Plan for Operations in the Absence of Appropriations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Anti-Slavery International Submission to the UN Special Rapporteur on Contemporary Forms of Slavery, Including Its Causes and Consequences

May 2018 Anti-Slavery International submission to the UN Special Rapporteur on contemporary forms of slavery, including its causes and consequences Questionnaire for NGOs and other stakeholders on domestic servitude Question 1 Please provide information on your organisation and its work with migrant domestic workers who became victims of contemporary forms of slavery, including the countries in which you work on this issue. Anti-Slavery International, founded in 1839, is committed to eradicating all forms of slavery throughout the world including forced labour, bonded labour, trafficking of human beings, descent-based slavery, forced marriage and the worst forms of child labour. Anti-Slavery International works at the local, national and international levels to eradicate slavery. We work closely with local partner organisations, directly supporting people affected by slavery to claim their rights and take control of their lives. Our current approaches include enabling people to leave slavery, through exemplar frontline projects with partner agencies; helping people to recover from slavery, with frontline work ensuring people make lasting successful lives now free from slavery; supporting the empowerment of people to be better protected from slavery; and using this knowledge base to inform, influence and inspire change through advocacy and lobbying within countries for legislation, policy and practice that prevent and eradicates slavery; international policy work and campaigning; and raising the profile and understanding of slavery through media work and supporter campaigns. We have projects across four continents. While the number of projects and the individual countries covered by projects varies at any one time, our current and/or recent work includes the United Kingdom, Peru, Mali, Mauritania, Niger, Senegal, Tanzania, Bangladesh, India, Nepal, Lebanon, Turkmenistan, Uzbekistan and Vietnam. -

International Labour Organisation

1 International Labour Organisation Introduction The International Labour Organization is an organization in the United Nations System which provides for tripartite—employers, unions, and the government-representation. The International Labour Organization (ILO) was established in 1919 and its headquarter is in Geneva. It is one of the important organs of the United Nations System. The unique tripartite structure of the ILO gives an equal voice to workers, employers and governments to ensure that the views of the social partners are closely reflected in labour standards and in shaping policies and programmes. The main aims of the ILO are to promote rights at work, encourage decent employment opportunities, enhance social protection and strengthen dialogue on work-related issues. Origin of International Labour Organisation The ILO was founded in 1919, in the wake of a destructive war, to pursue a vision based on the premise that universal, lasting peace can be established only if it is based on social justice. The ILO became the first specialized agency of the UN in 1946. The ILO was established as an agency of the League of Nations following World War I, its founders had made great strides in social thought and action before 1919. The core members all knew one another from earlier private professional and ideological networks, in which they exchanged knowledge, experiences, and ideas on social policy. In the post–World War I euphoria, the idea of a "makeable society" was an important catalyst behind the social engineering of the ILO architects. As a new discipline, international labour law became a useful instrument for putting social reforms into practice. -

IRS Publication 4128, Tax Impact of Job Loss

Publication 4128 Tax Impact of Job Loss The Life Cycle Series A series of informational publications designed to educate taxpayers about the tax impact of significant life events. Publication 4128 (Rev. 5-2020) Catalog Number 35359Q Department of the Treasury Internal Revenue Service www.irs.gov Facts JOB LOSS CREATES TAX ISSUES References The Internal Revenue Service (IRS) recognizes that the loss of a job may • Publication 17, Your create new tax issues. The IRS provides the following information to Federal Income Tax (For assist displaced workers. Individuals) • Severance pay and unemployment compensation are taxable. • Publication 575, Payments for any accumulated vacation or sick time are also Pension and Annuity taxable. You should ensure that enough taxes are withheld from Income these payments or make estimated payments. See IRS Publication 17, Your Federal Income Tax, for more information. • Publication 334, Tax Guide for Small • Generally, withdrawals from your pension plan are taxable unless Businesses they are transferred to a qualified plan (such as an IRA). If you are under age 59 1⁄2, an additional tax may apply to the taxable portion of your pension. See IRS Publication 575, Pension and Annuity Income, for more information. • Job hunting and moving expenses are no longer deductible. • Some displaced workers may decide to start their own business. The IRS provides information and classes for new business owners. See IRS Publication 334, Tax Guide for Small Businesses, for more information. If you are unable to attend small business tax workshops, meetings or seminars near you, consider taking Small Business Taxes: The Virtual Workshop online as an alternative option. -

Annual Leave Act (1977:480)

Non-official translation Annual Leave Act (1977:480) Amendments: up to and including 2007:392 Section 1 An employee is entitled to annual leave benefits in accordance with this Act. Such benefits are annual leave, holiday pay and compensation in lieu of annual leave. Section 2 An agreement shall be invalid to the extent that it revokes or restricts an employee's rights under this Act. However, this shall not apply if this Act provides otherwise. Deviations from Sections 3, 9, 11, 16, 22, 23, 26, 29 and 30 may be made under a collective bargaining agreement that has been concluded or approved by an organisation which is deemed to be a central employees' organisation under the Employment (Co-Determination in the Workplace) Act (1976:580). An employer who is bound by such a collective bargaining agreement, by a collective bargaining agreement relating to matters referred to in Section 5, second paragraph, or by a collective bargaining agreement relating to deviations from Section 12, 19, 20 or 21, may in such respects also apply the agreement to employees who are not members of the employees' organisation which is a party to the agreement, provided that the employee is engaged in work that is referred to in the agreement and is not subject to any other applicable collective bargaining agreement. Section 3 The expression "annual leave year" means the period from and including 1 April of one year up to and including 31 March of the following year. The corresponding period immediately preceding an annual leave year is referred to as the "qualifying year". -

Hours of Duty and Leave Volume XV – Chapter 5 1 VA Financial Policies

Department of Veterans Affairs October 2011 Payroll: Hours of Duty and Leave Volume XV – Chapter 5 VA Financial Policies and Procedures Payroll: Hours of Duty and Leave CHAPTER 5 0501 OVERVIEW ...................................................................................................................... 3 0502 POLICIES ........................................................................................................................ 3 0503 AUTHORITY AND REFERENCES .................................................................................11 0504 ROLES AND RESPONSIBILITIES .................................................................................12 0505 PROCEDURES ...............................................................................................................14 0506 DEFINITIONS .................................................................................................................16 0507 RESCISSIONS ................................................................................................................21 0508 QUESTIONS ...................................................................................................................22 APPENDIX A: ONLINE RESOURCES ....................................................................................23 APPENDIX B: HOURS OF DUTY ............................................................................................24 APPENDIX B-1: HOURS OF DUTY FOR TITLE 5 EMPLOYEES ...........................................25 APPENDIX B-2: HOURS -

Addressing Modern Slavery Worker Vulnerability During COVID-19

Addressing Modern Slavery Worker Vulnerability During COVID-19 The Mekong Club Addressing Modern Slavery Worker Vulnerability During COVID-19 1 Introduction The COVID-19 outbreak has been affecting Asia since January 2020. It is now a global pandemic, with over 4.5 million cases detected in 168 countries and over 300,000 deaths globally as of 15 May 2020. Much of the world has implemented severe quarantine measures in an effort to contain the spread of the virus, and these measures have significantly affected many businesses. Most footwear and apparel manufacturers have seen major disruption in many parts of their supply chains and business operations. For example, in Bangladesh, 72% of apparel buyers have not paid for materials already purchased by the supplier. This has resulted in over US$2.5 billion worth of order cancellations in garment manufacturing and the loss of over one million garment worker jobs. Similar trends are being seen all over the world. This continuing crisis poses a number of challenges, some limited to moving activities online, others much more serious and related to the sustainability and profitability of business in the short, medium and long- term. While corporate professionals go through a major experiment of teleworking, supply chain workers directly employed by companies or by suppliers and sub-suppliers are facing much bigger challenges. There is no doubt that the COVID-19 crisis poses a higher risk to their wellbeing, job security, and basic rights. Modern Slavery and Worker Safety Vulnerability There are many reasons why workers will be more vulnerable to modern slavery during the ongoing COVID-19 crisis and beyond. -

Employee? Contractor / Self-Employed Person?

Employee? Contractor / Self-employed Person? To avoid misunderstanding or dispute, the relevant persons should understand clearly their mode of cooperation according to their intention and clarify their identities, whether they are engaged as an employee or a contractor/self-employed person, before entering into a contract. This can safeguard mutual rights and benefits. Distinguishing an “employee” from a “contractor or self- employed person” There is no one single conclusive test to distinguish an “employee” from a “contractor or self-employed person”. In differentiating these two identities, all relevant factors of the case should be taken into account. Moreover, there is no hard and fast rule as to how important a particular factor should be. The common important factors include: • control over work procedures, working time and method • ownership and provision of work equipment, tools and materials • whether the person is carrying on business on his own account with investment and management responsibilities • whether the person is properly regarded as part of the employer’s organisation • whether the person is free to hire helpers to assist in the work • bearing of financial risk over business (e.g. any prospect of profit or risk of loss) • responsibilities in insurance and tax • traditional structure and practices of the trade or profession concerned • other factors that the court considers as relevant Since the actual circumstances in each case are different, the final interpretation will rest with the court in case of a dispute. Employees should note An employee should identify who his employer is before entering into an employment contract. If necessary, before the commencement of employment, the employee may make a written request to the employer for written information on conditions of employment in accordance with the Employment Ordinance (EO). -

Wesleyan Guide Self-Employment in the Dental and Medical Industry 10

THE ULTIMATE GUIDE TO SELF-EMPLOYMENT IN THE DENTAL AND MEDICAL INDUSTRY ADVICE FROM THE NEXT STEP INTRODUCTION 02 WHAT DOES “SELF-EMPLOYMENT” MEAN IN THE DENTAL AND MEDICAL INDUSTRIES? For some, it can be the consequence of choosing a particular career path, while for others it may be due to lifestyle and financial choices. There are some key differences between being an employee and being self-employed that you should be aware of, from the availability of benefits to your tax treatment. For guidance on how to understand these differences, we’ve created this informative guide. By reading this guide you’ll learn: What it means to be self-employed How it’ll impact your career – for both medics and dentists Key considerations to ensure you are prepared Advice from self-employed professionals FACTS AND FIGURES: 03 What do you already know about becoming self-employed as a doctor or dentist? To get us started, we’ve shared a few facts and figures to help you understand. If dentists choose to become an associate in a practice, they’ll automatically be self-employed Many dentists and doctors will become self-employed because of career choices Self-employment may offer more flexibility 4.93M people in the UK 29,660 were self-employed self-employed dentists in 2019 across the UK in 2018 ONS NHS If an NHS doctor takes up private work alongside their regular role, they will earn their secondary income as self- employed Nearly Some trainees opt to 1 in 5 take a gap between of all licensed foundation and further doctors training, and may are Locums become self-employed GMC to work flexibly in the NHS From 2013 to 2017, there was an increase of almost 12,000 licensed doctors working as Locums GMC WHAT DOES SELF-EMPLOYMENT 04 LOOK LIKE? How you are self-employed can differ considerably across dentistry and medicine. -

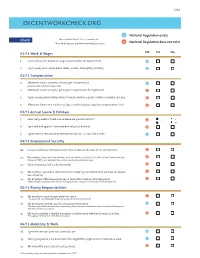

Decentworkcheck.Org

USA DECENTWORKCHECK.ORG National Regulation exists Check DecentWorkCheck USA is a product of WageIndicator.org and www.paywizard.org/main National Regulation does not exist 01/13 Work & Wages NR Yes No 1. I earn at least the minimum wage announced by the Government 2. I get my pay on a regular basis. (daily, weekly, fortnightly, monthly) 02/13 Compensation 3. Whenever I work overtime, I always get compensation ȋƤȌ 4. Whenever I work at night, I get higher compensation for night work 5. I get compensatory holiday when I have to work on a public holiday or weekly rest day 6. Whenever I work on a weekly rest day or public holiday, I get due compensation for it 03/13 Annual Leave & Holidays 7. How many weeks of paid annual leave are you entitled to?* 1 3 2 4+ 8. I get paid during public (national and religious) holidays 9. I get a weekly rest period of at least one day (i.e. 24 hours) in a week 04/13 Employment Security 10. I was provided a written statement of particulars at the start of my employment 11. Dzdz 12. My probation period is only 06 months 13. My employer gives due notice before terminating my employment contract (or pays in lieu of notice) 14. ơ Ǥ 05/13 Family Responsibilities 15. My employer provides paid paternity leave Ȁ 16. My employer provides (paid or unpaid) parental leave Ǥ Ǥ 17. ƪ Ǧƪ 06/13 Maternity & Work 18. I get free ante and post natal medical care 19. ǡ ȋȌ 20. -

Employed Or Self- Employed? What’S the Difference?

v EMPLOYMENT LAW DEPARTMENT Employed or Self- Employed? What’s the difference? 1. When recruiting, employers may be asked by a candidate if they can be hired as a self-employed contractor, rather than an employee. While this may be common practice in some industries, it is important to understand the difference between someone who is employed and self- employed, and when that difference will really matter. The difference between someone who is employed to provide their services and someone who is self-employed and provides a specific service can be very important, particularly when a problem in the arrangement arises. Courts and tribunals can look at many factors to determine which relationship exists, but if the answers to the following questions are “yes”, the person is likely to be an employee: a) Does the employer control what work is done? b) Does the employer control where, when and how the work is done? c) Does the worker have to do the work themselves? d) Can the worker get overtime pay or bonus payments? e) Is the worker doing work or performing a function that is part of the regular business of the employer? f) Does the worker get paid whether or not there is work for them to do? 2. What are the factors that are likely to mean that a person really is self-employed? Sometimes employers will be particularly interested in considering whether the arrangement might work for a particular candidate who is well suited for a very important role in the company and who wants to be self-employed. -

Annual Leave Policy

ANNUAL LEAVE POLICY Responsible Office: HR – Payroll & Employee Benefits (PEB) I. POLICY STATEMENT Auburn University provides Annual Leave benefits to all eligible employees. All leave programs are administered in accordance with applicable state and federal laws. II. POLICY PRINCIPLES A. Annual leave is provided to all eligible employees to assist them in maintaining appropriate work-life balance for their health and wellbeing. Employees are encouraged to take and to not accumulate annual leave. B. Eligible employees earn annual leave at the accrual rate of 13.34 hours per month (160 hours per year). The accrual rates of annual leave for nonexempt and exempt employees are identical. C. Annual leave accrues when an employee is in active pay status. D. Annual leave does not accrue during any period of leave without pay or while an employee is being paid under the salary continuation program. E. Annual leave may be taken in any amount up to the total of the employees’ accrual. F. Annual leave cannot be used until it is accrued. Leave accruals for exempt employees become available for use on the first day of the pay period following the accrual. Leave accruals for nonexempt employees become available on the Wednesday following the pay period of the accrual. G. An employee who transfers or is promoted from one department to another will retain any unused annual leave balance. If an employee transfers to a non-leave eligible position they will no longer accrue annual leave and leave will be paid to the employee up to 173.33 hours. An employee will not receive credit for previously accumulated leave if rehired after an interruption of employment. -

OPM Fact Sheet: Pay and Benefit for Employees Affected by the Lapse In

Issue Date: January 23, 2019 FACT SHEET: Pay and Benefits Information for Employees Affected by the Lapse in Appropriations This information covers pay and benefits matters that may be important to employees if the lapse in appropriations continues past payroll processing deadlines. Payroll deadlines vary from agency to agency, so the actual timing of when an employee’s pay and benefits may be impacted will vary. This information is only for employees who are: • Furloughed (a type of nonpay status), or • “Excepted” from furlough (i.e., continuing to work and earn pay, but their pay is delayed until appropriations are authorized). Employees who are “exempt” from the lapse in appropriations (e.g., because they are not paid from annually appropriated funds) are not impacted. What you should know PAY Furloughed employees: After the lapse ends, you are entitled to receive your “standard rate of pay” for the furlough period, which includes any— • basic pay; • overtime and other premium pay for regularly scheduled work; • regular premium payments (e.g., law enforcement availability pay); and • allowances and differentials payable on a regular basis. Employees who were on previously approved leave without pay (LWOP) or who were absent without leave (AWOL) during the lapse in appropriations will not receive pay for those hours. Excepted employees: After the lapse ends, you will receive your “standard rate of pay” for the actual hours that you worked (e.g., including any overtime or other premium pay, allowances, and differentials earned based on actual hours worked). Any time that an excepted employee is placed in a furlough status will be compensated under the rules for furloughed employees.