Pembina Pipeline Corporation, 2021 ABASC 144 Date: 20210902

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2010-Annual-Report.Pdf

The Best 2010 ANNUAL REPORT Pick Organically Grown Strong Yields Highly Productive An outstanding record of distribution growth and value-creation. 6,651 Enterprise Value ($ Millions) 5,372 233 3,984 3,922 202 187 2,510 172 161 Annual Distributions Paid ($ Millions) 06 07 08 09 10 Table of Contents 08 Financial and Operating Highlights 14 Management’s Discussion and Analysis 123 Five-Year Historical Summary 09 Five-Year Growth Summary 83 Consolidated Financial Statements 124 Board of Directors 10 President’s Letter 87 Notes to Consolidated Financial Statements 126 Offi cers and Corporate Information Payout ratio Distribution growth per unit over 10 years Total return in 2010 Why are investors picking Inter Pipeline for their portfolio? It’s simple, really. Average Annual Total Return We’ve generated outstanding total returns over Unit price appreciation plus distributions the past decade, and have steadily increased 1 year ..................................46.4% cash distributions. 3 year ..................................31.6% We‘ve done it by focusing our investments on 5 year ..................................21.4% long-life energy infrastructure assets that deliver 7 year ..................................21.8% sustainable and predictable cash fl ow. Our assets are 10 year ................................22.2% managed safely and effi ciently by strong operational teams, and are primarily supported by long-term contracts with blue-chip customers. We’re well positioned to capture further opportunities by leveraging our competitively positioned infrastructure assets. We have a large inventory of organic growth projects under development which will provide steady cash fl ow in the years to come. That’s the investment value we create. 2010 ANNUAL REPORT 1 Our presence in the Canadian oil sands is unmatched, with three key petroleum transportation systems serving the heart of the Athabasca and Cold Lake oil sands regions. -

![List of Securities Eligible for Reduced Margin [Effective from November 24, 2020 Until Replaced by a Subsequent List]](https://docslib.b-cdn.net/cover/8637/list-of-securities-eligible-for-reduced-margin-effective-from-november-24-2020-until-replaced-by-a-subsequent-list-738637.webp)

List of Securities Eligible for Reduced Margin [Effective from November 24, 2020 Until Replaced by a Subsequent List]

Attachment #1 List of Securities Eligible for Reduced Margin [effective from November 24, 2020 until replaced by a subsequent list] Compiled by the Investment Industry Regulatory Page 1 of 21 September 30, 2020 Organization of Canada IIROC Notice 20-0225 Rules Notice – Technical – List of Securities Eligible for Reduced Margin List of Securities Eligible for Reduced Margin Attachment #1 Description Symbol Description Symbol ABSOLUTE SOFTWARE J ABT AUTOMOTIVE PPTY UN APR.UN BARRICK GOLD CORP ABX APTOSE BIOSCIENCES APS AIR CANADA VOTE & VV AC ALGONQUIN PWR & UTIL AQN ATCO LTD. CL I NV ACO.X ALGONQUIN PWR A PR AQN.PR.A ATCO LTD. CL II ACO.Y ALGONQUIN PWR D PR AQN.PR.D AUTOCANADA INC. ACQ ARGONAUT GOLD INC. J AR ANDREW PELLER A NV ADW.A AECON GROUP INC. ARE ANDREW PELLER LTD. B ADW.B ARC RESOURCES LTD. ARX AGNICO EAGLE MINES AEM ACUITYADS HLDGS J AT AG GROWTH INT'L INC. AFN ATS AUTOMATION TOOL ATA AGF MANAGEMENT B NV AGF.B ALIMENTATION CL A MV ATD.A ALAMOS GOLD INC. J AGI ALIMENTATION CL B SV ATD.B ATRIUM MTG INVEST AI ATLANTIC POWER ATP ALTUS GROUP LIMITED AIF ARITZIA INC. SV ATZ AIMIA INC. AIM AURYN RESOURCES J AUG AIMIA INC. SER 1 PR AIM.PR.A A&W REVENUE RYLTY UN AW.UN AIMIA INC. SER 3 PR AIM.PR.C ARTIS REIT UN AX.UN ALTAGAS LTD. ALA ARTIS REIT SER A PR AX.PR.A ALTAGAS LTD SR A PR ALA.PR.A ARTIS REIT SER E PR AX.PR.E ALTAGAS LTD SR B PR ALA.PR.B ARTIS REIT SER I PR AX.PR.I ALTAGAS LTD SR E PR ALA.PR.E ALEXCO RESOURCE J AXU ALTAGAS LTD SR G PR ALA.PR.G BADGER DAYLIGHTING BAD ALTAGAS LTD SR H PR ALA.PR.H BROOKFLD ASSET A LV BAM.A ALTAGAS LTD SR I PR ALA.PR.I BROOKFLD ASSET PR 32 BAM.PF.A ALTAGAS LTD SR K PR ALA.PR.K BROOKFLD ASSET PR 34 BAM.PF.B ALTAGAS LTD C PR USF ALA.PR.U BROOKFLD ASSET PR 36 BAM.PF.C ALTIUS MINERALS CORP ALS BROOKFLD ASSET PR 37 BAM.PF.D ALTIUS MINERALS PR ALS.PR.A BROOKFLD ASSET PR 38 BAM.PF.E ALITHYA GROUP J A SV ALYA BROOKFLD ASSET PR 40 BAM.PF.F AMEX EXPL IN AMX BROOKFLD ASSET PR 42 BAM.PF.G ANDLAUERHLTHCR GRPSV AND BROOKFLD ASSET PR 44 BAM.PF.H ALLIED PROP. -

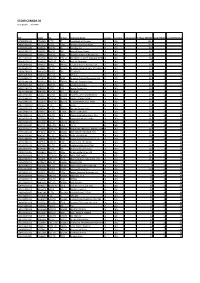

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

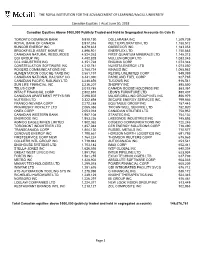

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2018 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) TORONTO DOMINION BANK 9,910,190 DOLLARAMA INC 1,209,739 ROYAL BANK OF CANADA 8,917,316 KELT EXPLORATION LTD 1,188,512 SUNCOR ENERGY INC 6,879,833 QUEBECOR INC 1,183,053 BROOKFIELD ASSET MGMT INC 4,896,921 ENERFLEX LTD 1,150,883 CANADIAN NATURAL RESOURCES 4,524,263 FIRST QUANTUM MINERALS LTD 1,145,213 CGI GROUP INC 4,482,828 MULLEN GROUP LTD 1,083,045 CCL INDUSTRIES INC 4,351,728 ENCANA CORP 1,073,348 CONSTELLATION SOFTWARE INC 4,212,781 NUVISTA ENERGY LTD 1,073,050 ROGERS COMMUNICATIONS INC 3,788,734 KINAXIS INC 1,065,983 ALIMENTATION COUCHE-TARD INC 3,581,197 RECIPE UNLIMITED CORP 949,389 CANADIAN NATIONAL RAILWAY CO 3,441,390 PARKLAND FUEL CORP 927,785 CANADIAN PACIFIC RAILWAY LTD 3,240,856 TUCOWS INC 916,541 SUN LIFE FINANCIAL INC 3,236,207 SHOPIFY INC 895,850 TELUS CORP 3,013,785 CANADA GOOSE HOLDINGS INC 883,361 INTACT FINANCIAL CORP 2,802,815 LEON'S FURNITURE LTD 880,407 CANADIAN APARTMENT PPTYS REI 2,498,502 MAJOR DRILLING GROUP INTL INC 856,979 NUTRIEN LTD 2,322,898 SECURE ENERGY SERVICES INC 799,566 FRANCO-NEVADA CORP 2,272,288 EQUITABLE GROUP INC 787,443 PRAIRIESKY ROYALTY LTD 2,065,386 TRICAN WELL SERVICE LTD 782,920 ONEX CORP 2,053,018 CANADIAN UTILITIES LTD 758,952 CANADIAN WESTERN BANK 1,987,108 STANTEC INC 754,132 ENBRIDGE INC 1,953,226 LASSONDE INDUSTRIES INC 745,893 AGNICO EAGLE MINES LIMITED 1,902,362 COGECO COMMUNICATIONS -

Stoxx® Canada Total Market Mid Index

STOXX® CANADA TOTAL MARKET MID INDEX Components1 Company Supersector Country Weight (%) EMERA Utilities Canada 3.01 BAUSCH HEALTH Health Care Canada 2.71 WSP GLOBAL Construction & Materials Canada 2.59 Teck Resources Ltd. Cl B Basic Resources Canada 2.48 Canadian Tire Corp. Ltd. Cl A Retail Canada 2.36 ALGONQUIN POWER & UTILITIES Utilities Canada 2.34 CAE Industrial Goods & Services Canada 2.27 CCL INDS.'B' Industrial Goods & Services Canada 2.12 CANADIAN APARTMENT PROP REIT Real Estate Canada 2.11 Kinross Gold Corp. Basic Resources Canada 2.11 TFI INTERNATIONAL Industrial Goods & Services Canada 2.04 LIGHTSPEED POS Technology Canada 1.97 AIR CANADA Travel & Leisure Canada 1.95 Cameco Corp. Energy Canada 1.93 INTER PIPELINE Energy Canada 1.83 TOROMONT INDUSTRIES Industrial Goods & Services Canada 1.81 TOURMALINE OIL Energy Canada 1.81 GILDAN ACTIVEWEAR Consumer Products & Services Canada 1.77 Blackberry Ltd Technology Canada 1.72 RITCHIE BROS.AUCTIONEERS (NYS) Consumer Products & Services Canada 1.68 WEST FRASER TIMBER Basic Resources Canada 1.62 FIRSTSERVICE Real Estate Canada 1.62 NORTHLAND POWER Utilities Canada 1.56 PAN AMER.SILV. (NAS) Basic Resources Canada 1.55 LUNDIN MINING Basic Resources Canada 1.53 ALTAGAS Utilities Canada 1.51 KEYERA CORP Energy Canada 1.51 IA FINANCIAL CORP Insurance Canada 1.51 EMPIRE 'A' Personal Care, Drug & Grocery Stores Canada 1.49 DESCARTES SYSTEMS GROUP Technology Canada 1.44 RIOCAN REIT.TST. Real Estate Canada 1.44 ONEX Financial Services Canada 1.44 TMX GROUP Financial Services Canada 1.41 ARC RESOURCES LTD Energy Canada 1.29 Element Fleet Management Corp. -

Bank of Montreal Canadian Q-Model® Principal at Risk Notes Series 17A

Bank of Montreal Canadian Q-Model® Principal at Risk Notes Series 17A Summary of Investment Portfolio as at December 1, 2016 Product Details Current Portfolio Holdings* Objective Ticker Company Name Composite Rank Sector Weight The Notes are designed for equity AC Air Canada 17 Industrial 4.79% investors seeking a return based on a ACO.X ATCO Ltd. I 8 Utilities 4.57% portfolio of Canadian large-cap stocks selected using the BMO Capital Markets BCE BCE Inc. 31 Communications 4.46% Quantitative Factor Model. BNS Scotiabank 1 Financial 5.12% BTO B2Gold Corp. 16 Basic Materials 4.43% Series 17A - Regular Accounts CM CIBC 4 Financial 5.13% Asset Class Canadian Equity ENF Enbridge Income Fund Holdings 7 Energy 4.70% Structure Debt Security FTS Fortis Inc. 24 Utilities 4.55% Discipline Quantitative IAG Industrial Alliance 13 Financial 5.47% IGM IGM Financial Inc. 20 Financial 4.99% Strategy Top 20/35 (Total Return) IPL Inter Pipeline Ltd. 12 Energy 4.83% Holdings 20 stocks LNR Linamar Corp. 15 Industrial 5.14% Code JHN 8040 MFC Manulife Financial Corp. 11 Financial 6.18% MG Magna International Inc. 5 Consumer (Cyclical) 5.12% Daily NAV $148.14 NA National Bank 2 Financial 5.44% Current Yield 3.32% PWF Power Financial 18 Financial 5.31% ETC Nil RY Royal Bank of Canada 14 Financial 5.21% SLF Sun Life Financial 3 Financial 5.72% Issue Date December 21, 2011 TD Toronto-Dominion Bank 9 Financial 5.27% Maturity Date December 21, 2016 THO Tahoe Resources 10 Basic Materials 3.55% Program Fee 1.75% per annum * Portfolio Holdings as of December 9, 2016 -

FERIQUE Canadian Equity Fund

C1 Contents C1 C2 SHORT-TERM-INCOME CANADIAN-BOND GLOBALLY-DIVERSIFIED-INCOME CONSERVATIVE MODERATE BALANCED GROWTH AGGRESSIVE-GROWTH CANADIAN-DIVIDEND-EQUITY CANADIAN-EQUITY AMERICAN-EQUITY EUROPEAN-EQUITY 20 ASIAN-EQUITY EMERGING-MARKETS INTERIM WORLD-DIVIDEND-EQUITY MANAGEMENT C4 REPORT of Fund Performance for the period ended June 30, 2020 EQUITY FUNDS FÉRIQUE Canadian Equity Fund This Interim Management Report of Fund Performance contains financial highlights but does not contain the complete interim or annual financial statements of the Fund. You can get a copy of the Interim Financial Statements at your request, and at no cost, by calling our Advisory Services at 514-788-6485 (toll-free 1-800-291-0337), by writing to us at Gestion FÉRIQUE, Place du Canada, 1010 de La Gauchetière Street West, Suite 1400, Montréal, Québec H3B 2N2, or by visiting our website at ferique.com or SEDAR at sedar.com. Unitholders may also contact us using one of these methods to request a copy of the Fund’s proxy voting policies and procedures, proxy voting disclosure record and quarterly portfolio disclosure. C2 There may be management fees and expenses associated with an investment in the Funds. Management expense ratios vary from one year to another. Please read the Prospectus before investing. Mutual funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or another government deposit insurer. Their values fluctuate frequently and past performance may not be repeated. FÉRIQUE Funds are distributed by Services d’investissement FÉRIQUE since July 1, 2013 and used to be by National Bank Securities Inc., until June 30, 2013. -

Management's Discussion and Analysis

Management’s Discussion and Analysis For the year ended December 31, 2013 Forward-Looking Information The following Management’s Discussion and Analysis (MD&A) highlights Inter Pipeline Ltd. and its predecessor Inter Pipeline Fund’s (together referred to as Inter Pipeline) significant business results and statistics for the three month period and year ended December 31, 2013, to provide Inter Pipeline’s shareholders and potential investors with information about Inter Pipeline and its subsidiaries, including management’s assessment of Inter Pipeline’s and its subsidiaries’ future plans and operations. This information may not be appropriate for other purposes. Effective September 1, 2013, Inter Pipeline completed an arrangement pursuant to which, among other things, the outstanding Class A units of Inter Pipeline Fund were converted into common shares of Inter Pipeline Ltd. This resulted in the conversion to a dividend paying corporation, Inter Pipeline Ltd., which continues as a successor issuer to Inter Pipeline Fund (Corporate Conversion). In this MD&A, any references to Inter Pipeline prior to September 1, 2013 refer to Inter Pipeline Fund and its consolidated subsidiaries, and any references to Inter Pipeline subsequent to September 1, 2013 refer to Inter Pipeline Ltd. and its consolidated subsidiaries. Similarly, any references to common shares, shareholders or dividends used prior to September 1, 2013, refer to Class A units, unitholders and distributions of Inter Pipeline Fund, and any references to common shares, shareholders or dividends used subsequent to September 1, 2013 refer to common shares, shareholders and dividends of Inter Pipeline Ltd. This MD&A contains certain forward-looking statements or information (collectively referred to as “forward-looking statements”) within the meaning of applicable securities legislation. -

Bank of Montreal Diversified Bull & Bear Callable Principal Protected Deposit Notes, Series 5

BMO Global Structured Products Principal Protected Solutions Bank of Montreal Diversified Bull & Bear Callable Principal Protected Deposit Notes, Series 5 100% of the positive price Or 15% of the negative price 100% Principal Protected 7 Year Term performance of the Reference performance of the Reference if held to Maturity Portfolio at maturity Portfolio at maturity Investment Highlights Reference Basket Callable Feature: The Reference Portfolio will consist of common shares or units of 10 TSX-listed Canadian large cap issuers. While the securities in Callable at the option of Bank of Montreal at any time prior to the Reference Portfolio had an average dividend or distribution Maturity with interest at annual compounded rate of return of 15% yield of 4.90% and an average market capitalization of $18.14 calculated from the Closing Date to the Call Date. billion as of September 8, 2017, investors in the Deposit Notes must be prepared to waive the aggregate dividend yield provided If not called for redemption, a holder will receive a return at by the securities of the issuers, representing approximately Maturity equal to 100% of any percentage increase or 15% of any 39.76% over the 7-year term of the Deposit Notes, assuming the percentage decrease in the Reference Portfolio Value from the average dividend yield on such securities remains constant at Closing Date to the Final Valuation Date. No Variable Return will 4.90% each year and assuming dividends are reinvested in such be paid if the Reference Portfolio Value has not changed from the securities. The value of the Reference Portfolio will not include Closing Date to the Final Valuation Date. -

STOXX CANADA 50 Selection List

STOXX CANADA 50 Last Updated: 20210702 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) CA7800871021 2754383 RY.TO RY Royal Bank of Canada CA CAD Y 121.8 1 1 CA8911605092 2897222 TD.TO TDpD Toronto-Dominion Bank CA CAD Y 107.6 2 2 CA29250N1050 2466149 ENB.TO IPL Enbridge Inc. CA CAD Y 68.5 3 5 CA0641491075 2076281 BNS.TO BNS Bank of Nova Scotia CA CAD Y 66.5 4 3 CA1363751027 2180632 CNR.TO TCNR Canadian National Railway Co. CA CAD Y 63.1 5 4 CA1125851040 2092599 BAMa.TO TEBC.A BROOKFIELD ASSET MANAGEMENTCA CAD Y 59.5 6 6 CA0636711016 2076009 BMO.TO BMO Bank of Montreal CA CAD Y 56 7 7 CA13645T1003 2793115 CP.TO 279311 Canadian Pacific Railway Ltd. CA CAD Y 43.3 8 8 CA1360691010 2170525 CM.TO 217052 Canadian Imperial Bank of Comm CA CAD Y 42.8 9 9 CA87807B1076 BJMY6G0 TRP.TO TRP TC ENERGY CA CAD Y 40.9 10 10 CA05534B7604 B188TH2 BCE.TO B BCE Inc. CA CAD Y 37.7 11 11 CA1363851017 2171573 CNQ.TO TCNQ Canadian Natural Resources Ltd CA CAD Y 36.3 12 13 CA56501R1064 2492519 MFC.TO 274642 Manulife Financial Corp. CA CAD Y 32.3 13 14 CA0679011084 2024644 ABX.TO ABX Barrick Gold Corp. CA CAD Y 31.1 14 12 CA8672241079 B3NB1P2 SU.TO T.SU Suncor Energy Inc. CA CAD Y 30.5 15 15 CA67077M1086 BDRJLN0 NTR.TO POT NUTRIEN CA CAD Y 29.2 16 16 CA21037X1006 B15C4L6 CSU.TO CA12F4 CONSTELLATION SOFTWARE CA CAD Y 27.1 17 20 CA94106B1013 BYQFRK5 WCN.TO 287864 WASTE CONNECTIONS CA CAD Y 26.4 18 17 CA01626P4033 2011646 ATDb.TO 201164 ALIMENTATION CCH.TARD CA CAD Y 25.6 19 19 CA87971M1032 2381093 T.TO BCT TELUS CA CAD Y 25.5 20 21 CA8667961053 2566124 SLF.TO 256612 Sun Life Financial Inc. -

News Release Inter Pipeline Issues Notice of Change Recommending

News Release Inter Pipeline Issues Notice of Change Recommending Brookfield Offer and Provides Update on Heartland Petrochemical Complex CALGARY, ALBERTA, August 3, 2021: Inter Pipeline Ltd. (“Inter Pipeline” or the “Company”) (TSX: IPL) today announced that it is filing its second notice of change to its Directors’ Circular (the “Notice of Change”) concerning the recommendation of the Inter Pipeline Board of Directors (the “Board”) that shareholders accept the revised takeover offer filed on July 19, 2021 (the “Revised Brookfield Offer”) from an affiliate of Brookfield Infrastructure Partners L.P. (“Brookfield”). Additionally, Inter Pipeline is providing an update on its Heartland Petrochemical Complex (“HPC”) related to additional contracting, expected start-up timing, capital costs, EBITDA guidance and the current state of commodity markets. Notice of Change Details Shareholders are advised to carefully read the Notice of Change, which provides the background and other details to the decision by the Inter Pipeline special committee of independent directors (the “Special Committee”) and the Board to recommend that shareholders TENDER their common shares to the Revised Brookfield Offer. The Notice of Change is available on the Company's website at www.interpipeline.com, and when filed will be available at www.sedar.com. The Notice of Change is also being mailed to all persons required to receive a copy under applicable securities laws. Under the Revised Brookfield Offer, each Inter Pipeline shareholder has the ability to elect to receive, per Inter Pipeline share, $20.00 in cash or 0.25 of a Brookfield Infrastructure Corporation class A exchangeable subordinate voting share ("BIPC Share"), or, solely in the case of eligible Canadian Inter Pipeline shareholders seeking a rollover for tax purposes, 0.25 of an exchangeable security (each an “Exchangeable Unit”) to be issued by an indirect subsidiary of Brookfield (“Exchange LP”), subject to pro-ration in respect of the BIPC Shares and Exchangeable Units. -

Quarterly Market Commentary December 2019

Quarterly Market Commentary December 2019 The U.S. and global industrial sectors follow a 40-month cycle of acceleration and deceleration which we know to be the inventory cycle. The global Producer Manufacturing Index (PMI) bottomed in July this year, 41 months after the February 2016 low. The 2016 low was 42 months after the August 2012 low. And the 2012 low came 44 months after the December 2008 low. Given that the duration of inventory cycles within this long economic expansion have been tracking close to the long-term average of 40 months, we believe that the next cycle low for the global PMI will be set within a few months of November 2022, almost three years from now. Unless inflation moves up to a degree that displeases the Fed, we expect the 2022 slowdown will also prove to be a soft landing rather than a slowdown that deteriorates into recession. We expect commodity prices will accelerate along with global industrial production (IP) reinforced by U.S. dollar weakness as global risk appetite increases. Rising commodity prices, along with further wage gains, should translate into higher inflation. Higher inflation combined with accelerating global IP should, in turn, translate into higher bond yields. Central banks are united in their desire for higher inflation in the years ahead. While progress towards higher inflation has been slow, the central bank commitment to this goal was reinforced this past fall with the European Central Bank’s return to quantitative ease and by the aggressive way the Fed responded to pressures in the overnight repo market.