Table of Contents Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

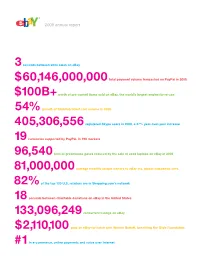

To Our Stockholders, In 2008, we embraced a tremendous amount of fundamental change against the backdrop of a deteriorating external market and economy. Even with the challenges, we exited the year a stronger company and remain a leader in e-commerce, payments and Internet voice communications. Our performance for the full year not only reflects the strength of our portfolio, but also the operating discipline, strategic clarity and focus with which our management team is leading the company going forward. Financially, the company had a good year, marked by strong revenue growth, stronger EPS growth and excellent free cash flow. Despite the extremely challenging economic environment in 2008 – including a slowdown in global e-commerce, a strengthening dollar, and declining interest rates – we delivered $8.5 billion in revenues, an 11 percent increase from the prior year, and $1.36 of diluted EPS. We also delivered a solid operating margin of 24 percent. The size of the eBay marketplace continues to be the largest in the world with nearly $60 billion of gross merchandise volume (the total value of goods sold in all of our Marketplaces) in 2008. PayPal continues to experience strong growth, both on eBay and across e-commerce, and Skype had a great year, growing both revenues and user base. In addition, we strengthened our portfolio by investing in the growth of our emerging businesses and through key acquisitions. In 2008, advertising, global classifieds and StubHub, the leading online tickets marketplace, all gained momentum in terms of revenues. Key acquisitions we made during the year will help us build on our strengths. -

Ebay Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K [x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 . OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to . Commission file number 000-24821 eBay Inc. (Exact name of registrant as specified in its charter) Delaware 77-0430924 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 2145 Hamilton Avenue San Jose, California 95125 (Address of principal (Zip Code) executive offices) Registrant's telephone number, including area code: (408) 376-7400 Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: Title of each class Name of exchange on which registered Common stock The Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [x] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [x] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Page 1 of 11 User Agreement

User Agreement - Privacy Policy - PayPal Page 1 of 11 Privacy Policy for PayPal Services Country:Australia (in English)|Austria (auf Deutsche)|Belgium (in English)|Belgium (en Français)|Belgium (in het Nederlands)|Canada (in English) |Canada (en Français)|European Union (in English)|European Union - send only (in English)|France (en Français)|Germany (auf Deutsch)|Italy (in Italiano)|Netherlands (in English)|Netherlands (in het Nederlands)|Poland (in English)|Poland (po polsku)|Spain (en Español)|Switzerland (auf Deutsch)|United States (in English)|Other Countries (in English)|Other Countries (日本語) This Privacy Policy applies to all European Union countries except Austria, Belgium, France, Germany, Italy, Netherlands, Poland, Spain and the Vatican City. To view the Privacy Policy for a different country or region, please click the appropriate link above. This Policy was last modified on 14 October 2009. Please view download and save this policy. The Privacy Policy below governs your PayPal account and any information you provide on this site. 1. Overview In order to operate the PayPal service and to reduce the risk of fraud, PayPal (Europe) S.à r.l. & Cie, S.C.A. ("PayPal" or "we"), the data controller, must ask you to provide us information about yourself and your credit or debit card and/or bank account. By consenting to, and agreeing the terms of, the Privacy Policy, you also expressly consent and agree to us processing your data in the manner set out in the Privacy Policy. This Privacy Policy describes the information we collect and how we use that information. PayPal takes the privacy of your personal information very seriously and will use your information only in accordance with the terms of this Privacy Policy. -

SELLING BEYOND Ebay

SELLING BEYOND eBay ................. 15844$ $$FM 03-27-06 08:28:25 PS PAGE i This page intentionally left blank SELLING BEYOND eBay Foolproof Ways to Reach More Customers and Make Big Money on Rival Online Marketplaces Greg Holden American Management Association New York • Atlanta • Brussels • Chicago • Mexico City • San Francisco Shanghai • Tokyo • Toronto • Washington, D.C. ................. 15844$ $$FM 03-27-06 08:28:26 PS PAGE iii Special discounts on bulk quantities of AMACOM books are available to corporations, professional associations, and other organizations. For details, contact Special Sales Department, AMACOM, a division of American Management Association, 1601 Broadway, New York, NY 10019. Tel.: 212-903-8316. Fax: 212-903-8083. Web site: www.amacombooks.org This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought. Library of Congress Cataloging-in-Publication Data Holden, Greg. Selling beyond eBay : foolproof ways to reach more customers and make big money on rival online marketplaces / Greg Holden. p. cm. Includes bibliographical references and index. ISBN-10: 0-8144-7349-0 ISBN-13: 978-0-8144-7349-8 1. Internet marketing. 2. Internet auctions. 3. Selling. I. Title. HF5415.1265.H654 2006 658.8Ј7—dc22 2005036479 ᭧ 2006 Greg Holden. All rights reserved. Printed in the United States of America. This publication may not be reproduced, stored in a retrieval system, or transmitted in whole or in part, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of AMACOM, a division of American Management Association, 1601 Broadway, New York, NY 10019. -

View Annual Report

Annual Report 2010 To Our Stockholders, In 2010, eBay Inc. became a stronger, more customer-focused company that is creating better experiences through technology-driven innovation. We extended our leadership in payments, strengthened and grew Marketplaces, and continued to operate efficiently so that we could reinvest in growth. In short, we delivered on our financial commitments to you, making progress against our goals and planting seeds for future growth. Our net revenues increased 5 percent in 2010 to $9.2 billion, compared to $8.7 billion in 2009. Excluding 2009 revenue from Skype (sold in November 2009) of $620.4 million, net revenues would have increased 13 percent, from $8.1 billion in 2009 to $9.2 billion in 2010. Diluted earnings per share decreased to $1.36 in 2010, compared to $1.83 in 2009. This was driven primarily by the gain on sale of Skype, which was partially offset by the impact of a Skype-related legal settlement charge in 2009. We achieved an operating margin of 22 percent in 2010 compared to 17 percent in 2009 and delivered $2.7 billion of operating cash flow for the year. Extending our lead in payments In 2010, we connected more buyers and sellers than ever before through PayPal. We ended the year with net total payment volume (TPV) of $92 billion – a 28 percent increase over 2009 – and more than 94 million active, registered accounts globally. Globally, PayPal continues to expand its footprint, with 47 percent of revenues coming from international markets, up from 44 percent in 2009. PayPal strengthened its local competitive offerings, creating innovative partnerships with local governments, and leading banks and mobile providers in markets such as Mexico, Brazil and China. -

View Annual Report

To our Stockholders, Partners, Employees and our Communities of Users As the Internet spreads throughout the world, more and more people are unlocking the opportunities it brings. The Internet is connecting us in ways not possible just a decade ago, and transforming the way we meet, communicate, learn, and do business. It has also sparked a new wave of innovation that continues to expand the boundaries of what technology can enable us to achieve. The changing Internet environment has allowed eBay to change as well. In 2005 we expanded our vision of how to best connect people online through community and commerce. We continued to innovate within our existing businesses while adding new formats and opportunities for our ever-growing communities of users. While the company may look different than it did a year ago, our core mission remains the same. We are pioneering communities built on commerce, sustained by trust, and inspired by opportunity. The Power of Three Today, the company is organized into three businesses: Marketplaces, Payments and Communications. Each is a thriving and successful business in its own right. Together, these three businesses create synergies that we believe will provide even more opportunity for our communities and lead to additional growth across the board. At the heart of the Marketplaces business is the eBay trading platform, which connects buyers and sellers in a single global marketplace. Continued innovation in marketing and product development and close cooperation with our community of users led to accelerating growth in 2005, particularly in our largest markets Ó the US and Germany. -

Ebay Inc. (Exact Name of Registrant As Specified in Its Charter) Delaware 77-0430924 (State Or Other Jurisdiction of (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ¥ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006. OR n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to . Commission file number 000-24821 eBay Inc. (Exact name of registrant as specified in its charter) Delaware 77-0430924 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 2145 Hamilton Avenue 95125 San Jose, California (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code: (408) 376-7400 Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: Title of each class Name of exchange on which registered Common stock The Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¥ No n Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes n No ¥ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Past Policy Updates

Past Policy Updates This page shows important changes that were made to the PayPal service, its User Agreement, or other policies. Policy Updates Last update: September 11, 2018 This page shall serve as advance information for PayPal Users with regards to important upcoming changes of PayPal Services, the PayPal User Agreement, and other policies (collectively, the “Legal Agreements”). Please read this document carefully. PayPal will change the Legal Agreements with effect to December 11, 2018. You do not need to do anything to accept the changes as they will automatically come into effect on December 11, 2018. Should you decide you do not wish to accept the changes, you can notify us prior to December 11, 2018 to close your account (https://www.paypal.com/at/cgi-bin/?&cmd=_close-account) immediately without incurring any additional charges. All changes and updates to the Legal Agreements are on this page highlighted in italic. This highlighting shall ensure better traceability of the changes and updates applied. Amendments made for linguistic adjustment, to correct or remove orthographical and grammatical mistakes, or changes to the formatting are not highlighted. This does also apply where we have corrected or standardized numbering and references. Updates to the PayPal User Agreement We have made the following amendments to our PayPal User Agreement: 3.1. Linking Your Funding Source At the end of clause 3.1. we have extended the previous last sentence and added another one to explain what we can do with regards to updates to your Funding Source information: 3.1. Linking Your Funding Source You can link or unlink a credit card or a bank account as a Funding Source for your PayPal Account. -

View Annual Report

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ¥ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007. OR n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to . Commission file number 000-24821 eBay Inc. (Exact name of registrant as specified in its charter) Delaware 77-0430924 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 2145 Hamilton Avenue 95125 San Jose, California (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code: (408) 376-7400 Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: Title of each class Name of exchange on which registered Common stock The Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¥ No n Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes n No ¥ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Policy Updates Page 1 of 57

Policy Updates Page 1 of 57 Sign Up Log In Help Security Center Home Personal Get Started Send Payment >> View all legal agreements View upcoming policy updates Past Policy Updates This page shows important changes that were made to the PayPal service, its User Agreement, or other policies. Amendment to the PayPal User Agreement Effective Date: Nov 18, 2013 Print Download PDF Please read this document. You do not need to do anything to accept the changes as they will automatically come into effect on the above date. Should you decide you do not wish to accept them you can notify us before the above date to close your account (https://www.paypal.com/va/cgi-bin/?&cmd=_close- account) immediately without incurring any additional charges. We do hope, however, that you continue to use PayPal and enjoy the following benefits: It’s safer When you pay with PayPal your financial details are never shared with sellers or retailers, so you’re more protected against fraud. It’s faster You don’t have to type in your card details each time you pay, so you can check out faster online. You can also get eBay items delivered more quickly, as you can pay the seller instantly. It’s easier PayPal is the preferred web payment method because it’s a smarter, savvier way to pay online in just a few clicks. All you need is your email address and a password. Please review the current User Agreement. Amendment to the PayPal User Agreement. 1. Definitions of Domestic Payment and Cross Border Payment A definition of Domestic Payment and Cross Border payments has been added and Article 5.1 “Fees” hould read as follows: "5.1 Fees. -

Paypal Privacy Policy Page 1 of 12

PayPal Privacy Policy Page 1 of 12 Privacy Policy for PayPal Services Last Update: Nov 01, 2010 Jump to section: 1. Overview 2. Binding Corporate Rules 3. Information We Collect 4. Our Use and Disclosure of Information 5. Information Security 6. Accessing and Changing Your Information 7. Accountability 8. IMPORTANT DATA PROTECTION FOR CUSTOMERS OF PAYPAL PRO This Privacy Policy applies to all European Union countries except Austria, Belgium, France, Germany, Italy, Netherlands, Poland, Spain and the Vatican City. Please view download and save this policy. The Privacy Policy below governs your PayPal account and any information you provide on this site or our products, services or any other feature, technologies or functionalities offered by us on our website or through any other means (collectively “the PayPal Services”). 1. Overview In order to operate the PayPal Services and to reduce the risk of fraud, PayPal (Europe) S.à r.l. & Cie, S.C.A. ("PayPal" or "we"), the data controller, must ask you to provide us information about yourself and your credit or debit card and/or bank account. By consenting to, and agreeing the terms of, the Privacy Policy, you also expressly consent and agree to us processing your data in the manner set out in the Privacy Policy. This Privacy Policy describes the information we collect and how we use that information. PayPal takes the privacy of your personal information very seriously and will use your information only in accordance with the terms of this Privacy Policy. We will not sell or rent your personally identifiable information or a list of our customers to third parties. -

Pro Hac Vice) VALERIE P

1 H. JASON GOLD (Pro Hac Vice) VALERIE P. MORRISON (Pro Hac Vice) 2 DYLAN G. TRACHE (Pro Hac Vice) WILEY REIN LLP 3 1776 K Street, N.W. Washington, D.C. 20006 4 Telephone: (202) 719-7000 Facsimile: (202) 719-7049 5 Email: [email protected] Email: [email protected] 6 Email: [email protected] 7 ROBERT A. FRANKLIN (091653) CRAIG M. PRIM (077820) 8 JENNY LYNN FOUNTAIN (226241) MURRAY & MURRAY 9 A Professional Corporation 19400 Stevens Creek Blvd., Suite 200 10 Cupertino, CA 95014-2548 Telephone: (650) 852-9000; (408) 907-9200 11 Facsimile: (650) 852-9244 Email: [email protected] 12 Email: [email protected] Email: [email protected] 13 14 Counsel to Howrey LLP 15 UNITED STATES BANKRUPTCY COURT 16 NORTHERN DISTRICT OF CALIFORNIA 17 SAN FRANCISCO DIVISION 18 In re: ) Case No. 11-31376-DM ) 19 HOWREY LLP, ) Chapter 11 ) 20 A District of Columbia Limited Liability ) Partnership, ) 21 ) Debtor(s). ) 22 ) 1299 Pennsylvania Avenue ) 23 Washington D.C., 20004 ) ) 24 Employer’s Tax I.D. No: 53-0231650 ) 25 CREDITOR MATRIX COVER SHEET 26 I, Robert Green, a Dissolution Committee Member of the Debtor herein, declare under 27 penalty of perjury that I have read the attached Creditor Mailing Matrix consisting of three hundred 28 and eighty nine (389) sheets, and that said list contains the correct, complete and current names and JLF:mw 1 CREDITOR MATRIX COVER SHEET Case:K:\Howrey 11-31376\Pldgs\Commence Doc#\Matrix Cvr 193 v2.docx Filed: 07/28/11 Entered: 07/28/11 12:20:59 Page 1 of 391 1 addresses of all priority, secured and unsecured creditors, and parties in interest, to the best of my 2 knowledge, information and belief.