Equity Research Coverage Page 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

You Can Double Your Gift to Extra Mile Education Foundation. Many Companies Will Match Their Employee's Contribution. Below I

You can double your gift to Extra Mile Education Foundation. Many companies will match their employee’s contribution. Below is a partial list of corporations and business who provide matching gifts. Please contact your Human Resource representative to help support children and their families seeking a values-based quality education. CBS GE Fund 3M CIGNA Foundation Gannett CNA Insurance Company Gap Foundation ADC Telecommunications, Inc. CNG General Electric AES Beaver Valley CR Bard General Mills AK Steel Corporation Cadence General Motors AMD Matching Gifts Program Design Systems, Inc. Gillette Company AMGEN Foundation (The) Capital Group Companies Charitable GlaxoSmithKline Foundation AT&T Casey Matching Gift Program Goldman, Sachs & Company Alcatel-Lucent Certain Teed Goodrich Corporation Alcoa Channel Craft Google Allegheny Energy Co., Inc. Chevron Texaco Corporation Allegheny Power Chicago Title & Trust Company H.J. Heinz Company Allegheny Technologies, Inc. Chubb & Son, Inc. Hamilton Sundstrand Alliant Techsystems Citigroup Harcourt, Inc. Altria Group, Inc. Citizens Bank Harsco Corporation Altria Program Cleveland H. Dodge Foundation, Inc. Hartford Steam Boiler Computer Associates International, Inc. American Express Financial Advisors Hewlett Packard Company Corning Incorporated American International Group Highmark Cyprus Amax Ameritech Hillman Company (The) Ameriprise Financial Home Depot, Inc. Del Monte Foods Company Aramark Honeywell Houghton Mifflin Deluxe Corporation Arco Chemical Company Dictaphone Corporation ARCO IBM Corporation Dominion Foundation Armco, Inc. International Minerals & Chemical Co. Astorino EQT Corporation Automatic Data Processing J.P. Morgan Chase ERICSSON AXA Financial/Equitable John Hancock Mutual Life Insurance. Co. East Suburban Medical Supply Johnson & Johnson Eaton Corporation B.F. Goodrich Johnson Controls Eli Lilly Company BNY Mellon Juniper Networks (The) Emerson Electric BP America Erie Insurance Group Baxter Allegiance Kaplan, Inc. -

Specialty Metals: Creating Value Through Relentless Innovation in a Dynamic, Global Industry

Specialty Metals: Creating Value Through Relentless Innovation in a Dynamic, Global Industry AISTech 2013 President’s Award Breakfast Keynote Address by Richard J. Harshman, Chairman, President and Chief Executive Officer, Allegheny Technologies, Inc. Good morning. I am honored Specialty metals, as we define to be the speaker at this year’s them, begin with stainless steel President’s Award Breakfast. I fol- alloys containing a minimum of low some very distinguished past 10% chromium, and move up the speakers, and I am proud to repre- alloy systems spectrum to include sent not only ATI, but the specialty titanium and titanium alloys, nickel- metals industry. based alloys and superalloys, spe- Before I begin, there are cialty steel alloys, zirconium, haf- some standard forward-look- nium and niobium alloys and ing statements that I need to tungsten heavy alloys (Figure 2). acknowledge. ATI’s specialty metals products Allegheny Technologies, that are made from these alloy Inc., or ATI, is one of systems include what we refer to as the largest and most long and flat rolled mill products. diversified specialty Our long mill products include metals producers in billet, bar, extrusions, rod and the world (Figure wire. Our flat rolled mill products 1). We have more include sheet, plate, coil and preci- than 11,000 full-time sion engineered strip (Figure 3). employees, 85% of It is no secret that a key chal- whom are located lenge facing all metal producers in the United States. is to move closer to near-net-shape At ATI, we use inno- and net-shape products (Figure 4). -

Ati 302™/Ati 304™/Ati 304L™/Ati 305™

ATI 302™/ATI 304™/ATI 304L™/ATI 305™ Technical Data Sheet ATI 302™/ATI 304™/ATI 304L™/ATI 305™ Stainless Steel: Austenitic (Chromium-Nickel) (UNS S30200) INTRODUCTION ATI 302™ (S30200), ATI 304™ (S30400), ATI 304L™ (S30403), and ATI 305™ (S30500) stainless steels are variations of the 18 percent chromium – 8 percent nickel austenitic alloy, the most familiar and most frequently used alloy in the stainless steel family. These alloys may be considered for a wide variety of applications where one or more of the following properties are important: 1. Resistance to corrosion 2. Prevention of product contamination 3. Resistance to oxidation 4. Ease of fabrication 5. Excellent formability 6. Beauty of appearance 7. Ease of cleaning 8. High strength with low weight 9. Good strength and toughness at cryogenic temperatures 10. Ready availability of a wide range of product forms Each alloy represents an excellent combination of corrosion resistance and fabricability. This combination of properties is the reason for the extensive use of these alloys which represent nearly one half of the total U.S. stainless steel production. ATI 304 alloy represents the largest volume followed by ATI 304L alloy. ATI 302 and ATI 305 alloys are used in smaller quantities. The 18-8 stainless steels, principally ATI 304 and 304L alloys, are available in a wide range of product forms including sheet, strip, foil and plate from ATI. The alloys are covered by a variety of specifications and codes relating to, or regulating, construction or use of equipment manufactured from these alloys for specific conditions. Food and beverage, sanitary, cryogenic, and pressure-containing applications are examples. -

Allegheny Technologies the Metals Renaissance Allegheny

COVER STORY COVER AlleghenyAllegheny TechnologiesTechnologies thethe metalsmetals renaissancerenaissance With nearly 40 years of experience in the metals industry Mr. L. Patrick Hassey, CEO at Allegheny Technologies Incorporated (ATI) in Pittsburgh, USA knows and loves this business like few others. As today’s metals industry enters a period of renaissance similar to, and yet far larger than, the boom years of the late 1950’s-to-early-1970’s, Mr. Hassey is passionate about ATI’s vast range of specialty metals and the outstand- ing innovations ATI provides for its customers around the globe. He took some time out from his busy schedule to share with us his vision of the metals industry … and his infectious enthusiasm for it. By Joanne McIntyre and John Butterfield Mr. Hassey entered the aluminium business in 1967 at parts of the world’s infrastructure after World War II a time when metals were on a surge in the world eco- and the Korean War was what first motivated Mr. nomy. “I joined Alcoa at a time when metal businesses Hassey to join the metals industry. “I see many similari- were booming” Mr. Hassey reminisces. “This cycle ties and parallels today with that earlier time period in ended in the mid-1970’s so for most of my career I was the tremendous demand for infrastructure growth in working in an industry in transition – one trying to China, Asia, India, and Brazil. In this respect my know- find its place in the global markets again. I retired from ledge and experience in the metals industry is quite Alcoa in 2003 after 35 years and joined Allegheny unique, spanning so many years. -

In the United States Bankruptcy Court for the District of Delaware

Case 15-10585-LSS Doc 245 Filed 04/21/15 Page 1 of 12 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re: ) Chapter 11 ) Quicksilver Resources Inc., et al.,1 ) Case No. 15-10585 (LSS) ) Debtors. ) Jointly Administered ) )Hearing Date: May 12, 2015 at 10:00 a.m. (EDT) )Obj. Deadline: May 5, 2015 at 4:00 p.m. (EDT) DEBTORS’ APPLICATION FOR ENTRY OF AN ORDER AUTHORIZING THE EMPLOYMENT AND RETENTION OF KPMG LLP AS TAX CONSULTANT NUNC PRO TUNC TO THE PETITION DATE The above-captioned debtors and debtors in possession (collectively, the “Debtors”) seek entry of an order, substantially in the form attached hereto as Exhibit A (the “Proposed Order”), (a) authorizing the Debtors to employ and retain KPMG LLP (“KPMG”) as tax consultant, nunc pro tunc to the Petition Date (as defined herein) pursuant to that certain engagement letter dated February 12, 2015, annexed as Exhibit 1 to Exhibit A (the “Engagement Letter”), by and between KMPG and Quicksilver Resources Inc. (“Quicksilver”); (b) approving the terms of the Engagement Letter; and (c) granting related relief. In support of the Application, the Debtors submit the Declaration of Chuck Thompson (the “Thompson Declaration”), which is attached hereto as Exhibit B. In support of the Application, the Debtors respectfully set forth as follows: 1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, are: Quicksilver Resources Inc. [6163]; Barnett Shale Operating LLC [0257]; Cowtown Drilling, Inc. [8899]; Cowtown Gas Processing L.P. -

Sustainability Report

Sustainability Report 2019 Message from Sustainability Policy Goals/Performance Health and Supply Chain ATI at a Glance Enviromental Social Governance Product Sustainability CEO and Innovation at a Glance Safety Responsibility Message from CEO At ATI, we live our values every day: Integrity, Safety & Sustainability, Accountability, Teamwork and Respect and Innovation. We are committed to doing the right thing on behalf of employees, customers and neighbors. Our commitment to Safety & Sustainability is especially clear in our sustainable operations. We strive to achieve a Zero Injury Culture. Advancing this belief means we proactively mitigate risks of all kinds to ensure the safety of our people, our products and materials, and the environment in the communities where we operate. This report details the progress we’re making toward our goals of ensuring our manufacturing facilities are ISO 14001 and 45001 certified by 2022 and reducing energy intensity, CO2/GHG emissions and freshwater intake by 5% while increasing recycled materials used in production to 80% by 2025. The COVID-19 pandemic has introduced risks that were unexpected, yet our Robert S. Wetherbee values helped us to quickly map a path allowing us to deliver as an essential President and business while keeping our people and their families safe and mitigating spread Chief Executive Officer of the disease. We will provide more details on our response to the virus in our 2020 Sustainability Report. Throughout 2019, collaboration and innovation across our company and the relentless dedication of our team helped to make ATI and the communities in which we operate a better place. I am proud of the work we’ve done to this point and look forward to discovering new ways to help solve the world’s challenges through materials science in the future. -

Heinz Report

Sustaining Pittsburgh’s Steel Technology Cluster Carey Durkin Treado Center for Industry Studies University of Pittsburgh September 2008 Center for Industry Studies Department of Economics University of Pittsburgh Pittsburgh, PA 15260 http:/www.IndustryStudies.pitt.edu ACKNOWLEDGEMENTS The content of this report represents the collective effort and insights of Pittsburghers from academia, industry, and economic development organizations. I would like to acknowledge the generosity of their time as well as the value of their contribution. Of course, any errors or omitted information are my responsibility alone. To begin with, I would like to thank the Innovation Economy Program of the Heinz Endowments for its generous support. In particular, I am grateful to Christina Gabriel, Director of the Innovation Economy Program, for the direction and encouragement that she has provided to this project. As mentioned in the Introduction, this report represents the third phase of an ongoing research project at the Center for Industry Studies on the Steel Technology Cluster and, as such, has benefited significantly from the efforts of my collaborators on that larger project. I am grateful to Chris Briem for his invaluable assistance with regional and geographic data issues, to Sabina Deitrick and Ravi Madhavan for sharing their excellent interview notes and subsequent observations about the cluster, and to Frank Giarratani and Gene Gruver for launching the project with the findings from their steel industry research. I also am indebted to the efforts of the Center’s Research Assistants and would like to thank Kelly Lafferty and Jake McGlynn for their hard work and patience and Susan Manikowski for her tremendous assistance in the collection and organization of a considerable amount of data on the Pittsburgh region. -

Standardized Parent Company Names for TRI Reporting

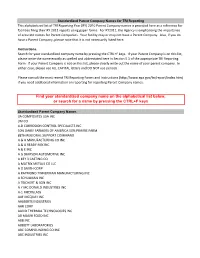

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2010 Parent Company names is provided here as a reference for facilities filing their RY 2011 reports using paper forms. For RY2011, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3M CO 4-D CORROSION CONTROL SPECIALISTS INC 50% DAIRY FARMERS OF AMERICA 50% PRAIRIE FARM 88TH REGIONAL SUPPORT COMMAND A & A MANUFACTURING CO INC A & A READY MIX INC A & E INC A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT -

2012 Annual Report Greaterpittsburghchamberofcommerce Pennsylvaniaeconomyleagueofgreaterpittsburgh Pittsburghregionalalliance

ALLEGHENY CONFERENCE ON COMMUNITY DEVELOPMENT 2012 ANNUAL REPORT GREATER PITTSBURGH CHAMBER OF COMMERCE PENNSYLVANIA ECONOMY LEAGUE OF GREATER PITTSBURGH PITTSBURGH REGIONAL ALLIANCE 11 STANWIX STREET, 17th FLOOR | PITTSBURGH, PA 15222-1312 TOLL FREE: 1 (877) 392-1300 | PHONE: (OUTSIDE OF U.S. AND CANADA) +1 (412) 281-1890 | FAX: (412) 471-2554 | AlleghenyConference.org Mission Statement Pittsburgh: A Re-Imagined, Re-Made Region The Allegheny Conference on Community Development and its affiliates – the Greater Pittsburgh Chamber of Commerce, the Pennsylvania Economy League of Greater Pittsburgh and the Pittsburgh Regional Alliance (PRA) – work together to FROM THE CHAIR stimulate economic growth and improve the quality of life in southwestern Pennsylvania. The Allegheny Conference and the Pittsburgh region are recognizing impor- tant milestones in 2013. For the Conference, this is the 10th anniversary of our affiliation with the Greater Pittsburgh Chamber of Commerce, the Penn- About the Conference: sylvania Economy League of Greater Pittsburgh and the Pittsburgh Regional Alliance. For our region, this marks 30 years since the metro unemployment The Whole Is Greater Than the Sum of the Parts rate hit an all-time high of 18 percent. Since then, the Pittsburgh region has been re-imagined and re-made. Today, ounded in 1944, the Allegheny Con- zations – to provide time, talent and re- research, analysis and advocacy to iden- more people are in our workforce than ever before. Our population is growing, Fference on Community Development sources to advance our agenda. tify and address competitive challenges and growing younger and better educated. Our diverse economy and high is one of the nation's leading economic and encourage business investment in quality of life are attracting global attention. -

Upcoming Exhibitions Help the History Center Shine

Volume 17 | No. 3 | Spring 2009 makingHISTORYThe Newsletter of the Senator John Heinz History Center Upcoming Exhibitions Help The History Center Shine resh off an exciting Pittsburgh 250 anni- Civil War and the details of Lincoln’s pre-inaugura- History Center By The Numbers versary celebration, the Senator John Heinz tion speech that was intended to soothe the public’s History Center recently announced a com- growing fear over a possible war. Fpelling schedule of upcoming exhibitions that will keep the museum buzzing for years to come. The outstanding lineup features a variety of Discovering the Real George Washington, blockbuster exhibitions that will complement the A View from Mount Vernon Number of 2009 History Maker awardees. History Center’s schedule of upcoming family pro- Feb. 12, 2010 – June 2010 7 Story, page 3. grams, community-based exhibits, and educational outreach. This brand new exhibition features highlights from Mount Vernon’s world-class collection of George Washington items, many of which have never trav- Lincoln: The Constitution and the Civil War eled outside of Virginia. and Lincoln Slept Here The History Center will serve as the first venue Nielsen rating of Pittsburgh’s Hidden Treasures . Presented by: PNC Financial Services Group on a national tour of Discovering the Real George 9.5Story, page 5. May 30, 2009 – February 2010 Washington, which celebrates the remarkable story of the first American hero. As part of Abraham Lincoln’s bicentennial in More than 100 original artifacts owned by, or Lincoln: 2009, the History Center will welcome closely related to, Washington will be on display, in- The Constitution and the Civil War , a 2,500 cluding: square-foot traveling exhibition from The National Constitution Center in Philadelphia. -

Palumbo-Donahue School of Business 2019-2020 Graduate Outcomes Employment Information AUGUST 2019, DECEMBER 2019 and MAY 2020 GRADUATES

Innovative Manufacturers Center Palumbo-Donahue 2019-2020 Jared the Galleria of Jewelry School of Business Graduate Outcomes Keener Management Average Annual Income KeyBank Kingsbury Inc. Mean $56,403 KPMG RESPONDENTS NUMBER OF EMPLOYED RESPONDENTS ATTENDING AVERAGE MAJOR TOP EMPLOYERS Median $53,500 Leukemia and Lymphoma Society RESPONDENTS Full-Time, Part-Time, Military, GRADUATE SCHOOL SALARY Mode Luttner Financial Group Service Year Volunteer $55,000 M&T Bank Manzella Manzella Bachelors Degree The average signing bonus Meaden and Moore reported was $4,620. Accounting 48 42% 46% $52,364 BNY Mellon, Cohen & Company, EY LLP, Medici Real Estate PNC Financial Services, PwC, Metal Fortress Radio Swagelok Company Miele Amusements Mount Saint Mary Academy Economics 12 42% 50% BNY Mellon, Continuing Care Actuaries, Paychex Matthews International Internship/Experiential Pittsburgh Int’l Airport Pittsburgh Penguins Entrepreneurship 16 56% 38% Alloy Oxygen Welding and Supply Education Information Pittsburgh Steelers Co., Amos Enterprises, Bobby Rahal PLS Logistics Automotive Group, Vibes by Chico LLC PNC Financial Services PPG Finance 74 78% 12% $53,299 BNY Mellon, Citizen’s Bank, Dick’s 79% of our graduates reported taking at least one internship PricewaterhouseCoopers Sporting Goods, Duquesne University, or career related work experience. The median number of Protiviti McAdam Financial, PNC Financial Prudential Financial Services, PwC internships was two. Reliable Contracting Rivers Casino General Business 4 50% Citizens Bank, Duquesne University A sampling of the most relevant Internship Employers as reported rue21 by graduates: Schneider Downs Information Systems 24 75% 21% $55,750 Amazon, BNY Mellon, Duquesne Light, SEI Investments CO. Management Federated Investors, PNC Financial #1 Cochran Services, PPG, PwC 535 Media Shipley Energy Solenture, LLC Ace Wires Spring & Form Co. -

Allegheny Technologies Was the First Specialty Materials Company to Source Goods and Services Online Through the Freemarkets® B2B Emarketplace

Growing Markets Annual Report 2000 Vision Statement Our vision is to create the world’s leading specialty materials company. The cornerstones of our value system are based on achieving the highest ethical standards, maintaining strong customer focus and providing exciting opportunities for our employees. Our objective is to provide an attractive investment to our stockholders by continuing to earn a premium return on our total invested capital. 1 2000 Financial Summary We are driven by these focused strategies: 2 Letter to Stockholders, Employees and Customers • To be a cost competitive producer of 6 Specialty Materials for Aerospace specialty materials 8 Specialty Materials for Electrical Energy • To enhance our customer focus and 10 Specialty Materials for Oil and Gas relationships by constantly improving 12 Specialty Materials for Medical and Electronics 14 Products and Markets quality, delivery and service 15 Segment Information • To use leading materials and 16 Safety processing technologies to pursue 17 Financial Review growth in high-value global markets 51 Corporate Ethics • To leverage our multi-materials 52 Company Management 53 Board of Directors capabilities 54 Glossary • To maintain and build on our solid 55 Investor Information financial base Financial Summary 2000 2000 1999 Sales $2.46 billion $2.30 billion Net Income from Continuing Operations Before Extraordinary Gains $132 million $111 million Net Income from Continuing Operations Before Extraordinary Gains per Diluted Share $1.60 $1.16 Return on Stockholders’ Equity (a) 13.2% 9.9% Return on Average Capital Employed (a, b) 10.3% 8.3% Cash Provided by Operating Activities $135 million $103 million Book Value Per Common Share $12.94 $13.28 Actual Number of Shares Outstanding (c) 80 million 90 million Number of Employees 11,400 11,500 (a) Excluding gains on disposal of assets, restructuring charges, discontinued operations and other special items.