090902.URS.DV.Task 7 Future Conditions Revised Draft Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BDE 05-13-14.Indd

A Special Section of BROOKLYN EAGLE Publications 6 Cool Things Happening IN BROOKLYN 1 2 3 4 5 6 Check out brooklyneagle.com • brooklynstreetbeat.com • mybrooklyncalendar.com Week of May 15-21, 2014 • INBrooklyn - A special section of Brooklyn Eagle/BE Extra/Brooklyn Heights Press/Brooklyn Record • 1INB EYE ON REAL ESTATE Victorian Flatbush Real Estate, Installment One Mary Kay Gallagher Reigns—and Alexandra Reddish Rocks, Too Bring Big Bucks If You Want to Buy— Home Prices Are Topping $2 Million By Lore Croghan INBrooklyn She’s the queen of Vic- torian Flatbush real estate, with nearly a half-century of home sales under her belt. Her granddaughter, who got her real estate license at age 18, is no slouch either. Mary Kay Gallagher, age 94, sells historic homes in y Prospect Park South, Ditmas Park, Midwood and nearby areas—stunning, stand-alone single-family properties that are a century old or more, with verdant lawns and trees. Ninety percent of them have driveways, which of course are coveted in Brooklyn. Granddaughter Alexan- dra Reddish, 40, is Gallagh- er’s savvy colleague in home sales at Mary Kay Gallagh- er Real Estate. A daughter- in-law, Madeleine Gallagh- er, handles rentals and helps with sales. Hello, Gorgeous! Welcome to Victorian Flatbush. Eagle photos by Lore Croghan “We keep it in the fami- ly,” Mary Kay Gallagher said. landmarked Ditmas Park that The map on Gallagher’s who’ve sold their townhous- She launched her bro- needs a lot of work. It went website—marykayg.com/ es for $3 million to $4 mil- ker career in 1970 after the for $1.42 million in March. -

Downtown Brooklyn's Residential Growth

1 A Five-Year DOWNTOWN BROOKLYN’S Review RESIDENTIAL GROWTH 2014–2018 Cover photos: TerraCRG Over the past two decades, Downtown Brooklyn has seen In this report, Downtown Brooklyn Partnership (DBP) provides transformative residential development as new projects give a data-driven snapshot of the Downtown Brooklyn housing rise to a changing Brooklyn skyline and a growing community market. DBP staff conducted interviews with citywide housing of residents. experts and more than a dozen developers and leasing professionals representing more than two-thirds of all newly- In the years following the 2004 adoption of the Downtown delivered rental units. Brooklyn Development Plan and an area-wide rezoning of the Special Downtown Brooklyn District more than 14,000 new Using data from city agencies, leading brokerage firms, housing units were delivered in Downtown Brooklyn, nearly developers, and property owners, this report: two-thirds of which were delivered during the past five years. • Illustrates the supply and makeup of Downtown The district’s growth has accompanied a boom in Brooklyn and Brooklyn’s housing stock in the last five years NYC’s economy, with record employment and population in the • Depicts occupancy and absorption trends from 2014 to borough and city. present • Provides an outlook on the development pipeline KEY FINDINGS Unprecedented growth of a residential neighborhood with mostly rental housing stock: Since the rezoning, more than 70 developments with over 14,000 housing units have been delivered in Downtown Brooklyn. The majority of new housing supply to date (82% of all units, or 11,800+ units) is rental housing. Significant rental and affordable housing growth in the past five years: Nearly two-thirds (64%) of Downtown Brooklyn’s housing supply (9,100+ units) was delivered between 2014 and 2018, including more than 8,500 rental units. -

Draft EIS ECF 80 Flatbush Avenue Part 4

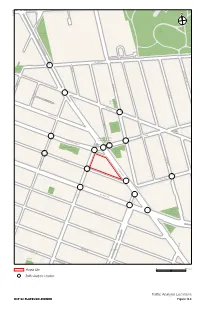

WILLOUGHBY STFLEET PL 2/5/2018 FLEET ST Fort Greene University Park Place FLATBUSH AVE EXTENSION DE KALB AVE HUDSON AVE Albee Square SOUTH PORTLAND AVE ASHLAND PL BOND ST SOUTH ELLIOTT PL HANOVER PL GROVE PL 230 Ashland Place POPS FULTON ST LIVINGSTON ST ST FELIX ST ROCKWELL PL Theatre for a New Audience Fowler Square VE TTE A FAYE Rockwell Place Bears LA SCHERMERHORN ST Community Garden Seating Sixteen Sycamores Area 2 Playground 300 Ashland Place Plaza FT GREENE PL STATE ST NEVINS ST FLATBUSH AVE HANSON PL North Pacific Plgd ATLANTIC AVE 3 AVE Atlantic PACIFIC ST Terminal Mall Plaza Barclay's Center DEAN ST Plaza 4 AVE E V A 5 BERGEN ST WYCKOFF ST Greenstreet Wykoff ST MARK'S PL Gardens Open Space Project Site 0 400 FEET Traffic Analysis Location Traffic Analysis Locations ECF 80 FLATBUSH AVENUE Figure 11-4 Chapter 11: Transportation Table 11-8 Traffic Level 2 Screening Analysis Results—Analysis Locations Incremental Vehicle Trips (Weekday) Intersection AM Midday PM Analysis Locations Fulton Street and DeKalb Avenue 0 0 0 Livingston Street and Bond Street 4 1 4 Schermerhorn Street and Bond Street 35 9 23 Flatbush Avenue and DeKalb Avenue 57 14 57 ✓ Flatbush Avenue and Fulton Street 72 19 92 ✓ Flatbush Avenue and Nevins Street 37 9 52 Livingston Street and Nevins Street 30 6 32 Schermerhorn Street and Nevins Street 61 13 51 ✓ State Street and Nevins Street 51 8 49 ✓ Atlantic Avenue and Nevins Street 32 7 36 Pacific Street and Nevins Street 10 0 7 DeKalb Avenue and Hudson Avenue 6 0 1 Hudson Avenue and Fulton Street 35 13 58 Flatbush -

Bridge Street

388 BRIDGE STREET Between Fulton & Willoughby Streets DOWNTOWN BROOKLYN 388 BRIDGE STREET ADDRESS ven 388 Bridge Street, Brooklyn, NY 11201 u e Ex Between Fulton & Willoughby Streets Columbus MetroTech t M en on Park Center tag R.V. Ingersoll Houses ue S Polytechnic FDNY/EMS sion tr University eet (B NYS Supreme & Family Courts r ooklyn Brid SIZE MetroTech R.V. Ingersoll Houses Commons Empire Blue Cross BlueShield Ground Floor: Approx. 192 SF N New York R Supreme Myrtle Avenue Fleet Pl Brooklyn Court g Second e Bouleva R District em New York Marriott FRONTAGE Heights sen MetroTech Str 2 at the Brooklyn Bridge eet Keyspan JP Morgan St. Francis Chase Gold Approx. 10' on Bridge Street r Center College 3 d) A Brooklyn Kingsview Jora Friends C S S Homes le t t mo School JP Morgan n St. Borough Civic Chase Hall F POSSESSION Center University Towers Verizon 2 3 Immediate Packer 4 Fort Fort Collegiate 5 N R Willoughby Street Institute Greene Greene Law Brid D Park u f field Willoughby r Brooklyn g ence COMMENTS ASHLAND PLACE Municipal Brooklyn e Square Sidney Place Building Law School S t NYC S Park Albee t BOE S • At the base of a 378-unit luxury residential building Clinton Street t Albee Square Redevelopment S • Within walking distance of 13 subway trains q ua Brooklyn r Long Island University Court Street F ult e Brooklyn Center Hospital on M W Center all e s t NEIGHBORS C t HOUSE H&M, Banana Republic, Manhattan Athletic Club, T-Mobile, Nordstrom Rack, Old Navy Cobble OF HOOPS Smith S 2 tin Pl New York City 3 Hill Transit Authority alla ce -

Brownfield Cleanup Program Citizen Participation Plan 388 Bridge Street

New York State Department of Environmental Conservation Brownfield Cleanup Program Citizen Participation Plan for 388 Bridge Street 388 Bridge Street Brooklyn, New York BCP# C224134 August 2010 1 Contents Section Page Number 1. What is New York’s Brownfield Cleanup Program? .....................................................3 2. Citizen Participation Plan Overview................................................................................3 3. Site Information.................................................................................................................5 4. Remedial Process ...............................................................................................................9 5. Citizen Participation Activities.......................................................................................12 6. Major Issues of Public Concern......................................................................................12 Appendix A – Site Location Map ...............................................................................................13 Appendix B – Project Contacts and Document Repositories...................................................15 Appendix C – Brownfield Site Contact List ..............................................................................16 Appendix D – Identification of Citizen Participation Activities..............................................21 Appendix E – Brownfield Cleanup Program Process ..............................................................22 * * * * * -

FY19 Tentative Assessment Roll Statistical Summary

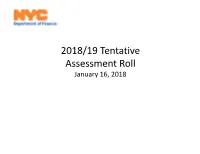

2018/19 Tentative Assessment Roll January 16, 2018 TAXABLE ASSESSMENT AND MARKET VALUE PROFILES FINAL FY 2017/18 VS TENT FY2018/19 CITYWIDE SUMMARY BY PROPERTY TYPE PROPERTY TYPE # OF TAX LOTS RESIDENTIAL UNITS OR SQUARE FOOTAGE* FY ''2017/18 F FY '2018/19T CHANGE FY ''2017/18 F FY '2018/19T CHANGE NUMBER NUMBER % NUMBER NUMBER % Class One 698,852 699,190 0.05% 1,094,689 1,095,675 0.09% Class Two 266,591 270,137 1.33% 1,908,110 1,926,056 0.94% Class Three 300 298 -0.67% Class Four 97,417 97,884 0.48% 1,215,940,036 1,239,855,152 1.97% TOTAL 1,063,160 1,067,509 0.41% PROPERTY TYPE FULL MARKET VALUE TAXABLE ASSESSED VALUE FY ''2017/18 F FY '2018/19T CHANGE FY ''2017/18 F FY '2018/19T CHANGE $ $ % $ $ % Class One 538,564,685,332 594,782,241,031 10.44% 19,442,761,767 20,238,453,279 4.09% Class Two 281,500,408,242 311,571,106,813 10.68% 81,049,886,199 90,378,606,123 11.51% Class Three 33,285,661,294 33,419,627,013 0.40% 14,683,905,855 14,744,285,832 0.41% Class Four 295,858,020,794 317,862,634,295 7.44% 109,284,705,717 117,864,425,114 7.85% TOTAL 1,149,208,775,662 1,257,635,609,152 9.43% 224,461,259,538 243,225,770,348 8.36% *Classes One and Two show residential unit counts. -

Brooklyn 2015 Mid-Year Sales Report by Ariel Property Advisors | Released July 2015

BROOKLyn 2015 Mid-YEAR SALES REPORT by Ariel Property Advisors | Released July 2015 Join Our Network: e-mail [email protected] or visit arielpa.com 212.544.9500 I arielpa.com 122 East 42nd Street, Suite 1015, New York NY 10168 BROOKLyn 2015 Mid-YEAR SALES REPORT Dear Friends, 2015 MID-YEAR SALES REPORT Posting major gains in dollar volume and the number of properties sold, Brooklyn’s in- vestment property sales market started the first half of 2015 in strong fashion. Dollar Volume Transaction Volume Property Volume For the 1H2015, Brooklyn saw 766 transactions consisting of 1,083 properties totaling $5.327 billion in gross consideration. This represents an impressive 76% increase in dol- lar volume, a 14% increase in transaction volume and a 20% increase in property volume compared to 1H14. While nearly every product type saw more selling activity across the $5.33 766 1,083 board, multifamily and development transactions accounted for over 90% of dollar vol- BILLION ume and had a pronounced positive impact on the first half. 59% increase 7% increase 12% increase Multifamily sales, which accounted for 60% of total dollar volume, were expansive in compared compared compared terms of product type and location. Sales ranged from large multifamily portfolios to to 2H 2014 to 2H 2014 to 2H 2014 existing, core rental buildings ideal for conversion to condominiums. Multifamily prices remained at the elevated levels seen at the end of 2014. With strong fundamentals and interest rates expected to stay low over the remainder of the year, 2015 is shaping up to be an incredible year for Brooklyn multifamily owners. -

Existing Conditions—Project Site and Primary Study Area ECF 80 FLATBUSH AVENUE Figure 8-5 ECF 80 Flatbush Avenue

2.5.18 333 Schermerhorn Street Lot 24 388 Bridge Street Lot 23 Lot 18 Lot 18 contains a three-story building with frontages on Flatbush Avenue and State Street; Lot 23 contains a two-story building, and 5 Lot 24 contains a five-story brick building with a triangular footprint. The primarily glass-clad building at 333 Schermerhorn Street and the building at 388 Bridge Street can be seen in the background. View from Flatbush Avenue near State Street facing northwest. 300 Ashland Place The project site, including the triangular building on Lot 24, is seen on the left. The 6 recently constructed building at 300 Ashland Place is seen on the right. View north along Flatbush Avenue from State Street. Existing Conditions—Project Site and Primary Study Area ECF 80 FLATBUSH AVENUE Figure 8-5 ECF 80 Flatbush Avenue Lot 24 contains a five-story (approximately 67-foot-tall) building with a triangular footprint with frontages on Flatbush Avenue and State Street (see Figure 8-5). The building is built out to the sidewalk along both streets and rises without setbacks. Along Flatbush Avenue, the ground floor contains a gym with large plate-glass windows and three recesses glass-door entries. Along State Street, the ground-floor entrances have been bricked in except for a raised entry at the west end of the façade, which is accessed by concrete stairs. This building formerly had a rounded bay front at that corner, as well as a cornice, both of which have been removed. VIEW CORRIDORS AND VISUAL RESOURCES The architecturally distinguished buildings at 362 Schermerhorn Street (School Building 2/Building D) and 475 State Street (School Building 1/Building E)—described above and in Chapter 7, “Historic and Cultural Resources”—are visual resources located on the project site (see Figure 8-3). -

Take a Good Look at the Brooklyn Skyline, Because What You See Won’T Be There for Long

September 1, 2015 From left: Greenland Forest City Ratner Partners’ 550 Vanderbilt in Pacific Park and Hudson Companies’ Gowanus Green Take a good look at the Brooklyn skyline, because what you see won’t be there for long. Fueled by a frothy economy and unrelenting demand, developers hit the gas on residential projects over the past 18 months. Overall, Brooklyn development topped 41.6 million square feet— second only to Manhattan — spanning nearly 600 projects and 45,359 apartments, according to The Real Deal’s analysis of building permits and offering plans filed between Jan. 1, 2011 and July 31, 2015. Notably, a massive 85 percent of those plans were submitted since January 2013. Since that time, developers initiated plans for 35.3 million square feet, 534 projects and 38,375 residential units, TRD found. Hudson Companies dominated the borough’s list of the most prolific developers by square footage. The firm filed plans for just over 2.71 million square feet since 2011, including 2,307 units spread over 14 projects. The largest, Gowanus Green, is a planned mixed-income village on 5.8 acres in Gowanus, which Hudson is developing with partners Bluestone Organization, the Fifth Avenue Committee and Jonathan Rose Companies. Plans call for eight towers totaling 790,000 square feet with 774 rental and condo units. Meanwhile, David and Jed Walentas’ Two Trees Management, the developers behind the $1.5 billion redevelopment of the old Domino Sugar refinery in Williamsburg, clocked in at No. 2 with just over 1.96 million square feet across seven projects with more than 2,200 total units. -

Brooklyn Market Report MID-1ST QUARTER 2015 REPORT Building 77 - Renderings Looking Ahead

Brooklyn Market Report MID-1ST QUARTER 2015 REPORT Building 77 - Renderings Looking Ahead Brooklyn Navy Yard’s Building 77 - City Plans to Repurpose Former Ammunition Depot Although quietly hiding behind most of the headlined activity within the borough, the Brooklyn Navy Yard has been anything but inactive. November brought the announcement of the city’s plans to invest $140 million to create a hub for private manufacturing and entrepreneurship out of the former ammunition depot Building 77 — a 17-story, 960,000-square-foot building that represents about 25% of the Navy Yard’s total existing building stock. Due to lack of space availability, the city is working to pick up the pace to redevelop space and meet the needs of a waiting list of prospective tenants that has reportedly reached 100. Building 77 is expected to demand asking rents ranging from $20-$40 per square foot, but anticipated city and state incentives could further reduce effective rents. The Brooklyn Navy Yard Development Corporation is currently marketing the building’s penthouse space comprised of a total of 150,000 square feet spread across Building 77 - Rendering top fl oors 14 and 15 offering 360º views of Lower Manhattan, and a 20,000-square-foot rooftop deck at an asking rent of $40 per square foot. • 3.5 Million – Total leasable square feet currently online. • 20 Acres – The approximate area within the complex’ 300 acres that is currently undeveloped. • 7,000 Employees – Total number of people currently spread across the 330 tenants at the complex of which about 70% of the tenant roster has been there for over 10-years, with a projected increase to 14,000 by 2020. -

Infrastructure Asset Management Review of Tall Residential Buildings Of

Journal of Built Environment, Technology and Engineering, Vol. 3 (September) 2017 ISSN 0128-1003 ASSET MANAGEMENT REVIEW OF TALL RESIDENTIAL BUILDINGS IN MAJOR CITIES: CHICAGO, HONG KONG AND SINGAPORE Raymond Cheng Email: [email protected] Reader, Industrial Doctorate (IndD) Programme, Asia e University, Kuala Lumpur, MALAYSIA Ivan Ng Email: [email protected] Executive Director, Russia Capital Investment Corporation Limited, HONG KONG ABSTRACT There is only one residential skyscraper within China’s top 100 tallest buildings in the crowded 24-million- population city of Shanghai, China (and eleven residential skyscrapers among the 134 tallest buildings, i.e. those taller than 150 metres), whereas there are comparatively a lot more skyscrapers used for residential purposes in equally densely populated cities like Hong Kong, Singapore, Kuala Lumpur and, of course, Chicago and New York. This paper, hence, looked, from a historical perspective, how the development of tall buildings in Chicago, Hong Kong and Singapore have evolved to become what we see today. How does the tall building development history of a city help forge the people’s view in terms of living in skyscrapers? Would such help provide explanations and hints as to the future development of skyscrapers in the other cities like Shanghai? Keywords: Tall building, skyscraper, high-rise, development history Learning from the American experience The mythical story of the Tower of Babel tells us that how height, in itself, since the beginning of known history, means power to human beings. But before Elisha Otis revolutionized and refined the safety of the elevator by inventing the elevator brakes1 in 1852, both the Greek mathematician Archimedes of Syracuse and King Louis XV of France could only have envisioned their great ideas through primitive, man-powered, inefficient mechanical lifting devices back in their days. -

388 Bridge Street Remedial Action Work Plan April 2012

388 BRIDGE STREET BROOKLYN, NEW YORK Remedial Action Work Plan NYSDEC BCP Number: C224134 Prepared For: 384 Bridge Street LLC c/o Stahl Real Estate Company Inc. 277 Park Ave New York, NY 10172 and R, K & G Associates, LLC 580 Sylvan Avenue Englewood Cliffs, NJ 07632 Submitted to: New York State Department of Environmental Conservation Division of Environmental Remediation 625 Broadway, 12th Floor Albany, N.Y. 12231-7016 Prepared by: Arnold F. Fleming, P.E. & Fleming Lee Shue, Inc. Environmental Management & Consulting 158 West 29th Street, 9th Floor New York, NY 10001 (212) 675-3225 APRIL 2012 388 Bridge Street Remedial Action Work Plan April 2012 REMEDIAL ACTION WORK PLAN TABLE OF CONTENTS CERTIFICATIONS ......................................................................................................................... i TABLE OF CONTENTS................................................................................................................ ii LIST OF ACRONYMS ............................................................................................................... viii EXECUTIVE SUMMARY ............................................................................................................ 1 Site Description/Physical Setting/Site History............................................................................1 Summary of the ON-SITE Remedial Investigation ....................................................................1 Qualitative Human Health Exposure Assessment.......................................................................3