Reference Document 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

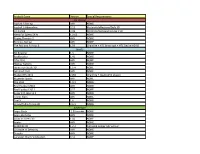

UPC Platform Publisher Title Price Available 730865001347

UPC Platform Publisher Title Price Available 730865001347 PlayStation 3 Atlus 3D Dot Game Heroes PS3 $16.00 52 722674110402 PlayStation 3 Namco Bandai Ace Combat: Assault Horizon PS3 $21.00 2 Other 853490002678 PlayStation 3 Air Conflicts: Secret Wars PS3 $14.00 37 Publishers 014633098587 PlayStation 3 Electronic Arts Alice: Madness Returns PS3 $16.50 60 Aliens Colonial Marines 010086690682 PlayStation 3 Sega $47.50 100+ (Portuguese) PS3 Aliens Colonial Marines (Spanish) 010086690675 PlayStation 3 Sega $47.50 100+ PS3 Aliens Colonial Marines Collector's 010086690637 PlayStation 3 Sega $76.00 9 Edition PS3 010086690170 PlayStation 3 Sega Aliens Colonial Marines PS3 $50.00 92 010086690194 PlayStation 3 Sega Alpha Protocol PS3 $14.00 14 047875843479 PlayStation 3 Activision Amazing Spider-Man PS3 $39.00 100+ 010086690545 PlayStation 3 Sega Anarchy Reigns PS3 $24.00 100+ 722674110525 PlayStation 3 Namco Bandai Armored Core V PS3 $23.00 100+ 014633157147 PlayStation 3 Electronic Arts Army of Two: The 40th Day PS3 $16.00 61 008888345343 PlayStation 3 Ubisoft Assassin's Creed II PS3 $15.00 100+ Assassin's Creed III Limited Edition 008888397717 PlayStation 3 Ubisoft $116.00 4 PS3 008888347231 PlayStation 3 Ubisoft Assassin's Creed III PS3 $47.50 100+ 008888343394 PlayStation 3 Ubisoft Assassin's Creed PS3 $14.00 100+ 008888346258 PlayStation 3 Ubisoft Assassin's Creed: Brotherhood PS3 $16.00 100+ 008888356844 PlayStation 3 Ubisoft Assassin's Creed: Revelations PS3 $22.50 100+ 013388340446 PlayStation 3 Capcom Asura's Wrath PS3 $16.00 55 008888345435 -

Présentation Powerpoint

Compatible Games 1941 Frozen Front Chicken Invaders Dr. Droid 3D MOTOR Chicken Invaders 2 DRAG racing 4 seasons Hunt 3D Chicken Invaders 3 Dream League Soccer Acceler 8 Chicken Invaders 4 Dungeon Hunter 3 Aces of the Luftwaffe Chrono&Cash Dungeon Hunter4 Aftermath XHD Clash - Space Shooter Dungeon Quest Angry Birds GO Cordy EDGE Extended Another World Cordy 2 EtERNITY WARRIORS Antigen Crazy Snowboard ETERNITY WARRIORS 2 Arma Tactics Critter Rollers EVAC HD Army Academy CS portable Everland: Unleashed Asphalt 5 Cup! Cup! Golf 3D! ExZeus Asphalt 6 Dark Incursion ExZeus 2 Asphalt 7 DB42 Farm Invasion USA Asphalt 8 Airborne Dead Effect Farming Simulator Asteriod 2012 Dead Rushing HD Fields Of Battle Auralux Dead Space Final Freeway 2R Avenger Dead Trigger FIST OF AWESOME AVP: Evolution Dead Trigger 2 Forsaken Planet B.M.Snowboard Free DEER HUNTER 2012 Fractal Combat Babylonian Twins Platform Game DEER HUNTER 2013 Fright fight Bermuda Dash DEER HUNTER 2014 Gangstar Vegas Beyond Ynth Dig! Grand Theft Auto : Vice City Beyond Ynth Xams edition Digger HD Grand Theft Auto III Bike Mania Dink smallwood Gravi Bird Bomb Diversion Grudger Blasto! Invaders Dizzy - Prince of the Yolkfolk GT Racing 2 Blazing Souls Acceleration Doom GLES Guns n Glory Block Story Doptrix Gunslugs Brotherhood of Violence II Double Dragon Trilogy Halloween Temple'n Zombies Run Compatible Games Helium Boy Demo Overdroy Sonic 4 Episode II Heretik GLEX Particle arcade shooter Sonic CD Heroes of Loot PewPew Sonic Racing transformed Hexen GLES Pinball Arcade Sonic the Hedgehog -

2006 Reference Document

2006 REFERENCE DOCUMENT Pursuant to Article 212-13 of the General Regulations of the Autorité des Marchés Financiers (AMF), this reference document was filed with the AMF on June 6, 2007. It may be used in support of a financial operation if accompanied by a “note d’opération” (securities note) approved by the AMF. Pursuant to Article 28 of European Commission (EC) Regulation 809/2004, the following information is included in this reference document by way of reference: ● The consolidated and individual financial statements for the fiscal year ended December 31, 2004, as well as the related statutory auditors’ reports, appear on pages 45 to 94 of the reference document filed with the AMF on June 10, 2005 under number D.05-871. ● The consolidated and individual financial statements for the fiscal year ended December 31, 2005, as well as the related statutory auditors’ reports, appear on pages 46 to 100 of the reference document filed with the AMF on June 9, 2006 under number D. 06-0546. Copies of this document are available at the business address of Gameloft S.A.– 14, rue Auber – 75009 Paris and at the company’s registered office. Registered office: 81 rue de Réaumur 75002 Paris French corporation with capital of 3,537,829.20 euros Tel.: (33) 1 58 16 20 40 Paris Corporate and Trade Register No. 429 338 130 - NAF code 722 A 1 CONTENTS 1 PERSONS RESPONSIBLE FOR THE DOCUMENT AND FOR THE AUDIT OF THE FINANCIAL STATEMENTS ............................................................................................................. 8 1.1 Person responsible for the document ...................................................................................... 8 1.2 Certification of the person responsible for the document ...................................................... -

Financial Report and Unaudited Condensed Financial Statements for the Nine Months Ended September 30, 2017

Financial Report and Unaudited Condensed Financial Statements for the nine months ended September 30, 2017 November 16, 2017 VIVENDI Société anonyme with a Management Board and a Supervisory Board with a share capital of €7,119,287,400.50 Head Office: 42 avenue de Friedland – 75380 PARIS CEDEX 08 – FRANCE IMPORTANT NOTICE: READERS ARE STRONGLY ADVISED TO READ THE IMPORTANT DISCLAIMERS AT THE END OF THIS FINANCIAL REPORT. Thursday November 16, 2017 KEY CONSOLIDATED FINANCIAL DATA FOR THE LAST FIVE YEARS ............................................................................................................. 4 I- FINANCIAL REPORT FOR THE FIRST NINE MONTHS OF 2017 ...................................................................................................................... 5 1 EARNINGS ANALYSIS: GROUP AND BUSINESS SEGMENTS ............................................................................................................................... 5 1.1 STATEMENT OF EARNINGS .................................................................................................................................................................................. 6 1.2 STATEMENT OF EARNINGS ANALYSIS ................................................................................................................................................................... 7 1.3 BUSINESS SEGMENT PERFORMANCE ANALYSIS ................................................................................................................................................... -

Envios a Todo El Pais Aspire 1820PT/1420P Series

www.SoporteTecnicoBsAs.com.ar Repuestos para tus equipos. Al mejor precio. Envios a Todo el Pais Aspire 1820PT/1420P Series Service Guide Service guide files and updates are available on the ACER/CSD web; for more information, please refer to http://csd.acer.com.tw PRINTED IN TAIWAN vi Table of Contents System Specifications 1 Features . .1 System Block Diagram . .3 Your Notebook Tour . .4 Front View . .4 Closed Front View . .5 Left View . .6 Right View . .6 Base View . .7 Rear View . .8 Indicators . .8 TouchPad Basics . .9 Using the Keyboard . .10 Lock Keys and embedded numeric keypad . .10 Windows Keys . .11 Hot Keys . .12 Special Keys . .13 Hardware Specifications and Configurations . .14 System Utilities 23 BIOS Setup Utility . .23 Navigating the BIOS Utility . .23 Information . .24 Main . .25 Security . .26 Boot . .29 Exit . .30 BIOS Flash Utility . .31 DOS Flash Utility . .32 WinFlash Utility . .33 Remove HDD/BIOS Password Utilities . .34 Removing BIOS Passwords: . .35 Miscellaneous Utilities . .36 Machine Disassembly and Replacement 39 Disassembly Requirements . .39 Related Information . .39 General Information . .39 Pre-disassembly Instructions . .39 Disassembly Process . .40 External Module Disassembly Process . .41 External Modules Disassembly Flowchart . .41 Removing the Dummy Card . .42 Removing the Battery Pack . .42 Removing the SIM Card . .43 Removing the Module Cover . .44 Removing the Hard Disk Drive Module . .45 Removing the DIMM Module . .47 Removing the WLAN Board . .48 Removing the 3G Module . .49 Main Unit Disassembly Process . .51 Main Unit Disassembly Flowchart . .51 Removing the Keyboard . .53 Removing the Hinge Covers . .55 vii Table of Contents Removing the Upper Cover . -

Board Committee Documents Academic Policy

Eugenio María de Hostos Community College The City University of New York Proposal for an Associate in Applied Science Degree in Game Design Proposal Approved by Hostos Community College Curriculum Committee: March 08, 2011 Hostos Community Senate: March 17, 2011 This program is dedicated to the memory of Professor Magda Vassilov. Through this program her vision, energy and dedication to the students at Hostos Community College will live forever. 2 THE STATE EDUCATION DEPARTMENT / THE UNIVERSITY OF THE STATE OF NEW YORK / ALBANY, NY 12234 OOffffffiiiccee oofff HHiiigghheerrr EEdduuccaatttiiioonn OOffffffiiiccee oofff CCoolllllleeggee aanndd UUnniiivveerrrssiiitttyy EEvvaallluuaatttiiioonn Proposal Cover Page Use this application for any new program below the doctoral level that does not lead to licensure or preliminary or advanced study in one of the areas licensed by the State Education Department. Any institution considering a new doctoral program should contact the Office of College and University Evaluation at (518) 474-1551 for the application, "Steps in the Review of Doctoral Program Proposals". Public institutions should use the appropriate SUNY/CUNY proposal submission forms in lieu of this document and submit the proposal to the Central Administration of SUNY/CUNY. If the program will lead to certification as a classroom teacher, use the Application Form for Registration of a Teacher Education Program instead of this document, available at www.highered.nysed.gov/ocue/tetappl.htm. If an already registered program will be offered in a distance education format use the application at http://web1.nysed.gov/ocue/distance/ and select “To Register a Distance Education Program.” A. Name of institution: Eugenio María de Hostos Community College/CUNY Specify campus where program will be offered, if other than the main campus: B. -

SESSION TITLE Speaker Name Title, Company

THE TEN COMMANDMENTS OF GOOD VIDEO-GAME STORYTELLING Rob Auten & Tom Bissell Thursday, October 13, 2011 Who Are You Guys? Thursday, October 13, 2011 ROB: I started working in games about ten years ago when I and a friend of mine who was film director started collaborating on writing and directing game cinematics, mostly for Ubisoft. A few years later, I took a long-term consulting gig at Fox where I was asked to keep an eye on the dozen or so licensed games they had in production, which is sort of the most thankless job in both Hollywood and the games industry. But, I spent a lot of time with some amazing game teams and filmmakers and learned a lot about how both worked. Some of the highlights for me were Aliens, Avatar, Alvin and the Chipmunks and Jumper. Who Are You Guys? Thursday, October 13, 2011 Tom jumps in to say Jumper: Griffinʼs Story. We donʼt want anyone to get confused about which Jumper property weʼre talking about. ROB: Anyway, now I work as a full-time writer and focus on trying not to repeat the mistakes I saw when I was sitting on the other side of the desk. Who Are You Guys? Thursday, October 13, 2011 TOM: I came to games as a literary writer and journalist who played games all his life, but especially when he had writerʼs block. A really, really severe case of writerʼs block led eventually to my wanting to write about video games. The book I wrote, Extra Lives, came out last year, and did not sell as well as anticipated, and please find me after this talk so I can blame you personally. -

Capcom Announces Its Big Game Lineup for Fiscal Ending March 2011

January 26, 2010 Press Release 3-1-3, Uchihiranomachi, Chuo-ku Osaka, 540-0037, Japan Capcom Co., Ltd. Haruhiro Tsujimoto, President and COO (Code No. 9697 Tokyo - Osaka Stock Exchange) Capcom Announces Its Big Game Lineup for Fiscal Ending March 2011 - F inancial outlook is good as Capcom’s heavy hitting titles are announced for this fiscal period - Capcom Co., Ltd. is proud to announce its lineup of Xbox 360® titles to be released before the fiscal year ending in March 2011. Our lineup announcement starts with “Super Street Fighter IV”, the latest iteration of the iconic “Street Fighter” franchise, which is scheduled for release on April 28, 2010. The next iteration of the globally popular “Lost Planet” series, “Lost Planet 2”, is slated for a May 20, 2010 release. In addition, the PC game “Monster Hunter Frontier Online” will begin Japanese service on the Xbox 360® in the summer of 2010. Lastly, the next installment in the “Dead Rising” series of video games, “Dead Rising 2”, is planned for release in the 2010 calendar year. Not only that, but a new live action film, “Zombrex: Dead Rising Sun”, will be released in Japan, leveraging a strong multiple media strategy for this series which has already been met with great success in Europe and America. Capcom’s release lineup for this period will include many other high-profile titles, and we can expect our lineup to perform increasingly well. Detailed sales forecasts for each title are still under review. Capcom will continue to release exciting titles on an aggressive schedule, maximizing the value of our titles and expanding our sales. -

Bioshock Infinite

SOUTH AFRICA’S LEADING GAMING, COMPUTER & TECHNOLOGY MAGAZINE VOL 15 ISSUE 10 Reviews Call of Duty: Black Ops II ZombiU Hitman: Absolution PC / PLAYSTATION / XBOX / NINTENDO + MORE The best and wors t of 2012 We give awards to things – not in a traditional way… BioShock Infi nite Loo k! Up in the sky! Editor Michael “RedTide“ James [email protected] Contents Features Assistant editor 24 THE BEST AND WORST OF 2012 Geoff “GeometriX“ Burrows Regulars We like to think we’re totally non-conformist, 8 Ed’s Note maaaaan. Screw the corporations. Maaaaan, etc. So Staff writer 10 Inbox when we do a “Best of [Year X]” list, we like to do it Dane “Barkskin “ Remendes our way. Here are the best, the worst, the weirdest 14 Bytes and, most importantly, the most memorable of all our Contributing editor 41 home_coded gaming experiences in 2012. Here’s to 2013 being an Lauren “Guardi3n “ Das Neves 62 Everything else equally memorable year in gaming! Technical writer Neo “ShockG“ Sibeko Opinion 34 BIOSHOCK INFINITE International correspondent How do you take one of the most infl uential, most Miktar “Miktar” Dracon 14 I, Gamer evocative experiences of this generation and make 16 The Game Stalker it even more so? You take to the skies, of course. Contributors 18 The Indie Investigator Miktar’s played a few hours of Irrational’s BioShock Rodain “Nandrew” Joubert 20 Miktar’s Meanderings Infi nite, and it’s left him breathless – but fi lled with Walt “Shryke” Pretorius 67 Hardwired beautiful, descriptive words. Go read them. Miklós “Mikit0707 “ Szecsei 82 Game Over Pippa -

URL-Адреса Mail.Ru Group Vk.Com Mail.Ru Group Mail.Ru

URL-адреса Mail.Ru Group Vk.com Mail.Ru Group Mail.ru // Почта, внутренние страницы Mail.Ru Group Mail.ru // Главная страница Mail.Ru Group Odnoklassniki.ru Mail.Ru Group Mail.ru // Ответы Mail.Ru Group Mail.ru // Новости Mail.Ru Group Mail.ru // Леди Mail.Ru Group Mail.ru // Мой мир Mail.Ru Group Mail.ru // Поиск Mail.Ru Group Mail.ru // Облако Mail.Ru Group Mail.ru // Дети Mail.Ru Group Mail.ru // Афиша & ТВ-программа Mail.Ru Group Mail.ru // Авто Mail.Ru Group Mail.ru // Hi-Tech Mail.Ru Group Mail.ru // Игры Mail.Ru Group Mail.ru // Здоровье Mail.Ru Group Mail.ru // Недвижимость Mail.Ru Group Mail.ru // Погода Mail.Ru Group Mail.ru // Знакомства Mail.Ru Group Mail.ru // Питомцы Mail.Ru Group Mail.ru // Товары Mail.Ru Group Mail.ru // Календарь Mail.Ru Group Одноклассники Mail.Ru Group Вконтакте Яндекс Яндекс // Результат поиска Яндекс Яндекс // Главная страница Яндекс Яндекс // Картинки Яндекс Яндекс // Видео Яндекс Яндекс // Карты Яндекс Яндекс // Почта Яндекс Яндекс // Новости Яндекс Яндекс // Маркет Яндекс Яндекс // Погода Яндекс Яндекс // Диск Яндекс Яндекс // Музыка Яндекс Яндекс // Перевод Яндекс Яндекс // ТВ Яндекс Яндекс // Расписания Яндекс Яндекс // Деньги Яндекс Яндекс // Афиша Яндекс Яндекс // Авиабилеты Яндекс Яндекс // Недвижимость Яндекс Яндекс // Метро Яндекс Яндекс // Работа Яндекс Яндекс // www.ya.ru Яндекс Яндекс // Такси Яндекс Яндекс // Путешествия Яндекс Яндекс // Радио Яндекс Яндекс // Автобусы Яндекс Яндекс // Фотки Яндекс Яндекс // Справочник Яндекс Yandex Google Sites Youtube.com Google Sites Google (ru+com) -

Notice of Meeting 2018 Combined General Shareholders’ Meeting Contents

Thursday, April 19, 2018 at 10:30 a.m. The Olympia 28, boulevard des Capucines 75009 Paris-France NOTICE OF MEETING 2018 COMBINED GENERAL SHAREHOLDERS’ MEETING CONTENTS LETTER FROM THE CHAIRMAN OF THE SUPERVISORY BOARD AND THE CHAIRMAN OF THE MANAGEMENT BOARD 3 CORPORATE GOVERNANCE BODIES OF THE COMPANY 4 AGENDA AND DRAFT RESOLUTIONS 7 REPORT OF THE MANAGEMENT BOARD AND THE SUPERVISORY BOARD ON THE RESOLUTIONS 18 ANNEX 24 STATUTORY AUDITORS’ REPORTS 25 POSITION OF THE COMPANY AND OF THE GROUP IN 2017 35 FINANCIAL RESULTS OF THE LAST FIVE YEARS 39 HOW TO PARTICIPATE IN THE GENERAL SHAREHOLDERS’ MEETING 41 REQUEST FOR DOCUMENTS 45 This is a free translation of the French Convening Notice (Brochure de convocation) and is provided solely for the convenience of English-speaking readers. In the event of a discrepancy, the French version shall prevail. LETTER FROM THE CHAIRMAN OF THE SUPERVISORY BOARD AND THE CHAIRMAN OF THE MANAGEMENT BOARD "STRONG PERFORMANCE IN 2017" Dear Shareholder, Since 2014, Vivendi’s strategy has been clear and ambitious: to build a leader in content, media and communications. Today, we operate across the entire value chain, from talent discovery to production, and from publishing to content distribution. The positive fi nancial results achieved in 2017 confi rm that our ambitions are well-founded. The performance of Universal Music Group (UMG) was driven by subscription and streaming services. Particularly dynamic, UMG has entered into agreements with Tencent, Spotify, YouTube and Facebook that will give it greater fl exibility and allow it to better monetize the content of its artists, while creating new sources of revenues for the future. -

Android Game Version Special Requirements Asphalt 5 Racing

Android Game Version Special Requirements Car Racing Asphalt 5 Racing ANY NONE Asphalt 6 Adrenaline 3.12 Motorola Milestone/Defy SD GT Racing 3.18 Motorola/Samsung Galaxy S SD Need For Speed Shift 1.0.63 NONE Raging Thunder 2 ANY NONE Reckless Racing ANY NONE The Fast and Furious 5 1.03 Chainfire + HTC Bravo apk + HTC Desire HD SD Sports 3D Bowling 1.3 NONE Backbreaker 1.41 NONE FIFA 2010 ANY NONE Hockey Nations ANY NONE Home-run Battle 3D 1.5.4 NONE Lets Golf 2 HD ANY NONE Maden NFL 2011 2138 Chainfire + Qualcomm plug-in Magnetic Sports ANY NONE PES 2011 1.0.1 NONE Real Football 2010 ANY NONE Real Football 2011 3.17 NONE Super K.O. Boxing 2 ANY NONE Tennis Slam ANY NONE Trial X 1.6 NONE Virtual Table-Tennis 3D 2.6.1 NONE Adventure Angry Birds 1.53 market NONE Angry Birds Rio ANY NONE Assasins Creed 3D 1.04 NONE Avatar ANY NONE Backstab HD 1.2.2 Samsung Galaxy Tab version Crussade of Destinity ANY NONE Dracula ANY NONE Gangstar Miami Vindication 3.14 NONE Gangstar West Coast Hustle 3.38 NONE Guerrilla Bob 1.0.1 market NONE Hero of Sparta ANY NONE Mystique ANY NONE Sacred Odyssey 1.03 Samsung Galaxy S version Samurai II Vengeance 1 Chainfire + NVIDIA plug-in Shadow Guardian 1.0.1 Chainfire + Qualcomm plug-in Splinter Cell Conviction HD 3.2 NONE Welcome To Hell ANY NONE Arcade Shooter Brothers In Arms 2 3.08 NONE Contract Killer 1.1.0 NONE Modern Combat ANY NONE Modern Combat 2 3.3 NONE Nova ANY NONE Nova 2 ANY NONE Tom Clancy Rainbow Six Shadow Vanguard 1.01 NONE Toon Warz ANY NONE Fight Bruce Lee Dragon Warrior 1.14.18 NONE Iron Sight ANY NONE Role Paying Dungeon Defenders ANY NONE Dungeon Defenders Second Wave ANY NONE Dungeon Hunter 2 HD ANY NONE Eternal Legacy ANY NONE Ships Galaxy On Fire 2 NVIDIA Chainfire + NVIDIA plug-in Galaxy On Fire Adreno Chainfire + Qualcomm plug-in Wave Blazer ANY NONE Turbo Fly 3D ANY NONE T-racer HD ANY NONE Jet Cars Stunt ANY NONE Air Attack HD ANY NONE Start Batallion ANY NONE Armaggedon Squadron ANY NONE.