Palestinian Affordable Housing Programme

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

November 2014 Al-Malih Shaqed Kh

Salem Zabubah Ram-Onn Rummanah The West Bank Ta'nak Ga-Taybah Um al-Fahm Jalameh / Mqeibleh G Silat 'Arabunah Settlements and the Separation Barrier al-Harithiya al-Jalameh 'Anin a-Sa'aidah Bet She'an 'Arrana G 66 Deir Ghazala Faqqu'a Kh. Suruj 6 kh. Abu 'Anqar G Um a-Rihan al-Yamun ! Dahiyat Sabah Hinnanit al-Kheir Kh. 'Abdallah Dhaher Shahak I.Z Kfar Dan Mashru' Beit Qad Barghasha al-Yunis G November 2014 al-Malih Shaqed Kh. a-Sheikh al-'Araqah Barta'ah Sa'eed Tura / Dhaher al-Jamilat Um Qabub Turah al-Malih Beit Qad a-Sharqiyah Rehan al-Gharbiyah al-Hashimiyah Turah Arab al-Hamdun Kh. al-Muntar a-Sharqiyah Jenin a-Sharqiyah Nazlat a-Tarem Jalbun Kh. al-Muntar Kh. Mas'ud a-Sheikh Jenin R.C. A'ba al-Gharbiyah Um Dar Zeid Kafr Qud 'Wadi a-Dabi Deir Abu Da'if al-Khuljan Birqin Lebanon Dhaher G G Zabdah לבנון al-'Abed Zabdah/ QeiqisU Ya'bad G Akkabah Barta'ah/ Arab a-Suweitat The Rihan Kufeirit רמת Golan n 60 הגולן Heights Hadera Qaffin Kh. Sab'ein Um a-Tut n Imreihah Ya'bad/ a-Shuhada a a G e Mevo Dotan (Ganzour) n Maoz Zvi ! Jalqamus a Baka al-Gharbiyah r Hermesh Bir al-Basha al-Mutilla r e Mevo Dotan al-Mughayir e t GNazlat 'Isa Tannin i a-Nazlah G d Baqah al-Hafira e The a-Sharqiya Baka al-Gharbiyah/ a-Sharqiyah M n a-Nazlah Araba Nazlat ‘Isa Nazlat Qabatiya הגדה Westהמערבית e al-Wusta Kh. -

Live, Work and Grow in the First Palestinian Planned City Fall Edition 2011

Fall Edition home 2011 RESIDENTIAL BUILDINGS UNDERWAY GET TO WORK! Live, Work and Grow in the first Palestinian planned city Fall Edition 2011 RESTORING COMMUNITY LIFE: RAWABI STRIVES TO PRESERVE PALESTINIAN COMMUNITY TRADITIONS 4 RESIDENTIAL BUILDINGS UNDERWAY 5 RAWABI IGNITES THE ISRAELI BOYCOTT LAW 6 CONSTRUCTION TEAM HELPS EXPAND NEIGHBORING VILLAGE SCHOOL IN AJJOUL 6 BIRZEIT BANI-ZAID BUS CO. LAUNCHES NEW ROUND-TRIP RAWABI-BIRZEIT-RAMALLAH BUS ROUTE 6 AFTER DELAYS, TEMPORARY ROAD APPROVAL EXPECTED SHORTLY 7 GET TO WORK! 8 BIM TEAM SPARKS IMAGINATIONS AT ENGINEERING DAY AT BIRZEIT UNIVERSITY 9 THOUSANDS OF HIGH SCHOOL STUDENTS INSPIRED BY PALESTINE’S LARGEST PROJECT 10 AL-BIREH MUNICIPALITY HELPS RAWABI CONTROL DUST AND CONSERVE WATER 10 HIGHLIGHTS: ENJOYING THE OUTDOORS IN A PLANNED CITY 11 RAWABI MODELS COMPLETED IN QATAR 11 HUNDREDS OF WORKERS COOPERATE TO BUILD THE CITY 12 A VIEW FROM THE AIR 14 RAWABI CHAMPION HONORED IN MALAYSIA 14 MEDIA COVERAGE CONTINUES 15 RAWABI VISITORS 16 Rawabi is being developed by Bayti Real Estate Investment Company, a joint BAYTI REAL ESTATE undertaking of Qatari government-owned Qatari Diar and Ramallah-based Massar INVESTMENT COMPANY International – two companies with unsurpassed real estate development experience and extensive knowledge of regional and international markets. Phone: +970 2 241 5444 P.O. Box 2132 Rawabi will provide more than 5,000 affordable housing units with nine different floor Ramallah, Palestine plans to choose from, spread across 23 neighborhoods. The city will also include [email protected] a commercial center, a business district, a hotel and convention center, public and www.rawabi.ps private schools, medical facilities, mosques and a church, as well as extensive green recreation space. -

National Report, State of Palestine United Nations

National Report, State of Palestine United Nations Conference on Human Settlements (Habitat III) 2014 Ministry of Public Works and Housing National Report, State of Palestine, UN-Habitat 1 Photo: Jersualem, Old City Photo for Jerusalem, old city Table of Contents FORWARD 5 I. INTRODUCTION 7 II. URBAN AGENDA SECTORS 12 1. Urban Demographic 12 1.1 Current Status 12 1.2 Achievements 18 1.3 Challenges 20 1.4 Future Priorities 21 2. Land and Urban Planning 22 2. 1 Current Status 22 2.2 Achievements 22 2.3 Challenges 26 2.4 Future Priorities 28 3. Environment and Urbanization 28 3. 1 Current Status 28 3.2 Achievements 30 3.3 Challenges 31 3.4 Future Priorities 32 4. Urban Governance and Legislation 33 4. 1 Current Status 33 4.2 Achievements 34 4.3 Challenges 35 4.4 Future Priorities 36 5. Urban Economy 36 5. 1 Current Status 36 5.2 Achievements 38 5.3 Challenges 38 5.4 Future Priorities 39 6. Housing and Basic Services 40 6. 1 Current Status 40 6.2 Achievements 43 6.3 Challenges 46 6.4 Future Priorities 49 III. MAIN INDICATORS 51 Refrences 52 Committee Members 54 2 Lists of Figures Figure 1: Percent of Palestinian Population by Locality Type in Palestine 12 Figure 2: Palestinian Population by Governorate in the Gaza Strip (1997, 2007, 2014) 13 Figure 3: Palestinian Population by Governorate in the West Bank (1997, 2007, 2014) 13 Figure 4: Palestinian Population Density of Built-up Area (Person Per km²), 2007 15 Figure 5: Percent of Change in Palestinian Population by Locality Type West Bank (1997, 2014) 15 Figure 6: Population Distribution -

Live, Work, and Grow in the First Palestinian Planned City Rawabi

Summer Edition home 2009 Rawabi The Masterplan Grow for a Greener Palestine Live, Work, and Grow in the first Palestinian planned city MORE THAN $500,000,000 The first Palestinian planned city - Rawabi in Area A under the full jurisdiction of the INVESTMENT - will be a state-of-the-art new metropolitan Palestinian Authority (PA), this project center located between Jerusalem and bears immediate political and economic MORE THAN 5,000 Nablus, 9 kilometers north of Ramallah. implications for the wider West Bank. HOUSING UNITS A residential, commercial, economic and Rawabi will be predominately comprised cultural development, Rawabi will offer more of affordable housing, helping to ease the ABOUT 40,000 than 5,000 affordable housing units, intially chronic shortage of homes in Palestine and RESIDENTS housing 25,000 and ultimately becoming meeting increased demand. In April 2008, home to 40,000 Palestinians. Well within 6,300,000 M2 Bayti and the Palestinian Authority entered the financial reach of young Palestinian CITY LIMITS into a public-private partnership in which families and Palestine’s growing class of the PA committed to support Rawabi in single working professionals, Rawabi will be accordance with the terms of the Affordable a true quality-of-life housing option. Housing program outlined in the Palestinian To ensure a vibrant city, Rawabi’s City Reform and Development Plan (PRDP). Center will feature commercial and retail From an economic perspective, Rawabi space, a shopping mall, primary and will moderate unemployment by generating secondary health care facilities, hotels, 8,000-10,000 jobs during construction a library, a cinema, and public parks. -

Ramallah and Al-Bireh Governorate (2030)

Spatial Development Strategic Framework الخطة التنموية المكانية االستراتيجية for Ramallah and Al-Bireh Governorate لمحافظة رام اهلل والبيرة (2030) (2030) Summary ملخـــص دولة فلسطني State of Palestine Spatial Development Strategic Framework for Ramallah and Al-Bireh Governorate (2030) Executive Summary March 2020 Ramallah & Al-Bireh Governorate Spatial Development Strategic Framework (2030) Disclaimer This publication has been produced with the assistance of the European Union under the framework of the project entitled: “Fostering Tenure Security and Resilience of Palestinian Communities through Spatial-Economic Planning Interventions in Area C (2017 – 2020)” , which is managed by the United Nations Human Settlements Programme (UN-Habitat). The Ministry of Local Government, and the Ramallah and Al-Bireh Governorate are considered the most important partners in preparing this document. The contents of this publication are the sole responsibility of the author and can in no way be taken to reflect the views of the European Union. Furthermore, the boundaries and names shown, and the designations used on the maps presented do not imply official endorsement or acceptance by the United Nations. Contents Disclaimer 2 Contents 3 Acknowledgments 4 Ministerial Foreword Hono. Minister of Local Government 6 Foreword Hono. Governor of Ramallah and Al-Bireh 7 This Publication has been prepared by Arabtech Jardaneh Consultative Company (AJPAL). The publication has been produced in a participatory approach and with substantial inputs from many local -

Kerns and Spector

THE INSTITUTE FOR MIDDLE EAST STUDIES IMES CAPSTONE PAPER SERIES THE PALESTINIAN PRIVATE SECTOR: CAPACITY DEVELOPMENT IN AN ERA OF SEPARATION ZACK KERNS KYLE SPECTOR MAY 2010 THE INSTITUTE FOR MIDDLE EAST STUDIES THE ELLIOTT SCHOOL OF INTERNATIONAL AFFAIRS THE GEORGE WASHINGTON UNIVERSITY COPYRIGHT OF THE AUTHORS, 2010 TABLE OF CONTENTS 1 Introduction .............................................................................................................................................. 3 1.1 Capacity in the Palestinian Context ................................................................................................... 5 1.2 Paper Organization ............................................................................................................................ 7 2 Remaking the boundaries of the Palestinian Economy ............................................................................. 8 2.1 The Palestinian economy since 1967 ................................................................................................. 8 2.2 The Current Period: an Era of Separation ........................................................................................ 12 3 Cases of capacity development in the private sector ............................................................................. 13 3.1 PalTel: Developing localized capacity ............................................................................................... 14 3.2 Bisan Systems: Developing localized, diversified and de-territorialized capacity -

Beyond Aid: a Palestinian Private Sector Initiative for Investment, Growth and Employment

Beyond Aid: A Palestinian Private Sector Initiative for Investment, Growth and Employment The Portland Trust November 2013 42 Portland Place, London, W1B1NB P.O. Box Al Bireh 4102, Ramallah Al Masyoun Azrieli 3, 132 Menachem Begin Road, Tel Aviv 67023 Website: www.portlandtrust.org Email: [email protected] The Portland Trust Beyond Aid: A Palestinian Private Sector Initiative for Investment, Growth and Employment The Challenge 23% unemployment in 2012 and 39% youth unemployment, the highest in the region 50% slowdown in GDP growth in 2012, following annual average growth of 8.2% between 2006 and 2011 1,000,000 new jobs needed to reduce unemployment to 10% by 2030 Addressing the Challenge 5 sectors prioritised as cornerstones of a private sector action plan: Agriculture, IT & Digital Entrepreneurship, Tourism, Construction, and Energy More than 50 projects identified across these five sectors as potential growth catalysts The Potential Impact Over $8 billion in GDP, more than 150,000 new direct jobs and around 220,000 indirect jobs can be created by 2030 through these projects The Portland Trust Beyond Aid: A Palestinian Private Sector Initiative for Investment, Growth and Employment Foreword from the Coordinating Committee The Palestinian economy faces a number of challenges. Restrictions resulting from the political situation continue to be the most significant impediment to economic growth. Uncertainty and lack of hope in progress, together with internal constraints, have also contributed to economic stagnation. Although it is true that the economy has grown between 2006 and 2011, this has been significantly driven by inflows of aid from the international donor community, and is therefore unsustainable in the long-term. -

Occupation, Resistance, and State-Building in Palestine and Timor-Leste

Pathways to Self-Rule: Occupation, Resistance, and State-Building in Palestine and Timor-Leste by Diana B. Greenwald A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy (Political Science) in The University of Michigan 2017 Doctoral Committee: Professor Mark A. Tessler, Co-Chair Professor William Roberts Clark, Co-Chair Assistant Professor Mark Dincecco Associate Professor Brian K. Min Professor Anne Pitcher Diana B. Greenwald [email protected] ORCID iD: 0000-0002-4408-4379 © Diana B. Greenwald 2017 All Rights Reserved In memory of: Sidney Fuld Greenwald (1921 - 2016) and Rose Lou Shelton (1934 - 2011) ii ACKNOWLEDGEMENTS I began my doctoral studies in 2010 with a scattered and wide-ranging set of interests related to the political economy of the Middle East. At the time, I had no idea how difficult it would be to transform those ideas into a concrete contribution to scholarly research. I thought it would take six years; it took seven. I thought I would wake up each morning motivated to attend class; complete a problem set; study for an exam; work on my dissertation proposal; collect data; transcribe an interview; prepare presentation slides; or write (and rewrite, and rewrite, and rewrite) a chapter. Some mornings, I had no such motivation. But, in 2010, I was also unaware of how many bright, inspiring, funny, and generous people I would meet along this journey. The actual cast of characters is inevitably longer than the list of those acknowledged below. These individuals not only helped me achieve the aforementioned checklist of research tasks, adding up to a completed dissertation, but they also encouraged me to take care of myself in the process. -

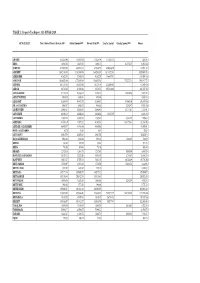

TABLE 1 : Property Tax Report : Q1 (DINAR) 2018

TABLE 1 : Property Tax Report : Q1 (DINAR) 2018. MUNICIPALITY Total Collected Property Revenue 100% Refund Amount 90% Revenue Total 10% Transfer Amount Clearing Amount 90% Balance ABO DIS 132,483.90 119,235.51 13,248.39 111,601.13 7,634.38 EDNA 14,081.50 12,673.35 1,408.15 21,576.17 (8,902.82) JERICHO 672,497.92 605,248.13 67,249.79 490,666.39 114,581.74 ALBIREH 3,492,104.98 3,142,894.49 349,210.50 1,613,852.54 1,529,041.95 ALKHADER 41,622.01 37,459.81 4,162.20 156,457.91 (118,998.10) ALKHALIL 1,968,939.64 1,772,045.68 196,893.96 733,227.91 1,038,817.77 ALDOHA 167,251.02 150,525.92 16,725.10 224,095.05 (73,569.13) ALRAM 66,765.49 60,088.94 6,676.55 305,616.29 (245,527.35) ALZABABDEH 31,181.32 28,063.18 3,118.13 18,985.26 9,077.92 ALZAYTOUNEH 4,954.55 4,459.10 495.46 4,459.10 ALSAMOU' 51,645.83 46,481.24 5,164.58 88,960.10 (42,478.86) SILA ALHARTHIA 5,000.57 4,500.52 500.06 9,202.47 (4,701.95) ALSHYOUKH 28,949.47 26,054.52 2,894.95 23,771.61 2,282.91 ALTAYBEH 24,899.13 22,409.22 2,489.91 25,027.55 (2,618.33) ALTHAHRIA 11,674.82 10,507.33 1,167.48 3,341.25 7,166.08 ALEZARIA 91,080.35 81,972.32 9,108.04 164,170.43 (82,198.11) ALMAZR'A ALSHARQIA 46,489.57 41,840.61 4,648.96 41,840.61 NAZLA ALGHARBIA 46.76 42.08 4.68 42.08 ALYAMOUN 29,615.59 26,654.03 2,961.56 26,654.03 BAQA ALSHARQIA 2,921.62 2,629.46 292.16 1,884.63 744.83 BEDDO 326.40 293.76 32.64 293.76 BEDIA 761.60 685.44 76.16 685.44 BROQIN 12,824.15 11,541.73 1,282.41 5,080.90 6,460.83 BANI ZEID ALGHARBIA 39,139.12 35,225.20 3,913.91 6,789.87 28,435.33 BANI NEIM 30,611.47 27,550.33 3,061.15 -

Private Citizenship: Real Estate Practice in Palestine

humanities Creative Private Citizenship: Real Estate Practice in Palestine Athar Mufreh Architect, New York, NY, USA; [email protected] Received: 7 July 2017; Accepted: 15 August 2017; Published: 31 August 2017 What is the function of the new towns and real estate developments in Palestine? The context of the West Bank serves as a unique example of the workings of real estate in an occupied territory, while considering real estate as a fundamental tool for globalization and the most critical infrastructure for urban development. The new tools that were introduced there in the mid-1990s—planned neighborhoods, title deeds, new land registrations, ownership contracts, mortgages, banks, and new sources of capital—now constitute a real estate infrastructure integral to the West Bank’s development. Rawabi, the first master-planned Palestinian city, is pioneering the mechanics and experience of this global transnational infrastructure. The evolution of a global real estate market under occupation has become the dominant spatial practice in the West Bank as well as the leading force for the Palestinian economy. The Palestinian Authority’s reforms since 1994, aggravated by continual political shifts that created a diffused system of actors, have allowed real estate developers to gain power due to the unclear distribution of tasks, power structures, and territorial sovereignty. The private sector became the governing power, the authority. These private companies use ‘real estate infrastructure’ to help impose and dictate a conclusive idea of comfort and stability within an imagined reality. This reality is imagined by certain actors from peace envoys and Israel. It is made possible through real estate communities of individual members which ‘invent nations where they do not exist’ and seek refuge away from the chaotic conditions of the absence of a nation-state. -

Rawabi HOME, the City’S Families Tell Stories That Pulse with the Excitement of New Home Ownership, of Dreams Coming True, of a Brighter Future for Their Children

WINTER EDITION home 2016 LIVE WORK GROW RESIDENTS HAPPY IN COMMERCIAL BUILDINGS: RAWABI AMPHITHEATER NEW LIVES AT RAWABI A VARIETY OF MODERN A MASTERPIECE GRACES INTEGRATED OFFICES THE HILLS OF PALESTINE LIVE, WORK, AND GROW IN THE FIRST PALESTINIAN PLANNED CITY The winter’s rain gives us a special feeling; pure raindrops foretell the fowers of spring and fll us with hope and optimism. At Rawabi, rain brings with it a special fragrance - FAMILIES BRING the sweet smell of our land is carried on the breezes from the surrounding green hills. Contemplating the lovely view from your balcony, time stands still as you take in the beauty all around you. Calm and serenity bring smiles and the laying down of daily burdens as the heart flls with the warmth of friends and family. A new city is emerging all WARMTH AND around you, flling you with pride and wonder. Like the rain, Rawabi whispers to us that we must continue to hope, to embrace life and all its seasons, to lift the stone from the earth COMMUNITY and use it to build the modern lifestyle we deserve. In this edition of Rawabi HOME, the city’s families tell stories that pulse with the excitement of new home ownership, of dreams coming true, of a brighter future for their children. TO LIFE As we spend a few evenings with them, the joy they feel is evident. At the families’ frst meeting with the city’s planners, the fullness of the dream of Rawabi begins to be revealed. This new city is clearly a true community, distinguished by a set of common values based on the importance of family, work, and the social fabric. -

The Discrepancy in Water Sales Prices in Palestine: Social Equity for the Household Customers and Financial Performance of the Water Service Providers

MEDRC Series of R & D Reports MEDRC Project: 17-WB-013 The Discrepancy in Water Sales Prices in Palestine: Social Equity for the Household Customers and Financial Performance of the Water Service Providers M.Sc. Thesis By Abdullah Murrar Supervisors Dr AbdelRahman Tamimi Graduate Studies Arab American University A Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Master in Strategic Planning & Fundraising MEDRC Water Research Muscat Sultanate of Oman June 20, 2019 1 The Discrepancy in Water Sales Prices in Palestine: Social Equity for the Household Customers and Financial Performance of the Water Service Providers By Abdullah Nasr Murrar Supervisor Dr. Abdelrahman Tamimi Dr. Subhi Samhan Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Master in Strategic Planning and Fundraising Arab American University Palestine, Faculty of Graduate Studies June 13, 2019 2 Arab American University Palestine, Faculty of Graduate Studies Authorization I, Abdullah Murrar, authorize Arab American University Palestine, Faculty of Graduate Studies to supply copies of my Thesis Dissertation to libraries or establishments or individuals on request, according to the regulations of Arab American University Palestine. Signature: Date: June 13, 2019 3 4 Acknowledgements I wish to express my deep sense of gratitude to Middle East Desalination Research Center (MEDRC) who financed this thesis, and to my supervisor Dr Abdelrahman Tamimi, for his outstanding guidance and support which helped me in completing my thesis work. I would also like to thank Dr Subhi Samhan, for his valuable assistance and help to fulfill my work. Besides my advisors, it is a matter of great privilege for me to present this project to my thesis external examiner Professor Marwan Ghanem, and Dr Eyad Yacub for their corporation and being a part of this work.