Investor Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Q4 & Full-Year 2019 Earnings Presentation

Q4 & FULL-YEAR 2019 EARNINGS PRESENTATION 0 3 / 1 0 / 2 0 2 0 SAFE HARBOR Forward-Looking Information This presentation includes forward-looking information and statements within the meaning of the federal securities laws. Except for historical information contained in this release, statements in this release may constitute forward-looking statements regarding assumptions, projections, expectations, targets, intentions or beliefs about future events. Statements containing the words “may”, “could”, “continue”, “would”, “should”, “believe”, “expect”, “anticipate”, “plan”, “goal”, “estimate”, “accelerate”, “target”, “project”, “intend” and similar expressions constitute forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Forward-looking statements are based on management’s current belief, as well as assumptions made by, and information currently available to, management. While the Company believes that its expectations are based upon reasonable assumptions, there can be no assurances that its goals and strategy will be realized. Numerous factors, including risks and uncertainties, may affect actual results and may cause results to differ materially from those expressed in forward-looking statements made by the Company or on its behalf. Some of these factors include, but are not limited to, risks related to the substantial uncertainties inherent in the acceptance of existing and future products, the difficulty of commercializing and protecting new technology, the impact of competitive products and pricing, general business and economic conditions, including the impact of coronavirus on consumer demands and manufacturing capabilities, the Company's partnerships with influencers, athletes and esports teams. -

God Games’, with the Player Supposedly Given Omnipotent Control Over the Game Environment, Revealing the Enduring Presence of the Second-Creation Narrative

Smith, B. T. L. (2017). Resources, Scenarios, Agency: Environmental Computer Games. Ecozon@, 8(2), 103-120. http://ecozona.eu/article/view/1365 Peer reviewed version Link to publication record in Explore Bristol Research PDF-document This is the author accepted manuscript (AAM). The final published version (version of record) is available online via Universidad de Alcale at http://ecozona.eu/article/view/1365 . Please refer to any applicable terms of use of the publisher. University of Bristol - Explore Bristol Research General rights This document is made available in accordance with publisher policies. Please cite only the published version using the reference above. Full terms of use are available: http://www.bristol.ac.uk/red/research-policy/pure/user-guides/ebr-terms/ Resources, scenarios, agency: environmental computer games Abstract In this paper I argue that computer games have the potential to offer spaces for ecological reflection, critique, and engagement. However, in many computer games, elements of the games’ procedural rhetoric limit this potential. In his account of American foundation narratives, environmental historian David Nye notes that the ‘second-creation’ narratives that he identifies “retain widespread attention [...] children play computer games such as Sim City, which invite them to create new communities from scratch in an empty virtual landscape…a malleable, empty space implicitly organized by a grid” (Nye, 2003). I begin by showing how grid-based resource management games encode a set of narratives in which nature is the location of resources to be extracted and used. I then examine the climate change game Fate of the World (2011), drawing it into comparison with game-like online policy tools such as the UK Department for Energy and Climate Change’s 2050 Calculator, and models such as the environmental scenario generation tool Foreseer. -

Turtle Beach Corp. (NASDAQ: HEAR) Price Target USD$ 16.00 Consumer Electronics - Videogame Peripherals Rating Buy a Sound Bull Case Share Price (Apr

Analyst: Ian Del Rio, BSc. ‘21 [email protected] Equity Research US Turtle Beach Corp. (NASDAQ: HEAR) Price Target USD$ 16.00 Consumer Electronics - Videogame Peripherals Rating Buy A Sound Bull Case Share Price (Apr. 30 Close) USD $10.08 April 30, 2020 Total Return 58.7% Turtle Beach Corporation (the Company), is a leading videogame Key Statistics peripheral brand offering a large selection of gaming accessories for all major gaming consoles, PC’s and mobile devices. A market 52 Week H/L $12.50/$4.05 leader in console gaming headsets for the past 10 years, Turtle Market Capitalization $143M Beach has recently expanded its product offering to include PC Average Daily Trading Volume 0.4M gaming peripherals such as headsets, keyboards and mice. Net Debt $7.4M Thesis – Over-Shorted and Underappreciated Enterprise Value $134.86M We believe the market has over-corrected for Turtle Beach’s Net Debt/EBITDA 0.5x inflated valuation in 2018 caused by the meteoric rise of battle Diluted Shares Outstanding 14.5M royale games. The current short interest on the stock suggests the market is now overly pessimistic of the company’s future Free Float 94% performance. Dividend Yield N/A WestPeak’s Forecast Drivers – Online Multiplayer Games The success of major gaming franchises with popular online 2019A 2020E 2021E multiplayer modes that encourage player communication tend to Revenue $238M $221M $227M drive increased gaming headset sales. Furthermore, the launch of EBITDA $15M $23M $20M new Xbox and Playstation gaming consoles in late 2020 is Net Income $18M $22M $21M expected to drive growth in headset sales in 2021 and 2022, as new buyers look to purchase a gaming headset to enhance their EPS $1.24 $1.53 $1.26 gaming experience with their new console and owners of the P/E 9.7x 7.1x 7.5x previous generation of consoles look to upgrade their gaming EV/EBITDA 7.2X 4.7X 5.6X headset. -

7:30 A.M. – AUDIT CONFERENCE PARK COMMISSIONERS and PARK DISTRICT AUDIT COMMITTEE (Pursuant to Section 121.22 (D) (2) of the Ohio Revised Code)

BOARD OF PARK COMMISSIONERS OF THE CLEVELAND METROPOLITAN PARK DISTRICT THURSDAY, MARCH 14, 2019 Cleveland Metroparks Administrative Offices Rzepka Board Room 4101 Fulton Parkway Cleveland, Ohio 44144 7:30 A.M. – AUDIT CONFERENCE PARK COMMISSIONERS AND PARK DISTRICT AUDIT COMMITTEE (Pursuant to Section 121.22 (D) (2) of the Ohio Revised Code) 8:00 A.M. – REGULAR MEETING AGENDA 1. ROLL CALL 2. PLEDGE OF ALLEGIANCE 3. MINUTES OF PREVIOUS MEETING FOR APPROVAL OR AMENDMENT • Regular Meeting of February 14, 2019 Page 88339 4. FINANCIAL REPORT Page 01 5. NEW BUSINESS/CEO’S REPORT a. APPROVAL OF ACTION ITEMS i) General Action Items (a) Chief Executive Officer’s Retiring Guest(s): • Terry L. Robison, Director of Natural Resources Page 07 • Stephen J. Schulz, Education Specialist Page 08 • Virginia G. Viscomi, Service Maintenance II Page 08 (b) 2019 Budget Adjustment No. 2 Page 09 (c) Revision of Rates and User Fees Page 10 (d) Club Metro 2019 Financial Request Page 10 (e) RFP #6149: Golf Cars Page 11 (f) Edgewater Marina Operations – Lease Agreement Page 12 (g) Whiskey Island Marina Operations – Management Services Agreement Page 14 (h) Branded Product Sponsor and Suppler of Beverages Agreement – Page 15 Amendment No. 2 (i) Contract Amendment – RFP #6344-B: Bonnie Park Ecological Restoration Page 16 and Site Improvement Project – Mill Stream Run Reservation -GMP 1 (j) Professional Services Agreement – RFQu #6402: Bridge Inspection and Page 18 Engineering Support Program 2019-2014; and 2020 Bridge Inspections and Summary Reports Proposal (k) Authorization of Funds – Whiskey Island Marina Emergency Repair – Page 21 Wind Damage (l) Nomination of Joseph V. -

DEMO Magazine

ISSUE 18 SPRING/SUMMER 2013 DEMOThe Alumni Magazine of Columbia College Chicago The avant-garde fashion designs of AGNES HAMERLIK Revitalizing Detroit with PHILLIP COOLEY Lessons learned on KICKSTARTER May 17, 2013 ALUMNI AT Want to perform? Volunteer? Or just come out and be a part of the awesome Manifest audience? If you are an alumnus and would like an application to perform on the Alumni Stage, contact Cyn Vargas at [email protected]. Stop by, sit back, and ALUMNI LOUNGE relax in our alumni ALUMNI & lounge! You'll enjoy your Noon – 7PM fellow alumni performers GRADUATION PARTY singing, reciting, dancing, 623 South Wabash and other cool stuff. 8PM – 11PM Quincy Wong Center Hilton Chicago for Artistic Expression 720 S. Michigan Ave. Grand Ballroom colum.edu/alumnimanifest Art: Thumy Phan, Manifest Creative Director Creative Phan, Manifest Art: Thumy ’12) Jacob Boll (BA Photos: CONTENTS DEMO ISSUE 18 SPRING/SUMMER 2013 18 11 FEATURES PORTFOLIO SPOT ON DEpaRTMENTS 8 22 30 Justin “Nordic Thunder” 03 Vision A question for Howard (BA ’07) reigns as President Carter KICKSTART MY ART LIFE DURING king in the competitive world Columbia alumni, students, WARTIME of air guitar. 04 Wire News from the and faculty share lessons Photographer Andrew Nelles Columbia community learned on their way to crowd- (BA ’08) recounts his days 32 Karine Saporta (BA ’72), funding success. covering American troops in knighted in France, 38 Alumni News & Notes By Stephanie Ewing (MA ’12) Afghanistan. As told to Andrew stays in demand as a Featuring class news, notes, Greiner (BA ’05) dancer, choreographer, and networking 14 and photographer. -

Vlaams Audiovisueel Fonds

VLAAMS AUDIOVISUEEL FONDS . jaarverslag 2018 VLAAMS AUDIOVISUEEL FONDS . jaarverslag 2018 uitgegeven door het .VLAAMS AUDIOVISUEEL FONDS vzw huis van de vlaamse film bischoffsheimlaan 38 - 1000 brussel [email protected] vaf.be Met de steun van de Vlaamse minister van Cultuur, Media, Jeugd en Brussel en de Vlaamse minister van Onderwijs INHOUD . jaarverslag 2018 VOORWOORDEN FINANCIEEL CREATIE TALENT- ONTWIKKELING •4 •7 •15 •26 COMMUNICATIE & PUBLIEKSWERKING GAMEFONDS SCREEN PROMOTIE FLANDERS •39 •47 •53 •67 DUURZAAM KENNISOPBOUW WERKING VLAAMSE FILM FILMEN IN CIJFERS •73 •77 •81 •89 Toen ik in mei vorig jaar op het Festival Deze maatregelen zullen ongetwijfeld om op dit vlak lessen te trekken. van Cannes de film Girl te zien kreeg, hun vruchten afwerpen. Toch wil ik een Het is duidelijk dat we erin geslaagd zijn voelde ik aan de stilte in de zaal bij warme oproep doen aan de volgende om ook dit jaar als VAF op verschillende de aftiteling welke magie er uitging Vlaamse Regering voor extra middelen vlakken toonaangevend te zijn. Hopelijk VOORWOORD van het brengen van zo’n mooi en in de nieuwe bestuursperiode. Er kunnen we in de toekomst op dit elan ontroerend verhaal. De tsunami aan werden in het verleden reeds extra doorgaan. Met het huidige team van Alles start met een prijzen die de film in ontvangst mocht middelen vrijgemaakt voor het VAF/ medewerkers heb ik er als voorzitter nemen, was ongezien. We mogen als Mediafonds en het VAF/Gamefonds die alvast het volste vertrouwen in. n goed verhaal VAF bijzonder fier zijn dat we mee aan zeker een boost gegeven hebben. -

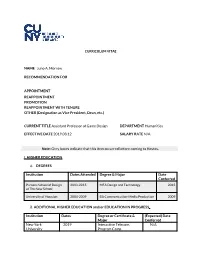

NAME Juno A. Morrow RECOMMENDATION FOR

CURRICULUM VITAE NAME Juno A. Morrow RECOMMENDATION FOR APPOINTMENT REAPPOINTMENT PROMOTION REAPPOINTMENT WITH TENURE OTHER (Designation as Vice President, Dean, etc.) CURRENT TITLE Assistant Professor of Game Design DEPARTMENT Humanities EFFECTIVE DATE 2019.08.12 SALARY RATE N/A Note: Grey boxes indicate that this item occurred before coming to Hostos. I. HIGHER EDUCATION A. DEGREES Institution Dates Attended Degree & Major Date Conferred Parsons School of Design 2013-2015 MFA Design and Technology 2015 at The New School University of Houston 2004-2009 BA Communication-Media Production 2009 B. ADDITIONAL HIGHER EDUCATION and/or EDUCATION IN PROGRESS Institution Dates Degree or Certificate & (Expected) Date Major Conferred New York 2019 Interactive Telecom. N/A University Program Camp II. EXPERIENCE A. TEACHING EXPERIENCE Institution Department Rank Dates CUNY—Eugenio María de Hostos Humanities Assistant Professor 2015- Community College Present Parsons School of Design Art, Media & Technology Part-time Lecturer 2015 Parsons School of Design Art, Media & Technology Teaching Fellow 2014 Parsons School of Design Art, Media & Teaching Assistant 2014 Technology B. OTHER EXPERIENCE Institution Department Rank or title role Dates (Independent/Freelance) N/A Photographer/Designer 2009- Present Try The World N/A Front-End Web Developer 2015 Parsons School of Design gadgITERATION Graduate Research 2014-2015 Assistant Reed Elsevier Universal Access Research Coordinator 2012-2013 HASH magazine Photography Staff Photographer 2012-2013 HRP/CoxReps -

United States Securities and Exchange Commission Form

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2019 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to Commission File Number: 0-29174 LOGITECH INTERNATIONAL S.A. (Exact name of registrant as specified in its charter) Canton of Vaud, Switzerland None (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) Logitech International S.A. EPFL - Quartier de l'Innovation Daniel Borel Innovation Center 1015 Lausanne, Switzerland c/o Logitech Inc. 7700 Gateway Boulevard Newark, California 94560 (Address of principal executive offices and zip code) (510) 795-8500 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Registered Shares par value CHF 0.25 per share The Nasdaq Global Select Market; SIX Swiss Exchange Securities registered or to be registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Biden Calls for New Gun Laws As Shootings Rekindle Debate

P2JW083000-6-A00100-17FFFF5178F ****** WEDNESDAY,MARCH 24, 2021 ~VOL. CCLXXVII NO.68 WSJ.com HHHH $4.00 DJIA 32423.15 g 308.05 0.9% NASDAQ 13227.70 g 1.1% STOXX 600 423.31 g 0.2% 10-YR. TREAS. À 13/32 , yield 1.637% OIL $57.76 g $3.80 GOLD $1,724.70 g $13.10 EURO $1.1851 YEN 108.58 Boulder Mourns Victims as Suspect Is ChargedWith Murder Intel Sets What’s News Strategy To Speed Business&Finance Its Chip ntel’snew CEO is fast Itracking effortstorevive the semiconductor giant Revival with abroad plan that mixes increased outsourcing with acommitment to spend $20 Semiconductor maker billion on newfactories. A1 earmarks $20 billion Powell, in a joint appear- ancewith Yellen on Capitol GES to expand U.S. plants, Hill, said he doesn’t expect IMA will boost outsourcing the $1.9trillion stimulus package will lead to an unwel- GETTY SE/ BY AARON TILLEY come increase in inflation. A2 U.S. stocks ended lower Intel Corp.’snew chief exec- afterthe testimonybyPowell ANCE-PRES utiveisfast tracking effortsto FR and Yellen, with the S&P 500, revivethe semiconductor gi- Dowand Nasdaq losing 0.8%, ENCE ant with abroad plan that AG 0.9% and 1.1%, respectively. B11 Y/ mixes increased outsourcing with acommitment to spend Robinhood Marketsfiled NNOLL $20 billion on newfactories paperworkwith the SEC for CO that could help addressa what is suretobeone of the ON global chip shortage. year’s most eagerly awaited JAS IN MEMORY: People gather foracandlelight vigil Tuesdaynight to honor the 10 victims killedMondaybyagunman at a Pat Gelsinger said Tuesday initial public offerings. -

Bowl Round 8

USABB National Bowl 2016-2017 Round 8 Round 8 First Half (Tossup 1) This leader's eunuch Zhao Gao managed to alter the line of succession by convincing this leader's son Fusu to commit suicide. This man was advised by Li Si, who inspired him to target the Hundred Schools of Thought, bury (*) Confucian scholars alive, and burn their teachings. This man defeated the state of Zhao to end the Warring States period in 221 BC. A large terracotta army was designed for the burial tomb of, for ten points, what first emperor of China and founder of the Qin [chin] dynasty? ANSWER: Qin Shi Huangdi (accept Ying Zheng or Zhao Zheng) (Bonus 1) This man consolidated power over Italy with his blackshirts in the March on Rome. For ten points each, [Part A] Name this leader of Italy before and during World War II, nicknamed \Il Duce." ANSWER: Benito Mussolini [Part B] Mussolini was a proponent of this far-right political ideology, which emphasizes the state over the individual via an authoritarian ruler. ANSWER: fascism (accept word forms) [Part C] Mussolini established Italian East Africa after his conquest of this country in 1936, which had been ruled at the time by Haile Selassie. ANSWER: Ethiopia (accept Abyssinia) (Tossup 2) A character in this story brings home an invitation to Georges Rampouneau's [rom-poo-NOH's] party, and sleeps in a side room while his wife dances until four in the morning. The central object of this story is only worth five hundred francs, but the (*) Loisels [lwah-ZELLS] nevertheless incur massive debt in order to repay Madame Forestier [foh-res-tee-AY] when that object is lost at a ball. -

Turtle Beach Corporation Market Share for Headsets

Mateo Panjol Tuflija, Chen Zhou, Jaro Van Diepen, Achyut Seth Video Game Industry Overview : Consumer Demographics Action and shooter games are within the top three categories of popular games genres; these games require higher sound quality for gamers to maintain a competitive advantage. For example, in a shooting video game, a headset with high sound quality would allow a gamer to better locate other players and know what direction bullets are coming from. % of population 47% 40% playing games Competition Completion Males’ 14.1% 17.0% predominant 14.1% 17.0% motive for playing video DestructionDestruction Fantasy games are competition and 11.9% 1.2% destruction. Completion Design With the rise in Battle Royale 10.2% 14.5% games, these gamers are more inclined to Fantasy Community purchase 9.5% accessories to 9.0% 9.5% give them a competitive Competition CommunityCommunity Story advantage over other players. 8.8% 8.8% 8.5% 2 Industry Overview | Company Overview | Investment Thesis | Valuation Video Game Industry Overview: Revenue and Segment Breakdown Worldwide Game Market Revenue from 2015 to 2017 by region Unit: Billions 51.2 2015 2016 2017 46.6 43.1 27 26.2 23.8 25.4 23.5 20.5 4 4.1 4.4 Asia Pacific North America Europe, Middle East, Africa Latin America Consumer Spending on Gaming in the US and By Segment (2010-2016) Unit: Billions 17% increase in spending on accessories from 2013 to 2016 because of high disposable income & advancements in tech 35 30 2.2 3.7 25 2.94 2.62 1.93 2.1 20 1.88 6.29 5.59 1.93 4.9 4.04 4.26 5.08 15 24.5 10 15.9 16.54 14.8 15.39 15.4 16.5 5 0 2010 2011 2012 2013 2014 2015 2016 Content Hardware Accessories 3 Industry Overview | Company Overview | Investment Thesis | Valuation Video Game Headsets & Accessories Industry Overview: General Info and Trends With gaming content in recent years becoming more focused on online multiplayer modes, communication and sound quality becomes more important in the gameplay experience. -

Egx Rezzed the Trpg

1: An anticapitalist and 2: An inscrutably baroque 3: An autobiographical 4: A hideously early access 5: A stealth-focused Present 6: A rhythm-based 7: An “apolitical” by Grant Howitt & Nate Crowley 8: A neon-drenched 9: An impossibly long 10: A free-to-play 1: Metroidvania THE INDIE GAME YOU ARE SUPER 2: “Wholesome” EXCITED TO PLAY AT REZZED 3: Couch co-op is generated by rolling on the tables 4: Pay-to-win to the right. Each player rolls up a 5: VR YOU ARE ATTENDING REZZED, game of their own, which they’ve 6: Massively Multiplayer THE COOL AND WELL KNOWN been excited about for years: 7: Viciously difficult GAMING SHOW... 8: Bullet hell But can you make it to the You know it’s in there somewhere. 9: FMV end of the day, having played But between you and that game 10: Roguelike the one game you’re desperate you’ve salivated over for decades to play, and without bursting is the show itself: a gauntlet 1: Arena shooter in to tears from fatigue and of overenthusiastic developers, 2: Garden simulator hunger? Can you maintain the bellowing streamers, brutally 3: Metaphor for depression separation between fantasy slow refreshment vendors, and 4: Dark Souls clone and reality? cosplayers walking twelve abreast 5: Visual novel And is the monstrous through the ten miles of winding 6: Historical RTS chimera hunting you through catacombs that comprise the 7: Ambient Storytelling Experience Tobacco Dock a genuine threat, Tobacco Dock venue. And you’re 8: Factory-making game or merely your imagination? certain there’s a minotaur in there 9: Tower Defence game Let’s find out! somewhere, too.