Propenomy of Economic and Property Downturn

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WE DELIVER | WE CARE Committed at DMB, We Work Hand in Hand with Our Accountable Clients to Deliver the Best Solutions Any Where, Any Time

DAYA MATERIALS BERHAD MATERIALS DAYA 200301033936 DAYA MATERIALS BERHAD 200301033936 (636357-W) (636357-W) www.dayagroup.com.my ANNUAL REPORT 2020 REPORT ANNUAL DAYA MATERIALS BERHAD 200301033936 (636357-W) D5-1-1, Solaris Dutamas No.1, Jalan Dutamas 1 50480 Kuala Lumpur. | Tel : 03 6205 3170 WE DELIVER WE CARE Fax : 03 6205 3171 annual report 2020 Contents Corporate Information 02 Corporate Structure 03 Financial Information 06 Profile of Directors 07 Senior Management Team 11 Management Discussion & Analysis 12 Sustainability Statement 15 Corporate Governance Overview Statement 20 Statement on Risk Management and 36 Internal Control Audit Committee Report 41 Financial Statements 46 Directors’ Responsibilities Statement on 164 Financial Statements Analysis of Shareholdings 165 Additional Compliance Information 168 List of Properties 169 Notice of Seventeenth Annual General Meeting 171 Proxy Form Committed WE DELIVER | WE CARE At DMB, we work hand in hand with our Accountable clients to deliver the best solutions any where, any time. Resolute Ethical 2 DAYA MATERIALS BERHAD [200301033936 (636357-W)] CORPORATE INFORMATION BOARD OF DIRECTORS DATUK LIM THEAN SHIANG DATUK ZULKARNAIN BIN MD EUSOPE Non-Independent Non-Executive Chairman Independent Non-Executive Director (Re-designated as Executive Chairman on 10 April (Appointed on 10 April 2019) 2019 and Non-Executive Chairman on 1 May 2020) SHAMSUL BIN SAAD AMINUDDIN BIN MOHD ARIF Group Managing Director Independent Non-Executive Director (Appointed on 10 April 2019) TUAN HAJI NORZAIN BIN ABDUL WAHAB ARUNASALAM A/L MUTHUSAMY Independent Non-Executive Director Independent Non-Executive Director (Appointed on 15 August 2019) AUDIT COMMITTEE REGISTERED OFFICE AUDITORS Chairman 12th Floor, Menara Symphony, Baker Tilly Monteiro Heng PLT Arunasalam A/L Muthusamy No. -

![For Sale - ALAM DAMAI [CONDITION TIP-TOP], Cheras, Kuala Lumpur](https://docslib.b-cdn.net/cover/2051/for-sale-alam-damai-condition-tip-top-cheras-kuala-lumpur-902051.webp)

For Sale - ALAM DAMAI [CONDITION TIP-TOP], Cheras, Kuala Lumpur

iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Sale - ALAM DAMAI [CONDITION TIP-TOP], Cheras, Kuala Lumpur Reference No: 100945552 Tenure: Leasehold Address: ALAM DAMAI [CONDITION Occupancy: Vacant TIP-TOP], Kuala Lumpur Furnishing: Partly furnished State: Kuala Lumpur Unit Type: Intermediate Property Type: 2-sty Terrace/Link House Land Title: Residential Asking Price: RM 790,000 Property Title Type: Individual Built-up Size: 1,800 Square Feet Posted Date: 22/04/2021 Built-up Price: RM 438.89 per Square Feet Property Features: Kitchen cabinet Land Area Size: 1,800 Square Feet Land Area 24 x 75 Name: Zulhisham Dimension: Company: IQI Realty - Klang Lama Land Area Price: RM 438.89 per Square Feet Email: [email protected] No. of Bedrooms: 3 No. of Bathrooms: 4 [CONDITION TIP-TOP] DOUBLE STOREY ALAM DAMAI CHERAS K.LUMPUR DETAILS: - Intermediate unit - Leasehold expiry 2104 - Non Bumi lot - Land area: 1,800 sqft (24x75) - 3 Bedrooms + 4 Bathrooms - 1 Utility room - Year completion: 2005 - Developer SPPK NEARBY: - Masjid Al-Mukhlisin (500m) - Surau Ar-Raudah Desa Damai (500m) - SK & SMK Alam Damai (850m) - Police Stattion Alam Damai (850m) - KLCC (14.4km) - National Stadium Bukit Jalil (12km) - Technology Park Malaysia (11km) - Kajang Town (13km) CONNECTIVITY: - MEX & MRR2 - Grand Saga Cheras-Kajang PRICE: - RM790,000 - Bank’s Loan & Lawy.... [More] View More Details On iProperty.com iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Sale - ALAM DAMAI [CONDITION TIP-TOP], Cheras, Kuala Lumpur. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2015 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU KUALA LUMPUR HIGH END CONDOMINIUM MARKET (MPC) meeting in May in an effort to support economic growth and domestic HIGHLIGHTS consumption. • Softening demand in the SUPPLY & DEMAND high-end condominium With the completion of seven notable segment amid a cautious projects contributing an additional market. 1,296 units [includes projects that are physically completed but pending Madge Mansions issuance of Certificate of Completion • Lower volume of transactions and Compliance (CCC)], the cumulative expected to come on-stream. The KL in 1Q2015. supply of high end condominiums in City locality will account for circa 35% Kuala Lumpur stands at 39,610 units. (1,310 units) of the new supply; followed • Developers with niche high by Mont’ Kiara / Sri Hartamas with Approximately 45% (582 units) of the new 34% (1,256 units); KL Sentral / Pantai / end residential projects in KL completions are located in the Ampang Damansara Heights with 20% (734 units); City review products, pricing Hilir / U-Thant area, followed by some and the remaining 11% (425 units) from and marketing strategies in 26% (335 units) in the locality of KL City; the locality of Ampang Hilir / U-Thant. a challenging market with 16% (204 units) from the locality of KL lacklustre demand, impacted Sentral / Pantai / Damansara Heights Notable projects slated for completion by a general slowdown in the area; and 14% (175 units) from the Mont’ in KL City include Face Platinum Suites, economy, tight lending Kiara / Sri Hartamas locality. Le Nouvel, Mirage Residences as well as guidelines, weaker job market the delayed project of Crest Jalan Sultan The three completions in Ampang Hilir amongst other reasons. -

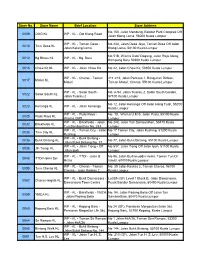

Senarai Klinik Swasta Yang Boleh Menjalankan Saringan Covid-19 Di ON-SITE / OUTREACH

SENARAI KLINIK PERUBATAN SWASTA BERDAFTAR YANG BOLEH MENJALANKAN SARINGAN COVID-19 ON-SITE/OUTREACH (KEMASKINI PADA 3 DISEMBER 2020) BIL. NAMA KLINIK ALAMAT KLINIK JENIS UJIAN TARIKH MULA JOHOR 1. BIOMEDICARE CLINIC NO.20 (ARAS BAWAH), EKO PERNIAGAAN 1/3, TAMAN RT-PCR 12 OKTOBER 2020 EKOPERNIAGAAN, 81100 JOHOR BAHRU, JOHOR 2. KLINIK SINARAN NO 43A GROUND FLOOR, JALAN KELISA 1, TAMAN SCIENTEX, RT-PCR 14 OKTOBER 2020 81700 PASIR GUDANG, JOHOR 3. KLINIK MEDIVIRON TAMAN NO 23-A (GF), JALAN BELATUK 2, 81700 PASIR GUDANG, JOHOR RT-PCR 15 OKTOBER 2020 SCIENTEX 4. KLINIK HO 1766, JALAN SENAI UTAMA 1/2, TAMAN SENAI UTAMA RT - PCR 20 OKTOBER 2020 81400 SENAI, JOHOR 5. KLINIK ASIA ACG HEALTHCARE 111, JALAN PERISAI, TAMAN SRI TEBRAU RT-PCR 20 OKTOBER 2020 SDN. BHD. 81100 JOHOR BAHRU, JOHOR 6. KLINIK FIRDAUS NO. 39 (GROUND FLOOR), JALAN PADI EMAS 1/8, BANDAR BARU RT-PCR 21 OKTOBER 2020 UDA, 81200 JOHOR BAHRU, JOHOR 7. KLINIK CENTURY 75, JALAN SUTERA 1, TAMAN SENTOSA, 80150 JOHOR BAHRU, RT-PCR 21 OKTOBER 2020 JOHOR 8. KLINIK YAP & PARTNERS 40G, JALAN PENDEKAR 13, TAMAN UNGKU TUN AMINAH, 81300 RT-PCR 27 OKTOBER 2020 SKUDAI, JOHOR 9. KLINIK YAP 19 & 20 (GROUND FLOOR), JALAN KENANGA 29/1, BANDAR RTK-AG 27 OKTOBER 2020 INDAHPURA, 81000 KULAI, JOHOR 10. KLINIK JOHOR 02 - 1A JALAN BANDAR, PUSAT PERNIAGAAN RT-PCR 27 OKTOBER 2020 81700 PASIR GUDANG, JOHOR 11. KLINIK ASIA ACG HEALTHCARE NO. 4, JALAN DEDAP 15, TAMAN JOHOR JAYA RT-PCR 3 NOVEMBER 2020 SDN. BHD. 81100 JOHOR BAHRU, JOHOR 12. -

SOALAN LAZIM PENYAKIT NOVEL CORONAVIRUS (COVID-19) 15 November 2020

SOALAN LAZIM PENYAKIT NOVEL CORONAVIRUS (COVID-19) 15 November 2020 Soalan 1: Apakah coronavirus? Coronavirus adalah satu keluarga besar virus yang menyebabkan jangkitan saluran pernafasan seperti Severe Acute Respiratory Syndrome (SARS) dan Middle East Respiratory Syndrome-related Coronavirus (MERS-CoV). Coronavirus terbaharu dan menjadi pandemik di seluruh dunia kini dikenali sebagai Novel Coronavirus 2019 (COVID-19). COVID-19 telah mula dikesan di negara China dengan kes pertama disahkan pada 7 Januari 2020 di Wuhan, Hubei, China. Dalam tempoh tiga (3) minggu seterusnya, kes-kes disahkan di Thailand, Nepal, Amerika Syarikat, Korea Selatan, Singapura, Perancis, Vietnam, Malaysia, Australia, Canada, Cambodia, Sri Lanka dan Jerman. Kes pertama di Malaysia disahkan pada 25 Januari 2020. Sehingga kini, penyakit COVID- 19 masih lagi menular di Malaysia. Sejak 20 September 2020, Malaysia sudah memasuki permulaan gelombang ketiga COVID-19 susulan peningkatan mendadak kes jangkitan virus COVID-19. Kementerian Kesihatan Malaysia dan pihak berkuasa terus menjalankan program dan aktiviti kawalan dan pencegahan bagi membendung wabak COVID-19 di Malaysia. Soalan 2: Bagaimanakah novel coronavirus 2019 (COVID-19) merebak? Cara penularan novel coronavirus COVID-19 daripada individu kepada individu yang lain adalah melalui titisan dari hidung atau mulut yang tersebar apabila seseorang yang dijangkiti COVID-19 batuk atau bersin. Titisan ini melekat pada objek dan permukaan di sekelilingnya. Orang lain yang menyentuh objek atau permukaan ini mempunyai risiko mendapat jangkitan COVID-19 apabila beliau menyentuh mata, hidung atau 1 mulutnya selepas menyentuh permukaan/objek yang tercemar. Seseorang itu juga boleh dijangkiti COVID-19 jika mereka berada dekat dengan pesakit COVID-19 yang batuk, bersin atau bercakap dalam jarak yang dekat. -

No Store Name Area Zone Outlet Address Ez Smart

EZ SMART PARK MERCHANT LIST NO STORE NAME AREA ZONE OUTLET ADDRESS NO. 205, JALAN GENTING KELANG, TAMAN AYER PANAS, 53300 KUALA LUMPUR. 1 KK SUPER MART AYER PANAS ZONE C 2 NO.522, JALAN AIR JERNEH, OFF JALAN AIR PANAS, SETAPAK, 53200 KUALA LUMPUR. NO.43-0-7, JALAN 1/48A, SENTUL PERDANA, BANDAR 2 KK SUPER MART BANDAR BARU SENTUL ZONE B 1 BARU SENTUL, 51000 KUALA LUMPUR. NO. 31, JALAN WANGSA DELIMA 13, WANGSA LINK@ 3 KK SUPER MART BANDAR BARU WANGSA MAJU ZONE C 1 SHOP OFFICE, PUSAT BANDAR WANGSA MAJU, 53300 KUALA LUMPUR. NO.25, JALAN SRI PERMAISURI 8, BANDAR SRI 4 KK SUPER MART BANDAR SRI PERMAISURI ZONE C 1 PERMAISURI, 56000 KUALA LUMPUR. NO. 6, JALAN 30A/146, DESA TASIK, SUNGAI BESI, 5 KK SUPER MART BANDAR TASIK SELATAN ZONE C 1 57000 KUALA LUMPUR. NO.68, JALAN JUJUR, BANDAR TUN RAZAK, 56000 6 KK SUPER MART BANDAR TUN RAZAK ZONE C 1 KUALA LUMPUR. NO.8, JALAN TELAWI, BANGSAR BARU, 59100 KUALA LUMPUR. NO. 88, LORONG MAAROF, BANGSAR PARK, 59000 7 KK SUPER MART BANGSAR ZONE B 3 KUALA LUMPUR. NO.36, JALAN TELAWI 2, BANGSAR BARU, 59100 KUALA LUMPUR. NO. 26, JALAN BANGSAR UTAMA 1, BANGSAR UTAMA, 8 KK SUPER MART BANGSAR UTAMA ZONE B 1 59000 KUALA LUMPUR. NO.112, JALAN TUN SAMBANTHAN, 50470 KUALA LUMPUR. KK SUPER MART NO: 13, JALAN TUN SAMBANTHAN 4, BRICKFIELDS, 50470 KUALA LUMPUR. 280, JALAN TUN SAMBANTHAN, BRICKFIELDS, 50470 STS CONNECTION KUALA LUMPUR NO 42, JALAN TUN SAMBATHAN 3, BRICKFIELDS, 9 HORIZON ENTERPRISE BRICKFIELDS ZONE B 7 50470 KUALA LUMPUR NO 2, JALAN THAMBIPILLAY, BRICKFIELDS, 50470 TECK SOON LOCKSMITH KUALA LUMPUR NO 39, JALAN THAMBIPILLAY, BRICKFIELDS 50470 CHEEMA MANAGEMENT SDN BHD KUALA LUMPUR 116, JALAN SULTAN ABDUL SAMAD, BRICKFIELDS, SILVER EXPRESS ENTERPRISE 50470 KUALA LUMPUR EZ SMART PARK MERCHANT LIST NO STORE NAME AREA ZONE OUTLET ADDRESS NO.75, JALAN BUKIT BINTANG, 55100 KUALA LUMPUR. -

Store No. Store Name Brief Location Store Address 0009 OUG KL WP

Store No. Store Name Brief Location Store Address No 150, Jalan Mendung, Bandar Park Complek Off 0009 OUG KL WP - KL - Old Klang Road Jalan Klang Lama, 58000 Kuala Lumpur WP - KL - Taman Desa - No 23A, Jalan Desa Jaya, Taman Desa Off Jalan 0010 Tmn Desa KL Jalan Kelang Lama Klang Lama, 58100 Kuala Lumpur No 51B, Wisma Dato' Dagang, Jalan Raja Alang, 0012 Kg Bharu KL WP - KL - Kg. Baru Kampung Baru 50300 Kuala Lumpur 0016 Chow Kit KL WP - KL - Jalan Chow Kit No 42, Jalan Chow Kit, 50350 Kuala Lumpur WP - KL - Cheras - Taman 211-213, Jalan Perkasa 1, Bangunan Dirikon, 0017 Maluri KL Maluri Taman Maluri, Cheras, 55100 Kuala Lumpur WP - KL - Salak South - No. A-94, Jalan Tuanku 2, Salak South Garden, 0022 Salak South KL Jalan Tuanku 2 57100 Kuala Lumpur No 12, Jalan Kenanga Off Jalan Hang Tuah, 55200 0023 Kenanga KL WP - KL - Jalan Kenanga Kuala Lumpur WP - KL - Pudu Raya - No. 10, Wisma U.M.S, Jalan Pudu, 55100 Kuala 0025 Pudu Raya KL Wisma UMS Lumpur WP - KL - Brickfields - Jalan No 243, Jalan Tun Sambanthan, 50470 Kuala 0032 Brickfields KL Tun Sambanthan No. 243 Lumpur WP - KL - Taman City - Jalan No 17 Taman City, Jalan Kuching, 51200 Kuala 0035 Tmn City KL Kuching Lumpur WP - KL - Bukit Bintang - 0036 Bukit Bintang KL No 77, Jalan Bukit Bintang, 55100 Kuala Lumpur Jalan Bukit Bintang No. 77 WP - KL - Jalan Tiong - Off No 537, Jalan Tiong Off Jalan Ipoh, 51100 Kuala 0038 Jln Tiong KL Jalan Ipoh Lumpur WP - KL - TTDI - Jalan B. -

List of Pos Laju Ezibox Ezudrive-Thru Pos Laju Bil

LIST OF POS LAJU EZIBOX EZUDRIVE-THRU POS LAJU BIL. STATE ADDRESS (EDT) Kuala Jln Terminal Putra, Taman Melati, 1 EziBox@LRT Gombak Lumpur 53100 Kuala Lumpur EziBox@Kiosk E- E-Commerce Kiosk, Level 1, Kuala 2 Commerce Hub Kompleks Dayabumi, Jln Tan Cheng Lumpur Dayabumi Lock, 50670 KL Kuala EziBox@POJln Jln Gombak, 53000 Kuala Lumpur, 3 Lumpur Gombak Wilayah Persekutuan Kuala Lumpur Jln Cerdas, Taman Connaught, Kuala EziBox@Shell Tmn 4 56000 Kuala Lumpur, Wilayah Lumpur Connaught Persekutuan Kuala Lumpur Kuala EziBox@POSungai Jln Pejabat Pos, Sungai Besi, 57000 5 Lumpur Besi Kuala Lumpur. Jln. Tun Sambanthan, Kuala Lumpur, Kuala EziBox@Pos Laju Brickfields, 50470 Kuala Lumpur, 6 Lumpur Kuala Lumpur Federal Territory of Kuala Lumpur Jln Klang Lama, Taman Lian Hoe, Kuala EziBox@POJln Klang 7 58100 Kuala Lumpur, Wilayah Lumpur Lama Persekutuan Kuala Lumpur JKR, 1693, Jln Besar, Jinjang Utara, Kuala 8 EziBox@POJinjang 52000 Kuala Lumpur, Wilayah Lumpur Persekutuan Kuala Lumpur Shell Wangsa Maju Jalan 34-26 Pt Kuala EziBox@Shell Wangsa 6559,Sector C7, r13, Wangsa Maju, 9 Lumpur Maju 53300 Kuala Lumpur, Federal Territory of Kuala Lumpur Kepong Village Mall, 3, Jln 7a/62a, Kuala EziBox@Tesco Taman Manjalara, 52200 Kuala 10 Lumpur Kepong Lumpur, Wilayah Persekutuan Kuala Lumpur Kuala EziBox@Shell Sri Off Jln Bukit Kiara, 50480 Kuala 11 Lumpur Hartamas Lumpur, Wilayah Perseketuan PO Universiti Malaya, Dewan Perdana Kuala EziBox@POUniversiti Siswa Jln Lembah Pantai, 59100 12 Lumpur Malaya Kuala Lumpur, Federal Territory of Kuala Lumpur Jln Tuanku -

FOR the QUARTER and FINANCIAL YEAR ENDED 31 DECEMBER 2020 (The Figures Have Not Been Audited)

MAXIM GLOBAL BERHAD [Reg No. 196801000620 (8184-W)] (formerly known as Tadmax Resources Berhad) CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE QUARTER AND FINANCIAL YEAR ENDED 31 DECEMBER 2020 (The figures have not been audited) 4th Quarter ended Financial year ended 31-12-2020 31-12-2019 31-12-2020 31-12-2019 RM'000 RM'000 RM'000 RM'000 Continuing Operations Revenue 150,904 83,358 389,940 279,380 Cost of sales (106,306) (54,016) (289,576) (211,238) Gross profit 44,598 29,342 100,364 68,142 Other operating income 4,550 226 5,003 643 Operating expenses (21,598) (13,918) (53,022) (33,851) Gain on disposal of subsidiary/associated companies 17,531 - 58,155 - Impairment loss on timber concession and land rights (169,357) - (169,357) - Operating (loss)/profit (124,276) 15,650 (58,857) 34,934 Finance income 746 190 1,306 452 Finance costs (815) (154) (1,352) (289) Share of net results of an associated company (322) - (322) - (Loss)/Profit before taxation (124,667) 15,686 (59,225) 35,097 Taxation (11,223) (4,541) (21,989) (10,846) Net (loss)/profit from continuing operations (135,890) 11,145 (81,214) 24,251 Discontinuing operations (59) - (1,803) - Net (loss)/profit for the period (135,949) 11,145 (83,017) 24,251 Other comprehensive (loss)/income, net of tax Items that will be reclassified subsequently to profit or loss, net of tax - Foreign currency translation (189) - 12 250 (185) Total comprehensive (loss)/profit for the period (136,138) 11,157 (82,767) 24,066 Net (loss)/profit attributable to: Owners of the Company (135,823) -

STORE LIST by STATE.Xlsx

KUALA LUMPUR AEON Metro Prima Shopping Centre NU Sentral Shopping Centre Great Eastern Mall Lot G25 Lot No LG23 & LG24 Lot 3B, Lower G. Floor Jalan Metro Prima Jalan Tun Sambanthan No. 303, Jalan Ampang Taman Kepong 50470 Kuala Lumpur 50450 Kuala Lumpur 52100 Kuala Lumpur Tel: +603-2272 1443 Tel: +603-4253 4508 Tel: +603-6250 3357 Vista MagnaMid Valley Megamall Sunway Velocity Mall No 16 Ground Floor Unit LG 047 B-12, Basement One Jalan Prima1 Metro Prima Lingkaran Syed Putra Lingkaran Sv Taman Kepong Mid Valley City Sunway Velocity 52100 Kuala Lumpur 59200 Kuala Lumpur 55100 Kuala Lumpur Tel: +603-6258 7971 Tel: +603-2284 3844 Tel: +603-9201 6476 Suria KLCC Solaris Mount Kiara Berjaya Times Square Lot C21B Concourse Area No. 8 & 10, Ground Floor No LG-06 & LG-07 Kuala Lumpur City Centre Jln Solaris 51, 1, Jalan Imbi 50088 Kuala Lumpur Off Jalan Duta Kiara 55100 Kuala Lumpur Tel: +603-2382 020850480 Kuala Lumpur Tel: +603-2144 2908 Tel: +603-6203 7941 Jalan Tun Perak Quill City Mall No. 40 & 42 Lot 2-37&38, 2nd Floor Jalan Tun Perak Jalan Sultan Ismail 50050 Kuala Lumpur 50250 Kuala Lumpur Tel: +603-2031 4349 Tel: +603-2602 2582 Bangsar Village Pavilion Shopping Mall 1 Mont Kiara Lot G8, Ground Floor Lot 1.23, Level 1 Lot LG-12 & 13A, LG Floor 1, Jalan Telawi 1 No. 168, Jalan Bukit Bintang No 1, Jalan Kiara Bangsar Baru 55100 Kuala Lumpur Mont' Kiara 59100 Kuala Lumpur Tel: +603 2142 2928 50480 Kuala Lumpur Tel: +603 2287 8928 Tel: +603 6203 7928 Mid Valley Megamall Berjaya Times Square TTDI Lot LG-060A Lot LG 32 & 33, LG Floor 94, Jalan Burhanuddin Helmi Lingkaran Syed Putra 1, Jalan Imbi Taman Tun Dr Ismail Mid Valley City 55100 Kuala Lumpur 60000 Kuala Lumpur 59200 Kuala Lumpur Tel: +603 2142 6918 Tel: +603 7710 4928 Tel: +603 2282 8928 Hartamas Shopping Centre Publika Shopping Gallery Mid Point Shopping Centre Lot 3, Ground Floor Lot 11, Level UG Lot G9 & G10 No. -

Hai-O Chain Store Info.(01-08-2016)

HAI-O RAYA BHD 海鸥中心有限公司 Lot 11995, Batu 2, Jalan Kapar, 41400 Klang, Selangor. Customer Hotline: 03-3343 8889 Headquarters Tel: 03-33420617 Fax: 03-3343 6755 / 3343 6543 Address HAI-O RAYA BHD ( KLANG BRANCH ) 80-82, JLN NANAS, 41400 KLANG, SELANGOR HAI-O RAYA BHD ( JLN SULTAN BRANCH ) 61, JALAN SULTAN, 50000 KUALA LUMPUR. HAI-O RAYA BHD ( SUN COMPLEX BRANCH ) GROUND FLOOR, SUN COMPLEX JLN BKT BINTANG, 55100 KUALA LUMPUR HAI-O RAYA BHD ( TMN PERTAMA BRANCH ) 27, JLN 2/90, TMN PERTAMA CHERAS, 56100 KUALA LUMPUR HAI-O RAYA BHD ( SETAPAK BRANCH ) 213, JLN GENTING KLANG 53300 SETAPAK, KUALA LUMPUR HAI-O RAYA BHD ( JINJANG BRANCH ) 5, JLN 8/32, TMN JINJANG BARU 52000 KUALA LUMPUR HAI-O RAYA BHD ( SS2 PJ BRANCH ) 18, JLN SS2/66 47300 PETALING JAYA, SELANGOR HAI-O RAYA BHD ( SERDANG BRANCH ) 1504-A GROUND FLOOR, JLN BESAR, 43300 SERI KEMBANGAN, SELANGOR HAI-O RAYA BHD ( METRO KAJANG BRANCH ) LG 28, PLAZA METRO KAJANG SEC.7, JLN TUN ABDUL AZIZ 43000 KAJANG, SELANGOR HAI-O RAYA BHD ( TMN MUDA AMPANG BRANCH ) 31, JLN BUNGA TANJONG 7 TMN MUDA, 56100 AMPANG HAI-O RAYA BHD ( USJ-SUBANG JAYA BRANCH ) 34, JLN USJ 10/1E 47620 UEP SUBANG JAYA, SELANGOR HAI-O RAYA BHD ( KEPONG BRANCH ) 60, PERSIARAN MERGASTUA (JLN 56), KEPONG BARU 52100 KUALA LUMPUR HAI-O RAYA BHD ( ENDAH PARADE BRANCH ) LOT 1-043 & 1-060, 1ST FLOOR ENDAH PARADE NO.1 JLN 1/149E, TMN SRI ENDAH BDR BARU SRI PETALING 57000 KUALA LUMPUR HAI-O RAYA BHD 海鸥中心有限公司 Lot 11995, Batu 2, Jalan Kapar, 41400 Klang, Selangor. -

Senarai Fasiliti Swasta Yang Boleh Menjalankan Saringan Covid-19 Di

SENARAI FASILITI SWASTA YANG BOLEH MENJALANKAN SARINGAN COVID-19 DI DALAM KAWASAN PREMIS (A) SENARAI KLINIK PERUBATAN SWASTA BERDAFTAR YANG BOLEH MENJALANKAN SARINGAN COVID-19 DI DALAM KAWASAN PREMIS SEHINGGA 30 NOVEMBER 2020 BIL. NAMA KLINIK ALAMAT KLINIK JENIS UJIAN TARIKH MULA JOHOR 1. KLINIK LEE DAN 45 (GROUND FLOOR), JALAN MUTIARA 1/2, TAMAN MUTIARA MAS, JALAN RT-PCR 16 APRIL 2020 SURGERI GELANG PATAH-SKUDAI, 81300 SKUDAI, JOHOR 2. KLINIK CENTRAL 24 92 GROUND FLOOR, JALAN ADDA 7, TAMAN ADDA, 81100 JOHOR BAHRU RT-PCR 13 MEI 2020 JAM 3. KLINIK MEDIVIRON NO 87, JALAN INDAH 15/2, TAMAN BUKIT INDAH, 81200 JOHOR BAHRU, RT-PCR 18 MEI 2020 BUKIT INDAH JB JOHOR 4. KLINIK RELY ON NO 1-01, GROUND FLOOR, JALAN SEMARAK 1, TAMAN DESARU UTAMA, RT-PCR 22 MEI 2020 BESTARI 81930 BANDAR PENAWAR, JOHOR 5. KLINIK YAP & (GROUND FLOOR), 7523 & 7524, JALAN ENGGANG 19, BANDAR PUTRA, 81000 RT-PCR 28 MEI 2020 PARTNERS KULAI, JOHOR 6. KLINIK ANGKASA TINGKAT BAWAH, NO 147, JALAN SCIENTEX JAYA 7, TAMAN SCIENTEX, RT-PCR 28 MEI 2020 81400 SENAI, JOHOR 7. MJ HEALTHCARE P-01-14 (TINGKAT BAWAH), TELUK AKUA BIRU, JALAN FOREST CITY 3, RT-PCR 29 MEI 2020 CLINIC PULAU SATU, 81550 GELANG PATAH, JOHOR 8. POLIKLINIK NO. 104, JALAN BINTANG, TAMAN BINTANG 81400 SENAI, JOHOR RT-PCR 29 MEI 2020 PENAWAR 9. POLIKLINIK NO. 16, PUSAT BANDAR, BANDAR PENAWAR, 81900 KOTA TINGGI, JOHOR RT-PCR 10 JUN 2020 PENAWAR 10. POLIKLINIK NO. 31 & 32, JALAN PADI RIA, BANDAR BARU UDA 81200 TAMPOI, JOHOR RT-PCR 10 JUN 2020 PENAWAR BANDAR BARU UDA 11.