BP Acquisition of BHP US Onshore Assets - Investor Call

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BHP Economic Contribution Report 2017 1 Chief Financial Officer’S Introduction

Economic Contribution Report 2017 We have a long-standing commitment to transparency. We are proud of the value we generate and how this contributes to building trust with the communities in which we operate. In this Report Chief Financial Officer’s Introduction 2 Tax and our 2017 Financial Statements 20 FY2017 Total economic contribution 3 Basis of Report preparation 21 Our contribution throughout the value chain 6 Glossary 22 Approach to transparency and tax 9 Independent auditor’s report to the Directors Our payments to governments 14 of BHP Billiton Plc and BHP Billiton Limited 23 Corporate Directory 24 BHP Billiton Limited. ABN 49 004 028 077. Registered in Australia. Registered office: 171 Collins Street, Melbourne, Victoria 3000, Australia. BHP Billiton Plc. Registration number 3196209. Registered in England and Wales. Registered office: Nova South, 160 Victoria Street London SW1E 5LB United Kingdom. Each of BHP Billiton Limited and BHP Billiton Plc is a member of the Group, which has its headquarters in Australia. BHP is a Dual Listed Company structure comprising BHP Billiton Limited and BHP Billiton Plc. The two entities continue to exist as separate companies but operate as a combined Group known as BHP. The headquarters of BHP Billiton Limited and the global headquarters of the combined Group are located in Melbourne, Australia. The headquarters of BHP Billiton Plc are located in London, United Kingdom. Both companies have identical Boards of Directors and are run by a unified management team. Throughout this publication, the Boards are referred to collectively as the Board. Shareholders in each company have equivalent economic and voting rights in the Group as a whole. -

Empirical Inference of Related Trading Between Two Securities: Detecting Pairs Trading, Merger Arbitrage, and Strategy Rules*

Empirical inference of related trading between two securities: Detecting pairs trading, merger arbitrage, and strategy rules* Keith Godfrey The University of Western Australia Working paper: 5 September 2013 The traditional approach to studying pairs trading is to simulate profitability using ex-post historical prices. I study the actual trades reported anonymously in security pairs and build statistical inferences of related trading. The approach is based on the time differences between trades. It can distinguish intrinsically related securities from pseudo-random sets, find stocks involved in merger arbitrage in massive sets of paired index constituents, and infer dominant trading rules of mean reversion algorithms. Empirical inference of related trading can enable further studies into pairs trading, strategy rules, merger arbitrage, and insider trading. Keywords: Inferred trading, empirical inference, pairs trading, merger arbitrage. JEL Classification Codes: G00, G10, C10, C40, C60 The availability of intraday trading or “tick” data with time resolution of a millisecond or finer is opening many avenues of research into financial markets. Analysis of two or more streams of tick data concurrently is becoming increasingly important in the study of multiple-security trading including index tracking, pairs trading, merger arbitrage, and market-neutral strategies. One of the greatest challenges in empirical trading research is the anonymity of reported trades. Securities exchanges report the dates, times, prices, and volumes traded, without identifying the traders. In studies of a single security, this introduces uncertainty of whether each market order that caused a trade was the buy or sell order, and there are documented approaches of inference such as Lee and Ready (1991). -

BP Code of Conduct – English

Our Code Our responsibility Code of Conduct Guiding you to make the right decisions Our values and behaviours are the foundation of our Code What we value Safety Safety is good business. Everything we do relies upon the safety of our workforce and the communities around us. We care about the safe management of the environment. We are committed to safely delivering energy to the world. Respect We respect the world in which we operate. It begins with compliance with laws and regulations. We hold ourselves to the highest ethical standards and behave in ways that earn the trust of others. We depend on the relationships we have and respect each other and those we work with. We value diversity of people and thought. We care about the consequences of our decisions, large and small, on those around us. Excellence We are in a hazardous business and are committed to excellence through the systematic and disciplined management of our operations. We follow and uphold the rules and standards we set for our company. We commit to quality outcomes, have a thirst to learn and to improve. If something is not right, we correct it. Courage What we do is rarely easy. Achieving the best outcomes often requires the courage to face difficulty, to speak up and stand by what we believe. We always strive to do the right thing. We explore new ways of thinking and are unafraid to ask for help. We are honest with ourselves and actively seek feedback from others. We aim for an enduring legacy, despite the short-term priorities of our world. -

19-1189 BP PLC V. Mayor and City Council of Baltimore

(Slip Opinion) OCTOBER TERM, 2020 1 Syllabus NOTE: Where it is feasible, a syllabus (headnote) will be released, as is being done in connection with this case, at the time the opinion is issued. The syllabus constitutes no part of the opinion of the Court but has been prepared by the Reporter of Decisions for the convenience of the reader. See United States v. Detroit Timber & Lumber Co., 200 U. S. 321, 337. SUPREME COURT OF THE UNITED STATES Syllabus BP P. L. C. ET AL. v. MAYOR AND CITY COUNCIL OF BALTIMORE CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR THE FOURTH CIRCUIT No. 19–1189. Argued January 19, 2021—Decided May 17, 2021 Baltimore’s Mayor and City Council (collectively City) sued various en- ergy companies in Maryland state court alleging that the companies concealed the environmental impacts of the fossil fuels they promoted. The defendant companies removed the case to federal court invoking a number of grounds for federal jurisdiction, including the federal officer removal statute, 28 U. S. C. §1442. The City argued that none of the defendants’ various grounds for removal justified retaining federal ju- risdiction, and the district court agreed, issuing an order remanding the case back to state court. Although an order remanding a case to state court is ordinarily unreviewable on appeal, Congress has deter- mined that appellate review is available for those orders “remanding a case to the State court from which it was removed pursuant to section 1442 or 1443 of [Title 28].” §1447(d). The Fourth Circuit read this provision to authorize appellate review only for the part of a remand order deciding the §1442 or §1443 removal ground. -

BP Plc Vs Royal Dutch Shell

FEBRUARY 2021 BP plc Vs Royal Dutch Shell 01872 229 000 www.atlanticmarkets.co.uk www.atlanticmarkets.co.uk BP Plc A Brief History BP is a British multinational oil and gas company headquartered in London. It is one of the world’s oil and gas supermajors. · 1908. The founding of the Anglo-Persian Oil Company, established as a subsidiary of Burmah Oil Company to take advantage of oil discoveries in Iran. · 1935. It became the Anglo-Iranian Oil Company · 1954. Adopted the name British Petroleum. · 1959. The company expanded beyond the Middle East to Alaska and it was one of the first companies to strike oil in the North Sea. · 1978. British Petroleum acquired majority control of Standard Oil of Ohio. Formerly majority state-owned. · 1979–1987. The British government privatised the company in stages between. · 1998. British Petroleum merged with Amoco, becoming BP Amoco plc, · 2000-2001. Acquired ARCO and Burmah Castrol, becoming BP plc. · 2003–2013. BP was a partner in the TNK-BP joint venture in Russia. Positioning BP is a “vertically integrated” company, meaning it’s involved in the whole supply chain – from discovering oil, producing it, refining it, shipping it, trading it and selling it at the petrol pump. BP has operations in nearly 80 countries worldwide and has around 18,700 service stations worldwide. Its largest division is BP America. In Russia, BP also own a 19.75% stake in Rosneft, the world’s largest publicly traded oil and gas company by hydrocarbon reserves and production. BP has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. -

Chapter 8: Colombia

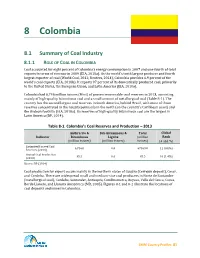

8 Colombia 8.1 Summary of Coal Industry 8.1.1 ROLE OF COAL IN COLOMBIA Coal accounted for eight percent of Colombia’s energy consumption in 2007 and one-fourth of total exports in terms of revenue in 2009 (EIA, 2010a). As the world’s tenth largest producer and fourth largest exporter of coal (World Coal, 2012; Reuters, 2014), Colombia provides 6.9 percent of the world’s coal exports (EIA, 2010b). It exports 97 percent of its domestically produced coal, primarily to the United States, the European Union, and Latin America (EIA, 2010a). Colombia had 6,746 million tonnes (Mmt) of proven recoverable coal reserves in 2013, consisting mainly of high-quality bituminous coal and a small amount of metallurgical coal (Table 8-1). The country has the second largest coal reserves in South America, behind Brazil, with most of those reserves concentrated in the Guajira peninsula in the north (on the country’s Caribbean coast) and the Andean foothills (EIA, 2010a). Its reserves of high-quality bituminous coal are the largest in Latin America (BP, 2014). Table 8-1. Colombia’s Coal Reserves and Production – 2013 Anthracite & Sub-bituminous & Total Global Indicator Bituminous Lignite (million Rank (million tonnes) (million tonnes) tonnes) (# and %) Estimated Proved Coal 6,746.0 0.0 67469.0 11 (0.8%) Reserves (2013) Annual Coal Production 85.5 0.0 85.5 10 (1.4%) (2013) Source: BP (2014) Coal production for export occurs mainly in the northern states of Guajira (Cerrejón deposit), Cesar, and Cordoba. There are widespread small and medium-size coal producers in Norte de Santander (metallurgical coal), Cordoba, Santander, Antioquia, Cundinamarca, Boyaca, Valle del Cauca, Cauca, Borde Llanero, and Llanura Amazónica (MB, 2005). -

Annual Review and Summary Financial Statements 2010 Shareholder Information Continued

Centrica plc Registered office: Millstream, Maidenhead Road, Windsor, Berkshire SL4 5GD Company registered in England and Wales No. 3033654 www.centrica.com Annual Review and Summary Financial Statements 2010 Shareholder Information continued SHAREHOLDER SERVICES Centrica shareholder helpline To register for this service, please call the shareholder helpline on 0871 384 2985* to request Centrica’s shareholder register is maintained by Equiniti, a direct dividend payment form or download it from which is responsible for making dividend payments and www.centrica.com/shareholders. 01 10 updating the register. OVERVIEW SUMMARY OF OUR BUSINESS The Centrica FlexiShare service PERFORMANCE If you have any query relating to your Centrica shareholding, 01 Chairman’s Statement please contact our Registrar, Equiniti: FlexiShare is a ‘corporate nominee’, sponsored by Centrica and administered by Equiniti Financial Services Limited. It is 02 Our Performance 10 Operating Review Telephone: 0871 384 2985* a convenient way to manage your Centrica shares without 04 Chief Executive’s Review 22 Corporate Responsibility Review Textphone: 0871 384 2255* the need for a share certificate. Your share account details Write to: Equiniti, Aspect House, Spencer Road, Lancing, will be held on a separate register and you will receive an West Sussex BN99 6DA, United Kingdom annual confirmation statement. Email: [email protected] By transferring your shares into FlexiShare you will benefit from: A range of frequently asked shareholder questions is also available at www.centrica.com/shareholders. • low-cost share-dealing facilities provided by a panel of independent share dealing providers; Direct dividend payments • quicker settlement periods; Make your life easier by having your dividends paid directly into your designated bank or building society account on • no share certificates to lose; and the dividend payment date. -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Argos Resources ARG Oil Gas and Coal — GBP 0.03 at close 16 April 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Apr-2015 1D WTD MTD YTD Absolute - - - - Rel.Sector - - - - Rel.Market - - - - VALUATION Data unavailable Trailing PE -ve EV/EBITDA -ve PB 0.2 PCF +ve Div Yield 0.0 Price/Sales - Net Debt/Equity -ve Div Payout 0.0 ROE -ve DESCRIPTION Data unavailable The principal activity of the Group is that of oil and gas exploration. Past performance is no guarantee of future results. Please see the final page for important legal disclosures. 1 of 4 FTSE COMPANY REPORT: Argos Resources 16 April 2021 Valuation Metrics Price to Earnings (PE) EV to EBITDA Price to Book (PB) 31-Mar-2021 31-Mar-2021 31-Mar-2021 100 ‖ ‖ 1 0.8 0.9 0.7 80 0.8 +1SD 0.7 0.6 60 0.6 0.5 +1SD 0.5 40 Avg 0.4 0.4 Avg 0.3 0.3 20 0.2 0.2 -1SD 0.1 -1SD 0 ‖ ‖ ‖ ‖ 0 ‖ ‖ ‖ ‖ 0.1 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Petrofac 5.8 Energean 73.2 Energean 2.0 Harbour Energy PLC -0.2 BP 45.5 Lamprell 1.3 EnQuest -0.6 Hunting 31.5 Diversified Gas & Oil 1.2 Tullow Oil -0.7 Diversified Gas & Oil 11.3 BP 1.1 Lamprell -1.4 Oil Gas and Coal 9.5 Oil Gas and Coal 1.1 Oil Gas and Coal -5.2 Tullow Oil 7.9 Cairn Energy 1.0 Cairn Energy -9.4 Harbour Energy PLC 2.8 Pharos Energy 0.3 Wood Group (John) -10.4 Pharos Energy 1.5 Argos Resources 0.2 Argos Resources -17.2 -

Jacobs MCM- Quantitative Cost Analysis and Business Case Of

Radi oacti ve Waste S tor age and Dispos al F acilities in S out h A ustr alia – Quantit ati ve C ost A nal ysis and Business C as e Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Project no: IW104700 Document title: Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Revision: Draft Report V1 Date: 09 February 2016 Client name: South Australian Nuclear Fuel Cycle Royal Commission Client no: Jacobs Report (0.4) Project manager: Tim Johnson Authors: Darron Cook, Charles McCombie, Neil Chapman, Nigel Sullivan, Rohan Zauner, Tim Johnson File name: J:\IE\Projects\03_Southern\IW104700\21 Deliverables\Reformatted Docs for Client Release\09022016 Combined Papers V1.0.docx Jacobs Group (Australia) Pty Limited ABN 37 001 024 095 Floor 11, 452 Flinders Street Melbourne VIC 3000 PO Box 312, Flinders Lane Melbourne VIC 8009 Australia T +61 3 8668 3000 F +61 3 8668 3001 www.jacobs.com COPYRIGHT: The concepts and information contained in this document are the property of Jacobs Group (Australia) Pty Limited. Use or copying of this document in whole or in part without the written permission of Jacobs constitutes an infringement of copyright. Document history and status Revision Date Description By Review Approved V0 19 Jan 2016 For Client review Darron Darron Cook Darron Cook, team Cook V1 9 February For public consultation Tim Johnson Darron Cook Darron Cook IW104700 i Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Contents Executive Summary .............................................................................................................................................. -

BHP Billiton Iron Ore Management Approach

BHP Billiton Iron Ore Orebody 32 East AWT – Environmental Referral Document BHP Billiton Iron Ore management approach 1.1 Environmental management overview BHP Billiton has developed a Company Charter and Sustainable Development Policy for its operations. The Company Charter and Sustainable Development Policy (BHP Billiton Iron Ore, 2013a) are guiding resources for maintaining an emphasis on health, safety, environment and community and clarifying a broader commitment to aspects of sustainability including biodiversity, human rights, ethical business practices and economic contributions at all BHP Billiton sites. To interpret and support the Company Charter and BHP Billiton Iron Ore’s Sustainable Development Policy, BHP Billiton Iron Ore has developed an Environmental Governance Hierarchy, an Environmental Management System and is currently developing a series of Regional Management Strategies. 1.2 Environment Governance Hierarchy BHP Billiton Iron Ore now operates under an Environmental Governance Hierarchy (Figure 1). The Environment Governance Hierarchy provides the processes and practices that enable BHP Billiton Iron Ore to achieve its environmental objectives, reduce its environmental impacts and increase its operating efficiency. It enables environmental legal compliance to be undertaken and audited and provides for continual improvement in environmental performance. Figure 1: BHP Billiton Iron Ore Environmental Governance Hierarchy As shown in Figure 1, BHP Billiton Iron Ore’s environment governance hierarchy is broadly comprised of three tiers, representative of BHP Billiton Iron Ore’s different levels of management – BHP Billiton (corporate level), BHP Billiton Iron Ore (Business Unit level) and site specific (operations level) – and reflective of BHP Billiton’s top-down approach to environmental management across the Group. -

Rio Tinto BHP, Tesco, Sainsbury, Arcelormittal, National Grid

Quarterly Engagement Rio Tinto Report July-September BHP, Tesco, 2020 Sainsbury, ArcelorMittal, National Grid 2 LAPFF QUARTERLY ENGAGEMENT REPORT | JULY-SEPTEMBER 2020 lapfforum.org CLIMATE EMERGENCY Puutu Kunti Kurrama and Pinikura Aboriginal Corporation Rio Tinto under pressure from investors over Juukan Gorge As LAPFF has been learning more about “My interaction with Mr. Rio Tinto’s involvement in the destruc- Thompson, in his roles as Chair tion of the historically significant caves of both Rio Tinto and 3i, has been at Juukan Gorge in Western Australia, there have been increasing concerns positive thus far. However, I sense about the company’s corporate govern- that investors are losing confidence ance practices. Consequently, the Forum in his leadership and in his board at – along with other investor groups, most Rio Tinto. It will be a long road back What happened at prominently the Australasian Centre for for the company.” Juukan Gorge? Corporate Responsibility (ACCR) - has been pushing the company to review its Cllr Doug McMurdo In May, Rio Tinto destroyed 46,000-year- corporate governance arrangements. old Aboriginal caves in the Juukan One of the main strategies in this Gorge region of Western Australia. The engagement has been to issue press responding to information issued by explosions were part of a government releases citing LAPFF’s concerns as vari- Australian Parliamentary inquiries into sanctioned mining exploration in ous details of Rio Tinto’s practices were this matter. There appears to be increas- the region. The caves are of cultural revealed through a range of investiga- ing evidence of corporate governance fail- significance to the Puutu Kunti tions. -

BP Transforms Its US Onshore Oil and Gas Business, Acquiring World-Class Unconventional Assets from BHP 26 July 2018

BP transforms its US onshore oil and gas business, acquiring world-class unconventional assets from BHP 26 July 2018 Acquisition accretive to earnings and cash flow, delivered within existing financial frame Company increases dividend for first time in 15 quarters Upgrades and repositions BP’s US onshore business Brings advantaged oil and gas assets in world-class basins Adds 190,000 boe/d production and 4.6 billion boe discovered resources Boosts liquids share of BP’s US onshore production and resources Offers growth into the next decade Creates significant value Accretive to earnings and cash flow on a per share basis Increases Upstream free cash flow target by $1 billion to $14-15 billion in 2021 Generates estimated pre-tax synergies of over $350 million a year Fully accommodated within existing financial frame Total cash consideration of $10.5 billion – 50% on completion, 50% deferred over six months Up to $5-6 billion of additional divestments planned to fund share buybacks of up to $5-6 billion over time Unchanged financial frame of $15-17 billion annual organic capital expenditure to 2021, and gearing of 20-30% BP transforms its US onshore oil and gas business, acquiring world-class unconventional assets from BHP Page | 1 Strong free cashflow outlook supports dividend rise for second quarter 2018 2.5% rise to 10.25c per ordinary share is first dividend increase since third quarter 2014 In a move that will upgrade and materially reposition its US onshore oil and gas business, BP has agreed to acquire a portfolio of world-class unconventional oil and gas assets from BHP.