Danske Bank Codelist Bank Status Message (EDIFACT D.96A – BANSTA)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Core Terms PRIVATE CLIENT

Core Terms PRIVATE CLIENT 234028395.indd 1 5/7/2021 4:44:30 PM Core Terms PRIVATE CLIENT Overview 1.4 If you do not have Sufficient Funds for a payment, ThesePrivate Client Core Terms form part of the we may treat a payment instruction as a request for Private Client Agreement between you (the client) an Unarranged Overdraft. and us (Coutts & Co). 1.5 If we allow the Unarranged Overdraft, you must: The following documents also form part of the Private Client Agreement: • repay the overdrawn amount on demand. • The Important Information booklet, which we • pay interest on the overdrawn amount at our have given you. Unarranged Borrowing Rate. • Our Private Client Banking Tariff (the Tariff) and 1.6 Our Unarranged Borrowing Rate, as detailed in the Interest Rates Notice, which we have given to you. Tariff, is set over the Coutts & Co Base Rate which • Each Application for an account, product or service. tracks the Bank of England Base Rate. We will • Any terms specific to an account, product or service. notify you of changes to the Coutts & Co Base Rate The Private Client Agreement Agreement( ) applies to by advertising the change after it comes into effect accounts, products and related services that we provide to you. in three national daily newspapers and on our If there is any conflict between any account, product or website coutts.com, or by telephone. We will also service specific terms and these Core Terms, the relevant display a notice of the change in our offices and account, product or service specific terms apply. -

Bank of Scotland Bank Account Switching to Us 1/4520768-6

Current Accounts Switching to us Switching your account The Current Account Switch Service makes switching your bank account easy. The Current Account Switch Guarantee means that we will: Take care of closing your old account for you. Transfer your balance from your old to your new account. Move any payments coming in, or going out of your old account to your new one. Switch to the new account on a date of your choice. Take ownership of your switch and getting this right. If you would like to switch a joint bank account, both customers need to allow us to do this. To find out more visit bankofscotland.co.uk/switch If your old account includes an overdraft you can switch this using the Current Account Switch Service. Speak to us before starting your switch, we will be able to advise if you’re eligible for an overdraft, depending on our lending criteria and your credit status. How the switch happens The switch begins. We request payment details from Days your old bank, once received your switch can start. Until 1-2 the switch date you can still use your existing account in the normal way. We set up your new account and move the payment Days arrangements across. For example direct debits and 3-5 your salary. We contact your old bank to transfer over your balance. Day If you have a debit balance on your old account you 6 need to make sure you have sufficient funds available on your new account to pay the balance off. Day Your switch is complete. -

Quilter International Ireland Banking Details

Quilter International Ireland banking details This document was last updated in September 2021. Please confirm with your financial adviser that this is the most up-to-date document for your product or servicing needs. Please enclose a copy of receipt of your electronic payment with the application or use Quilter International Ireland’s Bank Instruction Letter. Your financial adviser will be able to provide you with a Quilter International Ireland Bank Instruction Letter. Banking details Sterling payments From UK banks (CHAPS* payments) From non-UK banks (SWIFT** payments) Sort Code: 56-00-68 Swift code: NWBKGB2147K Bank: National Westminster Bank, Sort code: 56-00-68 High Street, Southampton Bank: National Westminster Bank, Beneficiary: Quilter International Ireland dac High Street, Southampton Account number: 37519611 Beneficiary: Quilter International Ireland dac IBAN code: GB59NWBK56006837519611 Other currency payments (swift payments) Payments should be made to Quilter International Ireland dac’s accounts held with National Westminster Bank, London. Swift code**: NWBKGB2LXXX Bank: National Westminster Bank, 2 1/2 Devonshire Square, London, EC2M 4XB Beneficiary: Quilter International Ireland dac IBAN***: (select as applicable, see below) 1. US dollar IBAN – GB36NWBK60730140501418 7. New Zealand dollar IBAN – GB26NWBK60730167576141 2. Euro IBAN – GB26NWBK60720240501469 8. Norwegian krone IBAN – GB18NWBK60730166004012 3. Australian dollar IBAN – GB24NWBK60730166004195 9. Singapore dollar IBAN – GB53NWBK60730167598838 4. Canadian dollar IBAN – GB80NWBK60730167521916 10. Swedish krona IBAN – GB48NWBK60730140501493 5. Danish krone IBAN – GB43NWBK60730166004047 11. Swiss franc IBAN – GB74NWBK60730166004071 6. Japanese yen IBAN – GB87NWBK60730166004128 12. Hong Kong dollar IBAN – GB21NWBK60730166004152 *** CHAPS is an electronic bank-to-bank same day value payment made in the UK in pound sterling (£). *** SWIFT is an acronym for Society for Worldwide Interbank Financial Telecommunications. -

Your Accounts at a Glance

Your statement Miss Carina Tavares Sanches 06 Mar 2020 MISS CARINA TAVARES SANCHES 18 NOLAN STREET MANCHESTER M9 5UH Your accounts at a glance u Your balances on 06 Mar 2020 Everyday banking To get your most up to date balances or find out about other accounts you have that aren’t listed here, log on to Barclays Bank Account £257.02 online banking (if you’re registered), call us on 03457 345 345*, or come into a branch. Miss Carina Tavares Sanches Sort code 20-55-59 • Account no 23924319 Savings Everyday Saver £510.11 Miss Carina Tavares Sanches Sort code 20-55-59 • Account no 40785792 This is the end of your account summary. We’re here Call 03457 345 345* Click barclays.co.uk Come in to a branch *Call charges apply. Please check with your service provider. We may monitor or record calls for quality, security, and training. Statement date 06 Mar 2020 Barclays Bank Last statement 06 Feb 2020 Account 07 Feb - 06 Mar 2020 Miss Carina Tavares Sanches • Sort Code 20-55-59 • Account no. 23924319 • SWIFTBIC BUKBGB22 • IBAN GB75 BUKB 2055 5923 9243 19 MISS CARINA TAVARES SANCHES 18 NOLAN STREET At a glance MANCHESTER M9 5UH Start balance £24.92 Money in £3,256.20 Money out £3,024.10 End balance £257.02 Your arranged limits Your Barclays Bank Account statement Emergency Borrowing £0 Current account statement NOTICEBOARD u We've stopped charging fees for returned payments. Your deposit is eligible for protection by the Financial Good news – since 1 November 2019, we've stopped charging fees for returned payments on your Services Compensation Scheme. -

Transferring Funds

International Personal Bank Transferring Funds For Citi International Personal Bank clients who hold an Account with Citibank UK Limited. For maximum flexibility, money in a number of currencies can be sent CHAPS is a service which enables you to send and receive money on the from and received into your account in several ways. Citi International same day to bank accounts in the UK, Channel Islands, Isle of Man and Personal Bank will not levy any charges against money received Gibraltar. Sending money through CHAPS is fee-free and can be made into your account, however, please note that the Citi IPB Reference through your Relationship Manager. Exchange Rate will apply to transactions across currencies. How to receive money into your account A Citibank Global Transfer (“CGT”) allows you to send money instantly between your Citibank accounts in over 20 countries worldwide, To make sure money is received quickly and easily into your account, transaction fee-free. CGTs can also be made across currencies without you should provide the following information to the bank sending the charge when the currency of the destination account is the same. money. Limits may apply. CGTs can be carried out via Citi Online or your Relationship Manager. Intermediary Bank Name: Citibank N.A., London Branch Another way to send money from and receive money into your Citi Intermediary Bank SWIFT/BIC: CITIGB2L International Personal Bank account is through a service called SWIFT. The SWIFT method of sending and receiving money can be used in all of Beneficiary Bank: Citibank NA INT PERSONAL BANKING the currencies listed below and overleaf. -

Account Number Portability Report Commissioned by the Financial Conduct Authority

Account Number Portability Report commissioned by the Financial Conduct Authority Published March 2015 01 Contents 02 Executive Summary 08 Introduction 10 Background 14 Assessment Criteria 16 Option 1: Retain Identifer Model 24 Option 2: New Identifier Model 32 Option 3: Central Utility Model 40 Option 4: CASS Perpetual Model 45 Option 5: Know Your Customer (KYC) Database 52 Comparative Analysis 57 Conclusion 60 Bibliography 63 Glossary 58 High-Level Option Descriptions 73 Moorhouse Contact Details Account Number Portability Published March 2015 02 Executive Summary Published March 2015 Account Number Portability 03 Executive Summary In September 2014, the Financial Conduct Authority (FCA) commenced a study of the costs and benefits of account number portability (ANP) as a way of increasing competition in banking by making it easier for customers to switch provider. This report has been commissioned by the FCA to facilitate discussion on ANP. The aim of this report is to: The Current Account Switch Service (CASS) was launched in September 2013. The Payments Council describe it • Consider and identify high-level, theoretically-feasible as a free-to-use service for consumers, small charities, solutions to provide ANP or enhance the existing small businesses and small trusts, and is designed to make account switching process switching current accounts from one bank or building • To help move the current discussions on ANP forward society to another, simpler, reliable and hassle-free.02 but not to impose any recommendations on a specific The service is backed by the Current Account Switch technical solution Guarantee that, amongst other things, guarantees the • To provide evidence, alongside other available redirection of payments paid into an old account to a new evidence, to inform a wider debate on the strategic account for a period of 13 months (to be extended to 36 priorities for industry and any associated infrastructure months by the end of March 2015). -

Private Client Conditions of Use

PRIVATE CLIENT CONDITIONS OF USE Private Client Conditions of Use CONTENTS Private Client Conditions of Use Introduction Section A: Conditions of General Application Section B: Account Specific Conditions Your information Private Current (a payment account) Account restrictions and Unarranged Overdrafts Private Reserve (a non-payment account) Giving us instructions Fixed Term Deposit (a non-payment account) Payments into your account Cash Management Account (a payment account) Payments out of your account Closing or converting your account Section C: Account Operations Schedule Liability Communications Changes to the agreement and charges Changes to interest rates Complaints 1 Private Client Conditions of Use Private Client Conditions of Use Introduction x. When these conditions require us to give you personal notice or service, this will be done by i. These Terms and Conditions (the ‘Conditions’) writing to you at the last address you provided form part of the contract between you and to us for this purpose, or by telephone, text us, The Royal Bank of Scotland International message, email, or secure message to your Limited trading as Coutts Crown Dependencies. inbox in online banking (the Online Service) , The contract also includes the terms about or any other form of communication we agree, interest rates and charges shown in the Banking including through third parties. Services, Dealing and Custody Fee Tariff (the "Tariff") and on couttscrowndependencies.com xi. All of the accounts that we offer are categorised and in any confirmation letters we send to you as either ‘Payment Accounts’ or ‘Non- regarding Fixed Term Deposits. payment Accounts’ in the index to the Account Specific Conditions and in the Account Specific ii. -

A Guide to Personal Banking

A guide to Personal Banking 1 Contents Welcome When money is available – Opening your account 1 the clearing cycle Our Products & Services Cheques from accounts at Current Accounts 1 the same branch 9 Range of savings accounts 1 Cheques from accounts Business banking 1 at another Bank of Ireland 365 online, phone and mobile banking 2 UK branch in Northern Ireland 9 365 online 2 Cheques from accounts at other 365 phone 2 Bank of Ireland UK branches in Great Mobile Banking 2 Britain or another bank in the UK 9 Text Alerts 2 Amounts paid in at other banks or branches to your Bank of Ireland UK Open Banking 3 account held in Northern Ireland 9 Foreign exchange services 3 Cheques you write from your account International payments 3 in the UK 10 Your borrowing needs 3 Paying amounts in at the Post Office® Overdraft requests 3 Cash paid in using your cash card 10 Flexibility 3 Cash paid in using a lodgement Mortgages 3 book, or personalised lodgement slip 10 Financial assessment 3 Cheques paid in at the Post Office® 10 Banker’s reference 4 Automated payments Cooling off period 4 Automated payments to or from How our accounts work other banks 10 Opening hours 4 Automated payments to or from another Telling us about changes 4 Bank of Ireland UK account 10 Fees and charges 4 Debit cardholders 10 Residency 5 Running your account Customers resident in the Republic of Ireland 5 Joint accounts 10 Interest 5 Protecting your accounts 11 Telling you about charges and Verified by Visa 11 interest on your account 5 Liability for losses 12 Changes in interest -

Correspondent Banks

Correspondent Banks Please ensure that all payments destined for The Royal Bank of Scotland International (RBS International), the remitting bank sends a SWIFT MT103 directly to the appropriate jurisdiction SWIFT BIC: RBS International, Jersey SWIFT BIC: RBOSJESX RBS International, Guernsey SWIFT BIC: RBOSGGSP RBS International, Isle of Man SWIFT BIC: RBOSIMDX RBS International, Luxembourg SWIFT BIC: RBOSLULL RBS International, London SWIFT: RBSIGB2L Your full Account Name should be quoted as the Beneficiary Customer as well as your Account Number (or IBAN) and full reference details should be quoted in ‘Details for Beneficiary’. For information purposes only, the remitting Bank may require details of RBS International’s Standard Settlement Institutions to allow cover for direct MT103’s: AUSTRALIAN DOLLARS: National Australia Bank Limited, Melbourne SWIFT: NATAAU3303M CANADIAN DOLLARS: Bank of Montreal, Montreal SWIFT: BOFMCAM2 DANISH KRONER: Den Danske Bank A.S., Copenhagen SWIFT: DABADKKK EURO: The Royal Bank of Scotland plc, London SWIFT: RBOSGB2L HONG KONG DOLLARS: DBS Hong Kong, Hong Kong SWIFT: DHBKHKHH JAPANESE YEN: Sumitomo Mitsui Banking Corporation, Tokyo SWIFT: SMBCJPJT NEW ZEALAND DOLLARS: Bank of New Zealand, Wellington SWIFT: BKNZNZ22 NORWEGIAN KRONER: Den Norske Bank, Oslo SWIFT: DNBANOKK SINGAPORE DOLLARS: Development Bank of Singapore, Singapore SWIFT: DBSSSGSG SOUTH AFRICAN RAND: Standard Bank Of South Africa, Johannesburg SWIFT: SBZAZAJJ STERLING: The Royal Bank of Scotland, London SWIFT : RBOSGB2L SWEDISH KRONER: Skandinaviska -

Clearing Codes Rules

Clearing Codes Rules Version 2.0 | 13/02/2020 Clearing Codes Rules Contents CLEARING CODES RULES 1 VERSION 1 DOCUMENT INFORMATION 4 1.1 VERSION HISTORY 4 1.2 COPYRIGHT STATEMENT 4 2 INTRODUCTION 5 3 ELIGIBILITY CRITERIA 6 3.1 ELIGIBILITY CRITERIA FOR DIRECT PARTICIPANTS 6 3.2 ELIGIBILITY CRITERIA FOR INDIRECT PARTICIPANTS IN BACS, FPS, CHAPS, & ICS SCHEMES 6 3.3 PAYMENT SERVICES REGULATION EXEMPTION FOR CERTAIN BODIES 8 3.4 OFFSHORE ELIGIBILITY (JERSEY, GUERNSEY, GIBRALTAR & ISLE OF MAN) 9 3.5 OVERSEAS BRANCHES AND INSTITUTIONS 9 4 SORTING CODE BANK REFERENCE DATA CHANGES 9 4.1 BANK REFERENCE DATA SORTING CODE REGISTRATION & AMENDMENTS 9 4.2 ALLOCATION OF NEW SORT CODES TO DIRECT PARTICIPANTS WHO ARE NOT DIRECT PARTICIPANTS OF BACS OR ICS SCHEMES 10 4.3 ISSUE OF NEW SORTING CODE NUMBERS 10 4.4 ISSUE OF NEW NORTHERN IRISH SORTING CODE NUMBER 11 4.5 ISSUE OF NON STANDARD SORTING CODE NUMBERS (IBANS) 11 4.6 BRANCH TITLE AND ADDRESS 11 4.7 INDIRECT PARTICIPANTS (INDIRECT CLEARER / AGENCY BANKS) 12 4.8 REISSUE / TRANSFER OF SORTING CODES (INCLUDING MERGERS & TAKEOVERS) 12 4.9 CHANGE OF SETTLEMENT OR SWITCH PARTICIPANT / PORTABILITY OF SORTING CODES 12 4.10 MULTIPLE SETTLEMENT PARTICIPANTS 13 © Pay.UK 2020 2 | VERSION 2.0 | 13/02/2020 Classification: Public Clearing Codes Rules 5 REFRESHING / UPDATING SORT CODE REFERENCE DATA 13 6 CURRENT ACCOUNT SWITCH SERVICE (CASS) 13 7 MODULUS CHECKING 14 8 BUSINESS IDENTIFIER CODES (BICS) – RULES GUIDELINES & REGISTRATION 14 8.1 INTRODUCTION 14 8.2 REISSUE OF BANK IDENTIFIER CODES 14 8.3 MULTIPLE SETTLEMENT -

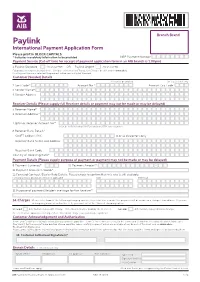

Paylink International Payment Application Form

Branch Brand Paylink International Payment Application Form Please print in BLOCK CAPITALS * Indicates mandatory information to be provided NBP Payment Number Payment Service (Cut-off time for receipt of payment application form in an AIB branch is 1:00pm) 1. Paylink Standard AIB Charge €20 OR Paylink Urgent AIB Charge €32 Full product description available in the ‘Schedule of International Transaction Charges’ booklet and on www.aib.ie. If no Payment Service is selected, the payment will be sent as Paylink Standard. Customer (Sender) Details Account to be debited For ccy accounts only 2. Sort Code* - - Account No.* Account Ccy Code 3. Sender Name* 4. Sender Address Receiver Details (Please supply full Receiver details or payment may not be made or may be delayed) 5. Receiver Name* 6. Receiver Address* 7. IBAN or Receiver Account No.* Must be in IBAN format if in Euro and intra SEPA zone countries. 8. Receiver Bank Details* SWIFT Address/BIC 8 or 11 characters only Receiver Bank Name and Address Receiver Bank Code Country of Receiving Bank* Payment Details (Please supply purpose of payment or payment may not be made or may be delayed) 9. Payment Currency* 10. Payment Amount* - 11. Payment Amount in Words* 12. Forward Contract / Dealer Rate Details. Please check to confirm that this rate is still available. Forward Contract Drawdown Amount if applicable Rate Reference 13. Purpose of payment/Sender’s message for the Receiver* 14. Charges Please select one of the following charging options; if no selection is made, the payment will be made on a charges shared basis. -

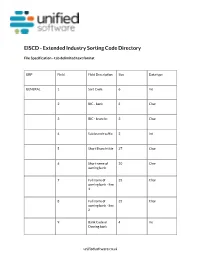

EISCD - Extended Industry Sorting Code Directory

EISCD - Extended Industry Sorting Code Directory File Specification - tab delimited text format GRP Field Field Description Size Data type GENERAL 1 Sort Code 6 Int 2 BIC - bank 8 Char 3 BIC - branch= 3 Char 4 Sub branch suffix 2 Int 5 Short Branch title 27 Char 6 Short name of 20 Char owning bank 7 Full name of 35 Char owning bank - line 1 8 Full name of 35 Char owning bank - line 2 9 Bank Code of 4 Int Owning bank unifiedsoftware.co.uk 10 National 2 Char Central Bank Country Code 11 Supervisory Body 1 Char 12 10 Char Deleted Date 13 Date of last 20 Char change 14 1 Int Print Indicator BACS 15 1 Char Status 16 Date of last 10 Char change 17 Date Closed in 10 Char BACS clearing 18 Redirection 1 Char from flag 19 Redirected to Sort 6 Int Code 20 BACS Settlement 4 Int Bank 21 Settlement section 2 Int 22 Settlement Sub- 2 Int section 23 4 Int Handling bank unifiedsoftware.co.uk 24 Handling Bank 2 Int stream 25 Account 1 Char numbered flag 26 1 Char DDI Voucher flag 27 Transactions 2 Char disallowed - DR 28 Transactions 2 Char disallowed - CR 29 Transactions 2 Char disallowed - CU 30 Transactions 2 Char disallowed - PR 31 Transactions 2 Char disallowed - BS 32 Transactions 2 Char disallowed - DV 33 Transactions 2 Char disallowed - AU 34 Transactions N/A N/A disallowed - Spare 35 Transactions N/A N/A disallowed - Spare 36 Transactions N/A N/A disallowed - Spare unifiedsoftware.co.uk 37 N/A N/A Spare field CHAPS £ 38 1 Char Return Indicator 39 1 Char Status 40 Effective date of 10 Char last change 41 Date closed in 10 Char CHAPS £ clearing 42