Bipartisan Coalition Introduces Hurricane Sandy Tax Relief

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RADPAC Contributions to Candidates 2011-2012 Election Cycle

RADPAC Contributions to Candidates 2011-2012 Election Cycle U.S. Senate Rep. Larry Bucshon (R - IN) Rep. Ann Marie Buerkle (R - NY) Sen. John Barrasso (R - WY) Rep. Michael Burgess (R - TX) Sen. Max Baucus (D - MT) Rep. Dave Camp (R - MI) Sen. Mark Begich (D - AK) Rep. John Campbell (R - CA) Sen. Scott Brown (R - MA) Rep. Francisco Canseco (R - TX) Sen. Sherrod Brown (D - OH) Rep. Eric Cantor (R - VA) Sen. Ben Cardin (D - MD) Rep. Lois Capps (D - CA) Sen. Tom Carper (D - DE) Rep. Bill Cassidy (R - LA) Sen. Bob Casey (D - PA) Rep. Kathy Castor (D - FL) Sen. Bob Corker (R - TN) Rep. Jason Chaffetz (R - UT) Sen. Dianne Feinstein (D - CA) Rep. Donna Christensen (D - VI) Sen. Kirsten Gillibrand (D - NY) Rep. Hansen Clarke ( D - MI) Sen. Orrin Hatch (R - UT) Rep. James Clyburn (D - SC) Sen. John Kerry (D - MA) Rep. Mike Coffman (R - CO) Sen. Amy Klobuchar (D - MN) Rep. Joe Courtney (D - CT) Sen. Robert Menendez (D - NJ) Rep. Rick Crawford (R - AR) Sen. Olympia Snowe (R - ME) Rep. Joe Crowley (D - NY) Rep. Danny Davis (D - IL) U.S. House Rep. Geoff Davis (R - KY) Rep. Susan Davis (D - CA) Rep. Sandy Adams (R - FL) Rep. Jeff Denham (R - CA) Rep. Todd Akin (R - MO) Rep. Charlie Dent (R - PA) Rep. Jason Altmire (D - PA) Rep. Scott DesJarlais (R - TN) Rep. Rob Andrews (D - NJ) Rep. Robert Dold (R - IL) Rep. John Barrow (D - GA) Rep. Sean Duffy (R - WI) Rep. Charlie Bass (R - NH) Rep. Renee Ellmers (R - NC) Rep. -

Limited Appearance Statement Of

July 26, 2013 By US Mail Commissioner Allison M. Macfarlane U.S. Nuclear Regulatory Commission Mail Stop 0-16G4 Washington, DC 20555 Dear Allison M. Macfarlane, Enclosed is a copy of "Generating Influence," Common Cause/New York's comprehensive study of Entergy Corporation's political spending and public relations campaign to secure new operating licenses for the Indian Point nuclear power plant in Buchanan, New York. As you are well aware, Entergy is currently in the late stages of the Nuclear Regulatory Commission license renewal process that began in 2007. While Common Cause takes no position on the relicensing of Indian Point, we strongly believe that the final decision should be based on objective analysis of the costs and benefits and not unduly shaped by the well-funded lobbying, campaign contributions, and publicity campaigns of Entergy Corporation. As such, it is crucial that NRC officials are fully aware of the extraordinary extent to which the appearance of "public support" for the Indian Point nuclear power plant appears to have been generated by the deceptive strategies of Entergy Corporation. In addition to the "inside game" of lobbying and campaign contributions, Entergy has engaged in an extensive "outside game" of public relations and grassroots "astroturfing" strategies. From making targeted campaign contributions and hiring former New York Mayor Rudy Giuliani to appear in an advertising campaign, to cultivating influential"front group" coalitions of business interests, unions, local political leaders, and non-profits (NY AREA and SHARE), Entergy is working the full spectrum of lobbying and publicity strategies in an all-out effort to keep Indian Point open. -

Joe Crowley (D-Ny-14)

LEGISLATOR US Representative JOE CROWLEY (D-NY-14) IN OFFICE CONTACT Up for re-election in 2016 Email Contact Form LEADERSHIP POSITION https://crowley.house.gov/ contact-me/email-me House Democratic Caucus Web crowley.house.gov 9th Term http://crowley.house.gov Re-elected in 2014 Twitter @repjoecrowley https://twitter.com/ repjoecrowley Facebook View on Facebook https://www.facebook.com/ repjoecrowley DC Office 1436 Longworth House Office Building BGOV BIOGRAPHY By Brian Nutting and Mina Kawai, Bloomberg News Joseph Crowley, vice chairman of the Democratic Caucus for the 113th Congress and one of the party's top campaign money raisers, works for government actions that benefit his mostly middle-class district while keeping in mind the needs of Wall Street financial firms that employ many of his constituents. He has served on the Ways and Means Committee since 2007. He was a key Democratic supporter of the 2008 bailout of the financial services industry -- loudly berating Republicans on the House floor as an initial bailout bill went down to defeat -- as well as subsequent help for the automobile industry. In addition to his post as caucus vice chairman -- the fifth-ranking post in the Democratic leadership -- Crowley is also a finance chairman for the Democratic Congressional Campaign Committee, the political arm of House Democrats, and serves on the Steering and Policy Committee. He has a garrulous personality to match his burly, 6-foot-4 frame. He's been known to break into song and is generally well-liked by friend and foe alike. Crowley has been a solid supporter of Democratic Party positions, as illustrated by the ratings he has received from organizations on opposite ends of the political spectrum: A lifetime score of 90 percent-plus from the liberal Americans for Democratic Action and 8 percent, through 2012, from the American Conservative Union He favors abortion rights, gun control and same-sex marriage. -

Democratic Party

Statement and Return Report for Certification Federal Primary - 06/26/2018 Bronx County - Democratic Party Democratic Representative in Congress 16th Congressional District Vote for 1 Page 1 of 5 BOARD OF ELECTIONS Statement and Return Report for Certification IN THE CITY OF NEW YORK Federal Primary - 06/26/2018 PRINTED AS OF: Bronx County 7/9/2018 12:25:30PM Democratic Party Democratic Representative in Congress (16th Congressional District), vote for 1 Assembly District 80 PUBLIC COUNTER 226 MANUALLY COUNTED EMERGENCY 0 ABSENTEE / MILITARY 18 FEDERAL 0 AFFIDAVIT 0 Total Ballots 244 Less - Inapplicable Federal/Special Presidential Ballots 0 Total Applicable Ballots 244 JONATHAN LEWIS 31 DERICKSON K. LAWRENCE 9 JOYCE N. BRISCOE 28 ELIOT L. ENGEL 173 KORTNEY B WILSON (WRITE-IN) 1 Total Votes 242 Unrecorded 2 Assembly District 81 PUBLIC COUNTER 4,184 MANUALLY COUNTED EMERGENCY 0 ABSENTEE / MILITARY 414 FEDERAL 0 AFFIDAVIT 18 Total Ballots 4,616 Less - Inapplicable Federal/Special Presidential Ballots 0 Total Applicable Ballots 4,616 JONATHAN LEWIS 678 DERICKSON K. LAWRENCE 93 JOYCE N. BRISCOE 315 ELIOT L. ENGEL 3,489 ALEXANDRIA OCASIO-CORTEZ (WRITE-IN) 3 JEFF KLEIN (WRITE-IN) 2 MICHAEL KLEINMAN (WRITE-IN) 1 MICHAEL SULLIVAN (WRITE-IN) 1 SANDRA BIAGGI (WRITE-IN) 1 UNATTRIBUTABLE WRITE-IN (WRITE-IN) 7 Total Votes 4,590 Unrecorded 26 Page 2 of 5 BOARD OF ELECTIONS Statement and Return Report for Certification IN THE CITY OF NEW YORK Federal Primary - 06/26/2018 PRINTED AS OF: Bronx County 7/9/2018 12:25:30PM Democratic Party Democratic Representative in Congress (16th Congressional District), vote for 1 Assembly District 82 PUBLIC COUNTER 2,832 MANUALLY COUNTED EMERGENCY 0 ABSENTEE / MILITARY 158 FEDERAL 0 AFFIDAVIT 8 Total Ballots 2,998 Less - Inapplicable Federal/Special Presidential Ballots 0 Total Applicable Ballots 2,998 JONATHAN LEWIS 365 DERICKSON K. -

Zadroga 9/11 Health and Compensation Act, Bill to Help Responders, May Die by Michael Mcauliff — Wednesday, July 28Th, 2010 ‘The New York Daily News’

Zadroga 9/11 Health and Compensation Act, bill to help responders, may die BY Michael Mcauliff — Wednesday, July 28th, 2010 ‘The New York Daily News’ WASHINGTON - The House votes Wednesday or Thursday for the first time ever on a bill to care for the heroes and victims of Sept. 11, 2001 - and it's likely to fail. That's because Democratic House leaders decided Tuesday to push ahead with the Zadroga 9/11 Health and Compensation Act under a rule that requires two-thirds approval to pass. Many Republicans are concerned about the $10.5 billion price tag, and many don't like the way it's paid for. News of the scheme immediately alarmed 9/11 responders. "Whoever votes 'No' tomorrow should go to jail for manslaughter," said John Feal, who lost half his foot at Ground Zero in the cleanup. Feal thinks House leaders should have found a way to move the bill in the regular way, needing just a simple majority. "They'll all go home and lick their wounds after the vote, but 9/11 responders are the ones who are going to suffer without health care after nine years," Feal said. Sources told the Daily News that Democrats feared Republicans would attach toxic changes in a simple majority vote. No such tinkering is allowed under the two-thirds rule. New York's legislators were still holding out hope they would prevail. "Every time we had a vote on this, we did much better than people thought," said Rep. Anthony Weiner (D-Brooklyn/Queens). And Republicans who oppose the bill can be cast in a politically poisonous light, Democrats said, noting the measure is paid for by closing tax loopholes on subsidiaries of foreign companies. -

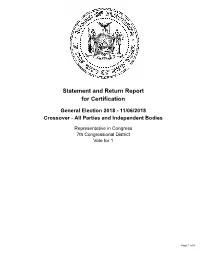

Statement and Return Report for Certification General Election 2018

Statement and Return Report for Certification General Election 2018 - 11/06/2018 Crossover - All Parties and Independent Bodies Representative in Congress 7th Congressional District Vote for 1 Page 1 of 9 BOARD OF ELECTIONS Statement and Return Report for Certification IN THE CITY OF NEW YORK General Election 2018 - 11/06/2018 PRINTED AS OF: Crossover 12/3/2018 10:29:01AM All Parties and Independent Bodies Representative in Congress (7th Congressional District), vote for 1 New York County PUBLIC COUNTER 20,927 MANUALLY COUNTED EMERGENCY 1 ABSENTEE / MILITARY 581 FEDERAL 148 AFFIDAVIT 398 Total Ballots 22,055 Less - Inapplicable Federal/Special Presidential Ballots 0 Total Applicable Ballots 22,055 NYDIA M. VELAZQUEZ (DEMOCRATIC) 17,696 JOSEPH LIEBERMAN (CONSERVATIVE) 1,319 NYDIA M. VELAZQUEZ (WORKING FAMILIES) 997 JEFFREY M. KURZON (REFORM) 289 ALEXANDRIA OCASIO-CORTEZ (WRITE-IN) 1 ANDREW BOYD (WRITE-IN) 1 BENJAMIN LESCZYNSKI (WRITE-IN) 1 BERNIE SANDERS (WRITE-IN) 1 CHAYA ROSENBAUM (WRITE-IN) 1 DANIEL SMALL (WRITE-IN) 1 DONALD TRUMP (WRITE-IN) 1 FISH LIVER (WRITE-IN) 1 GRACE MENG (WRITE-IN) 1 GREGORY W. MEEKS (WRITE-IN) 1 HILLARY CLINTON (WRITE-IN) 1 JENNIE L. VU (WRITE-IN) 1 LORA MALONE (WRITE-IN) 1 MICHAEL BLOOMBERG (WRITE-IN) 1 MING MUI (WRITE-IN) 1 NAOMI LEVIN (WRITE-IN) 3 PETER KING (WRITE-IN) 1 UNATTRIBUTABLE WRITE-IN (WRITE-IN) 11 UNCOUNTED WRITE-IN PER STATUTE (WRITE-IN) 4 WILLIAM SMITH (WRITE-IN) 1 Total Votes 20,336 Unrecorded 1,719 Page 2 of 9 BOARD OF ELECTIONS Statement and Return Report for Certification IN THE CITY OF NEW YORK General Election 2018 - 11/06/2018 PRINTED AS OF: Crossover 12/3/2018 10:29:01AM All Parties and Independent Bodies Representative in Congress (7th Congressional District), vote for 1 Kings County PUBLIC COUNTER 115,116 MANUALLY COUNTED EMERGENCY 190 ABSENTEE / MILITARY 3,515 FEDERAL 1,008 AFFIDAVIT 2,312 Total Ballots 122,141 Less - Inapplicable Federal/Special Presidential Ballots 0 Total Applicable Ballots 122,141 NYDIA M. -

U.S. Bancorp Political Contributions Report July – December 2012

U.S. Bancorp Political Contributions Report July – December 2012 U.S. Bancorp complies fully with all federal, state, and local laws and reporting requirements governing contributions by the affiliated political action committees (PACs) as well as political contributions made with corporate funds. U.S. Bancorp’s Political Contributions Policy requires that all contributions from U.S. Bancorp’s PACs and the corporation be compiled and published semi-annually in a report that is made publicly available on its corporate website. This report and the Political Contributions Policy are reviewed by the Community Reinvestment and Public Policy Committee of the U.S. Bancorp Board of Directors. The U.S. Bancorp Political Participation Program Board of Directors is comprised of no more than 11 senior leaders from across U.S. Bancorp’s retail footprint, which reviews and approves all PAC contributions on a quarterly basis. The members of the PAC Board of Directors for July- December 2012 include: Ed Dwyer Darrell Brown Mike Nickels Senior Vice President – Senior Vice President – Greater Region President – Eastern Community Banking Los Angeles Coastal Region Wisconsin Steve Caves Tim Hennessy Christine Hobrough Division Manager – Iowa Market President – North Dakota Metropolitan Region Manager – Twin Cities Ross Carey Bill Fanter Michael Shelley Executive Vice President – Metropolitan Region Manager – Region President – Arkansas Metropolitan Banking Chicago The U.S. Bancorp Federal Political Action Committee Board of Directors is comprised of no more than 11 senior leaders from across U.S. Bancorp’s retail footprint, which reviews and approves all PAC contributions on a quarterly basis. The members of the Federal PAC Board of Directors for July-December 2012 include: Joe Imbs Scott Lockard Regional Chairman & Senior Vice President of St. -

US Election Insight 2014

dentons.com US Election Insight 2014 Election results data contained in this report re lect data available as of 8:00 a.m. Eastern Standard Time on November 5, 2014. The boisterous sea of liberty is never without a wave Thomas Jeerson 2014 Election Results The Republican Senate Drought Ends In a Deluge For the past eight years, Republicans sought to reclaim As October closed, polling momentum favored the their Congressional majority, but their eorts to achieve Republicans, and Democrats faced lower than expected election night victory fell short of the mark. Last night, turnout among their base, including African Americans, riding a wave of enthusiasm among their supporters Democratic women, Hispanics and young voters. The and bolstered by voter frustration with the Obama general discontent of many voters toward Congress in administration, Republican candidates across the country general and President Obama in particular meant that delivered victories in virtually every key race. With at least a traditionally Republican-friendly issues like opposition to seven seat gain in the US Senate and an increase of more the Aordable Care Act, national security, the economy, than 10 seats in the US House of Representatives, the 2014 and even the Ebola epidemic in West Africa held sway with election was an unmitigated success for Republicans, voters, who ignored Democratic claims of an improving aording them an opportunity to set the agenda for the economy and the dangers of a Republican congress. last two years of the Obama presidency and setting the This last appeal was notably ineective with women stage for a wide open presidential election in 2016. -

A Record of Abuse, Corruption, and Inaction

A Record of Abuse, Corruption, and Inaction House Judiciary Democrats’ Efforts to Document the Failings of the Trump Administration & Lack of Oversight by the Republican Majority Interim Report From President Donald Trump’s Election to the Present Prepared by the Democratic Staff of the House Judiciary Committee Updated 11/9/18 TABLE OF CONTENTS Executive Summary………………………………………………………………2 Letters to the Administration…………………………………………….............4 Letters to the Department of Justice Inspector General………………………28 Letters to House Judiciary Committee and House Majority Leadership...….30 Letters to Outside Entities………………………………………………………38 Requests for a Minority Day of Hearings………………………………………40 Committee Discharge Letters (Pursuant to House Rule XI, Clause (C)(2))…40 Floor Discharge Petitions ……………………………………………………….40 Motions to Move Into Executive Session..……………………………………...41 Oversight-Related Press Conferences…………………………………………..42 Oversight-Related Forums……………………………………………………....44 Oversight-Related Reports……………………………………………………...47 Government Accountability Office Report Requests……………………….…49 Resolutions of Inquiry…………………………………………………………...50 Censure Resolutions……………………………………………………………..51 Oversight-Related Bills and Resolutions……………………………………….52 Lawsuits………………………………………………………………………….65 Amicus Briefs……………………………………………………………………68 1 EXECUTIVE SUMMARY House Judiciary Committee Democrats are committed to pursuing active oversight of the executive branch. In ordinary times, under the leadership of either party, the Committee would have focused its -

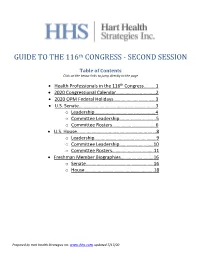

GUIDE to the 116Th CONGRESS

th GUIDE TO THE 116 CONGRESS - SECOND SESSION Table of Contents Click on the below links to jump directly to the page • Health Professionals in the 116th Congress……….1 • 2020 Congressional Calendar.……………………..……2 • 2020 OPM Federal Holidays………………………..……3 • U.S. Senate.……….…….…….…………………………..…...3 o Leadership…...……..…………………….………..4 o Committee Leadership….…..……….………..5 o Committee Rosters……….………………..……6 • U.S. House..……….…….…….…………………………...…...8 o Leadership…...……………………….……………..9 o Committee Leadership……………..….…….10 o Committee Rosters…………..…..……..…….11 • Freshman Member Biographies……….…………..…16 o Senate………………………………..…………..….16 o House……………………………..………..………..18 Prepared by Hart Health Strategies Inc. www.hhs.com, updated 7/17/20 Health Professionals Serving in the 116th Congress The number of healthcare professionals serving in Congress increased for the 116th Congress. Below is a list of Members of Congress and their area of health care. Member of Congress Profession UNITED STATES SENATE Sen. John Barrasso, MD (R-WY) Orthopaedic Surgeon Sen. John Boozman, OD (R-AR) Optometrist Sen. Bill Cassidy, MD (R-LA) Gastroenterologist/Heptalogist Sen. Rand Paul, MD (R-KY) Ophthalmologist HOUSE OF REPRESENTATIVES Rep. Ralph Abraham, MD (R-LA-05)† Family Physician/Veterinarian Rep. Brian Babin, DDS (R-TX-36) Dentist Rep. Karen Bass, PA, MSW (D-CA-37) Nurse/Physician Assistant Rep. Ami Bera, MD (D-CA-07) Internal Medicine Physician Rep. Larry Bucshon, MD (R-IN-08) Cardiothoracic Surgeon Rep. Michael Burgess, MD (R-TX-26) Obstetrician Rep. Buddy Carter, BSPharm (R-GA-01) Pharmacist Rep. Scott DesJarlais, MD (R-TN-04) General Medicine Rep. Neal Dunn, MD (R-FL-02) Urologist Rep. Drew Ferguson, IV, DMD, PC (R-GA-03) Dentist Rep. Paul Gosar, DDS (R-AZ-04) Dentist Rep. -

Social Media Pages -- House

Social Media Pages -- House Need to know your members of Congress? Click here! Alabama Bradley Byrne (AL-1) Martha Roby (AL-2) Mike Rogers (AL-3) Robert Aderholt (Al-4) Mo Brooks (AL-5) Gary Palmer (AL-6) Terri Sewell (AL-7) Alaska Don Young (AKAL) Arizona Ann Kirkpatrick (AZ-1) Martha McSally (AZ-2) Raul Grijalva (AZ-3) Paul Gosar (AZ-4) Matt Salmon (AZ-5) David Schweikert (AZ-6) Ruben Gallego (AZ-7) Trent Franks (AZ-8) Kyrsten Sinema (AZ-9) Arkansas Rick Crawford (AR-1) French Hill (AR-2) Steve Womack (AR-3) Bruce Bruce Westerman (AR-4) California Doug LaMalfa (CA-1) Jared Huffman (CA-2) John Garamendi (CA-3) Tom McClintock (CA-4) Mike Thompson (CA-5) Doris Matsui (CA-6) Ami Bera (CA-7) Paul Cook (CA-8) Jerry McNerney (CA-9) Jeff Denham (CA-10) Mark DeSaulnier (CA-11) Nancy Pelosi (CA-12) Barbara Lee (CA-13) Jackie Speier (CA-14) Eric Swalwell (CA-15) Jim Costa (CA-16) Mike Honda (CA-17) Anna Eshoo (CA-18) Zoe Lofgren (CA-19) Sam Farr (CA-20) David Valadao (CA-21) Devin Nunes (CA-22) Kevin McCarthy (CA-23) Lois Capps (CA-24) Steve Knight (CA-25) Julia Brownley (CA-26) Judy Chu (CA-27) Adam Schiff (CA-28) Tony Cardenas (CA-29) Brad Sherman (CA-30) Pete Aguilar (CA-31) Grace Napolitano (CA-32) Ted Lieu (CA-33) Xavier Becerra (CA-34) Norma Torres (CA-35) Raul Ruiz (CA-36) Karen Bass (CA-37) Linda Sanchez (CA-38) Ed Royce (CA-39) Lucille Roybal-Allard (CA-40) Mark Takano (CA-41) Ken Calvert (CA-42) Maxine Waters (CA-43) Janice Hahn (CA-44) Mimi Walters (CA-45) Loretta Sanchez (CA-46) Alan Lowenthal (CA-47) Dana Rohrabacher (CA-48) Darrell Issa (CA-49) Duncan D. -

NAR Federal Political Coordinators 115Th Congress (By Alphabetical Order )

NAR Federal Political Coordinators 115th Congress (by alphabetical order ) First Name Last Name State District Legislator Name Laurel Abbott CA 24 Rep. Salud Carbajal William Aceto NC 5 Rep. Virginia Foxx Bob Adamson VA 8 Rep. Don Beyer Tina Africk NV 3 Rep. Jacky Rosen Kimberly Allard-Moccia MA 8 Rep. Stephen Lynch Steven A. (Andy) Alloway NE 2 Rep. Don Bacon Sonia Anaya IL 4 Rep. Luis Gutierrez Ennis Antoine GA 13 Rep. David Scott Stephen Antoni RI 2 Rep. James Langevin Evelyn Arnold CA 43 Rep. Maxine Waters Ryan Arnt MI 6 Rep. Fred Upton Steve Babbitt NY 25 Rep. Louise Slaughter Lou Baldwin NC S1 Sen. Richard Burr Robin Banas OH 8 Rep. Warren Davidson Carole Baras MO 2 Rep. Ann Wagner Deborah Barber OH 13 Rep. Tim Ryan Josue Barrios CA 38 Rep. Linda Sanchez Jack Barry PA 1 Rep. Robert Brady Mike Basile MT S2 Sen. Steve Daines Bradley Bennett OH 15 Rep. Steve Stivers Johnny Bennett TX 33 Rep. Marc Veasey Landis Benson WY S2 Sen. John Barrasso Barbara Berry ME 1 Rep. Chellie Pingree Cynthia Birge FL 2 Rep. Neal Dunn Bill Boatman GA S1 Sen. David Perdue Shadrick Bogany TX 9 Rep. Al Green Bradley Boland VA 10 Rep. Barbara Comstock Linda Bonarelli Lugo NY 3 Rep. Steve Israel Charles Bonfiglio FL 23 Rep. Debbie Wasserman Schultz Eugenia Bonilla NJ 1 Rep. Donald Norcross Carlton Boujai MD 6 Rep. John Delaney Bonnie Boyd OH 14 Rep. David Joyce Ron Branch GA 8 Rep. Austin Scott Clayton Brants TX 12 Rep. Kay Granger Ryan Brashear GA 12 Rep.