Minutes-Of-Meeting-MB-GE32.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Faculty Details Proforma for College Web-Site

Faculty Details Proforma For College Web-Site Title Dr. First Nirmal Last Jindal Name Nam e Photograph Designation Associate Professor Address Deptt. Of Political Science, Satyawati College (Day), Ashok Vihar, Phase – III, Delhi –110052 Phone No 01127219570 Office H-151,Phase - I, Ashok Vihar, Delhi – Residence 110052 9958769090 Mobile Email [email protected] Web-Page Educational Qualifications: Degree Institution Year Ph.D. Department of Political Science, 1987 University of Delhi Page 1 of 16 Recipients of Fulbright Predoctoral Fellowship at the Centre for Science and International Affairs, JF Kennedy School of Government, Harvard University, USA (1984-85) M.Phil. Department of Political Science, 1981 University of Delhi M.A. Political Hindu College, University of Delhi 1979 Science B.A. (Hons) Hindu College, University of Delhi 1977 Political Science Diploma in Deptt. Of Peace and Conflict 1991 Advanced Research, Uppsala University, International Sweden Studies Administrative Assignments Taken at Satyawati College (M): ● Convenor, Board of examinations, Department of political science, Delhi University, 2018 ● Acing Principal : du.ac.in ● 24/12/18-2/1/19 -January 15-19, 2018;7/12/18- 14/12/18 -November 23-29,2017; May 1-6, 2017; Feb 3-9, 2017; ● Convenor, Alumni committee (2018-19) ● convener, Placement cell (2016-2018) ● convener, Annual Day committee (2017) ● Member Alumni committee (2018) ● Member, Governing Body (2016) ● Teacher-In-Charge (Two Times), Deptt. Of Political Science Page 2 of 16 ● Convener and Chief Editor, Ujjwala, College Magazine (2010-11) ● Convener, Career Counseling and Placement Cell (2010 & 2016) ● Convener, Foreign Students Advisory Committee (2006-07) ● Member Sports committee, 2018 ● Member Art and Culture society 2018 ● Member, Debating Society (2016-2018) ● Member, Gardening Committee (2013-15) ● Chaired sessions of various seminars and conferences from time to time. -

Self Study Report of Satywati College (University of Delhi)

SELF STUDY REPORT OF SATYWATI COLLEGE (UNIVERSITY OF DELHI) INDEX SR. NO. CONTENT PAGE NO. A INTRODUCTION B PROFILE OF THE COLLEGE C CRITERIA WISE INPUT Criteria (i) – Curricular Aspects Criteria (ii) – Teaching- Learning and Evaluation Criteria (iii) – Research Consultancy and Extension Criteria (iv) – Infrastructure and Learning Resources Criteria (v) – Student Support and Progression Criteria (vi) – Governance, Leadership and Management Criteria (vii) – Innovations and Best Practices D EVALUATIVE REPORTS OF THE DEPARTMENTS E APPENDIXES (a) Declaration by the Principal (b) Certificate of Recognition by U.G.C. (c) Income and Expenditure Statement INTRODUCTION Satyawati College is named after Satyawati Devi, an ardent freedom fighter from Delhi, who was instrumental in drawing a large number of women from their homes into the Civil Disobedience Movement. She combined the zest for national liberation with the cause of freedom for women. Her inspiring speeches and acts of defiance during the time of freedom struggle embody the spirit of the College. Satyawati College was established in 1972, by the Delhi Government and is one of the prominent off- campus colleges of Delhi University. The College has seen remarkable growth over the years. Apart from brilliant academic distinctions, our students have also excelled in extra-curricular activities. The College maintains an inclusive atmosphere for students from diverse socio-economic, cultural and regional background and provides them with the space to interact with each other. Spread over ten acres of land, the College houses well equipped classrooms, a rich library, and also provides facilities of a seminar room, computer room, canteen, bank, a photocopier, etc. The College offers campus wide Wi-Fi to the students and faculty. -

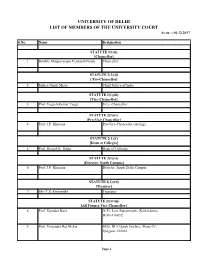

UNIVERSITY of DELHI LIST of MEMBERS of the UNIVERSITY COURT As on :- 04.12.2017

UNIVERSITY OF DELHI LIST OF MEMBERS OF THE UNIVERSITY COURT As on :- 04.12.2017 S.No. Name Designation STATUTE 2(1)(i) [Chancellor] 1 Hon'ble Muppavarapu Venkaiah Naidu Chancellor STATUTE 2(1)(ii) [ Pro-Chancellor] 2 Justice Dipak Misra Chief Justice of India STATUTE 2(1)(iii) [Vice-Chancellor] 3 Prof. Yogesh Kumar Tyagi Vice -Chancellor STATUTE 2(1)(iv) [Pro-Vice-Chancellor] 4 Prof. J.P. Khurana Pro-Vice-Chancellor (Acting) STATUTE 2(1)(v) [Dean of Colleges] 5 Prof. Devesh K. Sinha Dean of Colleges STATUTE 2(1)(vi) [Director, South Campus] 6 Prof. J.P. Khurana Director, South Delhi Campus STATUTE 2(1)(vii) [Tresurer] 7 Shri T.S. Kripanidhi Treasurer STATUTE 2(1)(viii) [All Former Vice-Chancellor] 8 Prof. Upendra Baxi A-51, Law Appartments, Karkardoma, Delhi-110092 9 Prof. Vrajendra Raj Mehta 5928, DLF Qutab Enclave, Phase-IV, Gurgaon-122002 Page 1 10 Prof. Deepak Nayyar 5-B, Friends Colony (West), New Delhi-110065 11 Prof. Deepak Pental Q.No. 7, Ty.V-B, South Campus, New Delhi-110021 12 Prof. Dinesh Singh 32, Chhatra Marg, University of Delhi, Delhi-110007 STATUTE 2(1)(ix) [Librarian] 13 Dr. D.V. Singh Librarian STATUTE 2(1)(x) [Proctor] 14 Prof. Neeta Sehgal Proctor (Offtg.) STATUTE 2(1)(xi) [Dean Student's Welfare] 15 Prof. Rajesh Tondon Dean Student's Welfare STATUTE 2(1)(xii) [Head of Departments] 16 Prof. Christel Rashmi Devadawson The Head Department of English University of Delhi Delhi-110007 17 Prof. Sharda Sharma The Head Department of Sanskrit University of Delhi Delhi-110007 18 Prof. -

Government of Nct of Delhi Department for the Welfare of Sc/St/Obc/Minorities B-Block, 2Nd Floor, Vikas Bhawan, I.P

GOVERNMENT OF NCT OF DELHI DEPARTMENT FOR THE WELFARE OF SC/ST/OBC/MINORITIES B-BLOCK, 2ND FLOOR, VIKAS BHAWAN, I.P. ESTATE, NEW DELHI-110002 SANCTION ORDER Sanction of the Competent Authority is hereby conveyed for incurring an expenditure of Rs. 2,52,80,484/-(Rs. Two Crore Fifty Two Lakh Eighty Thousand Four Hundred Eighty Four Only) on account of "Merit Scholarship to College/Technical/Professional Institutions to SC/ST/OBC/MIN” in r/o 3649 SC/ST (Lot-2) students studying in various recognized Colleges/Institutions for the year 2014-15 (List Enclosed). This sanction has been accorded in exercise of the powers delegated by the Finance Department, Govt. of NCT of Delhi and in consultation with the accounts of the department. The expenditure involved on this account would be debitable to Major Head of Accounts "2225" C-1 Welfare of SC/STs & Backward Classes C-1(3)-General, C-1(3)(2) Special Component Plan for Scheduled Castes, C-1(3)(2)(1) Scholarship for College and University students for SC/STs (SCSP) under Demand No 8 for the year 2014-15 (Plan) and Numerical Code is 2225 80 789 99 00 34. This issue with the approval of Pr. Secretary(DSCST), Govt. of NCT of Delhi vide their U.O.No. 1348 dated 31/03/2015. Sd/- (RP MEENA) DY. DIRECTOR (SC/ST/OBC/MIN) F.No. F11(82)/SCH/DSCST/2014-15/26143-54 Dated :- 31/03/2015 Copy to : 1) Add. Secretary (Planning Dept), Delhi Sectt.I.P. Estate New Delhi. 2) Deputy.Secretary (Finance Budget),DelhiSectt. -

SCHEDULE of SPORTS TRIALS for ADMISSION on the BASIS of SPORTS in UNDERGRADUATE PROGRAMME 2018 S.No

DELHI UNIVERSITY SPORTS COUNCIL UNIVERSITY OF DELHI SCHEDULE OF SPORTS TRIALS FOR ADMISSION ON THE BASIS OF SPORTS IN UNDERGRADUATE PROGRAMME 2018 S.No. Game / Sport Sports Trials (Men&Women) Date Time Venue 1 Archery (M&W) 22 nd June 18 8:00 am Hansraj College, University of Delhi, Delhi-110007 2 Athletics (M&W) 22nd June 18 7:00 am University Pologround, Near New Police Line, Kingsway Camp, Delhi-110009 3 Badminton (M) 25 th June 18 8:00 am Multipurpose Hall, Sports Complex, University of Delhi, Delhi-110007 4 Badminton (W) 28 th June 18 8:00 am Multipurpose Hall, Sports Complex, University of Delhi, Delhi-110007 5 Ball Badminton (M&W) 22 nd June 18 8:00 am Rugby Stadium, Sports Complex, University of Delhi, Delhi-110007 6 Baseball (M&W) 27 th June 18 7:30 am Lakshmibai College Ashok Vihar III, Delhi-110052 7 Basketball (M) 22 nd June 18 8:00 am Multipurpose Hall, Sports Complex, University of Delhi, Delhi-110007 8 Basketball (W) 29 th June 18 8:00 am Multipurpose Hall, Sports Complex, University of Delhi, Delhi-110007 9 Best Physique (M) 28 th June 18 9:00 am PGDAV College (E), Nehru Nagar, Power Lifting(M&W) Ring Road, Delhi- 110065 Weight Lifting (M&W) 10 Boxing (M&W) 26 th June 18 8:00 am Rajiv Gandhi Stadium, Bawana, Delhi, 110039 11 Chess (M&W) 26 th June 18 8:00 am Sri Venkateswara College, Benito Juarez Road, Delhi -110021 12 Cricket (M) 28 th June 18 7:00 am SGTB Khalsa College, University of Delhi, Delhi-110007 13 Cricket (W) 22 nd June 18 8:00 am Kamala Nehru College, August Kranti Marg, Delhi -110049 14 Diving (M&W) 22 nd June 18 9:30 am Dr. -

4Th Semester PD41 Principles of Macroeconomics II

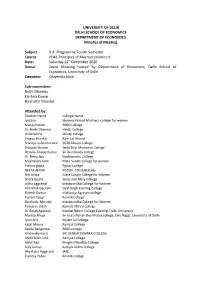

UNIVERSITY OF DELHI DELHI SCHOOL OF ECONOMICS DEPARTMENT OF ECONOMICS Minutes of Meeting Subject B.A. Programme Fourth Semester Course PD41 Principles of Macroeconomics II Date: Saturday 12th December 2020 Venue Zoom Meeting hosted by Department of Economics, Delhi School of Economics, University of Delhi Convenor Dibyendu Maiti Sub-committee: Nidhi Dhamija Krishna Kumar Baishakhi Mondal Attended by: Teacher Name College Name Jyotsna Shyama Prasad Mukherji college for women Manju Pande ARSD College Dr. Nidhi Dhamija Hindu College Iti Dandona Shivaji college Pragya Shankar Ram Lal Anand Srividya Subramaniam SGTB Khalsa College Bijoyata Yonzon Janki Devi Memorial College Renuka Anoop Kumar Sri Aurobindo college Dr. Neha Jain Deshbandhu College Meenakshi kohli Mata Sundri college for women Vishnu gupta Pgdav college GEETA AHUJA PGDAV COLLEGE(Eve) Niti Arora Mata Sundri College for Women Smita Gupta Jesus and Mary College vibha aggarwal Indraprastha College for Women Abhishek Gautam Dyal Singh Evening College Rakesh Kumar Maharaja Agrasen college Punam Tyagi Kalindi College Baishakhi Mondal Indraprastha College for Women Tanusree Dash Kamala Nehru College Dr Anjali Agarwal Motilal Nehru College Evening, Delhi University Mamta Ahuja Sri Guru Nanak Dev Khalsa college, Dev Nagar, University of Delhi Jyoti Atri Shyam lal College Kapil Meena Ramjas College Kavita Bangarwa ARSD college Krishnakumar S SRI VENKATESWARA COLLEGE ASHUTOSH DAS Ramjas College Rohit Rao Bhagini Nivedita College Ajay Kumar Kamala nehru college Akanksha Aggarwal JMC Pummy Yadav Kalindi college Jyoti Mavi Gargi college Sujit Basu Zakir Husain Delhi College (M) Richika SPM College for Women Phunchok Dolker Kalindi College Roopali Goyanka Indraprastha College for Women Dr. Jitender kumar Deshbandhu college Akshara Awasthi Jesus and Mary College Dr Swati Yadav Bhagini Nivedita College SWARUP SANTRA SATYAWATI COLLEGE Suggested number of lectures: Unit 1- 20, Unit 2 - 15; for Units 3- 10 and 4 -15. -

![Satyawati College [University of Delhi] Ashok Vihar, Phase-III, Delhi-110052 Phone No.011-27219570, Fax No.011-27446953 Website](https://docslib.b-cdn.net/cover/3017/satyawati-college-university-of-delhi-ashok-vihar-phase-iii-delhi-110052-phone-no-011-27219570-fax-no-011-27446953-website-1543017.webp)

Satyawati College [University of Delhi] Ashok Vihar, Phase-III, Delhi-110052 Phone No.011-27219570, Fax No.011-27446953 Website

Satyawati College [University of Delhi] Ashok Vihar, Phase-III, Delhi-110052 Phone No.011-27219570, Fax No.011-27446953 Website: www.satyawati.du.ac.in Advt.No. Teaching/SC/2017/01 12th May, 2017 APPLICATIONS FOR THE POST OF ASSISTANT PROFESSORS Online applications are invited in the prescribed Application Form available at web-link http://as1.du.ac.in/colrec2017/index.php from eligible candidates for appointment to the post of Assistant Professors, in the Pay Band of Rs. 15,600-39100/- AGP Rs. 6,000/- (as per VI Pay Commission), in the college. The last date for receipt of applications is 10.06.2017 or within two weeks from the date of publication of the advertisement in the Employment News, whichever is later. For details, please visit the college website www.satyawati.du.ac.in. Any addendum/corrigendum shall be posted only on the College website. Dr. Manjula Dass Officiating Principal Page 1 of 7 Satyawati College [University of Delhi] Ashok Vihar, Phase-III, Delhi-110052 Phone No.011-27219570, Fax No.011-27446953 Website: www.satyawati.du.ac.in Advt./Teaching/SC/2017/01 Online applications are invited in the prescribed Application Form available at web-link http://as1.du.ac.in/colrec2017/index.php for the post of Assistant Professors in the following departments in Pay Band-III of Rs. 15,600-39,100 with Academic Grade Pay of Rs. 6000/- (as per VIth Pay Commission) plus usual allowances as admissible under the rules of University of Delhi from time to time. The last date for receipt of application is 10.06.2017 or within two weeks from the date of publication of the advertisement in the Employment News, whichever is later. -

I Would Like to Welcome Our Honorable Chief Guest, Prof C. Rajkumar, Vice Chancellor, O.P

PRINCIPAL’S REPORT Namaskar! Warm greetings to all virtually present here! I would like to welcome our honorable Chief Guest, Prof C. Rajkumar, Vice Chancellor, O.P. Jindal University, our distinguished Guest of Honour, Lt General Madhuri Kanitkar, AVSM, VSM. I also take this opportunity to welcome our Governing Body Chairperson, Mrs Suman Chauhan, Treasurer Mr. Anwar Shahid and other respected GB Members, invited guests, media personnel, teaching faculty, our superannuated staff, non-teaching staff, support staff, and my very dear students. To begin with I express my concern for the well being of all during this Covid- 19 pandemic situation. Even so, the world around is not what it used to be, we, at Kamala Nehru College have decided to resist pessimism and foster new hope by continuing with our long standing tradition of celebrating our College Day virtually today. In this Annual Report, I would like to present a brief account of our achievements and accomplishments on the academic, co-curricular and the extra-curricular front over the last calendar year, 2019. Our Distinct Achievements It is an honour to report that Kamala Nehru College has been selected as the Mentor Institution under the ‘Paramarsh’ scheme of UGC following the ‘Quality mandate’ in higher education. Kamala Nehru College is one of the four colleges in Delhi University to be awarded ‘Paramarsh’ for mentoring the mentee institutions to enable them to get NAAC accreditation by 2022. Our Mentee institutions are Aryabhatt College, Satyawati College (E), Motilal Nehru College (E) and Indian Institute of Design and Craft, Jaipur. It proves that our College as a well performing institution is rendering high order service to promote Quality Assurance in Higher Education. -

Annual Report 2016-17 SAS

Annual Report 2017 Honourable guests, members of the college community and my dear students, I heartily welcome you all to the College Annual Day, the Day for which you have really worked hard, right from your academic scores to sports events, from NCC parades to NSS camps, from Departmental societies to the Arts & Culture Society. Well, the day has arrived and we all are here with our distinguished guest and invited dignitaries to appreciate your efforts. It is a pleasure to introduce the chief guest for the day, Prof. J.P.Khurana – Pro-Vice-Chancellor, University of Delhi. Prof. Jitendra P. Khurana is the Pro-Vice-Chancellor of Delhi University. As Head of the Plant and Molecular Biology Department, he was an avid believer in the ability to convert knowledge into practical application for the welfare of human beings. He specializes in Photoperception and Signal Transduction Mechanisms in plants; Plant Hormone Action Mechanisms; Structural and Functional Genomics in Plants. A recipient of the prestigious the Professor Birbal Sahni Medal by the Indian Botanical Society in the year 2011, the Professor Panchanan Maheshwari Memorial Lecture Award by the Indian National Science Academy in the year 2008; and the Prof. Shri Ranjan Memorial Award by the National Academy of Sciences, India in the year 2006; his research Interests and contributions to the field are noteworthy. He was awarded the ‘Tata Innovation Fellowship’ by the Department of Biotechnology, Government of India from 2010 to 2013. With over a 150 publications to his credit; his research group has contributed extensively to the area of light perception and signal transduction mechanisms in plants. -

AQAR-2018-KNC-DU-2.Pdf

Kamala Nehru College University of Delhi NAAC Accredited ‘A’ Grade Annual Quality Assurance Report 2018 The Annual Quality Assurance Report (AQAR) of the IQAC Part A 1. Details of the Institution 1.1 Name of the Institution Kamala Nehru College 1.2 Address Line 1 August Kranti Marg Address Line 2 Siri Fort Road City/Town New Delhi State Delhi Pin Code 110049 Institution e-mail address [email protected] Contact Nos. 011-26494881 Name of the Head of the Institution: Dr. Kalpana Bhakuni Tel. No. with STD Code: 011-26495964 Mobile: Mr. K. Ramesh (Admin. Officer) - 09811880906 Name of the IQAC Co-ordinator: Dr. Geetesh Nirban Mobile: 09811423241 IQAC e-mail address: [email protected] 1.3 NAAC Track ID(For ex. MHCOGN 18879) DLCOGN22288 OR 1.4NAAC Executive Committee No. & Date: EC (SC)/18/A&A/15.1, DATE: NOV.05, 2016 1.5 Website address: www.knc.edu.in Web-link of the AQAR: https://www.knc.edu.in/document/AQAR- 2018-KNC-DU-2.pdf AQAR-2018 | Kamala Nehru College | University of Delhi Page | 1 1.6 Accreditation Details Year of Validity Sl. No. Cycle Grade CGPA Accreditation Period 04.11.202 1 1st Cycle A 3.33 2016 1 2 2nd Cycle 3 3rd Cycle 4 4th Cycle 1.7 Date of Establishment of IQAC: 2016 1.8 Details of the previous year’s AQAR submitted to NAACafterthe latest Assessment and Accreditation by NAAC ((for example AQAR 2010-11submitted to NAAC on 12-10-2011) i. AQAR July 2016- June 2017 submitted to NAAC on 13/05/2018 1.9 Institutional Status: University State Central √ Deemed Private Affiliated College Yes No √ Constituent College -

University Court List -05.09.2014 UNIVERSITY of DELHI STATUTE

University Court List -05.09.2014 UNIVERSITY OF DELHI STATUTE 2(1)(i) STATUTE 2(1)(vii) 1. Hon’ble Mohd. Hamid Ansari 7. Shri T.S. Kripanidhi Chancellor Treasurer University of Delhi University of Delhi Vice-President of India Delhi-110007 New Delhi – 110001 STATUTE 2(1)(viii) STATUTE 2(1)(ii) 8. Prof. Upendra Baxi 2. Justice Rajendra Mal Lodha A-51, Law Apartments (Pro-Chancellor, University of Delhi) Karkardoma Chief Justice of India Delhi-110092 Supreme Court of India New Delhi-110001 9. Prof. Vrajendra Raj Mehta 5928,DLF Qutab Enclave STATUTE 2(1)(iii) Phase-IV Gurgaon - 122002. 3. Prof. Dinesh Singh Vice-Chancellor 10. Prof. Deepak Nayyar University of Delhi 5-B, Friends Colony (West) Delhi-110007 New Delhi -110065 STATUTE 2(1)(iv) 11. Prof. Deepak Pental Q.No. 7, Ty.V-B, 4. Prof. Sudhish Pachauri South Campus, Pro-Vice Chancellor New Delhi-110021. University of Delhi Delhi-110007 STATUTE 2(1)(ix) 12. Dr. S.C. Jindal (Offg.) STATUTE 2(1)(v) Librarian 5. Prof. Malashri Lal University of Delhi Dean of Colleges Delhi-110007 University of Delhi, Delhi-110007 STATUTE 2(1)(x) 13. Prof.(Ms.) Satwanti Kapoor Proctor STATUTE 2(1)(vi) University of Delhi Delhi-110007 6. Prof. Umesh Rai Director STATUTE 2(1)(xi) University of Delhi South Campus Benito Jaurez Road 14. Prof. J.M. Khurana New Delhi-110021 Dean Student’s Welfare University of Delhi Delhi-110007 Contd. p/2 1 STATUTE 2(1)(xii) 23. The Head of the Department of Buddhist Studies 15. The Head University of Delhi Department of English Delhi-110007. -

Details of Nodal Officers in Colleges

UNIVERSITY OF DELHI 31.07.2020 REVISED Details of the Nodal Persons in colleges to deal OBE matters and to monitor answer scripts received at E-mails. S.N. College Name Nodal Person e-mail IDs Mobile Nos. Alternate No/ WhatApp No 1 Acharya Narendra Dr Gagan Dhawan [email protected] 9891086006 Dev College 2 Aditi Mahavidyalaya Ms. Leena Sehgal [email protected] 9868932432 3 Aryabhatta College(Formally Mr. Binoy Bhushan Aggarwal [email protected] 9990268718 Ram Lal Anand College-Evg.) 4 Atma Ram Sanatan Dharma Dr. Vikas Kumar [email protected] 9971961377 7982439110 College 5 Bhagini Nivedita College Dr. Anjna Gupta [email protected] 9953894255 8447534736 Dr. Santosh Kaushik 6 Bharati College Dr. Roopa Johri [email protected] 9811976606 7 Bhaskaracharya College of Mr. Rajesh Raghav [email protected] 9868406898 Applied Sciences 8 College of Vocational Dr.Kumar Ashutosh [email protected] 9871930044 Studies 9 Daulat Ram College Mr Amit Kumar [email protected] 9911186879 10 Deen Dayal Upadhyaya Sunil Gupta [email protected] 9212426058 College 11 Delhi College of Arts & Ms Renu Sharma [email protected] 9811830748 Commerce 12 Deshbandhu College Dr. Biswajit Mohanty [email protected], 9015871555 [email protected] 13 Dr Bhim Rao Ambedkar Dr. Nalin Kumar [email protected] 9891463008 College 14 Dyal Singh College (Evening) Mr. Sudhir Kumar [email protected] 9811388040 15 Dyal Singh College Dr. P.V. Arya [email protected] 9868060402 (Morning) 16 Gargi College Ms. Puja Gupta [email protected] 8447041748 17 Hansraj College Dr.Animesh Naskar [email protected] 8920798515 18 Hindu College Dr K K Koul [email protected], 9718383989 [email protected] 19 Indira Gandhi Institute of Mr.