Cease Trading Orders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Page 1 of 2 Reporting Issuer List - Cover Page

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page Reporting Issuers Default When a reporting issuer is noted in default, standardized codes (a number and, if applicable a letter, described in the legend below) will be appear in the column 'Nature of Default'. Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Alberta Securities Commission (ASC) promptly. A reporting issuer’s management or insiders may be subject to a Management Cease Trade Order, but that order will NOT be shown on the list. Legend 1. The reporting issuer has failed to file the following continuous disclosure document prescribed by Alberta securities laws: (a) annual financial statements; (b) an interim financial report; (c) an annual or interim management's discussion and analysis (MD&A) or an annual or interim management report of fund performance (MRFP); (d) an annual information form; (AIF); (e) a certification of annual or interim filings under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109); (f) proxy materials or a required information circular; (g) an issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) a material change report; (i) a written update as required after filing a confidential report of a material change; (j) a business acquisition report; (k) the annual oil and gas disclosure prescribed by National Instrument -

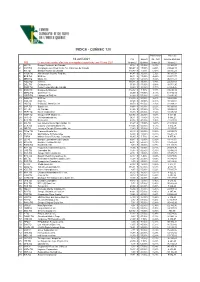

Avril 2021 Prix Aspect IQ - 120 Nombre D'actions N.B

INDICE - QUÉBEC 120 Pondération Nouveau 16 avril 2021 Prix Aspect IQ - 120 nombre d'actions N.B. : Le nouveau nombre d'actions sera appliqué à partir du lundi 10 mai 2021 16-avr-21 Québec 16-avr-21 16-avr-21 1 NA.TO Banque Nationale du Canada 87,92 $ 57,50% 6,67% 53 385,57 2 CNR.TO Compagnie des Chemins de Fer Nationaux du Canada 148,67 $ 17,50% 6,26% 29 644,15 3 RY.TO Banque Royale du Canada 118,49 $ 7,50% 5,47% 32 505,21 4 ATDb.TO Alimentation Couche-Tard Inc. 41,47 $ 35,00% 5,32% 90 335,58 5 BCE.TO BCE Inc. 58,11 $ 17,50% 4,42% 53 571,77 6 MRU.TO Metro Inc. 58,87 $ 52,50% 3,92% 46 837,77 7 GIBa.TO CGI Inc. 108,86 $ 35,00% 3,75% 24 253,51 8 DOL.TO Dollarama Inc. 57,63 $ 37,50% 3,58% 43 751,95 9 POW.TO Power Corporation du Canada 34,49 $ 30,00% 3,31% 67 454,76 10 BMO.TO Banque de Montréal 114,82 $ 7,50% 3,17% 19 410,39 11 QBRb.TO Québecor Inc. 35,59 $ 87,50% 3,13% 61 845,49 12 LSPD.TO Lightspeed POS Inc. 83,69 $ 55,00% 2,83% 23 816,95 13 DOO.TO BRP Inc. 114,75 $ 50,00% 2,41% 14 803,68 14 CAE.TO CAE Inc. 37,20 $ 32,50% 2,34% 44 322,84 15 IAG.TO iA Société financière Inc. -

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page Reporting Issuers Default When a reporting issuer is noted in default, standardized codes (a number and, if applicable a letter, described in the legend below) will be appear in the column 'Nature of Default'. Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Alberta Securities Commission (ASC) promptly. A reporting issuer’s management or insiders may be subject to a Management Cease Trade Order, but that order will NOT be shown on the list. Legend 1. The reporting issuer has failed to file the following continuous disclosure document prescribed by Alberta securities laws: (a) annual financial statements; (b) an interim financial report; (c) an annual or interim management's discussion and analysis (MD&A) or an annual or interim management report of fund performance (MRFP); (d) an annual information form; (AIF); (e) a certification of annual or interim filings under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109); (f) proxy materials or a required information circular; (g) an issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) a material change report; (i) a written update as required after filing a confidential report of a material change; (j) a business acquisition report; (k) the annual oil and gas disclosure prescribed by National Instrument -

OSC Bulletin

The Ontario Securities Commission OSC Bulletin February 20, 2020 Volume 43, Issue 8 (2020), 43 OSCB The Ontario Securities Commission administers the Securities Act of Ontario (R.S.O. 1990, c. S.5) and the Commodity Futures Act of Ontario (R.S.O. 1990, c. C.20) The Ontario Securities Commission Published under the authority of the Commission by: Cadillac Fairview Tower Thomson Reuters 22nd Floor, Box 55 One Corporate Plaza 20 Queen Street West 2075 Kennedy Road Toronto, Ontario Toronto, Ontario M5H 3S8 M1T 3V4 416-593-8314 or Toll Free 1-877-785-1555 416-609-3800 or 1-800-387-5164 Contact Centre – Inquiries, Complaints: Fax: 416-593-8122 TTY: 1-866-827-1295 Office of the Secretary: Fax: 416-593-2318 42711424 The OSC Bulletin is published weekly by Thomson Reuters Canada, under the authority of the Ontario Securities Commission. Thomson Reuters Canada offers every issue of the Bulletin, from 1994 onwards, fully searchable on SecuritiesSource™, Canada’s pre-eminent web-based securities resource. SecuritiesSource™ also features comprehensive securities legislation, expert analysis, precedents and a weekly Newsletter. For more information on SecuritiesSource™, as well as ordering information, please go to: http://www.westlawecarswell.com/SecuritiesSource/News/default.htm or call Thomson Reuters Canada Customer Support at 1-416-609-3800 (Toronto & International) or 1-800-387-5164 (Toll Free Canada & U.S.). Claims from bona fide subscribers for missing issues will be honoured by Thomson Reuters Canada up to one month from publication date. Space is available in the Ontario Securities Commission Bulletin for advertisements. The publisher will accept advertising aimed at the securities industry or financial community in Canada. -

OSC Bulletin, Volume 44, Issue 33

The Ontario Securities Commission OSC Bulletin August 19, 2021 Volume 44, Issue 33 (2021), 44 OSCB The Ontario Securities Commission administers the Securities Act of Ontario (R.S.O. 1990, c. S.5) and the Commodity Futures Act of Ontario (R.S.O. 1990, c. C.20) The Ontario Securities Commission Published under the authority of the Commission by: Cadillac Fairview Tower Thomson Reuters 22nd Floor, Box 55 One Corporate Plaza 20 Queen Street West 2075 Kennedy Road Toronto, Ontario Toronto, Ontario M5H 3S8 M1T 3V4 416-593-8314 or Toll Free 1-877-785-1555 416-609-3800 or 1-800-387-5164 Contact Centre – Inquiries, Complaints: Fax: 416-593-8122 TTY: 1-866-827-1295 Office of the Secretary: Fax: 416-593-2318 42869967 The OSC Bulletin is published weekly by Thomson Reuters Canada, under the authority of the Ontario Securities Commission. Thomson Reuters Canada offers every issue of the Bulletin, from 1994 onwards, fully searchable on SecuritiesSource™, Canada’s pre-eminent web-based securities resource. SecuritiesSource™ also features comprehensive securities legislation, expert analysis, precedents and a weekly Newsletter. For more information on SecuritiesSource™, as well as ordering information, please go to: https://www.westlawnextcanada.com/westlaw-products/securitiessource/ or call Thomson Reuters Canada Customer Support at 1-416-609-3800 (Toronto & International) or 1-800-387-5164 (Toll Free Canada & U.S.). Claims from bona fide subscribers for missing issues will be honoured by Thomson Reuters Canada up to one month from publication date. Space is available in the Ontario Securities Commission Bulletin for advertisements. The publisher will accept advertising aimed at the securities industry or financial community in Canada. -

Les Présidents Du Québec Inc En Bourse

LES PRÉSIDENTS DU QUÉBEC INC EN BOURSE Entreprises à siège social au Québec, de valeur boursière de plus de 100 millions Valeur en dollars canadiens, pour le dernier exercice complet de chaque entreprise Rémunération Variation Nom Fonction Entreprise totale (salaire et sur un an avantages) Président du conseil Joseph C. Papa Bausch Health 22,6 millions +16 % et chef de la direction Serge Godin Président exécutif du conseil CGI 14,1 millions +1,7 % Président et chef Calin Rovinescu Air Canada 12,87 millions +11,4 % de la direction Président et chef George A. Cope BCE 12,6 millions +5 % de la direction Chef de la direction Liminal BioSciences Kenneth Galbraith 12,6 millions s.o. (entrant) (ex-Prometic) Président et chef Alain Bédard TFI International 10,8 millions +32 % de la direction Président et chef George D. Schindler CGI 10,3 millions +21 % de la direction Président et chef Alain Bellemare Bombardier 10,1 millions -19,5 % de la direction Président et chef Glenn J. Chamandy Gildan 9,46 millions +0,5 % de la direction Président et chef Brian Hannasch Couche-Tard 9,4 millions +7,4 % de la direction Président et chef John D. Williams Domtar 9 millions -3,6 % de la direction Jean-Jacques Ruest Président-directeur général Canadien National 8,9 millions +5,3 % Sébastien St-Louis Chef de la direction Hexo 8,85 millions +481 % Président du conseil, Paul Desmarais jr. Power Corporation 8,77 millions +21 % co-chef de la direction Président et co-chef André Desmarais Power Corporation 8,42 millions +8,5 % de la direction Président et chef Louis -

Reporting Issuer List / Liste Des Émetteurs Assujettis Categories Of

Page 1 of 163 Reporting Issuer List / Liste des Émetteurs Assujettis Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Financial and Consumer Services Commission (New Brunswick) promptly. Categories of default The circumstances under which the securities regulatory authorities will consider a reporting issuer to be in default are: 1. The reporting issuer has failed to file the following continuous disclosure prescribed by securities laws: (a) annual financial statements; (b) interim financial statements; (c) annual or interim management’s discussion and analysis (MD&A) or annual or interim management report of fund performance (MRFP); (d) annual information form (AIF); (e) certification of annual or interim filings under Multilateral Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings (MI 52-109); (f) proxy materials or a required information circular; (g) issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) material change report; (i) written update as required after filing a confidential report of a material change; (j) business acquisition report; (k) annual oil and gas disclosure prescribed by National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities (NI 51-101) or technical reports for a mineral project required under National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101); (l) mandatory news release; (m) corporate governance disclosure as required by National Instrument 58-101 Disclosure of Corporate Governance Practices; (n) audit committee disclosure as required by Multilateral Instrument 52-110 Audit Committees or BC Instrument 52-509 Audit Committees; or (o) disclosure in an issuer’s MD&A relating to disclosure controls and procedures and their effectiveness that is referred to in a certificate filed under MI 52-109. -

Rapport Retrait PWF IQ-120

INDICE - QUÉBEC 120 Pondération Nouveau 18 février 2020 Prix Aspect IQ - 120 nombre d'actions N.B. : Le nouveau nombre d'actions sera appliqué à partir du mercredi 26 février 2020 18-févr-20 Québec 18-févr-20 18-févr-20 1 NA.TO Banque Nationale du Canada 73,79 $ 57,50% 6,94% 56 182,26 2 ATDb.TO Alimentation Couche-Tard Inc. 43,98 $ 35,00% 6,76% 91 824,08 3 BCE.TO BCE Inc. 65,19 $ 22,50% 6,44% 58 971,34 4 RY.TO Banque Royale du Canada 107,85 $ 7,50% 5,89% 32 627,11 5 CNR.TO Compagnie des Chemins de Fer Nationaux du Canada 122,75 $ 12,50% 5,17% 25 160,57 6 MRU.TO Metro Inc. 55,95 $ 52,50% 4,38% 46 760,76 7 GIBa.TO Groupe CGI Inc. 102,18 $ 35,00% 4,23% 24 734,70 8 QBRb.TO Quebecor Inc. 33,31 $ 87,50% 3,63% 65 076,44 9 BMO.TO Banque de Montréal 101,30 $ 7,50% 3,34% 19 672,78 10 DOL.TO Dollarama Inc. 41,62 $ 37,50% 3,20% 45 968,19 11 POW.TO Power Corporation du Canada 34,59 $ 35,00% 2,99% 51 660,21 12 SAP.TO Saputo Inc. 41,28 $ 35,00% 2,69% 38 927,02 13 IAG.TO Industrielle Alliance, Assurances et services financiers Inc. 70,10 $ 42,50% 2,59% 22 071,82 14 CAE.TO CAE Inc. 40,30 $ 27,50% 2,54% 37 620,34 15 DOO.TO BRP Inc. -

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page Reporting Issuers Default When a reporting issuer is noted in default, standardized codes (a number and, if applicable a letter, described in the legend below) will be appear in the column 'Nature of Default'. Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Alberta Securities Commission (ASC) promptly. A reporting issuer’s management or insiders may be subject to a Management Cease Trade Order, but that order will NOT be shown on the list. Legend 1. The reporting issuer has failed to file the following continuous disclosure document prescribed by Alberta securities laws: (a) annual financial statements; (b) an interim financial report; (c) an annual or interim management's discussion and analysis (MD&A) or an annual or interim management report of fund performance (MRFP); (d) an annual information form; (AIF); (e) a certification of annual or interim filings under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109); (f) proxy materials or a required information circular; (g) an issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) a material change report; (i) a written update as required after filing a confidential report of a material change; (j) a business acquisition report; (k) the annual oil and gas disclosure prescribed by National Instrument -

Annexes Et Autres Renseignements

Bulletin de l'Autorité des marchés financiers 6.11 Annexes et autres renseignements Annexe 1 Dépôt de documents d'information . 6. Marchés de valeurs et des instruments dérivés 14 mai 2020 - Vol. 17, n° 19 117 Bulletin de l'Autorité des marchés financiers ANNEXE 1 DÉPÔTS DE DOCUMENTS D'INFORMATION RAPPORTS TRIMESTRIELS Date du document ABSOLUTE SOFTWARE CORPORATION 2020-03-31 ADVANZ PHARMA CORP. LIMITED 2020-03-31 AG GROWTH INTERNATIONAL INC. 2020-03-31 AGJUNCTION INC. 2020-03-31 AIMIA INC. 2020-03-31 AIRBOSS OF AMERICA CORP. 2020-03-31 ALGONQUIN POWER & UTILITIES CORP. 2020-03-31 ALIMENTS HIGH LINER INCORPOREE (LES) 2020-03-28 ALLIANCE PIPELINE LIMITED PARTNERSHIP 2020-03-31 ALTIUS MINERALS CORPORATION 2020-03-31 ALTUS GROUP LIMITED 2020-03-31 AMERICAN HOTEL INCOME PROPERTIES REIT LP 2020-03-31 ANACONDA MINING INC. 2020-03-31 ANDLAUER HEALTHCARE GROUP INC. 2020-03-31 ARBUTUS BIOPHARMA CORPORATION 2020-03-31 ARGONAUT GOLD INC. 2020-03-31 ARTIS REAL ESTATE INVESTMENT TRUST 2020-03-31 ATEBA RESOURCES INC. 2020-03-31 ATLANTIC POWER CORPORATION 2020-03-31 ATLANTIC POWER LIMITED PARTNERSHIP 2020-03-31 ATLANTIC POWER PREFERRED EQUITY LTD. 2020-03-31 AUTORITE AEROPORTUAIRE DU GRAND TORONTO 2020-03-31 BADGER DAYLIGHTING LTD. 2020-03-31 BAUSCH HEALTH COMPANIES INC. 2020-03-31 BAYTEX ENERGY CORP. 2020-03-31 BCE INC. 2020-03-31 BIRCHCLIFF ENERGY LTD. 2020-03-31 BOMBARDIER INC. 2020-03-31 BONAVISTA ENERGY CORPORATION 2020-03-31 BONTERRA ENERGY CORP. 2020-03-31 BOYUAN CONSTRUCTION GROUP, INC. 2020-03-31 BRIQUE BRAMPTON LIMITEE 2020-03-31 BROOKFIELD BUSINESS PARTNERS L.P. -

Symbol Company Listing Market Market Maker Market Maker Type a Armor Minerals Inc

Symbol Company Listing Market Market Maker Market Maker Type A Armor Minerals Inc. Ven Canaccord Genuity Corp. (#033) Full AAL Advantage Lithium Corp. Ven Canaccord Genuity Corp. (#033) Full AAV ADVANTAGE OIL & GAS LTD. TSX Citadel Securities Canada ULC (#005) Full ABT ABSOLUTE SOFTWARE CORPORATION J TSX Citadel Securities Canada ULC (#005) Full ABX BARRICK GOLD CORPORATION TSX Citadel Securities Canada ULC (#005) Full AC AIR CANADA VOTING AND VARIABLE VOTING TSX Citadel Securities Canada ULC (#005) Full ACB Aurora Cannabis Inc. TSX Canaccord Genuity Corp. (#033) Full ACI AltaGas Canada Inc. TSX Virtu Financial Canada, ULC (#212) Full ACO.X ATCO LTD. CL 'I' NV TSX TD Securities Inc. (#007) Full ACQ AUTOCANADA INC. TSX TD Securities Inc. (#007) Full AD ALARIS ROYALTY CORP. TSX TD Securities Inc. (#007) Full ADVZ Advanz Pharma Corp. CAD TSX TD Securities Inc. (#007) Full AEM AGNICO EAGLE MINES LIMITED TSX Citadel Securities Canada ULC (#005) Full AEZS AETERNA ZENTARIS INC. TSX TD Securities Inc. (#007) Full AFN AG GROWTH INTERNATIONAL INC. TSX TD Securities Inc. (#007) Full AGF.B AGF MANAGEMENT LTD. CL 'B' NV TSX Citadel Securities Canada ULC (#005) Full AGI ALAMOS GOLD INC. J TSX Citadel Securities Canada ULC (#005) Full AIF ALTUS GROUP LIMITED TSX Citadel Securities Canada ULC (#005) Full AIM AIMIA INC. TSX TD Securities Inc. (#007) Full AKG ASANKO GOLD INC. J TSX Citadel Securities Canada ULC (#005) Full ALA ALTAGAS LTD. TSX Citadel Securities Canada ULC (#005) Full ALEF Aleafia Health Inc. TSX Canaccord Genuity Corp. (#033) Full ALO Alio Gold Inc. TSX Citadel Securities Canada ULC (#005) Full ALS ALTIUS MINERALS CORPORATION TSX Citadel Securities Canada ULC (#005) Full AMM ALMADEN MINERALS LTD. -

Company Overview Valuation Data Source

Valuation Data Source company overview No. Company No. Company No. Company "Bank "Saint-Petersburg" Public 60 AbClon Inc. 117 Activision Blizzard, Inc. 1 Joint-Stock Company Abdullah Al-Othaim Markets 118 Actron Technology Corporation 61 2 1&1 Drillisch AG Company 119 Actuant Corporation 3 1-800-FLOWERS.COM, Inc. Abdulmohsen Al-Hokair Group for 120 Acuity Brands, Inc. 62 4 11 bit studios S.A. Tourism and Development Company 121 Acushnet Holdings Corp. 5 1st Constitution Bancorp 63 Abengoa, S.A. 122 Ad-Sol Nissin Corporation 6 1st Source Corporation 64 Abeona Therapeutics Inc. 123 Adairs Limited 7 21Vianet Group, Inc. 65 Abercrombie & Fitch Co. 124 ADAMA Ltd. 8 22nd Century Group, Inc. 66 Ability Enterprise Co., Ltd. 125 Adamas Pharmaceuticals, Inc. Ability Opto-Electronics Technology 126 Adamis Pharmaceuticals Corporation 9 2U, Inc. 67 Co.,Ltd. 127 Adani Enterprises Limited 10 3-D Matrix, Ltd. 68 Abiomed, Inc. 128 Adani Gas Limited 11 361 Degrees International Limited 69 ABIST Co.,Ltd. 129 Adani Green Energy Limited 12 3D Systems Corporation 70 ABL Bio Inc. Adani Ports and Special Economic 13 3i Group plc 130 71 Able C&C Co., Ltd. Zone Limited 14 3M Company 131 Adani Power Limited 72 ABM Industries Incorporated 15 3M India Limited 132 Adani Transmissions Limited 73 ABN AMRO Bank N.V. 16 3S KOREA Co., Ltd. 133 Adaptimmune Therapeutics plc 74 Aboitiz Equity Ventures, Inc. 17 3SBio Inc. 134 Adastria Co., Ltd. 75 Aboitiz Power Corporation 18 500.com Limited 135 ADATA Technology Co., Ltd. 76 Abraxas Petroleum Corporation 19 51 Credit Card Inc.