Market Dynamics Steady Price Rise with Stable Demand and Increased Supply Parameters India Hyderabad

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sale of Open Plots @ Uppal LOCATED at UPPAL BHAGATH VILLAGE, HYDERABAD

DEVELOPED PLOTS HYDERABAD METROPOLITAN DEVELOPMENT AUTHORITY (An Urban Development Authority - Government of Telangana State) UPPAL LIVE | WORK | PLAY Sale of Open Plots @ Uppal LOCATED AT UPPAL BHAGATH VILLAGE, HYDERABAD. www.hmda.gov.in hps://www.mstcecommerce.com 1 Preamble Hyderabad Metropolitan Development Authority (HMDA) formed by an Act with its jurisdictional area of 7257 sq.kms for the purpose of planning, co-ordination and securing the planned development of the Hyderabad Metropolitan Region. The organization undertakes preparation of metropolitan development and investment plan with revisions required, execution of projects and schemes as per the said plan, acts as an apex body with coordination, execution of the projects and developmental activities, implementation of the area level plans, execution of works relating to infrastructure, public amenities, development and conservation of the environment. The HMDA and Erstwhile HUDA (Hyderabad Urban Development Authority) has taken up several projects such as road projects (PVNR Expressway, Inner and Outer Ring Roads, Flyover, ROBs, Radial Roads, etc.,) Lake Improvement Projects, Recreational Parks, Urban Greening to improve the comforts and living standards of the Hyderabad Metropolitan Area. As per the HMDA Act, 2008 the HMDA and Erstwhile HUDA have developed residential projects in and around Hyderabad such as Vanasthalipuram, Shamshabad, Saroornagar, Chandanagar, Mushkmahal, Nallagandla, Tellapur, Miyapur, Ramachandrapuram & also in the prime locations of Jubilee Hills, Nandagiri Hills, Madhapur offering developed Layouts with infrastructure, hassle free plots and housing for the public of Hyderabad. HMDA has ventured a prestigious layout at Uppal Bhagat in an area of about 500 acres under the land pooling scheme. The layout is developed in a phased manner with 413 acres as first phase for the residential purpose and 70 acres in the second phase of bigger size plots suitable for high rise buildings (MSB) for multipurpose including residential and other usage by making 67 plots of various sizes. -

Download Hyderabad Report

PropIndex | Magicbricks Hyderabad Apr-Jun 2020 Residential Market Insights Market Dynamics Government polices and builder incentives to assist the revival of residential market Parameters India Hyderabad After a staggering ~50% return in the last 5 years, the city's prices witnessed a momentary dip of 5.2% in Q2 2020 Demand+ -27% -24% due to the ongoing pandemic. The state government has taken some quick measures to support the falling demand Supply++ -43% -22% such as it dropped the plan to increase stamp duty and registration charges for the time being. To support the Price Index+++ -1.5% -5.2% sales, the developers started offering incentives such as no EMI until possession and gold vouchers to attract home Notes: buyers. We expect, more builders to follow suit and more such offers in the market in the coming quarter. According Above parameters represent QoQ change in Q2 2020 at to Magicbricks Research, Hyderabad real estate market has solid fundamentals. Government initiatives such as India and city level + change in the volume of property searches permits to construct a house through self-certification (built up area <675 sqft), decision to spend INR 50,000 Crore ++ change in the volume of active listings in the next five years for the development of Hyderabad Urban Agglomeration Area, and positive policy for IT/ITeS +++ change in the weighted average price sector would ensure the long term growth in the market. Source: Magicbricks Research Ready to Move Price Index Key Developers based on active listings 6,000 "After a stellar rise of -

India- Hyderabad- Residential Q4 2019

M A R K E T B E AT HYDERABAD Residential Q4 2019 New launches on the rise, more projects underway in 2020 A total of 4,340 new units were launched in Q4, a 2X rise on a quarterly basis. This is in line with our predictions during Q2-Q3 when several large- scale projects were awaiting approvals. Established catchments such as Kondapur, Hafeezpet, Nallagandla and fast-growing locations such as 14,464 NEW UNIT LAUNCHES (2019) Gopanpally – Tellapur, Bachupally are have witnessed new launches during the quarter. On an annual basis, the number of launches were higher by 30% y-o-y, suggesting a positive momentum in the residential market. Western quadrant accounted for 3/4th of the total launches during the year with majority of the projects launched within close proximity to IT and financial districts. Locations with major new launches in other parts of the SHARE OF MID SEGMENT IN NEW city include Uppal, Bolarum, Patancheru and Kismatpur etc. Mid segment projects accounted for nearly 90% of the units launched during the quarter 46% LAUNCHES (2019) in addition to a a luxury project in Kondapur. This sub-market continues to attract buyers in the premium segment on the back of its excellent physical and social infrastructure and proximity to IT and financial districts. Growth in new launches is likely to continue as developers are gearing up to launch nearly 20,000 units over the next 12-18 months. Several high-end projects with basic selling price exceeding INR 6000/sf were SHARE OF WESTERN QUADRANT IN launched in 2019, indicative of a demand shift and robust market fundamentals. -

Hyderabad Residential June 2019 Marketbeats

HYDERABAD RESIDENTIAL JUNE 2019 MARKETBEATS 90% 82% 28% SHARE OF NEW LAUNCHES IN SHARE OF MID SEGMENT IN DECREASE IN LAUNCHES WESTERN QUADRANT(Q2 2019) NEW LAUNCHES (Q2 2019) (Q- O - Q) HIGHLIGHTS RENTAL VALUES AS OF Q2 2019* Larger projects are awaiting approvals, decline in Average Quoted QoQ YoY Change Short term Submarket new launches is temporary Rent (INR/Month) Change (%) (%) outlook Unit launches were recorded at 3300 units, a 28% q-o-q decline with the quarter coinciding High-end segment with the general elections. Developers were thereafter in a wait-and-watch mode for favorable Banjara Hills 58,000-1,50,000 0% 0% policy announcements in the proposed budget by the new government. In addition, some Madhapur, Gachibowli 35,000-70,000 0% 0% larger projects were also awaiting environmental clearance. Meanwhile, developers are Kukatpally 20,000-40,000 0% 2% focused on completing existing projects which are in advanced stages of construction. Mid- Himayathnagar 20,000-36,000 0% 0% segment accounted for around 80% of the new launches during the quarter, spread across Mid segment established and upcoming residential corridors of Kondapur, Nallagandla, Mokila and Kokapet. We expect new launches to pick up over the next 6-12 months as approvals for Banjara Hills 22,000-30,000 0% 0% larger projects gain pace. For now, a total of 2500-3000 units are scheduled for launch in H2 Madhapur, Gachibowli 18,000-27,500 0% 7% 2019. New projects by prominent developers such as Aparna Constructions, Sumadhura Kukatpally 14,500-22,500 0% 10% Group and Vasavi Group are likely in the short term. -

India Real Estate H2, 2020

Research years in INDIyears in A INDIA IndiaIndia RealReal Estate Estate Residential and Office - July - December 2020 INDIA REAL ESTATE INDIA REAL ESTATE Mumbai HO Knight Frank (India) Pvt. Ltd. Paville House, Near Twin Towers, Off. Veer Savarkar Marg, Prabhadevi, Mumbai 400 025, India 022 6745 0101 / 4928 0101 Bengaluru Knight Frank (India) Pvt. Ltd. 204 & 205, 2nd Floor, Embassy Square, #148 Infantry Road, Bengaluru 560001, India 080 40732600 / 22385515 Pune Knight Frank (India) Pvt. Ltd. Unit No.701, Level 7, Pentagon Towers P4, Magarpatta City, Hadapsar, Pune 411 013, India 020 67491500 / 30188500 Chennai Knight Frank (India) Pvt. Ltd. 1st Floor, Centre block, Sunny Side, 8/17, Shafee Mohammed Road, Nungambakkam, Chennai 600 006 044 4296 9000 Gurgaon Knight Frank (India) Pvt. Ltd. Office Address: 1505-1508, 15th Floor, Tower B, Signature Towers South City 1, Gurgaon 122 001, India 0124 4782700 Hyderabad Western Dallas Centre, 5th floor, Office #3, Hyderabad Knowledge City, Survey No. 83/1, Raidurg, Serilingampally Mandal, Ranga Reddy District, Telangana Hyderabad - 500 032 040 4455 4141 Kolkata Knight Frank (India) Pvt. Ltd. PS Srijan Corporate Park Unit Number – 1202A, 12th Floor, Block – EP & GP, Plot Number - GP 2, Sector – V, Salt Lake, Kolkata 700 091 033 66521000 Ahmedabad Knight Frank (India) Pvt. Ltd. Unit Nos. 407 & 408, Block ‘C’, The First, B/H Keshav Baugh Party Plot, Vastrapur, Ahmedabad – 380015 079 48940259 / 40380259 www.knightfrank.co.in/research 2 INDIA REAL ESTATE Foreword Shishir Baijal Chairman and Managing Director he year 2020 had reflections of both COVID-19 pandemic As we embark upon 2021, market developments in the last few associated disturbances in the beginning as well as months have enthused strong hope among market stakeholders. -

Hyderabad 2020

Residential Market Viewpoints Hyderabad 2020 City Launches Sales Unsold Inventory Avg. Quoted 21,110 Units 8,560 Units 36,760 Units Basic Selling Price Snapshot 42% 2020 vs 2019 -48% 2020 vs 2019 52% 2020 vs 2019 INR 4,195/sf Note: Basic selling price on BUA Residential Market Viewpoints Hyderabad 2020 A Bird’s Eye View Rental Values Capital Values Key Avg. Quoted Rent 2020 vs 2019 Avg. Quoted Rate 2020 vs 2019 Short-term Micro Markets (INR/month) (%) (INR/sf) (%) Outlook Gachibowli 18,000 - 28,000 Nil 4,790 Nil Kondapur 16,000 - 22,000 Nil 4,620 Nil Miyapur 13,000 - 20,000 Nil 4,240 Nil LB Nagar 8,000 - 14,000 Nil 4,500 Nil Adibatla 10,000 - 15,000 Nil 3,600 Nil Increase Stable Decrease Notes: Avg. quoted rent for 2 BHK apartment measuring 1,000 sf Avg. quoted rate (base price) on built-up area Source: ANAROCK Research Residential Market Viewpoints Hyderabad 2020 Only city amongst top 7 Sales declined by 48% Unsold inventory increased cities of India to witness an Y-o-Y; the lowest sales by 52% Y-o-Y; highest increase in launches during to supply ratio of 0.4 increase amongst top 7 2020 across the top 7 cities cities of India Zonal Classification Nearly 21,110 units launched during Despite a significant increase Unsold inventory increased by 52% 2020; an increase of 42% compared in new launches, sales almost during 2020 to 36,760 units. Central to previous year. The fourth quarter halved to 8,560 units in 2020 However, the city still has the 2nd witnessed the highest supply of from 16,590 in 2019. -

Pranit Mayfair Villas

https://www.propertywala.com/pranit-mayfair-villas-hyderabad Pranit Mayfair Villas - Tellapur, Hyderabad Fully furnished and equipped 1& 2 bedroom apartments and Villas Pranit Mayfair Villas contains total 208 Villas with luxurious features and it is located at Tellapur, Gachibowli, Hyderabad. Mayfair Villas is spread over 27 acres land. Project ID : J731190508 Builder: PRANIT PROJECTS Properties: Independent Houses Location: Pranit Mayfair Villas, Gachibowli, Tellapur, Hyderabad (Telangana) Completion Date: Oct, 2015 Status: Started Description Mayfair Villas is fully furnished and equipped 1, 2 bedroom apartments choices with all aspect outstanding amenities and specification like, 100% power backup, 24 hours Surveillance and Multi level security with intercom facility, Play ground for kids, Around 2 Kms - Walk with Nature Jogging Track and many more. Pranit Mayfair Villas is located at Tellapur, Gachibowli, Hyderabad and is HMDA approved. It contains totaling 208 villas which is spread over 27 acres land and built up area is 4000 sq ft to 4945 sq ft. Here 70 % area is open so, you will get fresh air Eco-friendly environment for your healthy life. Type - Luxury Duplex Villas Land Area / No. of Villas - 27 acres - 208 villas Type of Villas - East, West and North facing Villas Built-up Area Range - 4000 sq ft to 4945 sq ft Location - Tellapur, Gachibowli, Hyderabad Salient Features Forest Feel Avenue Plantations and vast landscapes 70% Open Areas untouched with Concrete This project is located in 150 acre villa zone Sustainable and Green -

RECOVERY DEPARTMENT Date & Time of Sale

10 SANJEEVAREDDY NAGAR BRANCH: Mr. Sujith Victor Schedule A: Equitable Mortgage of All that land & building situated at Flat No 510, 5th Floor of the building known RECOVERY DEPARTMENT Batchu, Flat No 510, 5th Floor, MNKS Vitttal Central Court, New as MNKS Vittal Center Court bearing Municipal No 6-2-97 to 100, 6-2-102 to 110 having plinth area of 1604 sqft BOI 10-1-1199/2, PTI Building, 2nd Floor, A.C. Guards, Hyderabad-500004. Bhoinguda, Near Vijaya Diagnostic Center, Secunderabad together car parking area along with undivided share of land 73.78 sq yrds out of total admeasuring 6600 sq yrds Ph: 040-23328143, 23322861. E-mail: assetrecovery.telangana@bankofindia.co.in 500003. Amount Due: Rs. 47,64,354.00/- + Interest @ 8.80 % situated at Bokkalaguda now known as New Bhoinguda, Secunderabad, Hyderabad 500003 District, Telangana E-AUCTION SALE NOTICE UNDER SARFAESI ACT, 2002 & RULES FRAMED THEREUNDER at monthly rests from 30.06.2019 together with costs, expenses State., and bounded by North: Flat NO 509, South: Flat NO 511, East: Open to sky, West: Corridor & Flat No 508. etc. Date of Demand Notice: 02.07.2019, Date of Possession: Though bank is a secured creditor, there is subsequent attachment order dated 09-10-2019 vide IA 649/2019,O/S Notice is hereby given to the public in general, in particular to the below mentioned Borrower(s) and Guarantor(s) and to the legal heirs of Borrowers & Guarantors if any that the 12.11.2020. Contact Nos: 040-23818888. No 284/2019 at III Honable Senior Civil Judge , Secunderabad. -

DETAILS of MOBILE RYTHU BAZARS and LOCATIONS Estate Locations and Timings S

DETAILS OF MOBILE RYTHU BAZARS AND LOCATIONS Estate Locations and Timings S. Name of the Concerned Officer Phone No. Ph. NO. Vehicle No. Incharge Name Phone No. 3rd No. Rythu Bazar Police Station 1st Location Timings 2nd Location Timings Timings Name Location 1 R.K.Puram Mahendar 7330733753 Neredmet 9490617153 TS08UG1659 Anitha Enclave Supthagiri Enclave AP28TB3696 Sainikpuri Srinivasnagar High Tension line 2 Vanasthalipuram Swapna 7330733749 Vanasthalipuram 94490617179 AP 11 X 6082 Muthayalu 9848970047 SAIBABA TEMPLE 11.00 AM VANASTHALI HILLS 1.00 SRINIVASAPURAM AP 29 tc 0044 A. Seenu 9949064869 HASTHINAPURAM CENTRAL 11.00 CHINTAL KUNTA 1.00 AP 10 W 6362 K. Chandraiah 9848135012 VENKATESHWARA TEMPLE 11.00 AGRICULTURAL 1.00 ANUPAMA NAGAR COLONY AP 29 U 1129 p. yadhireddy 9985038259 Z.P ROAD HASTHINAPURAM 11.00 INDRAPRASTHA 1.00 COLONY AP 11 Y 5279 Suresh 9666925850 B.D.REEDY GARDENS 11.00 HASTHINAPURAM 1.00 SOUTH AP 29 TV 763 K.Srinivas reddy 8897763165 B.N. REDDY BUS STOP 11.00 1.00 TS 07 UE 4537 SRINIVAS 9440287191 GOVT.SCHOOL NAGOLE 11.00 BLINDS COLONY 1.00 TS 07 UE 5988 BASKER 9866591708 MAMTHA NAGAR GANESH 11.00 BANK COLONY 1.00 MANDAPAM COMMUNITY HALL TS 07 UE 4947 G.MADHU 9700078172 NGOS COLONY 11.00 SACHIVALYI NAGAR 1.00 Ts 06 UA 6289 Srinivas Suthend park 11.00 Rock twon 1.00 3 Saroor nagar Sravanthi 7330733748 Chaitanyapuri 94910 53296 SALIM TS07UG4929 J.VENKATESH 9848071343 SRIPURAM COLONY 12:00 MOOSARAMBAGH 02:00 NAGAR 03:00 MALLANNA HP PETROL BUNK TEMPLE TS07UE4470 NARAYAN REDDY 8639788584 SRISAI NAGAR COLONY 12:00 BODUPPAL -

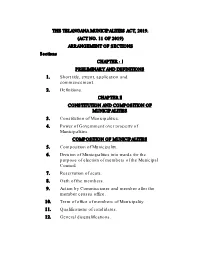

THE TELANGANA MUNICIPALITIES ACT, 2019. (ACT NO. 11 of 2019) ARRANGEMENT of SECTIONS Sections CHAPTER - I PRELIMINARY and DEFINITIONS 1

THE TELANGANA MUNICIPALITIES ACT, 2019. (ACT NO. 11 OF 2019) ARRANGEMENT OF SECTIONS Sections CHAPTER - I PRELIMINARY AND DEFINITIONS 1. Short title, extent, application and commencement. 2. Definitions. CHAPTER II CONSTITUTION AND COMPOSITION OF MUNICIPALITIES 3. Constitution of Municipalities. 4. Power of Government over property of Municipalities. COMPOSITION OF MUNICIPALITIES 5. Composition of Municipality. 6. Division of Municipalities into wards for the purpose of election of members of the Municipal Council. 7. Reservation of seats. 8. Oath of the members. 9. Action by Commissioner and member after the member ceases office. 10. Term of office of members of Municipality. 11. Qualifications of candidates. 12. General disqualifications. 2 [Act No. 11 of 2019] 13. Authority to decide questions of disqualification of members. 14. Special provision in the case of newly- constituted and reconstituted municipalities. 15. Vacancies of members. 16. Procedure when no member is elected. 17. Appointment of Committees. 18. Acts of the Municipality not to be invalidated by defect in constitution and vacancy. MUNICIPAL AUTHORITIES 19. Municipal Authorities. 20. Election of Chairperson and Vice-Chairperson. 21. Resolution of disputes relating to cessation for disobedience of party whip. 22. Oath of the office of the Chairperson or Mayor. 23. Duties and Responsibilities of the Chairperson. 24. Municipality wise “Green Action Plan”. 25. Function of Chairperson to incur contingent expenditure. 26. Emergency powers of the Chairperson. 27. Delegation and devolution of functions of Chairperson. 28. Reservation of the office of the Chairperson. 29. Reservation of the office of the Mayor. 30. Constitution of Ward Committees. 31. Functions of the Ward Committee. 32. -

SBI RACPC Moula-Ali, E-Auction Account, A/C No

RACPC-Himayat Nagar, Branch: System Suspense Branch Parking Account, A/c No: 37608219022, IFSC: SBIN0017894 1 Mr. Puppala Shekar, 12.00 PM Venkateswara MARUTI ERTIGA ZDI+SMART Rs. 8,70,000/- A/c.No: 37531953343, to Associates TS08FV2266/2018/66,491 KMS/DIESEL & Rs. 87,000/- E-Quotations are invited for E-Auction of below mentioned cars of our borrowers in "as it is where it is condition". The Cars have Branch: Himayath Nagar - 20067 1.00 PM 8555875511 been financed by various branches linked to various RACPC's (RACPC-Banjara Hills, RACPC-Moula Ali, RACPC-Kukatpally, 2 Mr. P. Surya Prakash Rao, CHEVROLET CRUZE/TS07FT9969/2017/ Rs. 7,60,000/- 12.00 PM Kishore & RACPC-Gunfoundry, RACPC-Himayath Nagar, RACPC-Secunderabad, RACPC-L.B Nagar, RACPC-Madhapur) and as the A/c.No: 36985633527, 82,915 KMS/DIESEL & Rs. 76,000/- to Gopal- borrowers defaulted in payment of EMI's, Bank has seized the cars and the same are being auctioned ONLINE on 28.02.2020. Branch: Old MLA Quarters - 01880 1.00 PM 9246826191 S. Barrower Name, Description of Cars/ Regd. No's/ Reserve Price Auction Contact No's RACPC - SECUNDERABAD, No A/c No. & Branch Name Model/ KM Runned/ Fuel Type & EMD Time for Car Details EMD A/c No: 33977795671, IFSC: SBIN0000916 SBI RACPC - BANJARA HILLS Kishore & 1 Mrs. Asepu Samatha, MAHINDRA KUV 100 NXT MFALCOND75 Rs. 3,62,000/- 1.00 PM E-Auction Account, A/c No: 37309665769, IFSC: SBIN0021118 A/c.No: 37493899410, to Gopal - BSIV/ TS11EM6143 /2017/62,996 KMS/Diesel & Rs. -

Dj15052015rcell.Pdf

HIGH COURT OF JUDICATURE AT HYDERABAD FOR THE STATE OF TELANGANA AND THE STATE OF ANDHRA PRADESH STATEMENT SHOWING THE LIST OF ELIGIBLE CANDIDATES WHO ARE APPLIED FOR THE 6 POSTS OF DISTRICT JUDGE UNDER DIRECT RECRUITMENT, NOTIFIED FOR THE YEAR 2014 SL Appl. NAME OF THE APPLICANT No. No.. ADDRESS 1. Venkata Narasimha Raju Krovvidi Plot No.44, Port Colony, 1 Back side of Nookambica Temple, Kasimkota Mandal, Kasimkota, Visakhapatnam District 531031 2. Suhasini Makina Dr.No.63-3-22/5, Flat No.202, 2 Dwarakamani Residence, Jawahar Nagar, Sriharipuram, Visakhapatnam 530011 3. Fareed Khan 3 4-10-6/1, Rajampet, Sanga Reddy Town, Medak District. 502001 4. Tejovathi Machisrajau Flot No.401, 4th Floor, 4 1-2-607/23/1/D, Om Nagar, Indira Park Road, Ashok Nagar, Hyderabad. 500080 5. Venkata Ratnakar Kondiparthi D.No.18-10-34, Zero Lane, 5 Kedareswarapet, Vijayawada, Krishna District 520003 6. Taruna Kumar Pillalamarri Door No.21-14-12-20/2A, Thota Vari 6 Street, 2nd Line, Ramalingeswarapet, Tenali, Guntur District. 522201 7. 7 Chandra Mohan Karumuru D.No.60-97-1, Nabikota, R.V.Nagar Post, Kadapa City and District 516003 8. Kasi Viswanadha Raju Alakunta 8 Dr.No.27-3-2, Rweddys Bazar, Near B.C. Colony, Burripalem Road, Tenali, Guntur District 522201 9. Subbalakshmi Nimmakayala C/o. V.Purushothama Rao, 10 Ramakrishna Homeo Hospita D.No.5-3-58, Konddappa Street, Pithapuram, East Godavari District 533450 10. Sreenivasulu Chennaiah Gari 11 H.No.87-1066, Ganesh Nagar-I, Kurnool Post, Kurnool Distrtict. 518002 11. Venkateshwarlu Vinjamuri H.No.8-2-338/1, Panchavati Co-Op 12 HSG Society, Road No3, Banjara Hills, Hyderabad.