WHAT IS the ROLE of PUBLIC PENSION PLANS in PROXY VOTING? a Submission to the SEC Roundtable on the Proxy Process – File Number 4-725

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dahl and Charles E

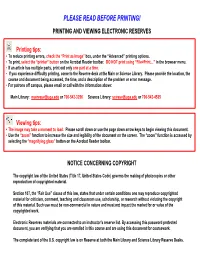

PLEASE READ BEFORE PRINTING! PRINTING AND VIEWING ELECTRONIC RESERVES Printing tips: ▪ To reduce printing errors, check the “Print as Image” box, under the “Advanced” printing options. ▪ To print, select the “printer” button on the Acrobat Reader toolbar. DO NOT print using “File>Print…” in the browser menu. ▪ If an article has multiple parts, print out only one part at a time. ▪ If you experience difficulty printing, come to the Reserve desk at the Main or Science Library. Please provide the location, the course and document being accessed, the time, and a description of the problem or error message. ▪ For patrons off campus, please email or call with the information above: Main Library: [email protected] or 706-542-3256 Science Library: [email protected] or 706-542-4535 Viewing tips: ▪ The image may take a moment to load. Please scroll down or use the page down arrow keys to begin viewing this document. ▪ Use the “zoom” function to increase the size and legibility of the document on the screen. The “zoom” function is accessed by selecting the “magnifying glass” button on the Acrobat Reader toolbar. NOTICE CONCERNING COPYRIGHT The copyright law of the United States (Title 17, United States Code) governs the making of photocopies or other reproduction of copyrighted material. Section 107, the “Fair Use” clause of this law, states that under certain conditions one may reproduce copyrighted material for criticism, comment, teaching and classroom use, scholarship, or research without violating the copyright of this material. Such use must be non-commercial in nature and must not impact the market for or value of the copyrighted work. -

The Cultural Politics of Proxy-Voting in Nagaland

TIF - The Cultural Politics of Proxy-Voting in Nagaland JELLE J P WOUTERS June 7, 2019 RODERICK WIJUNAMAI Voters in Kohima, Nagaland | PIB Photo Nagaland’s voter turnouts are often the highest in the country, and it may be so this time around as well. But why was the citizenry of Nagaland so keen to vote for their lone, largely ineffectual representative in the Lok Sabha? Of all truisms about democracy, one that is held to be particularly true is that any democracy’s vitality and verve depends on its voter turnouts during elections. As the acclaimed political and social theorist Steven Lukes (1975: 304) concluded long ago: “Participation in elections can plausibly be interpreted as the symbolic affirmation of the voters’ acceptance of the political system and of their role within it.” Indian democracy thence draws special attention; not just for its trope of being the world’s largest democracy (Indian voters make up roughly one-sixth of the world’s electorate) but for the democratic and electoral effervescence reported all across the country. While a disenchantment with democratic institutions and politics is now clearly discernible in large swathes of the so-called “West” and finds its reflection in declining voter turnouts, to the point almost where a minority of citizens elect majority governments, India experiences no such democratic fatigue. Here voter turnouts are not just consistently high, but continue to increase and now habitually outdo those of much older democracies elsewhere. And if India’s official voter turnouts are already high, they might well be a low estimate still. -

Types of Democracy the Democratic Form of Government Is An

Types of Democracy The democratic form of government is an institutional configuration that allows for popular participation through the electoral process. According to political scientist Robert Dahl, the democratic ideal is based on two principles: political participation and political contestation. Political participation requires that all the people who are eligible to vote can vote. Elections must be free, fair, and competitive. Once the votes have been cast and the winner announced, power must be peacefully transferred from one individual to another. These criteria are to be replicated on a local, state, and national level. A more robust conceptualization of democracy emphasizes what Dahl refers to as political contestation. Contestation refers to the ability of people to express their discontent through freedom of the speech and press. People should have the ability to meet and discuss their views on political issues without fear of persecution from the state. Democratic regimes that guarantee both electoral freedoms and civil rights are referred to as liberal democracies. In the subfield of Comparative Politics, there is a rich body of literature dealing specifically with the intricacies of the democratic form of government. These scholarly works draw distinctions between democratic regimes based on representative government, the institutional balance of power, and the electoral procedure. There are many shades of democracy, each of which has its own benefits and disadvantages. Types of Democracy The broadest differentiation that scholars make between democracies is based on the nature of representative government. There are two categories: direct democracy and representative democracy. We can identify examples of both in the world today. -

WHY COMPETITION in the POLITICS INDUSTRY IS FAILING AMERICA a Strategy for Reinvigorating Our Democracy

SEPTEMBER 2017 WHY COMPETITION IN THE POLITICS INDUSTRY IS FAILING AMERICA A strategy for reinvigorating our democracy Katherine M. Gehl and Michael E. Porter ABOUT THE AUTHORS Katherine M. Gehl, a business leader and former CEO with experience in government, began, in the last decade, to participate actively in politics—first in traditional partisan politics. As she deepened her understanding of how politics actually worked—and didn’t work—for the public interest, she realized that even the best candidates and elected officials were severely limited by a dysfunctional system, and that the political system was the single greatest challenge facing our country. She turned her focus to political system reform and innovation and has made this her mission. Michael E. Porter, an expert on competition and strategy in industries and nations, encountered politics in trying to advise governments and advocate sensible and proven reforms. As co-chair of the multiyear, non-partisan U.S. Competitiveness Project at Harvard Business School over the past five years, it became clear to him that the political system was actually the major constraint in America’s inability to restore economic prosperity and address many of the other problems our nation faces. Working with Katherine to understand the root causes of the failure of political competition, and what to do about it, has become an obsession. DISCLOSURE This work was funded by Harvard Business School, including the Institute for Strategy and Competitiveness and the Division of Research and Faculty Development. No external funding was received. Katherine and Michael are both involved in supporting the work they advocate in this report. -

Electronic Democracy the World of Political Science— the Development of the Discipline

Electronic Democracy The World of Political Science— The development of the discipline Book series edited by Michael Stein and John Trent Professors Michael B. Stein and John E. Trent are the co-editors of the book series “The World of Political Science”. The former is visiting professor of Political Science, University of Toronto, Toronto, Ontario, Canada and Emeritus Professor, McMaster University in Hamilton, Ontario, Canada. The latter is a Fellow in the Center of Governance of the University of Ottawa, in Ottawa, Ontario, Canada, and a former professor in its Department of Political Science. Norbert Kersting (ed.) Electronic Democracy Barbara Budrich Publishers Opladen • Berlin • Toronto 2012 An electronic version of this book is freely available, thanks to the support of libraries working with Knowledge Unlatched. KU is a collaborative initiative designed to make high quality books Open Access for the public good. The Open Access ISBN for this book is 978-3-86649-546-3. More information about the initiative and links to the Open Access version can be found at www.knowledgeunlatched.org © 2012 This work is licensed under the Creative Commons Attribution-ShareAlike 4.0. (CC- BY-SA 4.0) It permits use, duplication, adaptation, distribution and reproduction in any medium or format, as long as you share under the same license, give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made. To view a copy of this license, visit https://creativecommons.org/licenses/by-sa/4.0/ © 2012 Dieses Werk ist beim Verlag Barbara Budrich GmbH erschienen und steht unter der Creative Commons Lizenz Attribution-ShareAlike 4.0 International (CC BY-SA 4.0): https://creativecommons.org/licenses/by-sa/4.0/ Diese Lizenz erlaubt die Verbreitung, Speicherung, Vervielfältigung und Bearbeitung bei Verwendung der gleichen CC-BY-SA 4.0-Lizenz und unter Angabe der UrheberInnen, Rechte, Änderungen und verwendeten Lizenz. -

Islam and the Challenge of Democratic Commitment

Fordham International Law Journal Volume 27, Issue 1 2003 Article 2 Islam and the Challenge of Democratic Commitment Dr. Khaled Abou El-Fadl∗ ∗ Copyright c 2003 by the authors. Fordham International Law Journal is produced by The Berke- ley Electronic Press (bepress). http://ir.lawnet.fordham.edu/ilj Islam and the Challenge of Democratic Commitment Dr. Khaled Abou El-Fadl Abstract The author questions whether concurrent and simultaneous moral and normative commit- ments to Islam and to a democratic form of government are reconcilable or mutually exclusive. The author will argue in this Article that it is indeed possible to reconcile Islam with a commitment in favor of democracy. The author will then present a systematic exploration of Islamic theology and law as it relates to a democratic system of government, and in this context, address the various elements within Islamic belief and practice that promote, challenge, or hinder the emergence of an ideological commitment in favor of democracy. In many ways, the basic and fundamental ob- jective of this Article is to investigate whether the Islamic faith is consistent or reconcilable with a democratic faith. As addressed below, both Islam and democracy represent a set of comprehensive and normative moral commitments and beliefs about, among other things, the worth and entitle- ments of human beings. The challenging issue is to understand the ways in which the Islamic and democratic systems of convictions and moral commitments could undermine, negate, or validate and support each other. ISLAM AND THE CHALLENGE OF DEMOCRATIC COMMITMENT Dr. Khaled Abou El Fadl* The question I deal with here is whether concurrent and simultaneous moral and normative commitments to Islam and to a democratic form of government are reconcilable or mutually exclusive. -

PLS 135 -U.S. Government and Politics (3 CR.)

Revised 8/21 NOVA COLLEGE-WIDE COURSE CONTENT SUMMARY PLS 135 – U.S. GOVERNMENT AND POLITICS (3 CR.) Course Description Teaches the political structure, processes, institutions, and policymaking of the US national government. Focuses on the three branches of government, their interrelationships, and how they shape policy. Addresses federalism; civil liberties and civil rights; political socialization and participation; public opinion, the media; interest groups; political parties; elections; and policymaking. The assignments in the course require college-level reading fluency and coherent communication through written reports. This is a Passport Transfer course. Lecture 3 hours. Total 3 hours per week. General Course Purpose To enable students to demonstrate a well-rounded knowledge of American government and politics; demonstrate an understanding of how political scientists analyze and interpret the foundations, institutions, processes, and actors that constitute American government and politics; and, demonstrate critical thought about American government and politics. Course Prerequisites/Corequisites None. Course Objectives Upon completing the course, the student will be able to: • Civic Engagement o Explain the importance of citizen engagement, ways Americans can influence and become engaged in government, and factors that might affect people's willingness to become engaged in government. • Critical Thinking o Differentiate between the concepts of democracy, direct and representative democracy, and several of the philosophical concepts that contributed to the development of U. S. democracy. o Describe the origin and history of the U. S. Constitution and how the Constitution has adapted to our changing society. o Explain the concept of Federalism and how the distribution of power between the national and state governments affords possibilities for conflict or cooperation. -

Islam and Democracy: Is Modernization a Barrier? John O

Religion Compass 1/1 (2007): 170±178, 10.1111/j. 1749-8171.2006.00017.x Islam and Democracy: Is Modernization a Barrier? John O. Voll Georgetown University Abstract The relationship between Islam and democracy is a hotly debated topic. Usually the disagreements are expressed in a standard form. In this form, the debaters' definitions of ªIslamº and ªdemocracyº determine the conclusions arrived at. It is possible, depending upon the definitions used, to ªproveº both positions: Islam and democracy are compatible and that they are not. To escape from the predefined conclusions, it is necessary to recognize that ªIslamº and ªdemocracyº are concepts with many definitions. In the twenty-first century, important interpretations of Islam open the way for political visions in which Islam and democracy are mutually supportive. Does religion represent an obstacle to modernization and democratization? Does religion pose a threat to democracy if a democratically elected govern- ment becomes a ªtheocracyº? Does the majority rule of democracy threaten the liberty and freedom of other members of a society? If the majority imposes its will upon minorities, is that a departure from democracy in general or form of ªliberalº democracy? Does modernization strengthen or inhibit democratization and individual liberty? These broad questions are being debated in many different contexts around the world. They provide a framework for looking at the experience of Muslim societies and the relationships between Islam and democracy. Tensions between democracy and liberty -

Macroeconomics and Politics

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: NBER Macroeconomics Annual 1988, Volume 3 Volume Author/Editor: Stanley Fischer, editor Volume Publisher: MIT Press Volume ISBN: 0-262-06119-8 Volume URL: http://www.nber.org/books/fisc88-1 Publication Date: 1988 Chapter Title: Macroeconomics and Politics Chapter Author: Alberto Alesina Chapter URL: http://www.nber.org/chapters/c10951 Chapter pages in book: (p. 13 - 62) AlbertoAlesina GSIACARNEGIE MELLON UNIVERSITY AND NBER Macroeconomics and Politics Introduction "Social planners" and "representative consumers" do not exist. The recent game-theoretic literature on macroeconomic policy has set the stage for going beyond this stylized description of policymaking and building more realistic positive models of economic policy. In this literature, the policy- maker strategically interacts with other current and/or future policymakers and with the public; his behavior is derived endogenously from his preferences, incentives and constraints. Since the policymakers' incentives and constraints represent real world political institutions, this approach provides a useful tool for analyzing the relationship between politics and macroeconomic policy. This paper shows that this recent line of research has provided several novel, testable results; the paper both reviews previous successful tests of the theory and presents some new successful tests. Even though some pathbreaking contributions were published in the mid-1970s, (for instance, Hamada (1976), Kydland-Prescott (1977), Calvo (1978)) the game-theoretic literature on macroeconomic policy has only in the last five years begun to pick up momentum after a shift attributed to the influential work done by Barro and Gordon (1983a,b) on monetary policy. -

The Democratic Fatwa: Islam and Democracy in the Realm of Constitutional Politics

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by University of Oklahoma College of Law Oklahoma Law Review Volume 58 Number 1 2005 The Democratic Fatwa: Islam and Democracy in the Realm of Constitutional Politics Noah Feldman Harvard Law School, [email protected] Follow this and additional works at: https://digitalcommons.law.ou.edu/olr Part of the International Relations Commons, Islamic Studies Commons, Near and Middle Eastern Studies Commons, and the Political Theory Commons Recommended Citation Noah Feldman, The Democratic Fatwa: Islam and Democracy in the Realm of Constitutional Politics, 58 OKLA. L. REV. 1 (2005), https://digitalcommons.law.ou.edu/olr/vol58/iss1/1 This Article is brought to you for free and open access by University of Oklahoma College of Law Digital Commons. It has been accepted for inclusion in Oklahoma Law Review by an authorized editor of University of Oklahoma College of Law Digital Commons. For more information, please contact [email protected]. OKLAHOMA LAW REVIEW VOLUME 58 SPRING 2005 NUMBER 1 THE DEMOCRATIC FATWA: ISLAM AND DEMOCRACY IN THE REALM OF CONSTITUTIONAL POLITICS NOAH FELDMAN* The relation between Islam and democracy has become one of the great political questions of our age. But it is also a legal question, legal in the sense that Muslim scholars have addressed it from the perspective of Islamic law, and legal, too, in the sense that practical debates about it often take place in the context of constitutional drafting and negotiation. The purpose of this short essay is to consider one enormously influential, practically significant legal document touching on this great question: the constitutional fatwa of Ayatollah ‘Ali Sistani, who is today a household name but was, before the late summer of 2003, almost unknown outside the circle of Shi‘i clerics and those who study them.1 Begin with a remarkable, little-noticed fact. -

Totalitarianism 1 Totalitarianism

Totalitarianism 1 Totalitarianism Totalitarianism (or totalitarian rule) is a political system where the state holds total authority over the society and seeks to control all aspects of public and private life wherever necessary.[1] The concept of totalitarianism was first developed in a positive sense in the 1920's by the Italian fascists. The concept became prominent in Western anti-communist political discourse during the Cold War era in order to highlight perceived similarities between Nazi Germany and other fascist regimes on the one hand, and Soviet communism on the other.[2][3][4][5][6] Aside from fascist and Stalinist movements, there have been other movements that are totalitarian. The leader of the historic Spanish reactionary conservative movement called the Spanish Confederation of the Autonomous Right declared his intention to "give Spain a true unity, a new spirit, a totalitarian polity..." and went on to say "Democracy is not an end but a means to the conquest of the new state. Moloch of Totalitarianism – memorial of victims of repressions exercised by totalitarian regimes, When the time comes, either parliament submits or we will eliminate at Levashovo, Saint Petersburg. it."[7] Etymology The notion of "totalitarianism" a "total" political power by state was formulated in 1923 by Giovanni Amendola who described Italian Fascism as a system fundamentally different from conventional dictatorships.[8] The term was later assigned a positive meaning in the writings of Giovanni Gentile, Italy’s most prominent philosopher and leading theorist of fascism. He used the term “totalitario” to refer to the structure and goals of the new state. -

E-Democracy Handbook

Strasbourg, 27 August 2020 CDDG(2020)6 PROV1 Item 3.1 of the agenda EUROPEAN COMMITTEE ON DEMOCRACY AND GOVERNANCE (CDDG) E-DEMOCRACY HANDBOOK Secretariat Memorandum prepared by the Directorate General of Democracy Democratic Governance Division 1 Subject to proofreading 2 1. Introduction The terms of reference of the CDDG for the biennium 2018-2019 include specific task iv: “In the field of e-democracy, - in accordance with Recommendation CM/Rec(2017)5 on standards for e-voting, hold a review meeting on its implementation in 2019; - develop guidelines on e-democracy as a toolkit; - oversee the implementation of the priority “building democracy online” of the Internet Governance – Council of Europe Strategy 2016-2019.” The CDDG set up a working group on e-democracy, which met three times: - at its meetings on 27 November 2018 and 14-15 March 2019 respectively, the working group discussed the outline, content and structure of the guidelines on e-democracy in the form of a toolkit on the basis of Recommendation CM/Rec(2009)1 of the Committee of Ministers to member States on electronic democracy; - at its meeting on 24 May 2019, the CDDG Bureau examined the suggested approach and agreed that, whilst guidelines should be a high-level instrument addressed to Council of Europe member States, the toolkit should be a practical instrument which provides ‘practitioners’ with guidance and includes examples and practical steps to be taken; - at its third meeting on 12-13 September 2019, the working group finalised the draft Guidelines on e-democracy in the form of a toolkit, asking for further practical examples in relation to e-democracy initiatives or projects to be included in the Guidelines and a glossary to be added.