Mangalam Seeds Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Narrating North Gujarat: a Study of Amrut Patel's

NARRATING NORTH GUJARAT: A STUDY OF AMRUT PATEL’S CONTRIBUTION TO FOLK LITERATURE A MINOR RESEARCH PROJECT :: SUBMITTED TO :: UNIVERSITY GRANTS COMMISSION :: SUBMITTED BY :: DR.RAJESHKUMAR A. PATEL ASSOCIATE PROFESSOR SMT.R.R.H.PATEL MAHILA ARTS COLLEGE, VIJAPUR DIST.MEHSANA (GUJARAT) 2015 Preface Literature reflects human emotions, thoughts and expressions. It’s a record of activities and abstract ideas of human beings. The oral tradition of literature is the aspect of literature passing ideas and feelings mouth to mouth. I’ve enjoyed going through the precious and rare pieces of folk literature collected and edited by Amrut Patel. I congratulate and salute Amrut Patel for rendering valuable service to this untouchable, vanishing field of civilization. His efforts to preserve the vanishing forms of oral tradition stand as milestone for future generation and students of folk literature. I am indebted to UGC for sanctioning the project. The principal of my college, Dr.Sureshbhai Patel and collegues have inspired me morally and intellectually. I thank them. I feel gratitude to Nanabhai Nadoda for uploding my ideas and making my work easy. Shaileshbhai Paramar, the librarian has extended his time and help, I thank him. Shri Vishnubhai M.Patel, Shri R.R.Ravat, Shri.D.N.Patel, Shri S.M.Patel, Shri R.J.Brahmbhatt, Shri J.J.Rathod., Shri D.S.Kharadi, B.L.Bhangi and Maheshbhai Limbachiya have suppoted me morally. I thank them all. DR.Rajeshkumar A.Patel CONTENTS 1. Introduction: 1.1 North Gujarat 1.2 Life and Works of Dr.Amrut Patel 1.3 Folk Literature-An Overview 2. -

Request for Proposal (RFP)

Request For Proposal (RFP) For Selection of Build, Own, Operate, and Transfer (BOOT) Operator to set-up and manage Information & Communication Technology System (ICTS) Infrastructure For Gujarat State Disaster Response RFP Notice no. 03 of 2011 Date: 15 June, 2011 Issued by Gujarat State Disaster Management Authority Block No. 11, 5th Floor, Udyog Bhavan, Gandhinagar- 382011, Gujarat, India Tel: +91-79-23259025 / Fax: +91-79-23259275 email: [email protected] www.gsdma.org RFP Notice No.03 of 2011 Table of Contents DISCLAIMER 6 SECTION A – DEFINITIONS, ACRONYMS AND INTERPRETATION 8 I. Definitions 8 II. Acronyms 10 III Interpretation 12 SECTION – 1: OVERVIEW 13 1.1 Introduction: 13 1.1.1 Gujarat State: 13 1.1.2 Vulnerability to Disasters 13 1.1.3 Need Assessment: 14 1.2 Emergency & Disaster Management (DM) 14 1.2.1 DM Organisation – Gujarat State 14 1.2.2 Framework of Disaster Management System Activities 15 1.2.3 Planned Network Infrastructure 16 1.2.4 Emergency Operation Centers (EOC) 16 1.2.5 Emergency Resource Centers (ERCs) 17 1.2.6 State EOC-Concept of Operation 17 1.2.7 Brief description of the project 18 1.2.8 Deliverables 20 1.2.9 Available resources 20 1.2.10 Scope of work 21 1.3 Request for Proposal 22 1.3.1 Due diligence by Bidder 23 1.3.2 RFP Document and Tender Fee 23 1.3.3 Validity of the Bid 23 1.3.4 Brief description of the Bidding Process 23 1.3.5 Currency conversion rate and payment 24 1.3.6 Key Events and Dates 24 1.3.7 Communications 24 SECTION – 2: INSTRUCTIONS TO BIDDERS 26 A. -

Esmf-Ncrmp-Gsdma

Environment and Social Management Framework GUJARAT STATE DISASTER MANAGEMENT AUTHORITY (GSDMA) Draft Environment and Social Management Framework National Cyclone Risk Mitigation Project-II Abbreviations APL Adaptable Programme Loan APMC Agriculture Produce Market Committee BISAG Bhaskaracharya Institute of Space Application and Geo-Informatics, Gandhinagar BNHS Bombay natural History Society BP Bank Procedures BT Black Top CRZ Coastal Regulation Zone CSMMC Cyclone Shelter Management and Maintenance Committee CVCA Critically Vulnerable Coastal Areas CZMA Coastal Zone Management Authority CZMP Coastal Zone Management Plans DPO District Project Coordinator EA Environment Assessment EAC Expert Appraisal Committee EC Environmental Clearance EIA Environmental Impact Assessment EMP Environment Management Plan EPA The Environment (Protection) Act ESS Environment and Social Standards FCA Forest (Conservation) Act, 1980 GCZMA Gujarat Coastal Zone Management Authority GEC Gujarat Ecology Commission GoI Government of India GPCB Gujarat Pollution Control Board GS Gram Sabha GSDMA Gujarat State Disaster Management Authority GSDP Gujarat‟s State Domestic Product GVA Gross Value Added HRVA Hazard Risk and Vulnerability Atlas HTL High Tide Line IBA Important Bird Area IDA International Development Association IMD Indian Metrological Department LTL Low Tide Line MoEFCC Ministry of Environment and Climate Change NH National Highways NCRMP National Cyclone Risk Mitigation Project NDMA National Disaster Management Authority OP Operational Policies PAP Project Affected Persons PGA Peak Ground Acceleration PMSC Project Management Consultancy Service SAC, ISRO Space Application Centre, Indian Space Research Organization, Ahmedabad SEAC State Expert Appraisal Committee SH State Highway TOR Terms of Reference UTs Union Territories UNDP United Nation Development Program WB World Bank CONTENTS CHAPTER-1: BRIEF ABOUT NATIONAL CYCLONE RISK MITIGATION PROJECT ................................................. -

Hiv/Aids Prevention Plan

Public Disclosure Authorized Roads and Buildings Department Government of Gujarat Public Disclosure Authorized Second Gujarat State Highway Project (GSHP-II) Public Disclosure Authorized HIV/AIDS PREVENTION PLAN Public Disclosure Authorized May, 2019 Consultancy Services for Project Management of Second Gujarat State Highway Project (GSHP-II) Second Gujarat State Highway Project Roads & Buildings Department, GoG Roads in Gujarat TABLE OF CONTENTS EXECUTIVE SUMMARY................................................................................................................. 1 E1. PROJECT BACKGROUND........................................................................................................... 1 E2. NEED FOR PREPARATION OF HPP ............................................................................................ 1 E3. TARGET AND OBJECTIVES OF HPP ............................................................................................ 2 E4. METHODOLOGY ...................................................................................................................... 2 E5. HIV/AIDS Scenario in gujarat and key issues ............................................................................ 2 E6. identification of hotspots, health care centres ......................................................................... 3 E7. target interventions and health services .................................................................................. 4 Pattern of Truck Movement and Spread Effect of HIV/AIDS.............................................................. -

Directory Establishment

DIRECTORY ESTABLISHMENT SECTOR :RURAL STATE : GUJARAT DISTRICT : Ahmadabad Year of start of Employment Sl No Name of Establishment Address / Telephone / Fax / E-mail Operation Class (1) (2) (3) (4) (5) NIC 2004 : 0121-Farming of cattle, sheep, goats, horses, asses, mules and hinnies; dairy farming [includes stud farming and the provision of feed lot services for such animals] 1 VIJAYFARM CHELDA , PIN CODE: 382145, STD CODE: NA , TEL NO: 0395646, FAX NO: NA, E-MAIL : N.A. NA 10 - 50 NIC 2004 : 1020-Mining and agglomeration of lignite 2 SOMDAS HARGIVANDAS PRAJAPATI KOLAT VILLAGE DIST.AHMEDABAD PIN CODE: NA , STD CODE: NA , TEL NO: NA , FAX NO: NA, 1990 10 - 50 E-MAIL : N.A. 3 NABIBHAI PIRBHAI MOMIN KOLAT VILLAGE DIST AHMEDABAD PIN CODE: NA , STD CODE: NA , TEL NO: NA , FAX NO: NA, 1992 10 - 50 E-MAIL : N.A. 4 NANDUBHAI PATEL HEBATPUR TA DASKROI DIST AHMEDABAD , PIN CODE: NA , STD CODE: NA , TEL NO: NA , 2005 10 - 50 FAX NO: NA, E-MAIL : N.A. 5 BODABHAI NO INTONO BHATHTHO HEBATPUR TA DASKROI DIST AHMEDABAD , PIN CODE: NA , STD CODE: NA , TEL NO: NA , 2005 10 - 50 FAX NO: NA, E-MAIL : N.A. 6 NARESHBHAI PRAJAPATI KATHAWADA VILLAGE DIST AHMEDABAD PIN CODE: 382430, STD CODE: NA , TEL NO: NA , 2005 10 - 50 FAX NO: NA, E-MAIL : N.A. 7 SANDIPBHAI PRAJAPATI KTHAWADA VILLAGE DIST AHMEDABAD PIN CODE: 382430, STD CODE: NA , TEL NO: NA , FAX 2005 10 - 50 NO: NA, E-MAIL : N.A. 8 JAYSHBHAI PRAJAPATI KATHAWADA VILLAGE DIST AHMEDABAD PIN CODE: NA , STD CODE: NA , TEL NO: NA , FAX 2005 10 - 50 NO: NA, E-MAIL : N.A. -

Integrated Renewable Energy Resource Assessment for Gujarat

Final (March 2012) Project code 2010RT08 IInntteeggrraatteedd rreenneewwaabbllee eenneerrggyy rreessoouurrccee aasssseessssmmeenntt ffoorr GGuujjaarraatt Integrated renewable energy resource assessment for Gujarat © The Energy and Resources Institute 2012 Suggested format for citation T E R I. 2012 Integrated renewable energy resource assessment for Gujarat New Delhi: The Energy and Resources Institute. 121pp. [Project Report No. 2010RT08] Disclaimer: This initiative is supported by Shakti Sustainable Energy Foundation (―Foundation‖), however the views expressed and analysis in this document /tool does not necessarily reflect views of the Foundation. The Foundation also does not guarantee the accuracy of any data included in this publication and/or product nor does it accept any responsibility for the consequences of its use. For more information Project Monitoring Cell T E R I Tel. 2468 2100 or 2468 2111 Darbari Seth Block E-mail [email protected] IHC Complex, Lodhi Road Fax 2468 2144 or 2468 2145 New Delhi – 110 003 Web www.teriin.org India India +91 • Delhi (0)11 ii Integrated renewable energy resource assessment for Gujarat Table of Contents ACKNOWLEDGEMENTS ................................................................................................................ XI GLOSSARY ................................................................................................................................... XV EXECUTIVE SUMMARY ............................................................................................................. -

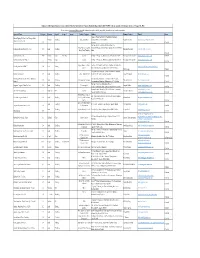

Annex Y COS Operator List

Biocert International Pvt Ltd certified operations as per STANDARD: •Pursuant to Part 13 of the Safe Food for Canadians Regulations (SFCR) (Canadian Organic STANDARDS (COS) Product Regulation Compliance with the 32.310 / CAN/CGSB 32.311 General Principles and Management Standards and Permitted Substances Lists) (Most Updated Version) ) and certified also as per USCOEA requirement Name of operator Category Address of the inspected site COUNTRYSTANDARD CERTIFIED with contact details BHARAT GLUCOSE PROCESSING PAKHANA-NADANA ROAD, INDIA Canada Organic Satndards CERTIFIED PRIVATE LIMITED VILLAGE PAKHANA, TARAORI, and U.S. - CANADA KARNAL, HARYANA- 132116 ORGANIC EQUIVALENCY AGREEMENT Betul Oil Limited PROCESSING B12, CHINCHOLI, MIDC, INDIA Canada Organic Satndards CERTIFIED SOLAPUR, DISTRICT and U.S. - CANADA SOLAPUR, MAHARASHTRA. ORGANIC EQUIVALENCY AGREEMENT ORCHID EXIM (INDIA) PROCESSING NEAR SAHARA HOTEL INDIA Canada Organic Satndards CERTIFIED PVT. LTD. UNJHA-PALANPUR HIGHWAY and U.S. - CANADA POST:-MAKTUPUR ORGANIC EQUIVALENCY (UNJHA) 384170 AGREEMENT NORTH-GUJARAT Bhargavi AGRO PROCESSING UMTA KHERALU HIGHWAYOPP INDIA Canada Organic Satndards CERTIFIED NALANDA COLLEGE, NEAR and U.S. - CANADA RUPEN RIVER UMTA, TA- ORGANIC EQUIVALENCY VISNAGAR MAHESANA AGREEMENT GUJARAT, 384170. Live Organics TRADING U.G.31, SUNRISE TOWER, 579- INDIA Canada Organic Satndards CERTIFIED M.G. ROAD, INDORE, MADHYA and U.S. - CANADA ORGANIC EQUIVALENCY PRADESH-452001. AGREEMENT Ethics Organic PROCESSING ETHICS ORGANIC INDIA Canada Organic Satndards CERTIFIED B/402, TITANIUM SQUARE, NR. and U.S. - CANADA THALTEJ CROSS ROAD, S. G. ORGANIC EQUIVALENCY HIGHWAY, THALTEJ AGREEMENT AHMEDABAD GUJARAT CAPITAL VENTURES PACKAGING AND 1002, 10th Floor, Aggarwal INDIA Canada Organic Satndards CERTIFIED PVT LTD LABELLING Corporate heights, Netaji and U.S. - CANADA Subash Place ORGANIC EQUIVALENCY Pitam Pura, New Delhi- AGREEMENT 110034, INDIA MANJEET FIBRES PROCESSING C/O VIHANA ORGANICS, INDIA Canada Organic Satndards CERTIFIED PRIVATE LIMITED SURVEY NO. -

DRAFT DETAILED PROJECT REPORT Volume IV (Environmental Management Plan)

Roads and Buildings Department Government of Gujarat Second Gujarat State Highway Project Mehsana-Palanpur SH 41 DRAFT DETAILED PROJECT REPORT Volume IV (Environmental Management Plan) December, 2018 LEA Associates South Asia Pvt. Ltd., India Consultancy Services for Project Management of Roads & Buildings Department, Second Gujarat State Highway Project Government of Gujarat Roads in Gujarat TABLE OF CONTENTS 1 INTRODUCTION ........................................................................................................................4 1.1 BACKGROUND .......................................................................................................................... 4 1.2 CONTEXT FOR THE EMP ........................................................................................................... 4 1.3 BRIEF DESCRIPTION OF THE PROJECT ROAD ............................................................................ 5 1.4 STRUCTURE OF THE REPORT .................................................................................................... 6 2 PROPOSED PROJECT IMPROVEMENT .........................................................................................7 2.1 IMPROVEMENT OF PROJECT CORRIDOR .................................................................................. 7 2.2 MAXIMUM UTILISATION OF ROW ............................................................................................ 7 3 ENVIRONMENTAL ISSUES AND DESIGN MEASURES .................................................................. 13 3.1 -

Operator List EU 20210805.Xlsx

Enlisted certified operations have been certified to OneCert International Organic Standards-Equivalent to EC 834/2007. This list includes certified operations as of August 05, 2021 Please contact [email protected] for information on decertified, suspended, surrendered and revoked operations. Operator Name Category Country Scope 1 Scope 2 Scope 3 Product Category Address Primary Contact E-mail Status Group 2, Thanh Tan Hamlet, Thanh Binh Commune, Doanh Nghiep Tu Nhan Phuc Thang c/o Pure Vietnam Handling Tapioca products Tan Bien District, Tinh Tay Ninh Nguyen Van Tu [email protected], [email protected] Diets Vietnam Co., Ltd D Vietnam Certified Plot No. 24 to 31 and 25 to 30, Khasra No. 135/1, Herbs, Spices, Vegetable Sonamukhi Nagar, Salawas Road, Jodhpur, Rajasthan-342013, Cultivator Natural Products Pvt. Ltd D India Handling Rupakshi Prajapati [email protected] Dried, Fruit, Triphala India Certified NC Coconut Co., Ltd. A, D Thailand Crop Handling Coconut 89 Moo 12 Paengpuay, Damnemsaduak, Ratchaburi 70130 Narongsak Chuensuchon [email protected] Certified NC Coconut Co., Ltd. Phase 2 Thailand Crop Coconut 89 Moo 12 Paengpuay, Damnoensaduak, Ratchaburi 70130 Narongsak Chuensuchon [email protected] A Certified Sugar, Molasses, Flour, Unit No: AU-15-K02, Gold Tower, Plot No: JLT-PH1-13A, Pure Organic Foods DMCC D UAE Trading [email protected], [email protected] Starch Jumeirah Lakes Towers, Dubai, United Arab Emirates Divya Singh Certified 132, SONAMUKHI NAGAR, SANGARIA FANTA, JODHPUR, Riddhi International D India Handling herbs, powder & Oil RAJASTHAN - 342013, jodhpur, Rajasthan Sanjeev Prajapati [email protected] Certified Vitthalrao Shinde Sahakari Sakhar Karkhana Gangamainagar-Pimpalner, Tal.-Madha, Dist. -

Institute Aishe Code

Institute Aishe Code Aishe SrNo Institute Name Code 1 C-56033 EVA COLLEGE OF AYURVEDA (Id: C-56033) 2 C-329 Indrashil Institute of Science & Technology (Id: C-329) 3 C-55916 L.J. INSTITUTE OF PHYSIOTHERAPY (Id: C-55916) 4 C-58709 Netra chikitsa ayurveda college (Id: C-58709) 5 C-56114 PARUL INSTITUTE OF APPLIED SCIENCES AND RESEARCH (Id: C-56114) Parul Institute of Engineering & Technology-MCA Programme (SFI)- 6 C-155 Vadodara 525 (Id: C-155) VIDHYADEEP INSTITUTE OF ENGINEERING AND TECHNOLOGY, 094 (Id: 7 C-45064 C-45064) VYAVASAYI VIDYA PRATISHTHAN SANCHALIT HARSUKHBHAI K. DHRUV 8 C-58341 CENTRE OF PLANNING (Id: C-58341) 9 C-50343 D V P COLLEGE, DEVIKA (Id: C-50343) 030 L.D.R.P. INSTITUTE OF TECH. & RESEARCH., GANDHINAGAR (Id: C- 10 C-322 322) 11 C-375 749 S.V. Institute of Management (SFI),Kadi. (Id: C-375) 12 S-12594 A B SOLANKI PTC COLLEGE KODINAR, JUNAGADH 13 C-50539 A L T TRAINING COLLEGE (Id: C-50539) A P TRIVEDI ARTS, COMMERCE AND SCIENCE COLLEGE, KHORDA (Id: C- 14 C-50313 50313) 15 C-176 A. D. Patel Institute Of Technology, Karamsad 001 (Id: C-176) A. R. COLLEGE OF PHARMACY & G.H.P. INSTITUTE OF 16 C-460 PHARMACY(Diploma), V.V.NAGAR 401 (Id: C-460) 17 C-495 A. V. Patel Commerce College, Bilimora (Id: C-495) 18 C-364 A. Y. Dadabhai Technical Institute, Kosamba 601 (Id: C-364) A.K.DOSHI MAHILA ARTS, COMM. &. HOMESCI. COLLEGE-JAMNAGAR 19 C-954 (Id: C-954) 20 S-13989 A.K.PATEL SCHOOL OF NURSING , VALAD, GANDHINAGAR. -

05APL-Details-Unpaid-Unclaimed-Dividend-2010-2011

ALEMBIC PHARMACEUTICALS LIMITED - DETAILS OF UNCLAIMED/UNPAID DIVIDEND FOR THE YEAR 2010-11 AS ON 31ST JULY, 2015 First Name Middle Name Last Name Father/Husband First Name Father/Husband Father/Husband Address Country State District PINCode Folio Number of Investment Type Amount Due Proposed Date of Middle Name Last Name Security (in Rs.) Transfer to IEPF (DD- MON-YYYY) A A JHAPIT S O REV AMOS S JHAPIT MEDICAL OFFICER HINDON RIVER MILLS INDIA UTTAR PRADESH 201001 ALEM000000000003 Amount for unclaimed and 150.00 27-Sep-2018 D C M DASNA GHAZIABAD U P 201001 2926 unpaid dividend A ANIL KUMAR UPPARA ASWARTHAPPA NO 11/13 2nd FLOOR 4th CROSS INDIA KARNATAKA 560029 ALEM120106000080 Amount for unclaimed and 40.00 27-Sep-2018 VENKATESHWAR LAYOUT S.G.PALYA 6633 unpaid dividend BANGALOR SOUTH DHRAMARAM COIIEBANGALORE A ANUPKUMAR K AIYAPPAN PILLAI SHROFF HOUSE TRIVANDRUM-695014 INDIA KERALA 695014 ALEM000000000003 Amount for unclaimed and 50.00 27-Sep-2018 KERALA STATE KERALA STATE 695014 3111 unpaid dividend A B AGASHE B AGASHE BHADKAMKAR WADA BRAMHINPURI INDIA MAHARASHTRA 416410 ALEM000000000005 Amount for unclaimed and 300.00 27-Sep-2018 MIRAJ 416410 6446 unpaid dividend A GANAPATHY UDUPA LATE A NARAYANA UDUPA 843, 10TH CROSS, 23RD MAIN 2ND INDIA KARNATAKA 560078 ALEM000000000003 Amount for unclaimed and 450.00 27-Sep-2018 PHASEJ.P.NAGAR 2824 unpaid dividend A I NATHAN S AROCKIANATHAU ST.MARY'S BUILDING MAIN ROAD INDIA KARNATAKA 560066 ALEM000000000003 Amount for unclaimed and 150.00 27-Sep-2018 CROSS WHITEFIELD BANGALORE- 2484 unpaid dividend -

Ground Water Quality Evaluation for Drinking Purpose in Some Areas of Unjha Taluka, Mehsana District (North Gujrat), India

Available online a t www.pelagiaresearchlibrary.com Pelagia Research Library Der Chemica Sinica, 2014, 5(6):69-73 ISSN: 0976-8505 CODEN (USA) CSHIA5 Ground water quality evaluation for drinking purpose in some areas of Unjha Taluka, Mehsana District (North Gujrat), India *Manoj R. Solanki and Girish D. Acharya Department of Chemistry, R. R. Mehta College of Science & C. L. Parikh College of Commerce, Palanpur(Gujrat), India _____________________________________________________________________________________________ ABSTRACT Water plays a vital role in human life. Ground water quality is an essential for healthy population. In the present study of drinking water samples for 20water sources tubewells in the Unjha field has been carried out. The purpose of this study was to ascertain the quality of water from these sources. The physical properties suchas pH and Total dissolved solids (TDS) showed the range of pH (7.24-8.48) and TDS (643.0-1208.6) mg/L which is within the -2 - - permissible limits of World Health Organization (WHO) except few samples. We have measured of SO 4 ,F , Cl Na +,K +,Ca +2 and Mg +2 also. The analytical data are processed and interpretented as per slandered laboratory method of APHA. Key words : Ground water quality, Electric conductivity (EC), Total dissolved Solids(TDS), Sodium adsorption ratio(SAR), American public health association (APHA) _____________________________________________________________________________________________ INTRODUCTION Water is an elixir part of our life .Without water, there is no life on our planet. The safe portable water is absolutely essential for healthy living. Ground water extraction for various purposes has made a major contribution to the improvement of social and economic life of people.