UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, DC 20549

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Equity Markets USD 47 Tn

19 January 2012 2011 WFE Market Highlights 2011 equity volumes remained stable despite a fall in market capitalization. Derivatives, bonds, ETFs, and securitized derivatives continued to grow strongly. Total turnover value remained stable in 2011 at USD 63 tn despite a sharp decrease of the global market capitalization (-13.6% at USD 47 tn). High volatility and global uncertainty created from the sovereign debt crisis affected volumes all year through and made August 2011 the most active month in terms of trading value, a highly unusual annual peak for markets. Despite overall unfavorable conditions for primary markets in several regions, WFE members increased their total listings by 1.7% totaling 45 953 companies listed. Total number of trades decreased by 6.4% at 112 tn. This trend combined with the stability of turnover value led to a small increase in the average size of transaction which was USD 8 700 in 2011. The high volatility and lack of confidence that affected financial markets globally probably drove the needs of hedging as derivatives contracts traded grew by 8.9%. WFE members continued to diversify their products range as other products such as bonds, ETFs, and securitized derivatives all had solid growth in 2011. Equity Markets Market capitalization USD 47 tn -13.6% Domestic market capitalization declined significantly in 2011 to USD 47 401 bn roughly back to the same level of end 2009. The decline affected almost all WFE members, as there were only four exchanges ending 2011 with a higher market capitalization. The magnitude of the decline is quite similar among the three time zones: -15.9% in Asia-Pacific, -15.2% in EAME and -10.8% in the Americas. -

United States Securities and Exchange Commission Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-36169 BLUE CAPITAL REINSURANCE HOLDINGS LTD. (Exact name of registrant as specified in its charter) Bermuda 98-1120002 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) Waterloo House 100 Pitts Bay Road Pembroke, Bermuda HM 08 (Address of principal executive offices) Registrant’s telephone number, including area code: (441) 278-0400 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol(s) Name of each exchange on which registered Common Shares, par value $1.00 per share BCRH New York Stock Exchange Common Shares, par value $1.00 per share BCRH.BH Bermuda Stock Exchange Securities registered pursuant to Section 12(g) of the Act None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Annual Report 2020 the Bank of N.T

ANNUAL REPORT 2020 THE BANK OF N.T. BUTTERFIELD & SON LIMITED ANNUAL REPORT 2020 REPORT ANNUAL Banking, trust, investments, by . Established as Bermuda’s first bank in 1858, Butterfield today offers a range of community banking and bespoke financial services from eight leading international financial centers, supported by centralized service centers in Canada and Mauritius. The Butterfield team comprises 1,314 employees working together to help our clients manage their wealth and protect it for future generations, while creating sustainable, long-term value for our shareholders. Vision Mission To be the leading independent offshore bank To build relationships and wealth. and trust company. Values APPROACHABLE COLLABORATIVE EMPOWERED IMPACTFUL We commit to We collaborate for We foster We celebrate personal service. effective teamwork. individual initiative. collective success. Locations The Bahamas Bermuda Jersey United Kingdom Cayman Islands Canada* Switzerland Mauritius* Singapore Guernsey *Non-client-facing service center. Results Core Net Income* (millions) Core Return on Average Tangible Total Assets (millions) $250 Common Equity* 30.0% $16,000 $13,922 $14,739 $197.0 $197.9 25.6% $14,000 $200 25.0% 22.4% 23.4% 20.5% $12,000 $11,103 $10,779 $10,773 $158.9 $154.5 20.0% $150 17.3% $10,000 $123.0 15.0% $8,000 $100 $6,000 10.0% $4,000 $50 5.0% $2,000 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 Capital** 25.0% 22.4% 19.9% 19.6% 19.6% 19.8% 20.0% 19.4% 17.6% 18.2% 18.2% 17.3% 17.3% 16.1% 16.1% 15.3% 15.3% 15.0% -

Listings Advisory: ESG & Green Bonds

Global Legal and Professional Services ADVISORY Industry Information Listings Advisory: ESG & Green Bonds July 2020 If ever there was a year when ESG bonds would come to the fore, 2020 has proven to be such a year. As international capital markets respond to the Covid-19 pandemic, we have witnessed a renewed focus on the social element of ESG bonds reflecting strong investor appetite for ESG issuance, particularly where the proceeds of such issuance may have a beneficial societal impact during this crisis. Walkers has been pleased to act as listing agent on a number of recent ESG issuances and we expect to see increased demand from capital markets participants for ESG products during 2020 and beyond. Alongside increased investor demand for ESG & green bonds, we’ve seen the development and promotion of ESG & Green market segments on many international stock exchanges including Euronext Dublin, the Cayman Islands Stock Exchange (CSX), The International Stock Exchange (TISE), Vienna MTF and the Bermuda Stock Exchange (BSX) for whom Walkers acts as a recognised listing agent. This advisory aims to provide clients with a flavour of our listing expertise alongside the options available when choosing to list ESG & Green Bonds. Listing ESG & Green Bonds on a Recognised Stock Exchange At Walkers we offer issuers a choice of market on which to list your securities with the added attraction of recognised ESG & Green segments. The process for listing ESG and Green Bonds follows the standard listing process with the additional benefit of boosting the profile of your bond through its admission to the green/ESG segment of an internationally recognised stock market. -

POLICE 2003 Cover Visual

strength, determination + perseverance 2003 ANNUAL REPORT Vision Statement The Bermuda Police Service, focusing on its core functions, is operating at full strength and is support- ed by an effective and efficient Human Resources Department and civilianisation process. Facilities are specifically built or adapted to meet the unique demands of modern policing. Proven technological and support equipment as well as the required financial resources are utilised. Its highly trained and respected Bermudian Commissioner is heading an effective, apolitical management team that is practicing shared leadership of a disciplined Service. Consistent application of policies reflects its values, mission and vision. Effective training and development programmes continuously enhance job performance and meet individual and organisational needs. The communication process is open, honest and respectful. It flows effectively, both internally and exter- nally. It is working in partnership with the community and other agencies to provide the necessary edu- cation and information that enhances these relationships. There is a safe, practical and healthy work environment for all. An effective welfare policy and enforced code of conduct promote openness, trust and unity. Its members have access to legal representation and funding when a complaint has been lodged. The Hon. Randolph Through unified representation, all members are covered by an equitable medical policy and are pro- Horton, JP, MP vided with similar benefits. Minister of Labour, Home Affairs and Public Safety Introduction Section 62 (1) (c) and (d) of the Bermuda Constitution set out the responsibilities of the Governor of Bermuda for the internal security of Bermuda and the Bermuda Police Service. The operational control of the Bermuda Police Service (BPS) is vested in the Commissioner of Police by virtue of the Police Act 1974. -

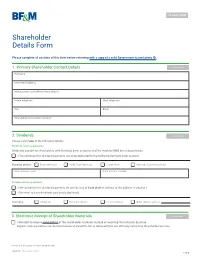

Shareholder Update Form

Shareholder Details Form Please complete all sections of this form before returning with a copy of a valid Government-issued photo ID. 1. Primary Shareholder Contact Details Full name Residential address Mailing address (if different from above) Home telephone Work telephone Cell Email Shareholder registration name(s)* 2. Dividends Please select one of the following options: Bermuda currency payments: Dividends payable to shareholders with Bermuda bank accounts shall be made by BMD direct deposit only. I/We authorise that dividend payments are to be deposited to the following Bermuda bank account. Banking details: Butterfield Bank HSBC Bank Bermuda Clarien Bank Bermuda Commercial Bank Bank account name: Bank account number: Foreign currency payments: I/We authorise that dividend payments be sent by way of bank draft as follows to the address in Section 1. I/We elect to have dividends paid yearly (optional). Currency: US Dollars Canadian Dollars Pounds Sterling Other (please specify): 3. Electronic Receipt of Shareholder Materials I/We elect to receive HARD COPIES of the shareholder materials instead of receiving the materials by email. Reports and newsletters can be found online at www.bfm.bm or obtained from our office by contacting Shareholder Services. * Name as it will appear on the share certificate. LGL100 / December 2020 1 of 3 4. Compliance Details Please complete the following for each named shareholder, including joint shareholders and minors/beneficiaries. Please include all nationalities and countries of residence. Type of -

Annual Report December 31, 2009

ANNUAL REPOR T 2 0 0 9 Corporate Information EXECUTIVE OFFICE: DIRECTORS & OFFICERS 150 King Street West OF THE COMPANY: Suite 1702, Toronto, Ontario Thomas S. Caldwell, C.M. M5H 1J9 Director and President Telephone: (416) 595-9106 Toronto, Ontario Facsimile: (416) 862-2498 John R. Campbell, Q.C. TRANSFER AGENT & REGISTRAR: Director and CIBC Mellon Trust Company Vice-President P.O. Box 7010, Toronto, Ontario Adelaide Street Postal Station Bethann Colle Toronto, Ontario Director M5C 2W9 Toronto, Ontario AUDITORS: DELOITTE & TOUCHE LLP Michael B.C. Gundy Brookfield Place Director 181 Bay Street Toronto, Ontario Suite 1400 George Mencke Toronto, Ontario M5J 2V1 Director INDEPENDENT REVIEW Toronto, Ontario COMMIT TEE: Jean Ponter Robert Guilday Chief Financial Officer H. Clifford Hatch Jr. Harry Liu Sharon Kent Corporate Secretary Urbana Corporation’s Common Shares, Non-Voting Class A Shares are listed for trading on the Toronto Stock Exchange. Ticker Symbols: URB (Common Shares) URB.A (Non-Voting Class A Shares) Website: www.urbanacorp.com URBANA CORPORATION Year-End Report To Shareholders For the year ended December 31, 2009 The past year was essentially flat for Urbana Corporation (“Urbana”). The financial industry debacle of 2008 was compounded in the exchange space by existing low barriers to entry for numerous, low cost, new trading venues which resulted in hyper competition for most stock markets. The resulting squeeze on volumes and margins was evident within both Europe and North America. Emerging markets, such as India, still have enough barriers to entry to contain the destructive influence of institutions effectively re-mutualizing the exchange industry through their use of proprietary Alternative Trading Systems. -

Miami International Holdings Acquires 100% Ownership of the Bermuda Stock Exchange

Miami International Holdings Acquires 100% Ownership of The Bermuda Stock Exchange Princeton, NJ and Hamilton, Bermuda — December 18, 2020 — Miami International Holdings (MIH), the parent holding company of MIAX®, and the Bermuda Stock Exchange (BSX) today announced that MIH has acquired 100% ownership of the BSX. MIH previously announced the acquisition of a majority interest in the exchange in November 2019. The BSX will continue its operations as a wholly owned subsidiary of MIH. This acquisition aligns directly with MIH's corporate strategy, allowing the company to expand its world-class technology, derivatives trading and regulatory expertise to address emerging markets, such as digital assets, and provide the BSX with additional support in the evolving global (re)insurance risk market. “We have long held that the Bermuda government's commitment to fintech regulation and the country’s established (re)insurance market make the BSX and Bermuda key components of MIH’s global ambitions,” said Thomas P. Gallagher, Chairman and CEO of MIH and BSX Chairman. “We are thrilled to complete this acquisition and have the BSX as a wholly owned subsidiary. BSX CEO Greg Wojciechowski and his team have done a tremendous job of helping to expand Bermuda’s domestic capital market and positioning the BSX for future growth. We look forward to MIH and the BSX jointly pursuing various initiatives, especially in the digital asset and (re)insurance sectors.” “The BSX team is delighted to be joining MIH and to be able to take full advantage of the support, resources and infrastructure of MIH to bring innovative products and services to market,” said Mr. -

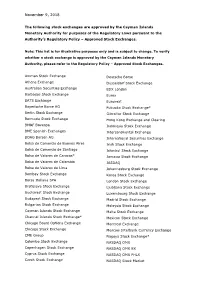

The List of Approved Stock Exchanges

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

The Bermuda Society

The Bermuda Society November 2002 Newsletter - Issue 3 IN THIS ISSUE H.E. Sir John Vereker KCB The Bermuda Regiment The Stock Exchange (BSX) International Business Week 2002 Society Events Masefield Collection of African Artifacts. Part 2 Message from The Chairman H.E. Sir John Vereker KCB One year on from the horrendous events of September On 11th April of this year Sir John Vereker KCB was 11th 2001 – Bermuda, which suffered as did many sworn in as – by his own count - Bermuda’s 87th destinations, is looking at rising commercial and Governor; or 63rd if you count only those appointed by financial activity, particularly in insurance and banking the Monarch, i.e. since 1685 when that responsibility and, most importantly, at a better year for the hospitality passed from the Bermuda Company. Clearly there is industry. Progress in telecommunications and scope for some definitional uncertainty here. development in e-commerce is keeping Bermuda at the forefront of competition in these areas. There is, however, no such lack of precision about the man himself. Sir John is a tall man who can carry the The Bermuda Society continues to grow and so does its cocked hat, high-collared ceremonial uniform of his new biannual Newsletter, available now on the Society’s office with an elegance not granted to many. But his website at www.bermudasociety.com. Continued support precision is not restricted to sartorial matters. from both corporate and private members is greatly appreciated. Educated at Marlborough College and Keele University, he joined the Ministry of Overseas Development in 1967. -

Bermuda's Blue-Chip Advantages

FACTS, STATISTICS & TALKING POINTS BERMUDA’S BLUE-CHIP ADVANTAGES LOCATION, TIME ZONE & ACCESS Bermuda is a 21-square-mile, self-governing British Overseas Territory, 650 miles (1,000 km) east- southeast of Cape Hatteras, NC, with daily direct flights to Toronto, London and US gateway cities (less than two hours from New York). The Atlantic Standard Time is ideal for serving global markets. MULTI-INDUSTRY STRENGTH Bermuda is a global business hub comprising numerous markets: insurance and reinsurance; captive insurance; life and annuity insurance; insurance-linked securities; asset management; trusts and private client vehicles; family offices and other high-net-worth services; shipping and aviation registries; ship- finance and ship-management; arbitration; film business; technology and life sciences. MAJOR INSURANCE CENTRE Bermuda is one of the top two largest re/insurance hubs, with London. The jurisdiction is the single most important property and catastrophe market; the largest captive insurance market; and the largest depository of ILS listings ($26 billion or 84 percent of global capacity by Q2 2017). Thirteen of the world’s top 40 (re)insurers hold licences on the island, employing more than 40,000 people worldwide. BLUE-CHIP REPUTATION Bermuda is globally respected for its leadership and proven record on compliance and transparency. The jurisdiction has more than 100 treaty partnerships with nations around the world. In 2016, the European Union awarded Bermuda full equivalence with Europe’s Solvency II insurance regulatory regime; only one other non-EU jurisdiction (Switzerland) has that distinction. COLLABORATION Bermuda is a highly collaborative jurisdiction. Industry, government and regulators work closely together to facilitate speed to market and innovative, expeditious resolution of client issues. -

Group Limited Oup Limited

GROOUPUP LLIIMMITEDITED Annual Report 2009 2 2009 Group Highlights 4 To the Shareholders 10 Bermuda Electric Light Company Limited 14 Bermuda Gas & Utility Company Limited 16 PureNERGY Renewables, Ltd. 18 InVenture Limited 21 Financial Information 22 Management’s Analysis 30 Report of Management 31 Auditors’ Report 32 Financial Statements 36 Notes to Financial Statements 48 Comparative Statistics 51 Corporate Information ASCEN DANT G ROUP AT A G LANCE MISSION 2009 ACHIEVEMENTS 2010 GOALS Ascendant Group Limited was established in 2009, replacing To maximise shareholder value Name change. Develop opportunities BELCO Holdings Limited as the through growth in existing Incorporated InVenture. for revenue generation. publicly traded investment holding energy-related businesses company. and investment in utility and infrastructure companies. Bermuda Electric Light Company Limited was established in 1904 as Bermuda’s To provide a secure, reliable Achieved reasonable financial Move forward on Central sole supplier of electricity. BELCO and sustainable electric results despite downturn in Plant development and operates generating plant and power system for the people economy in last quarter. Com- the New Energy Equation transmission and distribution systems of Bermuda. menced installation of three for Bermuda. to service over 35,000 metered new gas turbines. Delivered connections. draft Interconnect Agreement to Energy Commission. Bermuda Gas & Utility Company Limited was established in 1936 as a To provide environmentally Increased net earnings, Grow propane gas, distributor of propane gas and responsible energy products returning the company to parts and service and operates an appliance and service and services, while normal levels of profitability. appliance markets. centre. The Company was purchased delivering exceptional value by BELCO in 1994.