Press Release Kirorimal Kashiram Marketing and Agencies Private Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Initiation Report

Company Sponsored Research Food Industry Initiation of Coverage Hunter Diamond, CFA 03/27/2019 Vivian Zhang (Equity Research Associate) Amira Nature Foods Ltd. [email protected] 1120 Avenue of Americas, 4th Floor New York, NY 10036 Attractive Valuation with Basmati Rice Representing A Large and Growing Market Price-Volume History Investment Highlights: • Amira Nature Foods (ANFI) operates within the large and growing basmati rice and specialty food market, which is expected to reach $17.74 billion by 20221. Amira Nature Foods is uniquely positioned with its global sourcing and distribution abilities and owned brands. The company targets various market segments with unique product offerings and price points, allowing it to diversify its revenue. The company operates globally on five continents, with a geographically diverse customer base. • Rice is an enormous global staple food, which enjoys favorable market dynamics, Key Statistics with Basmati rice having a large pricing premium over other varieties of rice with Share Price (As Of 03/25/2019) $1.52 Basmati rice prices additionally recently recovering from their 2015/2016 depressed price levels. The fragmented supply chain of Basmati rice has also made it difficult Valuation $4.00 for Western companies to effectively distribute it, creating a unique opportunity for 52 Week Range $0.30-$4.39 Amira. The company has a large opportunity to expand its top line, with the market for Indian Basmati rice representing $6.9 billion2 of which 70% is sold internationally. Average Daily Volume(th) 793.38 • The international opportunity is enormous, with the company looking to create a $200 Shares Outstanding (th) 46.384 to $300 million -dollar international business over the next three years (Amira averaged $320.2 million in international sales during the FY14 through FY18 period). -

Food Products

Rating |Target | Estimate Change USA | Consumer | Food Products February 14, 2018 EQUITY RESEARCH Food Products Brands Still Matter To Consumers - Do They To Investors? Key Takeaway Previously our sector thesis was that accelerating consolidation & cost cutting activity should drive earnings upside. We are adding a new element, related to brands that we believe will drive an inflection in sales growth and drive further earnings upside. The attached Brands Still Matter report, is the result of a collaborative project with Accenture & Barkley that we began 3 months ago, and forms the basis of this new “brand” element to our thesis. Key takeaways from our Brands Still Matter report are outlined below. AMERICAS Consumer preferences have not changed, and emerging brands are not tapping into newfound preferences. Taste and price remain top attributes for consumers. However, consumers have more leverage and are demanding that brands do more – i.e. meeting needs of a “holistic experience” that includes attributes such as health, trust and sustainability. Contrary to popular belief, leading brands have maintained their ground & it is important to be a leader. 60% of leading brands are growing sales and 53% are growing share. Mid-tier brands and the long “tail” is struggling. Loyalty to Leading Brands remains very high and relatively stable. Leading Brands are incredibly productive at retail. Consumer insights, brand activation and operating model agility are key to succeeding. Companies that build next-generation capabilities in consumer insights and category development, brand activation and operating model agility are likely to succeed. Cost-savings opportunity is significant and can fund next-gen capability investments. -

Background of the Corporate Debtor*

Background of the Corporate Debtor* Amira Pure Foods Pvt Ltd (‘Amira’) is a major international producer of packaged Indian specialty rice, with sales in over 60 countries. AMIRA offers an extensive portfolio of brands that have been carefully developed to appeal to local markets around the world. Customer tastes and expectations have been finely segmented to deliver authentic flavours that go well with a variety of popular cuisines. Consumer palettes across the market segments have been well researched and adapted to suit the requirements of various trade channels. AMIRA has expanded its product line into snacks, Ready-to-eat and organic food products. Founded in 1915, AMIRA group in the past six years, transitioned from a family-managed company to a professionally run international food company, under the leadership of the fourth generation. In October 2012, AMIRA Nature Foods Ltd (parent company of Amira Pure Foods Pvt Ltd) completed an initial public offering. Its stock trades on the New York Stock Exchange (NYSE) listed under the ticker symbol “ANFI”. They generate the majority of their revenue through the sale of Basmati rice, premium long-grain rice grown only in certain regions of the Indian sub-continent, under their flagship AMIRA brand as well as under third-party brands. HISTORY WITH FARMERS Company has worked for decades with farmers in parts of India where basmati rice is grown. They work to educate them in the best techniques of agriculture, and share with them their technology for mapping and weather analysis. The result is that Amira have a regular and a large supply of the highest quality product. -

Significantly Regulated Organizations Added

Significantly Regulated Organizations Added ‐ September 2017 DUNS COUNTRY BUSINESS NAME TICKER SYMBOL EXCHANGE NAME NUMBER NAME 565406188 BRITISH AMERICAN TOBACCO ZIMBABWE ZIMBABWE BAT.ZW Zimbabwe Stock 565568949 MEDTECH HOLDINGS LTD ZIMBABWE MMDZ.ZW Zimbabwe Stock 565412350 NATIONAL FOODS LTD ZIMBABWE NTFD.ZW Zimbabwe Stock 565679081 STARAFRICA CORPORATION LTD ZIMBABWE SACL.ZW Zimbabwe Stock 555364141 CENTRAL PHARMACEUTICAL JOINT STOCK VIETNAM DP3 Hanoi Stock Exchange CHUONG DUONG BEVERAGE JOINT STOCK Ho Chi Minh Stock 555317798 COMPANY VIETNAM SCD Exchange 555297766 DANAMECO MEDICAL JOINT STOCK VIETNAM DNM Hanoi Stock Exchange DUC GIANG CHEMICALS AND DETERGENT 555345573 POWDER JOINT STOCK COMPANY VIETNAM DGC Hanoi Stock Exchange 555248250 Ha Long Canned Food Joint Stock Co. VIETNAM CAN Hanoi Stock Exchange 555530381 HA NOI INVESTMENT GENERAL VIETNAM SHN Hanoi Stock Exchange 555271543 HA TAY PHARMACEUTICAL JOINT STOCK VIETNAM DHT Hanoi Stock Exchange HOANG ANH GIA LAI JOINT STOCK Ho Chi Minh Stock 555335798 COMPANY VIETNAM HNG Exchange 555319636 HUNG HAU AGRICULTURAL CORPORATION VIETNAM SJ1 Hanoi Stock Exchange 555530218 HUNG VIET GREEN AGRICULTURE JOINT VIETNAM HVA Hanoi Stock Exchange KLF JOINT VENTURE GLOBAL INVESTMENT 555529792 JOINT STOCK COMPANY VIETNAM KLF Hanoi Stock Exchange 555340068 LAM DONG PHARMACEUTICAL JOINT STOCK VIETNAM LDP Hanoi Stock Exchange MECHANICS CONSTRUCTION AND 555303278 FOODSTUFF JOINT STOCK COMPANY VIETNAM MCF Hanoi Stock Exchange Ho Chi Minh Stock 555365190 NAFOODS GROUP JOINT STOCK COMPANY VIETNAM NAF Exchange NORTH PETROVIETNAM FERTILIZER & 555458287 CHEMICALS JOINT STOCK COMPANY VIETNAM PMB Hanoi Stock Exchange Ho Chi Minh Stock 555279715 S.P.M CORPORATION VIETNAM SPM Exchange SAIGON BEER ALCOHOL BEVERAGE Ho Chi Minh Stock 555254439 CORPORATION VIETNAM SAB Exchange 555341953 SAM CUONG ELECTRIC MATERIALS JS CO. -

Gibson Dunn 2

Practice Group Overviews: Anti Money Laundering Financial Institutions Securities Litigation Contents Anti-Money Laundering Practice ........................................................................................................................... 3 Financial Institutions Practice ................................................................................................................................ 6 Securities Litigation Practice .................................................................................................................................. 9 Selected Attorney Profiles .................................................................................................................................... 26 Gibson Dunn 2 Anti-Money Laundering Practice Lawyers at Gibson, Dunn & Crutcher are recognized as leaders in providing advice to financial institutions and other businesses on issues related to compliance with anti-money laundering and economic sanctions laws and regulations and the development of global and risk-based anti-money laundering compliance programs. The Anti-Money Laundering practice provides legal and regulatory advice to all types of financial institutions and nonfinancial businesses with respect to compliance with federal and state anti-money laundering laws and regulations, including the U.S. Bank Secrecy Act as amended by the USA PATRIOT Act. We represent clients in criminal and regulatory government investigations. We have developed extensive knowledge and broad anti-money laundering -

Food and Beverage Industry Update November 2013

Food and Beverage Industry Update November 2013 Member FINRA/SIPC www.harriswilliams.com Food and Beverage Industry Update November 2013 What We’re Seeing CONTENTS Food & Beverage in the Marketplace INDUSTRY VITAL SIGNS After an active finish to 2012 and a slow start to 2013, HW&Co. has seen pitch activity increase EQUITY MARKET OVERVIEW substantially across the food & beverage sector in the back half of 2013. Both strategic and private equity M&A MARKET OVERVIEW buyers continue to covet high quality food & beverage assets, and we expect that M&A activity at the beginning of 2014 with be at a “normal” level. The combination of strong financing markets, growth DEBT MARKET OVERVIEW oriented strategic buyers, and private equity fund expirations is fueling the strengthening market for food NOTABLE M&A ACTIVITY & beverage transactions. PUBLIC COMPARABLES What We’ve Been Doing EARNINGS CALENDAR Closed HW&Co. Transactions GROUP OVERVIEW Harris Williams & Co. is a leading advisor to the food and beverage a portfolio company of a portfolio company of a portfolio company of market. Our significant experience has divested a portfolio company of selected assets to covers a broad range of end has been acquired by has been acquired by has been acquired by markets, industries, and business has been acquired by and has been acquired by models. This particular report and focuses on trends and metrics in the following areas: • Agribusiness • Baked and Prepared Goods a portfolio company of • Beverages a portfolio company of a portfolio company of a portfolio -

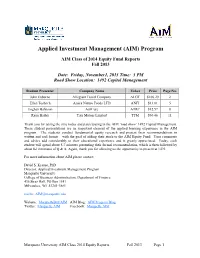

Applied Investment Management (AIM) Program

Applied Investment Management (AIM) Program AIM Class of 2014 Equity Fund Reports Fall 2013 Date: Friday, November1, 2013 Time: 3 PM Road Show Location: 1492 Capital Management Student Presenter Company Name Ticker Price Page No. John Osborne Allegiant Travel Company ALGT $106.29 2 Ellen Toshach Amira Nature Foods LTD ANFI $13.81 5 Eoghan Bahnson AtriCure ATRC $12.57 8 Ryan Bailey Tata Motors Limited TTM $30.46 11 Thank you for taking the time today and participating in the AIM ‘road show’ 1492 Capital Management. These student presentations are an important element of the applied learning experience in the AIM program. The students conduct fundamental equity research and present their recommendations in written and oral format – with the goal of adding their stock to the AIM Equity Fund. Your comments and advice add considerably to their educational experience and is greatly appreciated. Today, each student will spend about 5-7 minutes presenting their formal recommendation, which is then followed by about 8-10 minutes of Q & A. Again, thank you for allowing us the opportunity to present at 1492. For more information about AIM please contact: David S. Krause, PhD Director, Applied Investment Management Program Marquette University College of Business Administration, Department of Finance 436 Straz Hall, PO Box 1881 Milwaukee, WI 53201-1881 mailto: [email protected] Website: MarquetteBuz/AIM AIM Blog: AIM Program Blog Twitter: Marquette AIM Facebook: Marquette AIM Marquette University AIM Class 2014 Equity Reports Fall 2013 Page 1 Allegiant Travel Company (ALGT) October 29, 2013 John Osborne Domestic Industrials Allegiant Travel Company (NASDAQ: ALGT), through its subsidiaries, operates as a leisure travel company in the United States. -

Amira Nature Foods, Ltd, a Company Formed Under the Laws of The

DUBAI, United Arab Emirates--(BUSINESS WIRE)-- Amira Nature Foods, Ltd, a company formed under the laws of the British Virgin Islands, (the “Company”) whose shares are listed on the New York Stock Exchange with the symbol “ANFI” announced today that on December 4, 2019, its Board of Directors approved a 20:1 reverse stock split of its ordinary shares. The Company’s ordinary shares will begin trading on a split adjusted basis on December 20, 2019. As a result of the reverse stock split, each twenty (20) pre-split shares of the Company’s ordinary stock will automatically combine into one (1) ordinary share without any action on the part of the holders, and the number of outstanding ordinary shares will be reduced from 44,421,835 to approximately 2,221,091ordinary shares. The Company’s ordinary shares will continue to trade on the New York Stock Exchange under the symbol "ANFI" but will trade under a new CUSIP number. The reverse split is intended to increase the market price per share of the Company’s ordinary shares to allow the Company to maintain its New York Stock Exchange listing. No fractional shares will be issued as a result of the reverse stock split. Shareholders who otherwise would be entitled to a fractional share because they hold a number of ordinary shares not evenly divisible by the one (1) for twenty (20) reverse split ratio, will automatically be entitled to receive an additional fractional share of the Company’s ordinary shares to round up to the next whole share. The reverse stock split will not be submitted to a vote of the Company’s shareholders and a vote was not required under the laws of the BVI. -

Big Stores Hold Off Reopening As States Ease Restrictions

P2JW116000-7-A00100-17FFFF5178F Reopening theU.S. EconomyEvenif ThePandemic Endures REVIEW Flowers to Power WSJ Yo ur Garden THE WALL STREETJOURNAL WEEKEND OFF DUTY ******* SATURDAY/SUNDAY,APRIL 25 -26, 2020 ~VOL. CCLXXV NO.97 WSJ.com HHHH $5.00 AT&T What’s News Chief to Retireat World-Wide TheEnd he FDAsaid two ma- Tlaria drugstouted by Trump and some doctorsfor Of June use against the coronavirus arelinked to heart problems and should only be used on Stankey to take reins hospitalized patientsoras part of clinical trials. A1 from Stephenson just Health experts and the as new streaming maker of Lysol issued warn- ingsafter Trump speculated service set to launch about using disinfectants inside the body,comments BY DREW FITZGERALD that he later walked back. A6 AT&T Inc. Chief Executive TheU.S.death toll from JOURNAL Randall Stephenson said he the coronavirus surpassed would step aside at the end of 50,000 as some states be- REET ST June, handing leadership of one ganreopening partsoftheir LL of the world’slargest media economies.Trump signed WA and telecommunications com- stimulus legislation. A5 THE panies to alongtime deputy R Esper told Navy officials FO amid the coronavirus pandemic. that he wasn’t ready to sign N Companyveteran John TO off on arecommendation Stankey will succeed Mr. Ste- MEL to reinstatethe USS Theo- A phenson, whoturned 60 this DR doreRoosevelt’scaptain. A3 AU week.Mr. Stephenson has A barber worked with a client in Decatur, Ga., on Friday, after the state permitted many businesses to reopen. spent most of his 13 years as Trump indicated he plans chairman and CEO piecing to- to use acoronavirus-relief gether a modern media busi- lawasleveragetoforce the ness by scooping up DirecTV Postal Servicetoraise rates Big Stores Hold Off Reopening and then Time Warner,remak- forpackagedelivery. -

Food & Beverage Industry Update 2/20/2013

Food & Beverage Industry Update 2/20/2013 Member FINRA/SIPC www.harriswilliams.com Food & Beverage Industry Update 2/20/2013 Key Trading Stock Price % Change EV/EBITDA % Change Current Valuation Stats Net Debt / Statistics1 Industry Segment 3 Month 1 Year 3 Month 1 Year Fwd PE LTM PE EV/EBITDA EBITDA Food and Beverage Branded Processed Foods 9.9% 24.8% (12.1%) (18.7%) 17.0x 21.2x 12.8x 2.0x Private Label Foods 11.0% 14.8% (4.2%) 6.2% 21.4x 28.6x 11.9x 3.0x Natural / Organic Foods 4.4% 19.2% (4.6%) 0.5% 22.6x 27.6x 13.7x 2.5x Baked Goods / Snack Foods 16.9% 28.0% 6.8% 3.4% 19.4x 20.7x 9.9x 2.0x Dairy 7.5% 15.4% 11.0% 6.7% 15.9x 18.2x 12.2x 1.4x Non-Alcholic Beverages 4.3% 7.0% 5.7% 2.9% 16.4x 18.6x 10.1x 1.8x Alcoholic Beverages 11.9% 23.4% 6.9% 19.4% 18.2x 20.4x 14.7x 3.2x Inputs Protein Processing 14.5% 8.7% 16.5% 34.0% 11.2x 15.4x 8.1x 1.7x Fruit and Vegetable 11.0% 14.4% 5.4% 10.0% 11.3x 13.4x 9.3x 4.3x Ingredients / Flavors 11.7% 26.8% 10.4% 16.3% 15.3x 21.7x 12.0x 1.4x Agribusiness 17.5% 11.7% 10.0% 35.4% 13.3x 15.1x 7.6x 2.1x Consumer Food Retail 6.4% 2.4% 4.6% (1.7%) 11.7x 13.7x 5.7x 2.4x Foodservice / Distribution 5.9% 14.6% 5.7% (0.1%) 14.7x 19.6x 8.0x 0.9x Quick Service Restaurant 15.5% 14.7% 7.6% 5.3% 19.8x 18.9x 10.0x 2.5x Casual Dining Restaurant 8.3% (1.3%) 4.4% (10.9%) 17.5x 21.6x 7.8x 1.6x Overall Median* 9.9% 14.1% 5.7% 2.0% 16.4x 19.7x 10.1x 2.0x *Quick-service restaurant and casual dining restaurant excluded from overall median calculation. -

Companies That Exploit Animals ©2019 Crueltyfreeinvesting.Org Title Stock Exchange Stock Symbol Animal Usage 1-800 FLOWERS.COM, Inc

Companies That Exploit Animals ©2019 CrueltyFreeInvesting.org Title Stock Exchange Stock Symbol Animal Usage 1-800 FLOWERS.COM, Inc. NASDAQ FLWS Meat/Dairy/Eggs 22nd Century Group, Inc AMEX XXII Animal Testing 3M Company NYSE MMM Animal Testing 500.com Limited NYSE WBAI Entertainment|Tangential A. Schulman, Inc. NASDAQ SHLM Animal Testing ABAXIS, Inc. NASDAQ ABAX Animal Testing ABB Ltd NYSE ABB Tangential Abbott Laboratories NYSE ABT Animal Testing|By-product AbbVie Inc. NYSE ABBV Animal Testing Abeona Therapeutics Inc. NASDAQ ABEO Animal Testing Abercrombie & Fitch Company NYSE ANF Leather/Hide/Fur ABIOMED, Inc. NASDAQ ABMD Animal Testing AC Immune SA NASDAQ ACIU Animal Testing Acacia Research Corporation NASDAQ ACTG Animal Testing ACADIA Pharmaceuticals Inc. NASDAQ ACAD Animal Testing Acasti Pharma, Inc. NASDAQ ACST Animal Testing B&G Foods, Inc. NASDAQ BGS Meat/Dairy/Eggs Balchem Corporation NASDAQ BCPC Animal Testing|By-product|Pet Industry Alexion Pharmaceuticals, Inc. NASDAQ ALXN Animal Testing|Meat/Dairy/Eggs Amazon.com, Inc. NASDAQ AMZN Entertainment|Leather/Hide/Fur|Meat/Dairy/Eggs American Airlines Group, Inc. NASDAQ AAL Meat/Dairy/Eggs Amgen Inc. NASDAQ AMGN Animal Testing Bed Bath & Beyond Inc. NASDAQ BBBY Animal Testing|By-product|Leather/Hide/Fur|Tangential Biogen Inc. NASDAQ BIIB Animal Testing C.H. Robinson Worldwide, Inc. NASDAQ CHRW Meat/Dairy/Eggs|Tangential Celgene Corporation NASDAQ CELG Animal Testing Costco Wholesale Corporation NASDAQ COST Leather/Hide/Fur|Meat/Dairy/Eggs DENTSPLY SIRONA Inc. NASDAQ XRAY Animal Testing Dollar Tree, Inc. NASDAQ DLTR Leather/Hide/Fur|Meat/Dairy/Eggs eBay Inc. NASDAQ EBAY Leather/Hide/Fur|Meat/Dairy/Eggs|Pet Industry Endo International plc NASDAQ ENDP Animal Testing Garmin Ltd. -

Gibson, Dunn & Crutcher

Practice Group Overviews: Anti Money Laundering Financial Institutions Securities Litigation Contents Anti-Money Laundering Practice ………………………………………………………………………………………………………………………………..2 Financial Institutions Practice ............................................................................................................................................... 5 Securities Litigation Practice................................................................................................................................................. 8 Selected Attorney Profiles .................................................................................................................................................. 20 Gibson, Dunn & Crutcher LLP 1 Anti-Money Laundering Practice Lawyers at Gibson, Dunn & Crutcher are recognized as leading experts in providing advice to financial institutions and other businesses on issues related to compliance with anti-money laundering and economic sanctions laws and regulations and the development of global and risk-based anti-money laundering compliance programs. The Anti-Money Laundering practice provides legal and regulatory advice to all types of financial institutions and nonfinancial businesses with respect to compliance with federal and state anti-money laundering laws and regulations, including the U.S. Bank Secrecy Act as amended by the USA PATRIOT Act. We represent clients in criminal and regulatory government investigations. We have developed extensive knowledge and broad anti-money laundering experience.