Embracer Group Subsidiary THQ Nordic Sets up Development Studio Nine Rocks Games in Bratislava, Slovakia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Redeye-Gaming-Guide-2020.Pdf

REDEYE GAMING GUIDE 2020 GAMING GUIDE 2020 Senior REDEYE Redeye is the next generation equity research and investment banking company, specialized in life science and technology. We are the leading providers of corporate broking and corporate finance in these sectors. Our clients are innovative growth companies in the nordics and we use a unique rating model built on a value based investment philosophy. Redeye was founded 1999 in Stockholm and is regulated by the swedish financial authority (finansinspektionen). THE GAMING TEAM Johan Ekström Tomas Otterbeck Kristoffer Lindström Jonas Amnesten Head of Digital Senior Analyst Senior Analyst Analyst Entertainment Johan has a MSc in finance Tomas Otterbeck gained a Kristoffer Lindström has both Jonas Amnesten is an equity from Stockholm School of Master’s degree in Business a BSc and an MSc in Finance. analyst within Redeye’s tech- Economic and has studied and Economics at Stockholm He has previously worked as a nology team, with focus on e-commerce and marketing University. He also studied financial advisor, stockbroker the online gambling industry. at MBA Haas School of Busi- Computing and Systems and equity analyst at Swed- He holds a Master’s degree ness, University of California, Science at the KTH Royal bank. Kristoffer started to in Finance from Stockholm Berkeley. Johan has worked Institute of Technology. work for Redeye in early 2014, University, School of Business. as analyst and portfolio Tomas was previously respon- and today works as an equity He has more than 6 years’ manager at Swedbank Robur, sible for Redeye’s website for analyst covering companies experience from the online equity PM at Alfa Bank and six years, during which time in the tech sector with a focus gambling industry, working Gazprombank in Moscow he developed its blog and on the Gaming and Gambling in both Sweden and Malta as and as hedge fund PM at community and was editor industry. -

25 Jahre Koch Media – Ein Jubiläum (PDF Download)

25 JAHRE KOCH MEDIA - EIN JUBILÄUM Während Unternehmen in manch anderen Branchen mit 25 Und so ist die Entwicklung von Koch Media in den vergange- Jahren noch zu den Newcomern zählen würden, ist diese nen 25 Jahren auch ein Mutmacher: Sie zeigt, dass man mit Zeitspanne in der Entertainment-Branche kaum zu überbli- der Entwicklung und dem Vertrieb von Games auch in und cken. Zu schnell kommen und gehen Trends und mit ihnen aus Deutschland heraus enorm erfolgreich sein kann. häufig auch ganze Unternehmen. Das gilt ganz besonders für die Games-Branche, die zwar seit vielen Jahren stark Koch Media hat sich in den vergangenen 25 Jahren zu einem wächst, deren dynamische Entwicklung aber selbst Bran- integralen Bestandteil der deutschen Games-Branche ent- chen-Urgesteine von Zeit zu Zeit überfordert. Das 25-jähri- wickelt. Als Gründungsmitglied des BIU – Bundesverband ge Jubiläum von Koch Media ist daher ein Meilenstein, der Interaktive Unterhaltungssoftware und mit Dr. Klemens Kun- gar nicht hoch genug geschätzt werden kann. dratitz als aktivem Vorstand des Verbandes hat sich Koch Media immer für die Themen der Branche und die Weiter- Die Erfolgsgeschichte von Koch Media ist auch mit dem entwicklung der gamescom engagiert. Seit vielen Jahren ist Blick auf ihren Entstehungsort einmalig. Die Geschichte der Koch Media Partner von Spiele-Entwicklern in Deutschland deutschen Games-Branche ist sehr wechselhaft, nur wenige wie aktuell von King Art oder hat eigene Studios wie Deep Unternehmen schaffen es über viele Jahre, hier Games zu Silver Fishlabs. Doch darf man das Unternehmen nicht nur entwickeln und zu verlegen. Das Image von Games hat sich auf seine Rolle in Deutschland beschränken: Mit Niederlas- erst in den vergangenen Jahren verbessert und war zuvor sungen in allen europäischen Kernmärkten, in Nordamerika allzu lange von Klischees bestimmt. -

Embracer Group Acquires Easy Trigger

Press release Karlstad, Sweden, 5 August 2021 Embracer Group acquires Easy Trigger Embracer Group AB (“Embracer”) through its wholly owned subsidiary Coffee Stain Studios AB ("Coffee Stain"), have entered into an agreement to acquire 100 percent of the shares in Easy Trigger AB ("Easy Trigger"), the studio behind the critically acclaimed title Huntdown. “We have worked with Easy Trigger for a couple of years already on the Huntdown game and are impressed with talent within the studio. We will continue to work closely with the team and are excited welcome them into the Embracer family”, says Anton Westbergh, Co-founder and CEO Coffee Stain. Background and rationale Easy Trigger is a development studio founded in 2016, with headquarters located in Trollhättan, Sweden. The studio consists of 5 employees that have collaborated with Coffee Stain on the development and release of the critically acclaimed indie title Huntdown. Easy Trigger is led by co-founder and CEO Tommy Gustafsson, and co- founder and lead programmer Andreas Renberg. The company was wholly owned by the two co-founders who will remain in their current roles post-transaction. Through the acquisition, Coffee Stain onboards a talented team that will boost the development of 1st party IP within the group. Going forward, Easy Trigger will collaborate with Coffee Stain to continue working on the Huntdown IP as well as creating new original indie titles. “We look forward to continuing our partnership with Coffee Stain and further leverage the knowledge and experience within the entire Embracer Group, to accelerate growth within Easy Trigger and continue to make great games” says Tommy Gustafsson, Co-founder and CEO Easy Trigger. -

OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 EXTENDED FINANCIAL YEAR REPORT • 1 JAN 2018 – 31 MAR 2019 OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION JANUARY–MARCH 2019 JANUARY 2018–MARCH 2019, 15 MONTHS (Compared to January–March 2018) (Compared to full year 2017) > Net sales increased 158% to SEK 1,630.5 m > Net sales increased to SEK 5,754.1 m (507.5). (632.9). > EBITDA increased to SEK 1,592.6 m (272.6), > EBITDA increased 174% to SEK 618.6 m (225.9), corresponding to an EBITDA margin of 28%. corresponding to an EBITDA margin of 38%. > Operational EBIT increased to SEK 897.1 m > Operational EBIT increased 217% to SEK 395.9 m (202.3) corresponding to an Operational EBIT (124.9) corresponding to an Operational EBIT margin of 16%. margin of 24%. > Cash flow from operating activities amounted > Cash flow from operating activities amounted to SEK 1,356.4 m (179.1). to SEK 777.2 m (699.8). > Earnings per share was SEK 4.68 (1.88). > Earnings per share was SEK 1.10 (1.02). > As of 31 March 2019, cash and cash equivalents were SEK 2,929.1 m. Available cash including credit facilities was SEK 4,521.1 m. KEY PERFORMANCE INDICATORS, Jan-Mar Jan-Mar Jan 2018- Jan-Dec GROUP 2019 2018 Mar 2019 2017 Net sales, SEK m 1,630.5 632.9 5,754.1 507.5 EBITDA, SEK m 618.6 225.9 1,592.6 272.6 Operational EBIT, SEK m 395.9 124.9 897.1 202.3 EBIT, SEK m 172.0 107.3 574.6 188.2 Profit after tax , SEK m 103.0 81.1 396.8 139.2 Cash flow from operating activities, SEK m 777.2 699.8 1,356.4 179.1 Sales growth, % 158 673 1,034 68 EBITDA margin, % 38 36 28 54 Operational EBIT margin, % 24 20 16 40 Throughout this report, the extended financial year 1 January 2018 – 31 March 2019 is compared with the financial year 1 January – 31 December 2017. -

THQ Nordic AB (Publ) Acquires Koch Media

THQ Nordic AB (publ) acquires Koch Media Investor Presentation February 14, 2018 Acquisition rationale AAA intellectual property rights Saints Row and Dead Island Long-term exclusive licence within Games for “Metro” based on books by Dmitry Glukhovsky 4 AAA titles in production including announced Metro Exodus and Dead Island 2 2 AAA studios Deep Silver Volition (Champaign, IL) and Deep Silver Dambuster Studios (Nottingham, UK) #1 Publishing partner in Europe for 50+ companies Complementary business models and entrepreneurial cultural fit Potential revenue synergy and strong platform for further acquisitions EPS accretive acquisition to THQ Nordic shareholders 2 Creating a European player of great scale Internal development studios1 7 3 10 External development studios1 18 8 26 Number of IPs1 91 15 106 Announced 12 5 17 Development projects1 Unannounced 24 9 33 Headcount (internal and external)1 462 1,181 1,643 Net sales 2017 9m, Apr-Dec SEK 426m SEK 2,548m SEK 2,933m2 Adj. EBIT 2017 9m, Apr-Dec SEK 156m SEK 296m3 SEK 505m2,3 1) December 31, 2017. 2) Pro forma. 3) Adjusted for write-downs of SEK 552m. Source: Koch Media, THQ Nordic 3 High level transaction structure THQ Nordic AB (publ) Koch Media Holding GmbH, seller (Sweden) (Germany) Purchase price EUR 91.5m 100% 100% SALEM einhundertste Koch Media GmbH, Operations Holding GmbH operative company (Austria) 100% (Austria) Pre-transaction Transaction Transaction information . Purchase price of EUR 91.5m – EUR 66m in cash paid at closing – EUR 16m in cash paid no later than August 14, 2018 – EUR 9.5m in shares paid no later than June 15, 2018 . -

Video Games and the Mobilization of Anxiety and Desire

PLAYING THE CRISIS: VIDEO GAMES AND THE MOBILIZATION OF ANXIETY AND DESIRE BY ROBERT MEJIA DISSERTATION Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Communications in the Graduate College of the University of Illinois at Urbana-Champaign, 2012 Urbana, Illinois Doctoral Committee: Professor Kent A. Ono, Chair Professor John Nerone Professor Clifford Christians Professor Robert A. Brookey, Northern Illinois University ABSTRACT This is a critical cultural and political economic analysis of the video game as an engine of global anxiety and desire. Attempting to move beyond conventional studies of the video game as a thing-in-itself, relatively self-contained as a textual, ludic, or even technological (in the narrow sense of the word) phenomenon, I propose that gaming has come to operate as an epistemological imperative that extends beyond the site of gaming in itself. Play and pleasure have come to affect sites of culture and the structural formation of various populations beyond those conceived of as belonging to conventional gaming populations: the workplace, consumer experiences, education, warfare, and even the practice of politics itself, amongst other domains. Indeed, the central claim of this dissertation is that the video game operates with the same political and cultural gravity as that ascribed to the prison by Michel Foucault. That is, just as the prison operated as the discursive site wherein the disciplinary imaginary was honed, so too does digital play operate as that discursive site wherein the ludic imperative has emerged. To make this claim, I have had to move beyond the conventional theoretical frameworks utilized in the analysis of video games. -

THQ Nordic Acquires Coffee Stain

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES, AUSTRALIA, CANADA, NEW ZEALAND, HONG KONG, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL OR WOULD REQUIRE REGISTRATION OR ANY OTHER MEASURES. Press release Karlstad (Sweden), November 14, 2018 THQ Nordic acquires Coffee Stain THQ Nordic AB today has entered into agreement to acquire Coffee Stain Holding AB including 100 percent of its subsidiary Coffee Stain Publishing AB. Coffee Stain is a leading game developer and publisher with a growing footprint in the Nordics. The acquisition includes Intellectual property rights to Satisfactory, Goat Simulator, Sanctum and publishing rights to Deep Rock Galactic. The initial cash consideration is equivalent to SEK 317 million on a cash and debt free basis, plus additional earn-out considerations subject to fulfilment of agreed milestones. THQ Nordic estimates Coffee Stain will have net sales in the range of SEK 200-250 million and EBT in the range of SEK 100-150 million in the next financial year. "We are creating a complementary digital native pillar to THQ Nordic. Coffee Stain is a passionate and highly competent team creating and publishing great games. After some years without major releases the pipeline of new game releases such as Satisfactory and Deep Rock Galactic look strong. I look forward to work together with Anton Westbergh and his team in the future" says Lars Wingefors, CEO THQ Nordic. The transaction in brief • THQ Nordic AB ("THQ Nordic" or the "Company") acquires 100 percent of the shares in both Coffee Stain Holding AB ("CSH") and Coffee Stain Publishing AB ("CSP") (CSH and CSP jointly referred to as "Coffee Stain"). -

The Intellectual Functions of Gothic Fiction

University of New Hampshire University of New Hampshire Scholars' Repository Doctoral Dissertations Student Scholarship Spring 1977 FEARFUL QUESTIONS, FEARFUL ANSWERS: THE INTELLECTUAL FUNCTIONS OF GOTHIC FICTION PAUL LEWIS Follow this and additional works at: https://scholars.unh.edu/dissertation Recommended Citation LEWIS, PAUL, "FEARFUL QUESTIONS, FEARFUL ANSWERS: THE INTELLECTUAL FUNCTIONS OF GOTHIC FICTION" (1977). Doctoral Dissertations. 1160. https://scholars.unh.edu/dissertation/1160 This Dissertation is brought to you for free and open access by the Student Scholarship at University of New Hampshire Scholars' Repository. It has been accepted for inclusion in Doctoral Dissertations by an authorized administrator of University of New Hampshire Scholars' Repository. For more information, please contact [email protected]. INFORMATION TO USERS This material was produced from a microfilm copy of the original document. While the most advanced technological means to photograph and reproduce this document have been used, the quality is heavily dependent upon the quality of the original submitted. The following explanation of techniques is provided to help you understand markings or patterns which may appear on this reproduction. 1.The sign or “target" for pages apparently lacking from the document photographed is "Missing Page(s)". If it was possible to obtain the missing page(s) or section, they are spliced into the film along with adjacent pages. This may have necessitated cutting thru an image and duplicating adjacent pages to insure you complete continuity. 2. When an image on the film is obliterated with a large round black mark, it is an indication that the photographer suspected that the copy may have moved during exposure and thus cause a blurred image. -

William Hope Hodgson's Borderlands

William Hope Hodgson’s borderlands: monstrosity, other worlds, and the future at the fin de siècle Emily Ruth Alder A thesis submitted in partial fulfilment of the requirements of Edinburgh Napier University, for the award of Doctor of Philosophy May 2009 © Emily Alder 2009 Contents Acknowledgements 3 Abstract 4 Introduction 5 Chapter One. Hodgson’s life and career 13 Chapter Two. Hodgson, the Gothic, and the Victorian fin de siècle: literary 43 and cultural contexts Chapter Three. ‘The borderland of some unthought of region’: The House 78 on the Borderland, The Night Land, spiritualism, the occult, and other worlds Chapter Four. Spectre shallops and living shadows: The Ghost Pirates, 113 other states of existence, and legends of the phantom ship Chapter Five. Evolving monsters: conditions of monstrosity in The Night 146 Land and The Boats of the ‘Glen Carrig’ Chapter Six. Living beyond the end: entropy, evolution, and the death of 191 the sun in The House on the Borderland and The Night Land Chapter Seven. Borderlands of the future: physical and spiritual menace and 224 promise in The Night Land Conclusion 267 Appendices Appendix 1: Hodgson’s early short story publications in the popular press 273 Appendix 2: Selected list of major book editions 279 Appendix 3: Chronology of Hodgson’s life 280 Appendix 4: Suggested map of the Night Land 281 List of works cited 282 © Emily Alder 2009 2 Acknowledgements I sincerely wish to thank Dr Linda Dryden, a constant source of encouragement, knowledge and expertise, for her belief and guidance and for luring me into postgraduate research in the first place. -

THQ Nordic (THQNO.ST)

COMPANY ANALYSIS 1 March 2018 Summary THQ Nordic (THQNO.ST) List: Power-up! Market Cap: 11,190 MSEK The company had an immense release schedule with loads of Industry: Gaming new content during the quarter. The reported numbers beat CEO: Lars Wingefors Chairman: Kicki Wallje-Lund our estimates. Even though that THQ Nordic produced a record quarter, the thing stole the spotlight was the announcement of the acquisition of Koch Media; we get into OMXS 30 THQ Nordic detail about the acquired company in this research update. 160 The acquisition is a prime example of THQ Nordic’s 140 acquisition strategy. We believe that the market is yet to fully 120 100 grasp the underlying value and cash flow generating 80 capabilities of THQ Nordic’s growing IP portfolio, which was 60 enhanced significantly by the acquirement. 40 20 We raised our Base-case valuation to 140 SEK per share 0 28-Feb 29-May 27-Aug 25-Nov 23-Feb based on a Back-Of-The-Envelope assessment on the same day as the acquisition. Following a more in-depth analysis, we increase our fair value estimate further to 168 SEK per share. We argue that the new addition to the Group was acquired at a low price and that the long-term possibilities following the purchase are vast. Redeye Rating (0 – 10 points) Management Ownership Profit outlook Profitability Financial strength 8.0 points 9.0 points 7.0 points 6.0 points 8.0 points Key Financials 2016 2017 2018E 2019E 2020E Share information Revenue, MSEK 302 508 3,666 3,909 4,300 Share price (SEK) 141.0 Growth 42% 68% 622% 7% 10% Number of shares (m) 79.4 EBITDA 132 273 929 1,009 1,212 Market Cap (MSEK) 11,190 EBITDA margin 44% 54% 25% 26% 28% Net cash (MSEK) 255 EBIT 95 188 616 696 849 Free float (%) 50 % EBIT margin 31% 37% 17% 18% 20% Daily turnover (’000) 60 Pre-tax earnings 93 182 616 696 849 Net earnings 72 139 480 543 662 Net margin 24% 27% 13% 14% 15% Analysts: Kristoffer Lindstrom 2016 2017 2018E 2019E 2020E [email protected] Dividend/Share 0.00 0.00 0.00 0.00 2.50 2016 2017 2018E 2019E 2020E EPS adj. -

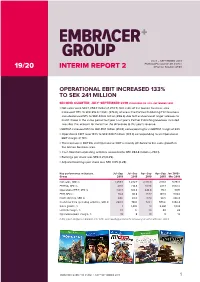

19/20 Interim Report 2 Reg No

JULY – SEPTEMBER 2019 EMBRACER GROUP AB (PUBL) 19/20 INTERIM REPORT 2 REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 133% TO SEK 241 MILLION SECOND QUARTER, JULY–SEPTEMBER 2019 (COMPARED TO JULY–SEPTEMBER 2018) > Net sales were SEK 1,259.7 million (1,272.7). Net sales of the Games business area increased 117% to SEK 816.0 million (376.0), whereas the Partner Publishing/Film business area decreased 51% to SEK 443.6 million (896.6) due to the absence of larger releases to match those in the same period last year. Last year’s Partner Publishing revenues included two titles that account for more than the difference to this year’s revenue. > EBITDA increased 95% to SEK 418.1 million (214.8), corresponding to an EBITDA margin of 33%. > Operational EBIT rose 133% to SEK 240.7 million (103.4) corresponding to an Operational EBIT margin of 19%. > The increase in EBITDA and Operational EBIT is mainly attributed to the sales growth in the Games business area. > Cash flow from operating activities amounted to SEK 284.8 million (–740.1). > Earnings per share was SEK 0.21 (0.25). > Adjusted earnings per share was SEK 0.65 (0.28). Key performance indicators, Jul–Sep Jul–Sep Apr–Sep Apr–Sep Jan 2018– Group 2019 2018 2019 2018 Mar 2019 Net sales, SEK m 1,259.7 1,272.7 2,401.8 2,110.1 5,754.1 EBITDA, SEK m 418.1 214.8 807.6 421.7 1,592.6 Operational EBIT, SEK m 240.7 103.4 444.8 173.1 897.1 EBIT, SEK m 76.4 90.8 157.7 143.3 574.6 Profit after tax, SEK m 64.6 65.0 117.4 98.5 396.8 Cash flow from operating activities, SEK m 284.8 –740.1 723.1 –575.6 1,356.4 Sales growth, % –1 1,403 14 2,281 1,034 EBITDA margin, % 33 17 34 20 28 Operational EBIT margin, % 19 8 19 8 16 In this report, all figures in brackets refer to the corresponding period of the previous year, unless otherwise stated. -

Jordanes and the Invention of Roman-Gothic History Dissertation

Empire of Hope and Tragedy: Jordanes and the Invention of Roman-Gothic History Dissertation Presented in Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy in the Graduate School of The Ohio State University By Brian Swain Graduate Program in History The Ohio State University 2014 Dissertation Committee: Timothy Gregory, Co-advisor Anthony Kaldellis Kristina Sessa, Co-advisor Copyright by Brian Swain 2014 Abstract This dissertation explores the intersection of political and ethnic conflict during the emperor Justinian’s wars of reconquest through the figure and texts of Jordanes, the earliest barbarian voice to survive antiquity. Jordanes was ethnically Gothic - and yet he also claimed a Roman identity. Writing from Constantinople in 551, he penned two Latin histories on the Gothic and Roman pasts respectively. Crucially, Jordanes wrote while Goths and Romans clashed in the imperial war to reclaim the Italian homeland that had been under Gothic rule since 493. That a Roman Goth wrote about Goths while Rome was at war with Goths is significant and has no analogue in the ancient record. I argue that it was precisely this conflict which prompted Jordanes’ historical inquiry. Jordanes, though, has long been considered a mere copyist, and seldom treated as an historian with ideas of his own. And the few scholars who have treated Jordanes as an original author have dampened the significance of his Gothicness by arguing that barbarian ethnicities were evanescent and subsumed by the gravity of a Roman political identity. They hold that Jordanes was simply a Roman who can tell us only about Roman things, and supported the Roman emperor in his war against the Goths.