Trading Strategies Involving Options

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Here We Go Again

2015, 2016 MDDC News Organization of the Year! Celebrating 161 years of service! Vol. 163, No. 3 • 50¢ SINCE 1855 July 13 - July 19, 2017 TODAY’S GAS Here we go again . PRICE Rockville political differences rise to the surface in routine commission appointment $2.28 per gallon Last Week pointee to the City’s Historic District the three members of “Team him from serving on the HDC. $2.26 per gallon By Neal Earley @neal_earley Commission turned into a heated de- Rockville,” a Rockville political- The HDC is responsible for re- bate highlighting the City’s main po- block made up of Council members viewing applications for modification A month ago ROCKVILLE – In most jurisdic- litical division. Julie Palakovich Carr, Mark Pierzcha- to the exteriors of historic buildings, $2.36 per gallon tions, board and commission appoint- Mayor Bridget Donnell Newton la and Virginia Onley who ran on the as well as recommending boundaries A year ago ments are usually toward the bottom called the City Council’s rejection of same platform with mayoral candi- for the City’s historic districts. If ap- $2.28 per gallon of the list in terms of public interest her pick for Historic District Commis- date Sima Osdoby and city council proved Giammo, would have re- and controversy -- but not in sion – former three-term Rockville candidate Clark Reed. placed Matthew Goguen, whose term AVERAGE PRICE PER GALLON OF Rockville. UNLEADED REGULAR GAS IN Mayor Larry Giammo – political. While Onley and Palakovich expired in May. MARYLAND/D.C. METRO AREA For many municipalities, may- “I find it absolutely disappoint- Carr said they opposed Giammo’s ap- Giammo previously endorsed ACCORDING TO AAA oral appointments are a formality of- ing that politics has entered into the pointment based on his lack of qualifi- Newton in her campaign against ten given rubberstamped approval by boards and commission nomination cations, Giammo said it was his polit- INSIDE the city council, but in Rockville what process once again,” Newton said. -

Up to EUR 3,500,000.00 7% Fixed Rate Bonds Due 6 April 2026 ISIN

Up to EUR 3,500,000.00 7% Fixed Rate Bonds due 6 April 2026 ISIN IT0005440976 Terms and Conditions Executed by EPizza S.p.A. 4126-6190-7500.7 This Terms and Conditions are dated 6 April 2021. EPizza S.p.A., a company limited by shares incorporated in Italy as a società per azioni, whose registered office is at Piazza Castello n. 19, 20123 Milan, Italy, enrolled with the companies’ register of Milan-Monza-Brianza- Lodi under No. and fiscal code No. 08950850969, VAT No. 08950850969 (the “Issuer”). *** The issue of up to EUR 3,500,000.00 (three million and five hundred thousand /00) 7% (seven per cent.) fixed rate bonds due 6 April 2026 (the “Bonds”) was authorised by the Board of Directors of the Issuer, by exercising the powers conferred to it by the Articles (as defined below), through a resolution passed on 26 March 2021. The Bonds shall be issued and held subject to and with the benefit of the provisions of this Terms and Conditions. All such provisions shall be binding on the Issuer, the Bondholders (and their successors in title) and all Persons claiming through or under them and shall endure for the benefit of the Bondholders (and their successors in title). The Bondholders (and their successors in title) are deemed to have notice of all the provisions of this Terms and Conditions and the Articles. Copies of each of the Articles and this Terms and Conditions are available for inspection during normal business hours at the registered office for the time being of the Issuer being, as at the date of this Terms and Conditions, at Piazza Castello n. -

Introduction to Options

FIN-40008 FINANCIAL INSTRUMENTS SPRING 2008 Options These notes describe the payoffs to European and American put and call options|the so-called plain vanilla options. We consider the payoffs to these options for holders and writers and describe both the time vale and intrinsic value of an option. We explain why options are traded and examine some of the properties of put and call option prices. We shall show that longer dated options typically have higher prices and that call prices are higher when the strike price is lower and that put prices are higher when the strike price is higher. Keywords: Put, call, strike price, maturity date, in-the-money, time value, intrinsic value, parity value, American option, European option, early exer- cise, bull spread, bear spread, butterfly spread. 1 Options Options are derivative assets. That is their payoffs are derived from the pay- off on some other underlying asset. The underlying asset may be an equity, an index, a bond or indeed any other type of asset. Options themselves are classified by their type, class and their series. The most important distinc- tion of types is between put options and call options. A put option gives the owner the right to sell the underlying asset at specified dates at a specified price. A call option gives the owner the right to buy at specified dates at a specified price. Options are different from forward/futures contracts as a put (call) option gives the owner right to sell (buy) the underlying asset but not an obligation. The right to buy or sell need not be exercised. -

Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces

DEGREE PROJECT IN MATHEMATICS, SECOND CYCLE, 30 CREDITS STOCKHOLM, SWEDEN 2020 Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON KTH ROYAL INSTITUTE OF TECHNOLOGY SCHOOL OF ENGINEERING SCIENCES Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON Degree Projects in Mathematical Statistics (30 ECTS credits) Master's Programme in Applied and Computational Mathematics (120 credits) KTH Royal Institute of Technology year 2020 Supervisor at Nasdaq Technology AB: Sebastian Lindberg Supervisor at KTH: Fredrik Viklund Examiner at KTH: Fredrik Viklund TRITA-SCI-GRU 2020:081 MAT-E 2020:044 Royal Institute of Technology School of Engineering Sciences KTH SCI SE-100 44 Stockholm, Sweden URL: www.kth.se/sci Abstract The implied volatility surface plays an important role for Front office and Risk Manage- ment functions at Nasdaq and other financial institutions which require mark-to-market of derivative books intraday in order to properly value their instruments and measure risk in trading activities. Based on the aforementioned business needs, being able to calibrate an end of day implied volatility surface based on new market information is a sought after trait. In this thesis a statistical learning approach is used to calibrate the implied volatility surface intraday. This is done by using OMXS30-2019 implied volatil- ity surface data in combination with market information from close to at the money options and feeding it into 3 Machine Learning models. The models, including Feed For- ward Neural Network, Recurrent Neural Network and Gaussian Process, were compared based on optimal input and data preprocessing steps. -

(NSE), India, Using Box Spread Arbitrage Strategy

Gadjah Mada International Journal of Business - September-December, Vol. 15, No. 3, 2013 Gadjah Mada International Journal of Business Vol. 15, No. 3 (September - December 2013): 269 - 285 Efficiency of S&P CNX Nifty Index Option of the National Stock Exchange (NSE), India, using Box Spread Arbitrage Strategy G. P. Girish,a and Nikhil Rastogib a IBS Hyderabad, ICFAI Foundation For Higher Education (IFHE) University, Andhra Pradesh, India b Institute of Management Technology (IMT) Hyderabad, India Abstract: Box spread is a trading strategy in which one simultaneously buys and sells options having the same underlying asset and time to expiration, but different exercise prices. This study examined the effi- ciency of European style S&P CNX Nifty Index options of National Stock Exchange, (NSE) India by making use of high-frequency data on put and call options written on Nifty (Time-stamped transactions data) for the time period between 1st January 2002 and 31st December 2005 using box-spread arbitrage strategy. The advantages of box-spreads include reduced joint hypothesis problem since there is no consideration of pricing model or market equilibrium, no consideration of inter-market non-synchronicity since trading box spreads involve only one market, computational simplicity with less chances of mis- specification error, estimation error and the fact that buying and selling box spreads more or less repli- cates risk-free lending and borrowing. One thousand three hundreds and fifty eight exercisable box- spreads were found for the time period considered of which 78 Box spreads were found to be profit- able after incorporating transaction costs (32 profitable box spreads were identified for the year 2002, 19 in 2003, 14 in 2004 and 13 in 2005) The results of our study suggest that internal option market efficiency has improved over the years for S&P CNX Nifty Index options of NSE India. -

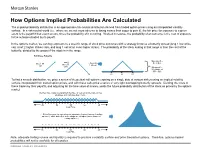

How Options Implied Probabilities Are Calculated

No content left No content right of this line of this line How Options Implied Probabilities Are Calculated The implied probability distribution is an approximate risk-neutral distribution derived from traded option prices using an interpolated volatility surface. In a risk-neutral world (i.e., where we are not more adverse to losing money than eager to gain it), the fair price for exposure to a given event is the payoff if that event occurs, times the probability of it occurring. Worked in reverse, the probability of an outcome is the cost of exposure Place content to the outcome divided by its payoff. Place content below this line below this line In the options market, we can buy exposure to a specific range of stock price outcomes with a strategy know as a butterfly spread (long 1 low strike call, short 2 higher strikes calls, and long 1 call at an even higher strike). The probability of the stock ending in that range is then the cost of the butterfly, divided by the payout if the stock is in the range. Building a Butterfly: Max payoff = …add 2 …then Buy $5 at $55 Buy 1 50 short 55 call 1 60 call calls Min payoff = $0 outside of $50 - $60 50 55 60 To find a smooth distribution, we price a series of theoretical call options expiring on a single date at various strikes using an implied volatility surface interpolated from traded option prices, and with these calls price a series of very tight overlapping butterfly spreads. Dividing the costs of these trades by their payoffs, and adjusting for the time value of money, yields the future probability distribution of the stock as priced by the options market. -

DERIVATIVE and SECURITY Winter 2009 VALUATION NEWS

DERIVATIVE AND SECURITY Winter 2009 VALUATION NEWS The bend in the road is not the end of the road unless you refuse to take the turn. - Anon Industry Update Trends in Hedge Fund Administration Also Featured Smaller, emerging, or startup fund managers have found that the discovery of so In This Issue many Ponzi schemes in the industry was a bigger hit to business than anything that has happened in the capital markets. These funds are finding that outsourcing, particularly back office activities, is the only real solution in order Valuation Challenges to establish credibility. This trend has been prevalent in Europe where even large Pricing illiquid securities and funds have independent administrators; in the US, traditionally, funds were self alternatives to stale broker quotes administered, but this is now changing as it is nearly impossible to raise capital and counterparty marks unless there are qualified and reputable service providers “looking over your .................................................... 02 shoulder”. Transparency and disclosure are key for funds to raise capital in this market environment, which includes providing investors detailed written procedures on operations and related risk mitigation. One of the primary areas investors are Regulatory Announcements focusing on is how the administrator values the fund’s portfolios, even though Are CCPs the answer to the the valuation of the fund is ultimately the responsibility of the fund and not the problem? administrator. ................................................... 04 Administrators have improved their valuation capabilities in the past year, but the issue of simply taking the manager’s price where it is most imperative to independently determine a valuation is still, particularly in the US, a hot button for the industry. -

Chapter 2 Roche Holding: the Company, Its

Risk Takers Uses and Abuses of Financial Derivatives John E. Marthinsen Babson College PEARSON Addison Wesley Boston San Francisco New York London Toronto Sydney Tokyo Singapore Madrid Mexico City Munich Paris Cape Town Hong Kong Montreal Preface xiii Parti 1 Chapter 1 Employee Stock Options: What Every MBA Should Know 3 Introduction 3 Employee Stock Options: A Major Pillar of Executive Compensation 6 Why Do Companies Use Employee Stock Options 6 Aligning Incentives 7 Hiring and Retention 7 Postponing the Timing of Expenses 8 Adjusting Compensation to Employee Risk Tolerance Levels 8 Tax Advantages for Employees 9 Tax Advantages for Companies 9 Cash Flow Advantages for Companies 10 Option Valuation Differences and Human Resource Management 12 Problems with Employee Stock Options 26 Employee Motivation 26 The Share Price of "Good" Companies 27 Motivation of Undesired Behavior 28 vi Contents Performance Improvement 28 Absolute Versus Relative Performance 29 Some Innovative Solutions to Employee Stock Option Problems 29 Premium-Priced Stock Options 30 Index Options 30 Restricted Shares 34 Omnibus Plans 34 Conclusion 35 Review Questions 36 Bibliography 38 Chapter 2 Roche Holding: The Company, Its Financial Strategy, and Bull Spread Warrants 41 Introduction 41 Roche Holding AG: Transition from a Lender to a Borrower 43 Loss of the Valium Patent in the United States 43 Rapid Increase in R&D Costs, Market Growth, and Industry Consolidation 43 Roche's Unique Capital Structure 44 Roche Brings in a New Leader and Replaces Its Management Committee -

Module 6 Option Strategies.Pdf

zerodha.com/varsity TABLE OF CONTENTS 1 Orientation 1 1.1 Setting the context 1 1.2 What should you know? 3 2 Bull Call Spread 6 2.1 Background 6 2.2 Strategy notes 8 2.3 Strike selection 14 3 Bull Put spread 22 3.1 Why Bull Put Spread? 22 3.2 Strategy notes 23 3.3 Other strike combinations 28 4 Call ratio back spread 32 4.1 Background 32 4.2 Strategy notes 33 4.3 Strategy generalization 38 4.4 Welcome back the Greeks 39 5 Bear call ladder 46 5.1 Background 46 5.2 Strategy notes 46 5.3 Strategy generalization 52 5.4 Effect of Greeks 54 6 Synthetic long & arbitrage 57 6.1 Background 57 zerodha.com/varsity 6.2 Strategy notes 58 6.3 The Fish market Arbitrage 62 6.4 The options arbitrage 65 7 Bear put spread 70 7.1 Spreads versus naked positions 70 7.2 Strategy notes 71 7.3 Strategy critical levels 75 7.4 Quick notes on Delta 76 7.5 Strike selection and effect of volatility 78 8 Bear call spread 83 8.1 Choosing Calls over Puts 83 8.2 Strategy notes 84 8.3 Strategy generalization 88 8.4 Strike selection and impact of volatility 88 9 Put ratio back spread 94 9.1 Background 94 9.2 Strategy notes 95 9.3 Strategy generalization 99 9.4 Delta, strike selection, and effect of volatility 100 10 The long straddle 104 10.1 The directional dilemma 104 10.2 Long straddle 105 10.3 Volatility matters 109 10.4 What can go wrong with the straddle? 111 zerodha.com/varsity 11 The short straddle 113 11.1 Context 113 11.2 The short straddle 114 11.3 Case study 116 11.4 The Greeks 119 12 The long & short straddle 121 12.1 Background 121 12.2 Strategy notes 122 12..3 Delta and Vega 128 12.4 Short strangle 129 13 Max pain & PCR ratio 130 13.1 My experience with option theory 130 13.2 Max pain theory 130 13.3 Max pain calculation 132 13.4 A few modifications 137 13.5 The put call ratio 138 13.6 Final thoughts 140 zerodha.com/varsity CHAPTER 1 Orientation 1.1 – Setting the context Before we start this module on Option Strategy, I would like to share with you a Behavioral Finance article I read couple of years ago. -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

Bond Futures Calendar Spread Trading

Black Algo Technologies Bond Futures Calendar Spread Trading Part 2 – Understanding the Fundamentals Strategy Overview Asset to be traded: Three-month Canadian Bankers' Acceptance Futures (BAX) Price chart of BAXH20 Strategy idea: Create a duration neutral (i.e. market neutral) synthetic asset and trade the mean reversion The general idea is straightforward to most professional futures traders. This is not some market secret. The success of this strategy lies in the execution. Understanding Our Asset and Synthetic Asset These are the prices and volume data of BAX as seen in the Interactive Brokers platform. blackalgotechnologies.com Black Algo Technologies Notice that the volume decreases as we move to the far month contracts What is BAX BAX is a future whose underlying asset is a group of short-term (30, 60, 90 days, 6 months or 1 year) loans that major Canadian banks make to each other. BAX futures reflect the Canadian Dollar Offered Rate (CDOR) (the overnight interest rate that Canadian banks charge each other) for a three-month loan period. Settlement: It is cash-settled. This means that no physical products are transferred at the futures’ expiry. Minimum price fluctuation: 0.005, which equates to C$12.50 per contract. This means that for every 0.005 move in price, you make or lose $12.50 Canadian dollar. Link to full specification details: • https://m-x.ca/produits_taux_int_bax_en.php (Note that the minimum price fluctuation is 0.01 for contracts further out from the first 10 expiries. Not too important as we won’t trade contracts that are that far out.) • https://www.m-x.ca/f_publications_en/bax_en.pdf Other STIR Futures BAX are just one type of short-term interest rate (STIR) future. -

11 Option Payoffs and Option Strategies

11 Option Payoffs and Option Strategies Answers to Questions and Problems 1. Consider a call option with an exercise price of $80 and a cost of $5. Graph the profits and losses at expira- tion for various stock prices. 73 74 CHAPTER 11 OPTION PAYOFFS AND OPTION STRATEGIES 2. Consider a put option with an exercise price of $80 and a cost of $4. Graph the profits and losses at expiration for various stock prices. ANSWERS TO QUESTIONS AND PROBLEMS 75 3. For the call and put in questions 1 and 2, graph the profits and losses at expiration for a straddle comprising these two options. If the stock price is $80 at expiration, what will be the profit or loss? At what stock price (or prices) will the straddle have a zero profit? With a stock price at $80 at expiration, neither the call nor the put can be exercised. Both expire worthless, giving a total loss of $9. The straddle breaks even (has a zero profit) if the stock price is either $71 or $89. 4. A call option has an exercise price of $70 and is at expiration. The option costs $4, and the underlying stock trades for $75. Assuming a perfect market, how would you respond if the call is an American option? State exactly how you might transact. How does your answer differ if the option is European? With these prices, an arbitrage opportunity exists because the call price does not equal the maximum of zero or the stock price minus the exercise price. To exploit this mispricing, a trader should buy the call and exercise it for a total out-of-pocket cost of $74.