Metro Pacific Investments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Metro Pacific Investments Corporation and Subsidiaries

Metro Pacific Investments Corporation and Subsidiaries Consolidated Financial Statements December 31, 2019 and 2018 and Years Ended December 31, 2019, 2018 and 2017 and Independent Auditor’s Report SyCip Gorres Velayo & Co. Tel: (632) 891 0307 BOA/PRC Reg. No. 0001, 6760 Ayala Avenue Fax: (632) 819 0872 October 4, 2018, valid until August 24, 2021 1226 Makati City ey.com/ph SEC Accreditation No. 0012-FR-5 (Group A), Philippines November 6, 2018, valid until November 5, 2021 INDEPENDENT AUDITOR’S REPORT The Board of Directors and Stockholders Metro Pacific Investments Corporation Opinion We have audited the consolidated financial statements of Metro Pacific Investments Corporation and its subsidiaries (the Company), which comprise the consolidated statements of financial position as at December 31, 2019 and 2018, and the consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows for each of the three years in the period ended December 31, 2019, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as at December 31, 2019 and 2018, and its consolidated financial performance and its consolidated cash flows for each of the three years in the period ended December 31, 2019 in accordance with Philippine Financial Reporting Standards (PFRSs). Basis for Opinion We conducted our audits in accordance with Philippine Standards on Auditing (PSAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. -

Annual Report 2010 Mission

sharpening our focus AnnuAl report 2010 Mission: to create long-term value for all its stakeholders Brand EssEncE: passion for better ways Brand spikEs • Driven • Driven to lead • Driven to excel • Driven to Serve corporatE ValuEs • passion • Innovation • professionalism • Integrity About the cover: Aboitiz equity Ventures, Inc. (AeV) has achieved unprecedented growth through the years, having expanded into power generation and distribution, banking and food. As it advances into another period filled with opportunities and challenges, AeV opts to sharpen its focus on its core strengths and maximize its potentials. TABLE OF CONTENTS 02 Financial Highlights Report to Stockholders 04 From your Chairman and President & CEO Results of Operations 08 Power 14 Financial Services 18 Food 20 Transport 22 From your Chief Financial Officer 25 From your Chief Risk Management Officer 26 Risk Management Report 28 From your Chief Compliance Officer 29 Corporate Governance Report FEATURES 42 CitySavings prepares to take on Luzon 44 Running the good race 46 Sustainability Statement 48 CSR: Helping people help themselves 50 Board of Directors / Board Committees 52 Corporate Officers 54 Operating Unit Heads 55 Management Directory 56 Location of Operations 57 Corporate Structure 58 Audit Committee Report 59 Statement of Management Responsibility 60 Independent Auditors’ Report 62 Consolidated Financial Statement The complete Securities & Exchange Commission Form 20-IS (Information Statement) and Annual Report is inside the CD inserted at the inside back cover -

FPC IR Handout 2019 03 26

Information Summary for Investors HKEx: 00142 Creating ADR: FPAFY long-term value www.firstpacific.com in Asia Copyright © First Pacific Company Limited 26 March 2019. All rights reserved. Consumer Foods Infrastructure Natural Resources Telecommunications First Pacific owns 50.1% of First Pacific owns 42.0% of First Pacific owns 31.2% of First Pacific owns 25.6% of Indofood and has an MPIC and has economic Philex and Two Rivers, a PLDT which in turn owns economic interest of 40.3% interests of 19.1% in PhiliPPine affiliate, holds 100% of Smart, its mobile in ICBP. Meralco, 26.2% in Global 15.0%. First Pacific holds an telecommunications Business Power, 47.3% of effective economic interest subsidiary. PacificLiGht, 22.2% of of 42.4% in PXP EnerGy, Maynilad, and 41.9% of 31.4% in IndoAgri, and Metro Pacific Tollways. 50.0% in Roxas HoldinGs. 2 Senior Management of First Pacific Joseph H.P. Ng John W. Ryan Stanley H. Yang Exec. Vice President, Chief Investor Relations Exec. Vice President, Manuel V. Pangilinan Chris H. Young Executive Director Group Finance & Sustainability Officer Corp. Development Managing Director and CEO & Chief Financial Officer Ray C. Espinosa Victorico P. Vargas Marilyn A. Associate Director Assistant Director Victorio-Aquino Assistant Director 3 Gross Asset Value of $5.45 Billion Investment Objectives Roxas Holdings o Unlock value, enhance cash flows to deliver $39 mln (0.7%) dividend/distribution returns, grow share price, and Philex finance further investment in value-enhancing PLP $230 Group $338 businesses, taking -

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Philippines USD Net Tax Index Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country Aboitiz Power 1.55 PHILIPPINES JG Summit Holdings 6.55 PHILIPPINES Semirara Mining and Power 0.48 PHILIPPINES Alliance Global 1.11 PHILIPPINES Jollibee Foods 2.48 PHILIPPINES SM Investments 16.27 PHILIPPINES Ayala Corporation 8.63 PHILIPPINES LT Group 1.16 PHILIPPINES SM Prime Hldgs 10.52 PHILIPPINES Ayala Land 9.44 PHILIPPINES Manila Electric 2.7 PHILIPPINES Universal Robina 4.26 PHILIPPINES Bank of The Philippine Islands 4.65 PHILIPPINES Megaworld 1.25 PHILIPPINES BDO Unibank 6.27 PHILIPPINES Metro Pacific Investments 1.97 PHILIPPINES Bloomberry Resorts 0.9 PHILIPPINES Metropolitan Bank & Trust 2.63 PHILIPPINES DMCI Holdings 0.65 PHILIPPINES PLDT 4.32 PHILIPPINES Globe Telecom 2.08 PHILIPPINES Puregold Price Club 1.44 PHILIPPINES GT Capital Holdings 1.51 PHILIPPINES San Miguel 1.28 PHILIPPINES International Container Terminal Service 4.37 PHILIPPINES San Miguel Food and Beverage 1.52 PHILIPPINES Source: FTSE Russell 1 of 2 28 October 2020 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points. Where very small values are concerned, which would display as 0.00 using this rounding method, these weights are shown as <0.005. Timing of data Constituents & Weights are generally published in arrears and contain the data as at the most recent quarter-end. However, some spreadsheets are updated on a more frequent basis. -

Communication Management Category 1: Internal Communcation List of Winners Title Company Entrant's Name AGORA 2.0 Aboitiz Equity Ventures, Inc

Division 1: Communication Management Category 1: Internal Communcation List of Winners Title Company Entrant's Name AGORA 2.0 Aboitiz Equity Ventures, Inc. Lorenne Alejandrino-Anacta Keep It Simple, Sun Lifers: Gamifying A Simple Language Sun Life Financial Philippines Campaign Donante Aaron Peji Data Defenders: Data Privacy Lessons Made Fun and Sun Life Financial Philippines Engaging For Sun Life Employees Donante Aaron Peji PLDT Group Data Privacy Office Handle With Care Ramon R. Isberto Campaign PLDT Aboitiz Equity Ventures, Inc. (Pilmico Foods Super Conversations with SMA Corporation) Lorenne Alejandrino-Anacta Inside World: Engaging a new generation of Megaworld employees via a dynamic e-newsletter Megaworld Corporation Harold C. Geronimo Harnessing SYKES' Influence from Within to Inspire Beyond Reach Sykes Asia, Incorporated Miragel Jan Gabor ManilaMed's #FeelBetter Campaign Comm&Sense Inc. Aresti Tanglao Category 2: Employee Engagement Title Company Entrant's Name LOVE Grants Resorts World Manila Archie Nicasio a.Lab Aboitiz Equity Ventures, Inc. Lorenne V. Alejandrino CineNRW Maynilad Water Services, Inc Sherwin DC. Mendoza Central NRW Point System Maynilad Water Services, Inc Sherwin DC. Mendoza Leadership with a Heart Megaworld Foundation Dr. Francisco C. Canuto Dare 2B Fit ALLIANZ PNB LIFE INSURANCE, INC. ROSALYN MARTINEZ Category 3: Human Resources and Benefits Communication Title Company Entrant's Name Recruitment in the Social Media Era Manila Electric Company Gavin D. Barfield Category 5: Safety Communication Title Company Entrant's Name Championing cybersecurity awareness Bank of the Philippine Islands (BPI) Owen L. Cammayo Unang Hakbang Para Sa Kaligtasan: 2018 First Working MERALCO - Organizational Safety and Day Safety Campaign Resiliency Office Antonio Abuel Jr. -

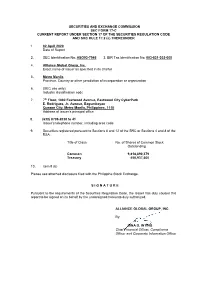

SECURITIES and EXCHANGE COMMISSION SEC FORM 17-C CURRENT REPORT UNDER SECTION 17 of the SECURITIES REGULATION CODE and SRC RULE 17.2 (C) THEREUNDER

SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-C CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2 (c) THEREUNDER 1. 02 April 2020 Date of Report 2. SEC Identification No: ASO93-7946 3. BIR Tax Identification No: 003-831-302-000 4. Alliance Global Group, Inc. Exact name of issuer as specified in its charter 5. Metro Manila Province, Country or other jurisdiction of incorporation or organization 6. (SEC use only) Industry classification code 7. 7th Floor, 1880 Eastwood Avenue, Eastwood City CyberPark E. Rodriguez, Jr. Avenue, Bagumbayan Quezon City, Metro Manila, Philippines, 1110 Address of issuer’s principal office 8. (632) 8709-2038 to 41 Issuer’s telephone number, including area code 9. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA: Title of Class No. of Shares of Common Stock Outstanding Common 9,818,890,379 Treasury 450,937,600 10. Item 9 (b) Please see attached disclosure filed with the Philippine Stock Exchange. S I G N A T U R E Pursuant to the requirements of the Securities Regulation Code, the Issuer has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. ALLIANCE GLOBAL GROUP, INC. By: DINA D. INTING Chief Financial Officer, Compliance Officer and Corporate Information Officer 4/3/2020 Request for extension to file SEC Form 17-A CR01662-2020 The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. -

Corporate Profile First Pacific Is a Hong Kong-Based Investment Management and Holding Company with Operations Located in Asia

於亞洲創建 長期價值 第一太平有限公司 二零一零年年報 年報 二零一零年 Corporate Profile First Pacific is a Hong Kong-based investment management and holding company with operations located in Asia. Its principal business interests relate to Telecommunications, Infrastructure, Consumer Food Products and Natural Resources. Listed in Hong Kong, First Pacific’s shares are also available for trading in the United States through American Depositary Receipts. As at 21 March 2011, First Pacific’s economic interest in PLDT is 26.5%, in MPIC 55.6%, in Indofood 50.1% and in Philex* 31.3%. First Pacific’s principal investments are summarized on page 164. * Two Rivers Pacific Holdings Corporation, a Philippine affiliate of First Pacific, holds an additional 15.0% interest in Philex. Vision Strategy • Create long-term value in Asia • Identify undervalued or underperforming assets with strong growth potential and possible synergies Mission which bring strong cash flows • Manage investments by setting strategic direction, • Active management developing business plans and defining targets • Enhance potential • Raise governance levels to world-class standards at • Enrich lives the investee companies Contents Inside Corporate Profile, Vision, Mission 43 Chairman’s Letter 71 Financial Review Front and Strategy 71 Liquidity and Financial Cover 44 Managing Director and Chief Executive Officer’s Letter Resources 1 Financial Performance and 74 Financial Risk Management 46 Board of Directors and Recurring Profit 78 Adjusted NAV Per Share Senior Executives 2 Ten-year Statistical Summary 79 Statutory -

Diversification Strategies of Large Business Groups in the Philippines

Philippine Management Review 2013, Vol. 20, 65‐82. Diversification Strategies of Large Business Groups in the Philippines Ben Paul B. Gutierrez and Rafael A. Rodriguez* University of the Philippines, College of Business Administration, Diliman, Quezon City 1101, Philippines This paper describes the diversification strategies of 11 major Philippine business groups. First, it reviews the benefits and drawbacks of related and unrelated diversification from the literature. Then, it describes the forms of diversification being pursued by some of the large Philippine business groups. The paper ends with possible explanations for the patterns of diversification observed in these Philippine business groups and identifies directions for future research. Keywords: related diversification, unrelated diversification, Philippine business groups 1 Introduction This paper will describe the recent diversification strategies of 11 business groups in the Philippines. There are various definitions of business groups but in this paper, these are clusters of legally distinct firms with a managerial relationship, usually by virtue of common ownership. The focus on business groups rather than on individual firms has to do with the way that business firms in the Philippines are organized and managed. Businesses that are controlled and managed by essentially the same set of principal owners are often organized as separate corporations, not as separate divisions within the same firm, as is often the case in American corporations like General Electric, Procter and Gamble, or General Motors (Echanis, 2009). Moreover, studies on emerging markets have pointed out that business groups often occupy dominant positions in the business landscape in markets like India, Korea, Indonesia, Thailand, and the Philippines (Khanna & Palepu, 1997; Khanna & Yafeh, 2007). -

Corporate Governance Issues in Philippine-Listed Companies

Philippine Management Review 2019, Vol. 26, 1-16. Corporate Governance Issues in Philippine-Listed Companies Arthur S. Cayanan* University of the Philippines, Cesar E.A. Virata School of Business, Diliman, Quezon City 1101, Philippines This paper discusses corporate governance issues in Philippine-listed companies such as ownership structure, separation of Chairman and CEO positions, independent directors, related party transactions, among others, and how non-controlling stockholders are adversely affected by these issues. The paper also assesses the sufficiency of existing rules and regulations and the effectiveness of regulators in protecting minority interest. 1 Introduction Corporate Governance is defined as the system of stewardship and control to guide organizations in fulfilling their long-term economic, moral, legal and social obligations towards their stakeholders.1 On November 10, 2016, the Securities and Exchange Commission (SEC) approved the Code of Corporate Governance for Publicly-Listed Companies (CG Code for PLCs).2 The Code provides a list of the governance responsibilities of the board of directors (BOD), corporate disclosure policies, standards for the selection of external auditor, and duties to stockholders, among others. In this paper, emphasis will be on ownership structure, the positions of Chairman and Chief Executive Officer (CEO) being held by separate individuals, the independence of independent directors, some related party transactions, and how these issues affect the interest of non-controlling stockholders.3 2 Objectives This study has the following objectives: 1. To assess some corporate governance practices of the 30 Philippine Stock Exchange index (PSEi) PSEi-indexed stocks, e.g., ownership structure, different individuals holding the positions of the chairman of the BOD and CEO, related party transactions, and tender offers. -

BLAZING NEW TRAILS Annual Report 2017 BLAZING NEW TRAILS

BLAZING NEW TRAILS annual report 2017 BLAZING NEW TRAILS annual report WHAT’S INSIDE 1 2 4 6 Financial Highlights Chairman’s Message At a Glance AGI Subsidiaries 10 12 14 16 Residentials Offices Lifestyle Malls Hotels 18 20 24 28 Leisure and Entertainment Spirits Quick Service Restaurants Infrastructure 30 34 38 57 Corporate Social Raising the Bar Board of Directors Financials Responsibility and Key Officers Our Cover The cover design depicts AGI as a hi-tech shuttle, entering a threshold like a portal to the future, bringing the country into a whole new world. With its bright headlights illuminating visions of milestone achievements, emerging along its path, it continues blazing new trails as it moves headstrong, fast and sure into the far horizons. financial highlights 141.6 139.7 139.1 124.9 17% 119.7 10-year CAGR* 102.1 63.0 44.5 33.3 37.3 revenues (in billion Pesos) 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 39.9 38.7 17% 35.9 33.4 35.0 10-year CAGR* 32.4 18.9 14.5 8.9 6.7 EBITDA (in billion Pesos) 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 22.8 21.8 21.8 16% 20.9 * 20.5 10-year CAGR 19.4 11.6 6.9 8.0 7.7 6.6 5.6 7.7 1.8 14.9 14.8 14.0 9.5 13.9 13.8 13.2 5.2 9.8 3.3 2.6 2.0 6.9 2.2 3.2 NET PROFIT (in billion Pesos) 1.1 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Owners of AGI Non-controlling interest All figures exclude non-recurring items *CAGR is compound annual growth rate BLAZING NEW TRAILS / 2017 ANNUAL REPORT 1 2 chairman’s message Visioning Beyond Tomorrow P141.6 B consolidated revenues P21.8 B net income he year 2017 Our property arm, Its world-class and high-tech t was marked Megaworld Corporation, office buildings are home to by trailblazing posted another stellar a number of multinationals achievements, unprecedented performance as net income belonging to the Fortune in the history of Alliance reached P13.2 billion on 500 companies. -

Press Release

Press Release FIRST PACIFIC AND MERALCO POWERGEN BUY 70% OF SINGAPORE POWER PLANT FOR US$537MLN US$488 Mln Payment Plus US$49 Mln Equity Contribution Natural Gas-Fired Plant Has Two 400 Megawatt Capacities Power Plant Is Located on Jurong Island, Singapore Scheduled Commercial Operations in December 2013 First Pacific Holds 60% of Joint Venture Investment Company Meralco PowerGen Holds Remaining 40% Stake Ownership First Pacific Effective Interest Totals 48% of Power Plant Hong Kong, 4th March, 2013 – First Pacific Company Limited (HKSE:00142) (“First Pacific” or the “Company”) and Meralco PowerGen Corporation (“Meralco PowerGen”) today announced that FPM Power Holdings Limited (“FPMP”), a non-wholly owned subsidiary of the Company, has entered into a sale and purchase agreement to acquire 70% of GMR Energy (Singapore) Pte Ltd. (“GMRE”), a company building a power plant located on Jurong Island, Singapore, from GMR Infrastructure for US$488 million in cash, with a further committed US$49 million equity contribution into the project. The acquisition of 70% of GMRE will be financed by internal resources. First Pacific will hold 60% of the joint venture investment vehicle; Meralco PowerGen will own the remaining 40%. The combined cycle combustion turbine power project consists of two 400 megawatt natural gas-fired turbines which are scheduled to go online in December 2013. The remaining 30% of the project will continue to be held by Petronas Power Sdn Bhd (“Petronas”), a subsidiary of Malaysia’s state-owned oil and gas company. “This represents an attractive investment opportunity in an advanced economy and an exciting first step in our power vision for the region,” said Manuel V. -

PLDT and Corporation (BLC) Pledged As Security, Convertible Bonds

FIRST PACIFIC COMPANY LIMITED ANNUAL REPORT 2002 CORPORATE PROFILE First Pacific is a Hong Kong-based investment and management company with operations located primarily in Southeast Asia. Its principal business interests relate to Consumer and Telecommunications. Listed in Hong Kong, First Pacific’s shares are also available in the United States through American Depositary Receipts. 1 Mar SIGNIFICANT EVENTS Metro Pacific announces asset 16 Jan impairment provisions and undertakes US$10 million of First Pacific convertible debt reduction initiatives with its bonds are canceled at a total cost of creditors. US$13 million. First Pacific offers to 29 May 2002 purchase outstanding convertible First Pacific announces that it is in 8 Jan bonds in the market. discussions with an investor concerning US$40 million of First Pacific convertible 17-24 Jan First Pacific’s Philippine telecom and bonds are canceled at a total cost of US$68 million of First Pacific convertible property interests. The investor is US$53 million. bonds are canceled at a total cost of subsequently identified as the 9 Jan US$92 million. Market purchases cease. Gokongwei Group. Metro Pacific advises First Pacific that it 31 Jan 4 Jun is unable to repay the US$90.0 million First Pacific deposits US$176 million with First Pacific signs MOA with the loan (the Larouge Loan). First Pacific, the trustee of its convertible bonds to Gokongwei Group for the establishment as a secured creditor in respect of the redeem, on 27 March 2002, the of joint venture arrangements in relation 50.4 per cent interest in Bonifacio Land outstanding US$131 million of to First Pacific’s interests in PLDT and Corporation (BLC) pledged as security, convertible bonds.