Employee? Contractor / Self-Employed Person?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Anti-Slavery International Submission to the UN Special Rapporteur on Contemporary Forms of Slavery, Including Its Causes and Consequences

May 2018 Anti-Slavery International submission to the UN Special Rapporteur on contemporary forms of slavery, including its causes and consequences Questionnaire for NGOs and other stakeholders on domestic servitude Question 1 Please provide information on your organisation and its work with migrant domestic workers who became victims of contemporary forms of slavery, including the countries in which you work on this issue. Anti-Slavery International, founded in 1839, is committed to eradicating all forms of slavery throughout the world including forced labour, bonded labour, trafficking of human beings, descent-based slavery, forced marriage and the worst forms of child labour. Anti-Slavery International works at the local, national and international levels to eradicate slavery. We work closely with local partner organisations, directly supporting people affected by slavery to claim their rights and take control of their lives. Our current approaches include enabling people to leave slavery, through exemplar frontline projects with partner agencies; helping people to recover from slavery, with frontline work ensuring people make lasting successful lives now free from slavery; supporting the empowerment of people to be better protected from slavery; and using this knowledge base to inform, influence and inspire change through advocacy and lobbying within countries for legislation, policy and practice that prevent and eradicates slavery; international policy work and campaigning; and raising the profile and understanding of slavery through media work and supporter campaigns. We have projects across four continents. While the number of projects and the individual countries covered by projects varies at any one time, our current and/or recent work includes the United Kingdom, Peru, Mali, Mauritania, Niger, Senegal, Tanzania, Bangladesh, India, Nepal, Lebanon, Turkmenistan, Uzbekistan and Vietnam. -

HOLIDAY PAY INTRODUCTION EXECUTIVE SUMMARY Introduction EUROPEAN LAW NATIONAL LAW the Right for Workers to Take Paid Annual Leave Is Well Established Across Europe

BREDIN PRAT HENGELER MUELLER NEWS SLAUGHTER AND MAY NO 12/ JUNE 2015 QUICK LINKS HOLIDAY PAY INTRODUCTION EXECUTIVE SUMMARY Introduction EUROPEAN LAW NATIONAL LAW The right for workers to take paid annual leave is well established across Europe. However, the way CONCLUSION in which holiday pay is calculated was for many years largely unregulated at a European level, with each Member State left to formulate its own rules. In recent years a spate of European cases have begun to lay down some core principles for the calculation of holiday pay. Despite these cases, many of the practical details for calculating holiday pay are still left to Member States, and this creates scope for some interesting variations. This briefing examines the European rules on holiday pay, and the way in which those principles are implemented in France, Germany and the UK. We have set out below an executive summary of the key differences in each jurisdiction, which is followed by more detail on the position under European law and in each of the three countries. Executive summary • Calculating holiday pay: In the UK, the process varies depending on the working pattern, but essentially workers are entitled to a week’s pay for each week of holiday, in some cases using a 12 week reference period. In Germany, holiday pay is based on a worker’s daily or hourly rate, calculated over a 13 week reference period. In France there is a dual calculation method; workers receive the higher of (i) what they would have earned if they had worked during their holiday; or (ii) an amount calculated over a one year reference period. -

Oregon Statewide Payroll Application ‐ Paystub Pay and Leave Codes

Oregon Statewide Payroll Application ‐ Paystub Pay and Leave Codes PAYSTUB PAY AND LEAVE CODES Pay Type Code Paystub Description Detail Description ABL OSPOA BUSINESS Leave used when conducting OSPOA union business by authorized individuals. Leave must be donated from employees within the bargaining unit. A donation/use maximum is established by contract. AD ADMIN LV Paid leave time granted to compensate for work performed outside normal work hours by Judicial Department employees who are ineligible for overtime. (Agency Policy) ALC ASST LGL DIF 5% Differential for Assistant Legal Counsel at Judicial Department. (PPDB code) ANA ALLW N/A PLN Code used to record taxable cash value of non-cash clothing allowance or other employee fringe benefit. (P050) ANC NRS CRED Nurses credentialing per CBA ASA APPELATE STF Judicial Department Appellate Judge differential. (PPDB code) AST ADDL STRAIGHTTIME Additional straight time hours worked within same period that employee recorded sick, holiday, or other regular paid leave hours. Refer to Statewide Policy or Collective Bargaining Agreement. Hours not used in leave and benefit calculations. AT AWARD TM TKN Paid leave for Judicial Department and Public Defense Service employees as years of service award. (Agency Policy) AW ASSUMED WAGES-UNPD Code used to record and track hours of volunteer non-employee workers. Does not VOL HR generate pay. (P050) BAV BP/AWRD VALU Code used to record the taxable cash value of a non-cash award or bonus granted through an agency recognition program. Not PERS subject. (P050 code) BBW BRDG/BM/WELDR Certified Bridge/Boom/Welder differential (PPDB code) BCD BRD CERT DIFF Board Certification Differential for Nurse Practitioners at the Oregon State Hospital of five percent (5%) for all Nurse Practitioners who hold a Board certification related to their assignment. -

Plan for Operations in the Absence of Appropriations

Plan for Operations in the Absence of Appropriations Purpose This policy provides contingency planning in the event of a funding hiatus caused by the absence of appropriations, either through failure to pass a regular appropriation bill or a continuing resolution. Policy In the event of a funding hiatus, the Institute will proceed with the orderly shutdown of operations, beginning on the first workday of the hiatus, and will limit all work activity to actions necessary for such a shutdown. It is estimated that such actions will require not more than one-half workday. Since it is assumed that such a hiatus would be temporary and of short duration, no action will be taken that will impede the orderly commencement of operations once funds are available. The USIP president or their designee will notify all vice presidents (VPs) regarding which activities and personnel are designated as excepted and therefore exempt from the furlough, as well as the duration of each exemption. Point of Contact The Human Resources Director maintains reporting and monitoring procedures and should be contacted for interpretations, resolution of problems, and special situations. USIP Staff As of close of business on January 14, 2019, USIP has a total of 186 employees. As of January 14th, 128 USIP employees remain on furlough and 58 are excepted and therefore exempt from the furlough. Discussion Action The following actions will be taken to implement the shutdown: A. Staff will be advised by the President or their designee of a possible funding hiatus as soon as such an event is deemed likely by management. -

International Labour Organisation

1 International Labour Organisation Introduction The International Labour Organization is an organization in the United Nations System which provides for tripartite—employers, unions, and the government-representation. The International Labour Organization (ILO) was established in 1919 and its headquarter is in Geneva. It is one of the important organs of the United Nations System. The unique tripartite structure of the ILO gives an equal voice to workers, employers and governments to ensure that the views of the social partners are closely reflected in labour standards and in shaping policies and programmes. The main aims of the ILO are to promote rights at work, encourage decent employment opportunities, enhance social protection and strengthen dialogue on work-related issues. Origin of International Labour Organisation The ILO was founded in 1919, in the wake of a destructive war, to pursue a vision based on the premise that universal, lasting peace can be established only if it is based on social justice. The ILO became the first specialized agency of the UN in 1946. The ILO was established as an agency of the League of Nations following World War I, its founders had made great strides in social thought and action before 1919. The core members all knew one another from earlier private professional and ideological networks, in which they exchanged knowledge, experiences, and ideas on social policy. In the post–World War I euphoria, the idea of a "makeable society" was an important catalyst behind the social engineering of the ILO architects. As a new discipline, international labour law became a useful instrument for putting social reforms into practice. -

IRS Publication 4128, Tax Impact of Job Loss

Publication 4128 Tax Impact of Job Loss The Life Cycle Series A series of informational publications designed to educate taxpayers about the tax impact of significant life events. Publication 4128 (Rev. 5-2020) Catalog Number 35359Q Department of the Treasury Internal Revenue Service www.irs.gov Facts JOB LOSS CREATES TAX ISSUES References The Internal Revenue Service (IRS) recognizes that the loss of a job may • Publication 17, Your create new tax issues. The IRS provides the following information to Federal Income Tax (For assist displaced workers. Individuals) • Severance pay and unemployment compensation are taxable. • Publication 575, Payments for any accumulated vacation or sick time are also Pension and Annuity taxable. You should ensure that enough taxes are withheld from Income these payments or make estimated payments. See IRS Publication 17, Your Federal Income Tax, for more information. • Publication 334, Tax Guide for Small • Generally, withdrawals from your pension plan are taxable unless Businesses they are transferred to a qualified plan (such as an IRA). If you are under age 59 1⁄2, an additional tax may apply to the taxable portion of your pension. See IRS Publication 575, Pension and Annuity Income, for more information. • Job hunting and moving expenses are no longer deductible. • Some displaced workers may decide to start their own business. The IRS provides information and classes for new business owners. See IRS Publication 334, Tax Guide for Small Businesses, for more information. If you are unable to attend small business tax workshops, meetings or seminars near you, consider taking Small Business Taxes: The Virtual Workshop online as an alternative option. -

FULL BENEFITS (PDF, 250K)

Employee Benefits Contents 125 PREMIUM ONLY PLANS 4 MEDICAL & PRESCRIPTION INSURANCE 4 TELEMEDICINE 7 DENTAL INSURANCE 9 HEALTHCARE FLEXIBLE SPENDING ACCOUNT 10 QUALIFIED EXPENSES 11 DEPENDENT CARE FLEXIBLE SPENDING ACCOUNT 12 AFLAC 13 401(k) SAVINGS PLAN 14 HOLIDAYS 15 EARNED TIME OFF 16 SERVICE AWARDS 17 EXTENDED SICK TIME 18 RHODE ISLAND PAID SICK & SAFE LEAVE 18 OVERTIME 19 TUITION REIMBURSEMENT 20 FREE ASL CLASSES 20 DIRECT SUPPORT PROFESSIONAL MENTOR PROGRAM 21 REFERRAL BONUS PROGRAMS 22 LEAVE OF ABSENCE 23 WORKERS COMPENSATION 23 BEREAVEMENT 23 JURY DUTY 24 DIRECT DEPOSIT OF PAYROLL 24 ANNUAL BIG BASH 24 VERIZON WIRELESS DISCOUNT 25 EMAIL & WEBSITE ACCESS 25 COMMUNITY PARTICIPATION 25 CLOSING REMARKS 25 Page | 2 Employee Benefits At Perspectives Corporation we recognize our ultimate success depends on our talented and dedicated workforce. We offer a variety of employment opportunities, 24 hours a day, 365 days a year. We pride ourselves on maximizing the talents of our employees so that the services we provide to people with intellectual and developmental disabilities are the best they can be. We understand the contribution each employee makes to our accomplishments and so our goal is to provide a comprehensive program of competitive benefits to attract and retain the best employees available. Through our benefits programs we strive to support the needs of our employees and their dependents by providing a benefit package that is easy to understand, easy to access and affordable for all our employees. This brochure will help you choose the type of plan and level of coverage that is right for you. -

Annual Leave Act (1977:480)

Non-official translation Annual Leave Act (1977:480) Amendments: up to and including 2007:392 Section 1 An employee is entitled to annual leave benefits in accordance with this Act. Such benefits are annual leave, holiday pay and compensation in lieu of annual leave. Section 2 An agreement shall be invalid to the extent that it revokes or restricts an employee's rights under this Act. However, this shall not apply if this Act provides otherwise. Deviations from Sections 3, 9, 11, 16, 22, 23, 26, 29 and 30 may be made under a collective bargaining agreement that has been concluded or approved by an organisation which is deemed to be a central employees' organisation under the Employment (Co-Determination in the Workplace) Act (1976:580). An employer who is bound by such a collective bargaining agreement, by a collective bargaining agreement relating to matters referred to in Section 5, second paragraph, or by a collective bargaining agreement relating to deviations from Section 12, 19, 20 or 21, may in such respects also apply the agreement to employees who are not members of the employees' organisation which is a party to the agreement, provided that the employee is engaged in work that is referred to in the agreement and is not subject to any other applicable collective bargaining agreement. Section 3 The expression "annual leave year" means the period from and including 1 April of one year up to and including 31 March of the following year. The corresponding period immediately preceding an annual leave year is referred to as the "qualifying year". -

Working in B.C

WORKING IN B.C. The law in B.C. sets standards for payment, com- MINIMUM DAILY PAY pensation and working conditions in most work- An employee who reports for work must be paid places. For more information, please contact the fort a least two hours, even if they work less than Employment Standards Branch: two. hours If the employee is scheduled for more Toll free: 1-833-236-3700 thant eigh hours, they must be paid for at least four gov.bc.ca/EmploymentStandards hours. If work stops for a reason beyond the employer’s MINIMUM WAGE control, the employee must be paid their minimum Employees must be paid at least minimum wage dailyy pa or the actual time worked, whichever is regardless of: longer. • How they are paid – hourly, salary, commission or An employee is only paid for time actually worked if: other incentive basis • They are unfit to work • Their status – full-time, part-time, temporary or permanent • They do not meet WorkSafeBC health and safety regulations The minimum wage in B.C. is as follows: • June 1, 2018 - $12.65 per hour MEAL BREAKS • June 1, 2019 - $13.85 per hour Ae 30-minut unpaid meal break must be provided • June 1, 2020 - $14.60 per hour when an employee works more than five hours in a • June 1, 2021 - $15.20 per hour row. Employers are not required to provide coffee Liquor servers must be paid at least the liquor serv- breaks. er minimum wage: An employee must be paid for the meal break if • June 1, 2018 - $11.40 per hour they’re required to work (or be available to work) • June 1, 2019 - $12.70 per hour during their meal break. -

Collective Bargaining Agreement

COLLECTIVE BARGAINING AGREEMENT BETWEEN CONDOMINIUM COOPERATIVE EMPLOYERS COUNCIL OF SAN FRANCISCO AND SERVICE EMPLOYEES INTERNATIONAL UNION LOCAL 1877 Effective October 1, 2009 – September 30, 2012 TABLE OF CONTENTS Page Section 0 GENERAL INFORMATION ……………………………………. 1 0.1 Duration of Contract 0.2 Parties to the Agreement 0.3 Intent Section 1 RECOGNITION ……………………………………………………….. 2 1.1 Bargaining Representative 1.2 Strikes and Work Stoppages 1.3 Discrimination 1.4 Contractors and Subcontractors Section 2 UNION MEMBERSHIP ………………………………………………. 3 2.1 Membership as a Condition of Employment 2.2 Discharge for Failure to Join the Union 2.3 Recognition of Shop Stewards and Regional Shop Stewards 2.4 Visitation by Union Representatives 2.5 Bulletin Board 2.6 Dues Collection 2.7 Dues Check Off Form 2.8 Hold Harmless Section 3 EMPLOYERS COUNCIL MEMBERSHIP …………………………. 5 3.1 Employers Council Membership Section 4 HIRING ………………………………………………………………… 5 4.1 Filling of Vacancies and New Positions 4.2 Probation Period for New Employees 4.3 Employer Sole Judge of Qualifications Section 5 SENIORITY ……………………………………………………………. 6 A. SENIORITY DEFINED…………………………………………………………. 6 5.1 Definition B. AN EMPLOYEE SHALL CONTINUE TO ACCRUE SENIORITY DURING .. 6 5.2 Periods of Absence for Worker’s Compensation 5.3 Reinstatement after Termination 5.4 Other Authorized Reasons C. LAYOFF AND RECALL……………………………………………………….. 7 5.5 Layoffs D. NOTICE OF LAYOFF………………………………………………………….. 7 5.6 Notice of Requirement and Pay in the Event of Layoff E. RECALL………………………………………………………………………… 7 5.7 Notice of Requirement for Recall F. CONSIDERATIONS FOR FILLING VACANT POSITIONS…………………. 7 5.8 Considerations – Regular Employees 5.9 Bumping 5.10 Short-term Vacancies G. TRANSFERS……………………………………………………………………. -

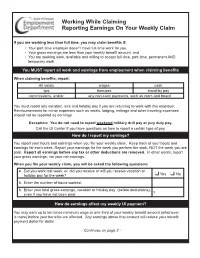

Working While Claiming Reporting Earnings on Your Weekly Claim

Working While Claiming Reporting Earnings On Your Weekly Claim If you are working less than full time, you may claim benefits if: • Your part-time employer doesn’t have full-time work for you, • Your gross earnings are less than your weekly benefit amount, and • You are seeking work, available and willing to accept full-time, part-time, permanent AND temporary work. You MUST report all work and earnings from employment when claiming benefits When claiming benefits, report: All salary wages cash tips bonuses stand-by pay commissions, and/or any non-cash payments, such as room and board You must report any vacation, sick and holiday pay if you are returning to work with this employer. Reimbursements for minor expenses such as meals, lodging, mileage and other traveling expenses should not be reported as earnings. Exception: You do not need to report weekend military drill pay or jury duty pay. Call the UI Center if you have questions on how to report a certain type of pay. How do I report my earnings? You report your hours and earnings when you file your weekly claim. Keep track of your hours and earnings for each week. Report your earnings for the week you perform the work, NOT the week you are paid. Report all earnings before any tax or other deductions are removed. In other words, report your gross earnings, not your net earnings. When you file your weekly claim, you will be asked the following questions: 4. Did you work last week, or, did you receive or will you receive vacation or q q holiday pay for the week? Yes No 5. -

Holiday Benefit Revised

5.12 Holidays All regular full-time and part-time employees are eligible for holiday benefit for the following holidays: 1st of January - New Year’s Day Third Monday in January – Martin Luther King Jr. Day Third Monday in February – Presidents' Day Last Monday in May – Memorial Day 4th of July – Independence Day First Monday in September – Labor Day Second Monday in October – Columbus Day 11th day of November – Veterans' Day Fourth Thursday in November – Thanksgiving Day Friday after Thanksgiving 25th of December – Christmas * One Floating Holiday *Floating holiday shall be designated by the City Manager and announced prior to January 1. When one of the foregoing regular holidays falls on a Saturday, the preceding Friday shall be declared the holiday. When one of the foregoing regular holidays falls on a Sunday, the following Monday shall be declared the holiday. A. Pay for Holidays Not Worked Full-time employees will receive holiday benefit equivalent to their basic hourly rate times their normal hours worked in a day. Normal hours worked in a day is calculated as their FLSA work week schedule (not to exceed ten (10) hours fire, rescue and police officers on 28 day work cycle, eight (8) hours all others) provided that: 1. The employee worked his or her complete scheduled workday before and after the holiday, unless the employee was on an approved paid leave. 2. Employees on a 7-day, 40-hour work week schedule who are working an alternate work schedule (i.e. 4-day, 10-hour work days), the supervisor will have the option of reverting those employees back to a 5-day, 8-hour work week during the week in which the holiday falls or approving annual leave in order for the employee to be paid for a full 40- hour week.