Funding Local Roads

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hume Coal Project RTS Appendix 5

Hume Coal Project — Response to Submissions - VOLUME 3 Appendix 5 Hume Coal Project – Response to community concerns regarding impacts on tourism (Judith Stubbs & Associates 2017) www.emmconsulting.com.au Hume Coal Project — Response to Submissions - VOLUME 3 www.humecoal.com.au Hume Coal Project: Response to Community Concerns regarding impacts on tourism 14 November 2017 This report has been prepared for Hume Coal Pty Limited by The Old Post Office 231 Princes Hwy, Bulli NSW 2516 Ph: 02 4283 7300 [email protected] www.judithstubbs.com.au This Report has been prepared by: Judith Stubbs BSW PhD MPIA John Storer, BE (Civil), Grad Dip (Econ) Disclaimer © Judith Stubbs & Associates All Rights Reserved. No part of this document may be reproduced, transmitted, stored in a retrieval system, or translated into any language in any form by any means without the written permission of Judith Stubbs & Associates. Intellectual Property Rights All Rights Reserved. All methods, processes, commercial proposals and other contents described in this document are the confidential intellectual property of Judith Stubbs & Associates and may not be used or disclosed to any party without the written permission of Judith Stubbs & Associates. Table of Contents 1 Executive Summary ....................................................................................... 1 1.1 Introduction .......................................................................................................... 1 1.2 The Project ............................................................................................................ 1 1.3 Importance of the Tourist Industry in the Locality ................................................... 2 1.4 Current Co-Existence of Industrial and Tourism Uses and Activities in the Locality . 3 1.5 Future Impacts of the Proposed Mine on Tourism Uses and Activities in the Locality3 1.6 Statistical Relationship between Coal Mining and Tourism Industries in NSW ........ -

Regional Tourism Statistics in Australia Occasional Paper Number 1

Regional Tourism Statistics in Australia Occasional Paper Number 1 Stephanie Hunt Gary Prosser Editors An outcome of the Regional Tourism Statistics Workshop Sydney 29 September 1998 Regional Tourism Statistics in Australia Occasional Paper Number 1 Stephanie Hunt and Gary Prosser (Editors) ISBN 1 86384 4449 X © 1998 Centre for Regional Tourism Research No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by means of electronic, mechanical, photocopying, recording or otherwise without the prior written permission of the publisher. Any inquiries should be directed to the Centre for Regional Tourism Research, Southern Cross University, PO Box 157, Lismore NSW 2480 Australia. Contents Introduction ............................................................................................................1 Tourism Statistics and Regional Tourism Development .....................................3 State Agency Perspective .............................................................................4 Large Operator Perspective .........................................................................6 Small Operator Perspective .........................................................................7 National Tourism Data Collections .......................................................................9 International Visitor Survey .........................................................................9 Domestic Tourism Monitor ........................................................................10 -

The Economic Importance of Tourism in Australia's Regions

The Economic Importance of Tourism in Australia’s Regions ISBN 978-1-921812-27-9 Tourism Research Australia GPO Box 1564 Canberra ACT 2601 Phone: 6243 7745 Email: [email protected] Web: www.ret.gov.au/tra Publication date: April 2011 This work is licensed under a Creative Commons Attribution 3.0 Australia licence. To the extent that copyright subsists in third party quotes and diagrams it remains with the original owner and permission may be required to reuse the material. This work should be attributed as The Economic Importance of Tourism in Australia’s Regions, Tourism Research Australia, Canberra. Enquiries regarding the licence and any use of work by Tourism Research Australia are welcome at [email protected] Contents 1 Introduction ....................................................................................................... 1 2 Australia’s tourism regions ................................................................................... 1 3 Methodology ...................................................................................................... 5 4 Results .............................................................................................................. 6 5 Conclusion ....................................................................................................... 11 Appendices Appendix A: Detailed methodology ...................................................................... 12 A1 Tourism output ....................................................................................... -

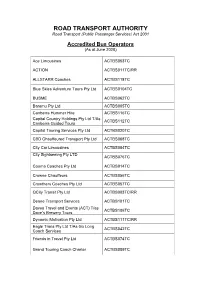

Accredited Bus Operators (As at June 2020)

ROAD TRANSPORT AUTHORITY Road Transport (Public Passenger Services) Act 2001 Accredited Bus Operators (As at June 2020) Ace Limousines ACTBS053TC ACTION ACTBS011TC/RR ALLSTARR Coaches ACTBS118TC Blue Skies Adventure Tours Pty Ltd ACTBS0104TC BUSME ACTBS062TC Baromu Pty Ltd ACTBS005TC Canberra Hummer Hire ACTBS116TC Capital Country Holdings Pty Ltd T/As ACTBS112TC Canberra Guided Tours Capital Touring Services Pty Ltd ACTBS020TC CBD Chauffeured Transport Pty Ltd ACTBS068TC City Car Limousines ACTBS084TC City Sightseeing Pty LTD ACTBS076TC Cooma Coaches Pty Ltd ACTBS014TC Crowne Chauffeurs ACTBS056TC Crowthers Coaches Pty Ltd ACTBS057TC QCity Transit Pty Ltd ACTBS003TC/RR Deane Transport Services ACTBS101TC Daves Travel and Events (ACT) T/as ACTBS106TC Dave’s Brewery Tours Dynamic Motivation Pty Ltd ACTBS111TC/RR Eagle Trans Pty Ltd T/As Go Long ACTBS042TC Coach Services Friends in Travel Pty Ltd ACTBS074TC Grand Touring Coach Charter ACTBS009TC Greyhound Australia Pty Ltd ACTBS034TC Horizon Coach Charters ACTBS081TC Hummingbird Charters T/As ACTBS071TC Snow Alliance Keir’s Group Of Companies Pty Ltd ACTBS015TC Kennedys Bus & Coach ACTBS078TC KMET Transport Services Pty Ltd ACTBS070TC T/As Roadcoach Lanaad Pty Ltd ATF DM Charters ACTBS117TC Trust Makeham’s Coaches ACTBS026TC Marulan Truck & Bus Pty Ltd T/as ACTBS121TC Marulan Coaches Marshall’s Bus & Coach company ACTBS036TC PTY Ltd Michael Minter T/as Voorpret ACTBS124TC Monaro Coaches ACTBS022TC Moonlight Stretch Limo Pty Ltd ACTBS085TC Murrays Australia PTY LTD ACTBS010TC North Sydney -

1 Governance and Accountability

Management Plan Quarterly Review January 2011 to March 2011 TABLE OF CONTENTS Our Values......................................................................................................................................................................4 Our Management Plan 2010 – 2013 ..............................................................................................................................5 Our Purpose ...................................................................................................................................................................6 Our Charter.....................................................................................................................................................................7 Our Code of Conduct.....................................................................................................................................................8 Our Current Council ......................................................................................................................................................9 Equal Employment Opportunity Management Plan..................................................................................................10 1. Economy...................................................................................................................................................................12 11 Economic Development .......................................................................................................................................................................13 -

Destination NSW Annual Report 2019/2020

INDEX & ACCESS Heading H2 Heading H3 DestinationUnt a cus, optia consequas volupidis voluptas alitasp NSW eribeaquame officab orehentio to magnate nonecabore, odita ilit quias que modita perum alibus. Henitiis dollut aperrovitin rererup tatur, sandit invel magnatus. Ame volorit veniscium voles dolumquodic tem rerum necus ANNUALsant fuga. Name rerum unt, eaqueREPORT re net ullaturenet ipsant ma comnis sit a vendeli genureius ma niendis plignih illabo. Ita ipitati onseque nemquibus aut aute cusdae voluptate nat rat. Cil il is rest platest et rate aliquam dolum faceseque derovit, atissusam quis eum re volorep edipsan daector eprorepelest 2019-2020verum que sintureperor simaximus et andis eat as dusa poriatium ant, qui andi consequam ima volo essit, nus cuptati busdaeria aborectibus, odi conseque esecus dolorem iunt as conseque voluptaturit laccus dolorit ipiet quaepro totatur epernatum enitatust, solorum eveliqu asperum is magnata turiorro quuntiam quostem porepe volum rem videnet ut quibus aut enistrum quaepro rerfera temquam autem etur audam faccusa nullam, undi quatibus eos simus re perroreictem eos sunt, ut volest, to ipsam quas ea conem lacerum exerae. Uptis endias estrum que pe pra DESTINATION NSW // Annual Report 2019-2020 Page 1 Destination NSW ANNUAL REPORT 2019-2020 The Hon. Stuart Ayres MP Minister for Jobs, Investment, Tourism and Western Sydney 52 Martin Place SYDNEY NSW 2000 30 November 2020 Dear Minister, We are pleased to submit the Annual Report of Destination NSW for the financial year ended 30 June 2020 for presentation to the NSW Parliament. This report has been prepared in accordance with the provisions of the Annual Reports (Statutory Bodies) Act 1984, the Annual Reports (Statutory Bodies) Regulation 2015, the Government Sector Employment Act 2013, the Public Finance and Audit Act 1983, and the Public Finance and Audit Regulation 2015. -

Classroom-Canberra-2021.Pdf

2021 CLASSROOM CANBERRA THE POWERFUL STORY OF 02 9540 0999 KOKODA VETERAN [email protected] REG CHARD p4 unearth-ed.com.au CANBERRA SYDNEY BATHURST MELBOURNE SNOWFIELDS BLUE MOUNTAINS BALLARAT JAPAN NEW ZEALAND Your venue of choice on the ACT’s doorstep ... Warrambui offers group accommodation facilities in a peaceful bush setting. Enjoy “They showed really the tranquil surroundings while staying with us for your camp, conference or retreat. lovely, friendly attitudes • Accommodation for groups from 20 to 200 people and I appreciated all the • Two styles of accommodation: dorm and ensuite • Full catering with delicious meals to suit all ages flexibility and care for us” • Located near Murrumbateman on the Barton Highway, just north of Canberra • A range of day and night on-site activities • Conference facilities and break-out rooms SL17026-0417 Ph (02) 6220 1000 • [email protected] • www.warrambui.com.au Managing Director’s Letter 2021 contents Your guide to the very best Canberra has to offer! “The Canberra Trip” is a rite of passage that has continued to inspire students for over 80 years! The merits are discussed in detail by industry 03 MANAGING luminaries later in this planner. We all have fond memories of when we DIRECTOR’S went to Canberra, often senior public figures recall it was their school LETTER Canberra trip that inspired them to pursue a career in public office. 04 UNEARTH-ED In our companies 95 years of operation we have never experienced such Digs in for Ugandan charity catastrophic conditions. Unearth Ed arranges travel for around 9,000 05 REG CHARD students from all over Australia each year, who visit Canberra and the The story of War Snow and not one student travelled to Canberra with us in 2020. -

Impact of Wind Farm Development on Surrounding

PETER REARDON Real Estate Consultant & Phone: (02) 48224522 Registered Valuer Fax: (02) 48224507 Po Box 1048 Mob: 0413 263666 Goulburn NSW 2580 Email: [email protected] ABN 53167858096 Preliminary Report: The Impact of Wind Turbine Developments on Surrounding Rural Land Values in the Southern Tablelands, N.S.W. Instructing Party: Mr. Paul Vallely September, 2013 PETER REARDON Real Estate Consultant & Registered Valuer Introduction I have been practicing as a Property Valuer and consultant in South East N.S.W. and the A.C.T for almost 15 years, specialising in the valuation of primarily rural land holdings ranging from small lifestyle allotments and subdivisions up to large broad acre grazing and farming properties. I have held major roles with National and International valuation firms including ‘Preston Rowe Paterson’, ‘Megaw & Hogg’ and ‘Savills’ prior to commencing my own business operation. The prevalence of wind turbine development in the Southern Tablelands has been a contentious issue for many rural communities over recent years, which I have had significant experience in business with, from both private land holders and wind turbine development proponents. Instructions This report has been prepared under instruction from Mr. Paul Vallely for and on behalf of a number of landholders in the Southern Tablelands who have concerns as to the economic impact that wind turbine development and infrastructure can have upon surrounding land values. Our instructions are to review various existing and proposed wind turbine developments in the Southern Tablelands, having regard to any potential impact upon values and marketability of properties in the locality, due to these developments. -

T E Oakes-Ash, President, Southern Highlands Business Chamber Inc

OBJECTION The Federal Redistribution 2009 NSW Objection Number 28 by T E Oakes-Ash, President, Southern Highlands Business Chamber Inc 3 Pages Southern Highlands Business Chamber Inc PO Box 623 Bowral NSW 2576 "Business Working Together" ,~, .> ,' f'"... a., - / ... , ~ , , / ... •/ ..a. /> .... 4p !~. .. RECEiVED , '. 24 AUG 2009 REDISTRIBUTION NSW 24th August 2009 Australian Electoral Commission, PO Box K406, Haymarket, Sydney, NSW2000. Dear Sir, Electoral Commission Redistribution Proposal. As you are aware the Wingecarribee Local Government Area is contained entirely within the Division of Hume. Under the proposed redistribution Wingecarribee Shire will be split into three, with over 25,000 residents being transferred into the Division of Throsby. At our general meeting held on Tuesday, 18 August, our members voted unanimously that Wingecarribee Shire remains as a discrete entity, being covered by only one Federal seat, not three. The business community is extremely concerned at any proposed change for the following reasons: 1. On the one hand we are being seen as part of the Southern Councils Group of the lIIawarra 2. Part of the Goulburn District of DSRD 3. Part of the Southern Tablelands for RDA 4. Part of Capital Country for Tourism Grant funding 5. South Western Sydney for Area Health etc. It is no wonder that we are concerned, how many proposals will we be forced to table for Federal Government Funding for three electorates within our Shire of 45,000, if you impose the boundary of the proposed seat of Throsby upon us? Affiliated with ~BDCU t:mmni)< ""'111"-Ctu*1llX2ll_1.1X211 It'sallaboutpeople l6>lolI<IIO.lOCll_ , . We ask that this matter be reconsidered as the inclusion of Wingecarribee in a Federal seat that includes the outer suburbs of Wollongong} will only water down rural Australia's community and business voice in the Parliament. -

Partnership Broker Providers, Partnership Numbers and Funding, by YAT Region

Attachment B Partnership Broker providers, partnership numbers and funding, by YAT region Explanatory Notes: Total Region Funding covers the period from 1 January 2010 – 31 December 2014 (GST Exclusive) with the exception of Victoria. The Commonwealth commenced direct contracting of Victorian Partnership Broker providers in January 2014, therefore, figures for Victoria only cover the 2014 calendar year. All funding is Commonwealth Government funding. Total $ Region Number Region Name Organisation Name (GST Excl) ACT01 Australian Capital Territory Confederation of ACT Industry T/a ACT & Region Chamber of Commerce and Industry $2,778,411 Total ACT $2,778,411 NSW01 Sydney Eastern Suburbs Sydney Business Education Partnerships $2,682,156 NSW02 St.George-Canterbury Bankstown Granville Industry Education Partnership Inc $2,196,762 NSW03 Sutherland Sutherland BEN (Business Education Network) Inc $1,964,590 NSW04 Lower North Sydney Hills Schools Industry Partnership $2,310,123 NSW05 Northern Beaches Northern Beaches Business Education Network Incorporated $2,091,503 NSW06 Central Northern Sydney Hills Schools Industry Partnership $2,199,174 NSW07 Central Western Sydney ParraSIP Inc $2,463,778 NSW08 Blacktown Blacktown Regional Economic & Employment Development Taskforce Inc $3,175,292 NSW09 Outer Western Sydney Blue Mountains, Hawkesbury & Penrith Schools Industry Partnership Inc $2,826,572 1 Total $ Region Number Region Name Organisation Name (GST Excl) NSW10 Bankstown & Inner Western Sydney Bankstown Granville Industry Education Partnership -

18152 Gday Warbirds Downunder 2018

Ride the rails with us to the largest gathering of warbird aircraft in Australia. warbirds downunder Travel in style on board Australia's only fleet of newly restored 1960's sleeping carriages. Enjoy the spectacular Warbird display on both Friday evening and Saturday. Saturday evening it's time to dance, with the eighteen piece Spectrum Big Band backing The Leisa Keen Trio and the Canberra Swing Katz dancers. inclusions • Sydney - Temora - Sydney • Three days plus two night experience aboard the 1960's vintage carriage fleet • Private sleeping quarters, most meals, Airshow entry, Swing Ball entry and transfers uniquea rail experience gdayrail.com.au/experiences/warbirds2018/ Day 1: Sydney - Temora the (Friday 12th October) Depart Sydney Central Station early Friday morning, travelling the route our carriages took in the 1960’s experience through the delightful Southern Highlands. Enjoy lunch in our dining carriages as we continue through the Southern Tablelands and into Capital Country around Goulburn and Sydney Yass. At Cootamundra we veer right toward Temora, which does not normally have Rail passenger access. Temora N Train A shuttle bus will meet us at the Temora Railway Station for transfer to the Temora Airfield for the Airshow. Be thrilled by the sights and sounds of Warbirds including Spitfires, Mustangs, Kittyhawks, a Boomerang, jet fighters Twinnette: and the only remaining airworthy Hudson bomber. Gold Pass ..................................... $2,095pp A shuttle bus will return us for a good night's sleep in our $1,814pp Advance (before 30 April) private cabins. Flightline Premium Grandstand .... $1,985pp Day 2: Temora (Saturday 13th October) $1,704pp Advance (before 30 April) Travel only ................................... -

2018-19 Australian Accommodation Monitor

Australian Accommodation Monitor Summary Financial-year performance: 2018-2019 Australian Accommodation Monitor (AAM) Northern Territory OCC(%) 60.2 Click on each territory ADR($) 144.03 to view detailed report. RevPAR % Chg -15.3 Queensland OCC(%) 69.0 ADR($) 177.43 RevPAR % Chg Western Australia -2.2 OCC(%) 68.7 ADR($) 165.11 RevPAR % Chg -2.0 South Australia OCC(%) 73.6 ADR($) 151.76 RevPAR % Chg -2.6 New South Wales OCC(%) 78.0 ADR($) 212.80 RevPAR % Chg -3.1 Total Australia Australian OCC(%) 74.0 Capital Territory ADR($) 186.57 OCC(%) 77.6 Victoria ADR($) 173.03 RevPAR % Chg -2.4 RevPAR % Chg 0.1 OCC(%) 78.5 ADR($) 184.32 RevPAR % Chg 0.4 Tasmania OCC(%) 75.1 ADR($) 172.90 RevPAR % Chg 3.4 *Financial-year performance: 2018-19 Accommodation type Class performance performance Hotels & Resorts Luxury & Upper Upscale Classes OCC(%) 75.9 OCC(%) 79.2 ADR($) 195.10 ADR($) 259.37 RevPAR % Chg -1.8 RevPAR % Chg -2.6 Motels/Private Hotels/Guest Houses Upscale & Upper Mid Classes OCC(%) 65.8 OCC(%) 73.6 ADR($) 145.30 ADR($) 165.71 RevPAR % Chg 0.6 RevPAR % Chg -2.5 Serviced Apartments Midscale & Economy Classes OCC(%) 73.6 OCC(%) 67.1 ADR($) 179.40 ADR($) 124.47 RevPAR % Chg -4.4 RevPAR % Chg -2.4 Holiday Parks Total for Australia OCC(%) OCC(%) 53.9 74.0 ADR($) ADR($) 143.07 186.57 RevPAR % Chg RevPAR % Chg 0.3 -2.4 *Financial-year performance: 2018-19 Tourism Regions Top Performers Bottom Performers State Tourism Region RevPAR % Chg. RevPAR 2018-2019 State Tourism Region RevPAR % Chg.