Planning & Retail Statement Former Poundstretcher Unit, Penllergaer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

What's Next for Ukpound Shops?

February 3, 2015 February 3, 2015 What’s Next For UK Pound Shops? Major UK pound shop chains have seen revenues surge in the post-recession years. The economic slump and the Woolworths failure paved the way for this segment’s rapid expansion of stores. With further expansion expected, we think the segment is looking increasingly crowded. Some players are now eying international markets in their bid for growth. DEBORAH WEINSWIG Executive Director–Head Global Retail & Technology Fung Business Intelligence Centre [email protected] New york: 646.839.7017 Fung Business Intelligence Centre (FBIC) publication: UK POUND SHOPS 1 Copyright © 2015 The Fung Group, All rights reserved. February 3, 2015 What’s Next For UK Pound Shops? THE POUND SHOP BOOM Variety-store retailers have proliferated rapidly in the UK, mirroring the store-expansion boom of discount grocery chains (notably Aldi and Lidl), as the low-price, no-frills formula has found particular resonance in Britain’s era of sluggish economic growth. This retail segment encompasses chains like Poundland, 99p Stores and Poundworld, which sell all of their products at fixed price points. Similar to the dollar chains Dollar General and Family Dollar in the US, everything in the pound stores sells for £1 (or 99p) and the goods are bought cheaply in bulk. The group also includes chains with more flexible pricing schemes. Those include B&M Bargains, Home Bargains and Poundstretcher. For both types of stores, the offerings are heavy on beauty and personal care, household fast-moving consumer goods (FMCGs) and food and beverages (particularly confectionery). Other categories typically include do-it-yourself (DIY) and automotive accessories, pet products and seasonal goods. -

A TIME for May/June 2016

EDITOR'S LETTER EST. 1987 A TIME FOR May/June 2016 Publisher Sketty Publications Address exploration 16 Coed Saeson Crescent Sketty Swansea SA2 9DG Phone 01792 299612 49 General Enquiries [email protected] SWANSEA FESTIVAL OF TRANSPORT Advertising John Hughes Conveniently taking place on Father’s Day, Sun 19 June, the Swansea Festival [email protected] of Transport returns for its 23rd year. There’ll be around 500 exhibits in and around Swansea City Centre with motorcycles, vintage, modified and film cars, Editor Holly Hughes buses, trucks and tractors on display! [email protected] Listings Editor & Accounts JODIE PRENGER Susan Hughes BBC’s I’d Do Anything winner, Jodie Prenger, heads to Swansea to perform the role [email protected] of Emma in Tell Me on a Sunday. Kay Smythe chats with the bubbly Jodie to find [email protected] out what the audience can expect from the show and to get some insider info into Design Jodie’s life off stage. Waters Creative www.waters-creative.co.uk SCAMPER HOLIDAYS Print Stephens & George Print Group This is THE ultimate luxury glamping experience. Sleep under the stars in boutique accommodation located on Gower with to-die-for views. JULY/AUGUST 2016 EDITION With the option to stay in everything from tiki cabins to shepherd’s huts, and Listings: Thurs 19 May timber tents to static camper vans, it’ll be an unforgettable experience. View a Digital Edition www.visitswanseabay.com/downloads SPRING BANK HOLIDAY If you’re stuck for ideas of how to spend Spring Bank Holiday, Mon 30 May, then check out our round-up of fun events taking place across the city. -

961 Bus Time Schedule & Line Route

961 bus time schedule & line map 961 Llansamlet - Swansea College via Winch Wen View In Website Mode The 961 bus line Llansamlet - Swansea College via Winch Wen has one route. For regular weekdays, their operation hours are: (1) Tycoch: 7:38 AM Use the Moovit App to ƒnd the closest 961 bus station near you and ƒnd out when is the next 961 bus arriving. Direction: Tycoch 961 bus Time Schedule 59 stops Tycoch Route Timetable: VIEW LINE SCHEDULE Sunday Not Operational Monday 7:38 AM Church Road, Llansamlet 141 Samlet Road, Swansea Tuesday 7:38 AM Lon-Las School, Gwernllwynchwyth Wednesday 7:38 AM Walters Road Roundabout, Gwernllwynchwyth Thursday 7:38 AM Friday 7:38 AM Walters Road, Felin Fran Walters Road, Llansamlet Community Saturday Not Operational Ynysallan Road, Heol-Las Heol Las, Heol-Las 961 bus Info Smiths Road, Birchgrove Direction: Tycoch Stops: 59 Heol Dulais, Heol-Las Trip Duration: 53 min Line Summary: Church Road, Llansamlet, Lon-Las Heol Dulais Corner, Birchgrove School, Gwernllwynchwyth, Walters Road Roundabout, Gwernllwynchwyth, Walters Road, Felin Heol Dulais, Birchgrove Community Fran, Ynysallan Road, Heol-Las, Heol Las, Heol-Las, School, Birchgrove Smiths Road, Birchgrove, Heol Dulais, Heol-Las, Heol Dulais Corner, Birchgrove, School, Birchgrove, Bridgend Inn, Birchgrove, Birchgrove Road, Bridgend Inn, Birchgrove Birchgrove, Birchgrove Stores, Birchgrove, Birchgrove Hill, Peniel Green, Peniel Green East, Birchgrove Road, Birchgrove Peniel Green, Library, Peniel Green, Llansamlet Railway Station, Peniel Green, Llansamlet -

Annual Monitoring Report 2017/18 November 2018

Richmondshire District Council Local Plan Annual Monitoring Report 2017/18 November 2018 Richmondshire District Council Annual Monitoring Report 2017/18 Contents 1.0 Introduction…………...........................................................................................2 2.0 Local Context…………………………………………………………………………..3 Local Contexts Facts for Monitoring Period………………………………………….4 3.0 Local Plan Progress…………………………………………………………………..5 4.0 Development Results…………………………………………………………………6 Housing Delivery………………………………………………………………………..6 Economic Development……………………………………………………….………9 Town Centres…………………………………………………………………………..11 Environment……………………………………………………………………………13 Heritage…………………………………………………………………………………14 Community & Recreation Assets…………………………………………………….14 5.0 Infrastructure………………………………………………………………………….14 Transport & Accessibility……………………………………………………………...15 A6136 Improvements………………………………………………………………….15 Community Infrastructure Levy…………………………………………………...….15 6.0 Duty to Cooperate……………………………………………………………...…….16 Appendix 1 – Richmond Town Centre Health Check & Surveys…………….18 Appendix 2 – Catterick Garrison Town Centre Health Check & Surveys….34 Appendix 3 – Leyburn Town Centre Health Check & Surveys..……………..44 Appendix 4 – Heritage at Risk in Richmondshire Plan Area 2017/18…...….57 2 1.0 Introduction 1.1 This Annual Monitoring Report (AMR) covers the period 01 April 2017 to 31 March 2018. 1.2 The requirement for a Local Planning Authority to produce an Annual Monitoring Report (AMR) is set out in section 35 of the Planning and Compulsory -

Report on the Examination Into the Swansea Local Development Plan 2010 – 2025

Adroddiad i Gyngor Report to Swansea Abertawe Council gan: by: Rebecca Phillips BA (Hons) MSc DipM Rebecca Phillips BA (Hons) MSc DipM MRTPI MCIM MRTPI MCIM Paul Selby BEng (Hons) MSc MRTPI Paul Selby BEng (Hons) MSc MRTPI Arolygyddion a benodir gan Weinidogion Inspectors appointed by the Welsh Cymru Ministers Dyddiad: 31/01/19 Date: 31/01/19 PLANNING AND COMPULSORY PURCHASE ACT 2004 (AS AMENDED) SECTION 64 REPORT ON THE EXAMINATION INTO THE SWANSEA LOCAL DEVELOPMENT PLAN 2010 – 2025 Plan submitted for examination on 28 July 2017 Hearings held 6 February – 28 March 2018 and 10 – 11 September 2018 Cyf ffeil/File ref: 515477 Swansea Local Development Plan 2010-2025 – Inspectors’ Report Abbreviations used in this report AA Appropriate Assessment AONB Area of Outstanding Natural Beauty AQMA Air Quality Management Area CBEEMS Carmarthen Bay and Estuaries European Marine Site DAMs Development Advice Maps DCWW Dŵr Cymru Welsh Water FCA Flood Consequences Assessment HRA Habitats Regulations Assessment IDP Infrastructure Delivery Plan IMAC Inspectors’ Matters Arising Change LDP Local Development Plan LHMA Local Housing Market Assessment LPA Local Planning Authority LSA Local Search Area MAC Matters Arising Change MoU Memorandum of Understanding NRW Natural Resources Wales PPW Planning Policy Wales RSL Registered Social Landlord SA Sustainability Appraisal SCARC Swansea Central Area Retail Centre SCARF Swansea Central Area Regeneration Framework SDA Strategic Development Area SEA Strategic Environmental Assessment SHPZ Strategic Housing Policy -

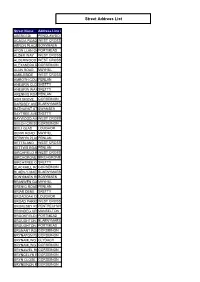

Street Address List

Street Address List Street Name Address Line 2 ABERCEDI PENCLAWDD ACACIA ROAD WEST CROSS AERON PLACEBONYMAEN AFON LLAN GARDENSPORTMEAD ALDER WAY WEST CROSS ALDERWOOD ROADWEST CROSS ALEXANDRA ROADGORSEINON ALUN ROAD MAYHILL AMBLESIDE WEST CROSS AMROTH COURTPENLAN ANEURIN CLOSESKETTY ANEURIN WAYSKETTY ARENNIG ROADPENLAN ASH GROVE GORSEINON BARDSEY AVENUEBLAENYMAES BATHURST STREETSWANSEA BAYTREE AVENUESKETTY BAYWOOD AVENUEWEST CROSS BEECH CRESCENTGORSEINON BEILI GLAS LOUGHOR BERW ROAD MAYHILL BERWYN PLACEPENLAN BETTSLAND WEST CROSS BETTWS ROADPENLAN BIRCHFIELD ROADWEST CROSS BIRCHGROVE ROADBIRCHGROVE BIRCHTREE CLOSESKETTY BLACKHILL ROADGORSEINON BLAEN-Y-MAESBLAENYMAES DRIVE BONYMAEN ROADBONYMAEN BRANWEN GARDENSMAYHILL BRENIG ROAD PENLAN BRIAR DENE SKETTY BROADOAK COURTLOUGHOR BROAD PARKSWEST CROSS BROKESBY ROADPENTRECHWYTH BRONDEG CRESCENTMANSELTON BROOKFIELD PLACEPORTMEAD BROUGHTON AVENUEBLAENYMAES BROUGHTON AVENUEPORTMEAD BRUNANT ROADGORSEINON BRYNAFON ROADGORSEINON BRYNAMLWG CLYDACH BRYNAMLWG ROADGORSEINON BRYNAWEL ROADGORSEINON BRYNCELYN ROADGORSEINON BRYN CLOSE GORSEINON BRYNEINON ROADGORSEINON BRYNEITHIN GOWERTON BRYNEITHIN ROADGORSEINON BRYNFFYNNONGORSEINON ROAD BRYNGOLAU GORSEINON BRYNGWASTADGORSEINON ROAD BRYNHYFRYD ROADGORSEINON BRYNIAGO ROADPONTARDULAIS BRYNLLWCHWRLOUGHOR ROAD BRYNMELIN STREETSWANSEA BRYN RHOSOGLOUGHOR BRYNTEG CLYDACH BRYNTEG ROADGORSEINON BRYNTIRION ROADPONTLLIW BRYN VERNEL LOUGHOR BRYNYMOR THREE CROSSES BUCKINGHAM ROADBONYMAEN BURRY GREENLLANGENNITH BWLCHYGWINFELINDRE BYNG STREET LANDORE CABAN ISAAC ROADPENCLAWDD -

Anticipated Acquisition of 99P Stores Limited by Poundland Group Plc

Non-confidential ANTICIPATED ACQUISITION OF 99P STORES LIMITED BY POUNDLAND GROUP PLC RESPONSE TO PHASE II STATEMENT OF ISSUES 9 JULY 2015 LON37045457/6 163772-0005 POUNDLAND GROUP PLC Response to the CMA’s Statement of Issues This document is Poundland Group plc’s (Poundland) response to the UK Competition and Markets Authority’s (CMA) statement of issues of 25 June (Statement of Issues) regarding Poundland’s proposed acquisition of 99p Stores Ltd (99p Stores) (the Transaction). Please note that this document contains Poundland confidential information and should not be shared with third parties absent Poundland’s express prior written consent. 1. Executive Summary 1.1 Poundland welcomes the opportunity to provide the CMA with its input on the CMA’s Statement of Issues. 1.2 Poundland believes that the evidence strongly supports the view that this transaction does not pose any risk to competition. On the contrary, Poundland considers that the merger will be pro-competitive – bringing a superior proposition to 99p Stores’ customers, and further enhancing competition along the High Street. 1.3 In particular, the evidence shows that: (a) Poundland competes in a competitive marketplace everywhere it operates. Poundland competes all along the High Street: all of the products that Poundland sells are either available at a supermarket, at a limited assortment discounter (LAD), at another value general merchandiser (VGM), at a specialist retailer or at an independent discounter. Customers are value conscious – they want more for less, can easily switch retailers and do not display any ‘fascia loyalty’ in their quest for value. (b) There is no variation of the offer across the Poundland estate. -

Florida Fantasy

NEW Britain’s Competition & Prize Draw Magazine LOOK CompersCompers NewsNewswww.CompersNews.com • April 2016 FLORIDA FANTASY Your favourite comping magazine has a new look this month, but some things haven’t changed – like the non-stop flood of entries in our exclusive Golden Ticket Bingo game! Never mind Mrs Brown’s Boys, here are Ms Brown’s Girls – Angie Reynolds and her daughter Katie, in fact! Last year, Angie was lucky enough to win a trip to Florida to meet Ms Brown with M&M’s – a prize draw that we featured in Compers News and on Chatterbox. “We took Katie for her 13th Birthday Our Latest Wins... last October and didn’t tell her until she Compers News members have reported blew the candles out on her cake,” Angie these BIG prizes since our last issue! told us. “She couldn’t believe it when we ✓✓State-of-the-art heating put her in the car and drove straight to system worth £10,000 the airport, it was a wonderful surprise!” ✓✓£8,000 worth of Angie wins a Spot Prize of a £10 photographic equipment shopping voucher – plus a Bonus Prize ✓✓Once-in-a-lifetime trip to for including Compers News in her the Great Wall of China winning photo – and her entry will also ✓✓Luxury sofa worth £2,500 go into the main category draw for one ✓✓£1,000 worth of garden furniture of our top prizes – remember, we’ve And here’s just a small selection of the other got very special Golden Tickets to be prizes you’ve told us about during the past month! won for an exclusive Comping Day in London! One-week VIP ski-ing Luxury Lake District break Perfume-making With so many Golden Ticket Bingo and music festival VIP Lords cricket day workshop holiday in France Night at the BRITS Luxury Fortnum entries still flooding in, we’re once again Luxury London break iPad Air & Mason hamper printing a bumper selection of lucky worth £2,000 Michelin-starred dining Plus LOTS of £100 Dinner cooked by a experience in London Asda gift vouchers winning entries inside this month’s professional chef in Romantic glamping UEFA Champions League issue. -

Hannah Lawson

Castle Ward By-Election Swansea Vote Abertawe HANNAH LAWSON Your LABOUR candidate for CASTLE WARD Only Labour can continue Cllr Sybil Crouch’s legacy, so in the upcoming Castle Ward by- election please vote for our Labour Candidate to join our ward team: Hannah Lawson. “Having worked with Sybil Crouch over several years, I saw first-hand the amazing work she did, and I feel honoured to be given the opportunity to follow in her footsteps. I care deeply for my part of the City and its culturally diverse and creative population and look forward to being part of the active and successful Castle Labour Team.” See overleaf for more about Hannah, your Castle Labour Candidate Swansea LAWSON, Hannah Abertawe Swansea Vote Abertawe HANNAH LAWSON for Castle Ward I was born in Castle Ward and have spent most of my working life in the City Centre. The twelve years I worked for Amgueddfa Genedlaethol y Glannau/National Waterfront Museum have given me considerable experience in Swansea‘s cultural heritage and tourism. As a practising artist and musician, I passionately believe that the arts are central both to personal wellbeing and creating a vibrant city. I have very strong links with the artistic community in Swansea, am a Director of Swansea Print Workshop, and a governor of St. Helen's Cllr Erika Kirchner, Cllr Fiona Gordon and Cllr David Phillips with Labour candidate Hannah Lawson Primary School. I was very actively involved in the trade union movement, as a rep and union official – both local and national. I was Chair of a PCS branch covering seven public sector sites across Wales; and am very proud of standing up for our lowest paid members, resulting in a successful high-profile industrial dispute that secured a victory for weekend working staff. -

City Centr Walking Tr

Image Credits and Copyrights National Waterfront Museum p7, Glynn Vivian Art Gallery p10: Powell Dobson Architects. The Council of the City & County of Swansea cannot guarantee the accuracy of the information in this brochure and accepts no responsibility for any error or misrepresentation, liability for loss, disappointment, negligence or other damage caused by the reliance on the information contained in this brochure unless caused by the negligent act or omission of the Council. This publication is available in alternative formats. Contact Swansea Tourist Information Centre (01792 468321. Published by the City & County of Swansea © Copyright 2014 Welcome to Swansea Bay, Mumbles and Gower City Centre Swansea, Wales’ Waterfront City, has a vibrant City Centre with over 230 shops and Wales’ largest Walking Trail indoor market. As well as a wide range of indoor attractions (including the oldest and newest museums in Wales), Swansea boasts award winning parks and gardens. Clyne Gardens is internationally famous for its superb collection of rhododendrons and Singleton Botanical Gardens is home to spectacular herbaceous borders and large glasshouses. Swansea sits on the sandy 5 mile stretch of Swansea Bay beach, which leads to the cosy but cosmopolitan corner of Mumbles. Capture its colourful charm from the promenade and pier, the bistros and boutiques, and the cafés and medieval castle. Mumbles marks the beginning of the Gower Peninsula’s coastline. Explore Gower’s 39 miles of captivating coastline and countryside. Ramble atop rugged limestone cliffs, uncover a cluster of castles or simply wander at the water’s edge - a breathtaking backdrop is a given. Your adventure starts here! This guide takes you on a walking tour of the ‘Top 10’ most asked about attractions in and near Swansea City Centre, by visitors to Swansea Tourist Information Centre. -

Parc Pensarn Carmarthen

> Parc Pensarn Retail Park Carmarthen SA31 2NF RETAIL WAREHOUSE INVESTMENT OPPORTUNITY 010.1 0.2 0.3 0.4 0.5 0.6 0.7 INVESTMENT LOCATION SITUATION / DESCRIPTION / TENANCY TENANT’S FURTHER HIGHLIGHTS & DEMOGRAPHICS RETAIL WAREHOUSING TENURE COVENANTS INFORMATION INVESTMENT HIGHLIGHTS Parc Pensarn is well located in the Welsh market town of Carmarthen, 35 miles north of Swansea. Carmarthen benefits from having awide catchment area due to limited competition from any major retail centres; the 30 minute drive time extends to 184,724 people. Easily accessible from the A484 in the prime retail pitch and is situated adjacent to a 60,000 sq ft Morrisons foodstore with petrol station. Totals 20,503 sq ft arranged across the 3 units occupied by national retailers; Halfords, Poundstretcher and Laura Ashley. The current income totals £208,850 per annum equating to a low average rent of £10.19 per sq ft. The income increases by 7.2% to £223,850 per annum in September 2021 due to a fixed uplift in the Poundstretcher lease. The retailers trade well here as evidenced by them all recently re-gearing their leases. The park benefits from a bulky goods consent with relaxations in favour of Unit 1 (Poundstretcher). Freehold. We are instructed to seek offers in excess of £2,300,000 (Two Million and Three Hundred Thousand Pounds), subject to contract and exclusive of VAT. This reflects an attractive net initial yield of 8.50% (assuming purchaser’s costs of 6.86%). The yield increases to 9.15% in September 2021 by virtue of the fixed uplift within the Poundstretcher lease. -

SWANSEA Road, Rail and Sea Connectivity to LET Close Proximity to Swansea City Centre Warehousing / Office / and M4 Motorway (Junction 42) Open Storage Opportunities

SWANSEA Road, rail and sea connectivity TO LET Close proximity to Swansea city centre Warehousing / Office / and M4 motorway (Junction 42) Open Storage Opportunities Port of Swansea, SA1 1QR Situated in a top tier (‘A’) grant assisted area and within the Swansea Bay City Region Available Property Swansea City Centre A483 M4 SA1 Swansea Waterfront J42 - 4.8 km / 3 mi Delivering Property Solutions Swansea, Available Property Sat Nav: SA1 1QR Opportunity M4 J45 J47 J46 Our available sites, warehousing and office accommodation are situated within the secure confines of the Port of Swansea, located M4 J44 less than 2 miles from Swansea city centre. J47 12.8 km A48 A4067 Over recent years the Port has benefitted from major investment and offers opportunity M4 for port-related users to take advantage of both available quayside access and port J43 J45 12.8 km Winch Wen handling services, together with non-port related commercial occupiers seeking well A483 M4 located and secure storage land, existing warehousing and development plots for J42 the design and construction of bespoke business accommodation. Cockett Swansea Location Port Services St Thomas M4 Swansea A483 A4118 City Centre J42 4.8 km The Port of Swansea is conveniently located ABP’s most westerly positioned Port in South Wales providing ABP Port 3 miles, via the A483 dual carriageway, to shorter sailing times for vessels trading in/out of the West of of Swansea the west of Junction 42 of the M4 motorway, UK. The docks provides deep sea accessibility (Length: 200m, A4067 offering excellent road connectivity.