Beatbox Review Hot Wheels® Monster Trucks 1:43 Scale Chevy Silverado Switch’em Set Hot Wheels® Stunt Set Asst. Play-Doh® Numbers & Counting Set Hot Wheels® Asst. 3-Packs Styles May Vary Rescue Heros® Forest Fuego or Reed Vitals Disney® Toy Story® Asst. Mini Character & Vehicle Hot Wheels® Moster Truck Display Mattel® Little Mommy Asst. Mini Baby DC® Batman® Asst. 6” Action Figures Disney Junior® Mickey Roadster Racers Vehicles Imaginext® Jurassic World Classic Asst. Egg Packs Disney Junior® Mickey Roadster Racers Wacky Workers Fisher Price® Asst. Blink & Go Blonkers Masks Thomas & Friends® Asst. Mini Fizz ‘N Go Cargo Fisher Price® Sunny Day 6” Bath Doll Imaginext® Jurassic World Classic Asst.