KFC Holdings Japan / 9873

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the Court of Chancery of the State of Delaware Kfc

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE KFC NATIONAL COUNCIL AND ) ADVERTISING COOPERATIVE, INC., ) ) Plaintiff, ) ) v. ) C.A. No. 5191-VCS ) ) ) KFC CORPORATION, ) ) Defendant. ) MEMORANDUM OPINION Date Submitted: November 13, 2010 Date Decided: January 31, 2011 Vernon R. Proctor, Esquire, Kurt M. Heyman, Esquire, Neal C. Belgam, Esquire, Melissa N. Donimirski, Esquire, PROCTOR HEYMAN LLP, Wilmington, Delaware; John K. Bush, Esquire, Janet P. Jakubowicz, Esquire, Mark T. Hayden, Esquire, Christie A. Moore, Esquire, Reva D. Campbell, Esquire, GREENEBAUM DOLL & MCDONALD PLLC, Louisville, Kentucky, Attorneys for Plaintiff. Kenneth J. Nachbar, Esquire, Megan Ward Cascio, Esquire, John A. Eakins, Esquire, MORRIS, NICHOLS, ARSHT & TUNNELL LLP; Layn R. Phillips, Esquire, David A. Schwarz, Esquire, Marshall A. Camp, Esquire, Garland A. Kelley, Esquire, IRELL & MANELLA LLP, Los Angeles, California, Attorneys for Defendant. STRINE, Vice Chancellor. I. Introduction Defendant Kentucky Fried Chicken Corporation (“KFCC”) and its franchisees are at odds over the authority the KFC National Council and Advertising Cooperative (“NCAC”) has to determine the national advertising strategy for the KFC brand. KFC is, of course, the moniker inspired by Colonel Harland Sanders’ famous creation, Kentucky Fried Chicken.1 The NCAC2 is a non-stock corporation that was founded over forty years ago and is licensed and authorized to serve as the advertising arm for the KFC brand in the United States, deploying advertising funds raised from KFC franchisees as part of their franchise agreements with KFCC. In lieu of a board of directors, the NCAC Committee (the “Committee”) serves as the NCAC’s governing body and consists of seventeen members, thirteen franchisee representatives and four KFCC representatives. -

KFC Holdings Japan / 9873

R KFC Holdings Japan / 9873 COVERAGE INITIATED ON: 2016.10.31 LAST UPDATE: 2018.12.07 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. KFC Holdings Japan / 9873 RCoverage LAST UPDATE: 2018.12.07 Research Coverage Report by Shared Research Inc. | www.sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 6 -

Fast Food Restaurants, Fast Casual Restaurants, and Casual Dining Restaurants

Commercial Revalue 2016 Assessment roll QUICK SERVICE RESTAURANTS AREA 413 King County, Department of Assessments Seattle, Washington John Wilson, Assessor Department of Assessments Accounting Division John Wilson 500 Fourth Avenue, ADM-AS-0740 Seattle, WA 98104-2384 Assessor (206) 205-0444 FAX (206) 296-0106 Email: [email protected] http://www.kingcounty.gov/assessor/ Dear Property Owners: Property assessments are being completed by our team throughout the year and valuation notices are being mailed out as neighborhoods are completed. We value your property at fee simple, reflecting property at its highest and best use and following the requirements of state law (RCW 84.40.030) to appraise property at true and fair value. We are continuing to work hard to implement your feedback and ensure we provide accurate and timely information to you. This has resulted in significant improvements to our website and online tools for your convenience. The following report summarizes the results of the assessments for this area along with a map located inside the report. It is meant to provide you with information about the process used and basis for property assessments in your area. Fairness, accuracy, and uniform assessments set the foundation for effective government. I am pleased to incorporate your input as we make continuous and ongoing improvements to best serve you. Our goal is to ensure every taxpayer is treated fairly and equitably. Our office is here to serve you. Please don’t hesitate to contact us if you should have questions, comments or concerns about the property assessment process and how it relates to your property. -

Happy Holidays!

FREE VOL. 16, NO. 30 The Gazette proudly serves El Cajon, Rancho San Diego, La Mesa, Lemon Grove, Ramona, Santee, Lakeside, Alpine, Jamul and the Back Country December 25-31, 2014 INSIDE THIS ISSUE Local ..................... 2-4 Inspirations ............... 6 East County Gazette wishes Health ...................... 5 Kids Page .................. 7 In the Community ...... 8 Entertainment ........... 9 everyone a Merry Christmas Meet Andy Puzzles ....................10 and his friends on Legals ................. 11-13 page 15 Classifieds ...............14 Best Friends .............15 Happy Holidays! $ .99 5Any Large Sub After 5 PM Everyday! Pickup only. No coupon required. 124 West Main St., El Cajon No limit. Not valid with any other coupons/ (Corner of Main & Magnolia) offers. Promotion expires Dec. 31, 2014 (619) 440-6512 The staff at the East County Gazette would like to take this opportunity to wish everyone a very Merry Christmas, a Happy Hanukkah and Kwanzaa. Let us all celebrate in peace and love this holiday season. East County GAZETTE PAGE 2 EAST COUNTY GAZETTE DECEMBER 25, 2014 Local News & Events enator Anderson’s Alpine Fire Board members sworn in SCorner our of the five Board All four incumbents; Patrick Members of the Al- Price, Martin Marugg, Jim Heartland Fire Fpine Fire Protection Easterling and Mary Fritz District were sworn into office and their seats were up for and Rescue Home for additional terms at the election in November. How- December 16 board meeting. ever no one entered the race Escape Plan Fire At the meeting, District legal to oppose the incumbents, council Steve Fitch, adminis- so they were officially re- Poster Contest tered the oath of office to all appointed by the San Diego Senator Joel Anderson four at the same time. -

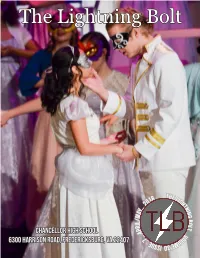

The Lightning Bolt

The Lightning Bolt 8 THE L 01 IGH . 2 T .. N y IN a G m B / O l i L T r p . A . V Chancellor High school . O . l 7 u . m e e u 6300 Harrison road, fredericksburg, va 22407 3 S S 0 I 1 April/May 2018 Mrs. Gattie Adviser Tyler Jacobs Editor-in-Chief Photo by Sarah Ransom and Naomi Nichols in the forefront, Jaime Ericson attends the Prince’s Ball in our spring makayla tardie dancing as townspeople. production of Cinderella Co-Editor-in-Chief/ Design editor Elizabeth Owusu News Editor becca Alicandro Photo by Makayla Tardie Photo by Lifetouch Ladies of the ball lament with one of Cinderella’s Kaitlyn Schwinn in action during a game. Features Editor stepsisters, played by Olivia Royster. Savannah Aversa Junior sports editor Ava purcell Junior op-ed editor Photo by TLB Staff Photo by TLB Staff The baseball team circles up in preparation before their game. Taylor sullivan Staff reporter Gynger adams staff reporter Photo by Makayla Tardie Photo by Molly McMullen Katelyn Siget and Molly McMullen chilling out at an Makayla Tardie, Natalie Masaitis, and Katelyn Siget art museum in D.C. taking a journey on the art field trip. April/May 2018 2 Editorials Going Beyond and Saying Goodbye By Tyler Jacobs indeed. longer be a Chancellor Charger, remain consistent and to always Editor-in-Chief While I am anxious to instead I’ll be transitioning to a have a smile for another person So here we are at the end of the pursue these paths, there is a Rowan Prof. -

Kentucky Fried Chicken Long Term Lease | Annual Rent Increases

INVESTMENT OPPORTUNITY KENTUCKY FRIED CHICKEN LONG TERM LEASE | ANNUAL RENT INCREASES GALLUP,ST. PAUL, NMMN OFFERED AT: $1,228,000 | 5.75% CAP EXECUTIVE SUMMARY PROPERTY INFORMATION TENANT OVERVIEW AREA OVERVIEW TABLE OF CONTENTS EXECUTIVE SUMMARY 4 Offering Summary 5 Investment Highlights 6 Lease Summary & Rent Overview 7 Lease Abstract PROPERTY INFORMATION 9 Location Maps 10 Site Plan 11 Property Photos 13 Neighboring Tenants 14 Aerials TENANT OVERVIEWS 20 About Kentucky Fried Chicken AREA OVERVIEW 22 Gallup Overview 23 Demographics Confidentiality Agreement & Disclosures EXCLUSIVELY REPRESENTED BY RYAN BARR RYAN BENNETT Principal Principal 760.448.2446 760.448.2449 [email protected] [email protected] AL APUZZO Principal 760.448.2442 [email protected] Color Scheme RGB R:145 / G:0 / B:40 CMYK C:0 / M:100 / Y:65 / K:47 RGB R:119 / G:120 / B:123 CMYK C:0 / M:0 / Y:0 / K65 Fonts GOTHAM/ BLACK GOTHAM/ MEDIUM GOTHAM/ LIGHT BROKER OF RECORD: Listed in conjunction with JDS Real Estate Services NM Broker’s Lic#08838 KENTUCKY FRIED CHICKEN | Gallup, NM | 2 EXECUTIVE SUMMARY KENTUCKY FRIED CHICKEN | GALLUP, NM EXECUTIVE SUMMARY PROPERTY INFORMATION TENANT OVERVIEW AREA OVERVIEW • Offering Summary • Investment Highlights Lease Summary & Rent Overview Lease Abstract -- OFFERING SUMMARY -- INVESTMENT HIGHLIGHTS Offering Price: $1,228,000 Net Operating Income: $70,583 Cap Rate: 5.75% Price/SF: $494 PROPERTY OVERVIEW 2504 East Highway 66 Address: Gallup, NM 87301 Property Size: Approx 2,485 sq ft Land Size: 0.695 Acres Ownership: Fee Simple Year Built: 1992 / Renovated 2014 Lee & Associates is pleased to exclusively offer for sale to qualified investors the opportunity to purchase a 100% fee-simple interest in a Kentucky Fried Chicken (“KFC”) property located at 2504 East Highway 66 in Gallup, New Mexico. -

Marketing Plan for a Fast Food Restaurant in Helsinki, Finland

Marketing Plan for a Fast Food Restaurant in Helsinki, Finland Case: Aloha Chicken Land, Helsinki, Finland LAHTI UNIVERSITY OF APPLIED SCIENCES Faculty of Business and Hospitality Degree programme in International Business Bachelor’s Thesis Spring 2018 Quynh Nguyen Lahti University of Applied Sciences Degree Programme in International Business NGUYEN, QUYNH Marketing plan for a fast food restaurant in Helsinki, Finland Case: Aloha Chicken Land, Helsinki, Finland Bachelor’s Thesis in International Business, 99 pages, 3 pages of appendices Spring 2018 ABSTRACT The aim of this thesis was to create a marketing plan for Aloha Chicken Land, a start-up fast food restaurant in Helsinki. As a start-up business, the restaurant needs a marketing plan to help it launch successfully. The objectives of the marketing plan were to analyse the internal and external environment of the business, raise the brand awareness, attract more customers and provide the restaurant with a practical and solid plan based on the four factors of the marketing mix which are price, place, product and promotion. The theories of this thesis consist of two parts. First, essential marketing theories which are used as principles to develop an effective marketing plan are presented logically. Second, theories which are used to analyse the current situations including the company, the competitors, the customers, PESTEL and SWOT are described thoroughly. The empirical part of this thesis presents the data collection procedures as well as the data analysis from the interviews and the questionnaire. Both quantitative and qualitative research methods are applied along with inductive research approach in order to serve the purpose of this thesis. -

Customer Satisfaction on Kfc Company in Cambodia

CUSTOMER SATISFACTION ON KFC COMPANY IN CAMBODIA Mr. PHARATT RUN ID: 5817192038 SUBMITTED IN THE PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE DEGREE OF MASTER IN BUSINESS ADMINISTRATION GRADUATE SCHOOL SIAM UNIVERSITY BANGKOK, THAILAND 2017 iv ACKNOWLEDGEMENT First of all, I would like to express my gratitude to Dr. Vijit Dupinij, Dean, Graduate School of Business, Siam University, Bangkok, Thailand who has devoted a lot of valuable time, shared his experience, knowledge, gave suggestion and guidance me to wrote my Independent Study. Second, I would like to say thanks to my parents, brothers and my sister especially my mother Mrs. Bou Ngo who supported me for study in Thailand. She always say to me do not give up when you face with the problem. Finally, I would like to say thanks to all lecturer and friends in Siam University who provided me the knowledge and help me in during of study. v TABLE OF CONTENTS ABSTRACT iii ACKNOWLEDGEMENT iv TABLE OF CONTENTS v Chapter I : Introduction Page 1. 1 Background 1 1.2 Objective Of Study 2 1.3 Conceptual Framework 3 1.4 Hypothesis 3 1.5 The limitations of this study 3 Chapter Ⅱ: Literature Review 4 1. The Related Theories 5 1.1 Consumer Behaviors Definition 5 1.2 Consumer Perception 19 1.3 Segmenting Consumer Markets 22 1.4 Marketing Positioning 22 1.5 Marketing Strategy 23 1.6 Customer Behavior 27 1.7 Customer Expectations and Satisfactions 31 2. Related Research 31 Chapter Ⅲ 32 3.1 Research Methology 32 3.2 Population and Sample 32 3.3 Research Instrument 32 3.4 Statistic Analysis 33 Chapter Ⅳ: Research Findings 34 4.1 Demographic Profile 34 vi 4.2 The Perceptions of the Patrons toward the Selected KFC Food 37 4.3 The Three most Important Factors that Influence Repeat Customers 44 Chapter Ⅴ: Conclusions and Recommendations 46 5.1 Conclusions 46 5.2 Recommendations for Further Study 46 REFFERENCES 48 APPENDIX 49 1 CHAPTER I INTRODUCTION 1.1 Background Globally, fast food make money of over $570 billion - that is much more than the economic value of most countries. -

Research Dynamics Sample Report

Table of Contents Page I. Background and Objectives...................................................................................... 1 II. Methodology............................................................................................................. 2 III. Summary of Findings................................................................................................ 3 IV. Conclusions............................................................................................................... 6 V. Detailed Findings A. Unaided Awareness Of Fast-Food Restaurants That Serve Fried Chicken................................................................................... 11 B. Usage Of Fast-Food Restaurants For Fried Chicken ......................................... 13 C. Change In Visitation To Restaurants.................................................................. 15 D. Reasons For Change In Visits To Restaurant A ................................................ 16 E. Restaurant A Customer Profile........................................................................... 28 F. Rating Of Primary Fast-Food Restaurant For Fried Chicken............................................................................................... 34 G. Overall Opinion Of Restaurant A....................................................................... 37 H. Sample Demographic Profile ............................................................................. 38 VI. Appendix Background and Objectives As it develops various marketing -

Yum! Brands 2002 Annual Report

YUM_covers_7a.qxd 3/18/03 7:54 PM Page 1 Pull Yum! up to you! seata for a serving of customer mania. Yum! Brands Alone we’re delicious. Together we’re 2002 ANNUAL REPORT ® ® 1. FINANCIAL HIGHLIGHTS (in millions, except for store and per share amounts) % B(W) Number of stores: 2002 2001 change Company 7,526 6,435 17 Unconsolidated affiliates 2,148 2,000 7 Franchisees 20,724 19,263 8 Licensees 2,526 2,791 (9) Total stores 32,924 30,489 8 Total revenues $ 7,757 $ 6,953 12 U.S. ongoing operating profit $ 825 $ 722 14 International ongoing operating profit 389 318 22 Unallocated and corporate expenses (178) (148) (20) Unallocated other income (expense) (1) (3) 59 Ongoing operating profit 1,035 889 16 Facility actions net (loss) (32) (1) NM Unusual items income 27 3NM Operating profit $ 1,030 $ 891 16 Net income $ 583 $ 492 18 Diluted earnings per common share(a): Ongoing $ 1.91 $ 1.61 19 Facility actions net (loss) (0.09) 0.01 NM Unusual items income 0.06 –NM Reported $ 1.88 $ 1.62 16 Cash flows provided by operating activities $ 1,088 $ 832 31 (a) Per share amounts have been adjusted to reflect the two-for-one stock split distributed on June 17, 2002. AVERAGE U.S. SALES PER SYSTEM UNIT(a) (in thousands) 5-year 2002 2001 2000 1999 1998 growth(b) KFC $ 898 $ 865 $ 833 $ 837 $ 817 3% Pizza Hut 748 724 712 696 645 3% Taco Bell 964 890 896 918 931 1% (a) Excludes license units. -

Shake Shack Inc. (SHAK) Is an American-Born Premium Fast- Company Data

THE FINAL PAGE OF THIS REPORT CONTAINS A DETAILED DISCLAIMER The content and opinions in this report are written by university students from the CityU Student Research & Investment Club, and thus are for reference only. Investors are fully responsible for their investment decisions. CityU Student Research & Investment Club is not responsible for any direct or indirect loss resulting from investments referenced to this report. The opinions in this report constitute the opinion of the CityU Student Research & Investment Club and do not constitute the opinion of the City University of Hong Kong nor any governing or student body or department under the University. Rating HOLD October 14th, 2019 Price (10/19/2019 USD) 88.49 Target price (USD) 77.85 Americas % down from Price on 10/19/2019 12.02% Equity Research Market cap. (USD, b) 03.30 Restaurants Enterprise Value (USD b) 03.24 Stock ratings are relative to the coverage universe in each analyst's or each team's respective sector. Target price is for SHAKE SHACK INCORPORATED (SHAK:NYSE) 12 months. Research Analysts: Our analysis on ‘Shake Shack’ (from hereupon referred to as “Shake Shack”, Murtaza Salman Abedin “Shack” or “SHAK”) is Discounted Cash Flow valuation-driven. Shake +852 59858568 [email protected] Shack is a growing brand with rapidly rising potential, however being a small company it still faces various growth-oriented challenges. Our Daria Yong-Tong Yip [email protected] Valuation gives SHAK a fair share value of USD 77.85 (HOLD) and this Samya Malhotra has been calculated through a DCF valuation of the 5-Year forecast period [email protected] ranging from 2019E to 2023E. -

Foreign Direct Investment in the Processed Food Sector

CHAPTER 3 Foreign Direct Investment in the Processed Food Sector The Concept and Scope of Foreign Direct Investment In addition to trade in goods themselves, such as processed foods, there is a large volume of international exchange of capital and technology used for food manufacturing and distribution. Modern measures of a country’s or a firm’s international competitiveness incorporate sales from foreign affiliates of home-country firms in addition to international trade (Horstmann and Markusen 1987, Kravis and Lipsey 1992, Porter 1990). Foreign affiliation can occur in various ways: license production to a foreign firm, franchise a foreign firm to market products under the home firm’s trademark, acquire a minority interest in a foreign firm, develop a joint venture with a foreign partner, or obtain complete or majority ownership of foreign operations. For purposes of this report, foreign direct investment (FDI) refers to investment in a foreign affiliate. The term “foreign affiliate” is used to identify a foreign entity in which a parent firm holds a substantial (but not necessarily majority) ownership interest. Parent firms are referred to as multinational firms or corporations (MNC’s). U.S. firms’ investing in production facilities in other countries is known as outbound FDI, while foreign firms’ investing in facilities located in the United States is known as inbound FDI. Foreign direct investment is distinctly different from foreign portfolio investments and other international capital flows such as bank deposits. Portfolio investment takes a passive management role and does not seek control over decisionmaking within the firm. Foreign direct investment, by contrast, is defined as the ownership of assets in an affiliate by a foreign firm for the purpose of exercising control over the use of those assets.